Integrated Value, Growth & Quality Portfolios

Searching for Cheap, Fast Growing and High Quality Stocks.

November 2017. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Integrated Value, Growth & Quality portfolios generated attractive returns year-to-date 2017

- Sorting stocks on several characteristics results in relatively smooth performance

- Mitigates the issue of factor timing, but not of factor selection

INTRODUCTION

Year-to-date 2017 is shaping up as a terrible year for the consensus trade of the beginning of the year – Value, which was based on animal spirits awoken by the Trump election in the US and a general recovery of the global economy. The winning factors of this year are Growth and Quality, which were deeply out of favour at the end of last year. Factor timing is likely impossible, but would an investor have been more successful by ranking stocks on Value, Growth and Quality characteristics simultaneously? In this short research note we will analyse the performance of three integrated portfolios: Value & Growth, Value & Quality and Value & Growth & Quality.

METHODOLOGY

We focus on the Value, Growth and Quality factors in the US, Europe and Japan. Value is defined as a combination of book-to-market and price-to-earnings multiples, Growth as a combination of the three-year sales and earnings per share growth, and Quality as a combination of return-on-equity and debt-over-equity. The portfolios are created by ranking stocks on multiple characteristics, i.e. selecting the stocks that rank highest on average for all three factors, and constructed as beta-neutral long-short portfolios by taking the top and bottom 10% of the stock universes. The analysis covers the period from 2002 to 2017 and includes costs of 10 bps per transaction.

VALUE, GROWTH & QUALITY INTEGRATED PORTFOLIOS IN THE US

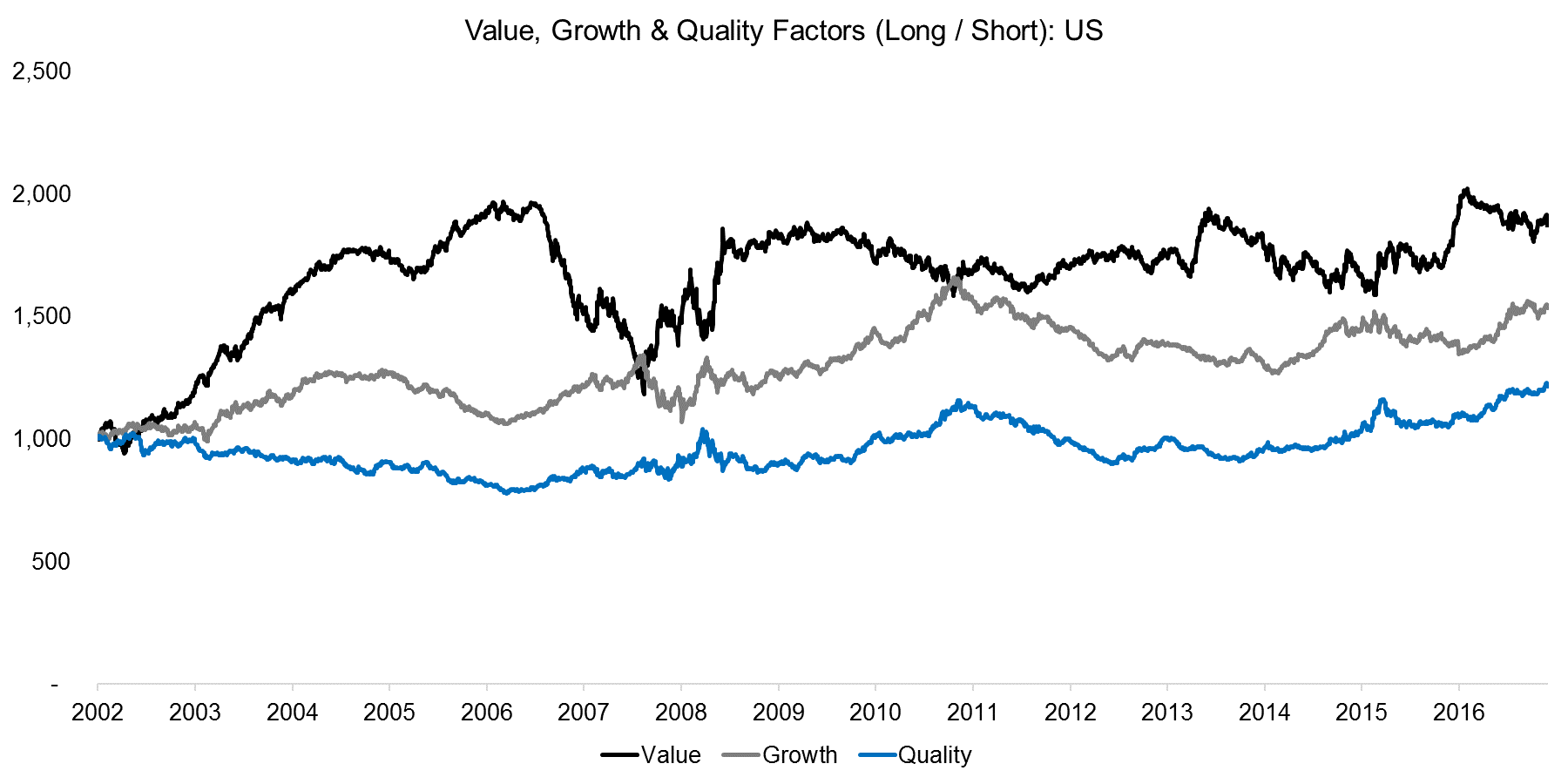

The chart below shows the performance of the single Value, Growth and Quality factors in the US since 2002. We can observe that Value had a strong performance from 2002 to 2006 and muted returns thereafter. Interestingly Growth and Quality have been highly correlated over the last 10 years and investors might be cautious of loading up on similar factor exposure (read Factors: Correlation Check).

Source: FactorResearch

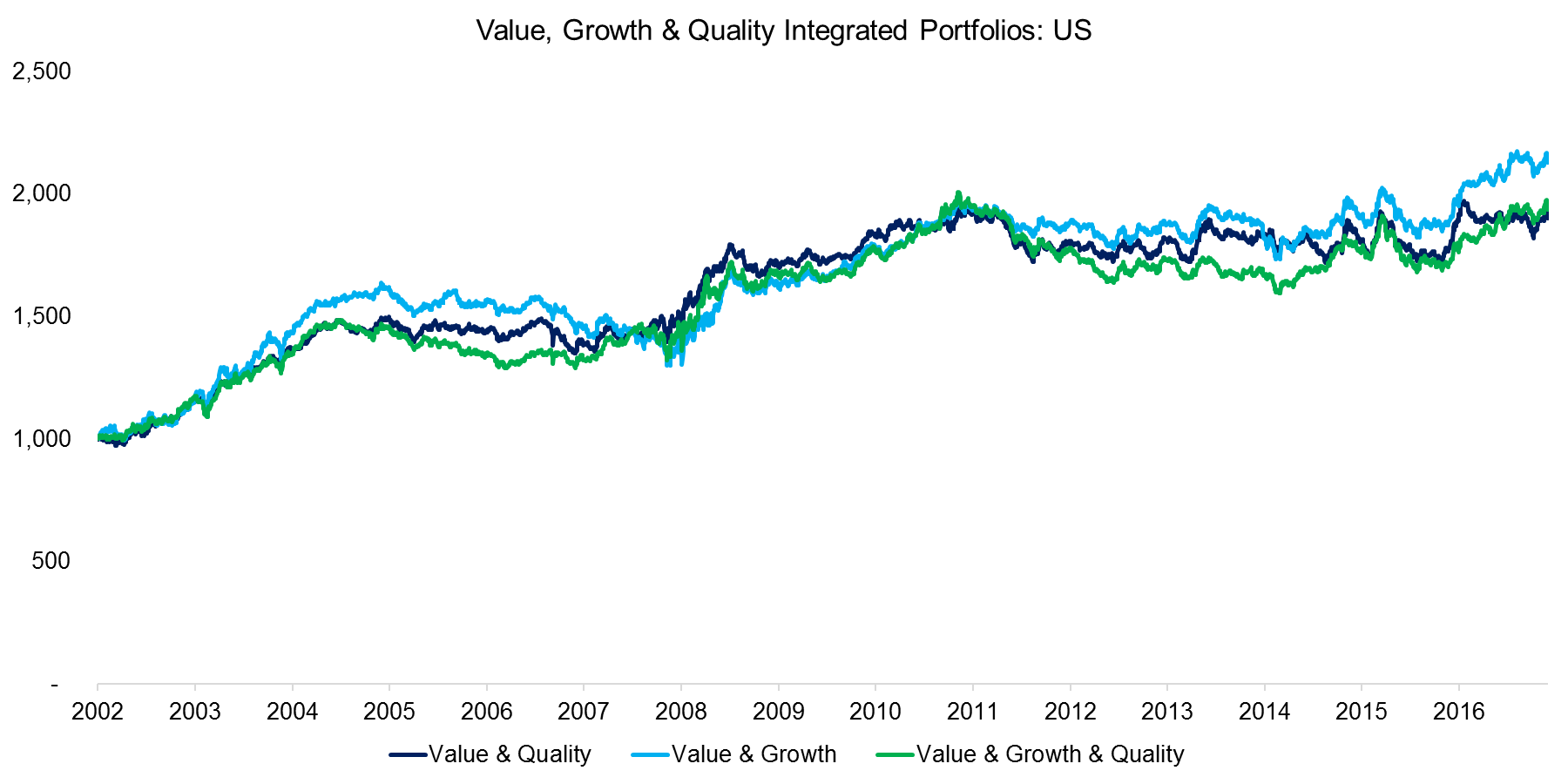

The next chart shows the performance of the three integrated portfolios that were created by sorting stocks for multiple characteristics (read Value+Quality or High Quality Value Stocks). Given that Quality and Growth in the US were highly correlated, it’s not surprising that the integrated portfolios look almost identical. The performance of the integrated portfolios is much more consistent than that of the single factors and would have nicely offset the significant drawdown of Value in 2008. However, the overall returns over the last 10 years are not particular attractive. An alternative methodology would have been combining the single factors into a multi-factor portfolio, which would likely have resulted in a similar profile.

Source: FactorResearch

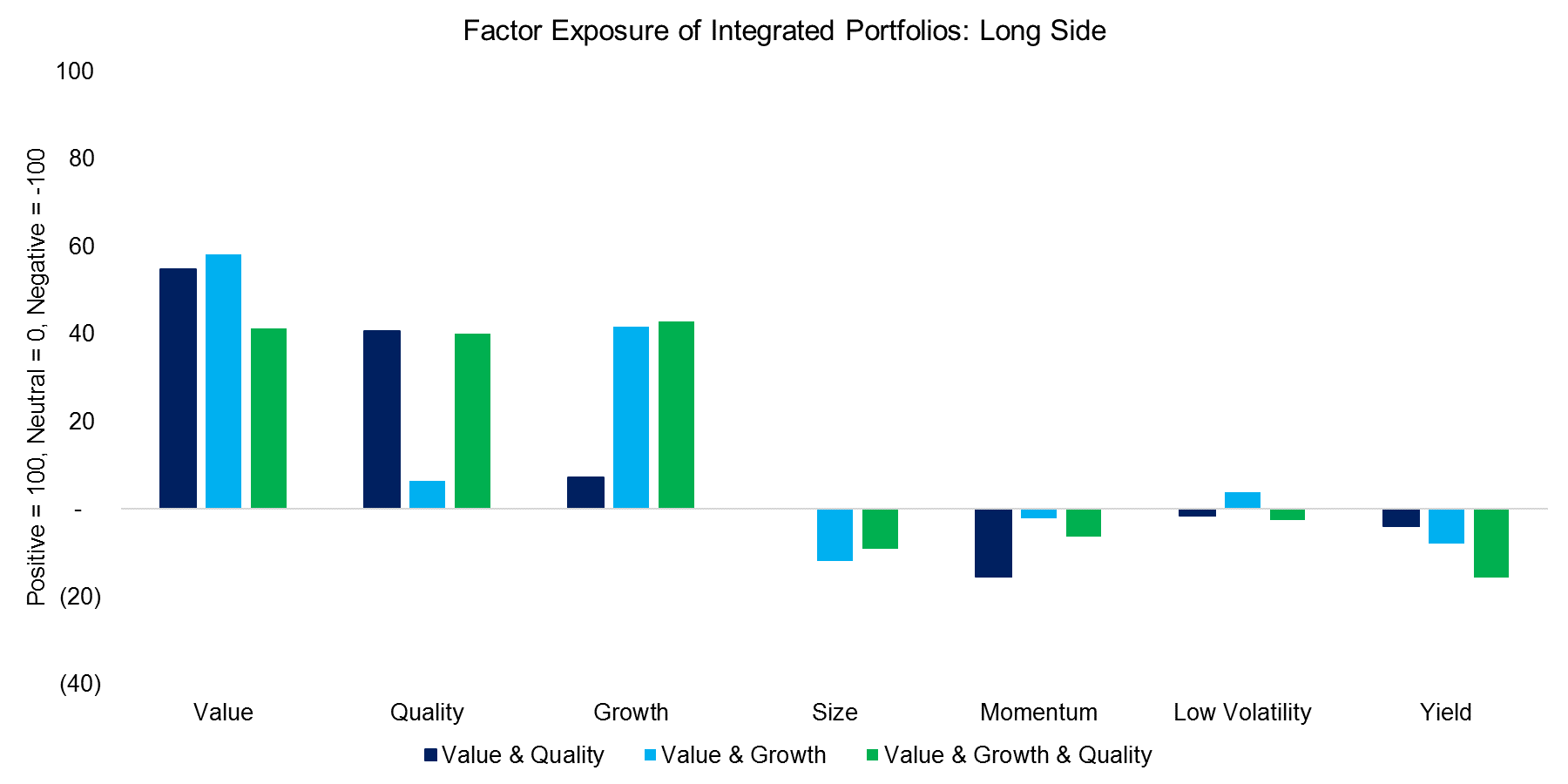

Before we move on to other regions it’s interesting to analyse the integrated portfolios. The analysis below shows factor exposures of the long positions of the three portfolios, where we can observe that none of these have significant exposure to Size, Momentum, Low Volatility, or Dividend Yield. Somewhat unexpectedly the Value & Quality portfolio has no exposure to Growth, meaning cheap and high quality stocks are companies with average sales and earnings growth, and the Value & Growth portfolio no exposure to Quality.

Source: FactorResearch

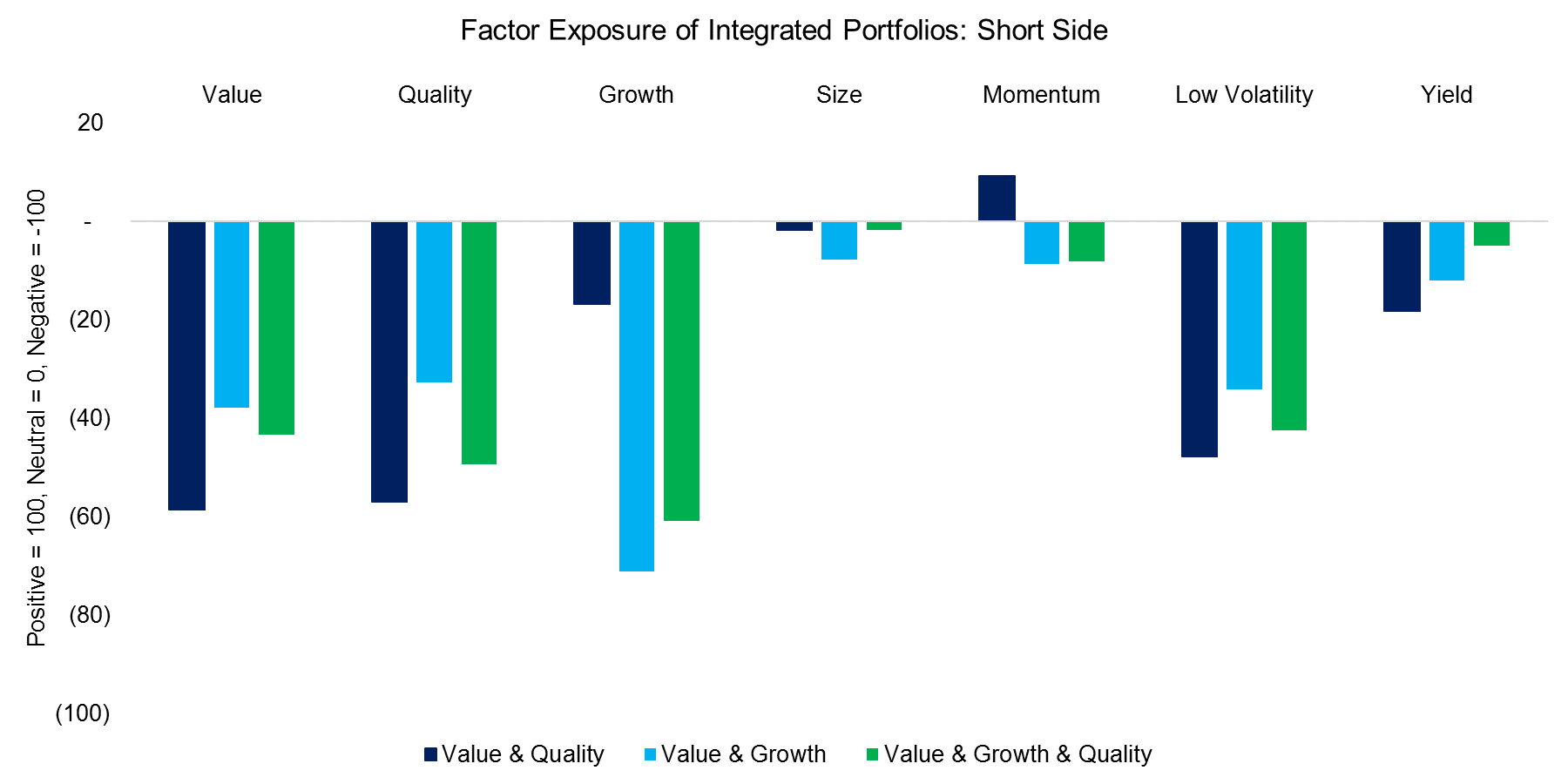

The short portfolios show a slightly different picture: the integrated Value & Quality portfolio has no significant negative Growth exposure, but the Value & Growth portfolio shows significant negative Quality exposure, meaning that expensive and slow growing companies are also low quality stocks. The analysis also shows that all three portfolios have negative exposure to Low Volatility, implying that the stocks are highly volatile.

Source: FactorResearch

VALUE, QUALITY & GROWTH INTEGRATED PORTFOLIOS IN EUROPE

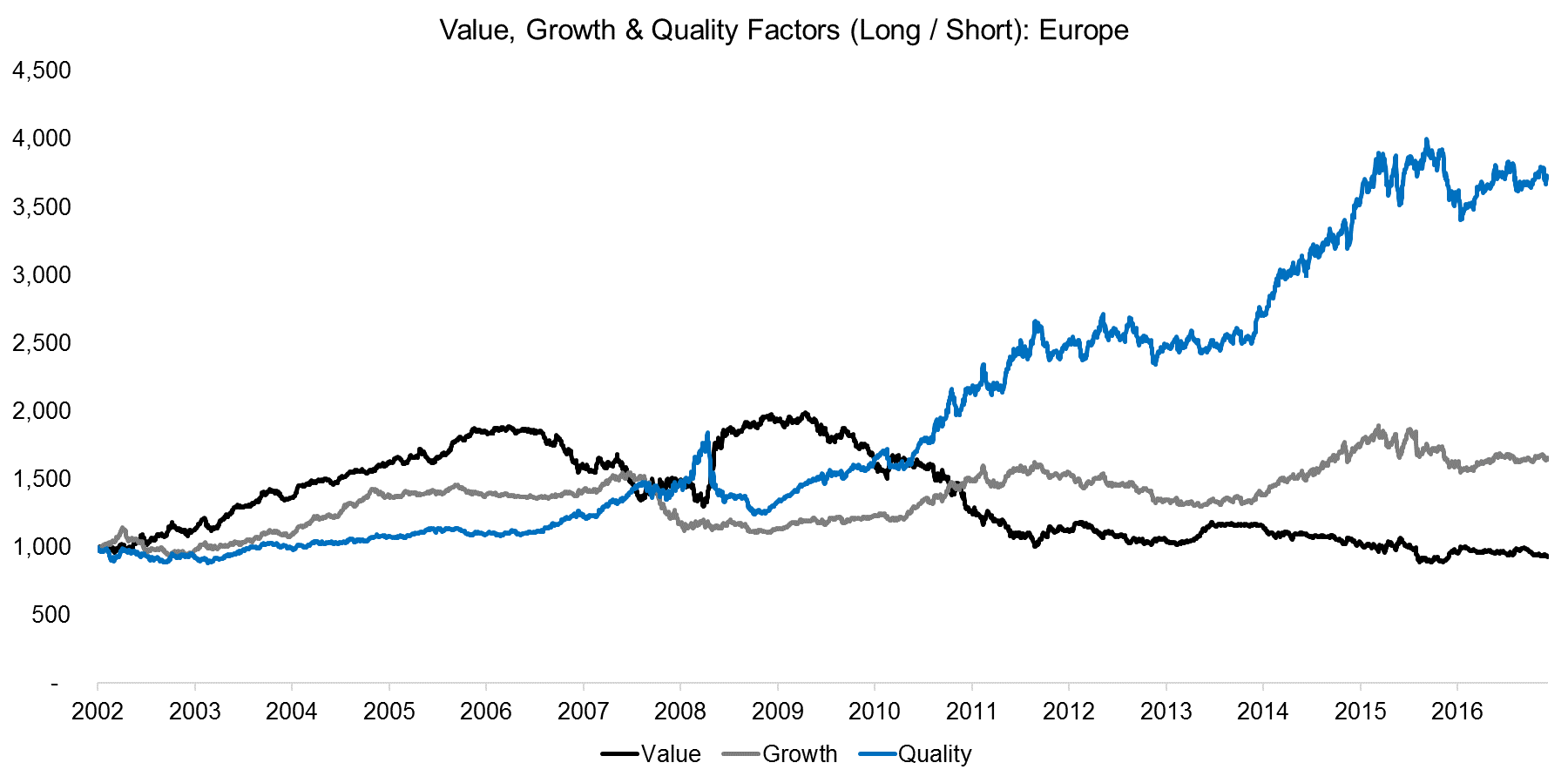

In Europe we can observe that the Quality factor has done exceptionally well since 2002, compared to a flat performance for Growth and negative returns for Value. The considerable amount of political and economic uncertainties over recent years has likely been driving the strong performance of Quality stocks in Europe.

Source: FactorResearch

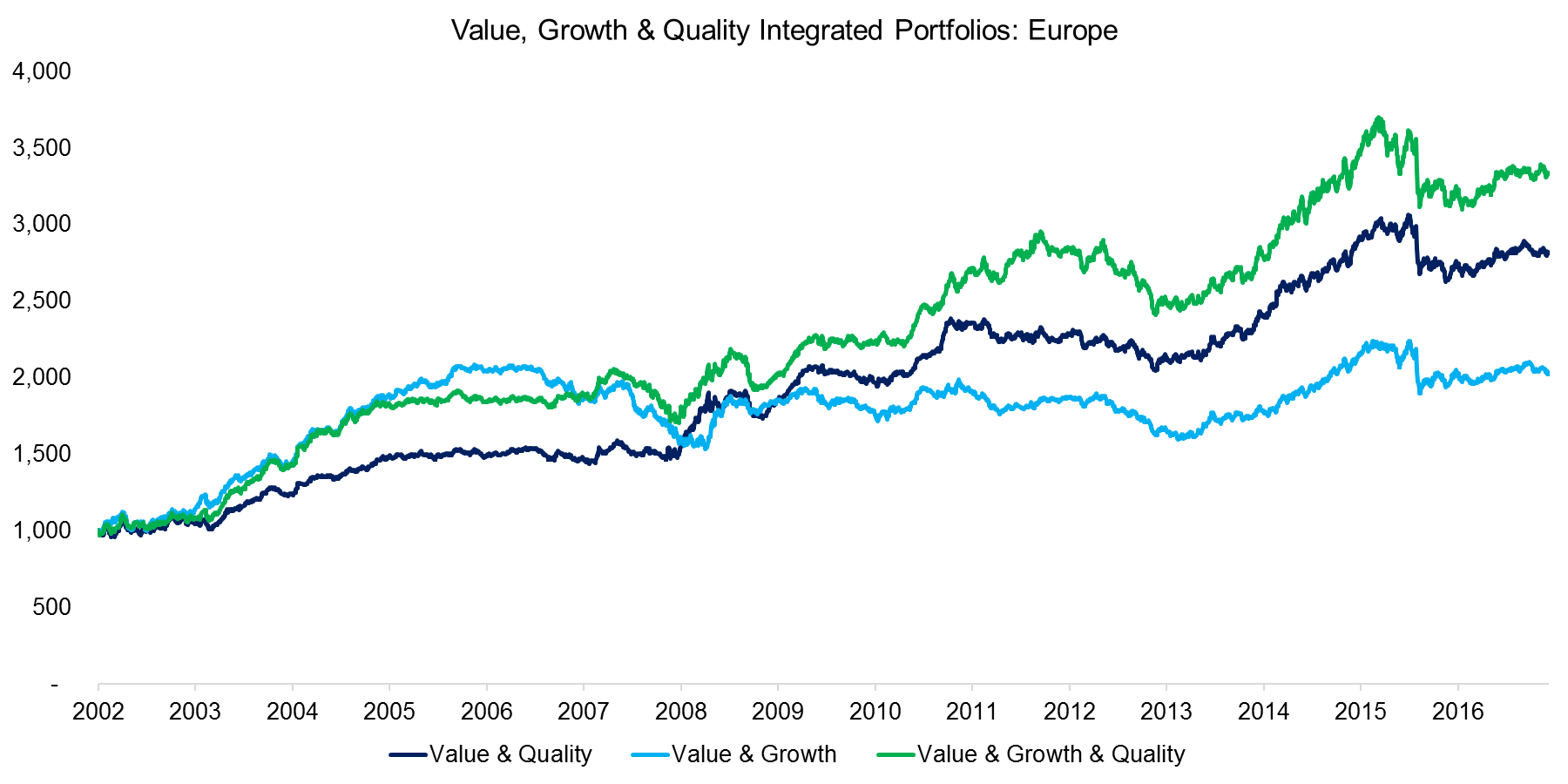

Similar to the US we can observe a much more steady performance of the integrated portfolios compared to the single factors, which is to be expected given diversification benefits. However, we can also see a much larger difference between the three portfolios compared to the US. Given the difficult nature of factor timing, investors might be better off sorting stocks on several characteristics versus having significant exposure to a single factor.

Source: FactorResearch

VALUE, GROWTH & QUALITY INTEGRATED PORTFOLIOS IN JAPAN

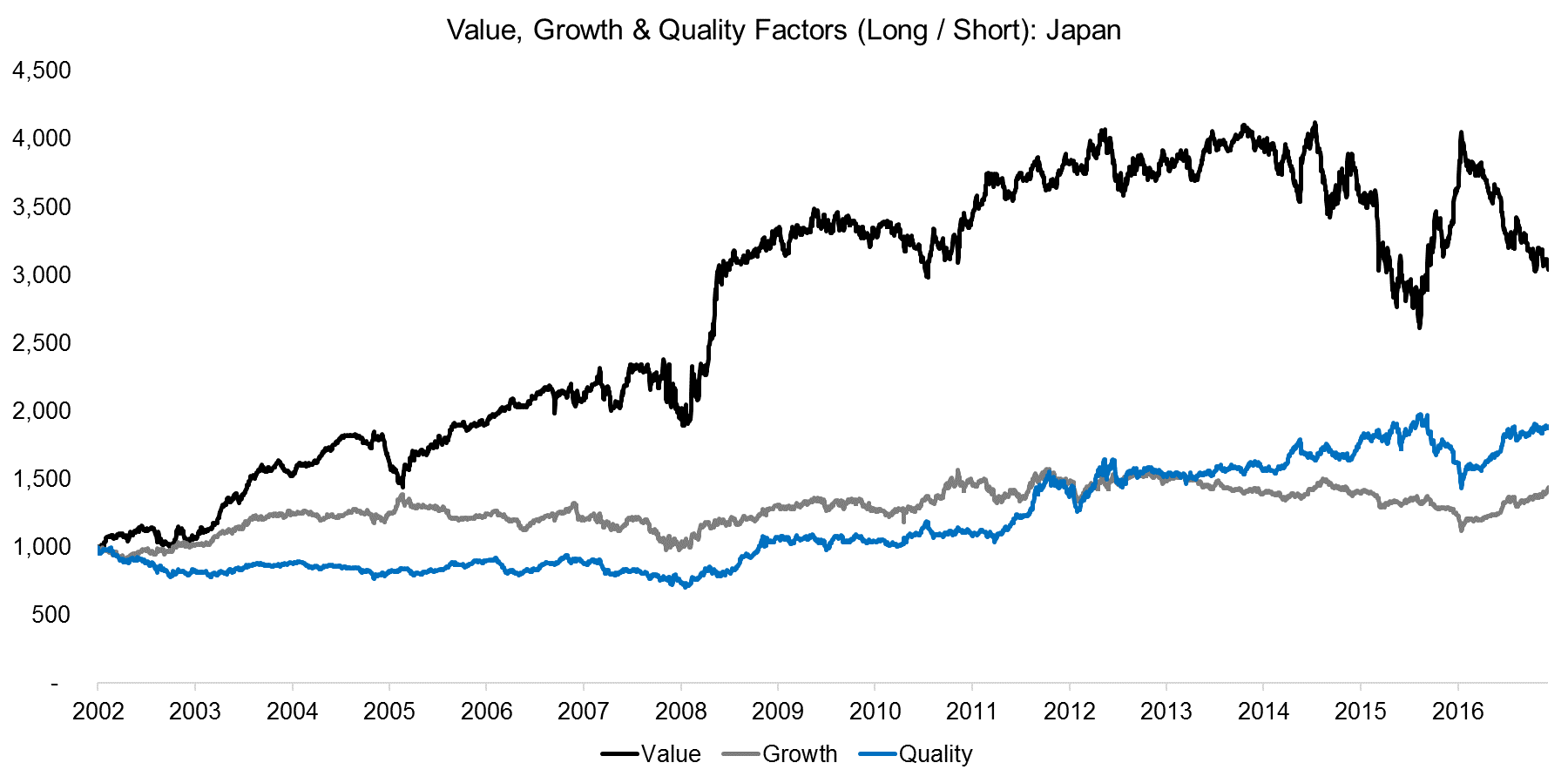

The Value factor has generated attractive returns in Japan, albeit with high volatility and two significant drawdowns in the last few years. Growth and Quality have essentially been flat since 2002, which is interesting given the slow economic growth of the country. Market participants might have expected investors to seek out companies with high profit margins and attractive sales and earnings growth, resulting in strong factor performance, but the results show otherwise.

Source: FactorResearch

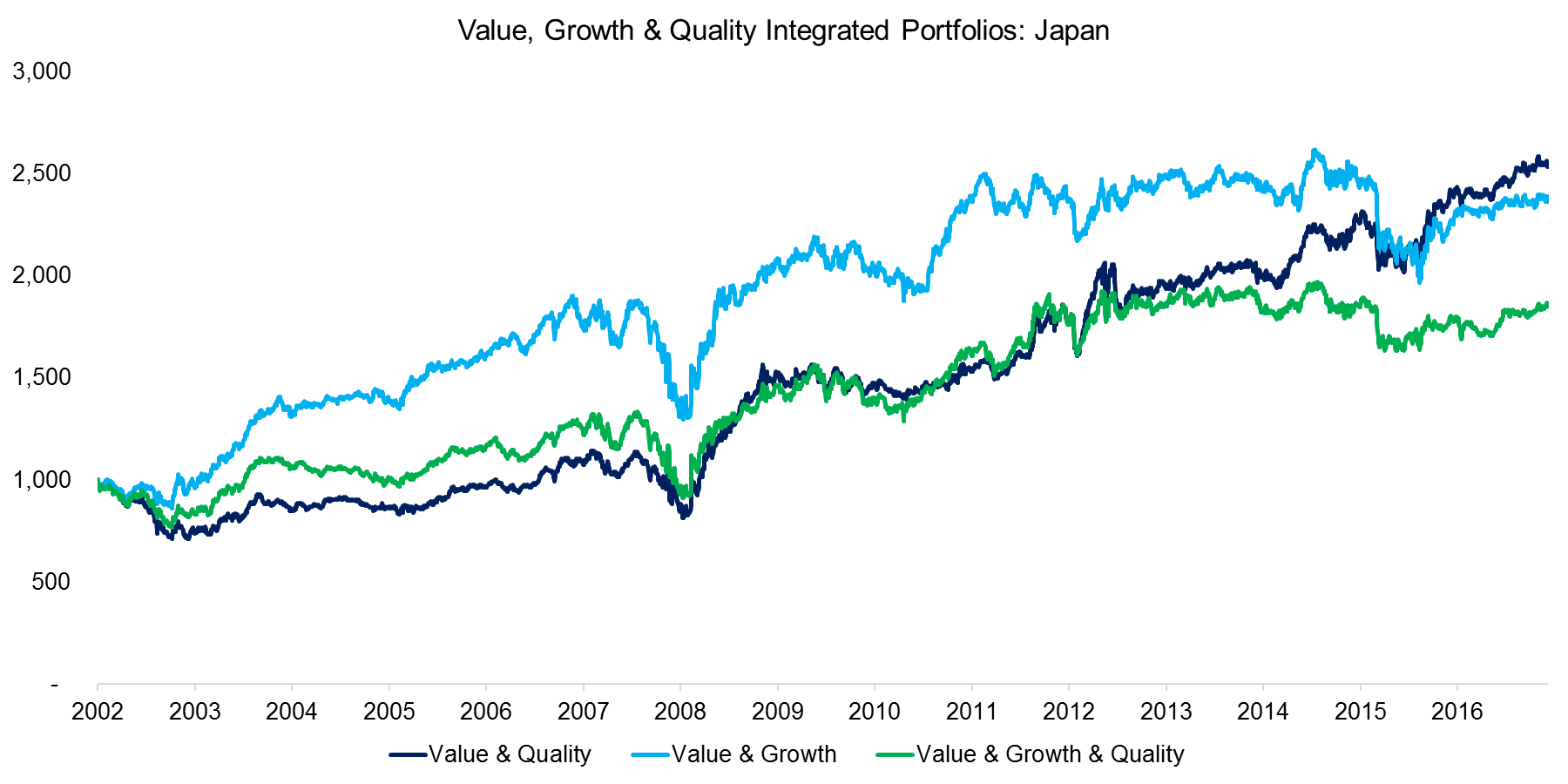

Similar to the US and Europe we can observe a more steady performance from the integrated portfolios. It’s worth highlighting that all three portfolios suffered significant drawdowns during the Global Financial Crisis in 2008, where investors might have expected Growth and Quality stocks to outperform and mitigate the drawdowns from Value. It seems that Growth and Quality stocks in Japan behave differently compared to the other regions.

Source: FactorResearch

FURTHER THOUGHTS

This short research note highlights that integrated portfolios that rank stocks on multiple characteristics show a fairly consistent performance. This approach somewhat mitigates the issue of factor timing; however, the issue of factor selection remains as only few factors show structural positive returns.

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.