Listed Private Equity ETFs: The Real Deal?

Investing in versus with the KKRs, Blackstones, and Apollos of this world

December 2023. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Listed private equity companies have significantly underperformed

- It seems more beneficial to work for a PE firm than being a shareholder

- Recent private equity fund valuations seem overly stale

INTRODUCTION

Stephen Schwarzman is worth $27 billion, Leon Black $8.6 billion, and Henry Kravis $7.5 billion, according to Forbes. All three made their money by creating asset management companies focused on private asset classes. The Blackstone Group and KKR started with private equity, while Apollo Global Management has its origin in distressed debt, although all three firms diversified their product ranges over time and today also offer funds investing in real estate, hedge funds, and infrastructure (read A Crescendo in Private Credit? and BDCs: Better Don’t Choose?).

The net worth of these three entrepreneurs reflects their track records as successful investors as well as their ability to raise multi-billion funds from investors. Historically investing in private equity funds was restricted to institutional investors and required large commitments of investment capital, but recently companies like iCapital in the U.S. or Moonfare in Europe have emerged that offer access to financial advisors and even retail investors.

Having said this, investing in private equity via such retail-oriented platforms is still complicated and many investors simply wish for an ETF that provides this exposure. Although this product does not exist, there are ETFs that invest in listed private equity companies.

If I can’t invest in Stephen Schwarzman’s funds, why not invest in his company directly? Surely a shareholder should benefit as much as a fund investor.

In this research article, we will analyze ETFs that invest in listed private equity companies.

PERFORMANCE OF LISTED PRIVATE EQUITY ETFS

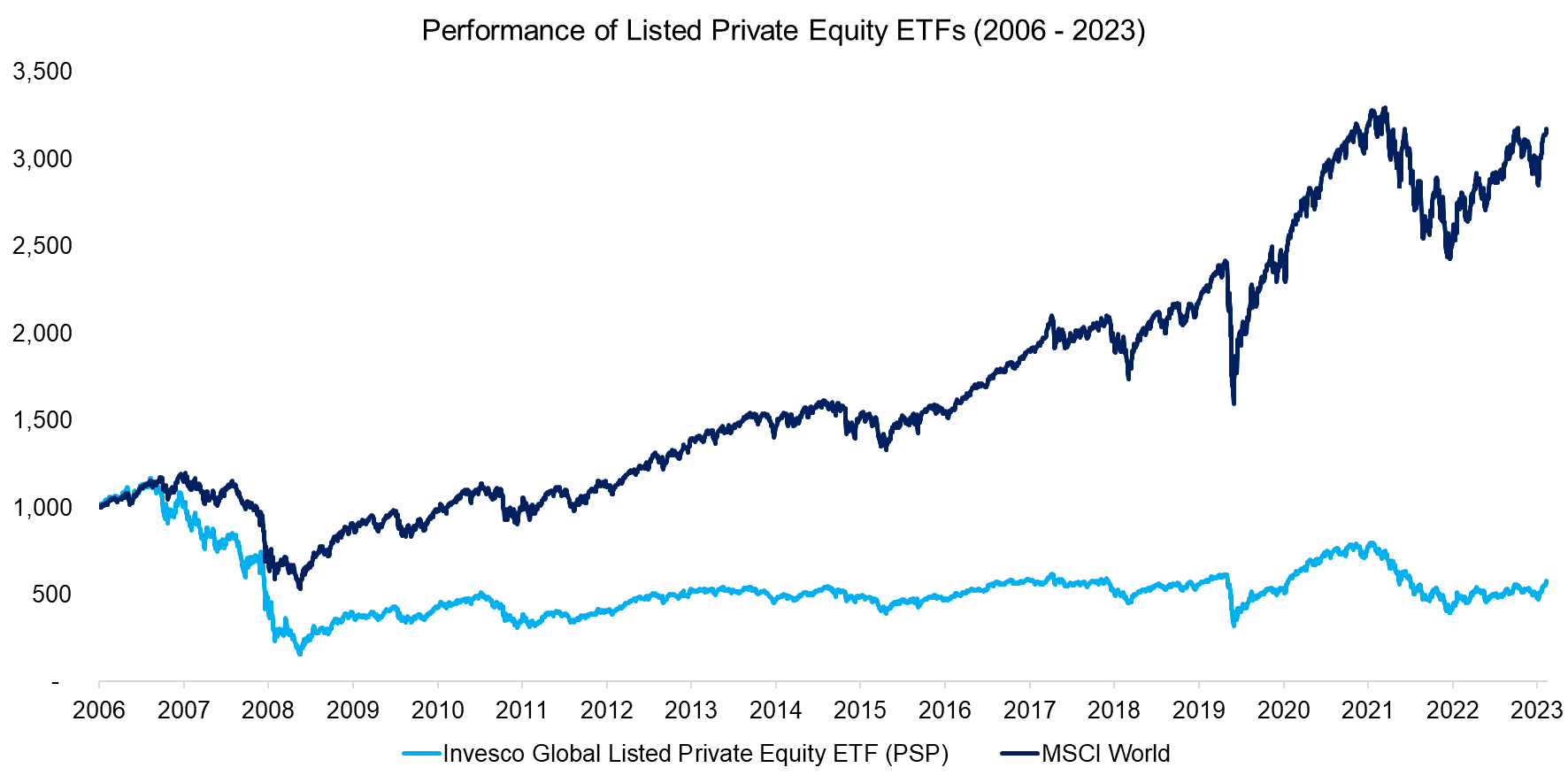

Only two ETFs are trading in the U.S. stock market that invest in listed private equity firms. The Invesco Global Listed Private Equity ETF (PSP) was listed in 2006, manages $200 million of assets, and charges an annual management fee of 1.06%. The ETF has a concentrated portfolio of approximately 50 positions and includes well-known private equity firms like Blackstone, KKR, and Carlyle. Given that many of the holdings like 3i, Partners Group, or EQT are international companies, the MSCI World Index is the appropriate benchmark.

Contrasting the performance of PSP versus the MSCI World Index highlights an abysmal performance of the ETF. PSP generated a CAGR of -3.2% versus 6.9% for the benchmark index in the period between 2006 and 2023, and significantly underperformed during the global financial crisis in 2009. Some like the Fortress Investment Group went private again.

Source: Finominal

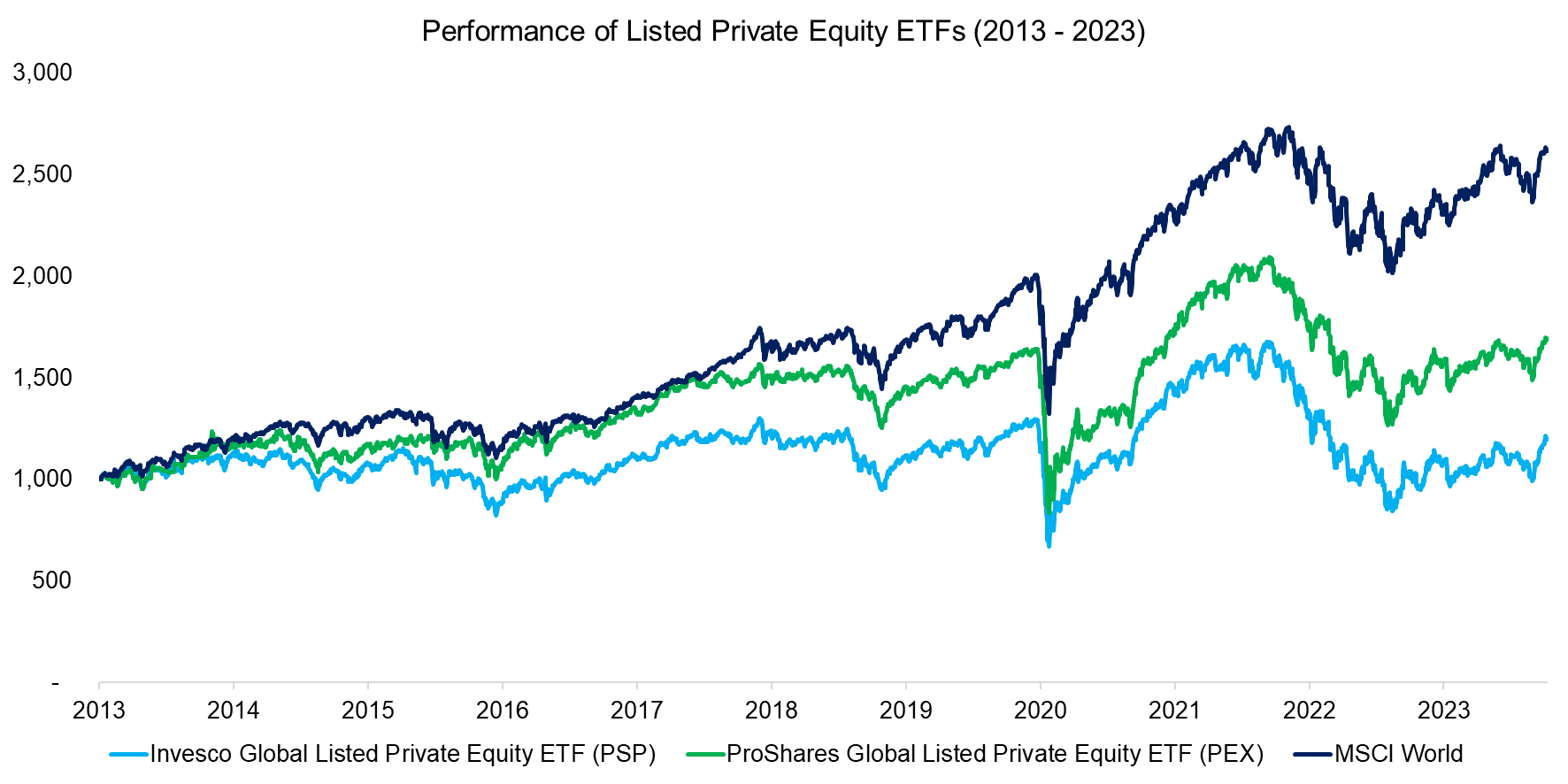

The ProShares Global Listed Private Equity ETF (PEX) was launched in 2013 and charges a lower management fee than PSP with 0.81% per annum, but its assets have fallen to a mere $8 million, which makes it almost uninvestable. The lack of investor interest is likely based on its poor performance. Both PEX and PSP have significantly underperformed the MSCI World Index since 2013, which is ironic given that companies like KKR or Apollo Global Management have consistently increased their assets under management throughout the last decade. The Blackstone Group is close to breaching $1 trillion of assets under management.

Given that many of the listed private equity companies are in the best shape of their corporate lives, why have their share prices done so poorly?

One of the reasons is likely that private equity firms, similar to investment banks, pay their staff exceptionally well, and so the main beneficiaries of private equity economics are their employees, especially the management, rather than their shareholders. Given that almost all private equity firms were created by former investment bankers, this is not particularly surprising.

Source: Finominal

PRIVATE EQUITY ETFS VS PRIVATE EQUITY BUYOUT INDEX

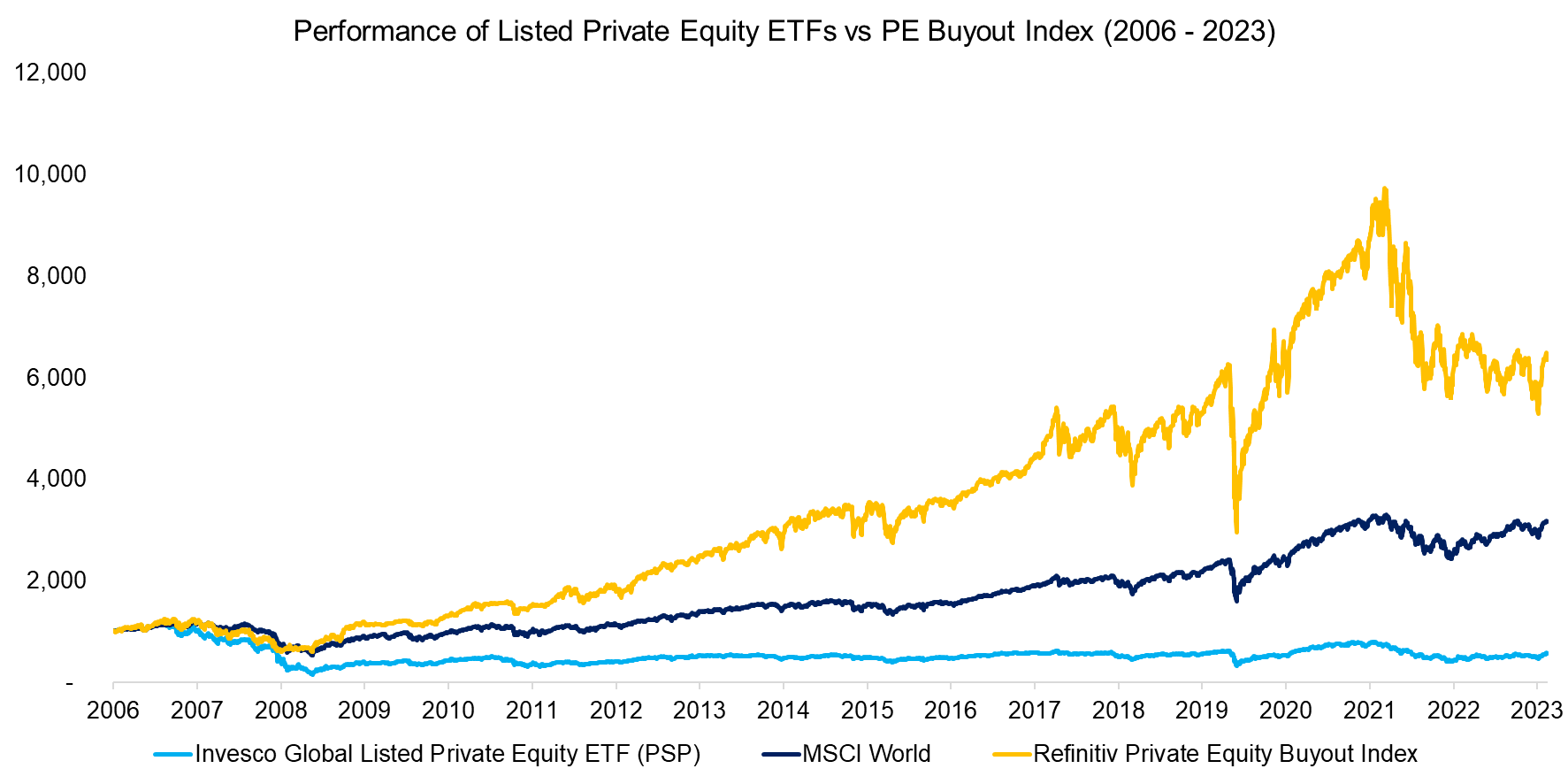

The poor track record of listed private equity companies makes these unappealing proxies for investing directly in private equity funds. However, there are also a few indices that aim to replicate the performance of private equity funds with public securities.

For example, Refinitiv computes the Refinitiv Private Equity Buyout Index (“Buyout Index”), which aims to replicate the gross returns of the U.S. private equity industry by aggregating companies involved in private equity transactions. Sector weights are derived from private company values, which allows Refinitiv to calculate an index using public securities with daily returns.

We observe that the Buyout Index outperformed the MSCI World as well as the Invesco Global Listed Private Equity ETF (PSP) significantly since its inception in 2006.

Source: Finominal

However, we need to highlight that the Buyout Index was launched as an index in 2014 and its performance before that is backtested. The nature of backtesting is that the in-sample results are almost always significantly better than the out-of-sample performance.

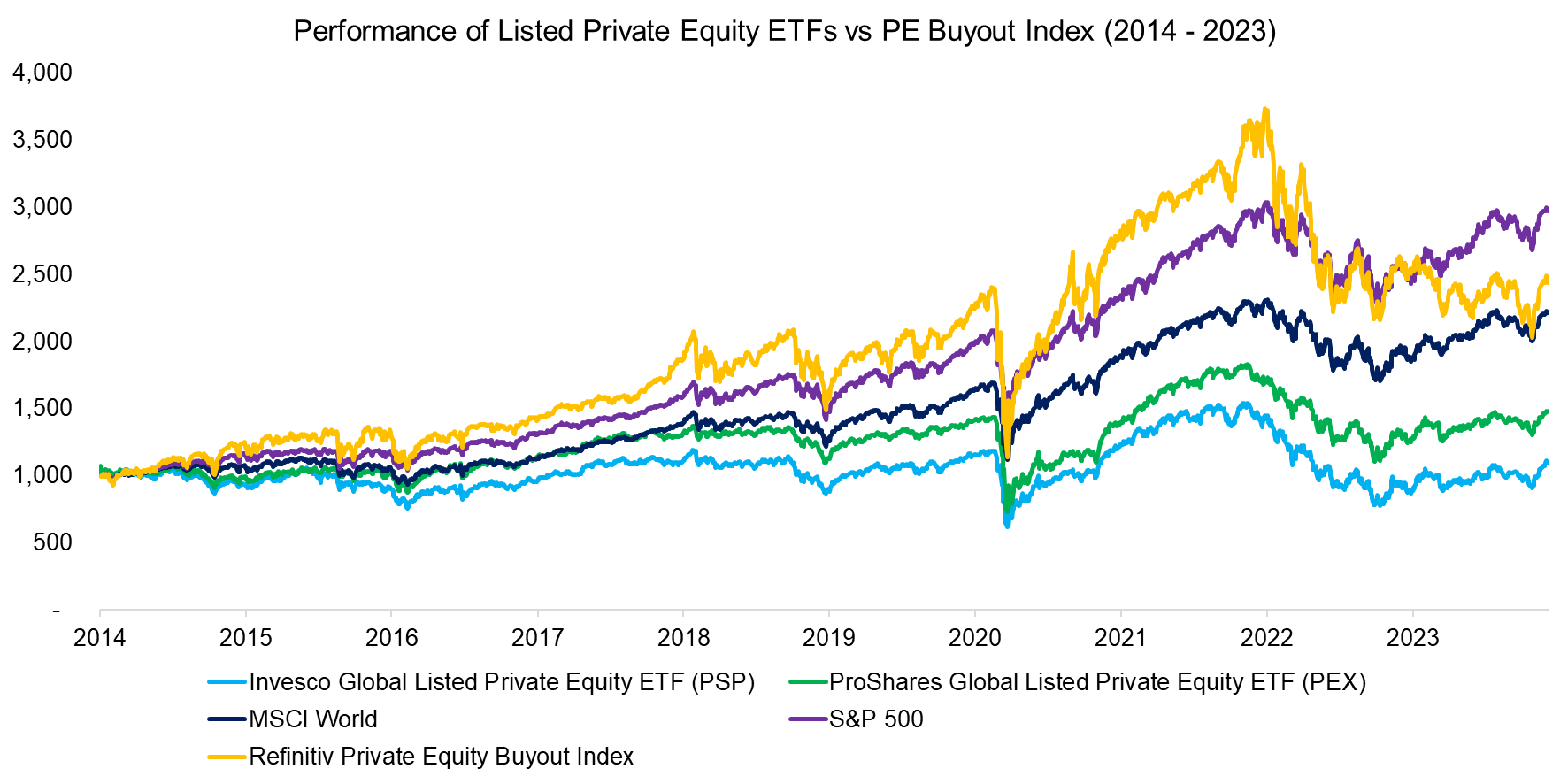

Given this, we review the performance of the Buyout Index from 2014 onward and also include the S&P 500 as the Buyout Index tracks the U.S. private equity industry. We observe that the Buyout Index did outperform the S&P 500 from 2014 to 2022, but underperformed thereafter.

Source: Finominal

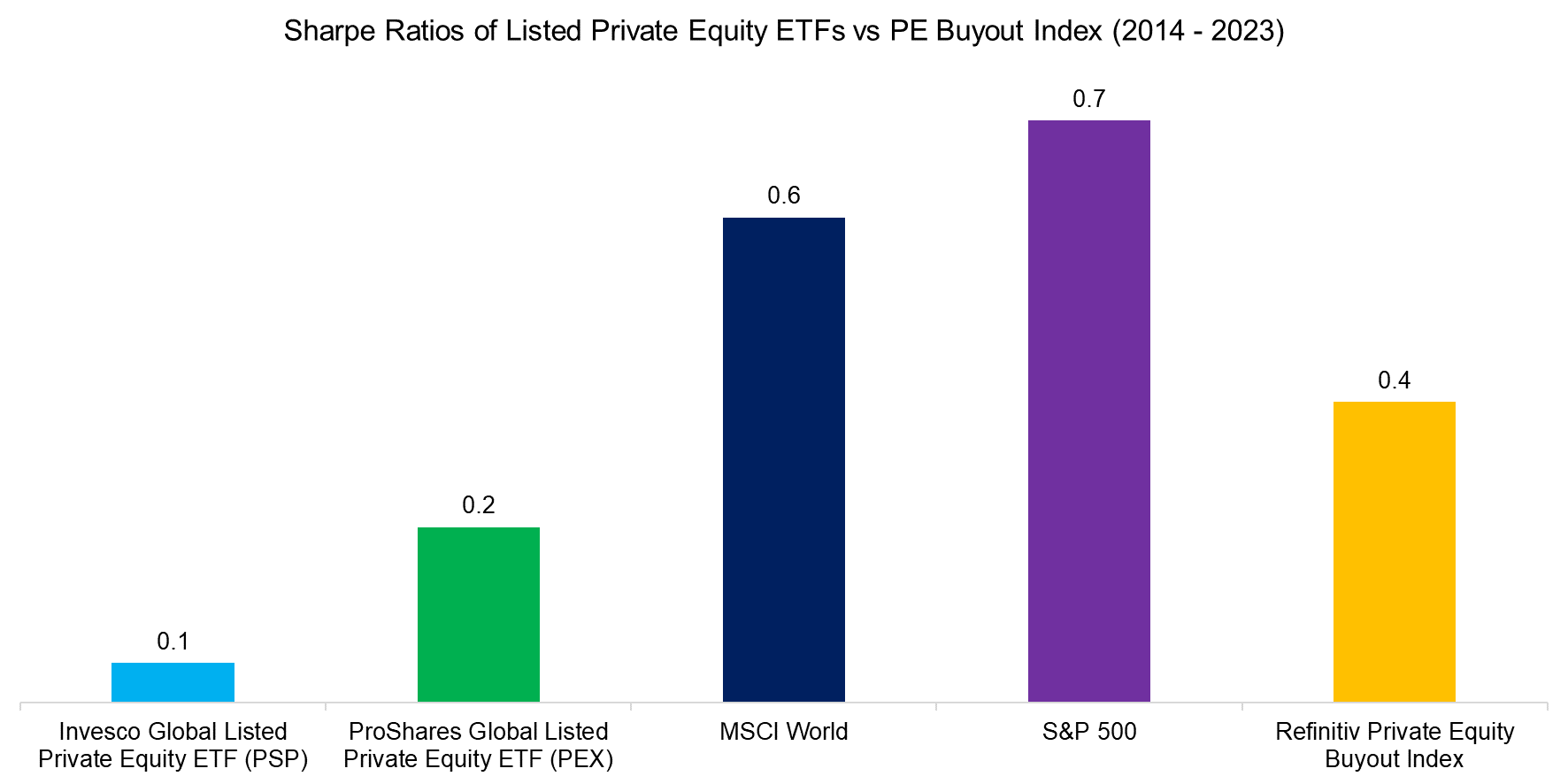

Reviewing returns without the risks undertaken to achieve them is like counting chickens before they hatch. Therefore, we compute the Sharpe ratios for these various products for the period from 2014 and 2023, which highlights 0.1 for PSP, 0.2 for PEX, 0.6 for the MSCI World, 0.7 for the S&P 500, and 0.4 for the Buyout Index.

Although the Buyout Index did outperform the S&P 500 for almost a decade, it seems it has done so with substantially higher risk. Investors looking for higher returns than the S&P 500 can simply consider leveraged ETFs.

Source: Finominal

FURTHER THOUGHTS

The lure of private equity funds remains strong for institutional and retail investors who look at track records with double-digit returns. However, it can be easily argued that the best days of the private equity industry are behind us as the returns of these funds can be attributed to decreasing interest rates, which favored highly leveraged investments, and expanding equity multiples. Furthermore, there are more than $4 trillion of assets under management by private equity firms, which means private markets have become highly efficient and there are few opportunities left to generate alpha.

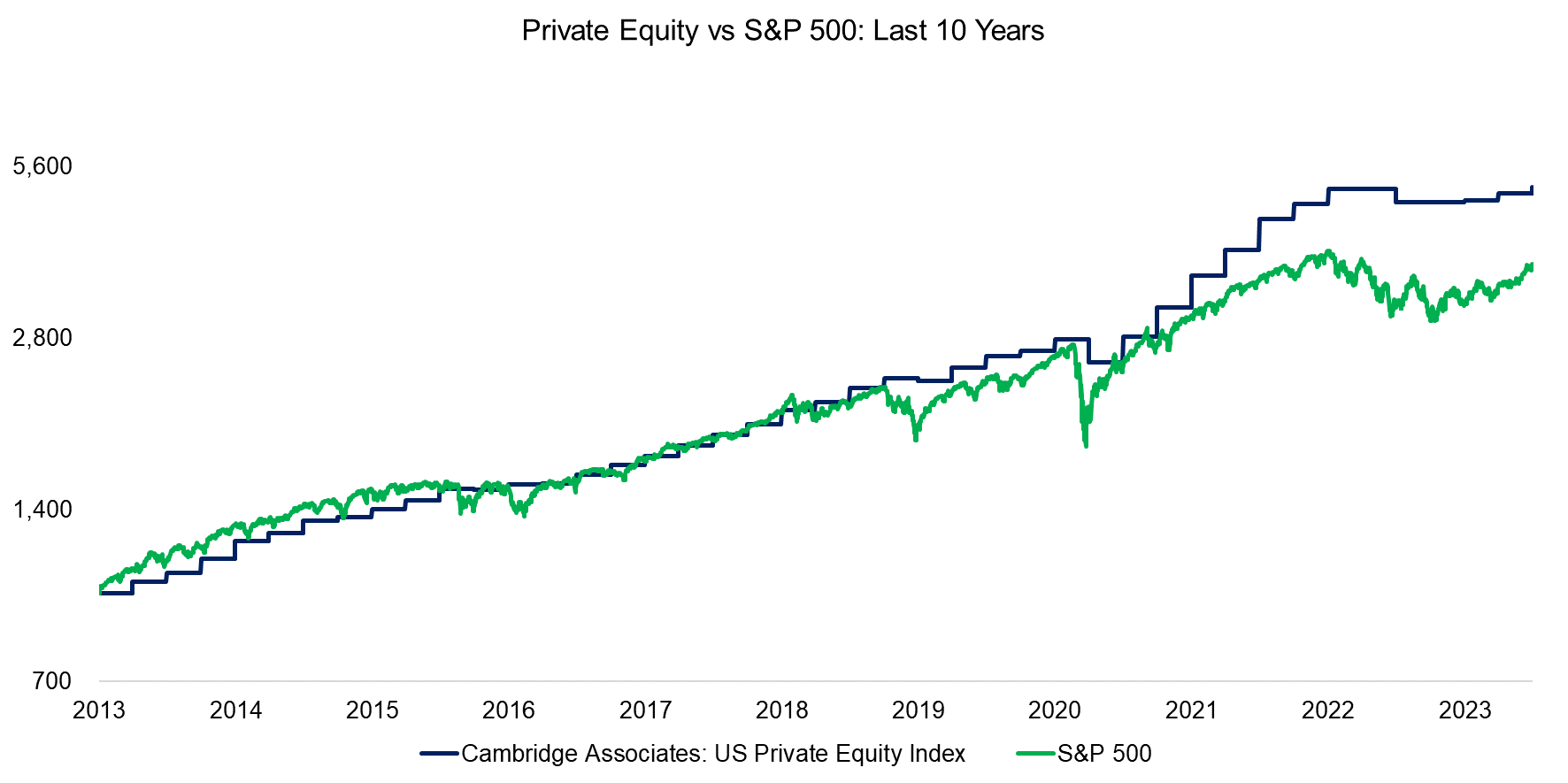

Worse, a dichotomy has opened between public and private markets that makes private equity funds even more alluring but is unlikely to last. The returns of the U.S. private equity industry have closely tracked those of the S&P 500 since 2013, which is intuitive given that both represent diversified portfolios of equity investments in U.S. companies. However, when interest rates started rising in 2021, the stock market tanked, while private equity funds hardly made any write-downs. Smoothing valuations by avoiding mark-to-market is a game that can only be played for so long and only serves to fool investors (read Private Equity: Fooling Some People All the Time? and Private Equity: The Emperor has No Clothes).

Source: Cambridge Associates, Finominal

RELATED RESEARCH

Private Equity: Fooling Some People All the Time?

Private Equity: The Emperor has No Clothes

Venture Capital: Worth Venturing Into?

Myth Busting: Alts’ Uncorrelated Returns Diversify Portfolios

A Crescendo in Private Credit?

BDCs: Better Don’t Choose?

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.