Low Volatility Funds: Lost Decade or Flawed Design?

Long-only vs long-short low volatility strategies

February 2026. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Low-volatility funds have generated poor absolute and risk-adjusted returns recently

- However, the long-term evidence still supports the defensive use case

- Significant difference between long-short and long-only low-volatility strategies

INTRODUCTION

Low-volatility strategies are relatively easy to market. There is almost always some economic or market risk that appears to justify reduced equity exposure. Adding to their appeal, academic research has long documented that low-risk stocks have outperformed the broader equity market on a risk-adjusted basis. On the surface, the case seems compelling.

Yet the experience during the COVID-19 crisis in 2020 challenged this narrative. Invesco’s S&P 500 Low Volatility ETF (SPLV) – one of the largest low-volatility ETFs by assets under management – experienced a slightly larger maximum drawdown than the S&P 500 itself, surprising and disappointing many investors expecting defensive characteristics. The fund’s significant exposure to traditionally anti-cyclical sectors, such as real estate, proved problematic as the pandemic abruptly altered consumer behavior and workplace dynamics, turning perceived low-risk sectors into sources of elevated risk.

In the years since, investor skepticism toward low-volatility strategies has increased. But is this skepticism justified? In this research article, we examine whether low-volatility strategies have merely suffered through a poor decade – or whether recent outcomes point to deeper structural shortcomings.

THE CASE FOR LOW VOLATILITY STRATEGIES

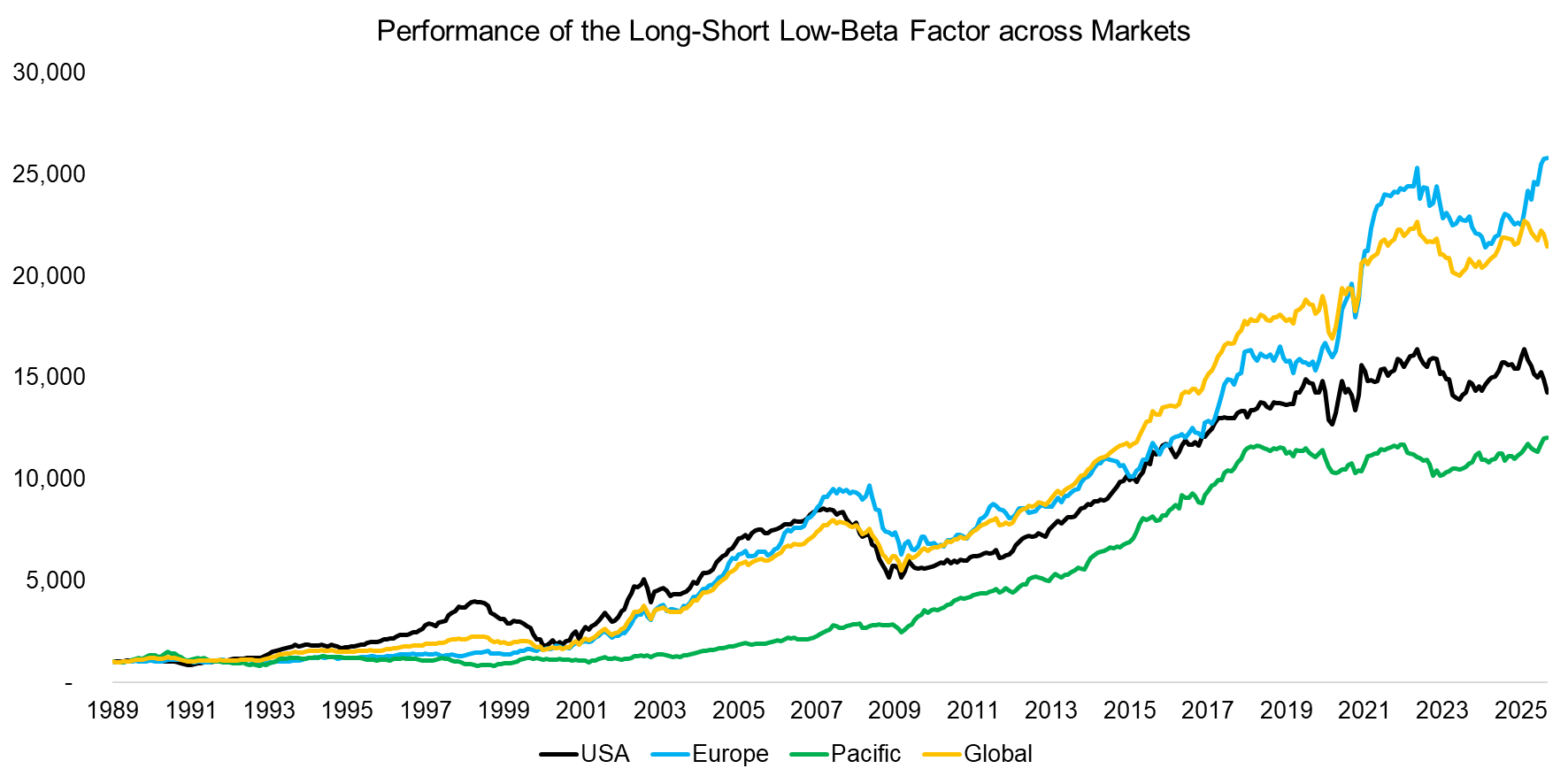

A substantial body of academic research documents that low-risk stocks tend to outperform high-risk stocks, with risk most commonly measured by a stock’s volatility or its beta relative to the broader equity market. AQR provides long-term evidence for this phenomenon across the United States, Europe, and the Pacific region, with data extending back to 1989. Their approach constructs portfolios that are long low-beta stocks and short high-beta stocks.

To isolate the low-risk effect, these portfolios are made beta-neutral by leveraging the long positions and deleveraging the short positions. The resulting long-short, market-neutral strategy delivers highly attractive excess returns across all regions. Notably, these returns exceed those associated with other well-known equity factors, such as value, quality, or size.

Source: AQR, Finominal

PERFORMANCE OF LOW VOLATILITY FUNDS

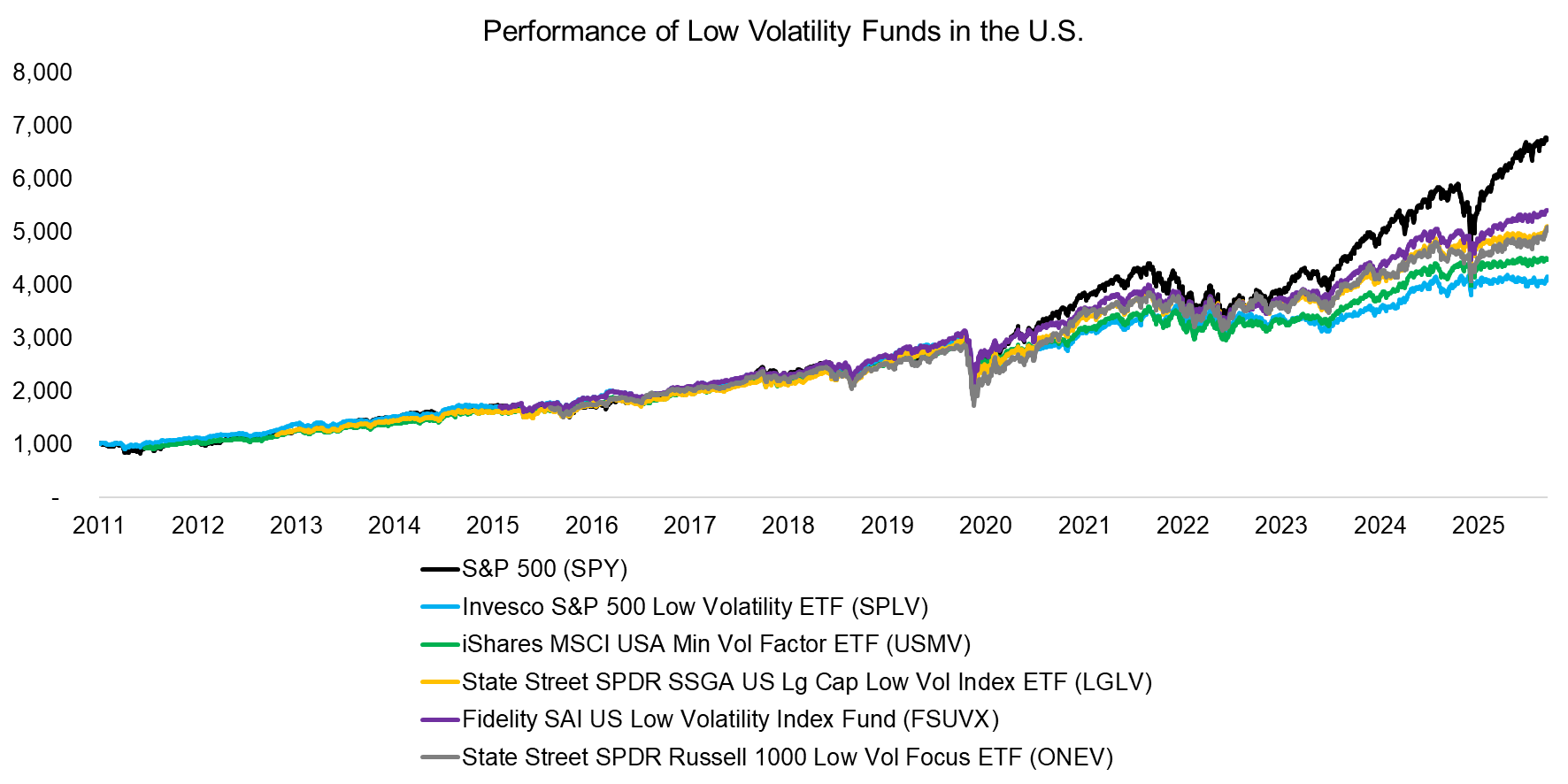

Shifting from theory to practice, we examine the performance of some of the largest U.S. low-volatility funds: Invesco S&P 500 Low Volatility ETF (SPLV), iShares MSCI USA Min Vol Factor ETF (USMV), State Street SPDR SSGA US Large Cap Low Volatility Index ETF (LGLV), Fidelity SAI US Low Volatility Index Fund (FSUVX), and State Street SPDR Russell 1000 Low Volatility Focus ETF (ONEV). Collectively, these funds manage nearly $50 billion in assets and charge annual fees ranging from 0.11% to 0.25%.

Between 2011 and 2020, these funds generally tracked the performance of the S&P 500. However, in more recent years, they have significantly underperformed. Much of this underperformance can be attributed to their relative underweight in highly volatile technology stocks, such as the so-called “Magnificent Seven.”

Source: Finominal

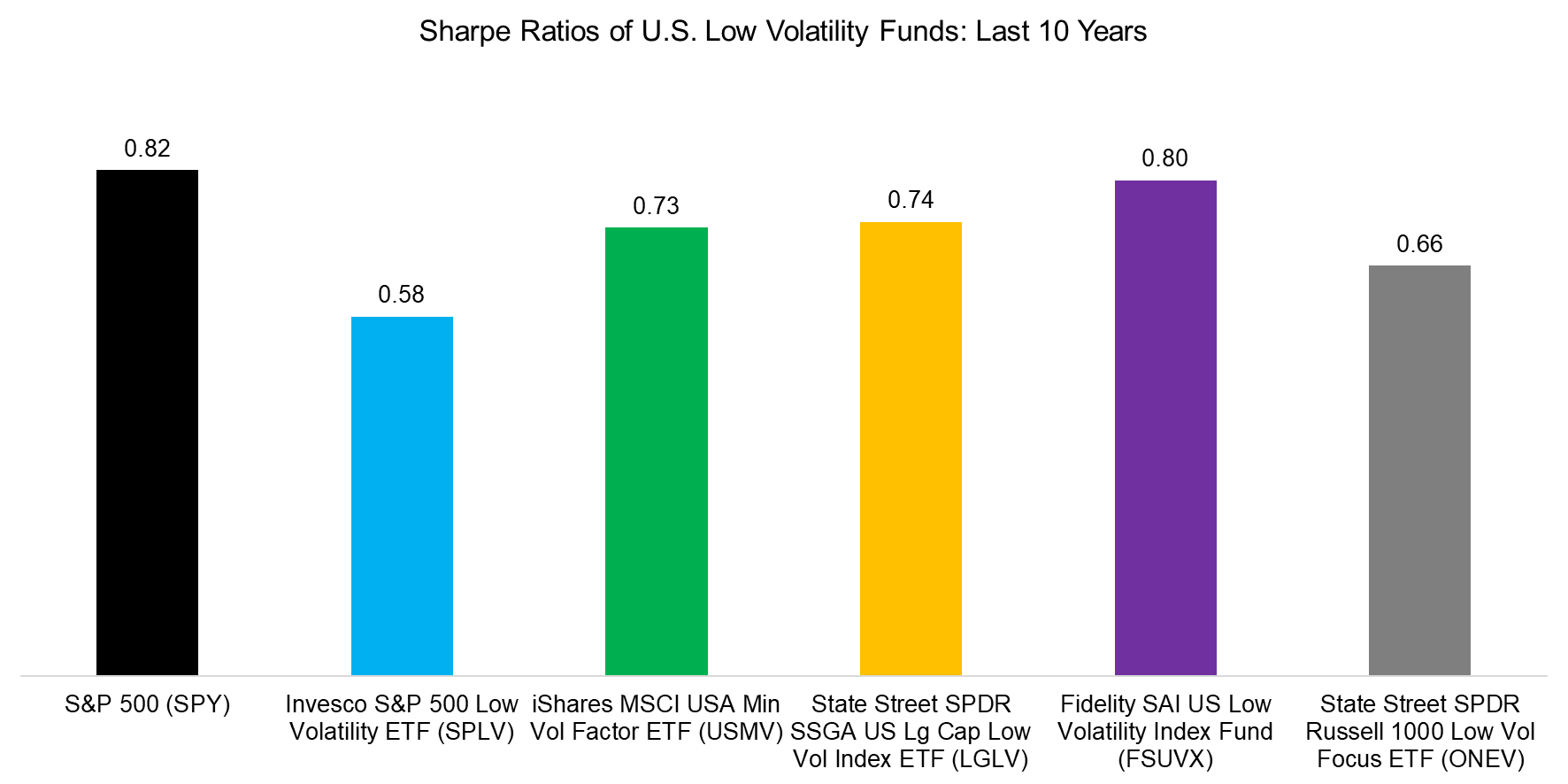

It is often overlooked that low-risk stocks are expected to deliver higher risk-adjusted returns, rather than higher absolute returns, compared with the broader stock market. When we calculate Sharpe ratios over the period from 2015 to 2025, we find that the S&P 500 actually achieved a higher Sharpe ratio than any of the low-volatility funds.

Source: Finominal

EXTENDED ANALYSIS

Given the weak absolute and risk-adjusted performance of U.S. low-volatility funds, investors may question whether the academic evidence supporting low-risk stocks is overstated – a phenomenon observed in other cases. It is important to note the distinction between long-short and long-only strategies: long-only portfolios lack a short component and do not employ leverage (read Market-Neutral versus Smart Beta Factor Investing).

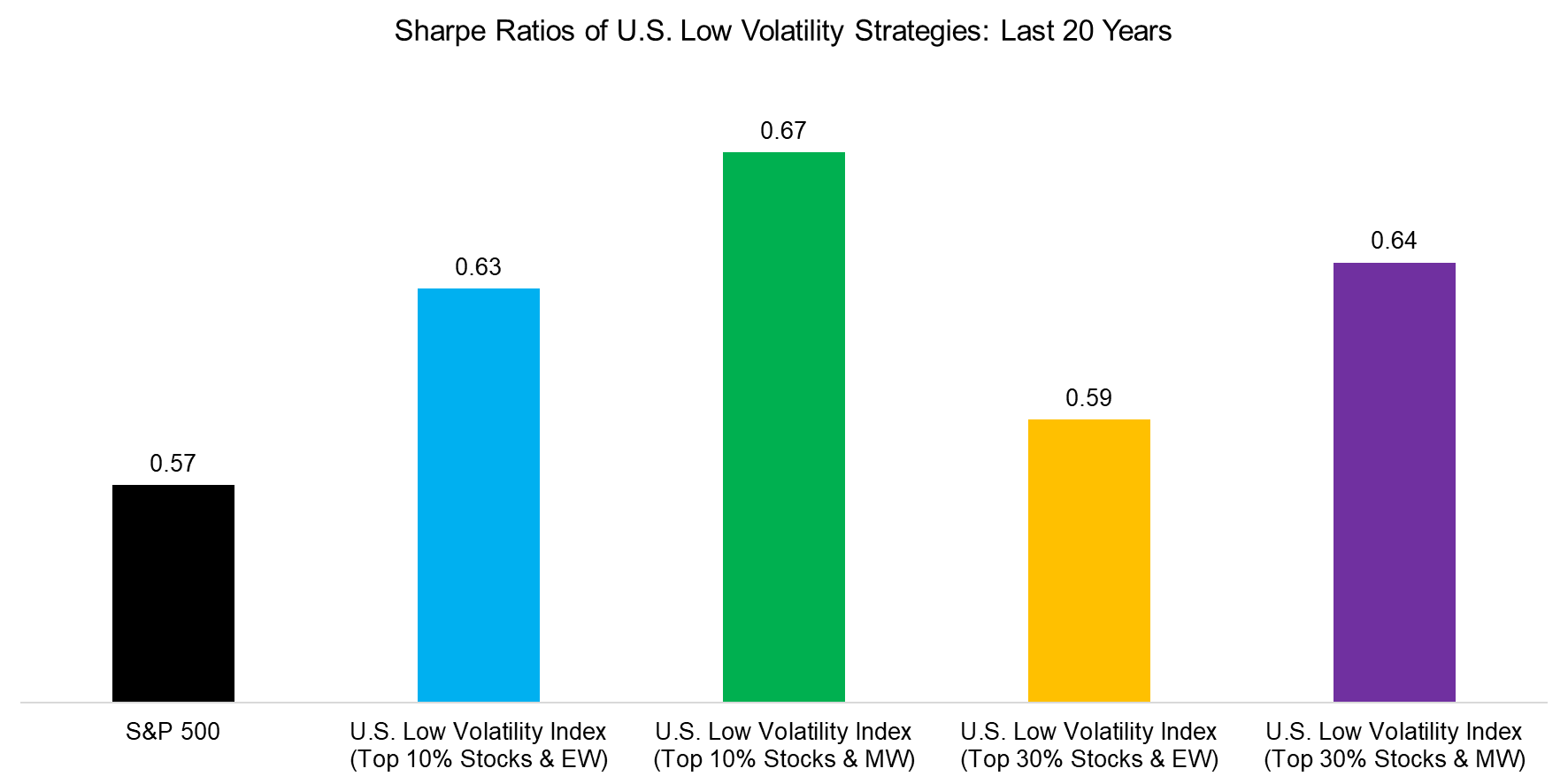

Nonetheless, a single decade of returns is insufficient to validate or dismiss a strategy. While the funds themselves have a relatively short track record, we can extend the analysis using backtested long-only low-volatility indices. We construct four indices based on either the top 10% or 30% least volatile U.S. stocks, applying either equal (“EW”) or market-capitalization (“MW”) weights. Portfolios are rebalanced monthly and assume transaction costs of 10 basis points.

The equal-weighted index of the top 10% least volatile stocks exhibits a correlation of 0.96 with USMV and 0.94 with SPLV, making it a reasonable proxy for existing funds. Across the 2005 to 2025 period, all four indices generated higher Sharpe ratios than the S&P 500, highlighting the potential benefits of low-volatility strategies over a longer horizon.

Source: Finominal

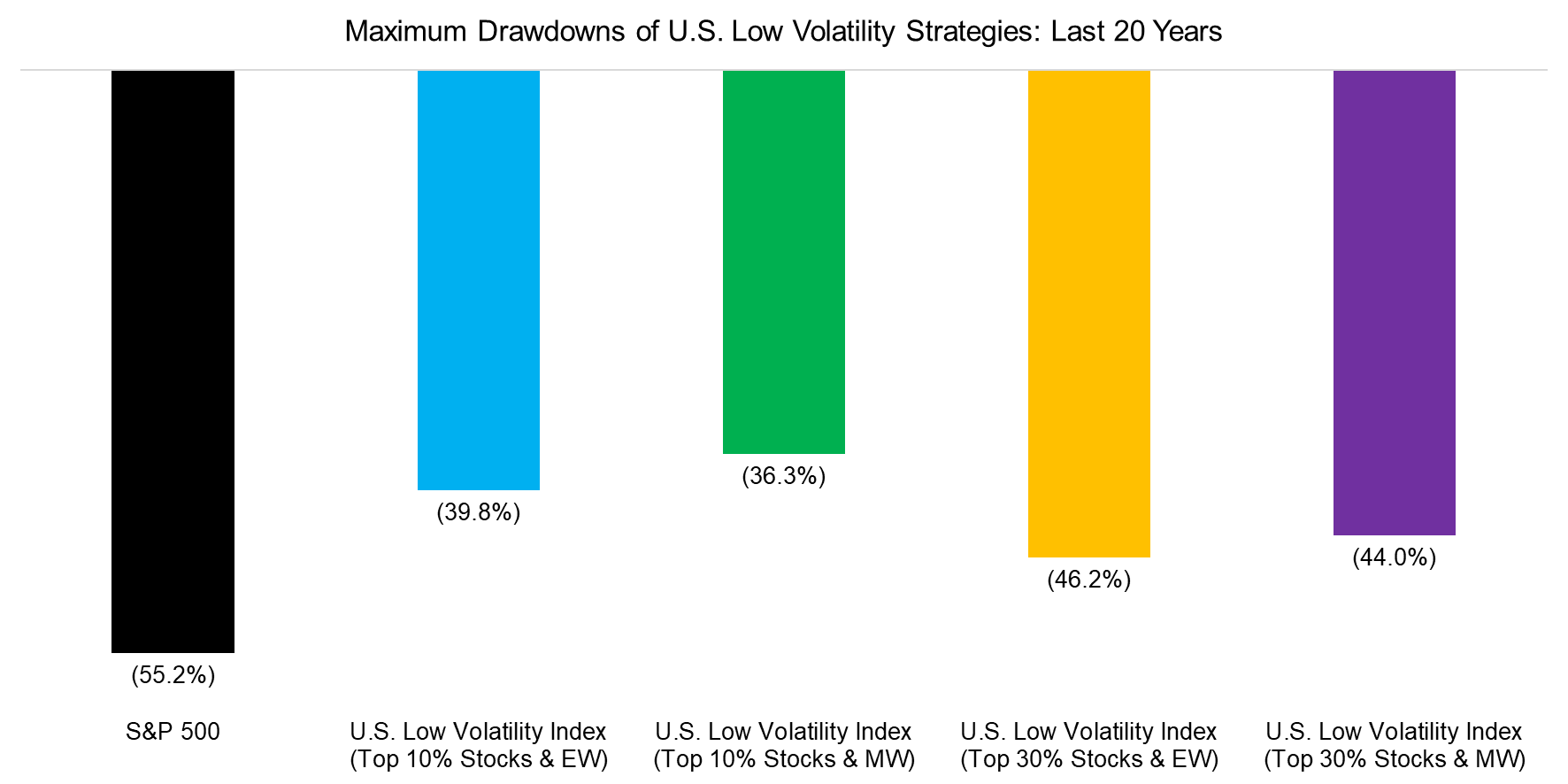

Extending the analysis to the past 20 years did not change the fact that low-volatility strategies have underperformed the S&P 500 in absolute terms. However, their annualized volatility was substantially lower, and this period includes the 2008 global financial crisis, during which the maximum drawdowns of these indices were far smaller than the S&P 500’s 55% loss.

Source: Finominal

FURTHER THOUGHTS

How should investors think about long-only low-volatility strategies given the poor performance over the last decade?

Unfortunately, no strategy works all the time and consistently achieves its desired objectives. The recent underperformance of low-volatility funds has been disappointing, but it is expected given their stock market betas of 0.4 to 0.6 and the prevailing bullish market. Long-term evidence, however, confirms that these can create value, particularly in a more balanced market environment.

Given their higher Sharpe ratios, it is notable that leveraged low-risk stock mutual funds or ETFs do not exist, which could potentially serve as alternatives to core equity holdings.

RELATED RESEARCH

Are Low-Risk Stocks Really Low-Risk?

Quality versus Low Volatility ETFs

Musings on Low Volatility

Is Low Vol the New Value?

Low Vol Factor: From Obscurity to Stardom

The Dark Side of Low Volatility-Stocks

Timing Low Volatility with Factor Valuations

LOVM: Low Volatility-Momentum Portfolios

Low Volatility vs Option-Based Strategies

Minimum Variance Versus Low Volatility

Low Volatility, Low Beta & Low Correlation

Low Volatility Factor: Interest Rate Sensitivity & Sector-Neutrality

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.