Long Volatility Strategies versus Tactical Asset Allocation

Both are great, both have challenges

August 2022. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Long volatility strategies are attractive diversifiers, but complex and not easily accessible

- Tactical asset allocation for equities may be considered as an alternative

- There is no clear winner between these two options

INTRODUCTION

Risk management in portfolio construction is primarily achieved via diversification or rules-based frameworks. The former simply means combining asset classes that tend to be lowly correlated, eg bonds and equities over the last few decades. The latter implies defining rules on when to exit, eg if the S&P 500 drops below the 200-day moving average, then reallocate capital from stocks to bonds.

Diversification has become more challenging as the primary diversifier, ie bonds, have become less attractive given low interest rates, especially in an environment of rising interest rates. Furthermore, many seemingly uncorrelated strategies like hedge funds or private equity have been found to provide nothing more than hidden equity exposure.

Investors frequently consider tail risk hedge funds for diversification, but these tend to be too negatively correlated to stocks, which does not make them immensely useful tools in portfolio construction. Long volatility strategies are more suitable as they feature only moderately negative correlations, but there are only a few asset managers offering this strategy and none in a public vehicle like an ETF (read Building a Long Volatility Strategy without Using Options).

Given this, perhaps a rules-based approach is superior as that can be easily implemented. In this research note, we will contrast long volatility and tactical asset allocation (TAA) strategies for equities.

DIVERSIFICATION BENEFITS OF LONG VOLATILITY STRATEGIES

Long volatility strategies aim to benefit from rising or high stock market volatility, and use options as well as risk-off assets in portfolio construction. The pay-off during a stock market crash will be lower than from a tail risk hedge fund, but there will also be less consistent losses during bull markets.

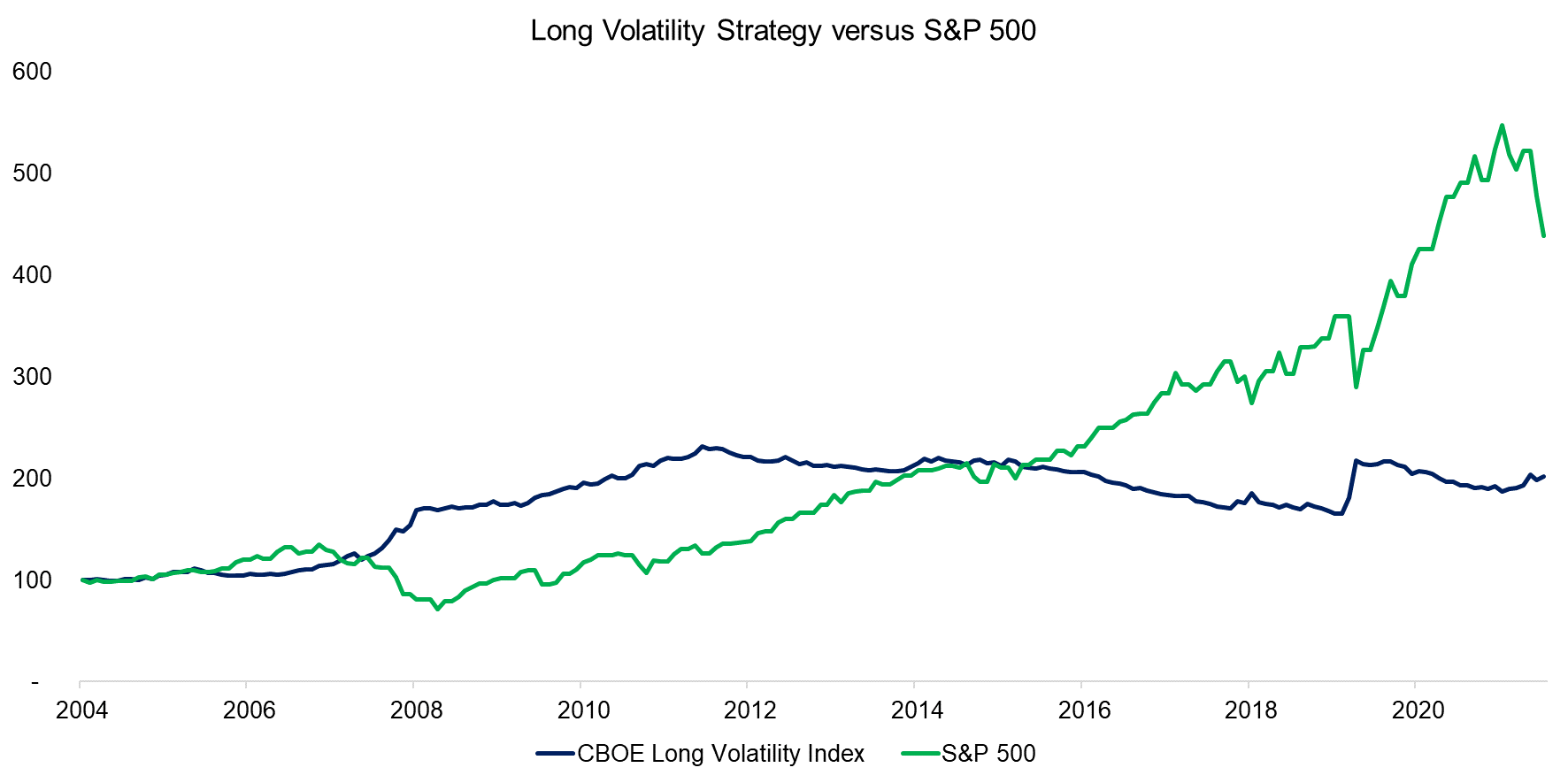

We use the CBOE Long Volatility Hedge Fund Index as a benchmark for long volatility strategies. The index is comprised of 15 hedge funds that are weighted equally and offers monthly returns since 2004.

We observe that long volatility strategies offered attractive returns during crisis periods such as the global financial crisis in 2008 and the COVID-19 crisis in 2020, where volatility spiked.

Source: CBOE, FactorResearch

LONG VOLATILITY INDEX REPLICATION

Although long volatility strategies offer attractive diversification benefits for equity portfolios given a correlation of -0.4 to the S&P 500 between 2004 and 2022, they bring their own challenges. First, none are offered as public products such as an ETF. Second, they are complex strategies and portfolio construction varies from manager to manager, which requires in-depth due diligence. Finally, they are not cheap, typically charging management and performance fees.

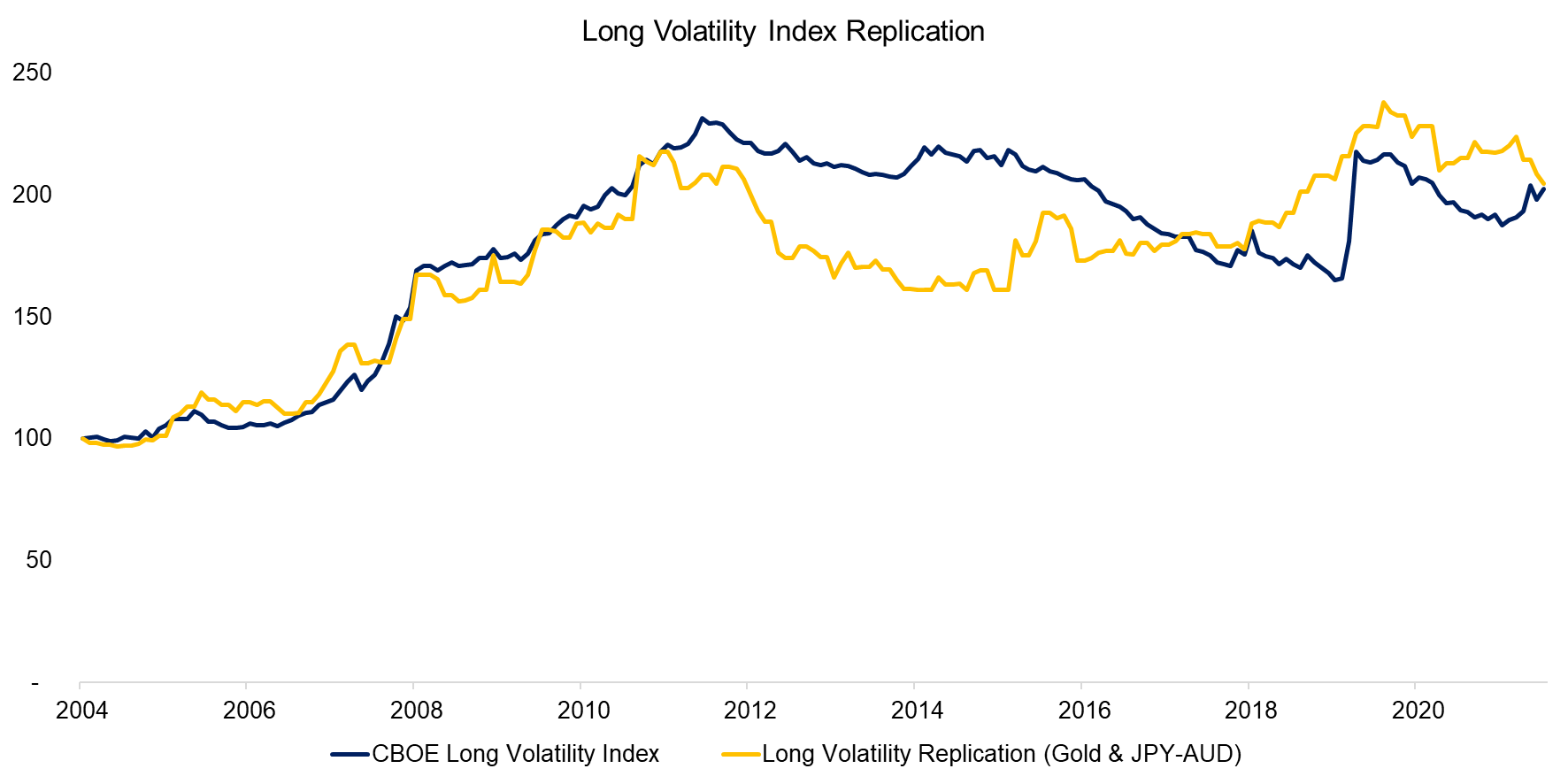

Perhaps the long volatility index can be replicated as most strategies can be decomposed by their risk exposures and recreated via ETFs or futures. Replicating option-based strategies is difficult, but we know that long volatility strategies often are partially comprised of risk-off assets. It seems historically a simple equal-weighted combination of gold and JPY-AUD would have approximately replicated the performance of the long volatility index.

However, although JPY-AUD represented a risk-off asset historically, it is clear that this will not always work going forward. Japan’s debt is close to 300% as a percentage of its GDP, and its population will decline by 27 million over the next 30 years, which will eventually require a debt restructuring. It is impossible to predict when this will happen, but it will likely have global repercussions and is unlikely to be accretive for the Japanese Yen. The JPY-AUD would likely change from a risk-off to risk-on asset.

Source: FactorResearch

TACTICAL ASSET ALLOCATION CONSIDERATIONS

Tactical asset allocation strategies are based on the concept of trend following. If the performance of an asset class is positive, have exposure, otherwise, invest elsewhere. The likely most popular version is an allocation to equities if the 200-day moving average is positive, otherwise hold cash or short-term bonds (read Defining Tactical Asset Allocation).

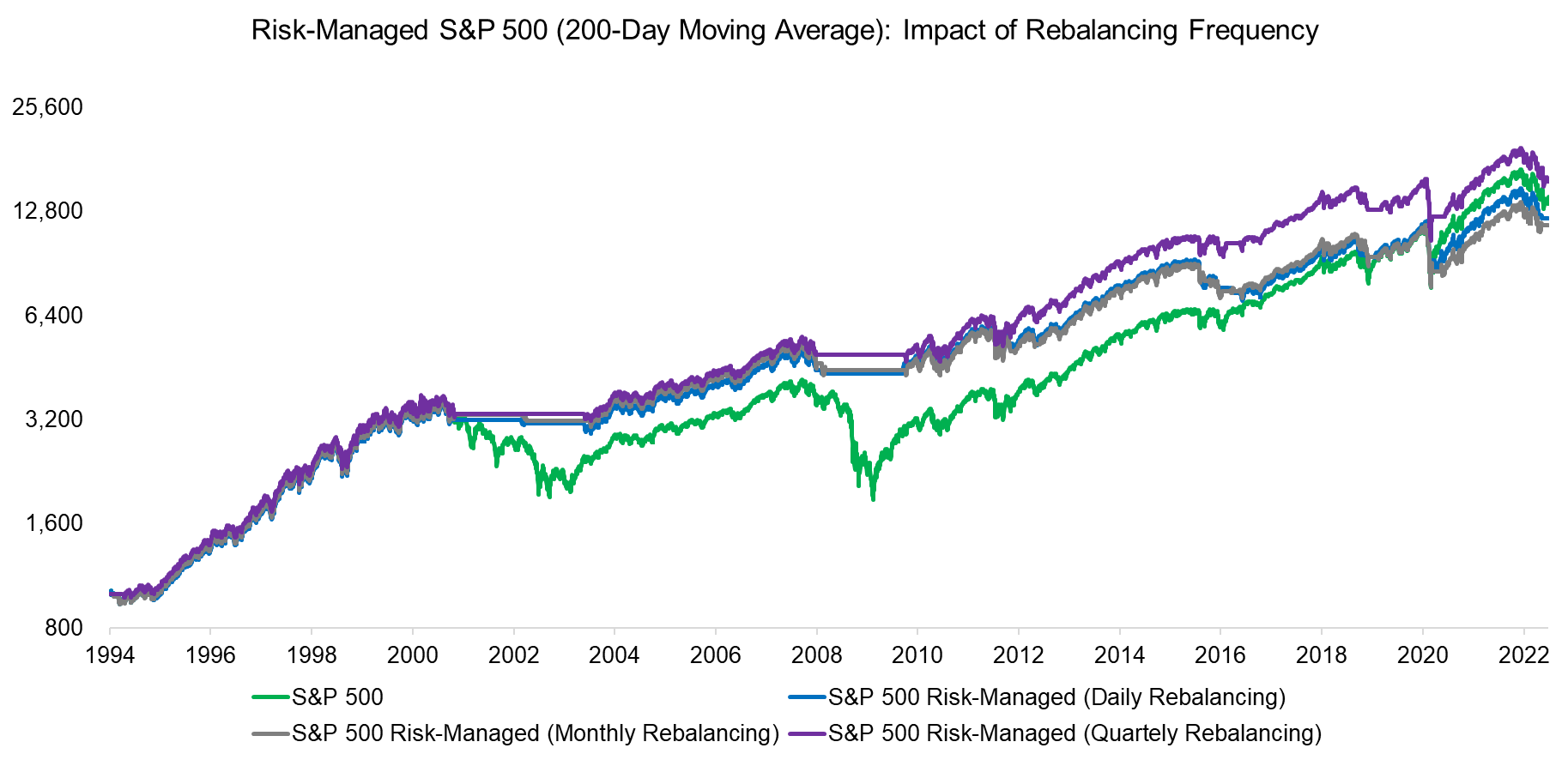

We simulate this strategy using the S&P 500 and highlight the impact on returns using different rebalancing periods. The strategy would have preserved capital in bear markets such as the tech bubble implosion between 2001 and 2003, as well as the global financial crisis between 2008 and 2009.

The performance would have been similar to the S&P 500 over the period between 1994 and 2022, although with less severe drawdowns and therefore higher risk-adjusted returns.

Source: FactorResearch

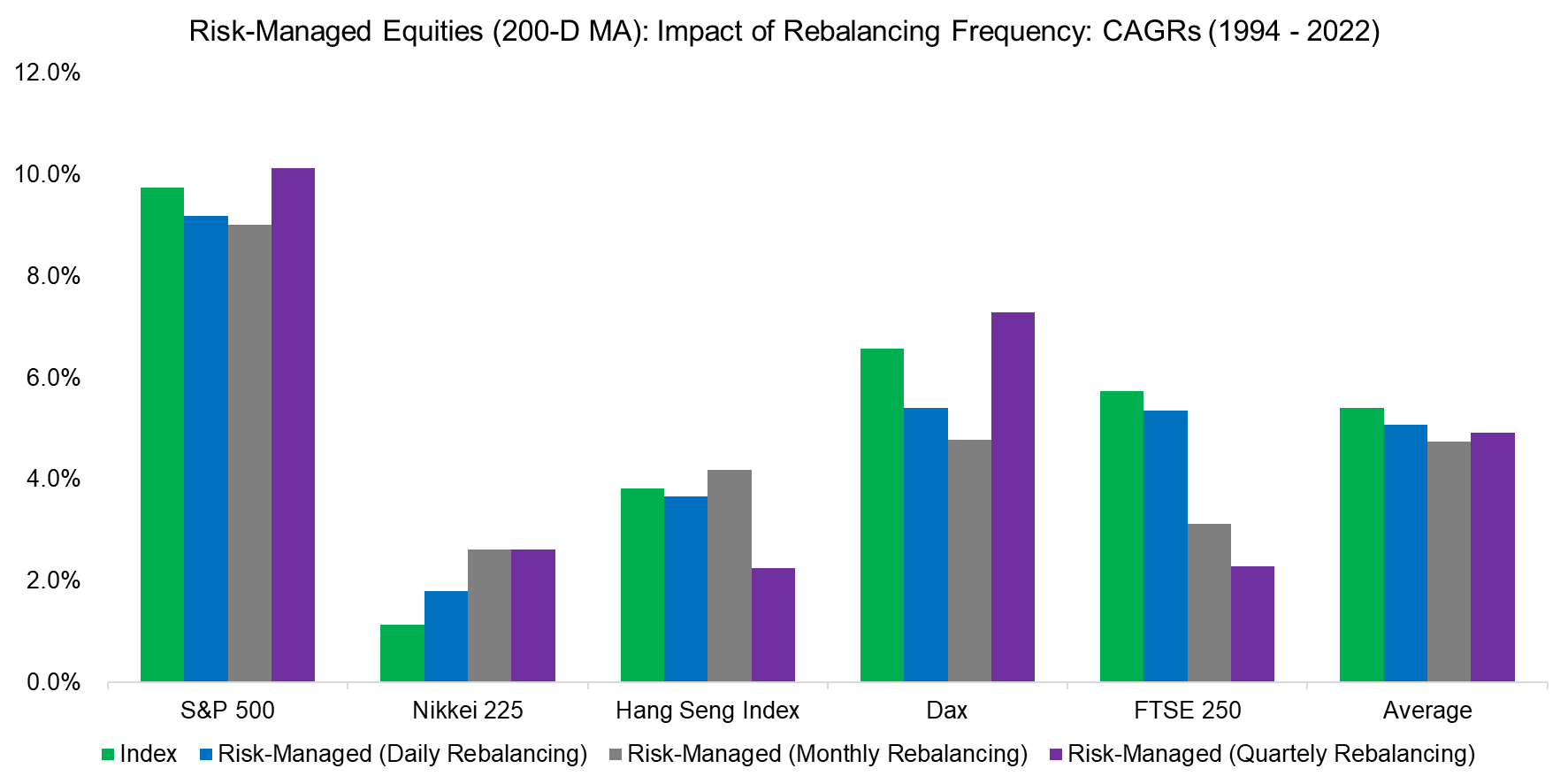

However, just backtesting a TAA strategy in the U.S. stock market is not particularly robust as that was one of the best-performing markets in recent decades. Therefore, we evaluate the same strategy in other markets and again vary the rebalancing frequency to test the model sensitivity.

We observe that there is a significant model risk, eg the return for the FTSE 250 in the UK ranged from 2.3% to 5.4% per annum. In some markets, TAA strategies generated higher returns than the index, in others lower returns. We would likely see a similar sensitivity if we change the lookback from 200 days to 100 or 300 days.

It is worth highlighting that TAA strategies aim at generating higher risk-adjusted and not necessarily higher absolute returns than the stock market. Investors do not cope well with large drawdowns and TAA strategies reduce these significantly.

Source: FactorResearch

LONG VOLATILITY VS TAA STRATEGIES

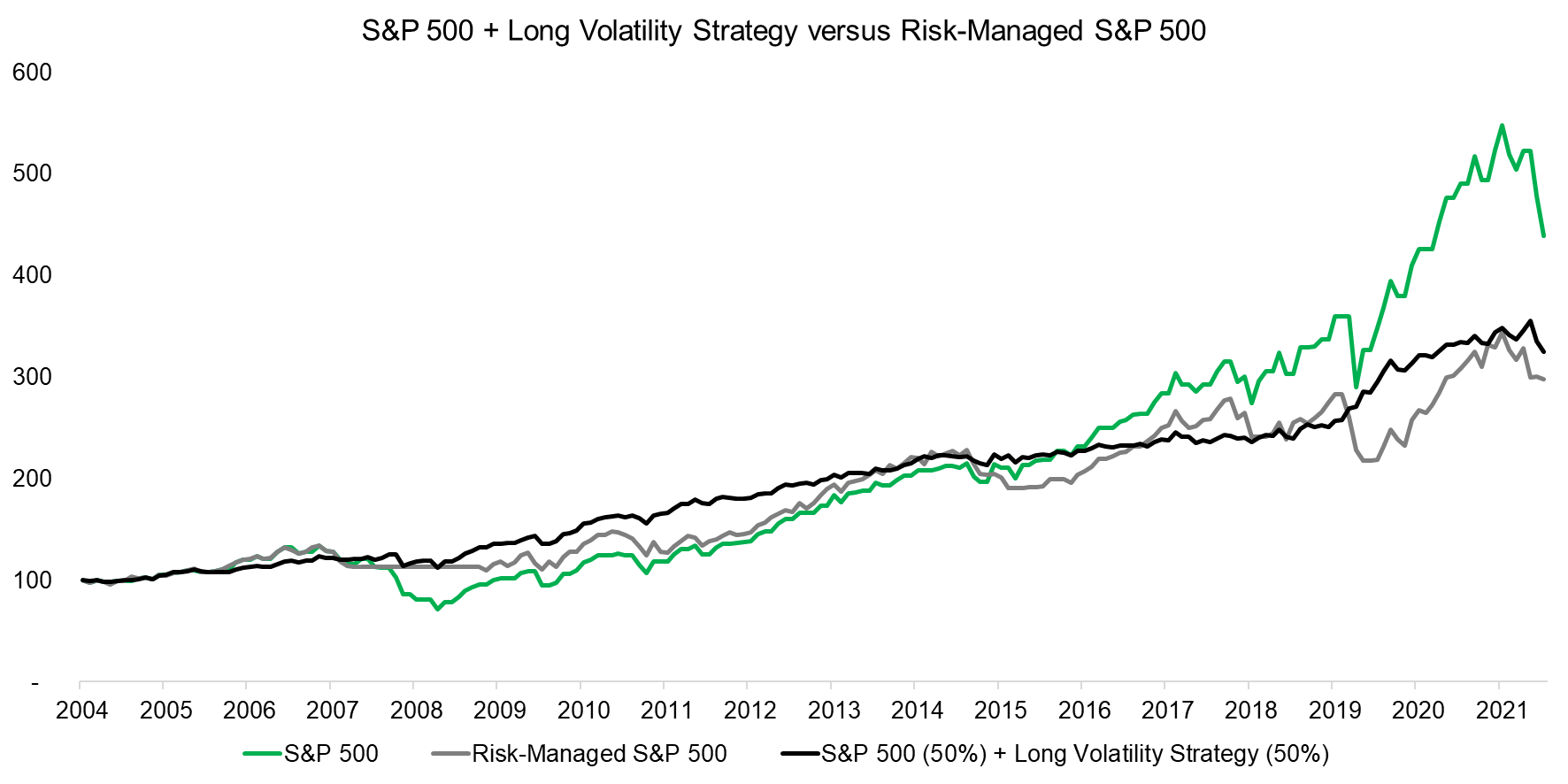

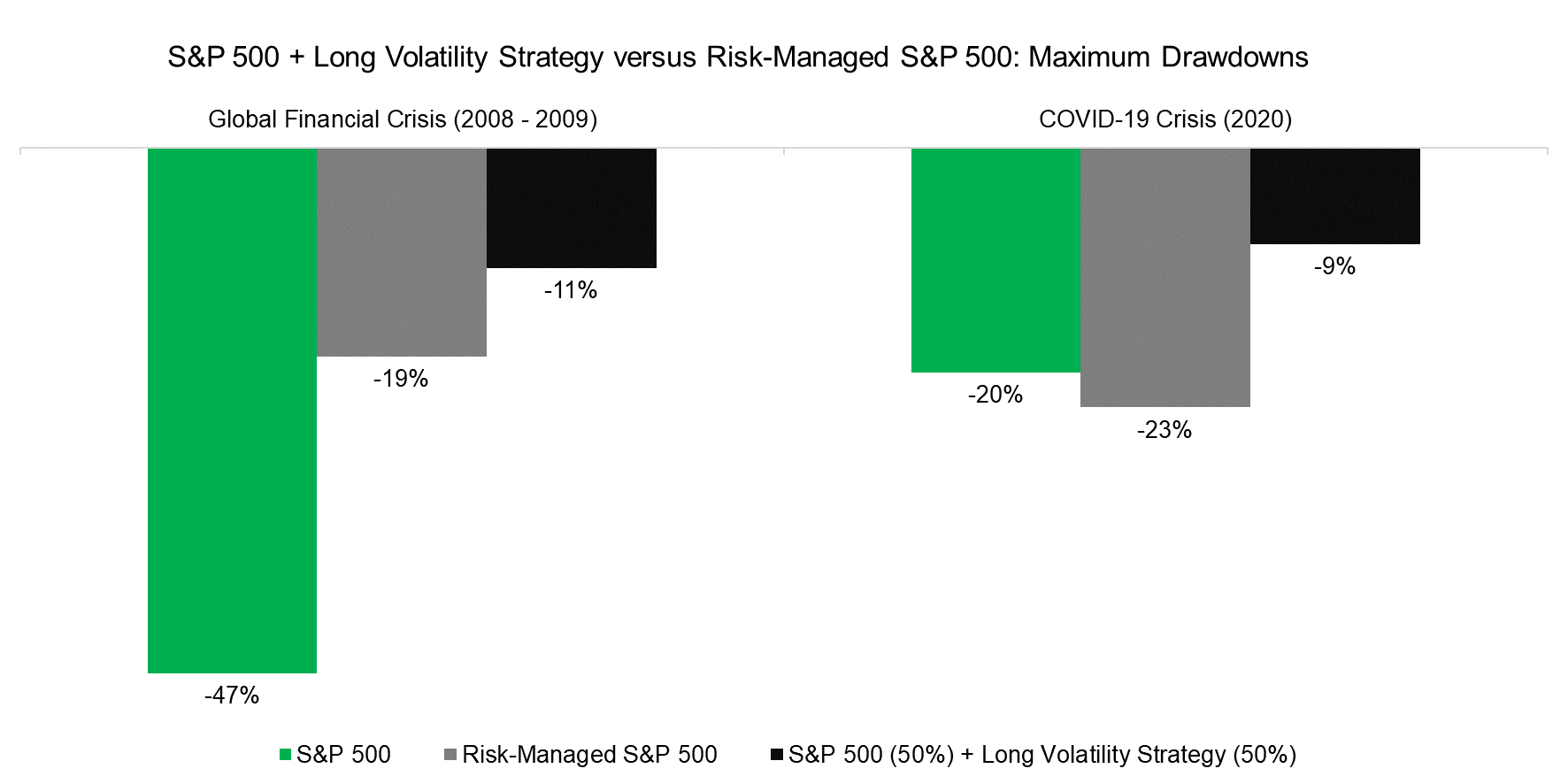

Next, we do a simple comparison of the S&P 500, a risk-managed S&P 500 based on the 200-day moving average, and a combination of the S&P 500 and the long volatility strategy.

For this we need to consider on how much to allocate to a long volatility strategy and we backsolved that the return of the risk-managed S&P 500 and combination portfolio was approximately the same over the 15-year period between 2004 and 2022, which required a 50% allocation to the long volatility strategy and is significantly higher than what most investors would likely be comfortable with.

Source: FactorResearch

The difference between long volatility and TAA strategies is that they provide different diversification benefits. TAA strategies are ideal for long and slow bear markets as they exit equities and preserve capital when stocks move from slowly declining to crashing, eg when Lehman Brothers collapsed in September 2008 a TAA strategy would have had a zero allocation to equities.

In contrast, long volatility strategies benefit from sharp increases in volatility that occur when stock markets suddenly crash, eg in March 2020 as COVID-19 put the global economy on standby modus. TAA strategies tend to have long lookback periods and do not exit quickly enough.

The last decade was characterized by frequent central bank interventions whenever stocks crashed. Given the quick rebounds, this was a poor period for TAA strategies given that they exited and reentered stock markets too late.

Source: FactorResearch

FURTHER THOUGHTS

Based on this analysis, combining equity exposure with a long volatility strategy generated better risk-adjusted returns than applying a tactical asset allocation strategy to equities. There is also less model risk as every TAA strategy requires numerous assumptions.

However, long volatility strategies are complex and require extensive due diligence as well as ongoing monitoring. Furthermore, they are not easily accessible. Finally, the CBOE Long Volatility Index like all hedge fund indices overstates returns and understates risks given survivorship bias. Realized investor returns are lower than portrayed by the index.

RELATED RESEARCH

Revisiting the Performance of TAA ETFs

Long Volatility Strategies: Hedge Funds vs DIY

Building a Long Volatility Strategy without Using Options – III

Tactical ETFs: Tactfully No, Thank You?

Risk-Managed Equity Exposure II

Risk-Managed Equity Exposure

Market Timing vs Risk Management

Market Timing with Multiples, Momentum, and Volatility

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.