Mid-Caps – The Hidden Champions?

Analyzing the In-Betweener Stocks

June 2021. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Mid-cap stocks are less popular than small or large caps

- In the US, they only outperformed in one out of 10 decades

- Globally, they have done better, creating a conundrum for investors

INTRODUCTION

A few weeks ago, David Stevenson, a well-known journalist and entrepreneur, asked me about my view on mid-cap stocks. To my own surprise, I had no view. Although I’ve published more than 150 research notes on factor investing, quant strategies, and similar topics, there was not a single one amongst these that focused on mid-caps.

How could I have ignored these stocks? Especially as a German national, where the Mittelstand, i.e. the mid-sized companies, is famous globally for representing the true economic force of the German economy. Some of these companies are affectionally called the hidden champions as they sell unsexy products like chain saws or molding machines, but at consistently high profit margins that made quite a few of their secretive founders billionaires.

Furthermore, although I’ve read plenty of research papers on small and large-cap stocks, I can not recall a memorable one on mid-caps. This lack of attention makes these stocks intruiging as alpha does not hide in plain sight (read Factor Returns: Small vs Large Caps).

In this research note, we will focus on analyzing mid-cap stocks globally.

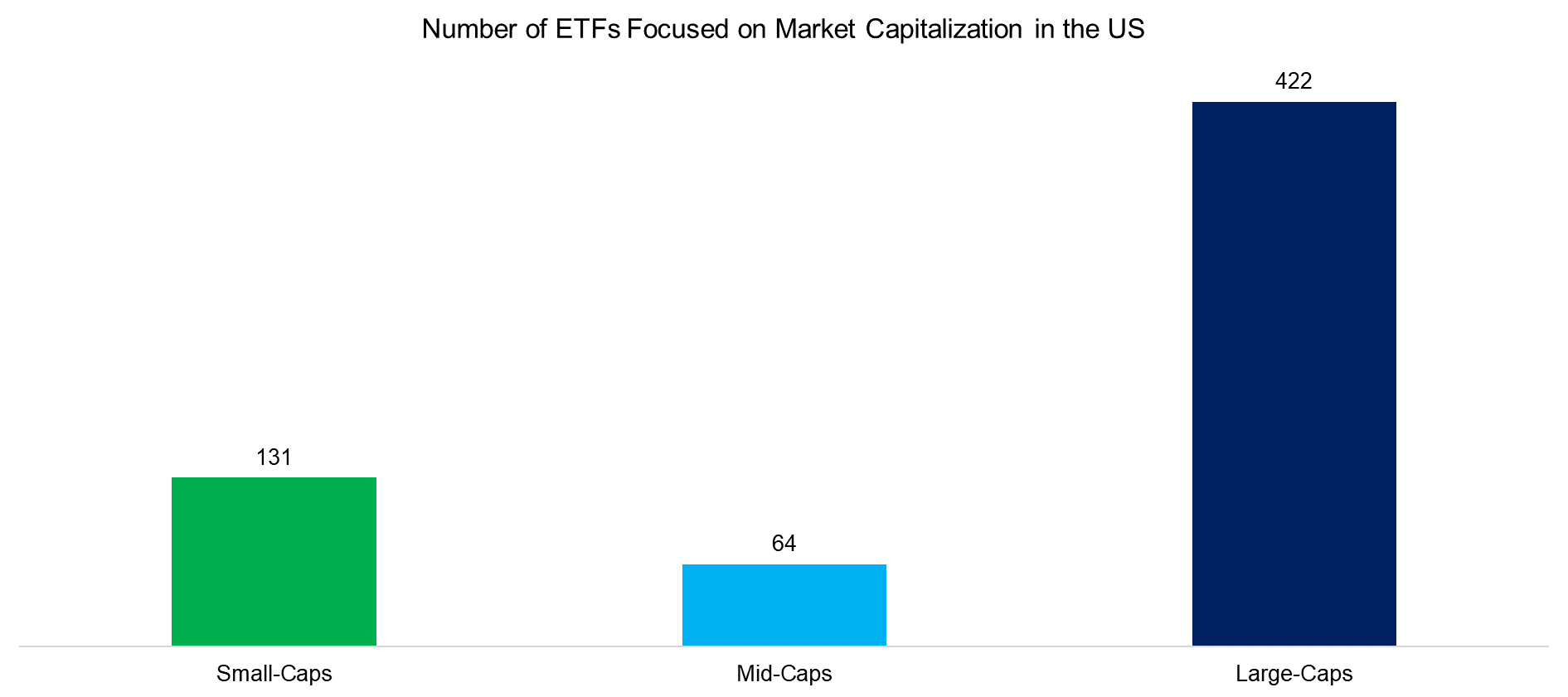

ETFS FOCUSED ON MARKET CAPITALIZATION

The lack of interest in mid-cap stocks by the investment community can be easily demonstrated by counting the number of ETFs focused on market capitalization in the US stock market. Using the filters from the website ETF.com highlights 131 ETFs focused on small and 422 ETFs on large-cap stocks, but only 64 ETFs on mid-sized companies.

Source: ETF.com, FactorResearch

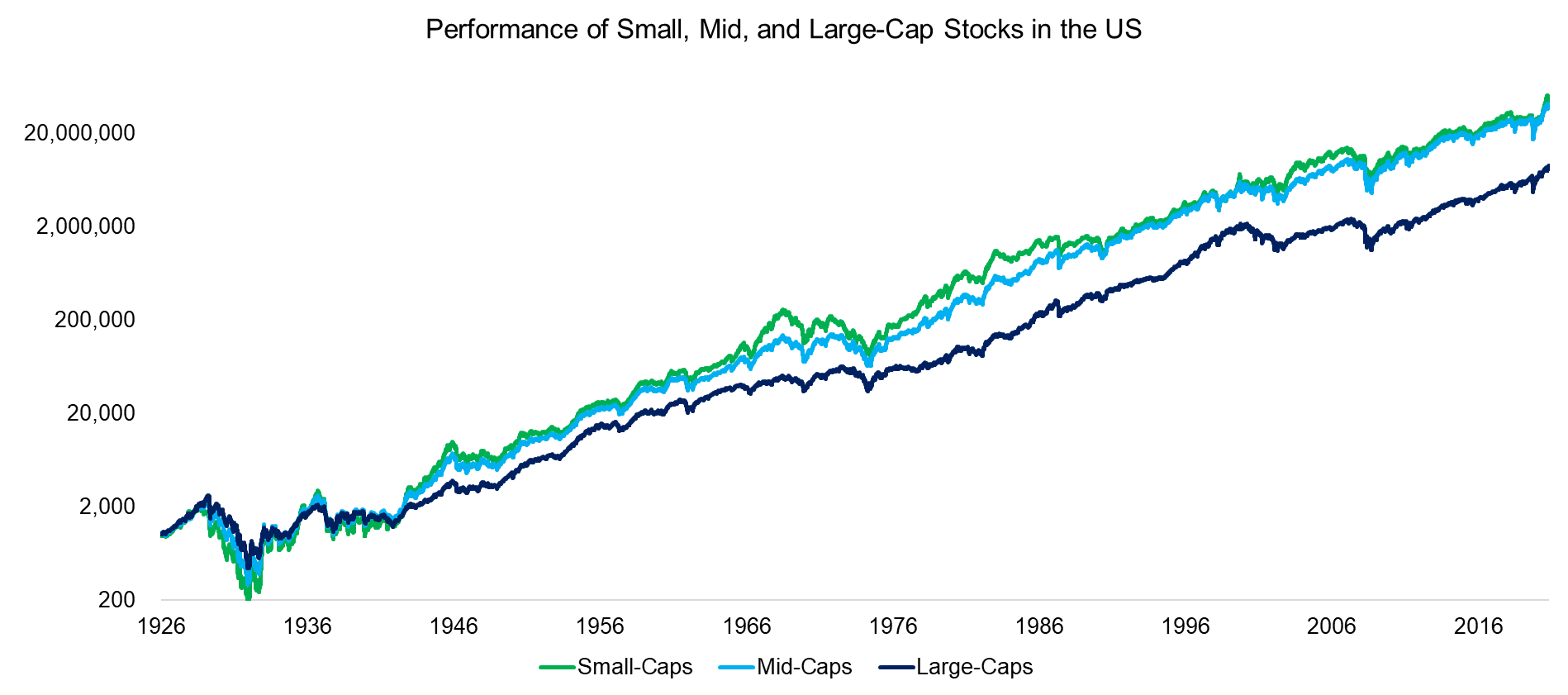

PERFORMANCE OF SMALL, MID, AND LARGE-CAP STOCKS IN THE US

In order to evaluate the attractiveness of mid-caps, we will focus on their relative performance and use data from the Kenneth R. French library. We create indices for each of the three market cap segments and stocks are weighted by their market capitalizations. We observe that mid and small-caps in the US stock market generated almost identical returns between 1926 and 2021, where the lack of differentiation is somewhat surprising. Both achieved significantly higher returns than large-caps.

It is worth noting that this data set excludes transaction costs. Given that it is more expensive to trade small than large-caps, the outperformance of small and mid-caps would be lower when transaction costs are included (read Factor Investing in Micro & Small Caps).

Source: Kenneth R. French Data Library, FactorResearch

The long-term performance chart highlighted that small and mid-caps outperformed over the last 90 years, but the difference to large-caps did not seem to have increased significantly post the 1980s.

Another way of looking at the excess returns of smaller and medium-sized companies is by analyzing the performance of the Size factor, which is defined as taking long positions in small and short positions in large-caps. Rolf Banz published the first paper about this factor in 1981, but sadly the small-cap premium has largely disappeared since then. Perhaps it was arbitraged away, or it was never a risk premium in the first place and the research results simply represented in-sample excess returns.

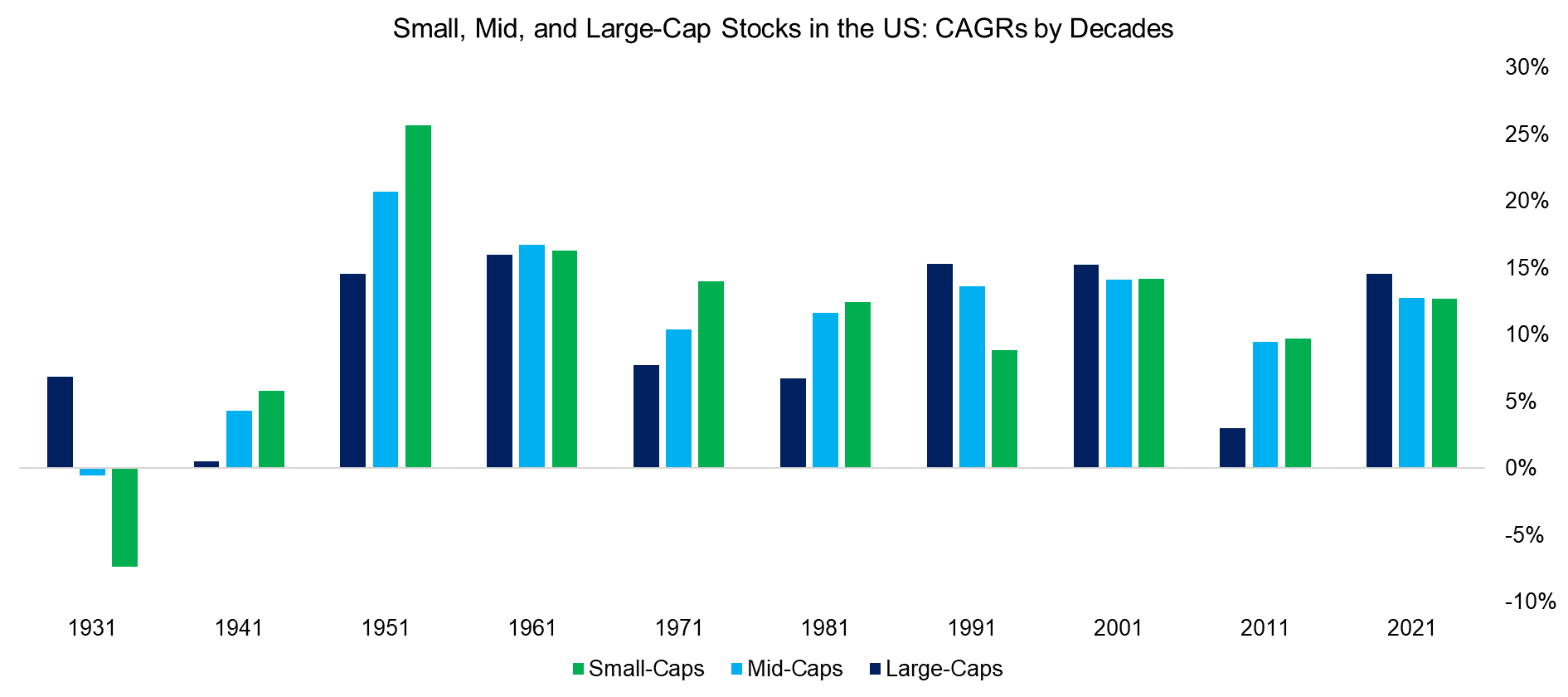

If we break down the returns of the three market cap segments by decades, then this highlights that mid (and small) caps outperformed between 1941 and 1981, but not much thereafter. However, more importantly, mid-caps outperformed both small and large-caps in only one out of ten decades. Mid-caps seem unpopular with investors, but it seems for the right reasons.

Source: Kenneth R. French Data Library, FactorResearch

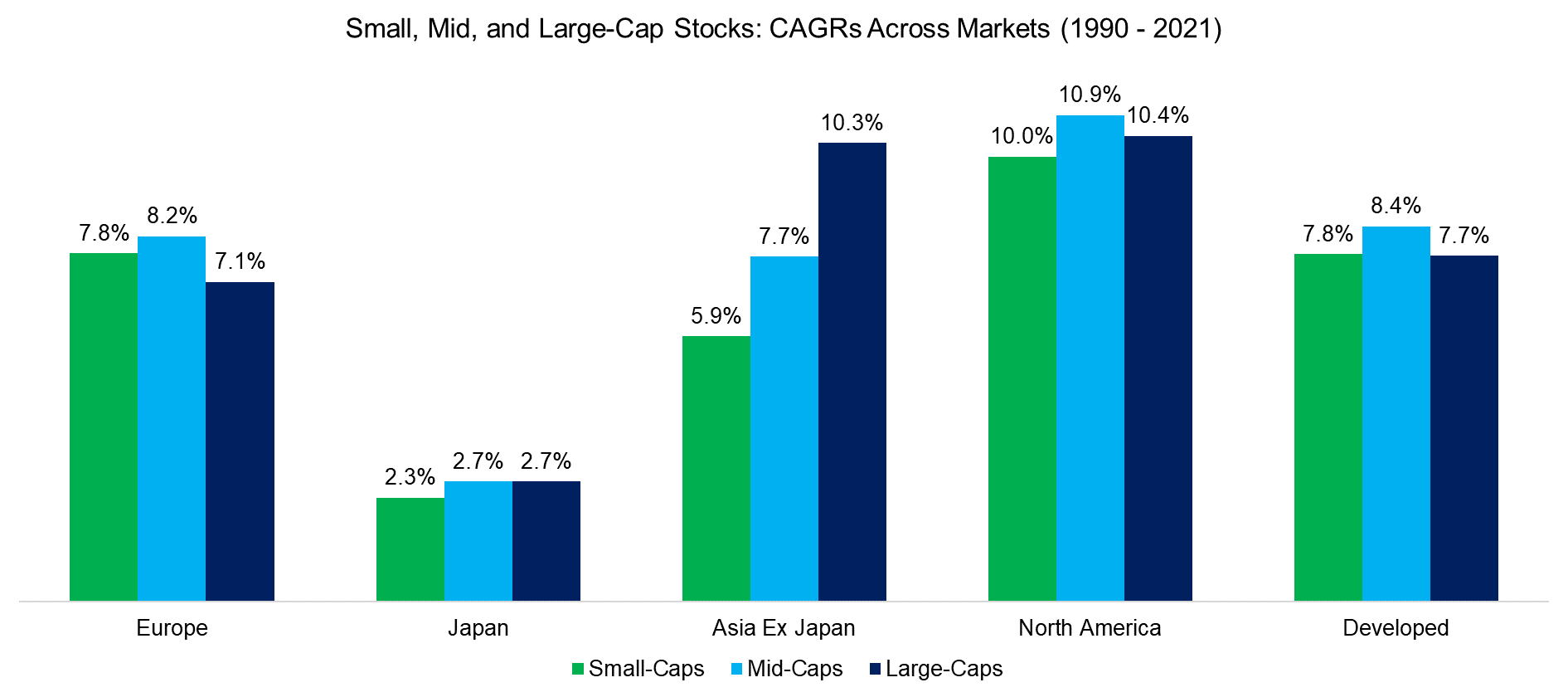

MID-CAPS ACROSS MARKETS

Although mid-caps in the US stock market do not deserve much attention, perhaps they have delivered stronger returns in other markets. We expand our analysis to global stock markets, where data is only available since 1990. We observe a more favorable perspective of mid-caps as they outperformed small and large-cap stocks in Europe and North America, as well as globally. In Japan, the performance was on par with large caps, and only in Asia ex-Japan large-caps generated higher returns.

Unfortunately, this creates a conundrum for investors. They can look at 90-years of data for US stocks, where mid-caps did not generate attractive excess returns, or 30-years of data across other stock markets where mid-caps outperformed.

Source: Kenneth R. French Data Library, FactorResearch.

FURTHER THOUGHTS

A mid-cap stock is somewhat like the middle child – neither the cute little baby nor the strong firstborn. Small-cap stocks seem to offer the opportunity to become the next Facebook or Netflix, which implies outsized returns for investors during that journey. In contrast, investing in large-caps means buying the most successful companies like Apple or Amazon. Mid-caps, well, they just are the in-betweeners.

Theoretically, this lack of excitement and attention should make mid-caps attractive, but our analysis highlights a mixed perspective on historical outperformance. An investor might hope that they at least trade relatively cheaply, but a factor exposure analysis reveals no significant exposure to the value factor. It seems there is nothing special about them, the market segment certainly does not represent a hidden champion.

RELATED RESEARCH

REFERENCED RESEARCH

The Relationship between Return and Market Value of Common Stocks, Rolf Banz, 1981

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.