Low Volatility vs Option-Based Strategies

Core Equity Alternatives

October 2019. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Option-based strategies have similar characteristics to Low Volatility portfolios

- Combining these reduces idiosyncratic strategy risks

- The combinations feature higher risk-adjusted returns and lower drawdowns than the S&P 500

INTRODUCTION

Some investment products and strategies can be considered toxic given their history on Wall Street. Portfolio insurance is rarely used in marketing materials, given its role in the 1987 stock market crash. CDO-Squared instruments and structured investment vehicles (SIVs) are also unlikely to make a major comeback as they were at the epicentre of the global financial crisis.

Less toxic, albeit still frequently viewed critically by mainstream investors are hedge funds, managed futures, structured products, amongst others. Mostly these concerns are justified based on poor performance and are typically related to complexity, which make risk-return decisions challenging (read Hedge Fund ETFs).

However, some of these complex strategies have become available as ETFs, which represents a game changer as they will be traded on a regulated stock exchange and usually offer full transparency by tracking an index with a documented methodology.

For example, option-based strategies like covered call and put writing were launched as ETFs and aim to offer equity-returns with reduced downside, similar to Low Volatility strategies. However, investors have allocated barely above $1 billion of assets to option-based ETFs, compared to more than $80 billion in Low Volatility ETFs, which is challenging to explain.

In this short research note, we will compare option-based and Low Volatility strategies as well as consider these as alternatives for core equity positions.

METHODOLOGY

We utilize the CBOE S&P 500 BuyWrite Index (BXM), which employs a covered call approach that buys the S&P 500 and sells at-the-money calls on the index, and the CBOE S&P 500 PutWrite Index (PUT), which sells at-the-money S&P 500 puts and invests the cash in short-term Treasuries, as option-based strategies.

We construct two Low Volatility portfolios by sorting for the 10% (P10) and 30% (P30) of stocks in the US stock market with the lowest price volatility over the last 12 months. Only stocks with a minimum market capitalization of $1 billion are included. Portfolios are rebalanced monthly and each transaction incurs costs of 10 basis points.

LOW VOLATILITY VS OPTION-BASED STRATEGIES IN THE US

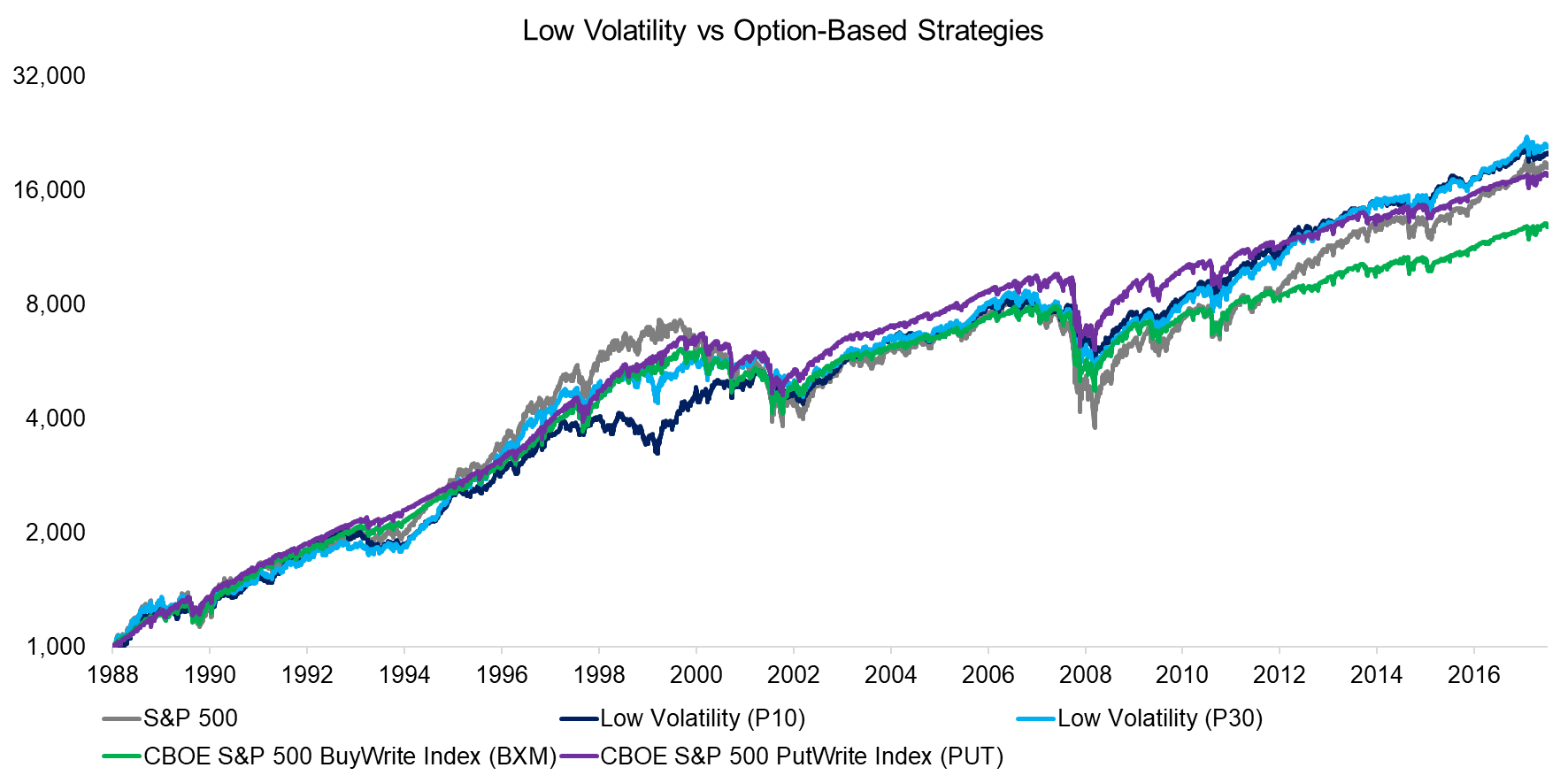

The total returns of the S&P 500, the two Low Volatility portfolios, and the PUT index were almost identical in the period from 1988 to 2019. BXM, which theoretically should have generated the same returns as the PUT index, generated a lower return.

However, more importantly, we observe markedly different behaviour during key financial market periods. In the tech bubble in 2000, the S&P 500 exhibited the strongest return, while the two Low Volatility portfolios underperformed as investors were chasing highly volatile technology stocks while ignoring unexciting low-risk stocks. In contrast, the S&P 500 experienced the largest drawdown of all indices during the global financial crisis in 2008, where the other strategies outperformed.

Source: CBOE, FactorResearch

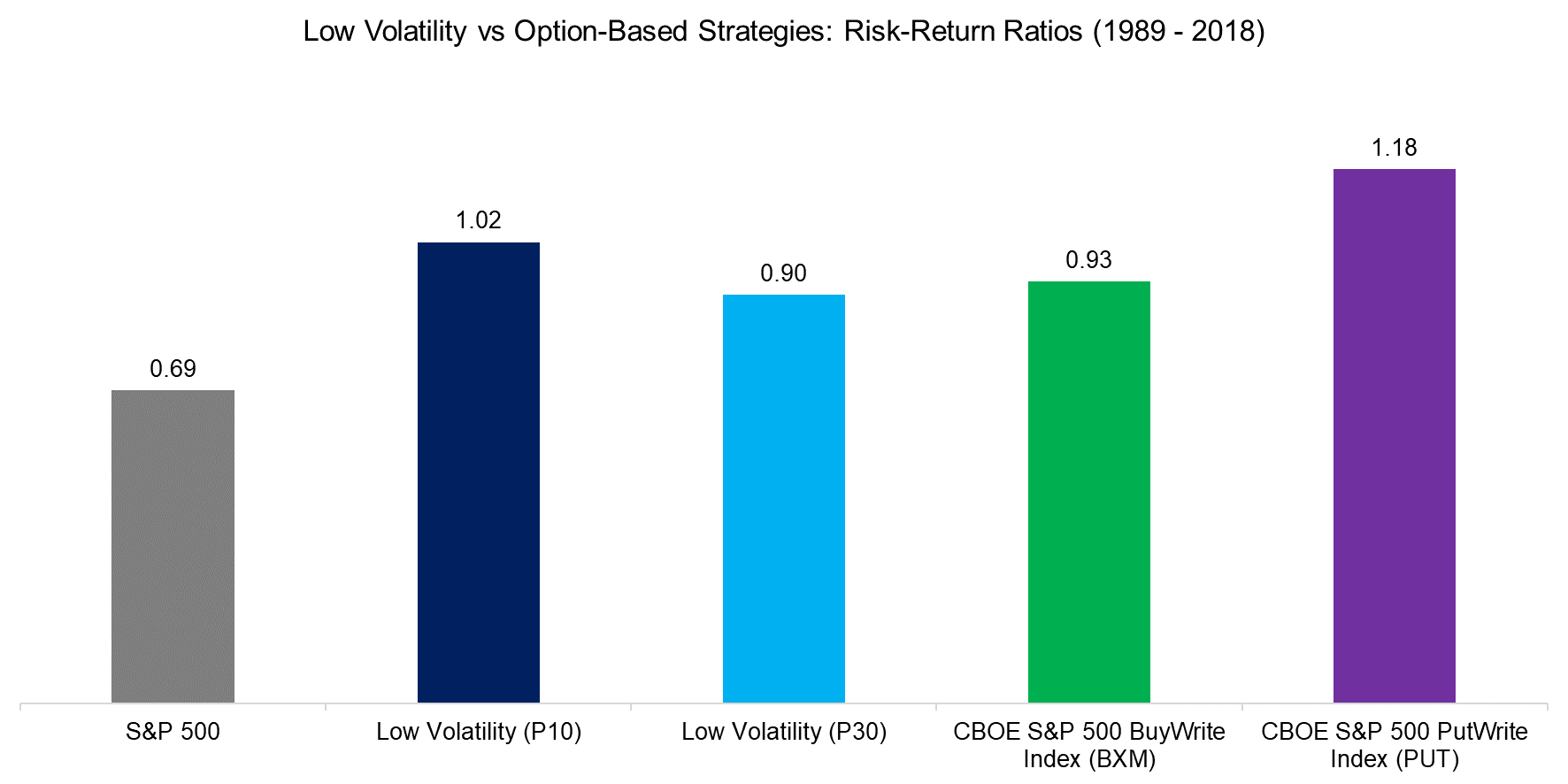

We can change the perspective to risk-adjusted returns, where we observe that all strategies generated significantly higher risk-return ratios than the S&P 500 between 1989 and 2018. Based on these results, investors could consider to replace core equity positions with any of these alternatives.

However, it is worth noting that both types of strategies typically feature betas below one, i.e. lower than the market, which leads to underperformance in strong bull markets. If investors replace simple beta exposure like the S&P 500 with Low Volatility or option-based strategies, then they would need to stay invested over a complete market cycle to reap the benefits.

Source: CBOE, FactorResearch

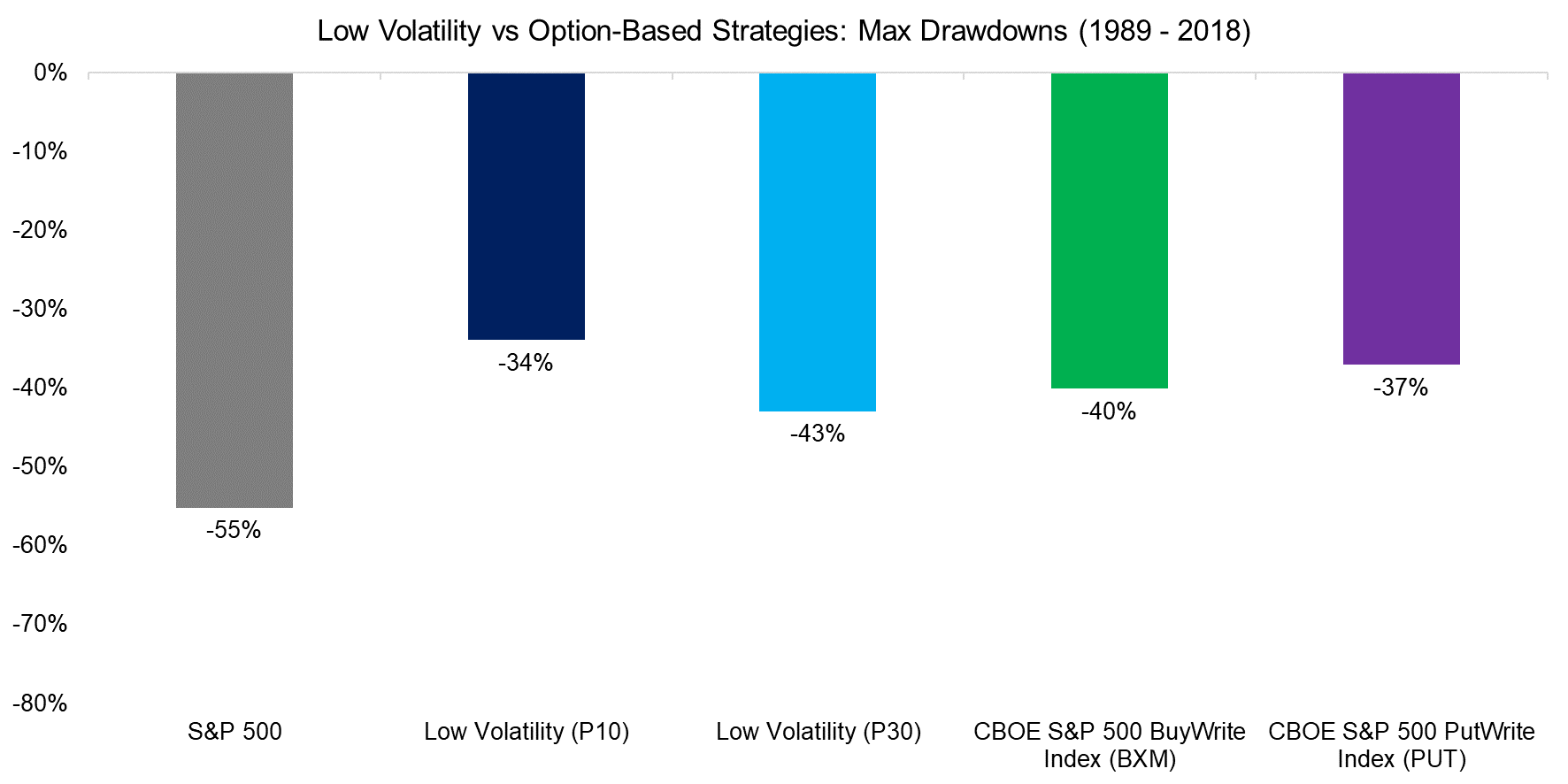

The higher risk-adjusted returns are reflected in lower maximum drawdowns than those of the S&P 500 during the 30-year period, which are attractive characteristics. Investors that allocate to Low Volatility strategies primarily seek risk-reduction and the results indicate that option-based strategies can be viewed as alternatives from this perspective.

However, option-based strategies are more negatively skewed than the S&P 500, which are signs that these are more prone to negative tail-events. Although Low Volatility strategies are favourable from this perspective given neutral skewness, they frequently exhibit positive exposure to bonds given sector biases to interest rate-sensitive sectors like utilities and real estate. Neither strategy is without additional risks.

Source: CBOE, FactorResearch

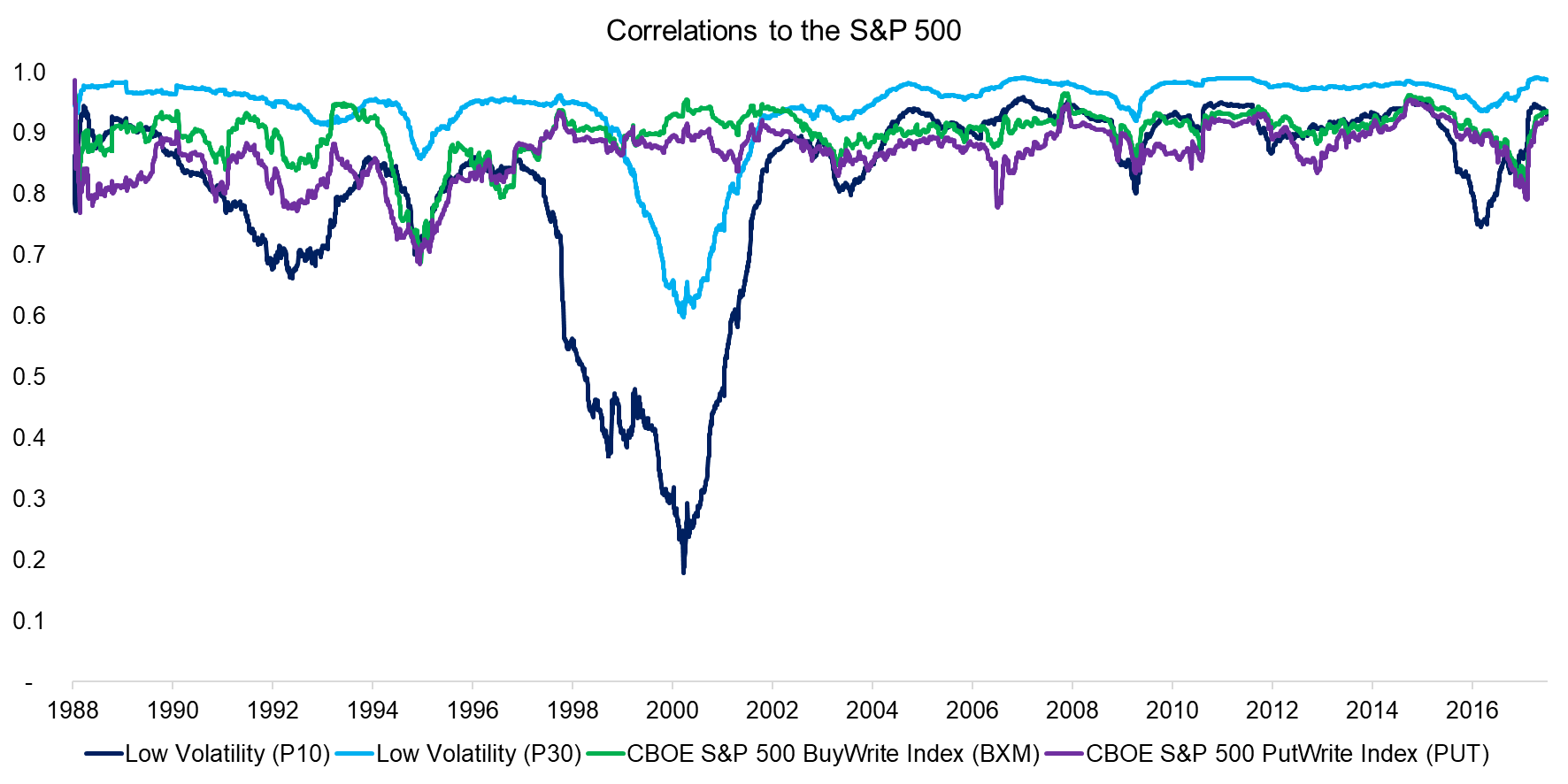

Finally, we calculate the correlation of the strategies to the S&P 500, which highlights that the concentrated Low Volatility (P10) portfolio featured the lowest correlation on average. Although this portfolio generated attractive risk-adjusted returns and the lowest maximum drawdown, it is also characterized by the largest tracking error. Investors could reduce that by allocating to a more diversified Low Volatility (P30) portfolio or the option-based strategies.

Source: CBOE, FactorResearch

CORE EQUITY ALTERNATIVES

Given better risk-adjusted returns than the S&P 500, investors might consider Low Volatility or option-based strategies as alternatives to core equity positions. However, as highlighted, neither strategy is without additional risks like negative skewness or bond exposure, which can be reduced by simply combining the strategies (read Low Volatility Factor: Interest Rate Sensitivity & Sector-Neutrality).

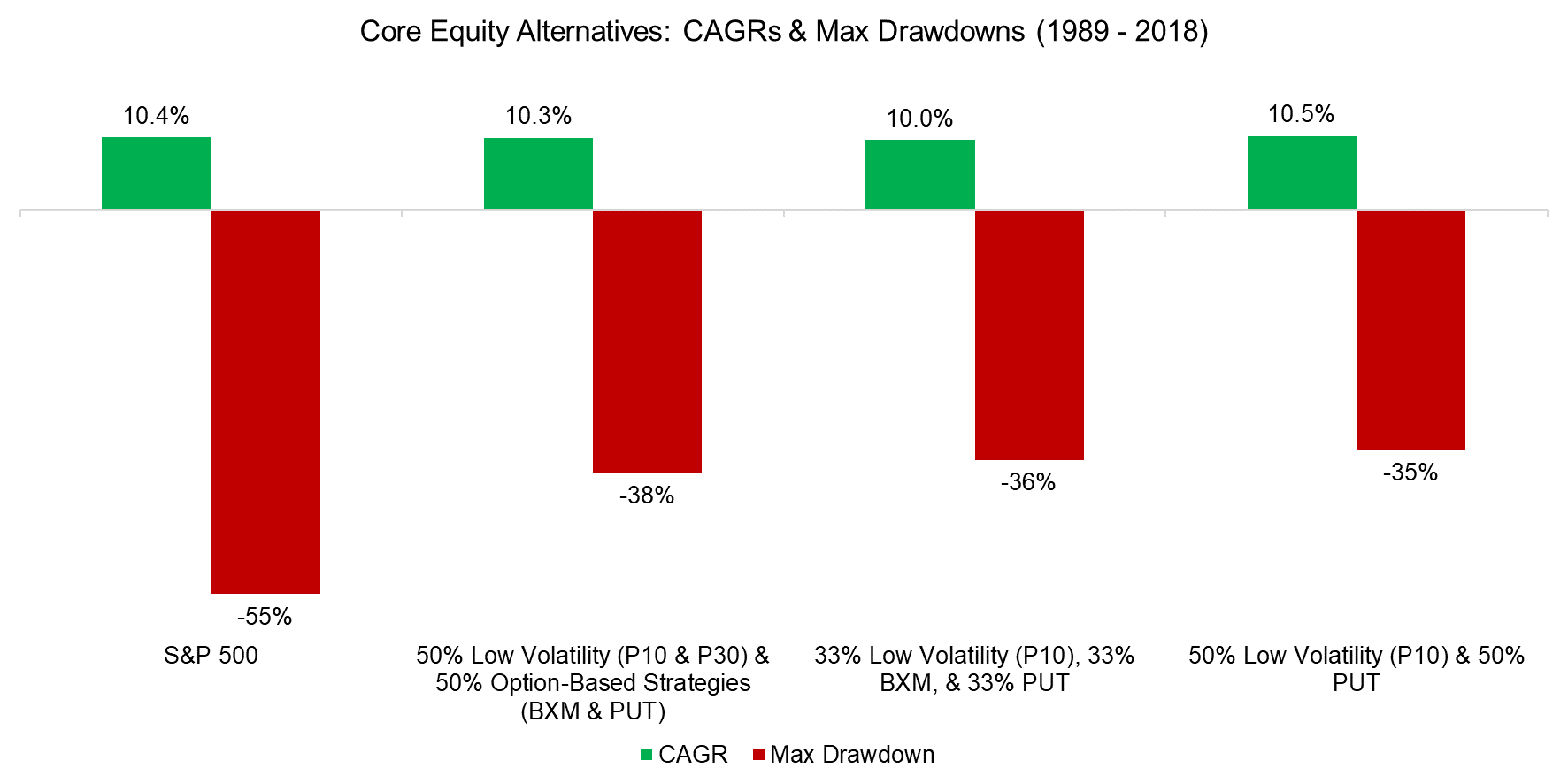

We create a few combinations comprised of Low Volatility and option-based strategies. Based on the previous results, the most attractive combination should consist of a concentrated Low Volatility (P10) portfolio and the PUT index. And indeed, such a combination would have achieved a higher CAGR and lower maximum drawdown than that of the S&P 500 in the last three decades.

Source: FactorResearch

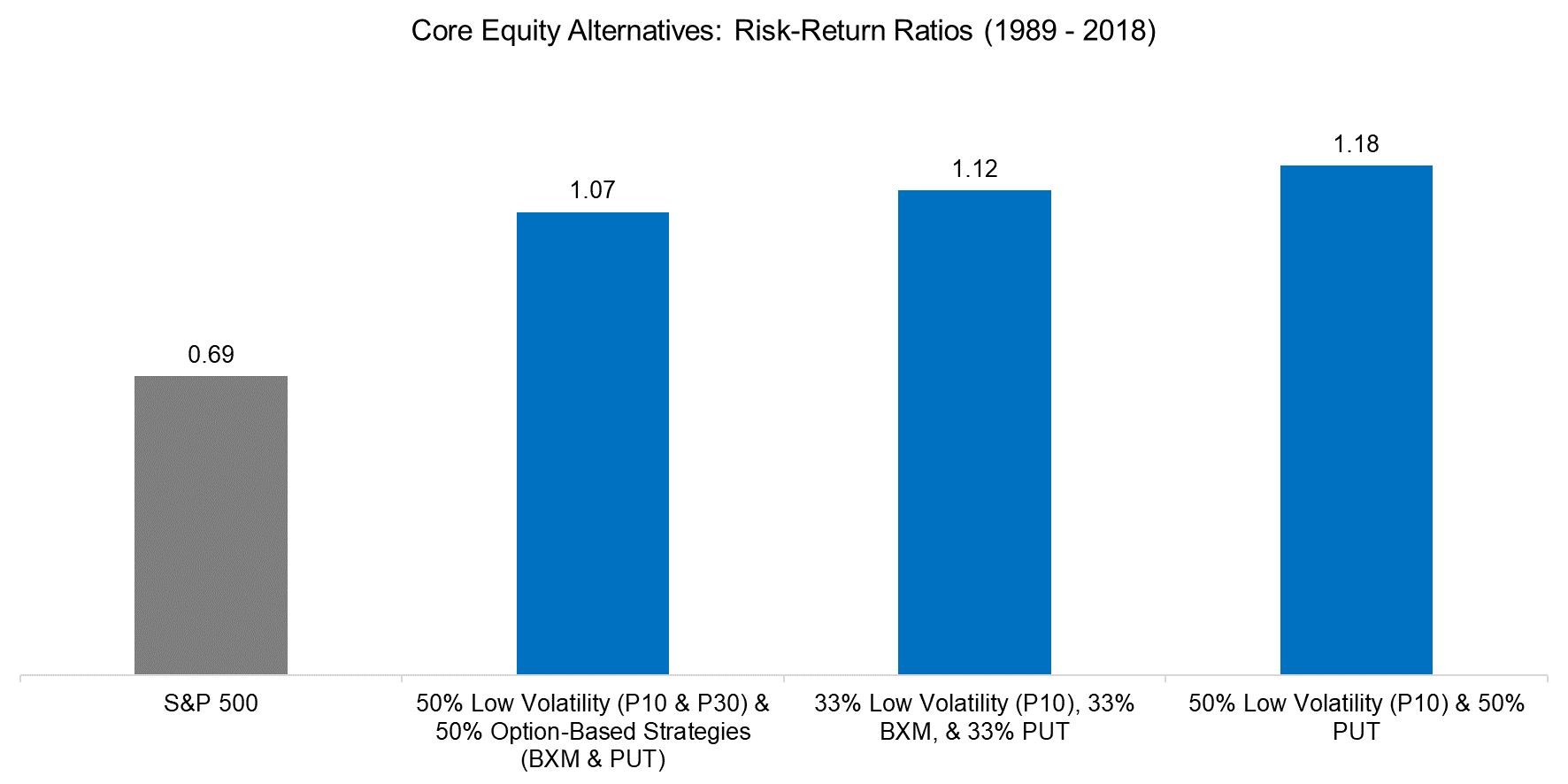

The combination portfolios become even more attractive when analysing the risk-adjusted returns, which are all higher than those of the S&P 500. Furthermore, the negative skewness and bond exposure were reduced by more than half, mitigating the idiosyncratic strategy risks.

Source: FactorResearch

FURTHER THOUGHTS

Investors captivated by Low Volatility strategies should consider option-based strategies like BXM and PUT as these provide attractive diversification benefits when combined. Given that these have become available as ETFs with low fees and high transparency levels, are backed by sound economic theories, and have a long data history for analysis, the stigma of investing in options should be disregarded.

Although it might seem unimportant to financial engineers, product names matter and option-based strategies often feature unfortunate ones, which likely contribute to the lack of popularity. Although the CBOE could advertise “to PUT investors to a sound sleep”, clients will likely raise questions about products with lengthy names that include “BuyWrite” or “PutWrite”, which are elaborate to answer. Compare that with Low Volatility, which is intuitively comforting.

RELATED RESEARCH

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.