Micro Cap or Micro Crap Stocks?

The endless quest for hidden gems in the stock market

April 2025. Reading Time: 10 Minutes. Author: Nicolas Rabener.

- Small-cap stocks have struggled to outperform since Banz’s 1981 study on the size factor

- Micro-cap stocks behave similarly to small caps

- Structural shifts have made them less appealing, with lower valuations being their only advantage

INTRODUCTION

The world is filled with stories that seemed true but were later proven wrong, such as:

- Cats were witches’ spies (Medieval Europe): People in the Middle Ages believed that black cats were evil and associated with witches. This led to widespread cat killings – ironically, reducing the natural predators of rats, which contributed to the spread of the Black Death.

- The Great Emu War (Australia, 1932): Australians once thought they could win a war against…emus. The government sent soldiers with machine guns to eliminate an emu overpopulation problem. The emus dodged bullets, outran the soldiers, and ultimately won the war.

- Victorian-era people feared “Train Madness”: When trains were invented, people thought going over 30 mph would melt your brain or make you go insane. In reality, the only madness was the expensive train tickets.

Finance is full of similar misconceptions. Take, for instance, the belief that higher risk leads to higher returns – a notion debunked by research on the low-volatility factor. Another persistent myth is that small-cap outperform large-cap stocks. This idea sticks around because it tells a compelling story – who wouldn’t want to discover the next Amazon or Microsoft before the rest of the market?

However, the evidence against small-cap outperformance has grown stronger. In response, some market participants have shifted their focus to micro-caps, a trend we will examine in this research article.

SMALL VERSUS LARGE STOCKS

The primary argument for small-cap stocks comes from data in the Kenneth R. French Data Library, which reports a CAGR of 11.7% for small caps versus 9.9% for large caps since 1926.

It’s important to note that these returns are calculated before transaction costs, and trading smaller stocks is typically more expensive than trading larger ones, meaning the actual outperformance is likely lower.

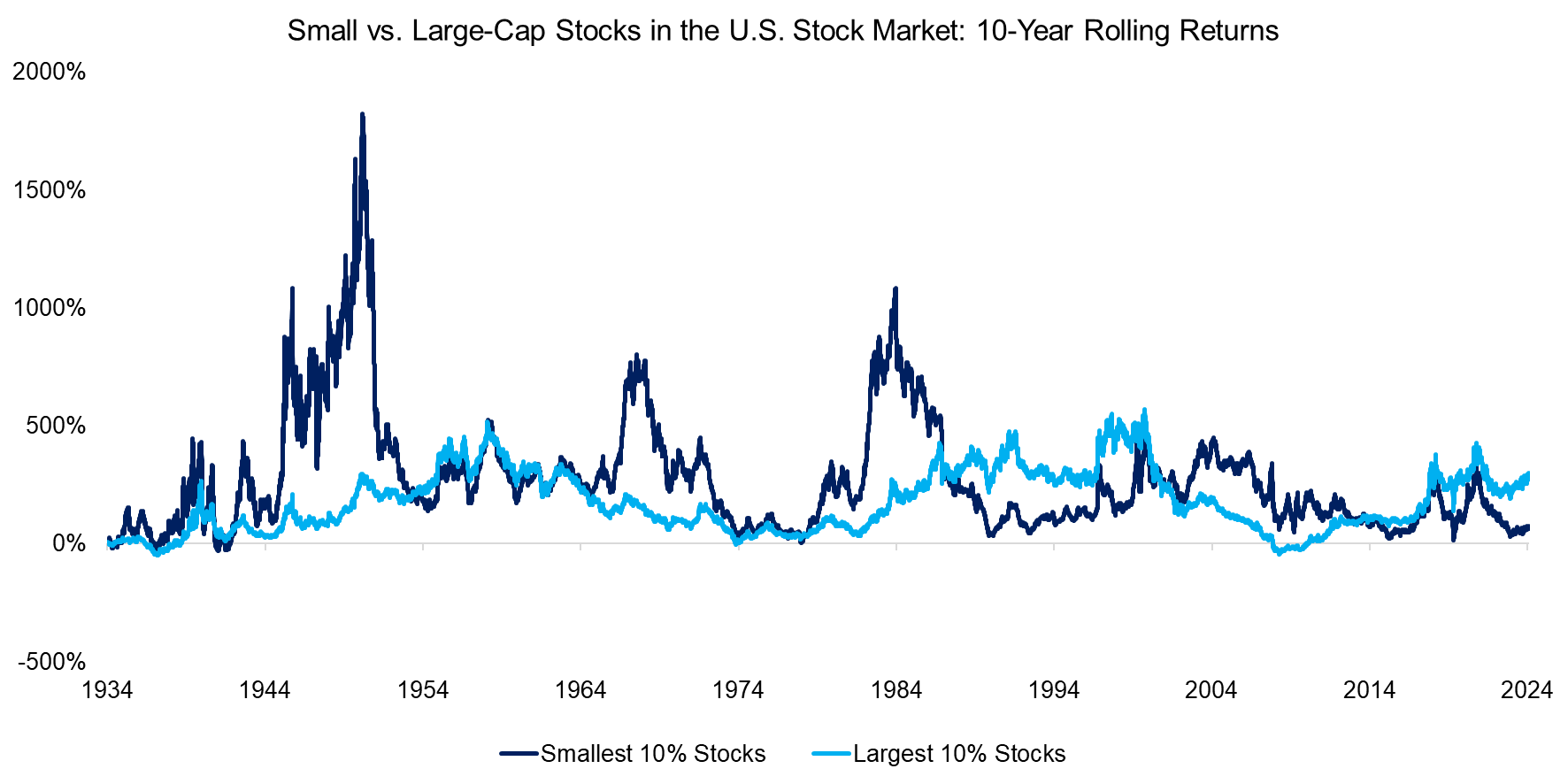

Moreover, most of the observed outperformance occurred during specific periods, notably around World War II, the 1970s, and the 1980s. Since then, the 10-year rolling returns of the smallest 10% of U.S. stocks have not shown the same level of outperformance (read The Illusion of the Small-Cap Premium).

Source: Kenneth R. French Data Library, Finominal

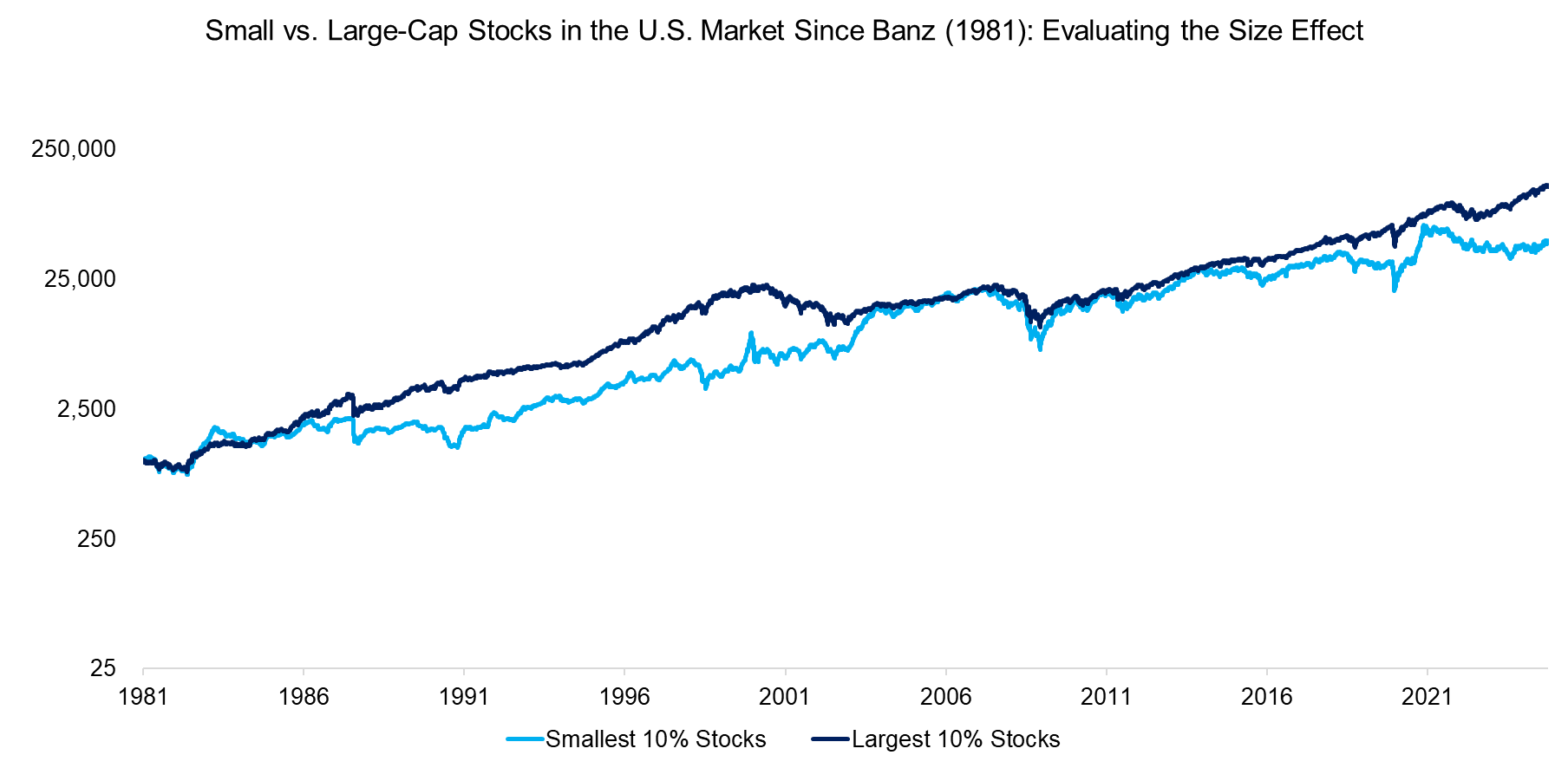

The size factor gained prominence with Rolf Banz’s 1981 paper, “Evaluating the Size Effect,” which, ironically, marked the peak of small-cap outperformance. Since its publication, small-cap stocks have struggled to keep pace with their larger counterparts.

Source: Kenneth R. French Data Library, Finominal

PERFORMANCE OF MICRO-CAP FUNDS

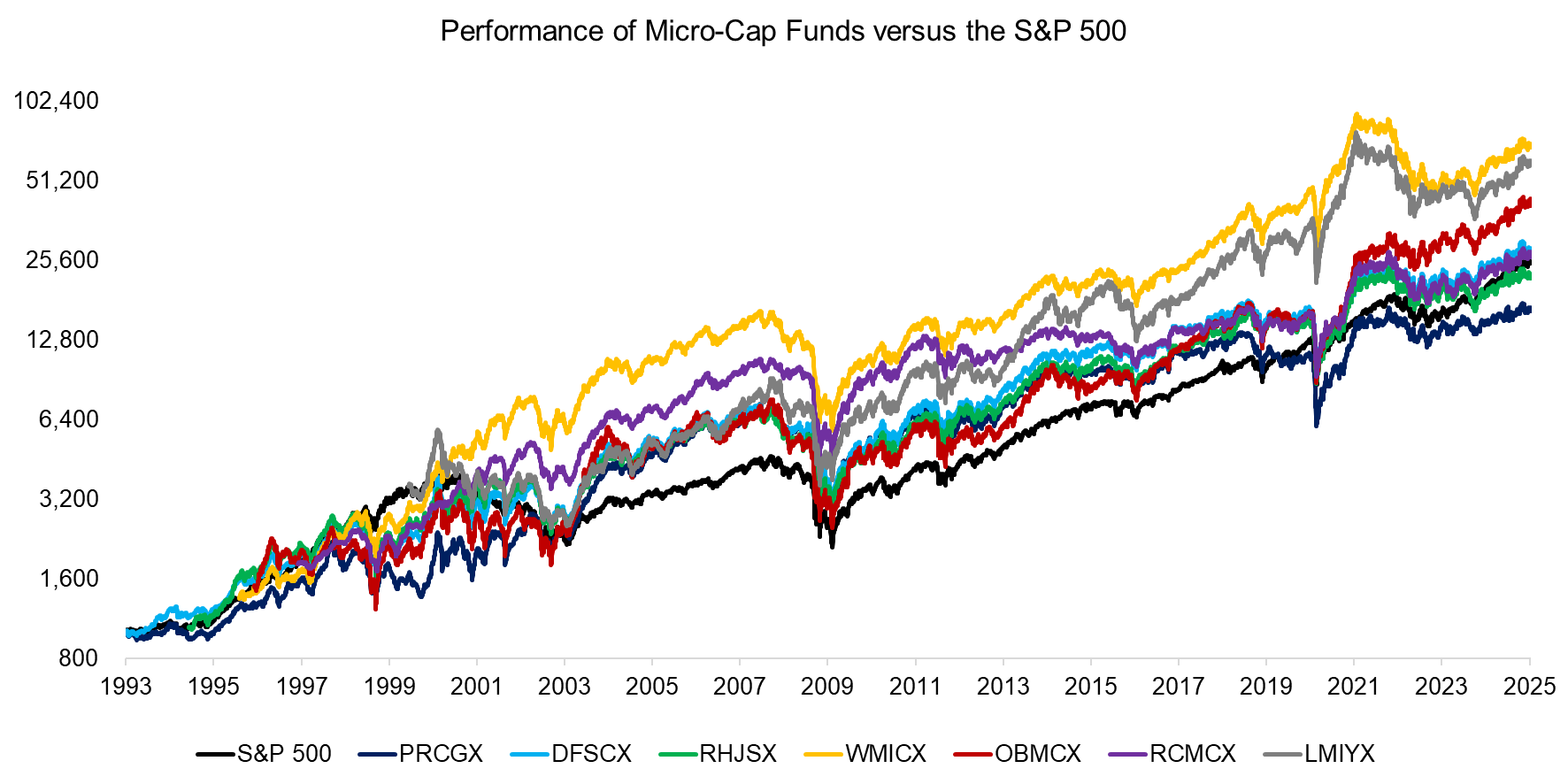

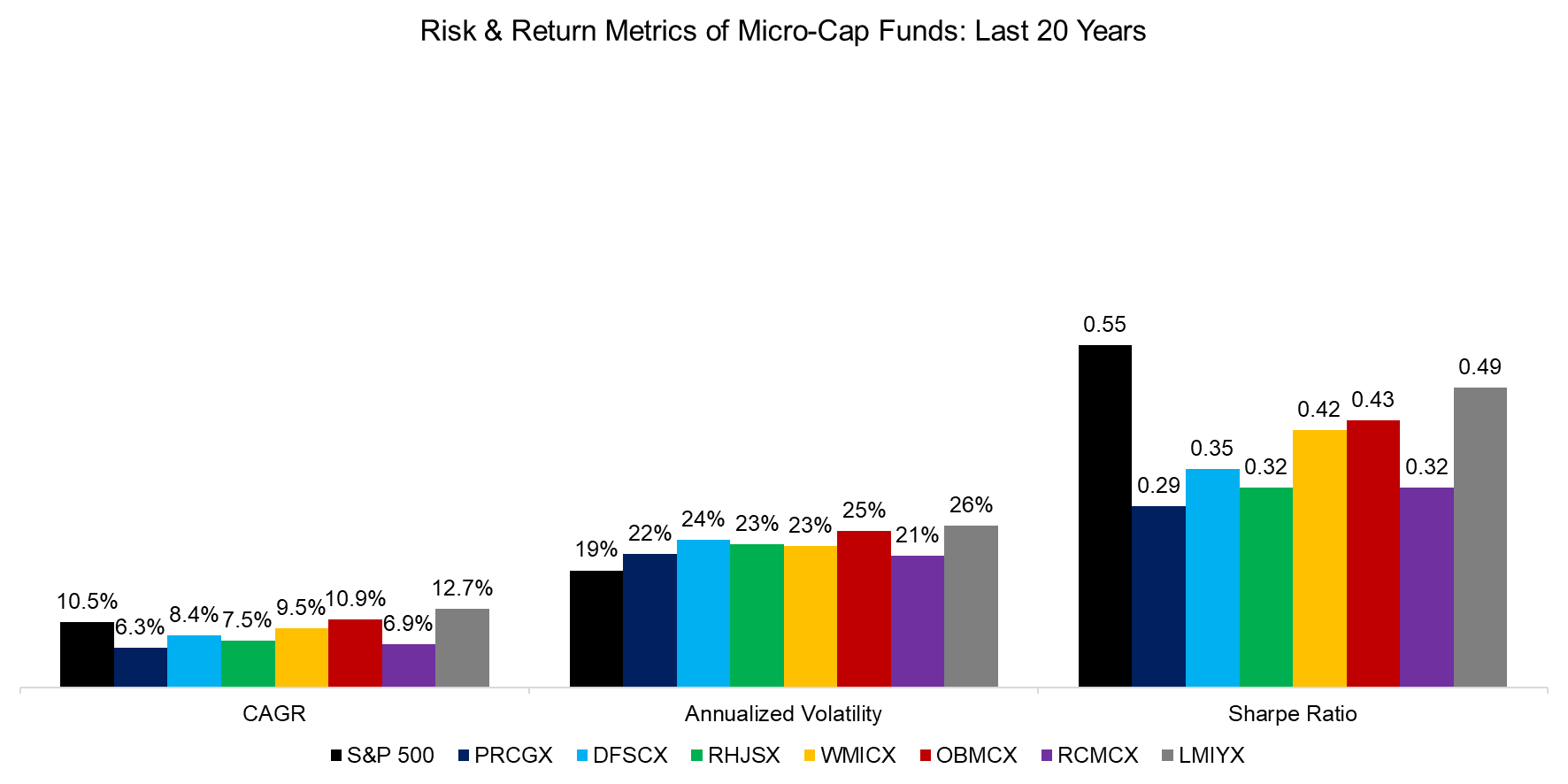

Next, we analyze seven micro-cap mutual funds that have track records exceeding 20 years, namely the DFA US Micro Cap Portfolio (DFSCX), Lord Abbett Micro Cap Growth Fund (LMIYX), Oberweis Micro-Cap Fund (OBMCX), Perritt MicroCap Opportunities Fund (PRCGX), Royce Capital Micro-Cap Portfolio (RCMCX), Rice Hall James MicroCap Portfolio (RHJSX), and Wasatch Micro Cap Fund (WMICX).

Cumulatively these manage close to $9 billion of assets, but DFA´s fund dominates this group with $7.4 billion, likely as it is by far the cheapest with 0.41% per annum, compared to the median fee of 1.25%. A factor exposure analysis reveals positive betas to the size, value, momentum, and quality factors.

We observe that five of the seven funds outperformed the S&P 500, with WMICX and LMIYX generating substantially higher total returns over the last 25 years.

Source: Finominal

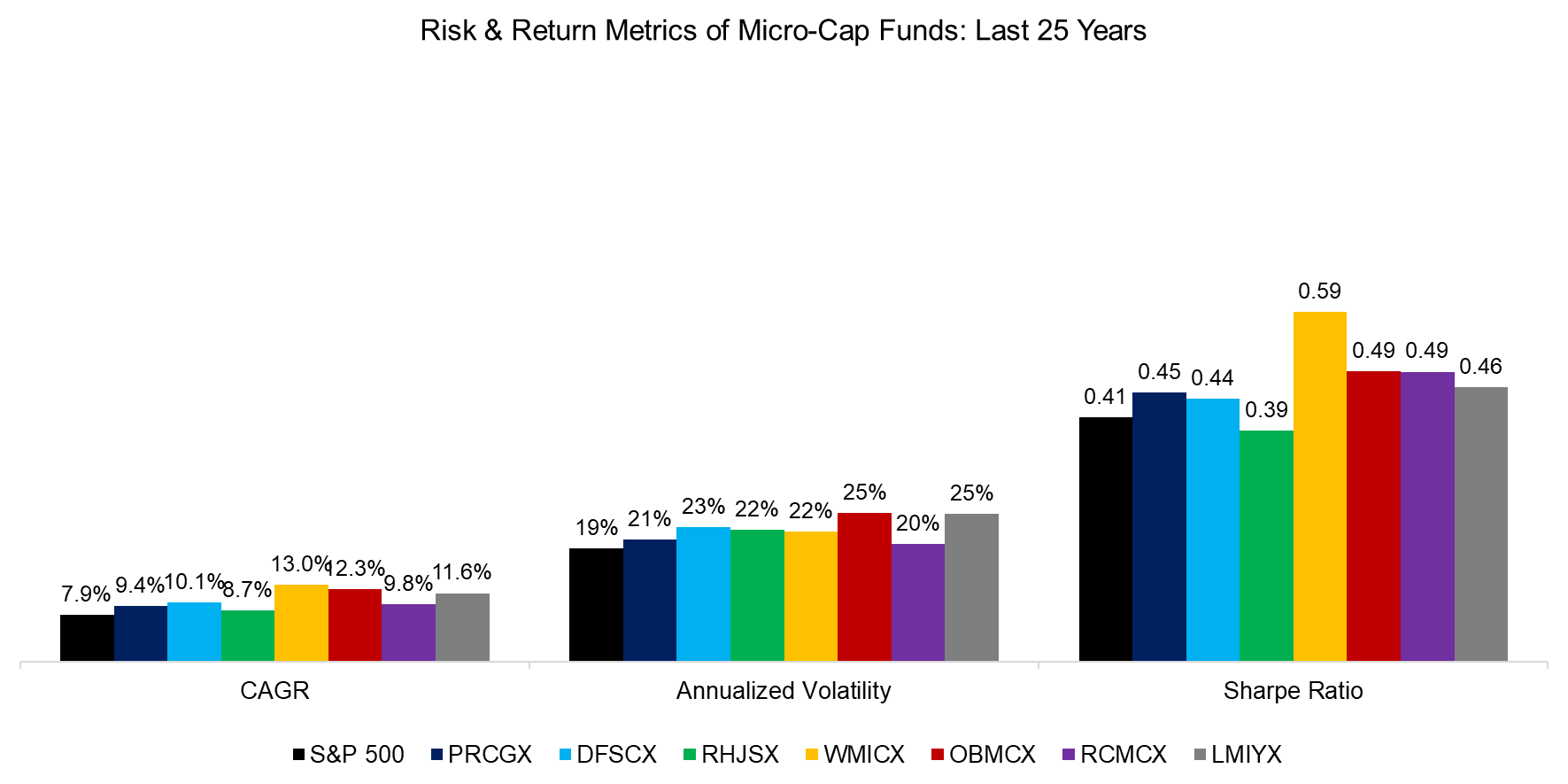

Intuitively, investors might expect micro-cap stocks to be significantly more volatile than large caps, but in reality, they were only moderately more volatile. Despite this, six out of the seven micro-cap funds achieved a higher Sharpe ratio than the S&P 500 over the past 25 years.

Source: Finominal

Astute readers may notice that micro-cap funds significantly outperformed during the tech bubble collapse in 2001, when overhyped large-cap stocks plummeted. As a result, using the past 25 years as the observation period introduces a selection bias. However, shortening the period by five years paints a different picture – large caps emerge with the higher Sharpe ratio in the risk-return analysis.

Furthermore, the selected micro-cap funds represent survivors, meaning they are the best-performing funds, as underperforming ones were liquidated. Stated differently, the average micro-cap fund will have performed worse than these funds.

Source: Finominal

MICRO VERSUS SMALL CAP FUNDS

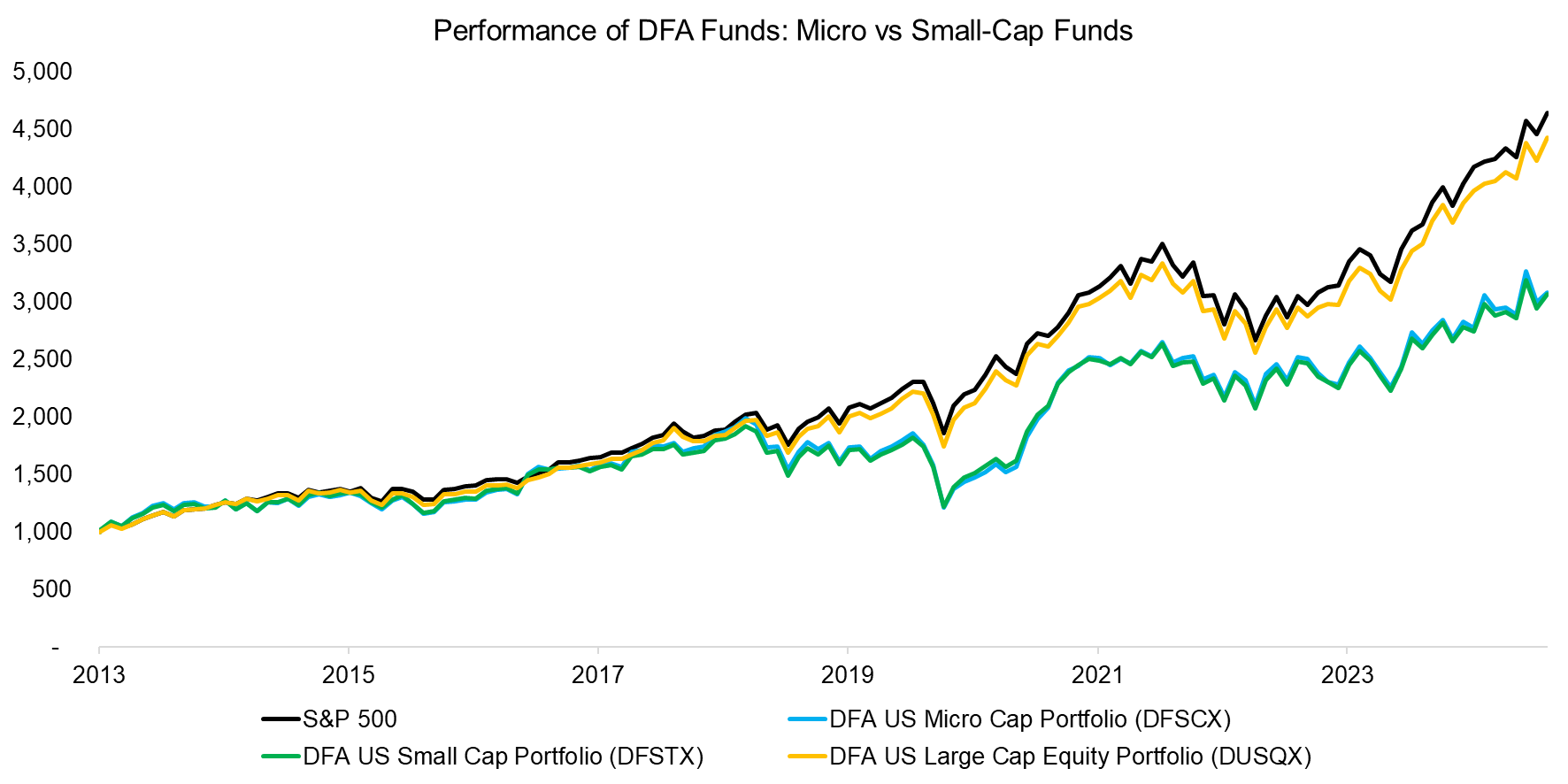

How different are micro-caps from small-caps? In theory, micro-caps should be more volatile due to their lower liquidity and higher firm risk. However, when using the DFA US Micro Cap Portfolio (DFSCX) and DFA US Small Cap Portfolio (DFSTX) as proxies, their performance has been virtually identical since 2013. Both funds are highly diversified, each holding over 1,500 stocks, and exhibit similar factor exposures due to DFA’s systematic investment approach.

FURTHER THOUGHTS

Have micro- or small-cap stocks outperformed large caps? The answer depends on the timeframe. Yes, if we look at data since 1926, excluding transaction costs. No, if we focus on the last 20 years, using either backtested data or actual returns from surviving mutual funds.

Explaining why smaller companies no longer offer higher returns is more complex. A key factor is that a larger share of small and micro-cap stocks are unprofitable, which likely weighs on performance. Additionally, the trend of technology companies like Airbnb staying private longer – going only public once they reach mid or even large-cap status – further limits the small-cap space by removing potential future winners.

Structurally, this space has become unattractive, and even active management has not helped. More than 80% of the small cap fund managers in developed and emerging stock markets underperform.

The only bullish case for micro- and small-cap stocks is a repeat of the tech bubble collapse, as large caps currently trade at much higher valuations. And as history has shown – sometimes it does repeat.

RELATED RESEARCH

Quality in Small versus Large-Cap Stocks

The Illusion of the Small-Cap Premium

The Case Against Small Caps

Factor Returns: Small vs Large Caps

Factor Investing in Micro & Small Caps

Size Factor

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.