Metaverse ETFs: Ready Investor One?

Perhaps they are more attractive in XR or VR

May 2022. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- 7 metaverse ETFs have been launched in the last 12 months

- Despite the hype about the metaverse, these have underperformed tech stocks

- Cryptocurrencies offer better exposure to Web 3.0 than these thematic ETFs

INTRODUCTION

Finding the right ticker for an ETF launch is critical for issuers as these have an outsized impact on the fortune of the ETF. Anyone looking for a gold ETF is bound to come across State Street’s GLD, similar to OIL for getting exposure to oil. TAIL is tough to beat for a tail-risk fund.

However, the best ticker of recent years must have been META of the Roundhill Ball Metaverse ETF. The product was launched in June 2021, which was well before the metaverse become the new playing field for crypto startups and tech giants. Specifically, it was before Facebook changed its name to Meta Platforms to emphasize its new focus on the metaverse.

Somewhat unsurprisingly, the Roundhill Ball Metaverse ETF changed its ticker from META to METV in January 2022, and sold META to Meta Platforms. The purchase price was undisclosed, but it is difficult to imagine a better buyer than a corporation run by a future-focused founder that has a market cap north of $600 billion and $16 billion of cash.

In addition to METV, there have been a further six ETF launches in the US over the last 12 months that aim to provide exposure to the metaverse. In this article, we will explore these.

ETF UNIVERSE

We focus on ETFs trading in the US that specialize on the metaverse, which is a universe of 7 instruments. There is no common agreement on what the metaverse represents, even amongst the developers and companies building the infrastructure or applications for it. The most common vision is a virtual reality environment that is accessed via goggles or headsets. The Steven Spielberg movie Ready Player One often gets referenced as a vision for the metaverse.

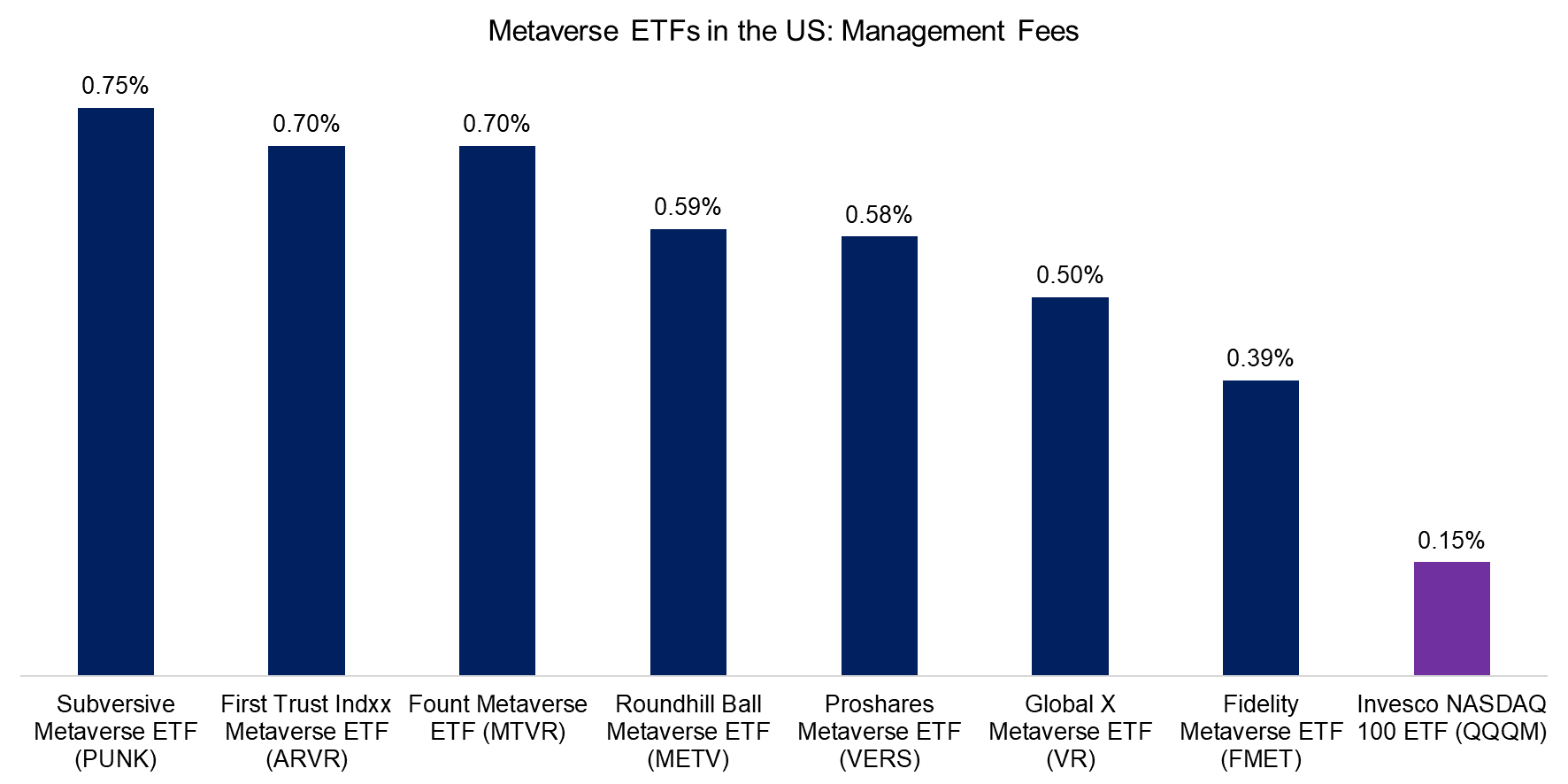

These ETFs can be characterized as thematic ETFs, which is reflected in their fees. The average management fees of the seven ETFs is 0.60%, compared to 0.15% for a Nasdaq 100 ETF like QQQM. Having said this, some of the newer products like the Fidelity Metaverse ETF are cheaper as it has become a crowded space, where price competitiveness matters.

Source: FactorResearch

COMMERCIAL SUCCESS

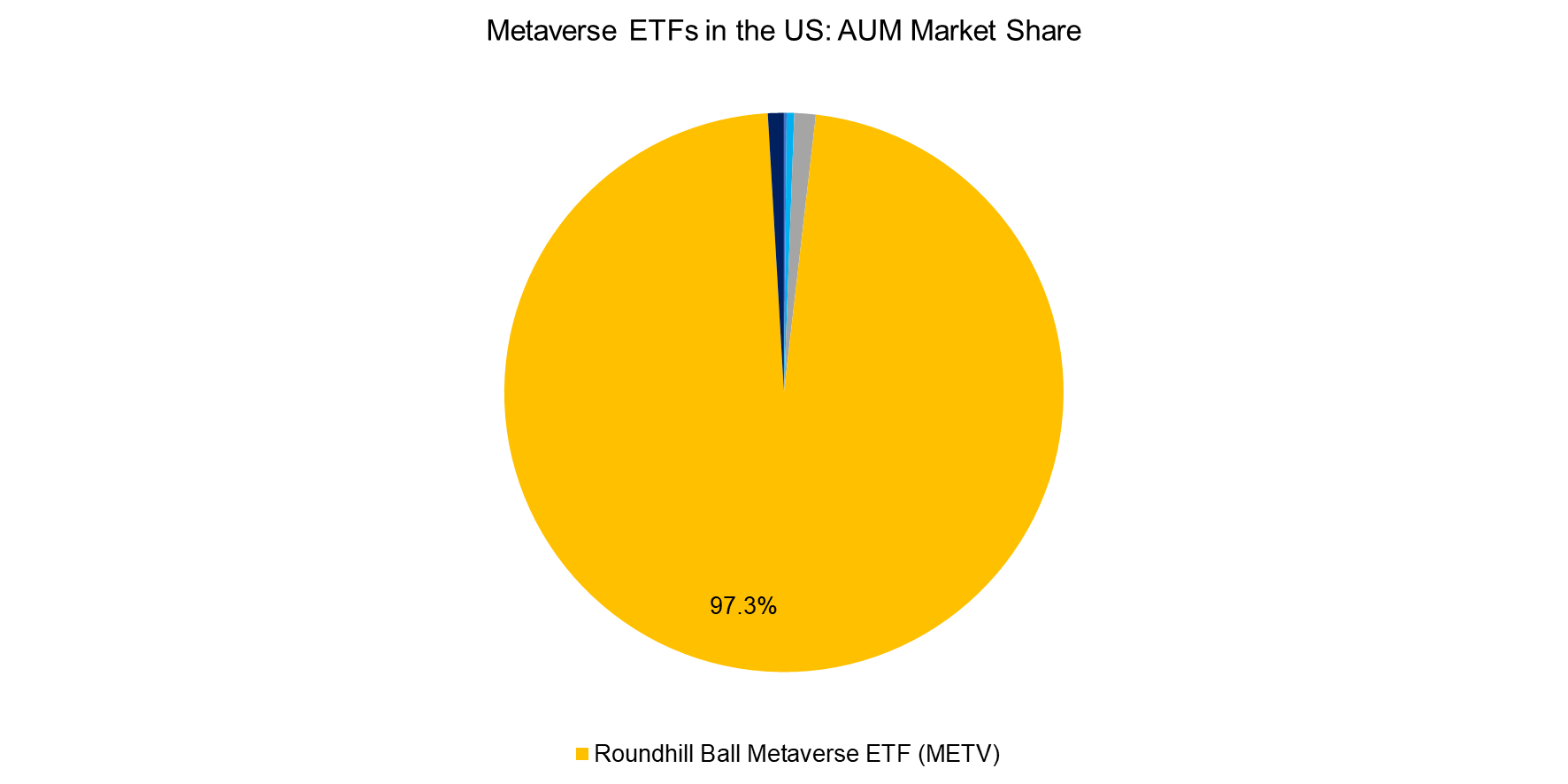

Although there are already seven ETFs providing exposure to the metaverse, their combined assets under management are only $650 million, which seems somewhat small compared to the media attention the metaverse has received in the last 12 months. In comparison, the Ark Innovation Fund (ARKK), which is the largest thematic ETF, manages $9 billion (read Thematic Indices: Looking at the Past or the Future?).

Furthermore, the oldest metaverse ETF (METV) has a 97% market share, which highlights the first-mover advantage in the ETF space. It will be interesting to see if the other ETFs can compete and grow their assets under management. Launching ETFs is much like venture capital, ie six ETFs fail, three break even, and one makes the effort worthwhile by accumulating sufficient assets to become a profitable fund for the issuer.

Source: FactorResearch.

PERFORMANCE

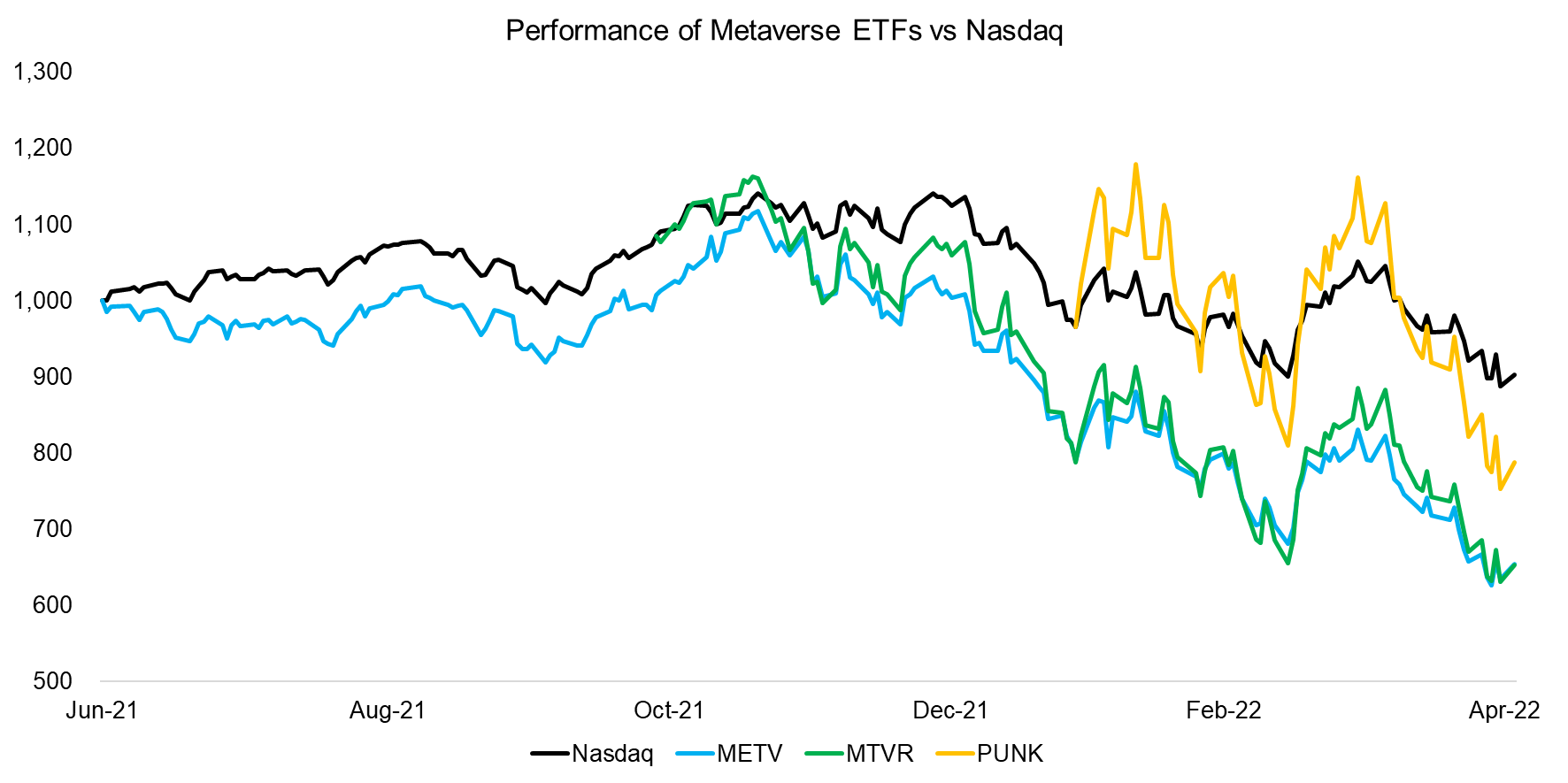

Thematic investing can be characterized as performance chasing with a narrative. The latter is apparent for metaverse ETFs as indicated by most of the major companies announcing metaverse strategies. Technology companies want to provide the software and hardware, while others like the fashion company Gucci want to engage with a younger audience.

However, the former, ie performance, is not there, which might explain the low amount of assets managed by these ETFs. Benchmarking the three ETFs that have some meaningful trading history to the Nasdaq highlights underperformance in the last 12 months.

Source: FactorResearch

BREAKDOWN BY COUNTRIES

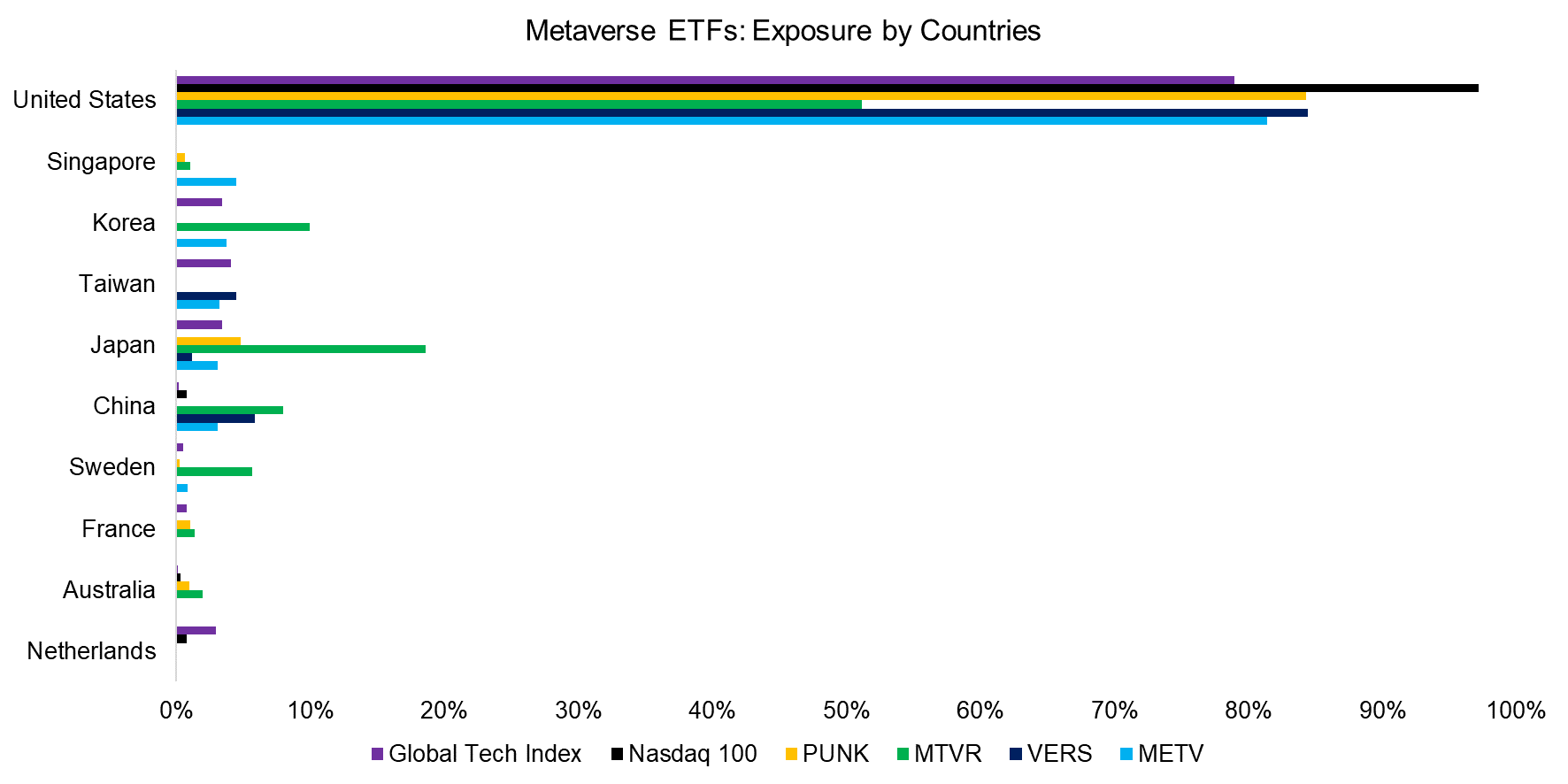

Analyzing the geographical exposure of the metaverse ETFs shows an overweight to the US, where about 80% of the stocks are derived from. The exception is the Fount Metaverse ETF (MTVR), which is more diversified with a 50% exposure to US stocks and meaningful allocations to Korean, Chinese, and Japanese stocks.

Source: FactorResearch.

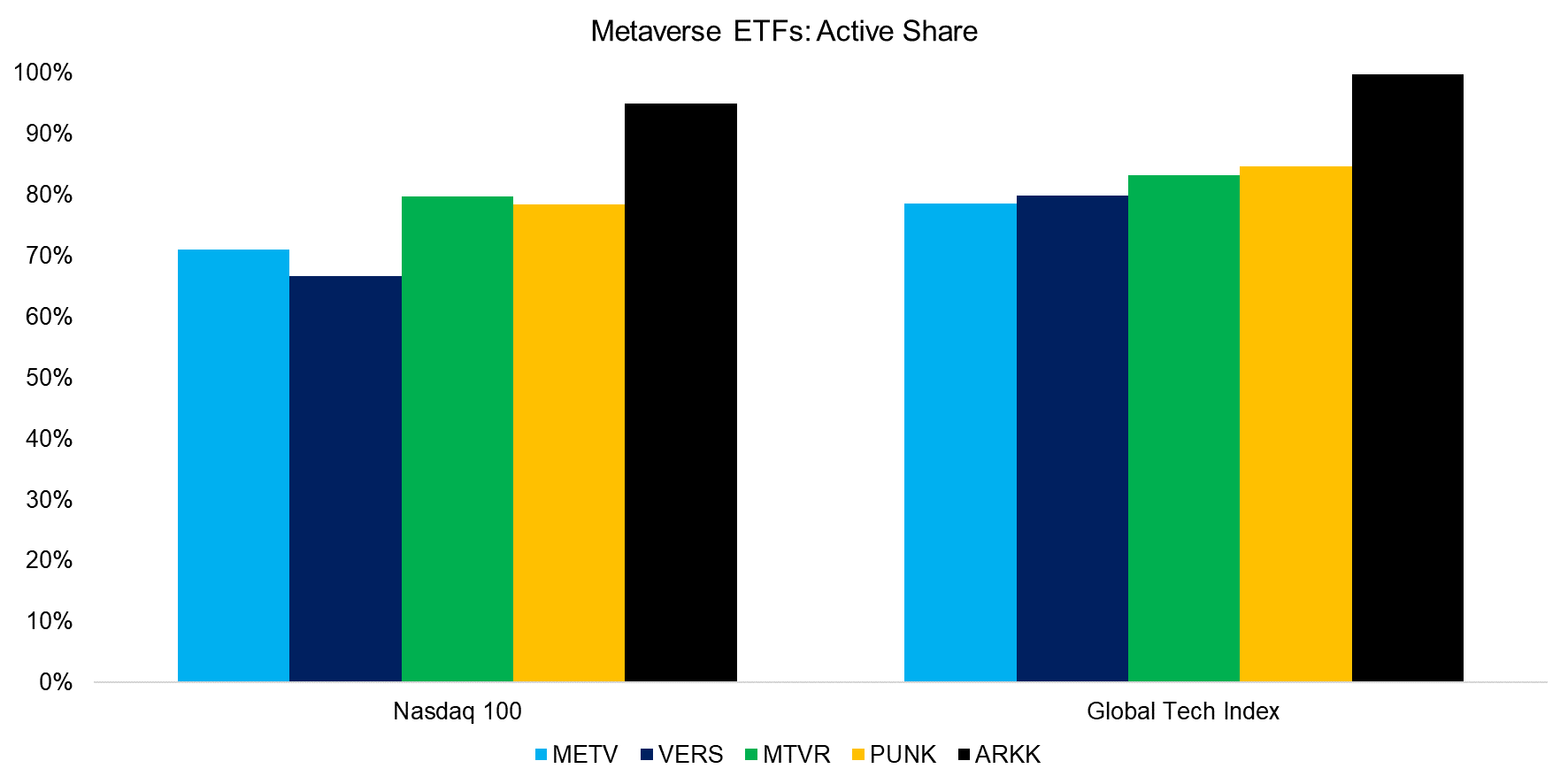

ACTIVE SHARES

Calculating the active share for the ETFs where holdings data is available highlights between 70% and 80% when using the Nasdaq 100 or a global tech index as benchmarks. Although this indicates that these ETFs feature concentrated portfolios that are different from the major indices, the active bets could be increased. For example, the Ark Innovation Fund (ARKK) features active shares above 90%.

Source: FactorResearch

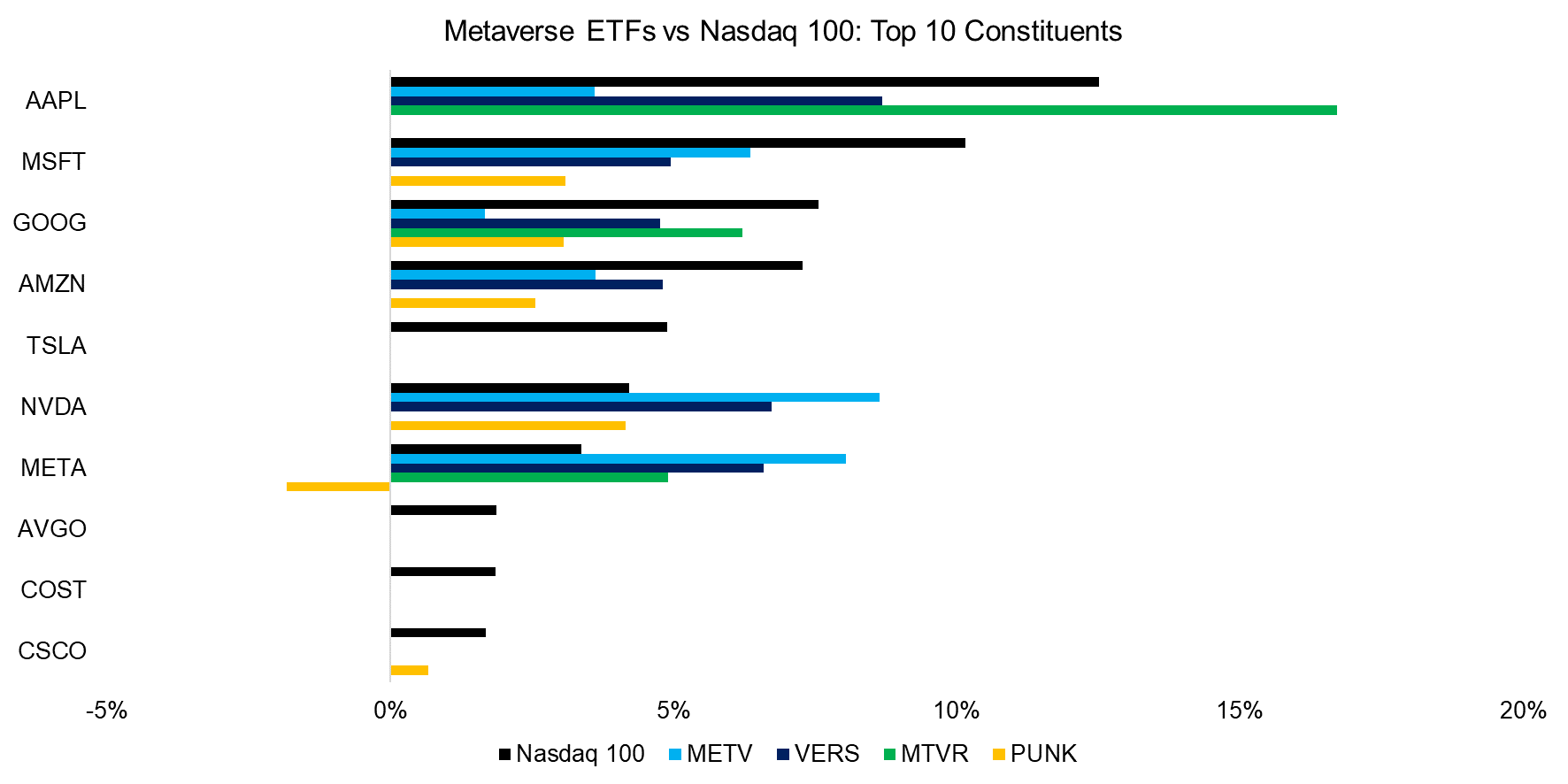

TOP 10 CONSTITUENTS

We can highlight the overlap of the metaverse ETFs with the Nasdaq 100 by showing the exposure of the top 10 constituents. For the Nasdaq, this handful of companies constitutes 55% of the entire index, but only 12% to 36% for the metaverse ETFs.

It is worth highlighting that Subversive Metaverse ETF (PUNK) has a 2% short position on Meta Platforms, aka the former Facebook, which is unusual for an ETF. According to the issuer, the company conflicts with its principles and “any market cap above zero is a direct assault on liberal democracy and the survival of our planet”.

Source: FactorResearch

FURTHER THOUGHTS

The metaverse may represent the next technological revolution after the internet and the mobile phone. However, metaverse ETFs are a poor choice for getting exposure to Web 3.0 as most stocks included in these ETFs generate most of their revenues elsewhere. The same applies to digital asset ETFs that provide almost zero exposure to cryptocurrencies (read Digital Asset ETFs: Not Crypto Enough?).

Investors interested in the metaverse can buy the tokens of cryptocurrencies like Ethereum or Solana that are dedicated to this space and are less correlated to equities. Just because it says META on it, does not mean there is meta in it.

RELATED RESEARCH

An Anatomy of Thematic Investing

Thematic Indices: Looking at the Past or the Future?

Thematic Investing: Thematically Wrong?

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.