Market Timing with Multiples, Momentum & Volatility

Getting Comfortable with High Equity Multiples

June 2018. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Equity multiples have been elevated in recent years

- Using valuation multiples for allocation decisions is a challenging strategy

- Momentum and volatility-based strategies are more attractive

INTRODUCTION

In recent years the stock market in the US has been expensive on a variety of valuation multiples, which is often cited for why investing has become more difficult. However, in 2009 valuation multiples were much lower, but investing was not regarded as particular easy as most market participants were concerned about a second Great Depression. A rational observer might conclude that investing is challenging regardless if stocks are expensive or cheap. The same observer might question if valuations are meaningful for future stock returns and can be used to make investing less difficult. In this short research note we will evaluate using valuation multiples for market timing and also assess alternative methods (read Market Timing vs Risk Management).

METHODOLOGY

We focus on the US stock market, where price and valuation multiple data is available from 1881 to 2016 from Robert Shiller. The analysis utilises the cyclically adjusted price earnings ratio (“CAPE”), which uses real earnings per share over a 10-year period to smooth out fluctuations in corporate profits that occur over a normal business cycle. The results do not include transaction costs, but turnover is infrequent and therefore costs are not significant.

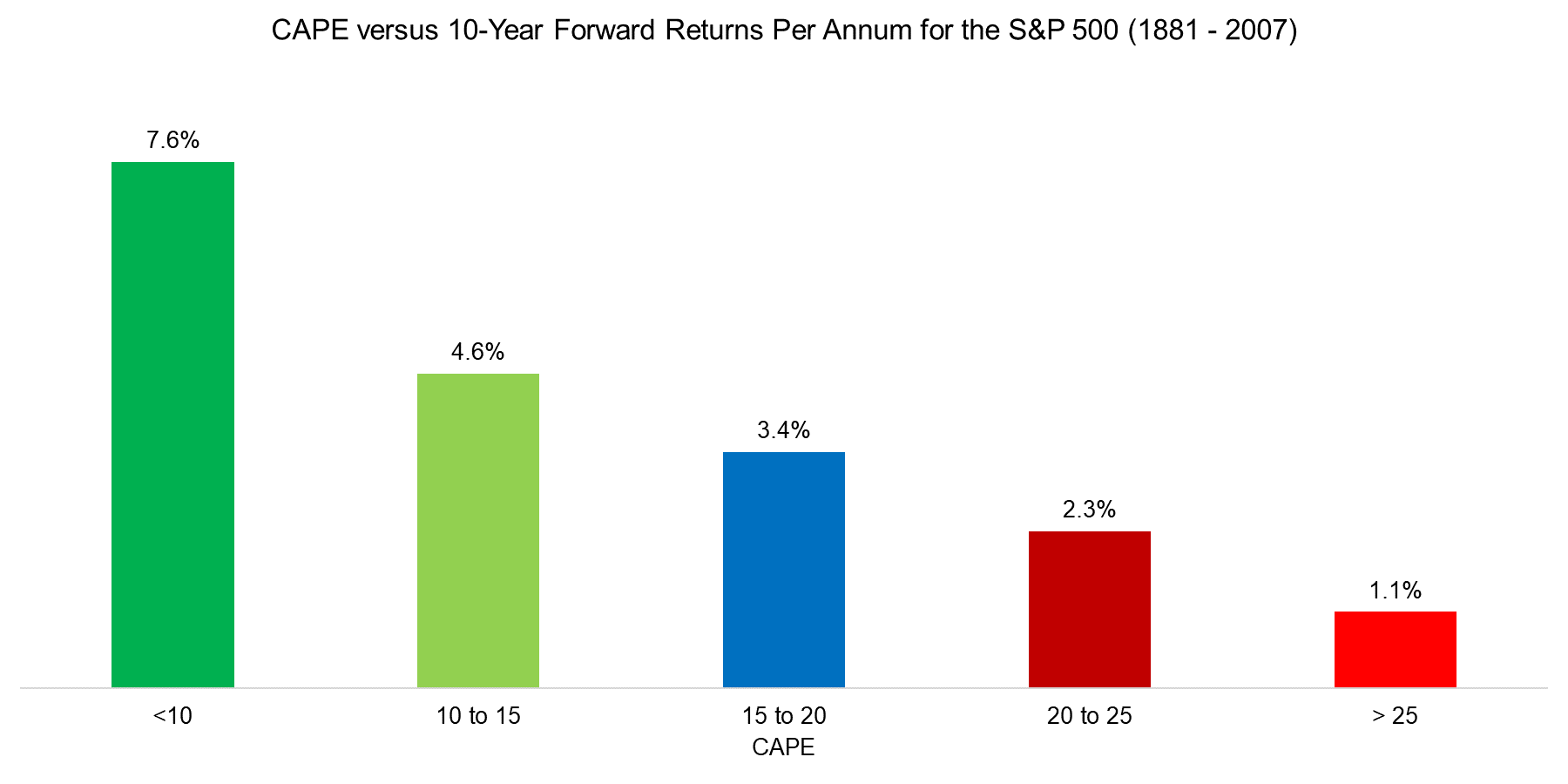

VALUATION MULTIPLES AND FORWARD RETURNS

Academic research has shown that buying cheap and selling expensive stocks generates excess returns across time and markets, which is typically referred to as the cross-sectional long-short value factor. The same concept can be applied to stock markets from a time series perspective, i.e. invest in the market when valuations are low and do not invest when valuations are high. The chart below shows the 10-year forward returns per annum for the S&P 500 based on different CAPE ranges. The analysis highlights that the lower the entry valuation multiple, the higher the annual return for the 10 years thereafter (read There is Value in the Value Factor).

Source: Robert Shiller, FactorResearch

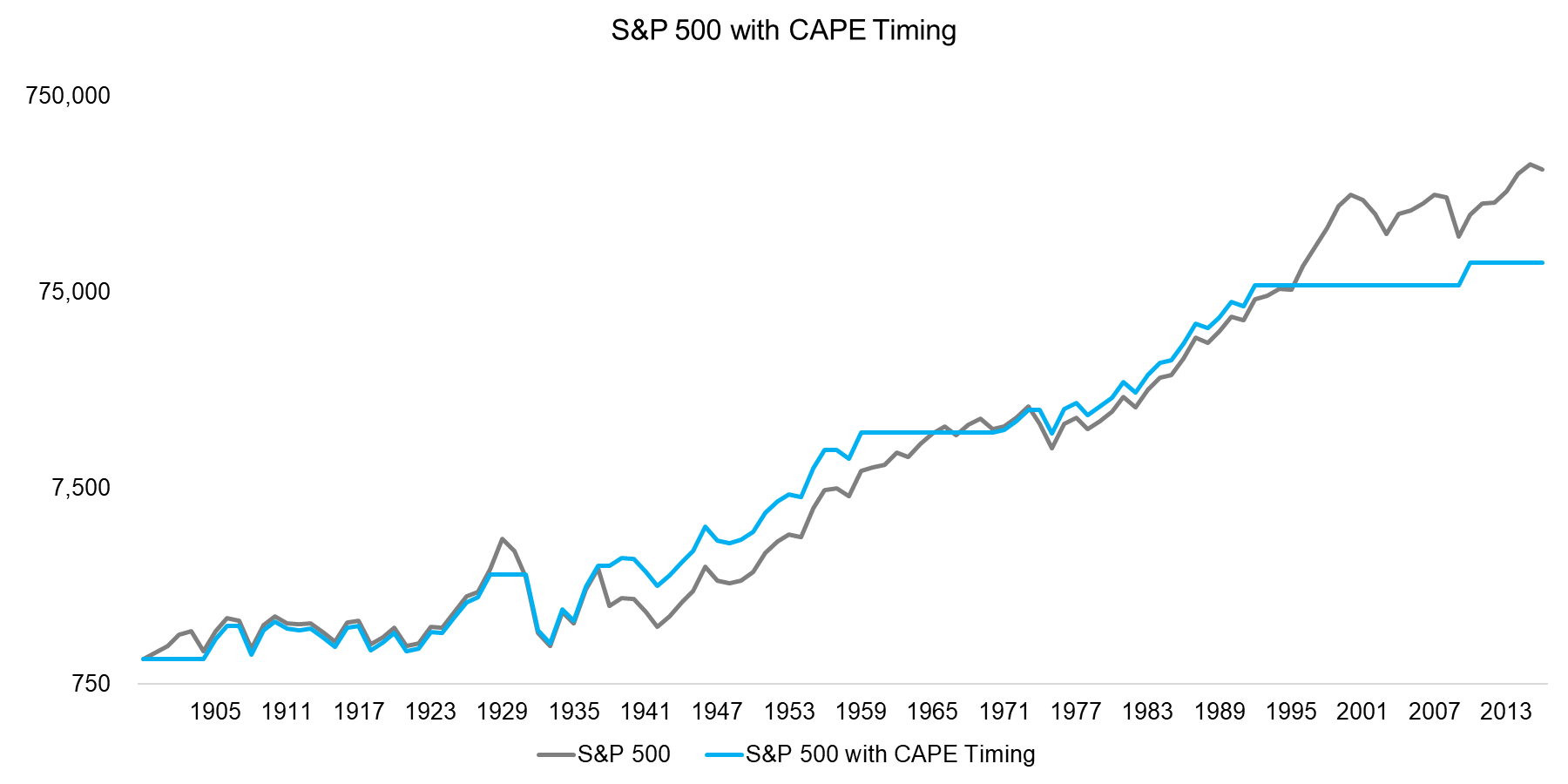

S&P 500 WITH CAPE TIMING

Given the linear relationship between CAPE multiples and expected returns, investors might not want to invest in the stock market when multiples are too high as expected returns would be too low. The chart below shows the performance of the S&P 500 from 1900 to 2016 as well as a tactical strategy, which only allocates when CAPE multiples are below the top quartile, which is measured on a rolling-forward basis to avoid any hindsight bias and to reflect the evolution of the US from an emerging to a developed country. Transactions are executed on an annual basis, which results in a low turnover.

We can observe that the tactical strategy approximates the performance of the S&P 500, but features multi-decade periods where CAPE multiples were too high and investors would have been out of the market. The results highlight that this strategy was not significantly more attractive over the 126-year time period, but more importantly, show that this strategy would have been difficult to implement. Having to wait on the sideline for years or decades when valuations are too high would be emotionally challenging for most investors.

Source: Robert Shiller, FactorResearch

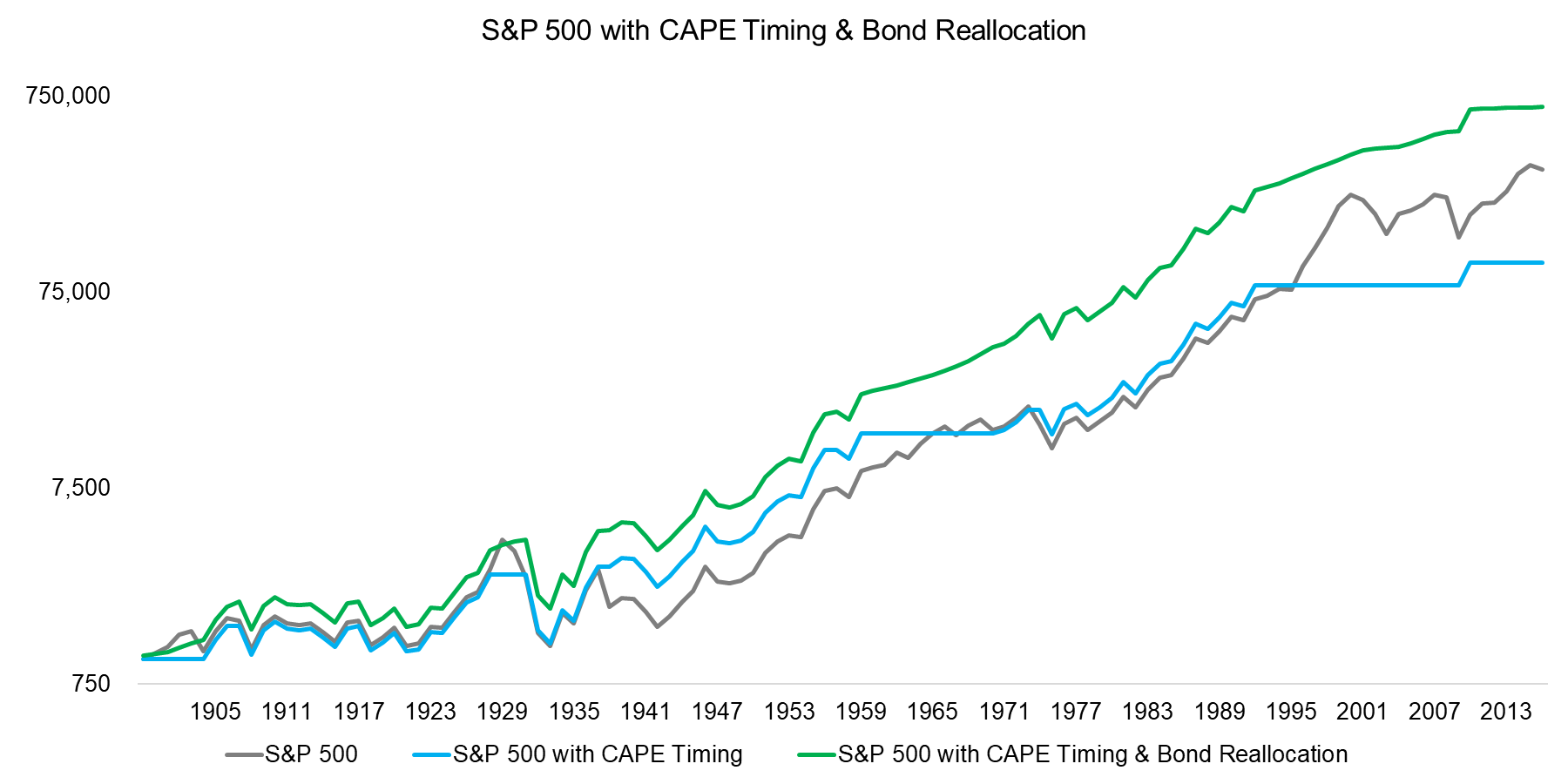

S&P 500 WITH CAPE TIMING AND BOND REALLOCATION

Using valuation multiples like the CAPE would have led investors to be in cash for long periods, especially over the last 30 years. Some investors have the flexibility to reallocate capital to other asset classes, which would make this strategy more implementable. The chart below shows a scenario where investors reallocated to short-term bonds when CAPE multiples were too high, which results in a performance significantly higher than that of the S&P 500. Unfortunately bond yields in recent years have been a fraction of historical yields, which makes this strategy currently less attractive.

Source: Robert Shiller, FactorResearch

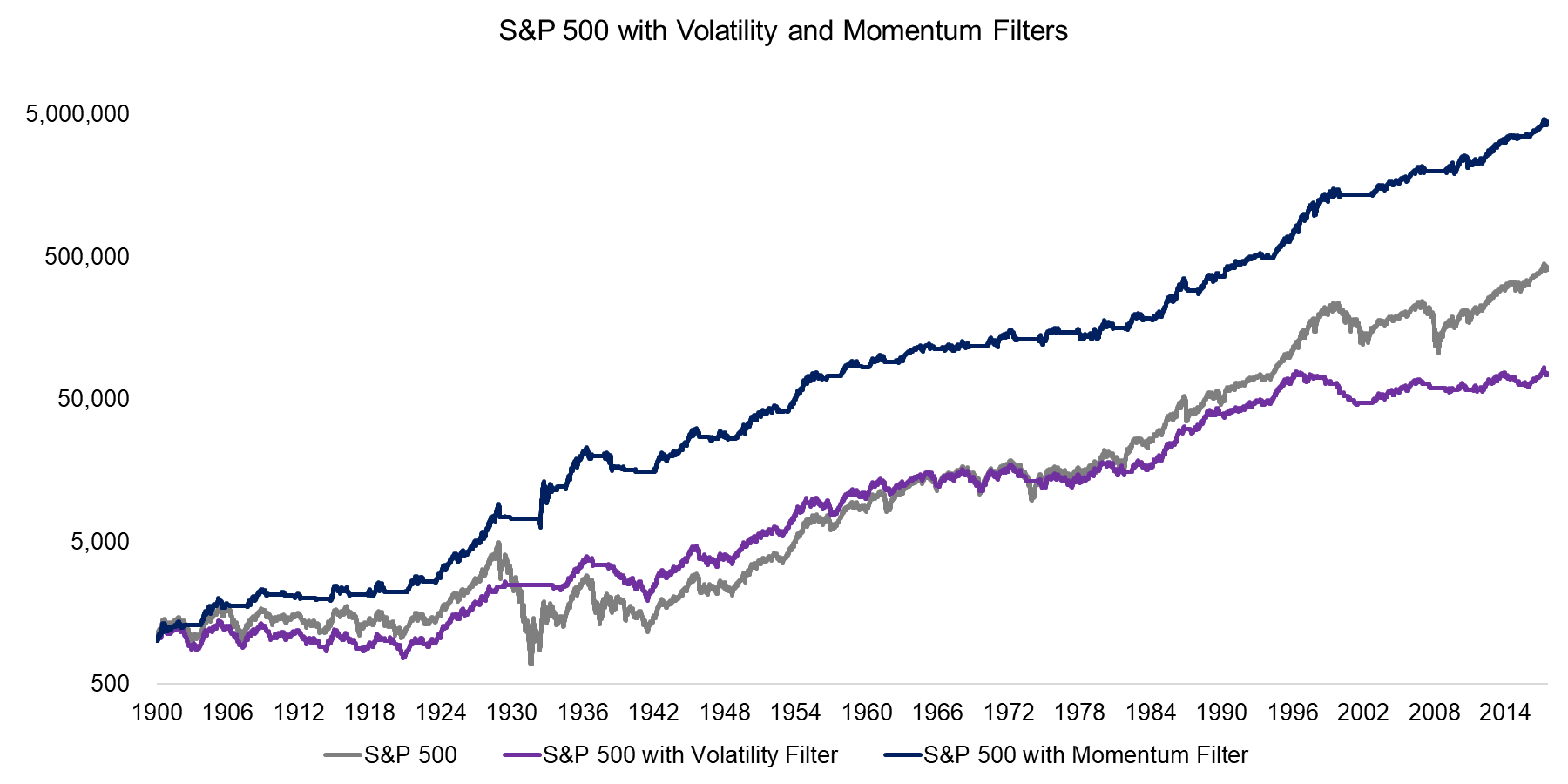

S&P 500 WITH MOMENTUM AND VOLATILITY FILTERS

Given that interest rates are currently low and a reallocation to bonds might not feasible for all investors, we can consider two additional frameworks for allocating to the stock market. Investors can use a simple momentum strategy, which allocates only to the S&P 500 when the last 12-month return was positive, and a volatility-based strategy, which allocates only when the realised 12-month volatility of the S&P 500 is below the top quartile, measured on a rolling-forward basis.

The chart below compares the performance of these two frameworks with the S&P 500 for the period from 1900 to 2018 and we can observe that the momentum strategy generated a higher performance while the volatility-based strategy produced a lower return. However, both strategies lead to significant lower drawdowns during the Great Depression in the 1930s and the Global Financial Crisis in 2008 to 2009. Compared to using valuation multiples for market timing, the advantage of either of these frameworks is that they are less dependent on noisy fundamental data and lead to less time out of the market, which makes these more implementable. Naturally investors could also be less concerned with high multiples.

Source: Stooq, FactorResearch

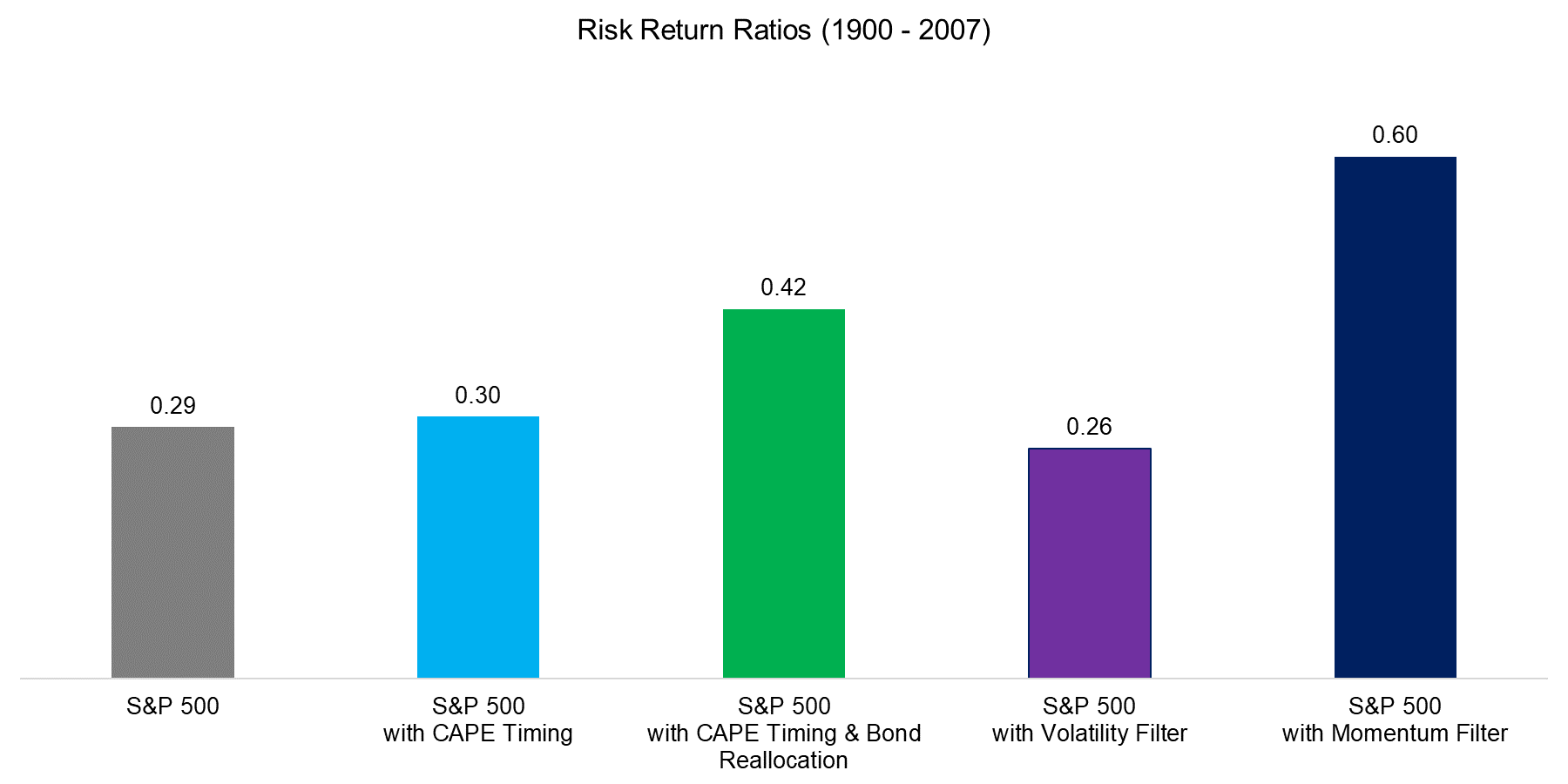

COMPARISON OF RISK-RETURN RATIOS

The chart below compares the risk-return ratios of the various strategies from 1900 to 2007. We can observe that the ratios are roughly comparable, except for the momentum-based strategy, which shows a significant improvement. Unfortunately momentum, despite significant empirical support, is often ignored and actively disliked by investors, likely due the simplicity. For most active managers complexity is intellectually more interesting as well as more attractive from a career perspective.

Source: FactorResearch

FURTHER THOUGHTS

This short research note highlights that valuation multiples can be used for market timing, but result in an emotionally challenging strategy. Momentum or volatility-based strategies are attractive alternatives. Naturally investors can question why market timing is relevant at all and why not simply buy and hold the market via a low cost ETF.

We believe the viewpoint should be changed from market timing to risk management as buy and hold is not a feasible strategy for most investors. Drawdowns of more than 50% occur on a regular basis on equity markets and evidence shows that investors tend to sell at the bottom and buy at market peaks.

It is also worth highlighting that only looking at the US stock market is a form of survivorship bias. Argentina used to be wealthier and further developed than the US. Venezuela was the richest country in South America in 2001. Japan’s Nikkei still trades below the 1989 peak. Risk management matters.

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.