Momentum Investing on Country Level

Comparable to stock-based momentum?

February 2026. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Momentum-based country investing outperformed the MSCI ACWI

- However, the outperformance was highly inconsistent

- The strategy underperformed since the GFC due to strong U.S performance

INTRODUCTION

BlackRock’s iShares launched the International Country Rotation Active ETF (CORO) in December 2024. The fund dynamically rotates across international equity markets and has outperformed the MSCI ACWI ex USA Index to date.

However, its performance history is very short, making the results not particularly meaningful. More importantly, CORO remains the only U.S.-listed ETF or mutual fund that explicitly implements a country rotation strategy – hardly a strong endorsement of the approach’s robustness.

In prior research (read Factor Investing on Country Level), we demonstrated that selecting countries using a stock-like, multi-factor framework could have generated excess returns. That approach, however, required aggregating fundamental metrics across entire equity markets, which is complex and data-intensive. A natural question, then, is whether the strategy can be simplified. Why not focus on momentum, a signal that is straightforward to compute and widely used at the stock level?

In this report, we examine the viability of momentum investing at the country level.

MOMENTUM ON COUNTRY LEVEL

We use data on 23 market capitalization-weighted national equity indices from AQR’s data library. The sample spans 1998 to 2025. Momentum is measured using a simple 12-month lookback period to identify the best-performing markets. Based on this signal, we construct portfolios consisting of the top 3, 6, and 12 countries by past returns, with monthly rebalancing. We ignore transaction costs, but introduce a day of delay for measuring performance.

The best-performing markets since 1998 were Denmark, Norway, and the U.S, while the worst-performing countries were the UK, Portugal, and Japan.

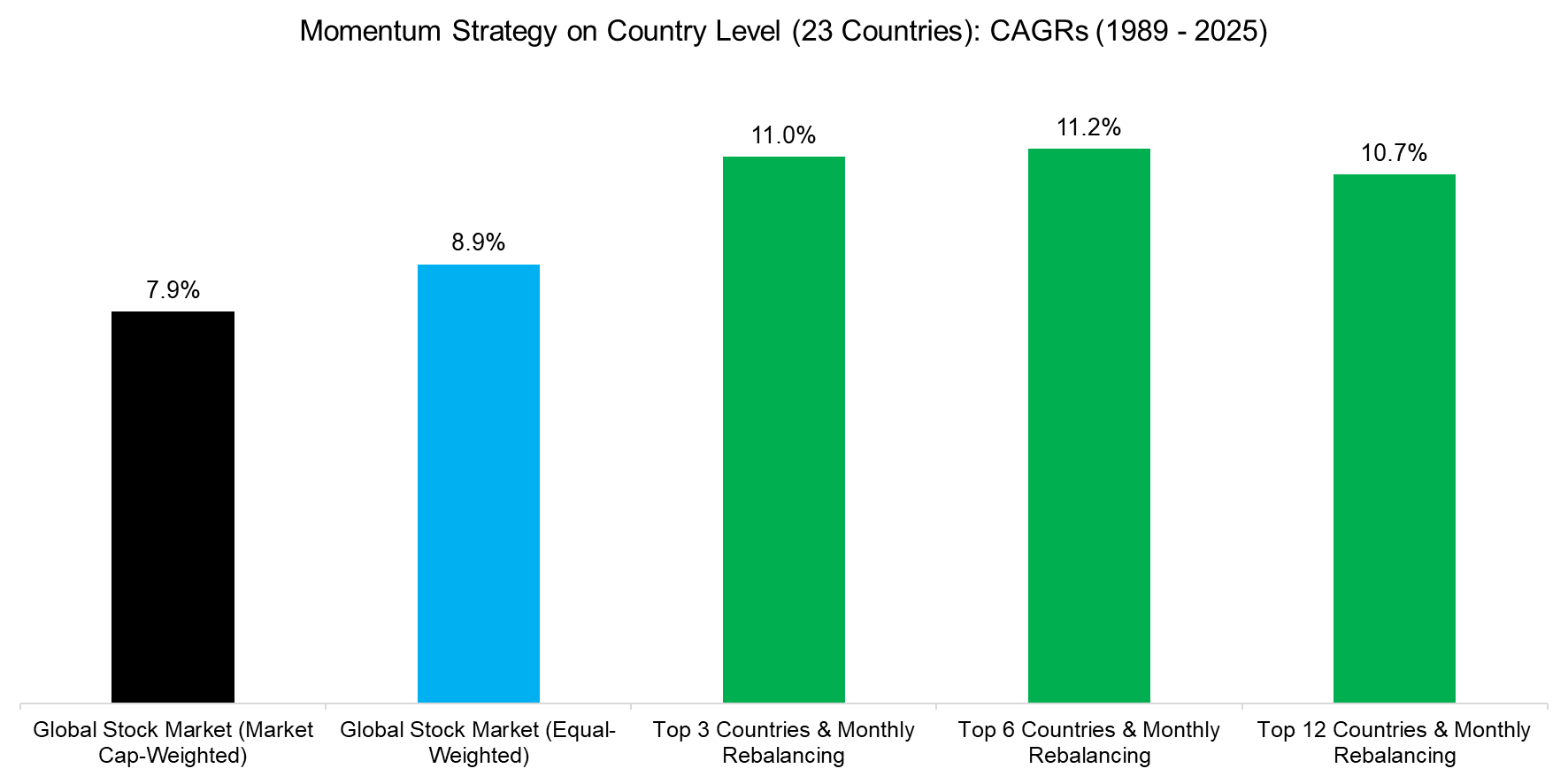

We find that all three momentum-based portfolios would have outperformed both market capitalization–weighted and equal-weighted global equity benchmarks over the sample period. Overall, outperforming the global stock market appears to have been relatively straightforward using country-level momentum.

Source: Finominal

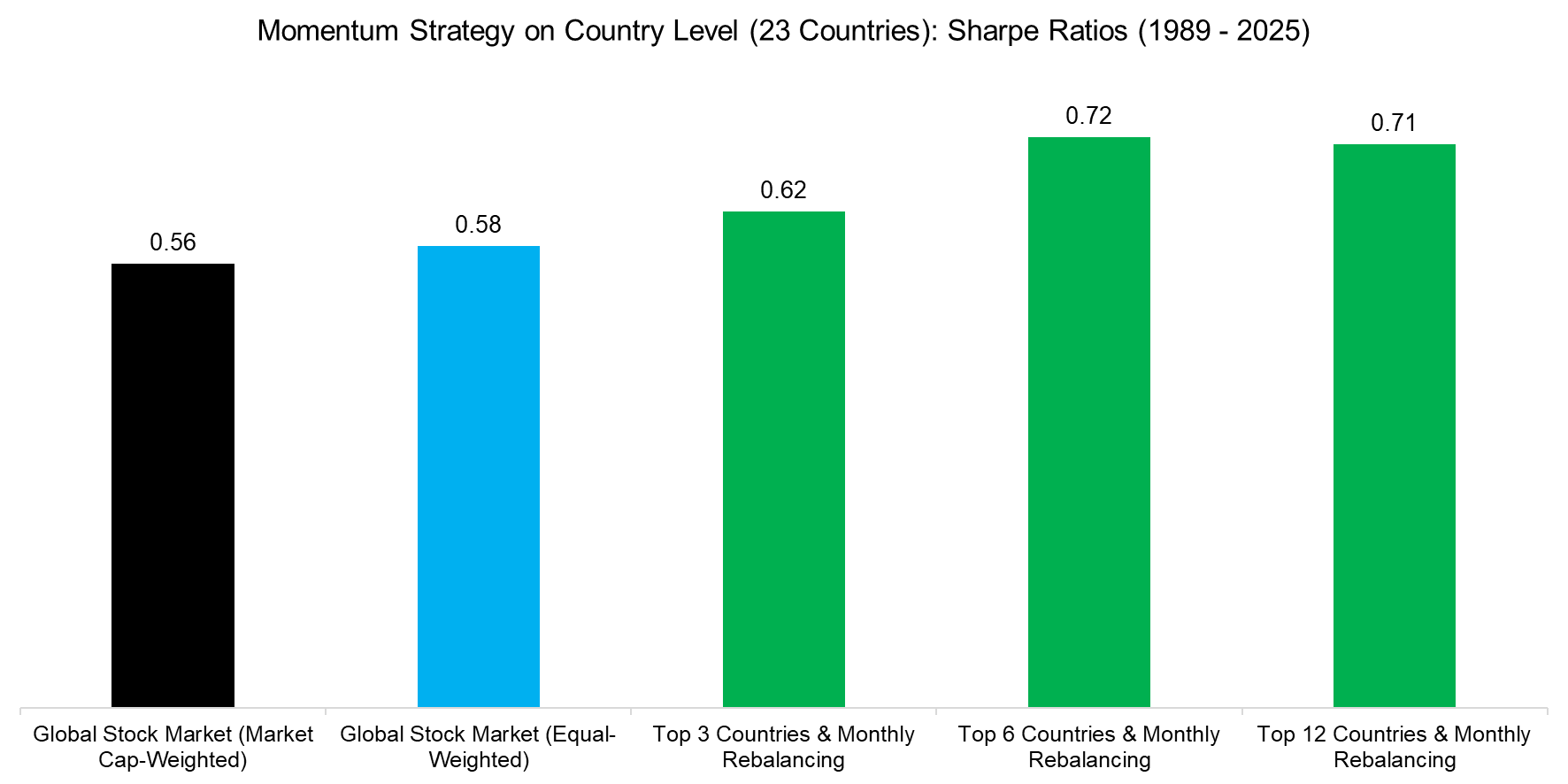

To assess whether the higher returns were merely a compensation for greater volatility, we compute Sharpe ratios. We find that all three momentum-based portfolios also delivered superior risk-adjusted returns.

Source: Finominal

ROBUSTNESS ANALYSIS

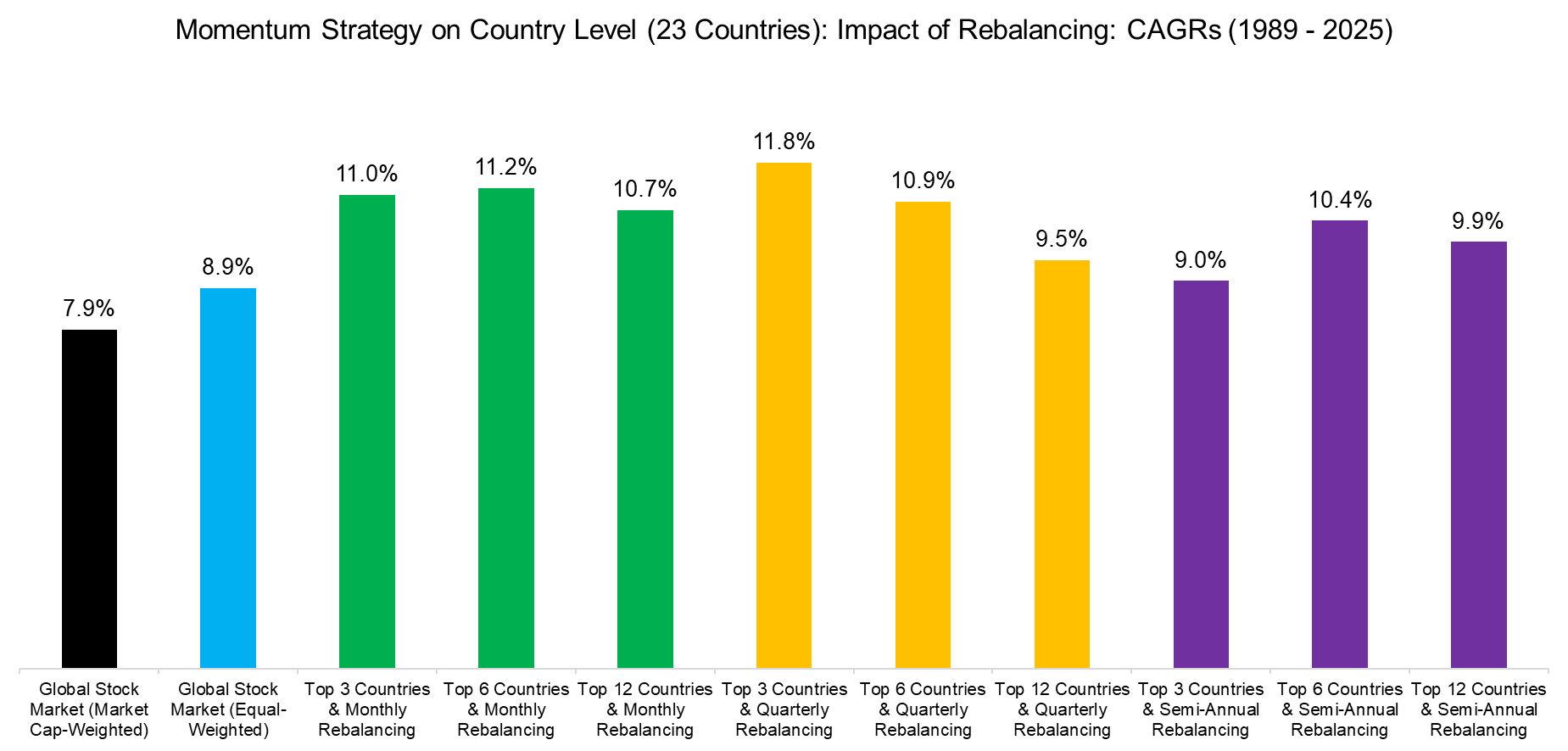

One limitation of this analysis is that it excludes transaction costs. While implementing this strategy today would likely involve minimal fees – especially using country ETFs – historically, trading costs would have been higher and would have reduced net returns.

Nevertheless, even when extending the rebalancing frequency from monthly to quarterly or semiannual, where transaction costs are largely irrelevant, momentum-based country selection would still have generated higher returns than the global stock market over the past 35 years.

Source: Finominal

TABLES VS CHARTS

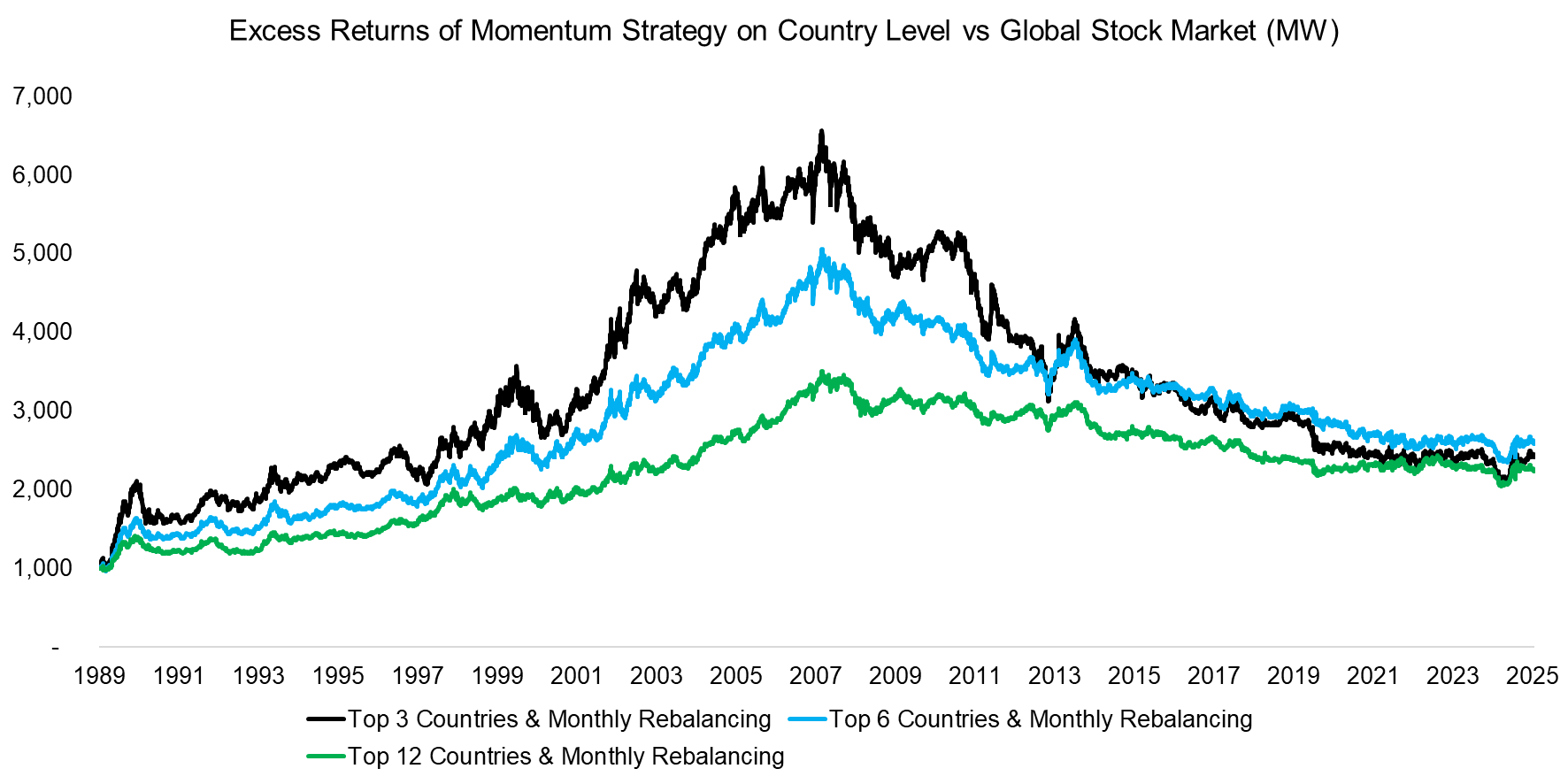

A key limitation of academic financial research is its heavy reliance on tables to present results. While tables can highlight numerous anomalies that historically generated excess returns, many of these findings are of limited practical use because the outperformance is often inconsistent. To address this, every table should ideally be accompanied by a performance chart.

When we visualize the excess returns of the momentum-based portfolios in a chart, the perspective changes. The strategy shows consistent outperformance relative to the global stock market from 1989 to 2007, but persistent underperformance in the subsequent period, making the approach far less compelling in practice.

Source: Finominal

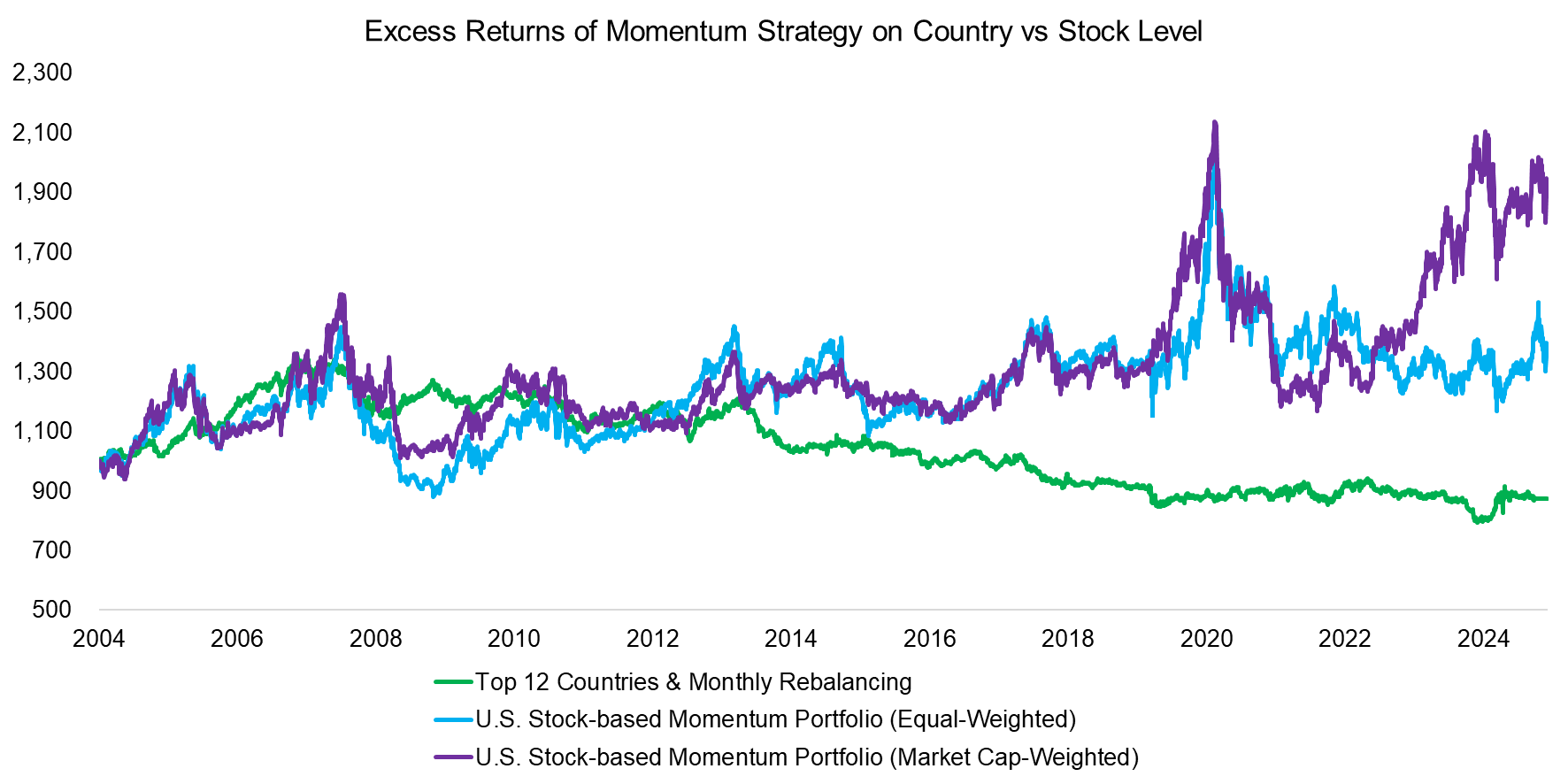

Finally, we compare the excess returns of the momentum strategy at the country level versus the stock level, in both cases measured relative to broad market returns. While stock-level momentum tends to behave similarly across different markets, e.g. all stock markets show a crash for the cross-sectional momentum factor in 2009, the patterns for country-level momentum are strikingly different.

Source: Finominal

FURTHER THOUGHTS

Examining the excess return charts suggests that something changed around 2008, when the momentum strategy shifted from consistent outperformance to persistent underperformance. While market participants often claim that “markets have changed”, our research indicates that this is not the case (read Have Stock Markets Changed?).

One possible explanation is that post-global financial crisis markets have been heavily influenced by frequent central bank interventions, making trend-following strategies more difficult.

Alas, the explanation is simpler: our excess returns are calculated relative to the market capitalization-weighted global stock market index, which is dominated by the U.S. – the best-performing market over the past decade. By allocating equally to other countries, the momentum strategy simply diluted the strong returns of the U.S. stock market. This naturally leads to the frequent question from U.S. investors – why look outside the U.S.?

RELATED RESEARCH

Factor Investing on Country Level

Sector versus Country Momentum

Value, Momentum & Carry Across Asset Classes

Absolute versus Relative Momentum Across Asset Classes

Risk-Managed Equity Exposure III

Risk-Managed Equity Exposure II

Risk-Managed Equity Exposure

Risk versus Momentum-based Equity Allocations

Combining Risk-Managed Equities and Managed Futures – II

Defining Tactical Asset Allocation

Revisiting the Performance of TAA ETFs

Tactical ETFs: Tactfully No, Thank You?

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.