Momentum in Emerging Markets

Reality < Theory

February 2022. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Long-short momentum investing highlights attractive performance in Asia and emerging markets

- However, realized excess returns are significantly lower than theoretical ones

- Likely explained by transaction costs

INTRODUCTION

Momentum has been shown to generate attractive excess returns across eight different markets and asset classes by AQR, a quantitative asset manager. Christopher Geczy and Mikhail Samonov demonstrated that it also works across centuries by measuring the price momentum of US stocks between 1801 and 2012.

Although we need to differentiate between cross-sectional and time-series momentum, broadly speaking it is a profitable investment strategy to buy assets when they are going up or outperforming, and shorting ones that are declining or underperforming. Few investment strategies have been more researched and are more widely supported by academic finance professionals (read Momentum Variations).

However, momentum investing in stocks is thought to work better in the US and Europe than in Asia or emerging markets. In this research note, we will explore cross-sectional momentum in Asia and EM.

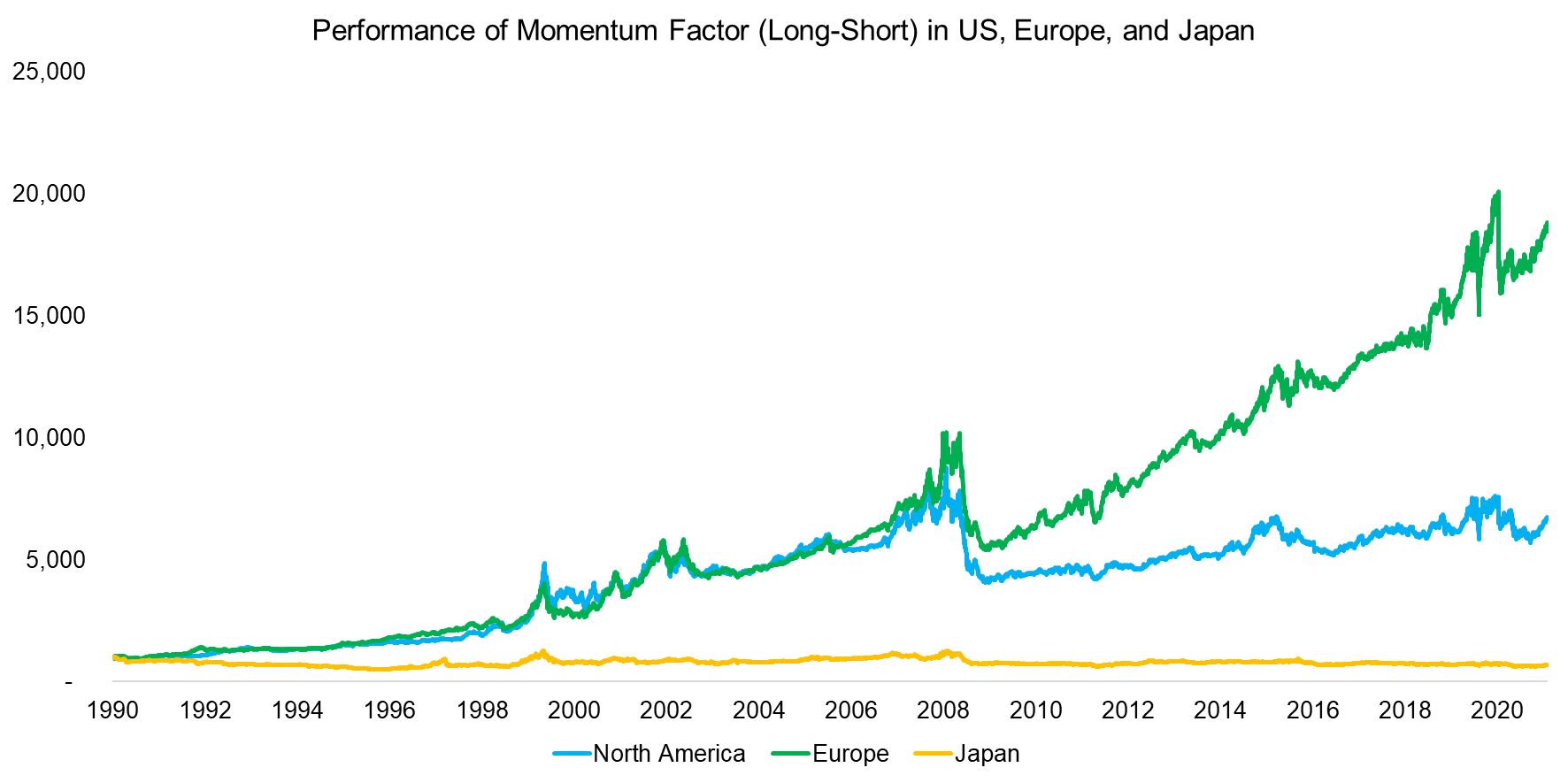

PERFORMANCE OF THE MOMENTUM FACTOR IN THE US, EUROPE, AND JAPAN

We use the factor returns from the Kenneth R. French data library in this analysis. First, we look at the long-short performance of the momentum factor, which buys outperforming and shorts underperforming stocks, across the major developed stock markets.

We observe that this strategy generated abnormally high excess returns in Europe, moderate returns in North America, but has been steadily losing money in Japan.

Source: Kenneth R. French Data Library, FactorResearch

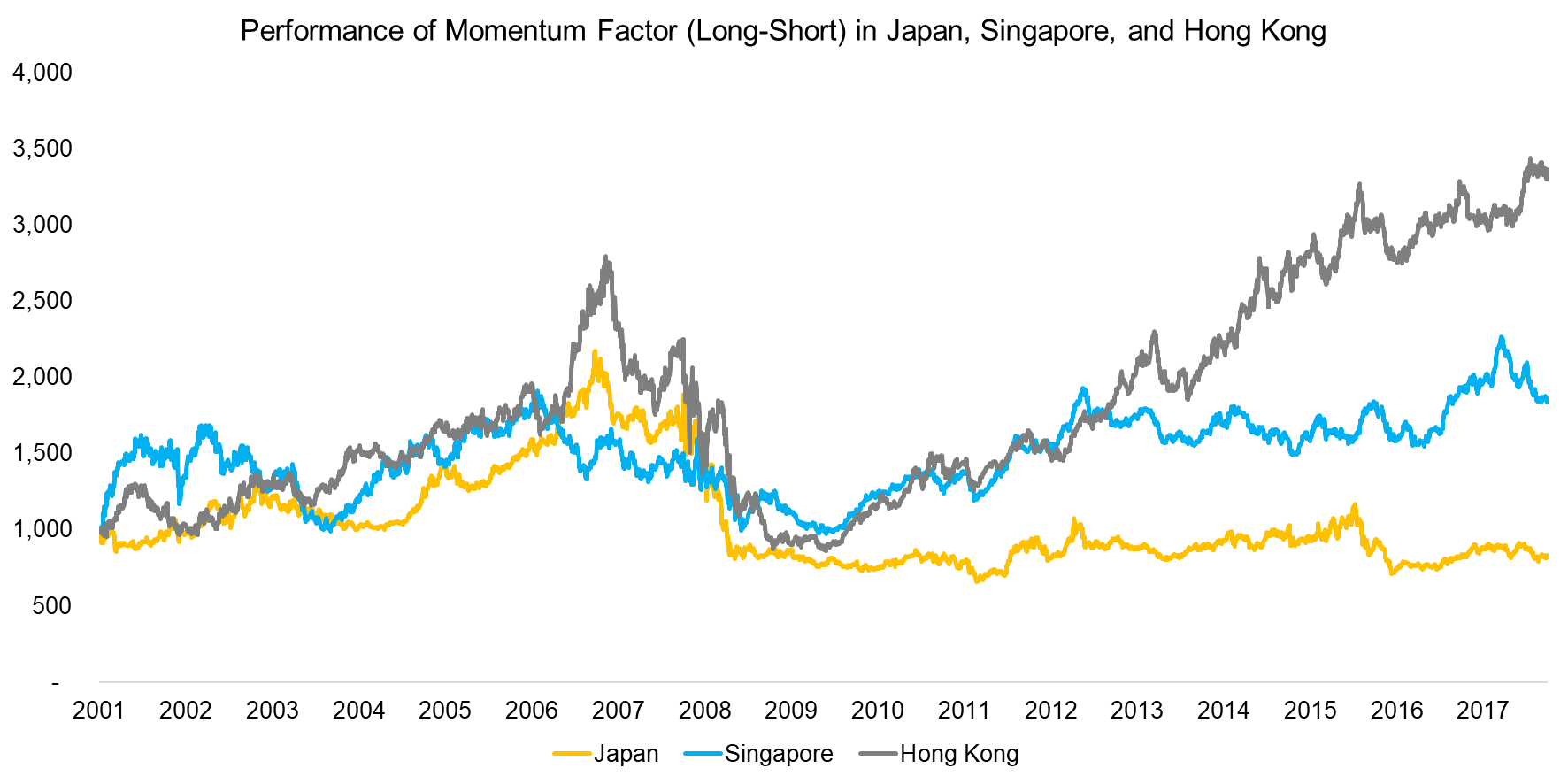

PERFORMANCE OF THE MOMENTUM FACTOR IN JAPAN, SINGAPORE & HONG KONG

Most academic financial research focuses on the major stock markets as these offer the best data quality for analysis. Given this, many market participants believe that momentum only works in the US and Europe, as they have seen the poor results from Japan. There are various theories why price momentum generated far less attractive returns in the Far East. The trends have certainly been the same, eg the momentum crash in 2009 also can be observed in Japanese stocks, but the return has been negative over the last few decades.

Some research shows that price momentum can only be found where earnings momentum exists, which also do not work in Japan. The obvious question is then why not?

Although we do not have a concise answer to this question, it is worth highlighting that momentum has generated positive excess returns in some Asian markets like Hong Kong or Singapore. The performance was not particularly consistent, but it was positive between 2001 and 2020.

Source: FactorResearch

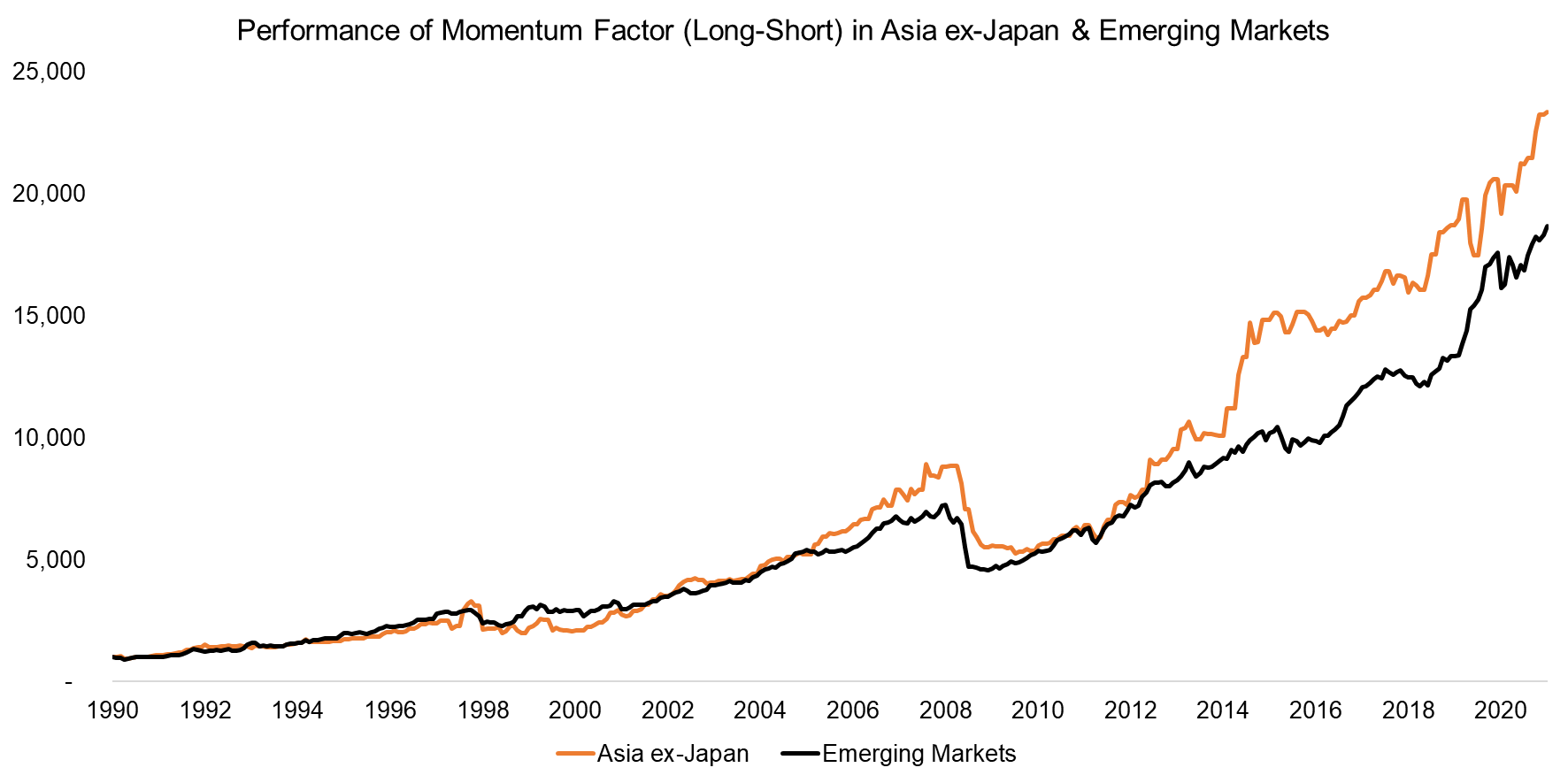

PERFORMANCE OF THE MOMENTUM FACTOR IN ASIA EX-JAPAN & EMERGING MARKETS

We can also analyze the performance of momentum in Asia excluding Japan, which highlights strong excess returns since 1990. The performance across emerging markets, which includes countries such as China, Argentina, and Turkey, was equally impressive (read Factor Investing in Emerging Markets).

It seems that momentum does work very well outside of the US and Europe, perhaps with the exception of Japan. However, no strategy works consistently across markets or time. The base criteria for a quantitative strategy is that it should work on average and be implementable.

Source: Kenneth R. French Data Library, FactorResearch

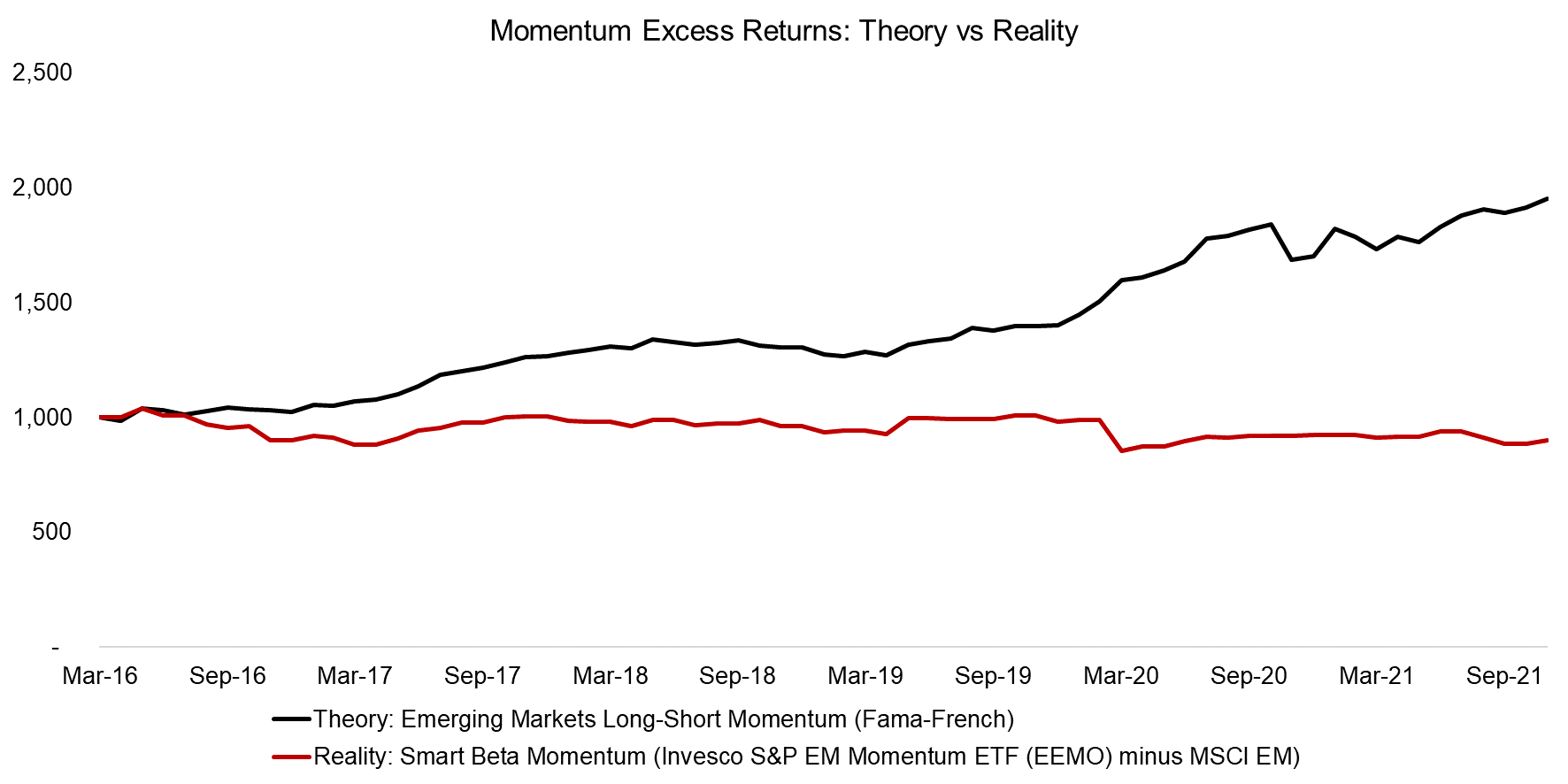

HARVESTING MOMENTUM EXCESS RETURNS

Given the attractive performance of the momentum factor in Asia ex-Japan and emerging markets, it would be intuitive to expect many investment products that enable investors to harvest the excess returns and generate outperformance.

However, surveying the landscape of related ETFs in the US highlights only a few investment options. Most of these have been launched several years ago, but they only manage relatively few assets. Notably are the iShares MSCI Intl Momentum Factor ETF (IMTM) with $862 million, Invesco S&P International Developed Momentum ETF (IDMO) with $9 million, and the Invesco S&P Emerging Markets Momentum ETF (EEMO) with $6 million.

All three of these ETFs use momentum as the primary stock selection methodology, but also employ volatility for position sizing in portfolio construction. It is worth highlighting that the excess returns from these smart beta ETFs can differ significantly from the theoretical indices. For example, EEMO generate negative excess returns since 2016, while the equivalent theoretical long-short momentum factor in emerging markets increased almost by 100%.

Source: Kenneth R. French Data Library, FactorResearch

THEORY VERSUS REALITY

The failure of actual investment products to produce the theoretical returns can be attributed to a variety of reasons. Smart beta products are long-only and typically market capitalization-weighted, while most theoretical strategies are long-short and equal-weighted.

However, the most important aspect is that most financial research excludes transaction costs, which unfortunately have a real-world impact. The factor data from the Kenneth R. French data library is a great resource, but does not include transaction costs, which can be differentiated into commissions, financing costs, market impact costs, shorting costs, and so on.

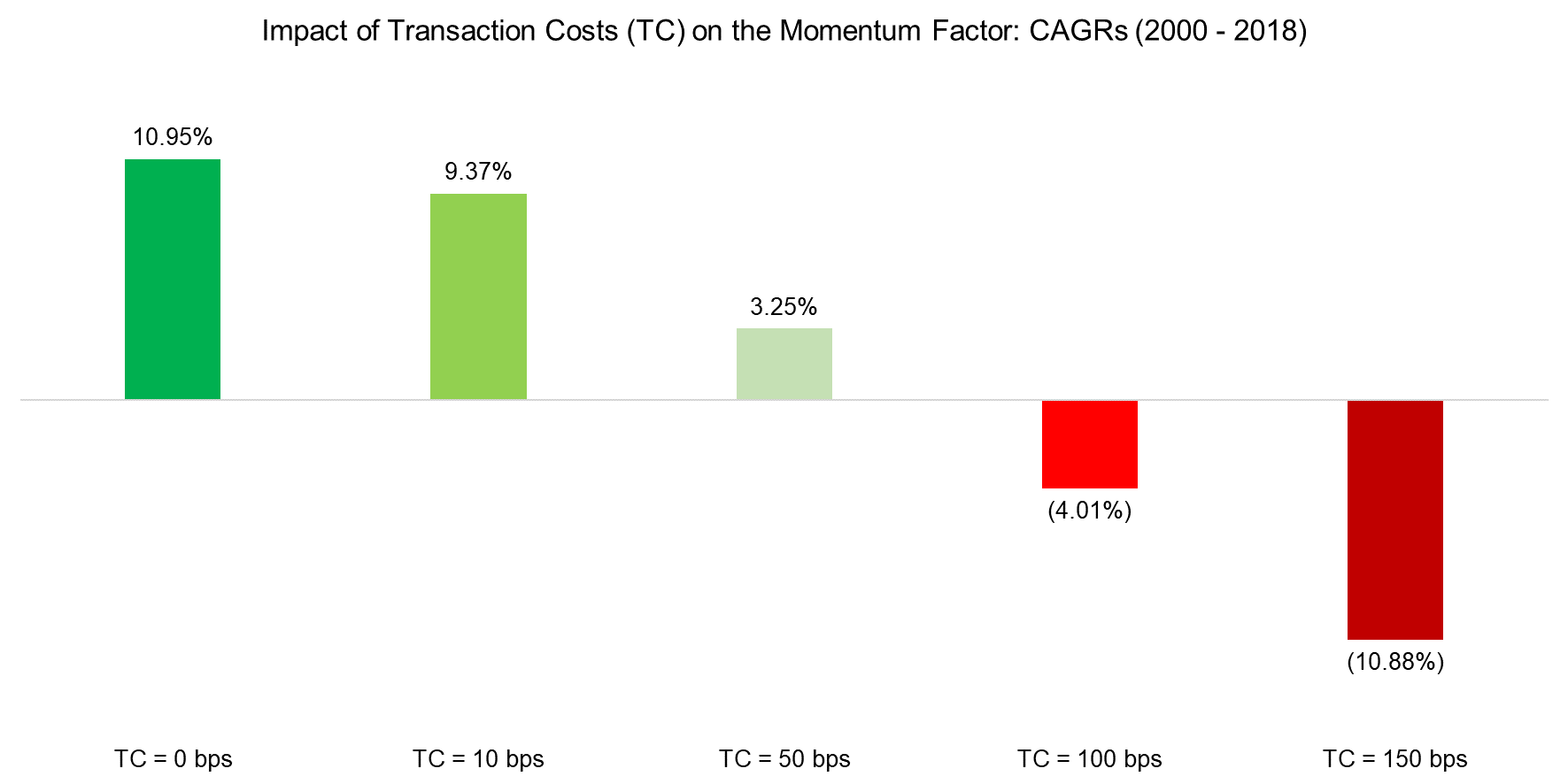

We can demonstrate the impact of transaction costs on the long-short momentum strategy by taking Australia as a case study. The Australian stock market is small with less than 200 stocks tradable for institutional investors. If we assume zero transaction costs, then the momentum factor would have generated almost 11% per annum between 2000 and 2018. If we assume 50 basis points, which is not unreasonable for less liquid and especially emerging markets stocks, this return would have decreased to slightly above 3%.

Source: FactorResearch

FURTHER THOUGHTS

Although the results from this analysis are not encouraging, should investors disregard the momentum factor?

Perhaps investors should be skeptical of implementing the strategy in certain markets and heavily discount theoretical returns, but there is still an overwhelming amount of financial research that supports the factor across developed stock markets, where trading stocks has become very cheap, and asset classes, where futures can be used.

Until this research gets challenged, onwards and upwards with momentum.

RELATED RESEARCH

Low Vol-Momentum vs Value-Momentum Portfolios

Cap-Weighted Benchmarks: Good Momentum Bets?

Quant Strategies: Theory versus Reality

REFERENCED RESEARCH

Value & Momentum Everywhere, Asness et al, 2013

Two Centuries of Price Return Momentum, Geczy and Samonov, 2016

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.