Market Neutral Funds: Powered by Beta?

Evaluating the neutrality of equity market neutral funds

November 2020. Reading Time: 10 Minutes. Author: Karl Rogers & Nicolas Rabener.

SUMMARY

- The long-term track record of equity market neutral hedge funds is attractive, but should be viewed with scepticism due to Madoff and survivorship bias

- Only one index from HFRX seems sound, but his highlights negative alpha since the GFC and positive returns primarily from market beta

- A factor exposure analysis reveals unusual factor loadings

INTRODUCTION

The mutual fund selection process would be significantly simpler if every mutual fund was structured market neutral. It would take a capital allocator less than a minute to decide if a fund manager has been generating alpha and is worth allocating to, or not. In contrast, the current modus operandi requires calculating the difference between the mutual fund and a benchmark, which is complicated. Why not make allocating capital as simple as possible?

Mutual fund managers would argue that market neutrality requires complex shorting, but that is a poor excuse. First, shorting can be done via futures or ETFs, which is cheap and straight-forward. Second, shorting can be operated by a centralized risk management team, so that the fund manager can exclusively focus on stock picking. And finally, actual shorting does not need to take place, it would even help capital allocators if performance was reported market neutral.

The sad truth is that most mutual fund managers do not generate alpha as evidenced by the S&P SPIVA Score Cards, which report that funds underperform their benchmarks over the short- to long-term, across market segments, and geographies. Showing performance in a market neutral fashion would simply put most fund managers out of their jobs.

For example, Fidelity launched a market neutral fund in Europe in 2008 that went long the stocks considered the most attractive and short the ones deemed least attractive by the firm’s team of fundamental analysts. It is worth recalling that Fidelity employs hundreds of highly-educated and experienced research analysts and portfolio managers, has access to the management of even the largest companies globally, relationships with every sell-side institution, and all relevant data and analytical systems. It is difficult to imagine a better set up for generating alpha via stock picking. However, the fund was liquidated in 2013 after losing 2% per annum, which was equivalent to the annual management fee over the 5-year time frame.

Given that mutual funds have struggled to generate alpha, it is surprising that there are more than $60 billion invested in equity market neutral hedge funds, according to data from BarclayHedge. Mutual fund and hedge fund managers have almost the same opportunity set, which makes it questionable why hedge funds should be better at generating alpha.

Equity market neutral hedge funds are ideal for studying the alpha generation of hedge funds as their correlation to stocks should be zero on average. In this short research note, we will explore the performance and characteristics of equity market neutral funds.

LONG-TERM TRACK RECORD OF EQUITY MARKET NEUTRAL FUNDS

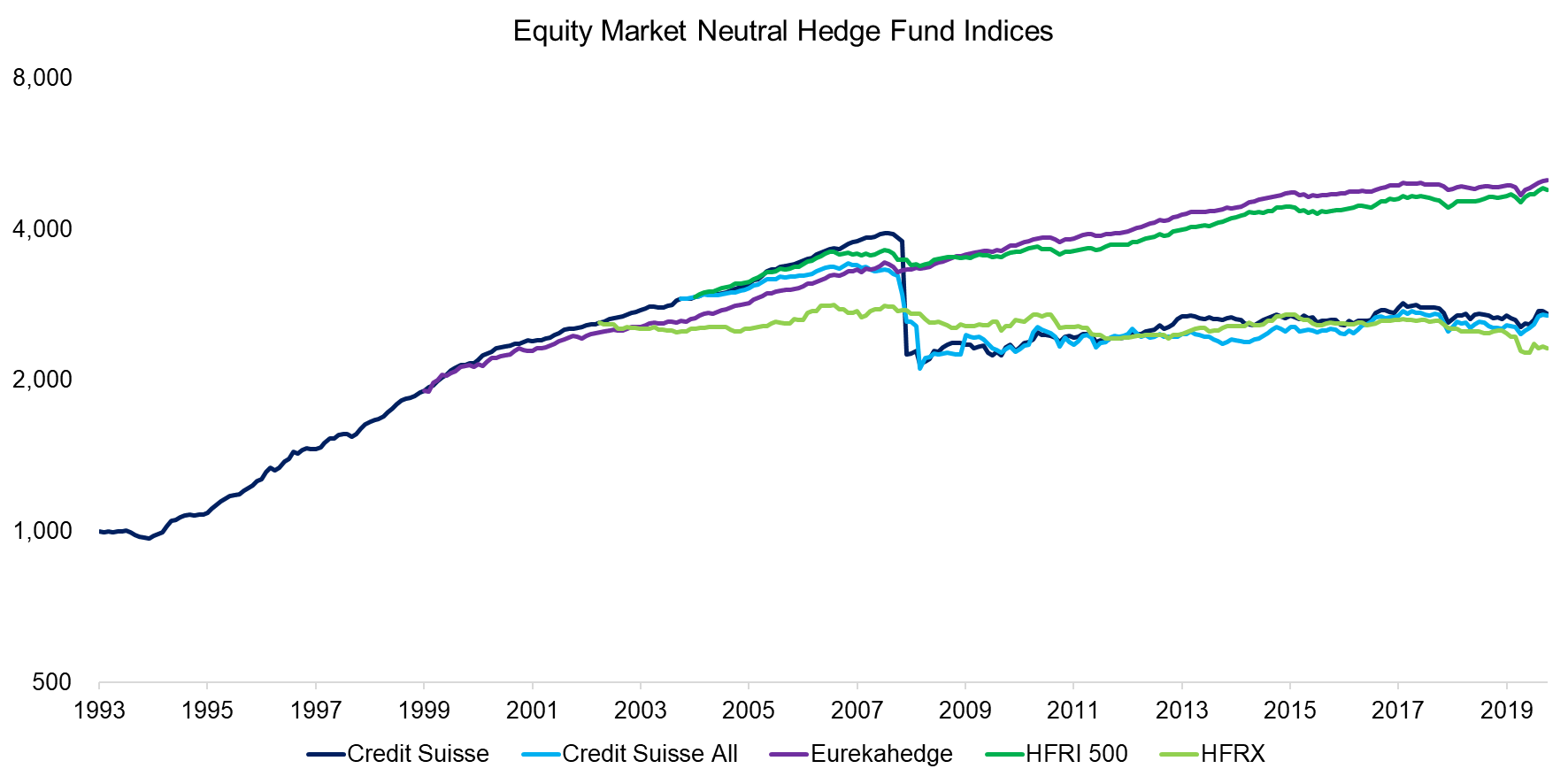

We highlight the performance of equity market neutral hedge funds via equal- or asset-weighted indices from three data providers, which have data going back to 1994.

We observe relatively consistent returns across time, except for a large drawdown in 2008 in two indices from Credit Suisse. The drawdown can be explained by the implosion of Madoff’s Ponzi scheme, which was marketed as a market neutral fund and was therefore included in these two indices. It can be debated if frauds should be included in indices, but capital allocators did lose somewhere between $17 and $50 billion on what they perceived as a market neutral strategy.

Source: Credit Suisse, Eurekahedge, HFRX, FactorResearch

The large drawdown in 2008 in the two Credit Suisse indices indicates that there were only very few index constituents, which implies that the Madoff fund drove most of the consistently positive returns before the global financial crisis. Given that the Madoff returns were made-up, the performance of the indices should be disregarded before 2009. It also explains the flat performance thereafter.

However, the Eurekahedge index does highlight attractive returns since 2009 and excludes Madoff, but this performance also needs to be viewed cautiously. The index provider allows hedge funds to include historical realized returns. Given that only hedge funds with positive past performance ask to be included in the database, this implies that the index suffers from survivorship bias. Funds also stop reporting performance when this deteriorates too much and redemptions are on the horizon, which means that the index returns are overstated.

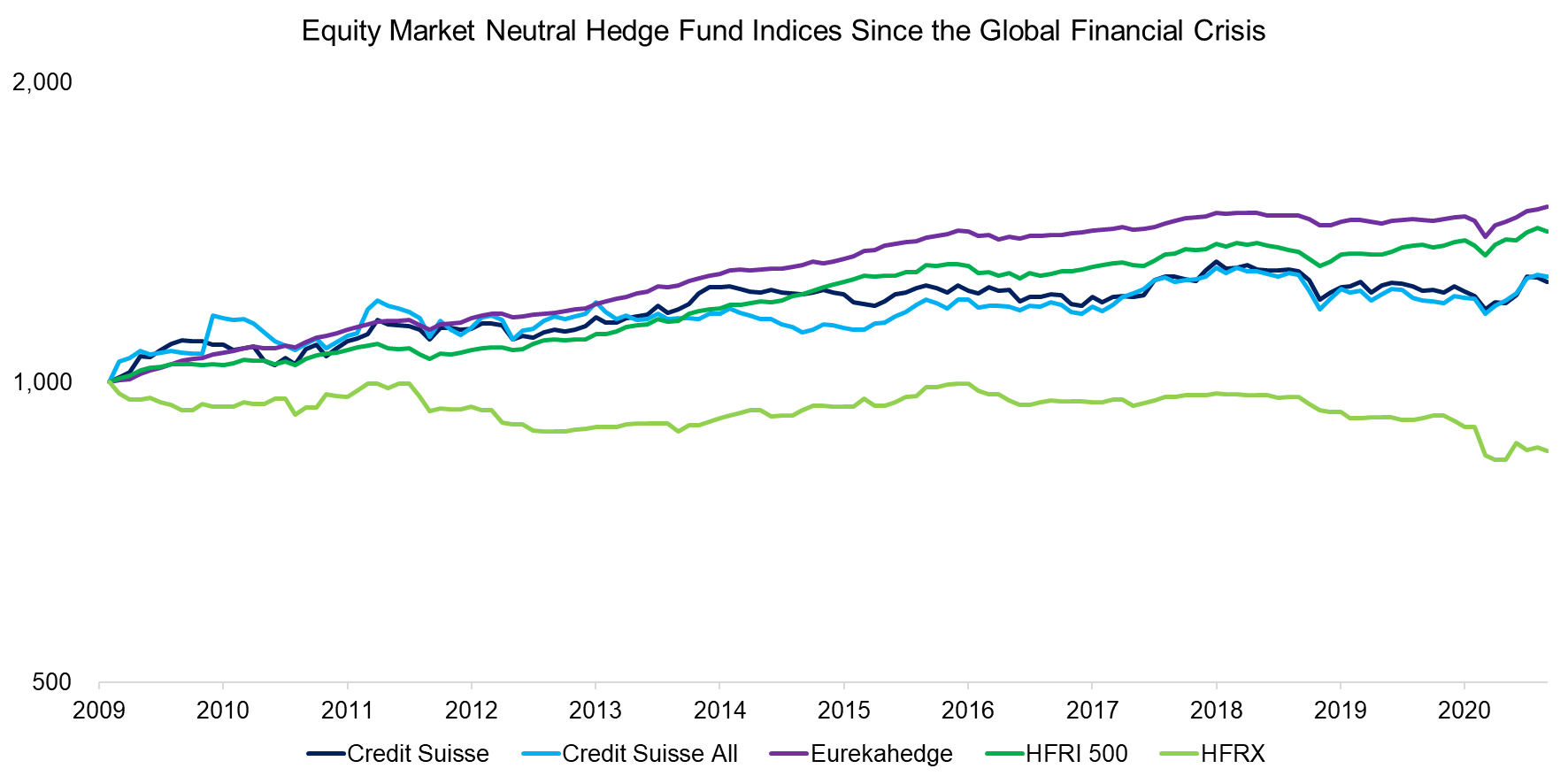

Finally, there are two indices from HFRX, which show a rather divergent performance. The HFRI 500 outperformed the HFRX index, which is explained by the former being comprised of the largest hedge funds. Unsurprisingly, these are also the best-performing hedge funds, which again represents survivorship bias. Given this, HFRX is likely the best representation of the performance of equity market neutral hedge funds, but unfortunately shows negative alpha generation since 2009. Although disappointing, this reconciles with the lack of alpha generation by mutual funds.

Source: Credit Suisse, Eurekahedge, HFRX, FactorResearch

FACTOR EXPOSURE ANALYSIS

It is interesting to explore why equity market neutral funds have not generated more alpha. One obvious explanation is fees. Although management fees in the hedge fund industry have reduced in recent years, these used to be 2%. There are also transaction costs, shorting and fund operating fees, which typically increased the total costs to above 3%. Given competitive markets, this represents a high hurdle rate.

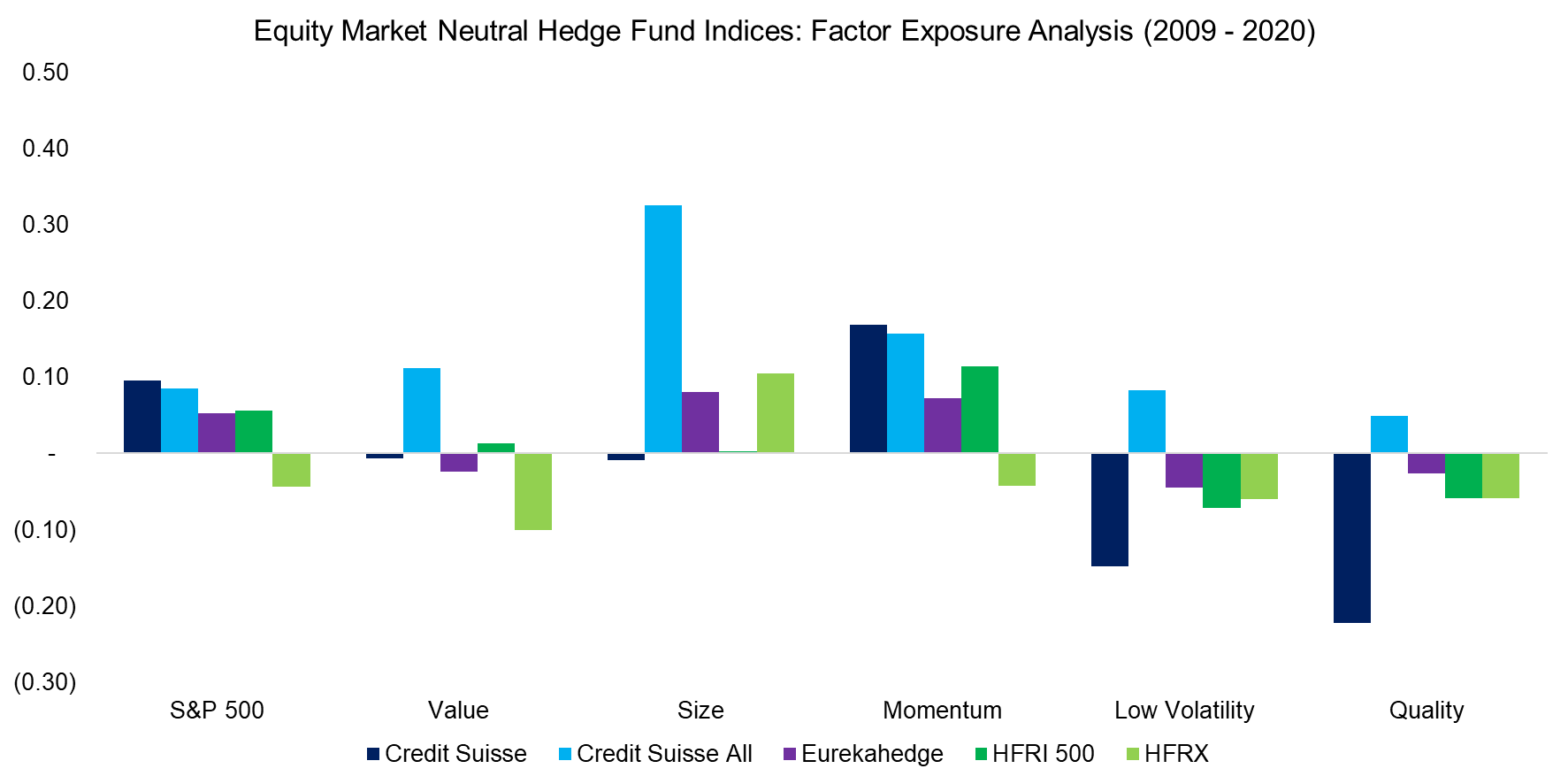

Another explanation might be negative exposure to common equity factors that could have detracted from the performance. We regress the equity market neutral hedge fund indices against market beta and common equity factors. We observe that almost all of the indices had slightly positive exposure to the stock market in the period between 2009 and 2020. Although the exposure was not high, this might result in the funds not offering returns as uncorrelated to the stock market as typically assumed.

However, more importantly, the exposure to equity factors was rather unusual. There were positive factor loadings to Size and Momentum, neutral to Value, but also negative exposure to Low Volatility and Quality. It is worth noting that the latter two factors did particularly well over the last decade while the Size factor performed poorly, which partially explains the low returns of equity market neutral hedge funds (read Low Vol Factor: From Obscurity to Stardom).

Equity market neutral hedge funds come in all flavors and although some are constructed to specifically offer long-short exposure to factors, others pursue different strategies and do not care about factors.

Source: Credit Suisse, Eurekahedge, HFRX, FactorResearch

EQUITY MARKET NEUTRAL HEDGE FUND REPLICATION

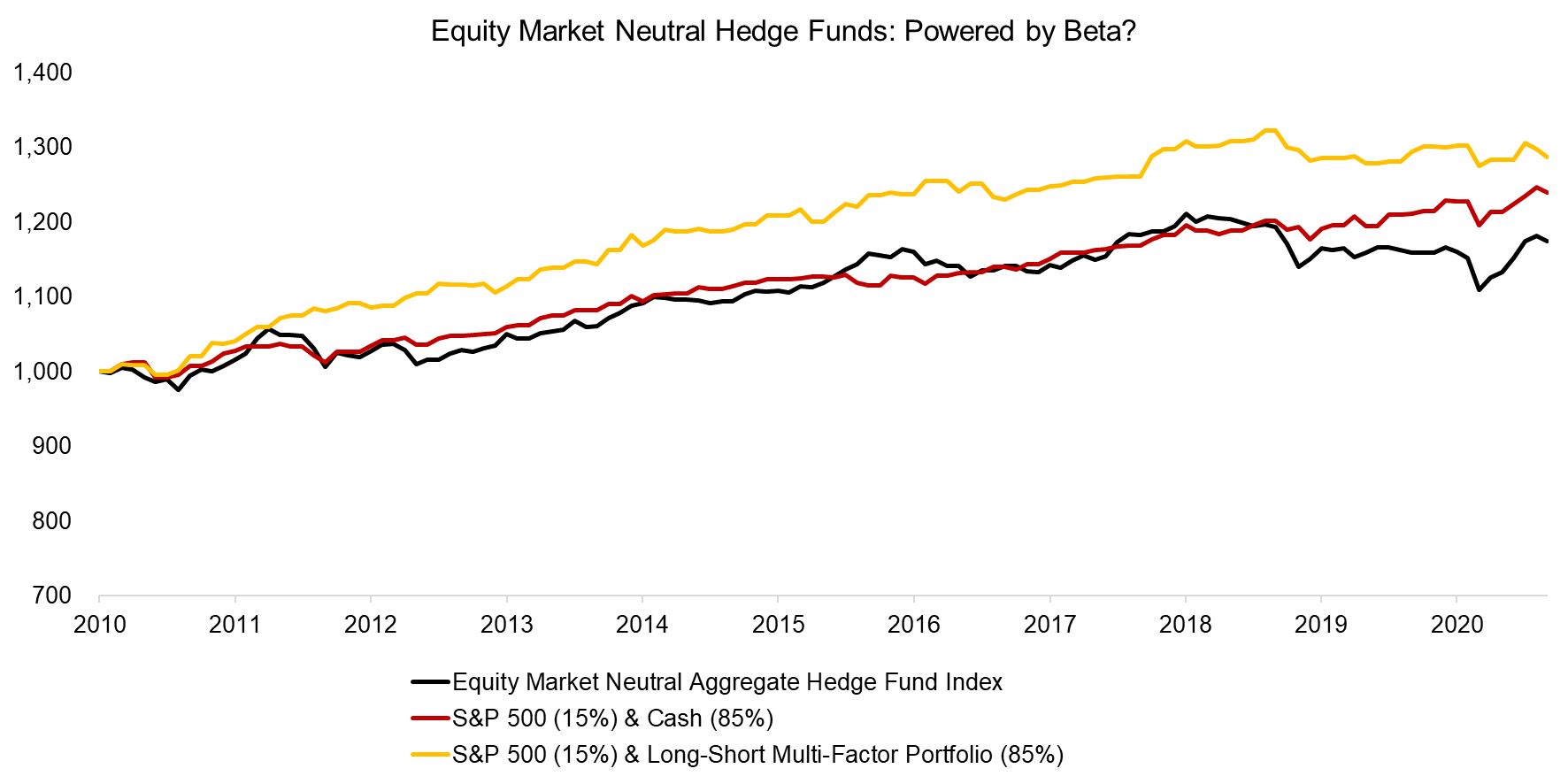

Next, we create an equal-weighted aggregate of the equity market neutral hedge fund indices and investigate if this can be replicated efficiently via market beta and common equity factors (read Replicating Famous Hedge Funds).

First, we create a simple index comprised of the S&P 500 (15%) and cash (85%), where the weights are approximately based on the beta of the S&P 500 from the regression analysis. We observe a meaningful overlap between both indices and it seems that the exposure to the stock market is responsible for most of the positive returns of equity market neutral hedge funds in the period between 2010 and 2020. Naturally, this is unattractive as investors seek uncorrelated returns when allocating to these funds.

As a second step, we replace the 85% cash allocation with a long-short beta-neutral multi-factor portfolio that is comprised of the Value, Size, Momentum, Quality, and Low Volatility factors. The regression analysis highlighted positive and neutral exposures to these factors, but we assume a positive allocation to each of these as all of them are supported by academic research. We also do not want to introduce any hindsight biases. We observe that this index would have outperformed the equity market neutral aggregate hedge fund index, at least before costs.

Source: FactorResearch

FURTHER THOUGHTS

In theory, equity market neutral hedge funds are some of the best strategies for asset allocation as they are designed to be uncorrelated to traditional asset classes. Return expectations should be low given highly efficient global equity markets, but that is acceptable given diversification benefits, especially in a world where bonds have largely lost their purpose in asset allocation.

In reality, the market beta contributed significantly to the historical performance of equity market neutral hedge funds, which is undesirable. The factor exposure was also sub-optimal and could be improved by avoiding negative exposure to factors where research indicates positive excess returns over time.

Furthermore, it could be argued that equity market neutral hedge funds should neither pursue beta nor provide factor exposure as this can be acquired more cheaply via ETFs and risk premia indices sold by investment banks. The sole focus should be creating alpha that is truly unexplained from idiosyncratic opportunities, but the funds have failed to achieve that.

Having said this, the analysis can be challenged as we analyzed equity market neutral hedge funds on index level. There are a few select funds that seem to generate large amounts of alpha and are commercially highly successful. For example, Millenium Capital Management recently managed investors to agree on partial five-year lockups, which is rare in the industry. Research indicates no performance consistency amongst mutual funds, it would be interesting to study if that is different in the hedge funds industry.

RELATED RESEARCH

Factor Exposure Analysis 101: Linear vs Lasso Regression

Hedge Fund ETFs

Liquid Alternatives: Alternative Enough?

ABOUT THE AUTHORS

Karl Rogers is the founder of ACE Capital Investments, an Irish-based alternative investments consultant, which specializes in niche, capacity-constrained hedge funds that diversify family office portfolios from their traditional asset class investments. Karl is also the Head of Trading, US Power for RISQ, where he is responsible for building out the proprietary US power trading desk and sits on the firm’s risk committee. Karl also sits in the adjunct faculty for Trinity College Dublin’s M.Sc. in finance program where he is both a guest lecturer in their alternative investment module and supervises the student’s theses. Karl is a market contributor across various industry platforms including CAIA, AlphaWeek, Family Capital Publishing, and the FM Report. He an alternative investment conference speaker and hedge fund panel moderator. Karl has macroeconomic research published by a top-tier academic journal and is a former hedge fund manager and commodity trader across Ireland and North America.

Connect with me on LinkedIn.

Nicolas Rabener is the Founder of Finominal, which empowers investors with data and technology to analyze and improve their portfolios. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (100km Ultramarathon).