Long Volatility Strategies: Hedge Funds vs DIY

Replicating Masters of the Universe

October 2021. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Long volatility exposure is typically achieved via hedge funds

- A simple DIY strategy would have generated similar attractive diversification benefits

- Most of the returns are explained by risk-off currencies, government bonds, and gold

INTRODUCTION

Do-it-yourself is the best and worst financial advice for retail investors. On the one hand, retail investors are not particularly good investors and perhaps should not invest on their own at all. For example, the trading platform eToro, which has more than 20 million users in over 100 countries, discloses that 67% of their self-trading clients lose money.

On the other, most retail investors would have generated higher returns in recent years if they invested themselves into index ETFs versus trusting capital to financial advisors or mutual fund managers.

The evidence is less clear for institutions considering replicating complex strategies themselves instead of hiring dedicated managers. Most hedge funds provide not much more than factor exposure and theoretically can be replaced with cheap risk premia indices, but only a minority of institutional investors have done so.

Long volatility strategies are particularly complex given primarily option-based portfolios, which makes fund manager due diligence and monitoring more expensive. The number of fund managers is also limited. A do-it-yourself approach might be attractive for institutional investors.

In this research note, we will compare long volatility strategy hedge funds versus a systematic replication.

CONSTRUCTING A DYNAMIC & SYSTEMATIC LONG VOLATILITY STRATEGY

We use the CBOE Eurekahedge Long Volatility Hedge Fund Index as the benchmark for long volatility hedge funds. The index has 10 equal-weighted constituents, which includes some of the best-known managers from this space.

For the do-it-yourself (DIY) strategy we measure the correlation of 59 asset class indices to the VIX and select the 10% with the highest correlation. The resulting portfolio was primarily comprised of risk-off currencies, eg USD/CAD, and government bonds. Implementation would be efficient and cheap via futures (read Building a Long Volatility Strategy without Using Options).

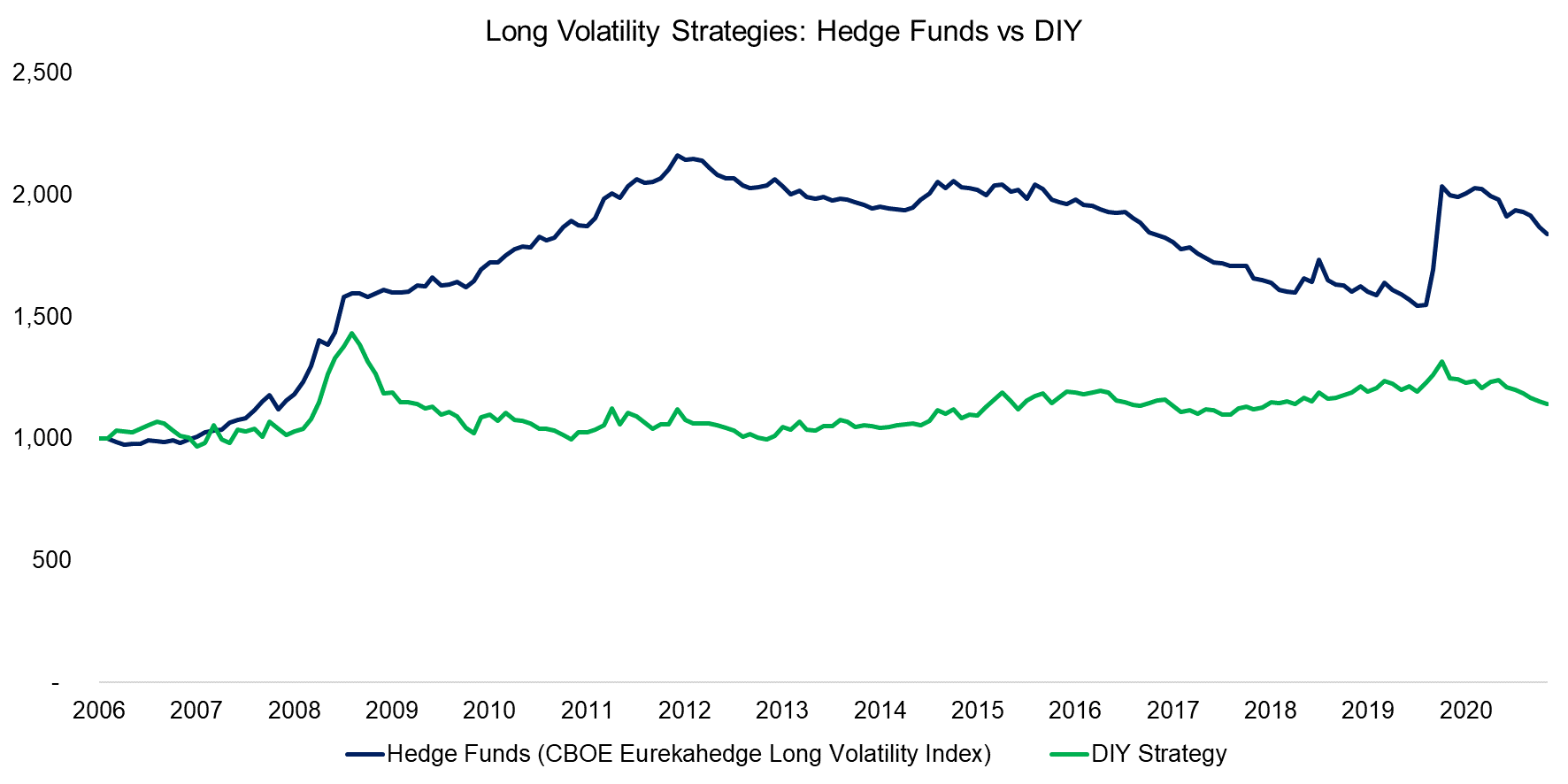

We observe that long volatility hedge funds provided a higher absolute return in the period from 2006 to 2021 than the DIY strategy. However, we also observe that both spiked when stock markets crashed, ie during the global financial crisis in 2009 and COVID-19 crisis in 2020, which highlights that both provided the desired negative correlation to equities during crisis times.

Hedge funds continued to generate positive returns between 2009 and 2012, but then lost all of these returns until the global pandemic hit. It would have been difficult to stay allocated to these managers during this period given the steady bleed. The DIY index was essentially flat throughout the decade between 2009 and 2020.

Source: Eurekahedge, FactorResearch

DIVERSIFICATION BENEFITS OF LONG VOLATILITY STRATEGIES

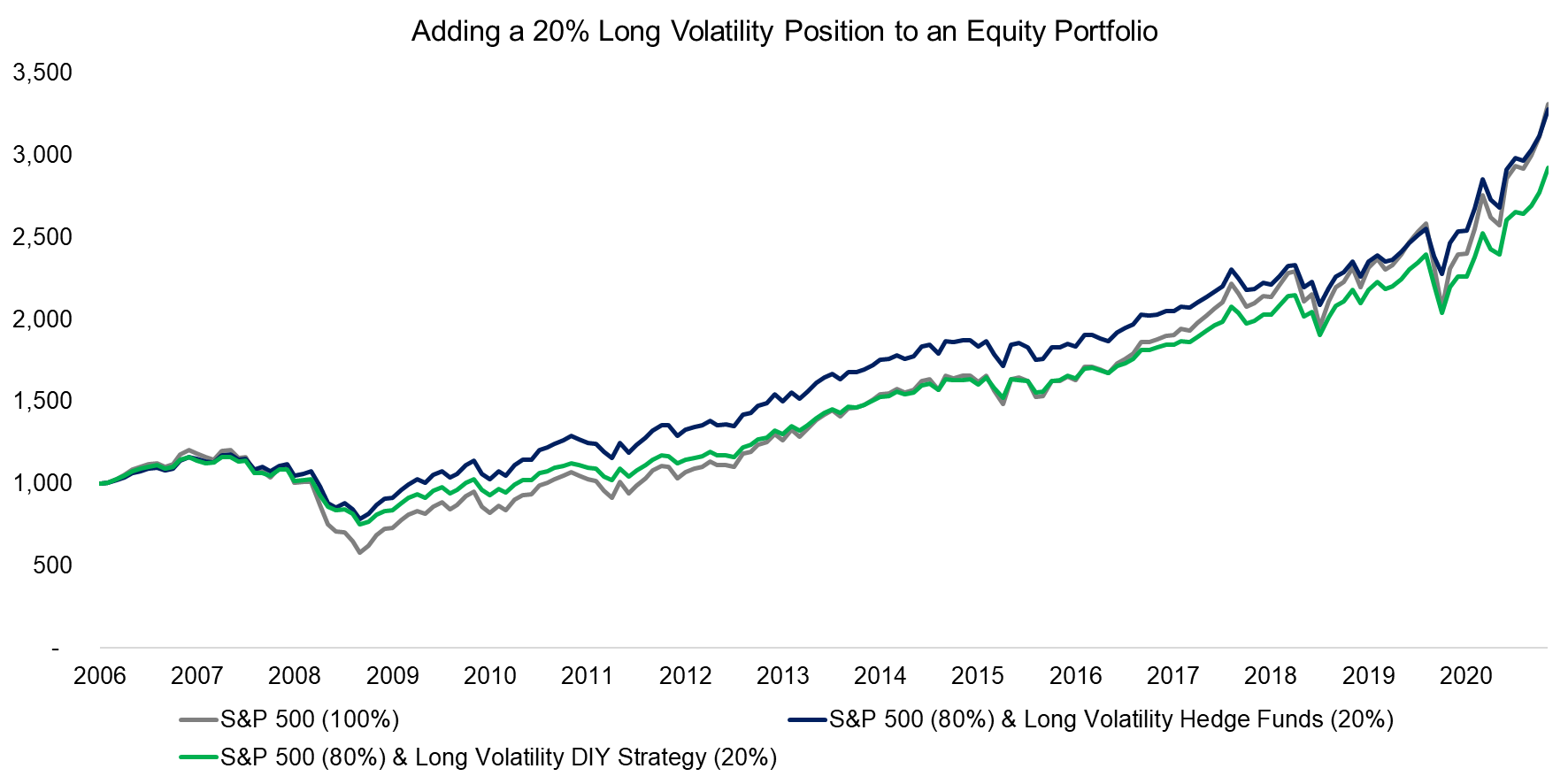

Next, we simulate the diversification benefits of adding a 20% allocation of long volatility strategies to an equities portfolio. Allocating to long volatility hedge funds would have generated almost the same return as being 100% invested in the S&P 500 since 2006, while the DIY index would have resulted in a slightly lower return.

It is worth highlighting that the CBOE Eurekahedge Long Volatility Hedge Fund Index allows hedge fund managers to include historic returns, and only managers with a strong track record are willing to report their returns, which implies the index returns are overstated.

However, more importantly, we observe that hedge funds and the DIY index both achieved a significant reduction of the maximum drawdown during the global financial crisis in 2009. The S&P 500 lost 52% at the worst point, compared to 34% when allocating 20% to long volatility hedge funds, or 36% to the DIY index.

Source: CBOE, FactorResearch

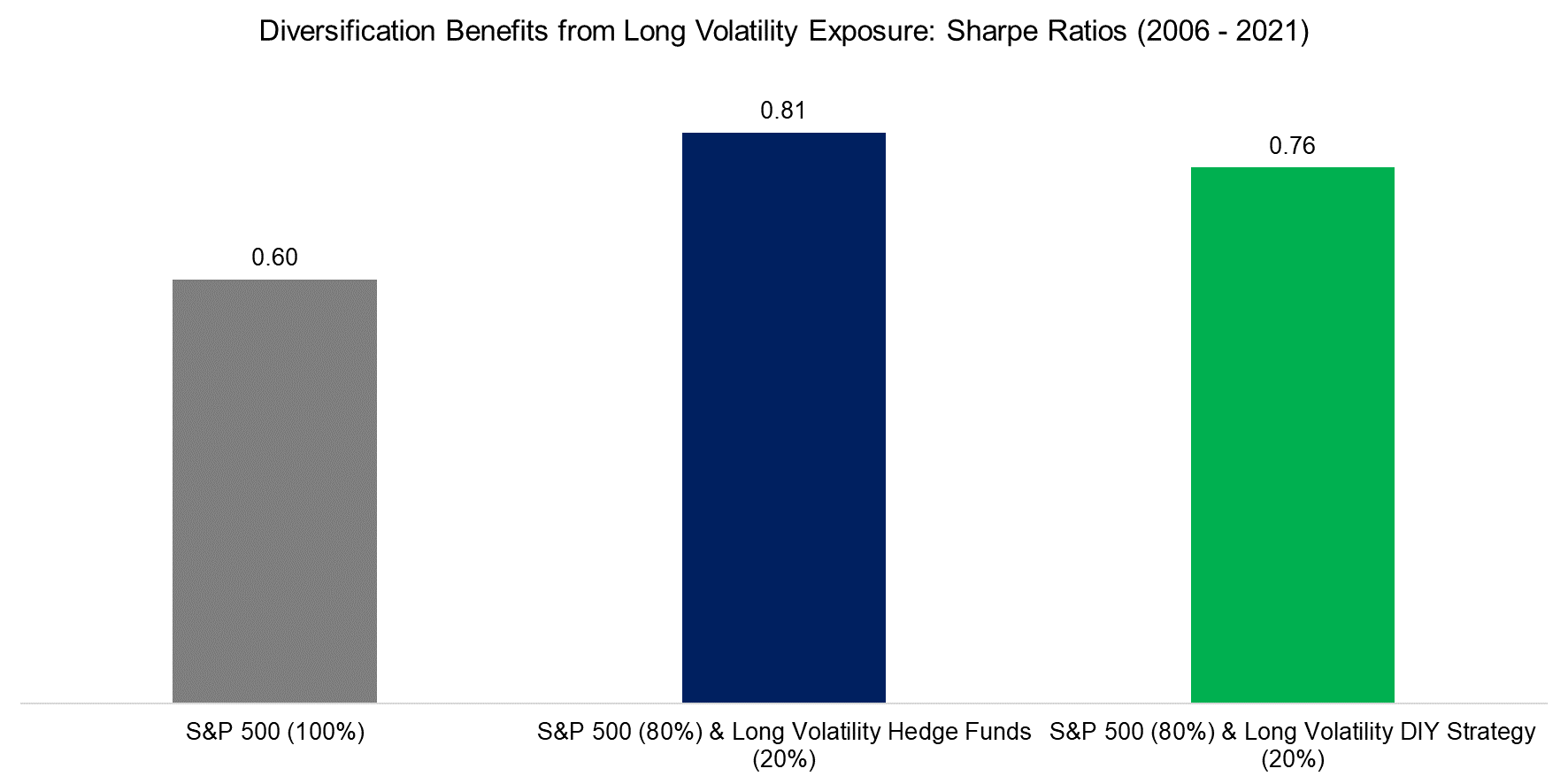

The diversification benefits are large as long volatility strategies are negatively correlated to equities as volatility tends to rise when stocks fall. The risk-adjusted returns of the combination portfolios are therefore significantly higher than for a stand-alone equities portfolio. The Sharpe ratio would have increased from 0.60 to 0.81 when using long volatility hedge funds and 0.76 for the DIY index.

Source: CBOE, FactorResearch

REPLICATING THE CBOE EUREKAHEDGE LONG VOLATILITY INDEX

The framework of the DIY strategy is to dynamically and systematically identify assets correlated to the VIX. However, an investor might simply want to replicate what the long volatility hedge fund managers are trading. Given that many of these are using options in portfolio construction, this is more challenging than replicating a long-short equity hedge fund manager (read Replicating Famous Hedge Funds).

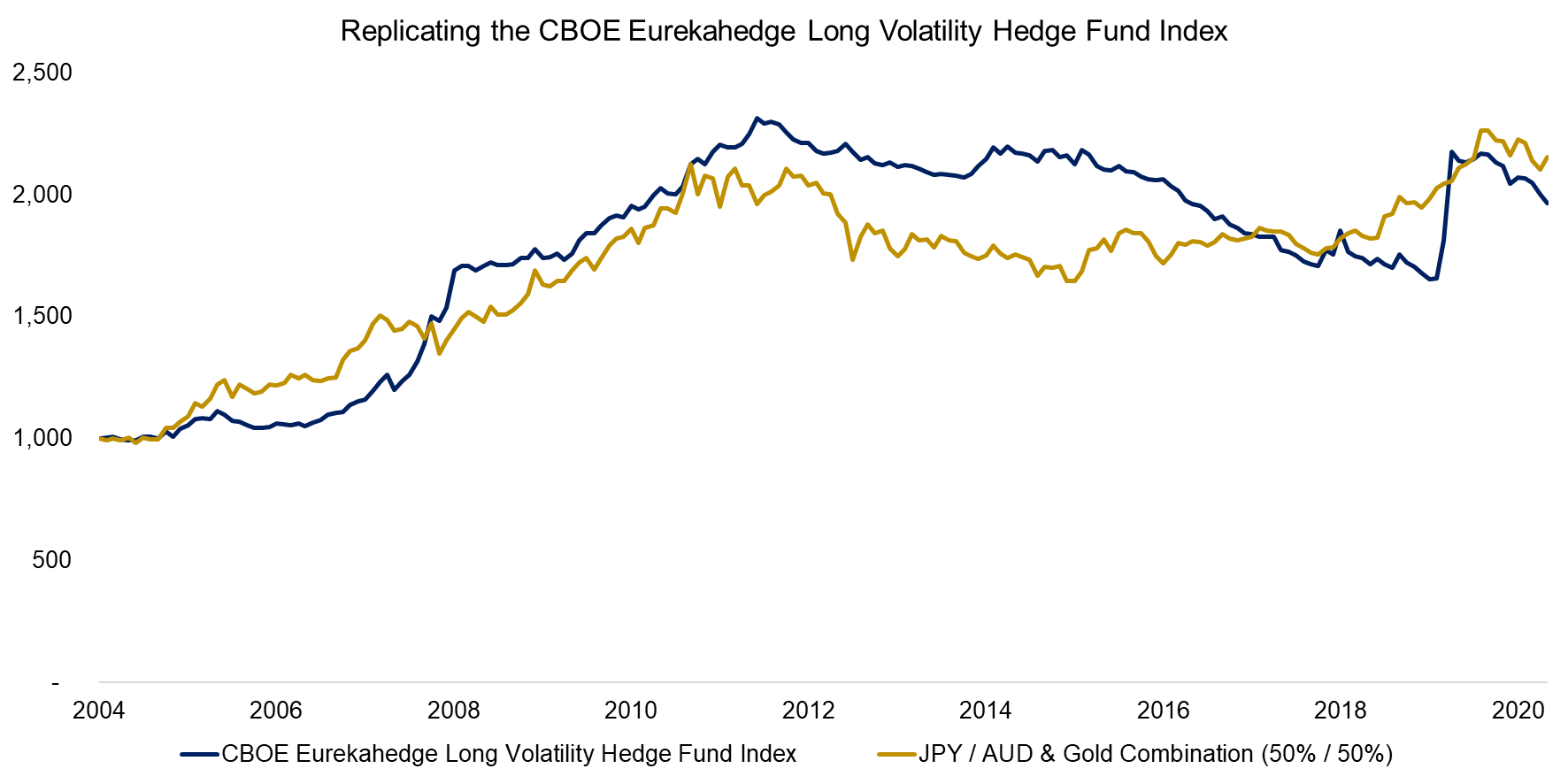

However, although not a perfect replication, a simple equal-weighted portfolio of JPY/AUD and gold would have replicated the CBOE Eurekahedge Long Volatility Hedge Fund Index reasonably well since 2004. Both of these assets represent typical risk-off trades that either provide similar exposure to long volatility hedge funds, or are used directly by these.

Source: FactorResearch

FURTHER THOUGHTS

Most investors believe stock markets will go up forever with a few occasional hick-ups on the way. The quickest way to destroy that illusion is to read Credit Suisse’s excellent Annual Investment Yearbook that highlights plenty of countries with stock markets that went into decade-long bear markets. Some even stopped trading altogether.

Unfortunately, most investors also believe that could not happen to their country. Well, Argentina was richer than the US at some point, Myanmar the wealthiest country in South East Asia, Venezuela the richest country in South America, Greece was classified as a developed market, and so on.

Diversifying across stock markets mitigates that risk, but only partially. Bonds have become less attractive given lower yields. Holding long volatility exposure is mostly unpleasant given long periods of flat or declining returns, but highly desirable given strong diversification benefits. Go long, stay strong.

RELATED RESEARCH

Building a Long Volatility Strategy without Using Options – III

Building a Long Volatility Strategy without Using Options – II

Building a Long Volatility Strategy without Using Options

60/40 Portfolios without Bonds

Creating Anti-Fragile Portfolios

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.