Low Volatility Factor: Interest Rate Sensitivity & Sector-Neutrality

Are Low Vol Stocks Bond Proxies?

April 2018. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- The interest rate-sensitivity of the Low Volatility factor has increased in recent years

- Mainly due to the sectoral biases from the long portfolio

- Sector-neutrality reduces the interest rate-sensitivity, albeit at the cost of performance

INTRODUCTION

Low Volatility strategies have become popular over recent years and become a staple in factor portfolios. From a classic financial theory perspective the strategy is somewhat problematic as it undermines the expectation that higher risks are rewarded by higher returns. However, academics and investors have provided a theoretical foundation by explaining the positive excess returns with investor lottery preferences and restrictions on leverage. One frequent criticism is that low volatility stocks are bond proxies as these stocks tend to be stable businesses with significant amounts of leverage. In this short research note we will analyse the interest rate sensitivity of the Low Volatility factor in the US and evaluate a sector-neutral approach (read Factors & Interest Rates).

METHODOLOGY

We focus on the Low Volatility factor, which selects stocks based on their volatility over the last 12 months. The long portfolio includes stocks that exhibit low volatility while the short portfolio is comprised of highly volatile stocks. The factor is created by constructing a long-short beta-neutral portfolio of the top and bottom 10% of stocks of the US stock market. Only stocks with a market capitalisation of larger than $1 billion are included. Portfolios are rebalanced monthly and each transaction incurs costs of 10 basis points (read Low Volatility: High Factor Valuation).

INTEREST RATE SENSITIVITY OF THE LOW VOLATILITY FACTOR

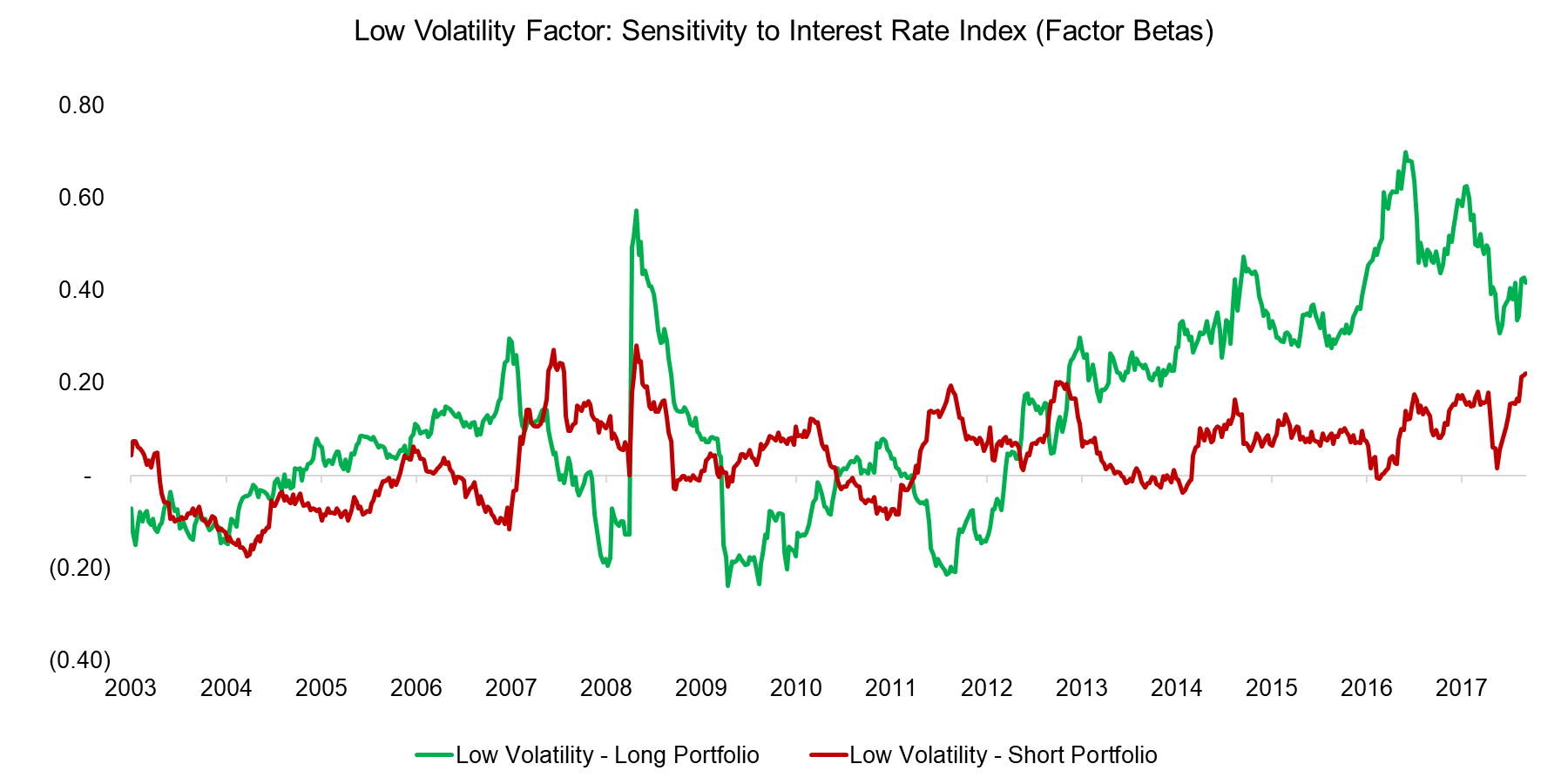

The chart below highlights the factor betas of the long and short portfolios of the Low Volatility factor to an interest rate index, specifically the iShares 7-10 Year Treasury Bond ETF, which were derived from a regression analysis with a one-year lookback. We can observe that the factor betas of the long portfolio have been zero on average from 2003 to 2011 and since then been gradually rising, which highlights that the performance of the long portfolio in recent years can be partially explained by changes in interest rates. Naturally this period is characterised by decreasing interest rates due to quantitative easing of central banks, which likely explains the stellar performance of the Low Volatility factor in the period. The short portfolio does not highlight any sensitivity to interest rates.

Source: Ishares, FactorResearch

LOW VOLATILITY FACTOR: BREAKDOWN BY SECTORS

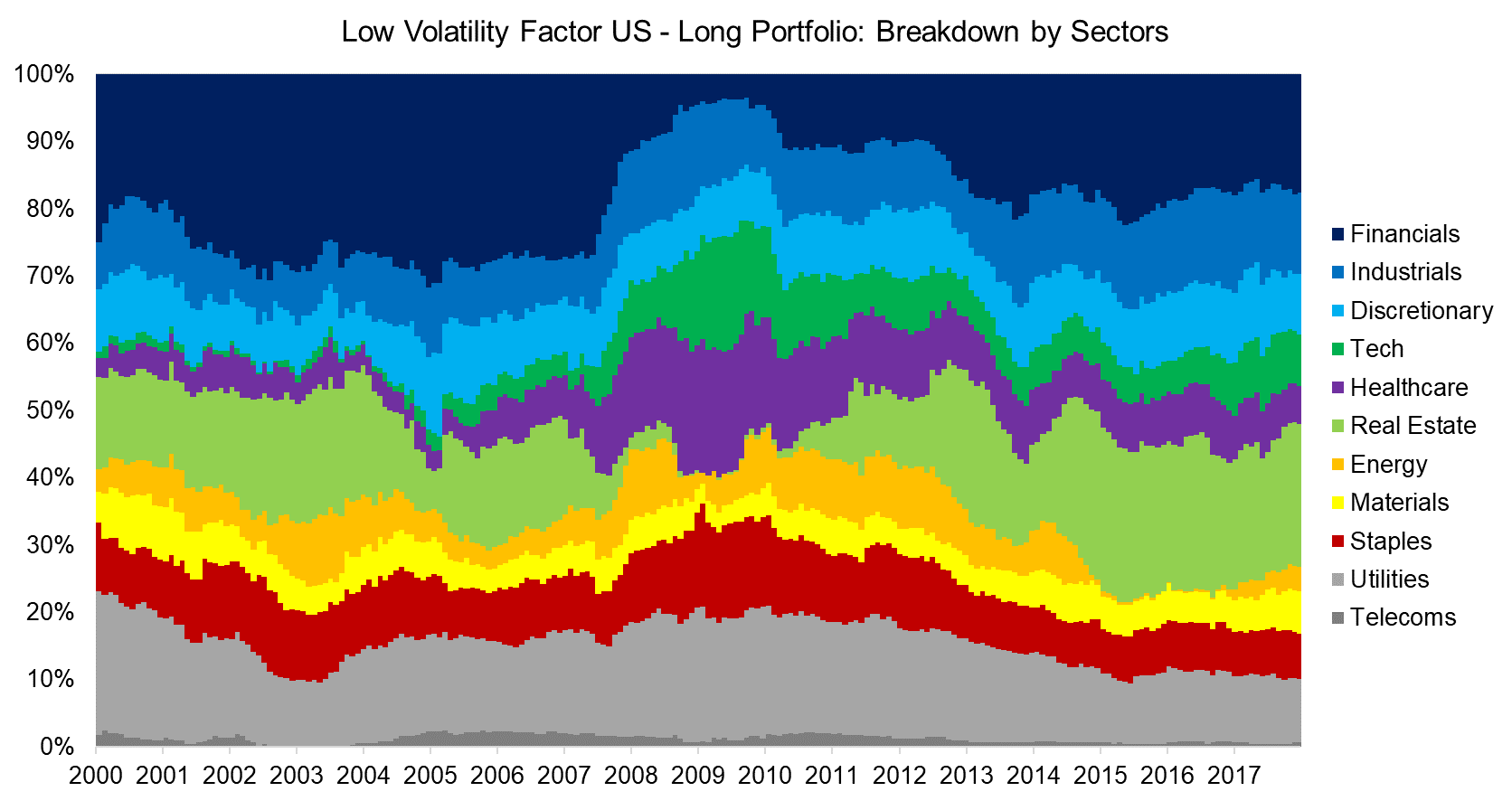

Given that the long portfolio of the Low Volatility factor highlighted a sensitivity towards interest rates it is interesting to analyse the sectoral composition. We can observe a relatively diversified portfolio with Financials, Real Estate and Utilities being the largest sectors. The latter two are highly interest rate-sensitive sectors as these contain companies with significant amounts of debt, i.e. decreasing interest rates increase earnings and vice versa.

Source: FactorResearch

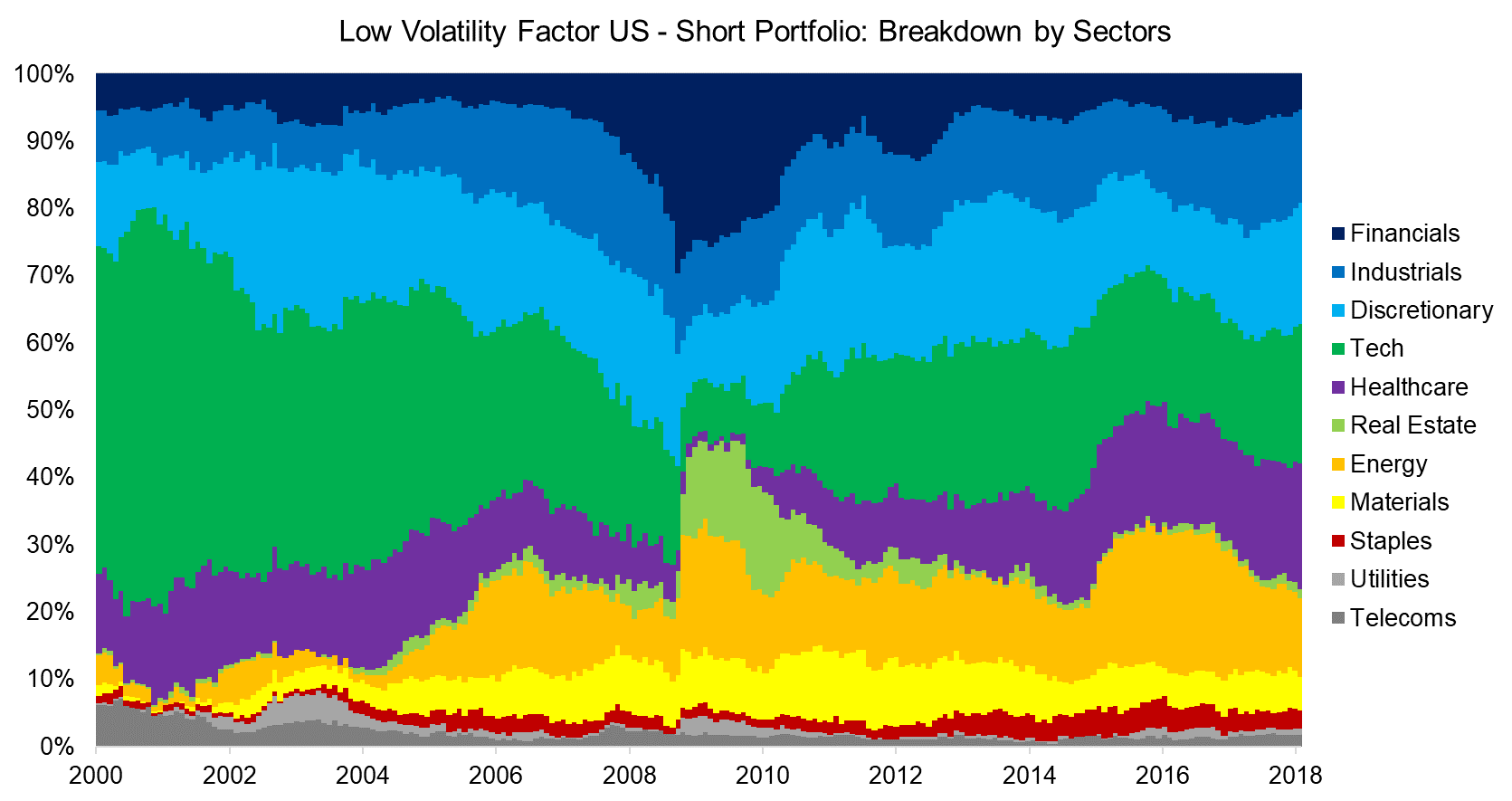

The short portfolio also highlights a relatively diversified portfolio with the Industrials, Discretionary, Technology and Healthcare sectors contributing most stocks. None of these sectors is particular interest rate-sensitive, e.g. Technology stocks tend to have low leverage and Healthcare stocks are more impacted by their product pipeline and changes in regulations.

Source: FactorResearch

LOW VOLATILITY FACTOR: CROSS-SECTOR VERSUS SECTOR-NEUTRAL

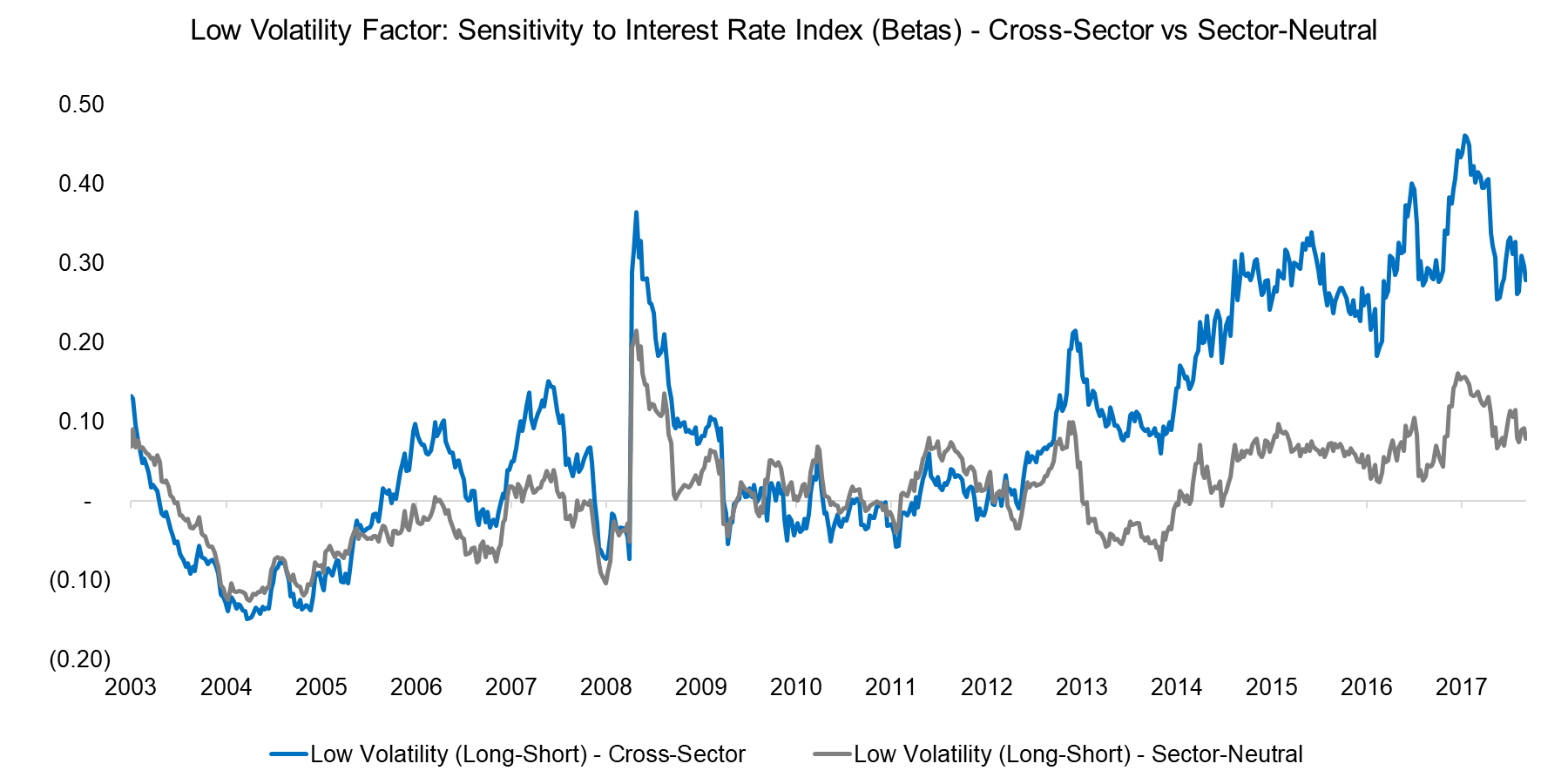

Some research suggests that the interest rate-sensitivity is mainly due to the large sector biases in the long and short portfolios, which could be mitigated by creating a sector neutral-portfolio. The chart below shows the factor betas of the cross-sector and sector-neutral Low Volatility factors. We can observe that sector-neutrality indeed lowers the interest rate-sensitivity, which can be considered an undesired risk exposure from a portfolio perspective.

Source: FactorResearch

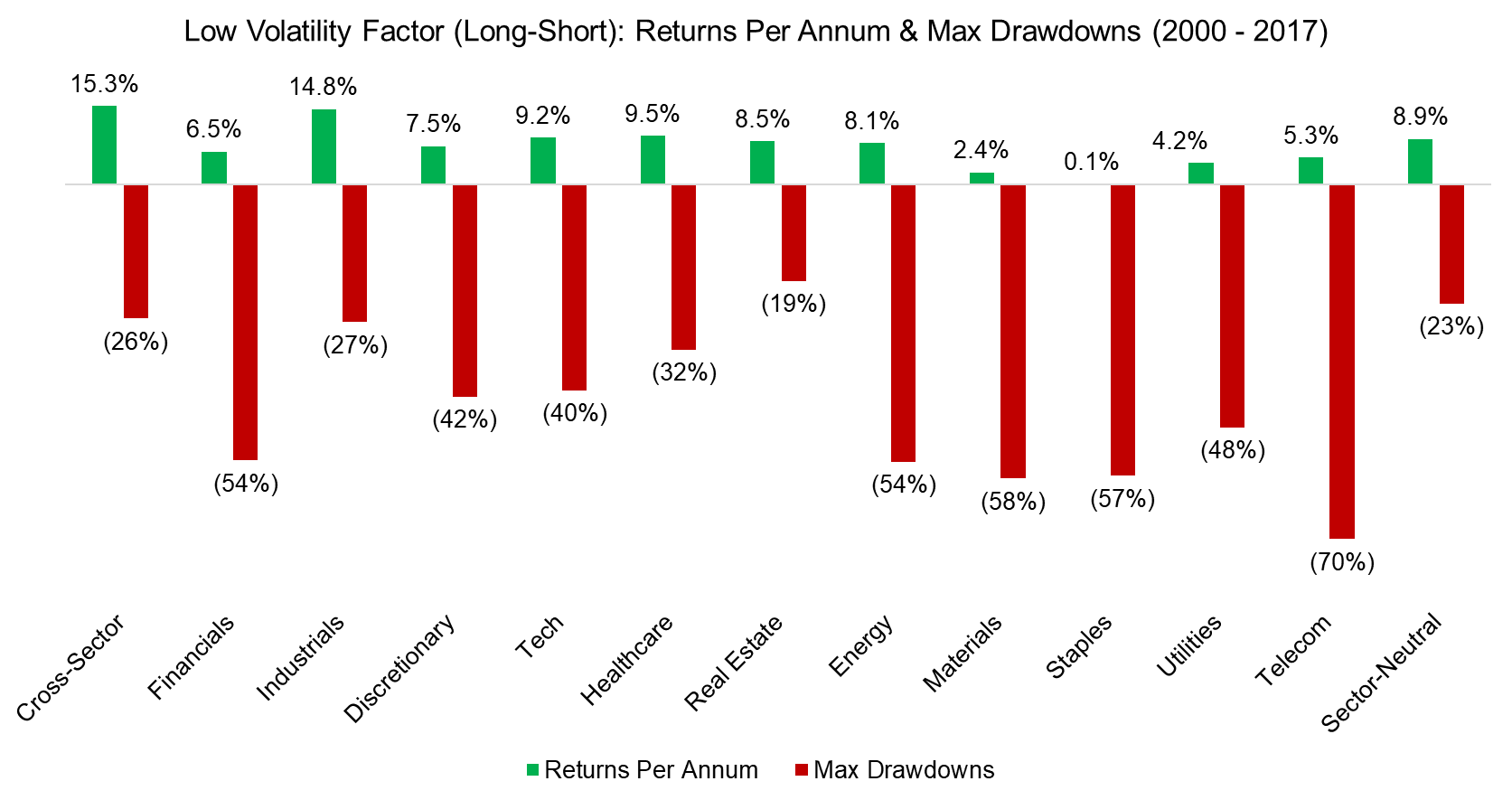

However, there are few free lunches in finance and introducing sector-neutrality may impact the performance and risk-metrics of the Low Volatility factor. The analysis below highlights the returns per annum and maximum drawdowns of the cross-sector, intra-sector and sector-neutral Low Volatility factors (long-short) from 2000 to 2017. We can observe that the maximum drawdowns of the intra-sector portfolios were much larger than those of the cross-sector and sector-neutral portfolios. The returns per annum of the sector-neutral portfolio were also significantly lower than that of the cross-sector portfolio, despite having comparable maximum drawdowns.

Source: FactorResearch

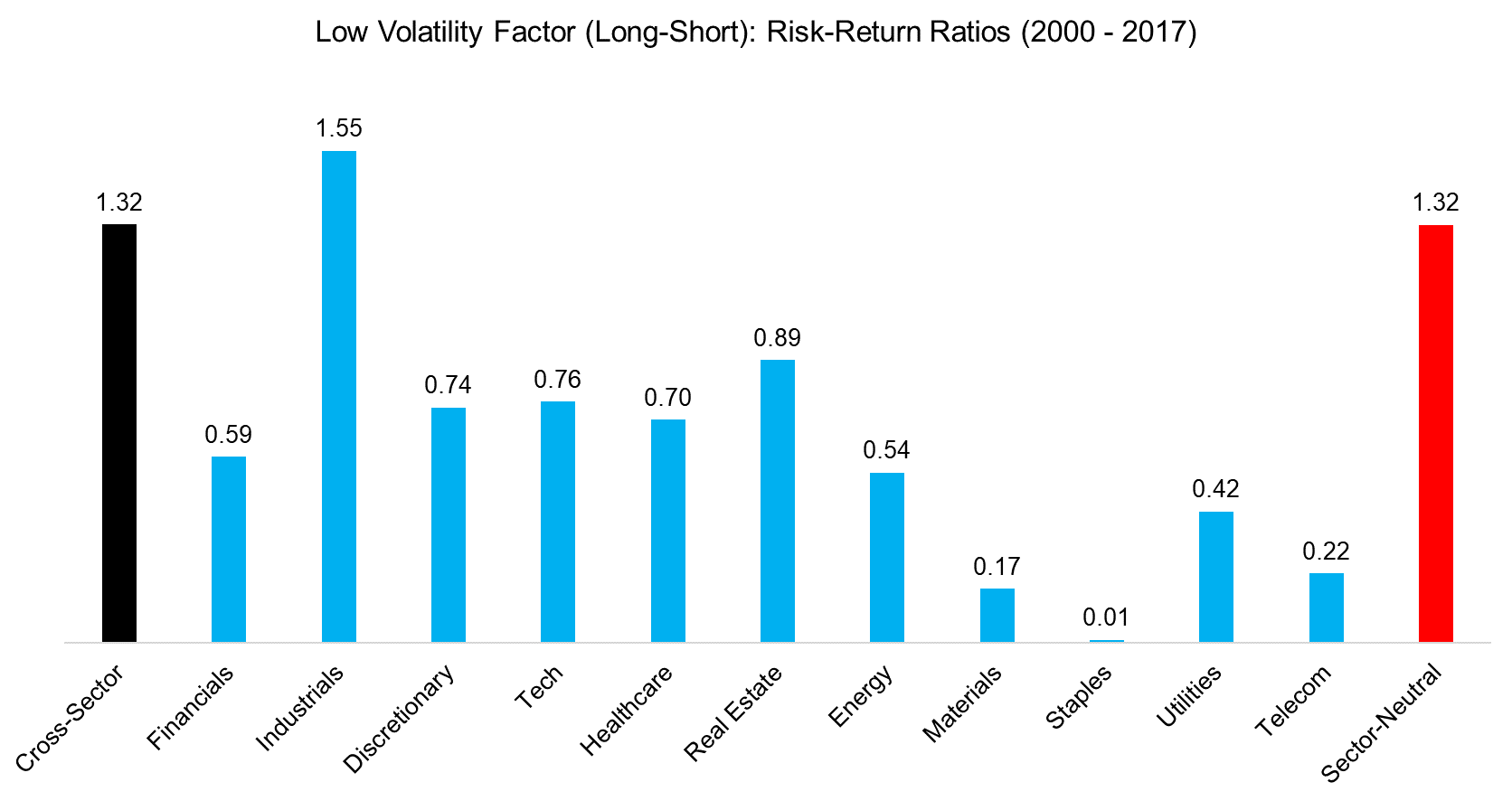

Finally we can compare the risk-return ratios, which highlights similar ratios for the cross-sector and sector-neutral portfolios. The ratios for the intra-sector portfolios are quite diverse and should be regarded with caution as some sectors, e.g. Telecoms, contain few constituents, which implies more firm-risk than factor exposure due to small portfolios (try Finominal’s Portfolio Diagnostics for portfolio analysis).

Source: FactorResearch

FURTHER THOUGHTS

This short research note highlights the interest rate-sensitivity of the Low Volatility factor and shows how a sector-neutral portfolio reduces that sensitivity, albeit at the cost of lower performance. Investors should regard the interest rate-sensitivity as undesirable risk as otherwise the factor exposure becomes a partial speculation on the direction of interest rates, which is an area where few investors succeed.

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.