Liquidity & Factor Performance

How Do Minimum Liquidity Requirements Impact Factor Returns?

January 2020. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Most institutional investors can only trade the largest, most liquid stocks

- Introducing minimum liquidity requirements impacts factors differently

- Factor portfolio construction with liquidity constraints is especially challenging in small stock markets

INTRODUCTION

Index funds have breached $11 trillion assets under management in late 2019 to the detriment of active managers according to data from Morningstar. As passive investing has increased in popularity, critical voices have become louder and various accusations have been made. Some of them have merit, most do not.

However, there is little debate on attributing the shift in trading to the closing auction when ETFs create new and cancel units for establishing the daily net asset values. Data from the French regulator AMF shows that the amount of shares traded in the closing auction has been increasing significantly in recent years and reached 44% in Madrid, 40% in London, 39% in Paris, and 36% in Frankfurt as of 2019. In contrast, less than 15% of the daily volume is traded in the closing auction at NYSE ARCA, partially because the ETF pricing mechanics are different in the US compared to Europe.

Liquidity attracts liquidity and investors focused on trading intraday will be negatively impacted by this development. However, most investment strategies do not require frequent rebalancing, where participating in the closing auction poses less of a risk.

A larger risk for investment strategies is that as they are successful and gather further assets under management they need to restrict the universe of stocks by focusing exclusively on highly liquid securities. It is questionable if the same returns can be generated when avoiding less liquid stocks. For example, factor investing is frequently challenged as being overly reliant on stocks with small capitalization that are not suitable for institutional investors.

In this short research note, we will explore imposing minimum liquidity requirements for the Value and Momentum factors.

METHODOLOGY

We focus on the Value and Momentum factors in the US and Hong Kong stock markets. The factor performance is calculated by constructing long-short beta-neutral portfolios, which are rebalanced monthly and include 10 basis points for each transaction. Value stocks are selected on a combination of price-to-book and price-to-earnings multiples and Momentum stocks based on their last 12-month performance, excluding the most recent month.

LIQUIDITY & FACTOR PERFORMANCE IN THE US STOCK MARKET

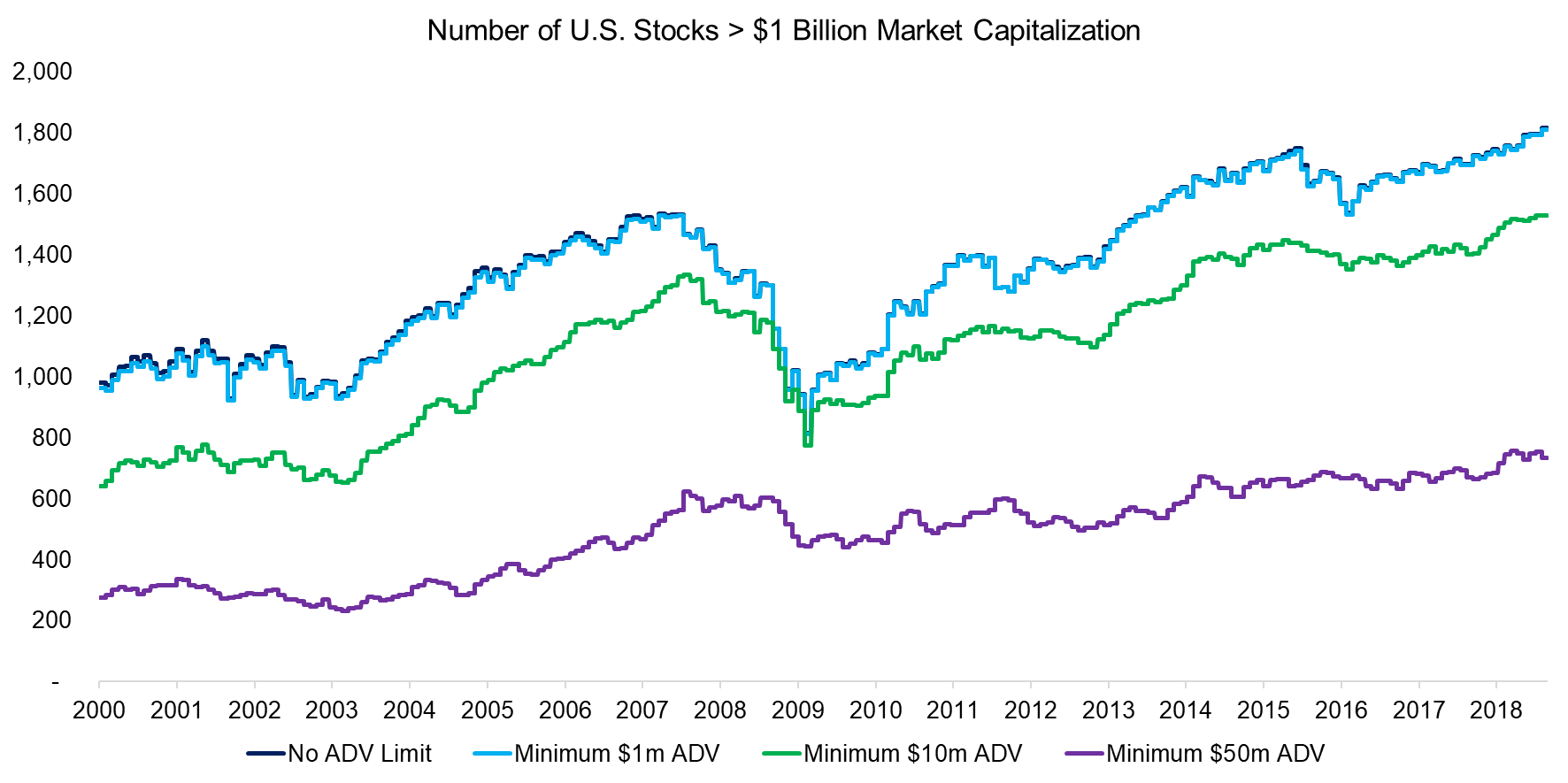

Investors typically consider two characteristics when evaluating the liquidity of stocks, which are market capitalization and the average daily value traded (ADV). As of the end of 2018, there were approximately 1600 stocks in the US with a market capitalization larger than $1 billion, most of which featured ADVs above $1 million.

However, an ADV of $1 million is still relatively low for most institutional investors, fortunately, a $10 million ADV minimum reduces the number of stocks only by 15% and leaves a sufficiently large universe for stock selection. Imposing a $50 million ADV requirement results in a significantly more constrained universe.

Source: FactorResearch.

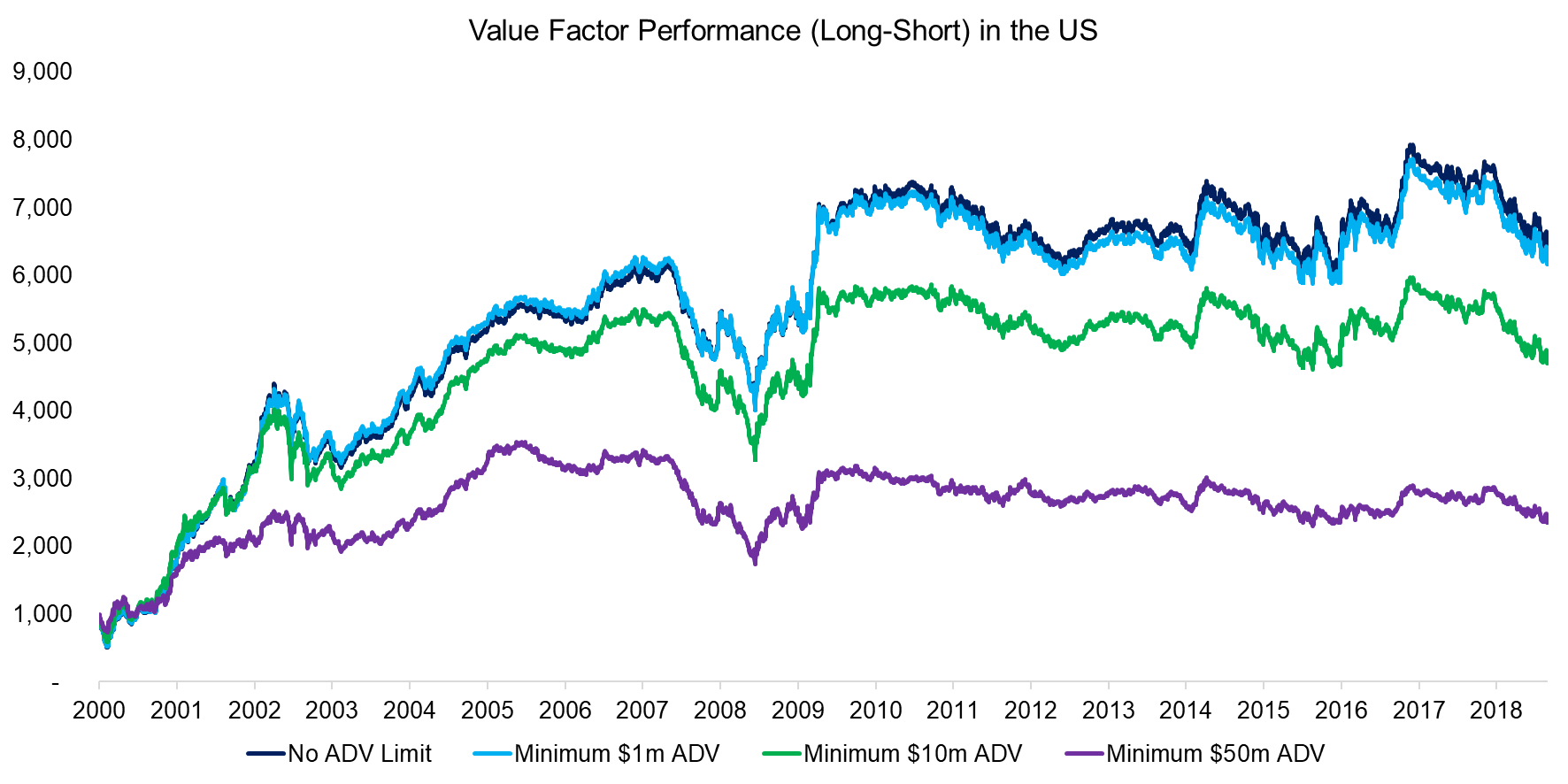

First, we analyse the performance of the long-short Value factor in the US by imposing minimum ADV levels. We observe that the performance of the factor decreased consistently as the minimum liquidity constraints increased. This result can be explained by cheap stocks frequently being small stocks, i.e. having exposure to the Size factor. Removing these small and cheap stocks led to lower factor performance (read Factor Returns: Small vs Large Caps).

Our approach to factor portfolio construction can be challenged as we selected the top and bottom 10% of the stocks in the universe ranked by their valuations, which results in a portfolio with more stocks the lower the ADV requirements. Alternatively, we could increase the percentage used in the stock selection process to keep the number of stocks constant, but that results in less concentrated factor exposure.

Source: FactorResearch.

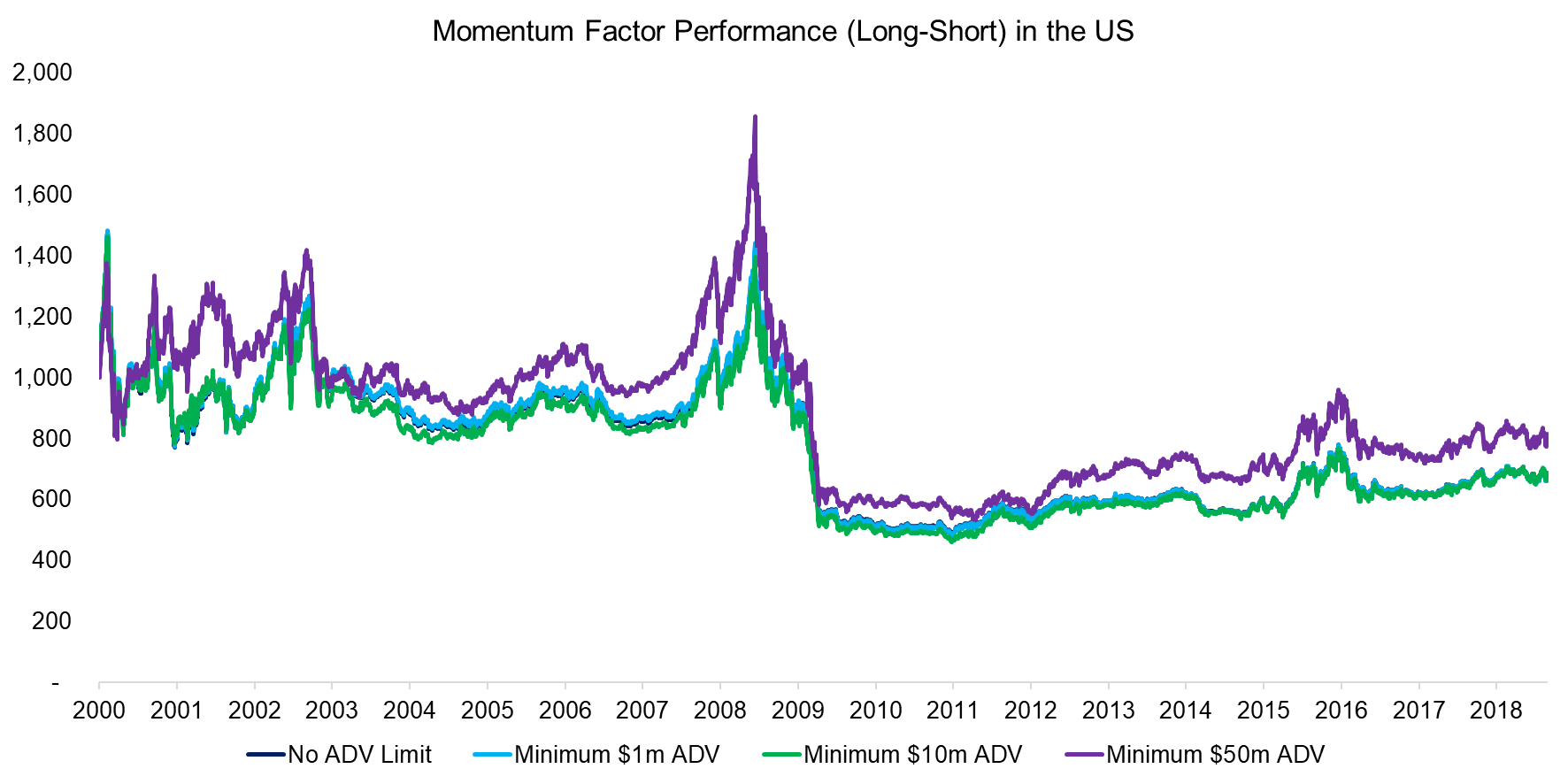

Next, we analyze the long-short Momentum factor in the US, which shows remarkable similar factor performance for the different portfolios, regardless of the minimum ADV requirements. In contrast to the Value factor, there is no structural exposure to the Size factor, which explains the more homogenous results.

The Momentum factor features the highest turnover of common equity factors as frequent rebalancing is essential for efficiently harvesting the factor returns. Investors critical of factor investing frequently highlight that high turnover might result in lower realized than theoretical returns as most investors can not trade stocks that are less liquid (read Equity Factors: Reducing Portfolio Turnover).

However, this analysis provides evidence that investors can focus exclusively on the most liquid stocks, where transaction costs are lowest, for the Momentum factor without being penalized with lower returns.

Source: FactorResearch.

LIQUIDITY & FACTOR PERFORMANCE IN HONG KONG

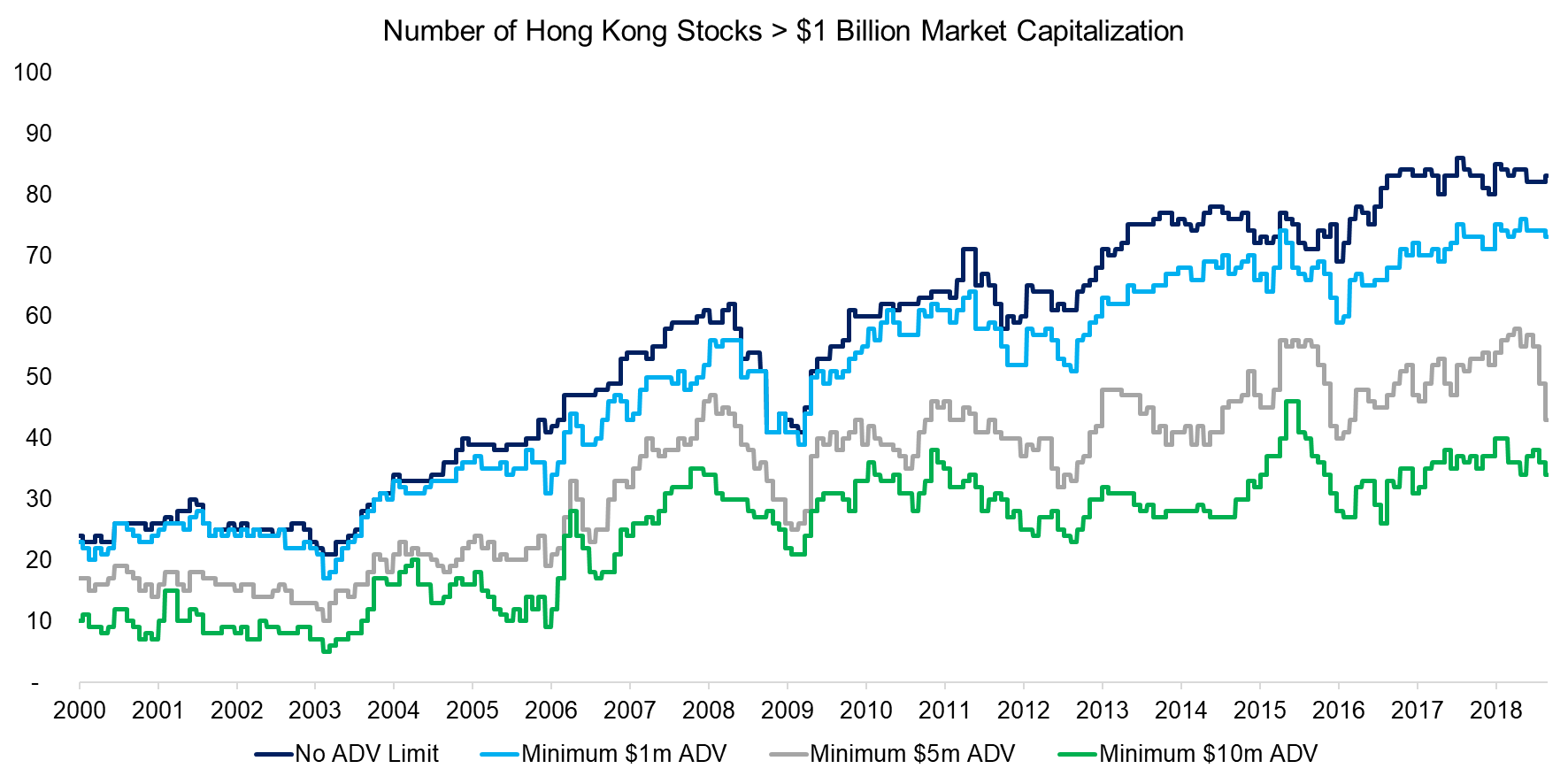

In addition to exploring liquidity constraints in the most liquid equity market, i.e. the US, it might be interesting to replicate the analysis in a stock market with far fewer stocks. Hong Kong features one of the largest stock markets globally as measured by the aggregated market capitalization and turnover, but had less than 100 stocks with a market capitalization larger than $1 billion in 2018, excluding Chinese stocks traded on the exchange.

There are too few stocks with ADVs greater than $50 million and even a $10 million minimum results in only slightly more than 30 stocks as a stock universe. Creating a factor portfolio based on the top and bottom 10% would result in three stocks in the long and three in the short portfolio, where firm-risk would dominate systematic risks. Therefore, we select the top and bottom 20% of stocks, although even this should be considered suboptimal for factor portfolios.

Factor portfolios should be concentrated to maximize the factor exposure, but still be diversified enough to minimize firm-risk, which is typically achieved with at least 25 stocks per portfolio. Unfortunately, most stock markets offer only a limited number of stocks that are suitable for trading by institutional investors.

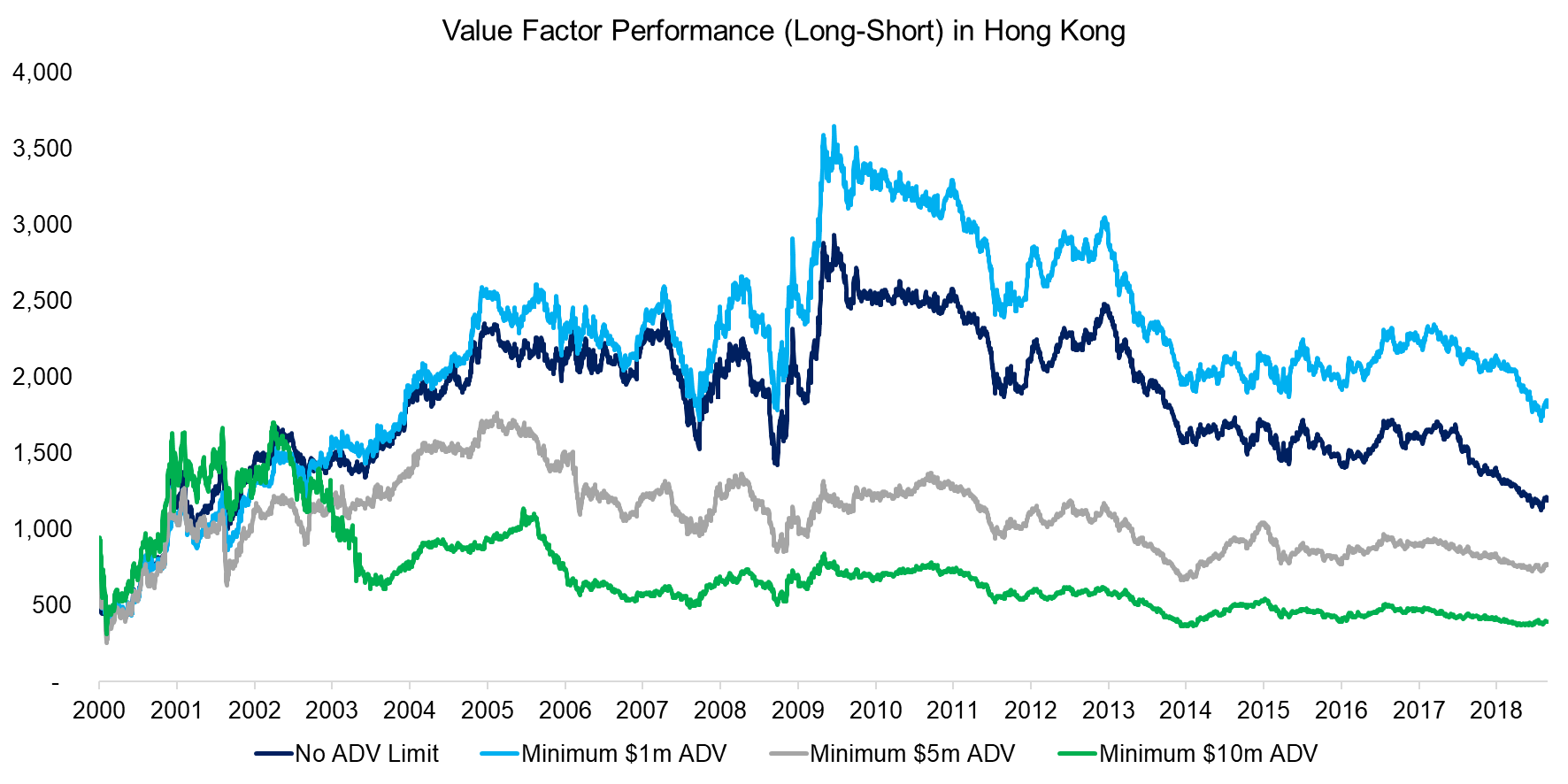

Source: FactorResearch.

The performance of the long-short Value factor in Hong Kong broadly mirrored the US Value factor over the last two decades. Cheap stocks outperformed expensive ones from the implosion of the tech bubble in 2000 to the global financial crisis in 2008, but underperformed thereafter. Factors tend to exhibit the same trends across regions, which indicates common performance drivers.

Similar to the results in the US, imposing ADV minimums had a significant impact on the Value factor in Hong Kong. Most positive performance could be attributed to the Size factor and removing less liquid stocks resulted in considerably less attractive returns.

Source: FactorResearch.

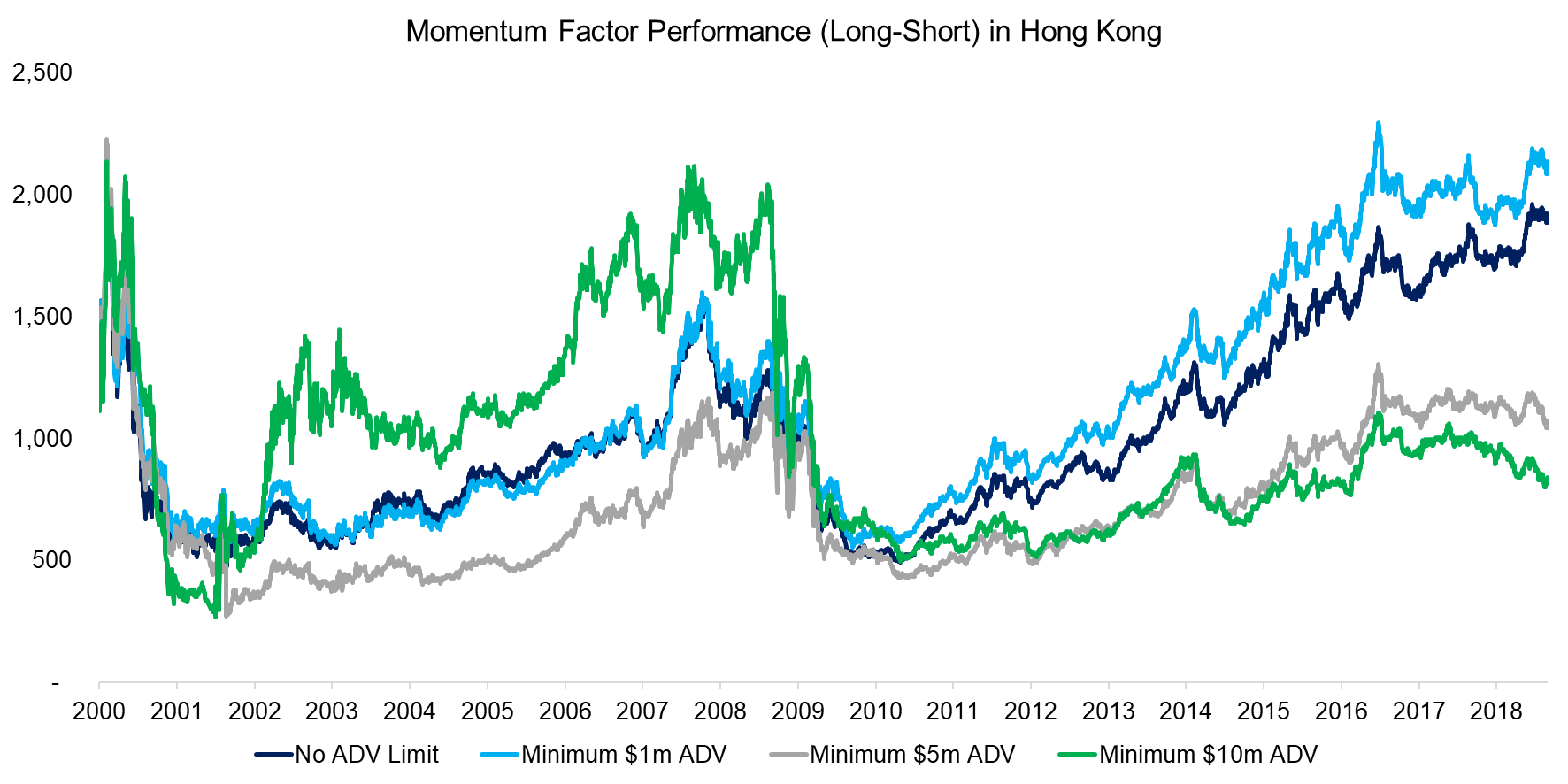

Finally, we analyze restricting the liquidity for the Momentum factor in Hong Kong. The performance becomes more volatile, the more concentrated the portfolios as the exposure to specific firms is increasing. However, similar to the US, the impact of liquidity constraints is less negative for Momentum than for Value, which implies less exposure to the Size factor.

Source: FactorResearch

FURTHER THOUGHTS

Passive investing has not only shifted trading to the closing auction, but ETFs have also become meaningful owners in many stocks. In some companies, ETF issuers have already become majority shareholders. For example, StateStreet, Vanguard, and BlackRock, which manage mostly passive funds, currently own more than 55% of Tanger Factory Outlet Centers (SKT), a shopping center REIT.

The currently available research provides no consistent perspective on how large passive ownership changes the liquidity of stocks. There is even less research on how passive impacts factor investing. It could become more attractive given the growth of factor-focused products like smart beta ETFs as inflows might amplify returns. However, there are also arguments that fundamentals matter less as there are fewer active managers, which is the main force that determines company valuations.

RELATED RESEARCH

Factor Portfolios: Turnover Analysis

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.