Is it Profitable to Invest in Profitable Firms?

Comparing stocks with positive versus negative earnings.

February 2025. Reading Time: 10 Minutes. Author: Abhik Roy, CFA.

SUMMARY

- The profitability of U.S. stocks has declined over the last two decades

- The number of unprofitable companies has increased

- Profitability is a complex stock selection metric on a stand-alone basis

INTRODUCTION

Investing is often seen as both an art and a science. While there are no absolute laws like gravity, certain time-tested principles—such as value investing—have proven effective over the long run. Another common strategy is focusing on high-quality stocks, particularly those with strong earnings. While definitions of “quality earnings” may vary, many investors start by avoiding unprofitable companies.

However, history tells a different story. Take Tesla, for example – it remained unprofitable until 2020 but consistently outperformed the S&P 500 for years. Similarly, companies like Palantir and Peloton delivered astonishing returns of over 50% in 2020, despite not being profitable (read Picking Profitable Companies Can Be Unprofitable).

In this research article, we will explore the prevalence of unprofitable companies in the U.S. market and their impact on overall index performance.

OVERALL PROFITABILITY IN U.S.

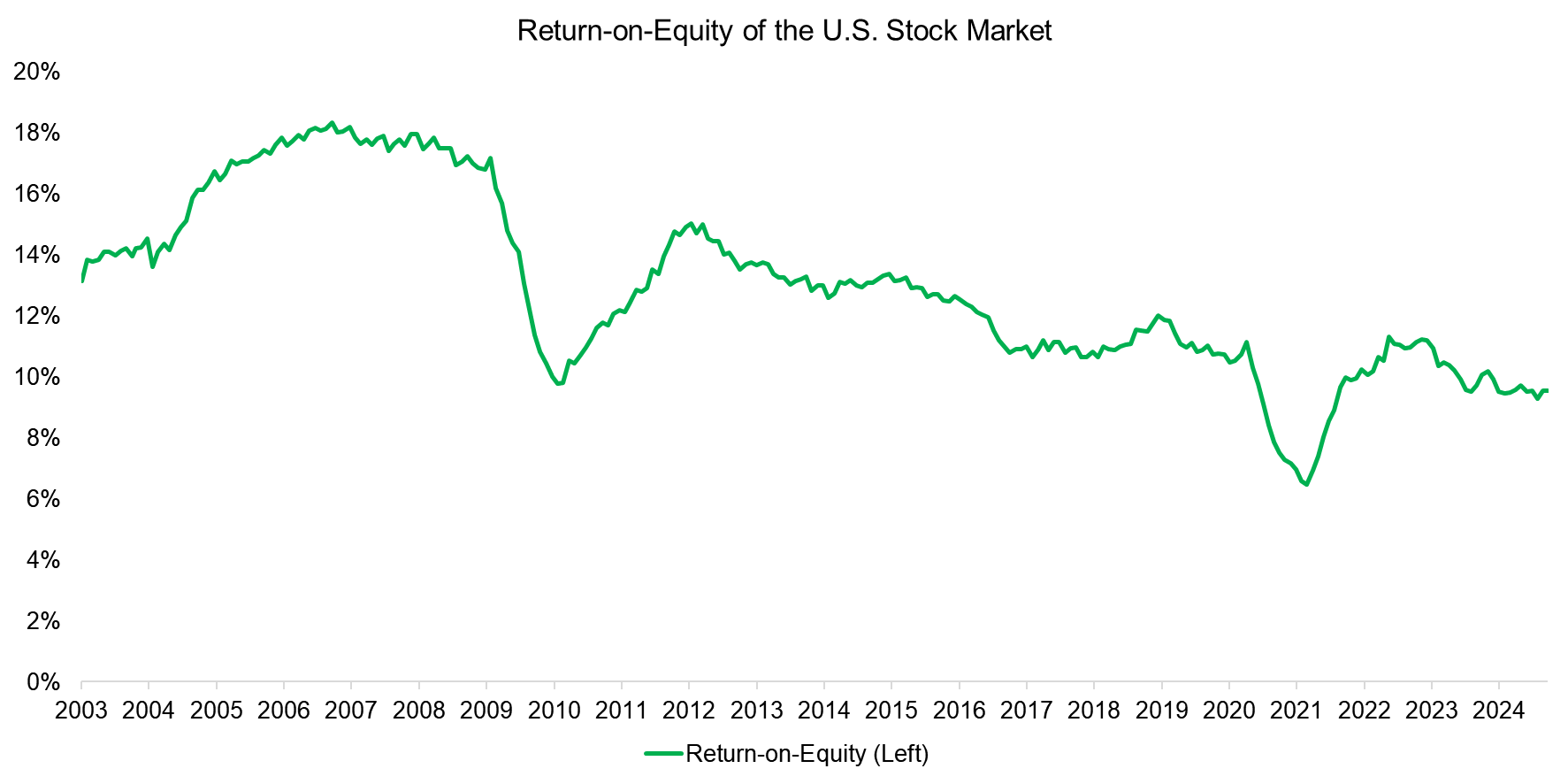

We start by examining one of the most widely used metrics for assessing quality – return on equity (ROE) in the U.S. – by analyzing median values over time. The data reveals a clear trend: the profitability of U.S. stocks has been steadily declining over the past two decades.

Source: Finominal

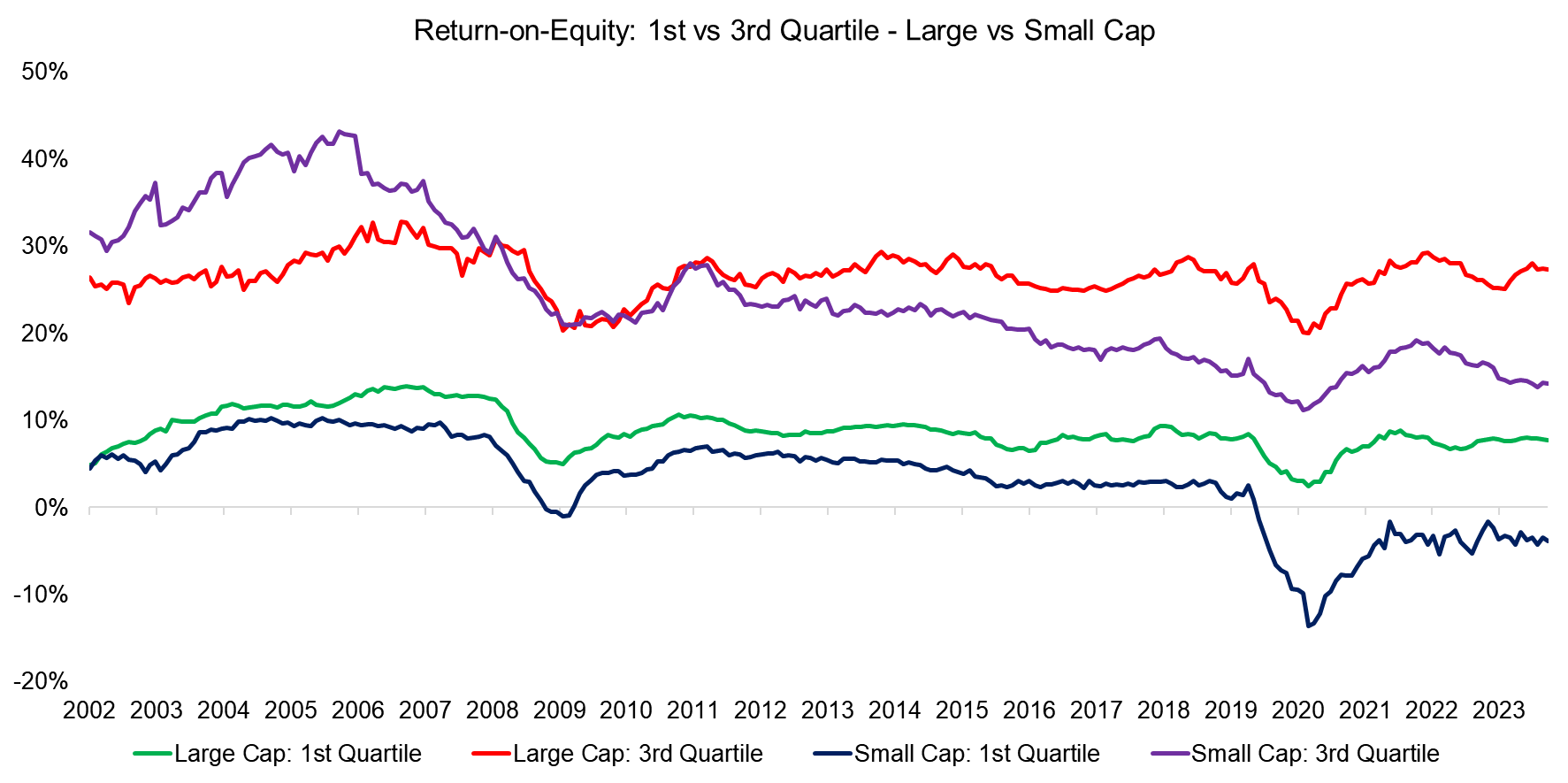

Next, we analyze profitability across large-cap and small-cap market segments. We classify companies with a market capitalization above $10 billion as large-cap, while those between $1 billion and $7 billion fall into the small-cap category. To illustrate this, we plot the first and third quartiles of ROE. As expected, large-cap companies generally exhibit higher profitability than small-caps. However, an interesting trend emerges – the decline in ROE is more pronounced among small-cap firms.

Source: Finominal

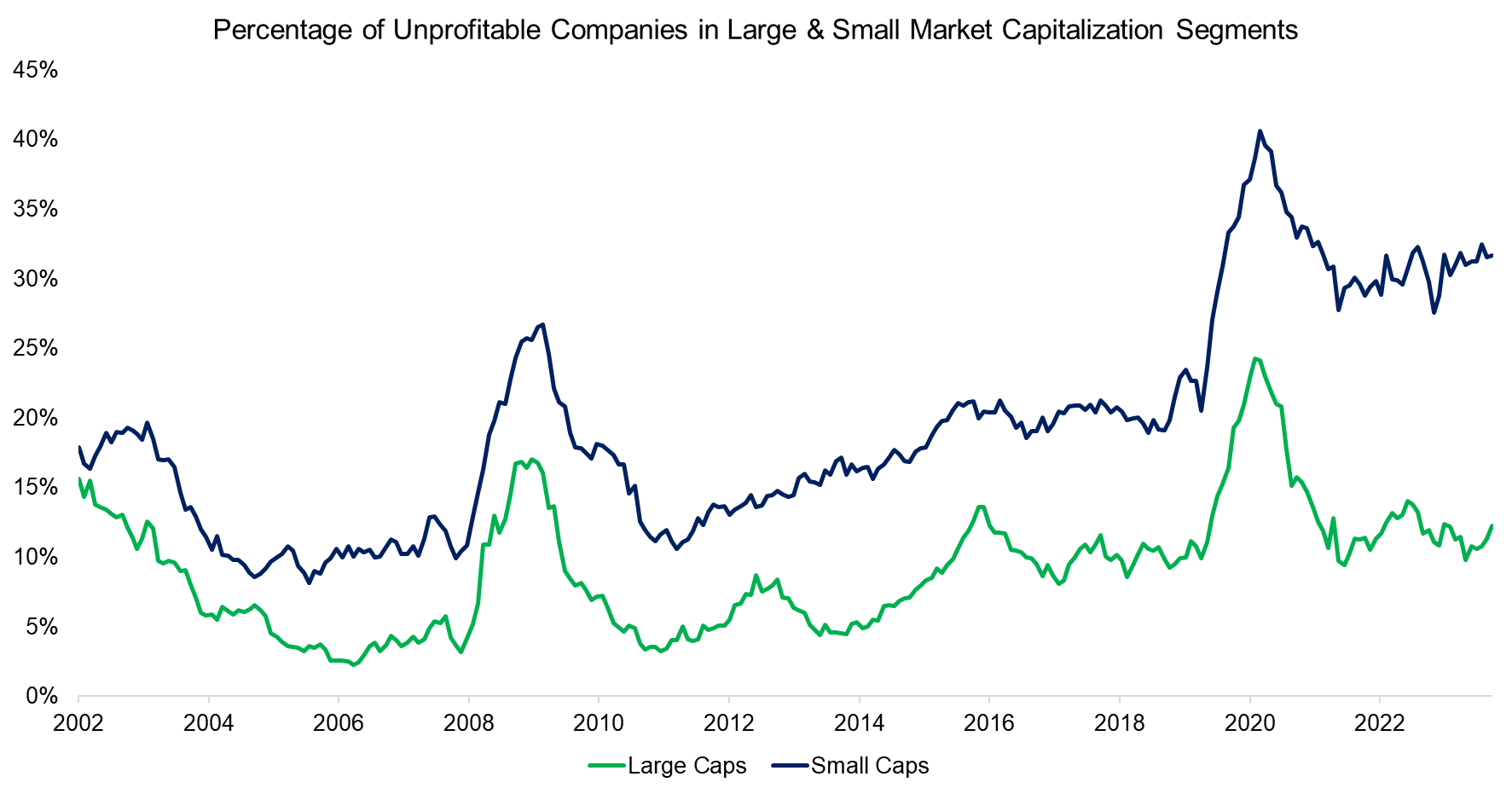

Next, we examine the distribution of unprofitable companies across large-cap and small-cap market segments. A company is classified as unprofitable if it has reported negative earnings at any point in the past 12 months.

Our analysis reveals that the proportion of unprofitable companies is consistently higher in the small-cap segment compared to large-caps. This aligns with expectations, as achieving a high market capitalization typically requires sustained profitability. Additionally, there is a clear upward trend in the percentage of unprofitable companies, indicating that an increasing number of firms are being listed without positive earnings.

Source: Finominal

SECTOR BREAKDOWN

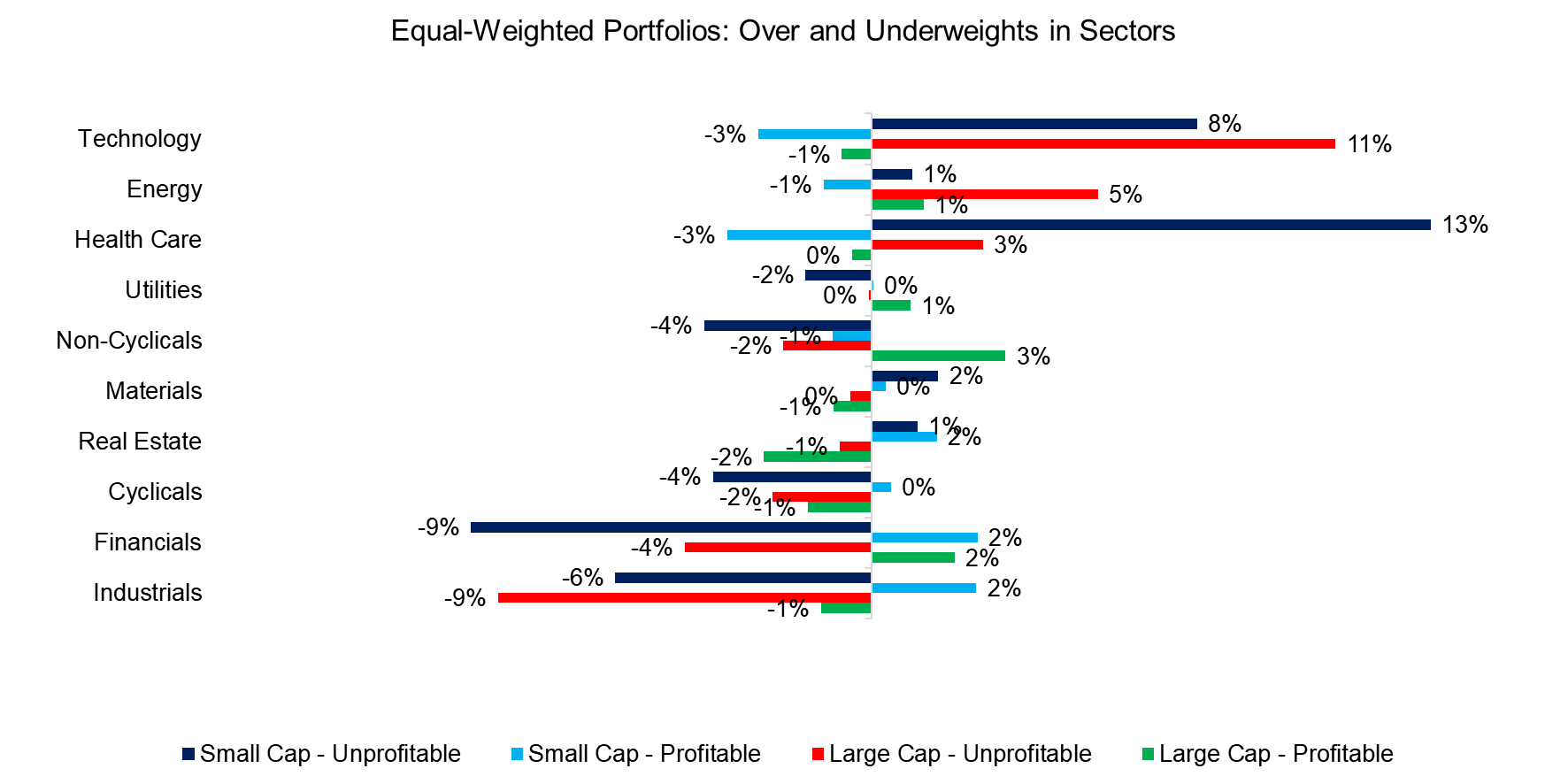

Next, we construct equal-weighted portfolios to assess the sector overweights and underweights within the large-cap and small-cap segments. Each market segment is divided into two portfolios: one consisting of profitable companies and the other of unprofitable ones.

Our analysis reveals a significant overweight in technology stocks among unprofitable large-cap companies, while unprofitable small-cap companies show a notable overweight in healthcare stocks. This trend reflects the tendency for technology and biotech firms to be overvalued due to expectations of future growth. On the other hand, we observe an underweight in financial and industrial stocks across both market segments, as these sectors tend to be less focused on growth and more reliant on stable, recurring cash flows for long-term sustainability.

Source: Finominal

PERFORMANCE

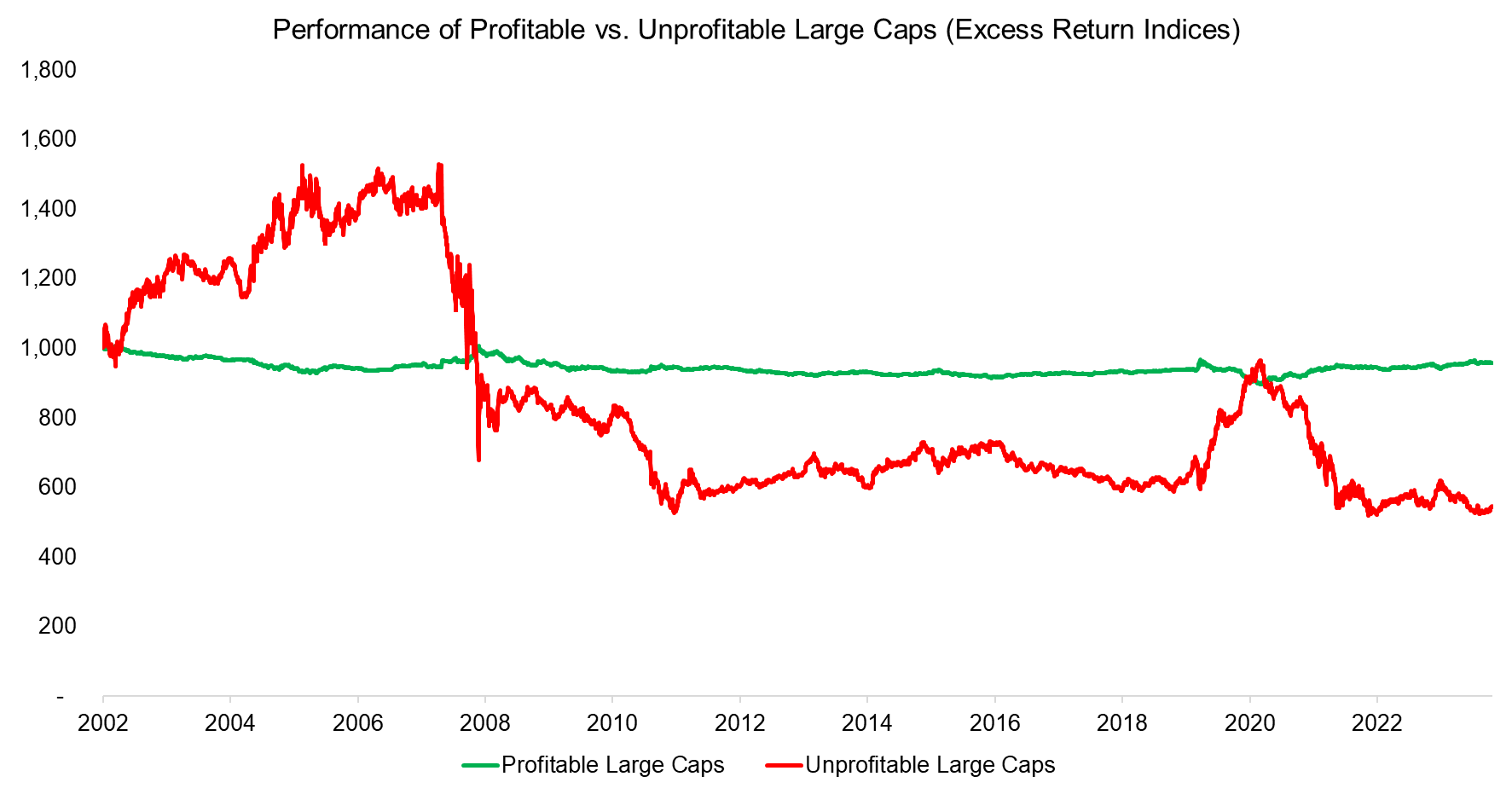

We now shift our focus to analyzing performance by constructing market-cap weighted portfolios of profitable and unprofitable companies. To do this, we create excess return indices by tracking the excess return of each portfolio relative to its respective market index.

While we don’t observe excess returns in the large-cap segment by simply excluding companies with negative earnings, i.e. focusing only on profitable stocks, we find that a portfolio consisting of unprofitable companies would have significantly underperformed the benchmark.

Source: Finominal

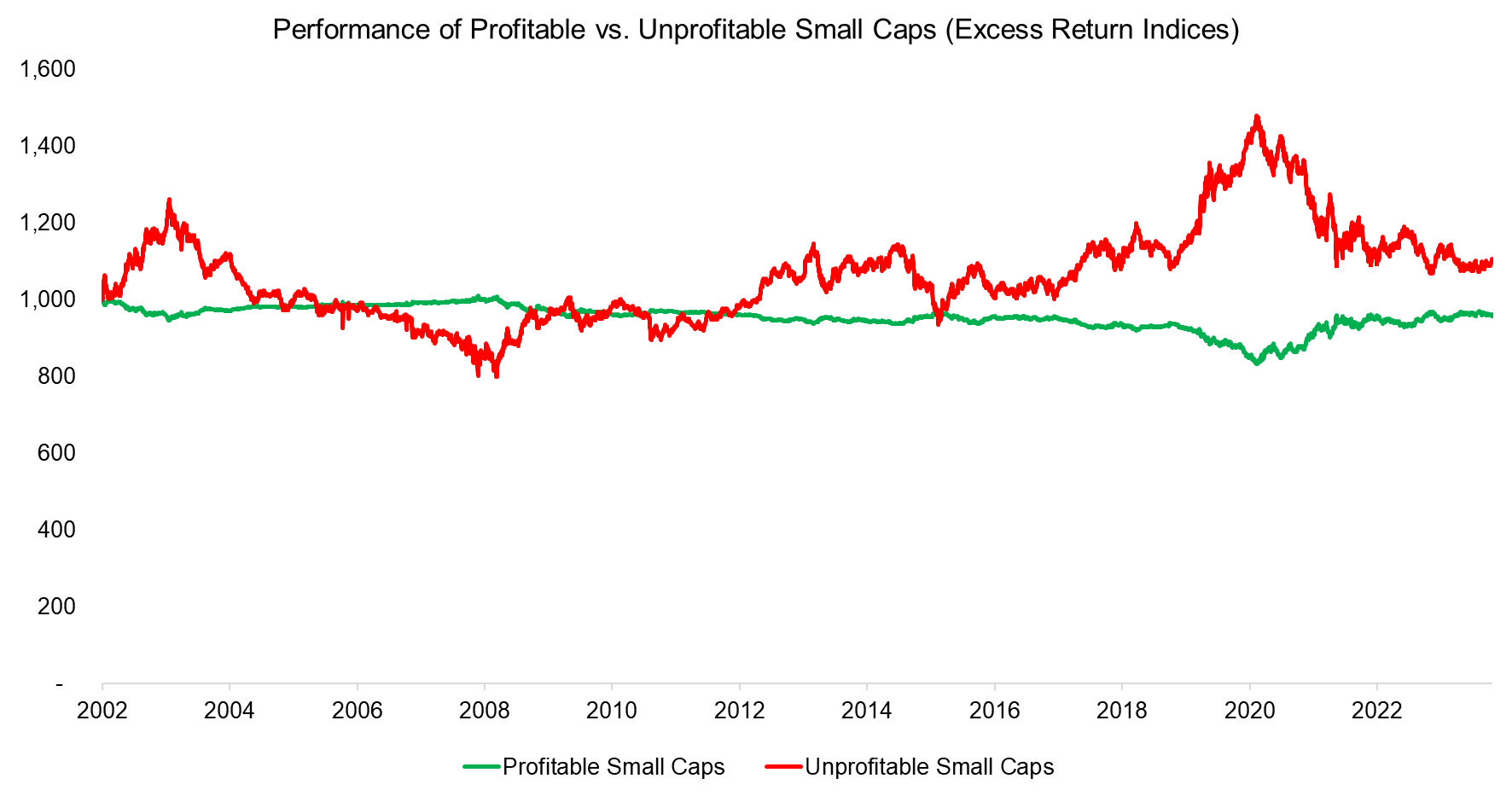

However, the situation is different for small-cap companies. In previous research, we observed that a highly concentrated portfolio of profitable small-cap companies tend to outperform (read Quality in Small versus Large-Cap Stocks), but merely excluding unprofitable firms is not sufficient to beat the small-cap index.

In fact, a portfolio of unprofitable small-cap companies actually outperformed the market during our backtesting period. Therefore, more stringent quality filters must be applied in the small-cap segment to build a portfolio that consistently outperforms.

Source: Finominal

FURTHER THOUGHTS

Value stocks typically represent struggling companies, making them difficult to hold for investors. These companies often suffer from poor management, lack of a solid corporate strategy, operating in declining industries, have excessive leverage, feature low or negative margins, and other issues. However, as market expectations tend to be overly pessimisticas, value investing can yield excess returns over time.

Given this reasoning, it’s surprising that many investors still believe that focusing solely on stocks with high profitability, which are not difficult to hold at all, will also lead to outperformance.

RELATED RESEARCH

Quality in Small versus Large-Cap Stocks

Profitability & Leverage of U.S. Sectors

Does Financial Leverage Make Stocks Riskier? Part II

Does Financial Leverage Make Stocks Riskier?

The Rise of Zombie Stocks

Building a Stock Portfolio for a Debt-Averse World

Picking Profitable Companies Can Be Unprofitable

Oh, Quality, Where Art Thou?

ABOUT THE AUTHOR

Abhik Roy, CFA is a Quantitative Researcher at Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Abhik holds a Masters in Economics and Bachelors in Engineering from BITS Pilani. Previously he worked at Kristal.AI, a Singapore based fintech firm as a Quantitative Analyst.

Connect with me on LinkedIn.