Managed Futures: Fast & Furious vs Slow & Steady

Short vs long-term trend followers

May 2021. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Managed futures strategies aim to exploit short- or long-term trends

- Short-term trend followers are often seen as offering better stock market crash protection characteristics

- Our analysis highlights that the differences are marginal

INTRODUCTION

Aesop’s famous story of the race between the tortoise and the hare was put up to a test in 2016 when researchers made them compete with each other in real life. To the surprise of the live audience, the tortoise won indeed each time, just like in the fable. The hare was quicker out of the gate, but rarely finished the race and was overtaken by the tortoise that continued at its steady pace.

Taking it a step further, Professor Bejan from Duke University published an article in the journal Scientific Reports in 2018 that showed that some of the fastest animals based on land, water, or air, are actually the slowest ones if their movements are averaged across their lifetimes. It is all about being able to be fast when required, which for animals means when hunting prey or fleeing from predators.

In the investment world speed also matters immensely. Most investors have equity-centric portfolios that are negatively skewed. Gains come slow and steady, but losses fast and furious. Given that most investors deal poorly with losses, portfolio diversification is essential.

One of the popular strategies for diversifying traditional portfolios is managed futures, which are also called trend followers or commodity trading advisors (CTAs). The strategy is to go long or short trending instruments across all asset classes, which results in a diversified portfolio of futures that typically has a low correlation to equities.

However, trends can be measured over various time frames. As transaction costs have reduced over time, some managers have started exploiting short-term trends. A frequent argument for this trading style is that the portfolio adapts more quickly to changing market conditions, which can be highly valuable when stock markets crash.

In this research note, we will contrast long-term to short-term managed futures strategies from the perspective of diversifying an equity portfolio.

MANAGED FUTURES INDUSTRY

Managed futures strategies have a special place within the hedge fund industry as their managers have strict reporting requirements from the CFTC and NFA that created an excellent database for analyzing their long-term performance. It is relatively easy to find the performance of a manager on the internet, which is mostly impossible for other hedge fund strategies.

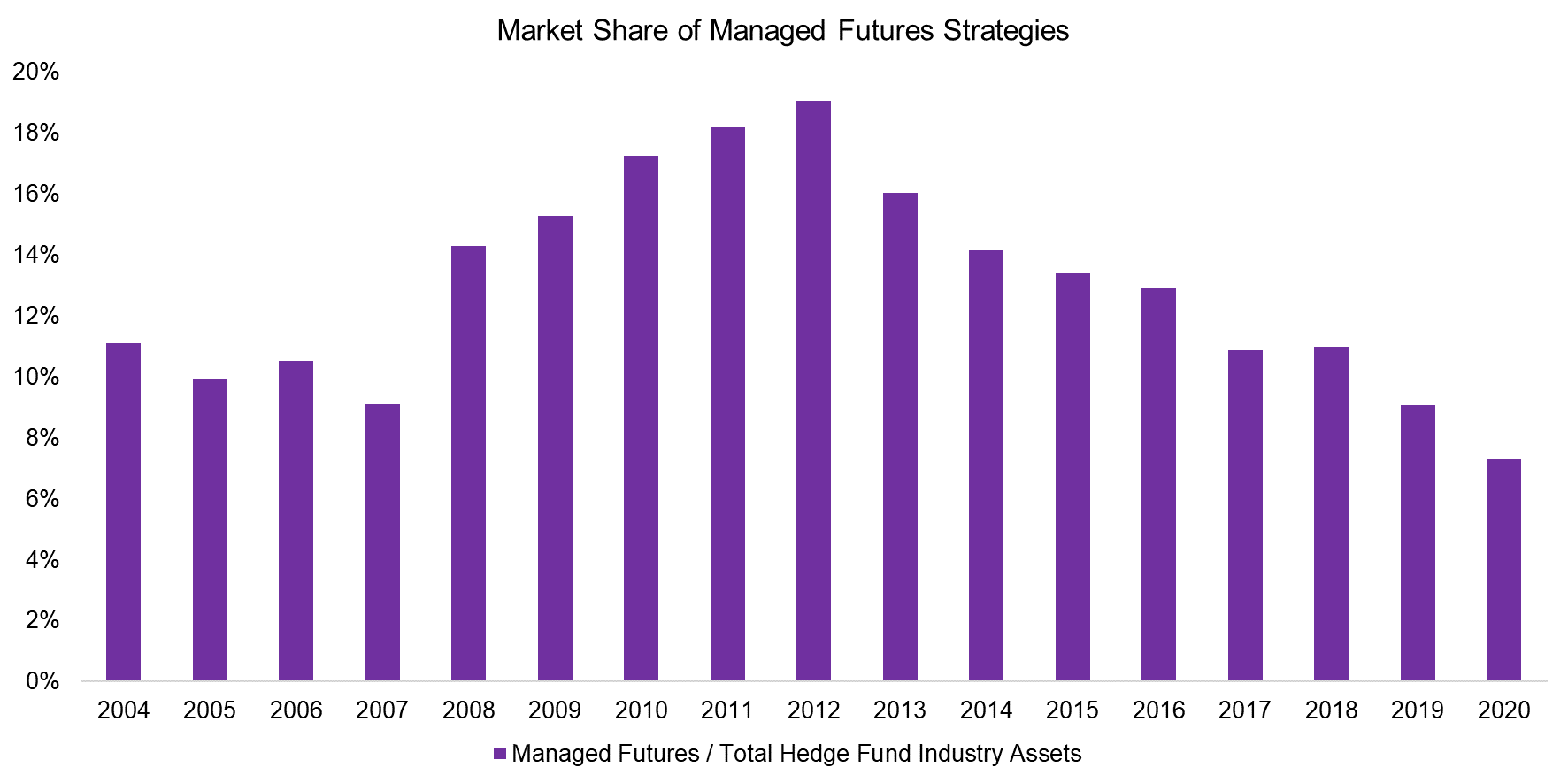

However, from a popularity perspective, managed futures strategies have been losing market share since 2012, when they represented almost 20% of the assets under management in the hedge fund industry. The market share fell to 7% in 2020, which is the lowest on record.

Source: BarclayHedge, FactorResearch

PERFORMANCE OF SHORT-TERM VS LONG-TERM MANAGED FUTURES STRATEGIES

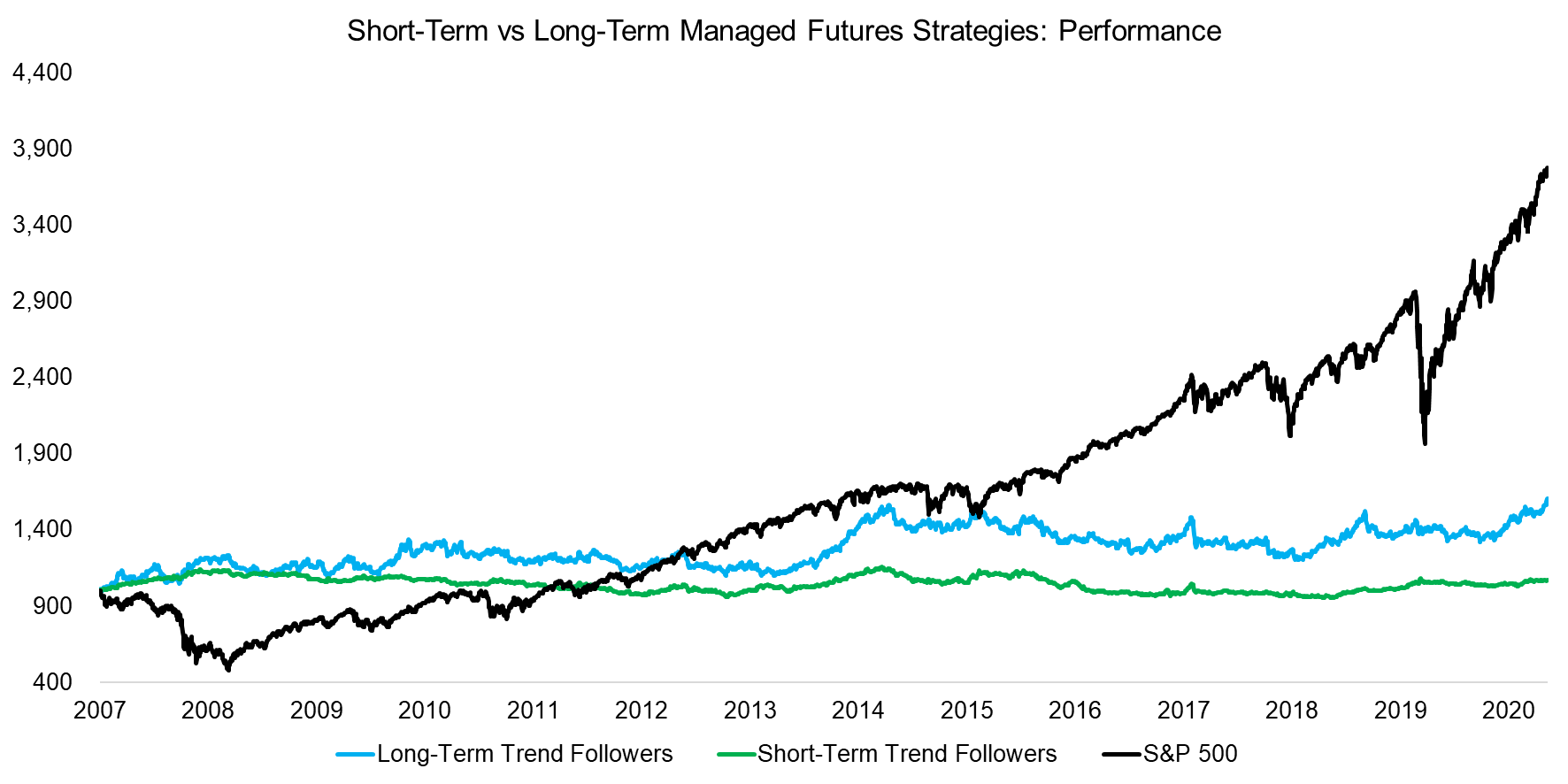

Societe Generale offers benchmark indices for the managed futures industry and we use two of these in our analysis. The Short-Term Traders Index has ten constituents that have investment holding periods of less than ten days on average. The index rebalances annually and weighs allocations inversely to the volatility of the managers. The Trend Index also has ten constituents that are rebalanced annually, but the managers have longer investment holding periods and are weighted equally within the index.

Comparing the performance of the short- and long-term managed futures strategies in the period from 2007 to 2021 reveals largely the same trends. The two major differences are performance and volatility. The short-term trend followers generated almost no returns over these 14 years, compared to a CAGR of 3.6% for the long-term ones. The volatility of the former was 50% lower than that of the latter, which is the result of the inverse volatility-weighting methodology.

Source: SG, FactorResearch

HEDGING CHARACTERISTICS OF MANAGED FUTURES STRATEGIES

Although an investor will likely bemoan the low returns over the last decade, these strategies should be regarded as diversifiers that help reduce the drawdowns on portfolio level when stock markets crash. For the avoidance of doubt, these do not represent tail hedge strategies that gain when equities lose and volatility spikes, but should generate returns unrelated to what happens on the stock market (read Hedging via Managed Futures Liquid Alts).

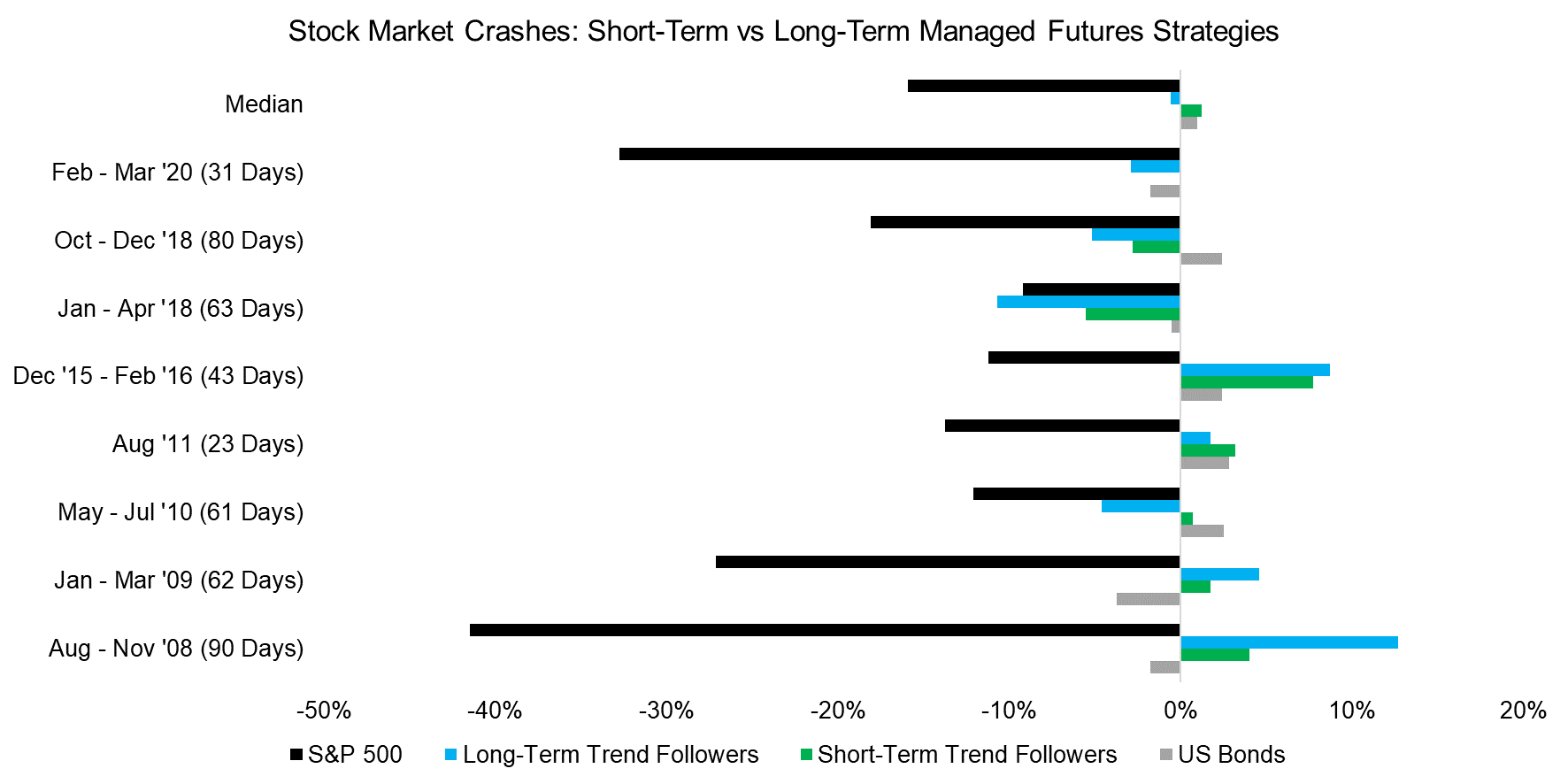

Unfortunately, we only have data for the managed futures indices from 2007 onward and there were only a few stock market crashes since then, so our sample size for analysis is narrow. We select eight periods where the S&P 500 declined more than 10% and the results provide a mixed perspective. On average, managed futures strategies remained unchanged when stocks crash, which is a positive as they provided the desired diversification benefits.

However, in the five stock market crashes between 2008 and 2016 trend followers gained when stocks lost. In the three crashes thereafter, managed futures strategies lost as well, which made them significantly less attractive for investors. We need to be careful not to read too much into a few data points, although it may also reflect that asset classes overall have become more correlated with fewer opportunities for diversification.

Interestingly there is little difference between the short- and long-term trend followers. Short-term traders have performed slightly better in recent years and it would be intuitive to attribute this to the aggressive behavior of the central banks that led to quick stock market recoveries, where slow-moving systems might be at a disadvantage. However, we need to recall that managed futures portfolios are comprised of many asset classes, not just equities, so these results are perhaps more random than indicative of something structural.

Source: SG, FactorResearch

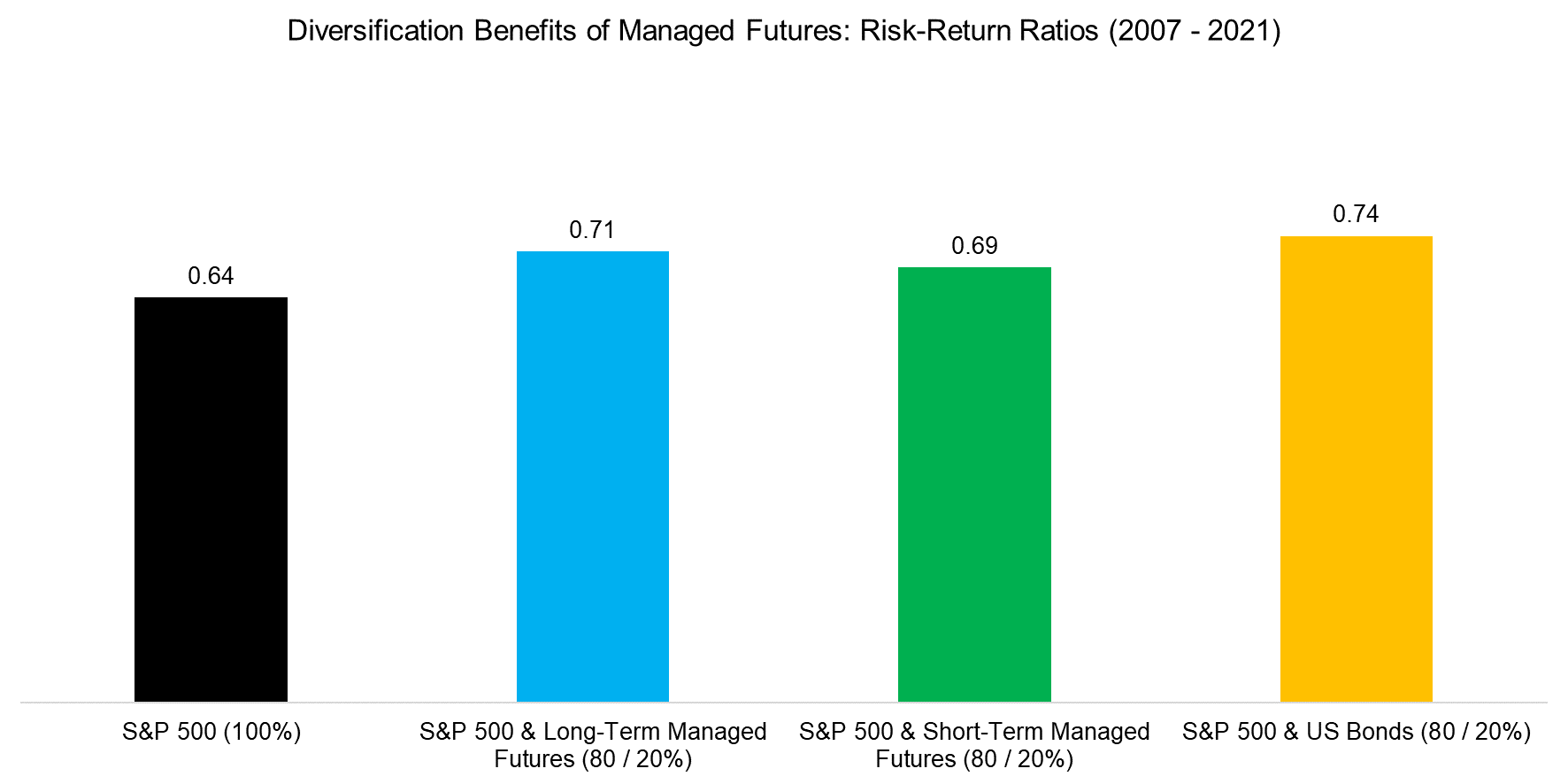

Another way of highlighting that short-term trend followers were not superior to long-term ones is by calculating what a 20% allocation would have achieved for an equities portfolio. We observe that adding managed futures strategies to an equities portfolio would have increased the risk-return ratio for the period from 2007 to 2021, but this was regardless of how trends were measured. The maximum drawdown would have decreased from -52% for an all-equity portfolio to -40% when including a 20% allocation to managed futures, which highlights the attractiveness of the strategy.

We also included a 20% allocation to US investment-grade bonds for comparative purposes in the analysis, which would have achieved similar diversification benefits to managed futures strategies. However, fixed-income instruments have become far less attractive in asset allocation recently given the low bond yields, so investors need to reconsider how attractive bonds are as diversifiers going forward.

Source: SG, FactorResearch

FURTHER THOUGHTS

Although we have demonstrated that short-term trend-following was not more attractive than long-term trend-following for diversification, we have not provided an explanation for this. The speed of information distribution continues to increase and short-term trend followers have the advantage to jump on new trends quicker. However, this also results in a much higher portfolio turnover and transaction costs. Trading futures is cheap, but not free (read Factor ETFs & Futures).

Another reason might be that long-term trends are more stable than short-term ones. Trend following and momentum are explained by the same behavioral biases, i.e. investors tend to chase performance. There are significantly more investors with more money eye-balling the 12-month than 10-day charts.

Trading slow and steady is perfectly fine, no need to be hasty.

RELATED RESEARCH

60/40 Portfolios without Bonds

Volatility Hedge Funds: The Good, the Bad, and the Ugly

Global Macro: Masters of the Universe

Merger Arbitrage: Arbitraged Away?

Multi-Strategy Hedge Funds: Equity in a Different Shade?

REFERENCED RESEARCH

Professor Bejan, The Tortoise versus the Hare, Duke University

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.