Investing & Unintended Consequences

Long gold stocks = long bonds, long banks = short bonds?

March 2023 Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Simple equity ETFs often have exposures to other asset classes

- Gold stocks are bond proxies & growth stocks are short commodities

- Investors may have unintended bets in their portfolios

INTRODUCTION

ETFs used to be like surgical instruments. StateStreet’s SPY tracks the stocks of the S&P 500, iShares’ AGG the universe of US investment-grade bonds, and so on. Investors knew exactly what they were getting to create simple and precise portfolios.

However, as the ETF universe exploded with products for every imaginable niche, the risk exposures have become less clear. For example, the ARKK Innovation ETF (ARKK), which represents a concentrated portfolio of growth stocks, has a beta of 1.7 to equities, 0.6 to bonds, and -0.5 to the US Dollar index. Stated differently, the ETF provides leveraged exposure to the US stock market, positive exposure to US bonds, and is short the USD. It is doubtful that investors are aware of getting such a hodgepodge of asset class exposures when allocating to this growth-oriented product (read Growth ETFs: Performance & Factor Exposures).

In this research article, we will explore some of the unintended risk exposure of equity ETFs.

ETFS WITH THE HIGHEST & LOWEST BETAS TO EQUITIES

We define our universe as all ETFs traded in the US that are classified as equity or alternative ETFs. We exclude bond, short, and leveraged products and require a five-year track record, which reduces the number of ETFs to approximately 1,000. We then run a regression for each of these ETFs using US equities, US investment-grade bonds, commodities, and the US Dollar (USD) index as independent variables.

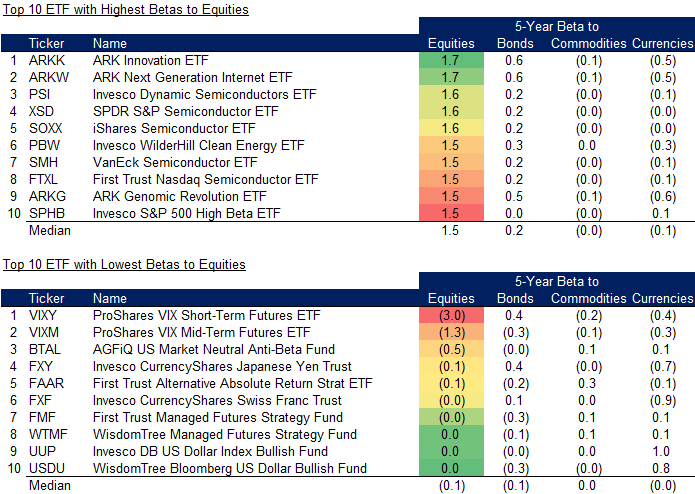

First, we rank the universe of ETFs and select the top and bottom 10 ETFs based on their factor betas from the regression analysis. We observe that the ETFs with the highest betas to equities are primarily thematic and sector products. Five out of ten provide exposure to the semiconductor industry, which has outperformed the S&P 500 significantly since 2020 given the reduced supply of chips due to COVID-19-related production issues.

The median beta to equities of the top 10 ETFs is 1.5, compared to only -0.1 for the bottom 10. There are only two products that provide meaningful negative betas to stocks and both are VIX proxies. Given that volatility tends to rise when stocks fall, these can be considered as short positions on the stock market. The other ETFs are currencies and managed futures products (read Smart Beta & Factor Correlations to the S&P 500).

Source: Finominal

ETFS WITH THE HIGHEST & LOWEST BETAS TO BONDS

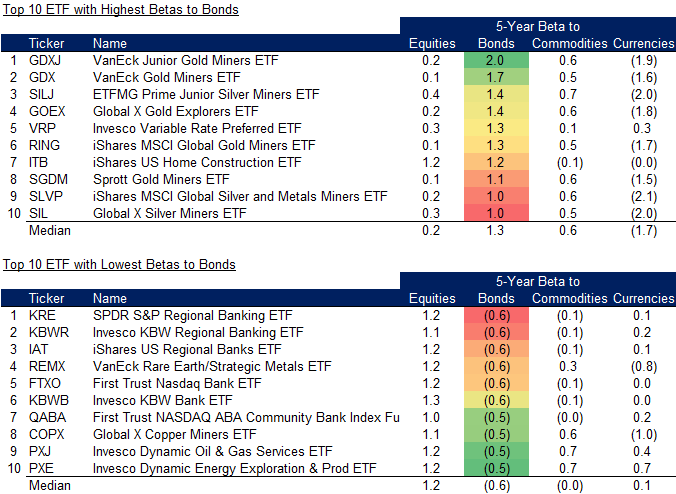

Next, we review the 10 ETFs with the highest and lowest betas to US investment-grade bonds. Given that we only considered equity ETFs, no traditional fixed-income ETFs are highlighted. Somewhat surprisingly, gold and silver miner ETFs dominate this list. The correlation between US investment-grade bonds and gold has been moderately positive at 0.4 over the last five years, which can perhaps be attributed to investors switching to gold when interest rates are declining as that indicates economic decline and a search for safe-haven assets.

The ETFs with the most negative beta to bonds were primarily regional banks, which can be explained by these benefitting from rising interest rates (read Equity & Bond Correlations – Higher than Assumed?). We also observe three commodity ETFs.

Source: Finominal

ETFS WITH THE HIGHEST & LOWEST BETAS TO COMMODITIES

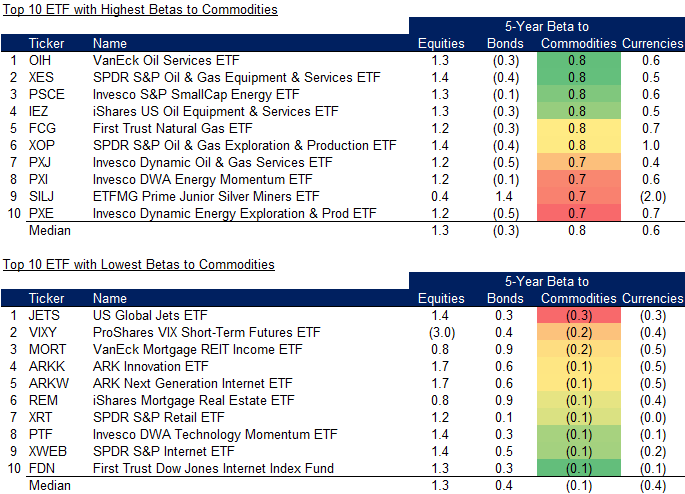

Post equities and bonds, we will analyze the 10 ETFs with the highest and lowest betas to commodities. There is no large surprise here as the top 10 ETFs are all commodity-focused, specifically on oil and gas.

The bottom 10 ETFs do not feature particularly negative betas with a median of -0.1, but most ETFs are thematic ones that offer exposure to the technology sector. Recalling that some of these ETFs have the highest betas to equities, highlights some cross-asset relationships.

Source: Finominal

ETFS WITH THE HIGHEST & LOWEST BETAS TO CURRENCIES

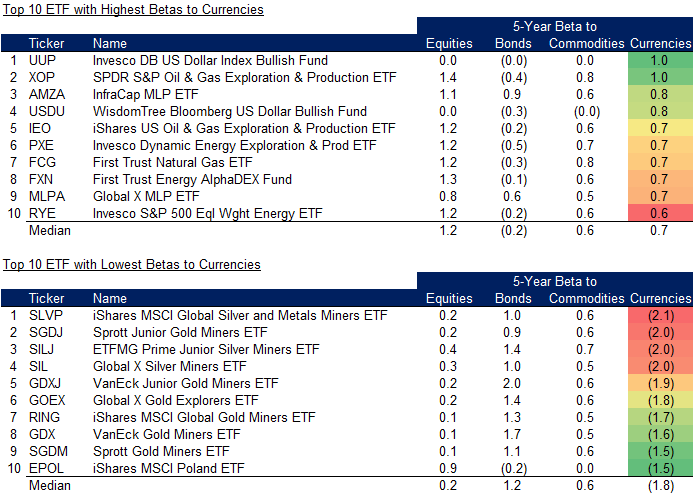

Finally, the top 10 ETFs with the highest beta to the USD index are mainly currency as well as oil and gas proxies. The bottom 10 ETFs with the lowest betas provide exposure to gold and silver, except for one ETF that represents the MSCI Poland. There are more country ETFs thereafter, so these seem to be negatively impacted by a high USD, likely due to their export-oriented economies.

Source: Finominal

FURTHER THOUGHTS

Aggregating these results indicate the following current relationships:

- Long equities = long growth stocks

- Long bonds = long gold & silver miners, short bonds = long regional banks, long oil & gas

- Long commodities = long oil & gas, short commodities = long growth stocks

- Long USD = long oil & gas, short USD = long gold & silver miners

We can simplify this to long equities = short commodities, long bonds = short USD, short bonds = long commodities, and long commodities = long USD. This can be further reduced to long equities & bonds = short commodities & USD.

Perhaps this is not surprising as the strong USD can be explained by higher rates in the US due to higher inflation from commodities and other factors, which has been negative for equities and bonds.

These relationships are not necessarily structural and explaining them is often challenging, but critical for investors is to measure and understand them as they impact the returns and risk of portfolios. If you don’t measure it, you can’t manage it, as they say.

RELATED RESEARCH

Equity & Bond Correlations – Higher than Assumed?

Factor Exposure Analysis 106: Macro Variables

Risk Parity & Rising Rates

Myth-Busting: Low Rates Don’t Justify High Valuations

Value, Momentum & Carry Across Asset Classes

Trend Following & Factor Investing – Unexpected Cousins?

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.