Momentum Variations

Does Complexity Beat Simplicity?

August 2018. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- The simplicity of the Momentum factor can be intellectually challenging

- Various alternative Momentum versions highlight remarkable similar return profiles

- The robustness is an attractive characteristic of the investment strategy

INTRODUCTION

What do selfies, the Kardashians, Crocs, blue cheese, and Boris Johnson have in common? They all rank within the top 50 things that split the opinion of modern British people according to a recent survey. An equivalent list in finance likely includes cryptocurrencies, the valuation of the S&P 500, the direction of interest rates, the future of the Euro, and the Momentum factor. The latter is a slightly more unusual component as there is a significant amount of academic research that has shown that Momentum, both time series and cross-sectional, works within various asset classes, across different markets and time periods.

However, especially long-short Momentum in equities tends to be either favoured, mostly by quants, or actively disliked, usually by discretionary investors. It is reasonable that investors who create detailed fundamental models, regularly meet corporate CEOs, and often studied hundreds of hours after work for the charted financial analyst (CFA) designation struggle with an investment strategy that can be replicated by high school students. In this short research note, we will therefore investigate more complex variations of the Momentum factor, which might intellectually be more satisfying and potentially result in higher risk-adjusted returns (read Momentum Factor: Intra vs Cross-Sector).

METHODOLOGY

We focus on the Momentum factor in the US, Europe and Japan, which is defined as buying the winning and shorting the losing stocks. The factor performance is calculated by constructing a long-short beta-neutral portfolio of the top and bottom 10% of stocks ranked by the factor definition. Only stocks with a minimum market capitalisation of $1 billion are included. Portfolios are rebalanced monthly and each transaction incurs costs of 10 basis points. We investigate the following Momentum variations:

- Classic (Fama-French): Sorting stocks by their performance over the last 12 months, excluding the most recent month

- Sharpe Ratio: Sorting stocks by their Sharpe ratio of the last 12 months

- Gain / Loss Ratio: Sorting simultaneously by performance (Classic) and the ratio of winning days over losing days, weighted equally

- Slope: Sorting simultaneously by performance (Classic) and the slope, which is calculated as the absolute difference between the 12-month return today and one-year ago, weighted equally

- Alpha: Sorting stocks by their alpha, which is defined as the residual between the 12-month stock return and the sum of seven common equity factor contributions to the stock return

- Ex. – Skew on Long: Removing all stocks in the long portfolio with negative skewness, then ranking by performance (Classic)

- Ex. + Skew on Long: Removing all stocks in the long portfolio with positive skewness, then ranking by performance (Classic)

- Ex. – Skew on Short: Removing all stocks in the short portfolio with negative skewness, then ranking by performance (Classic)

- Ex. + Skew on Short: Removing all stocks in the short portfolio with positive skewness, then ranking by performance (Classic)

DESIRABLE VERSUS UNDESIRABLE MOMENTUM STOCKS

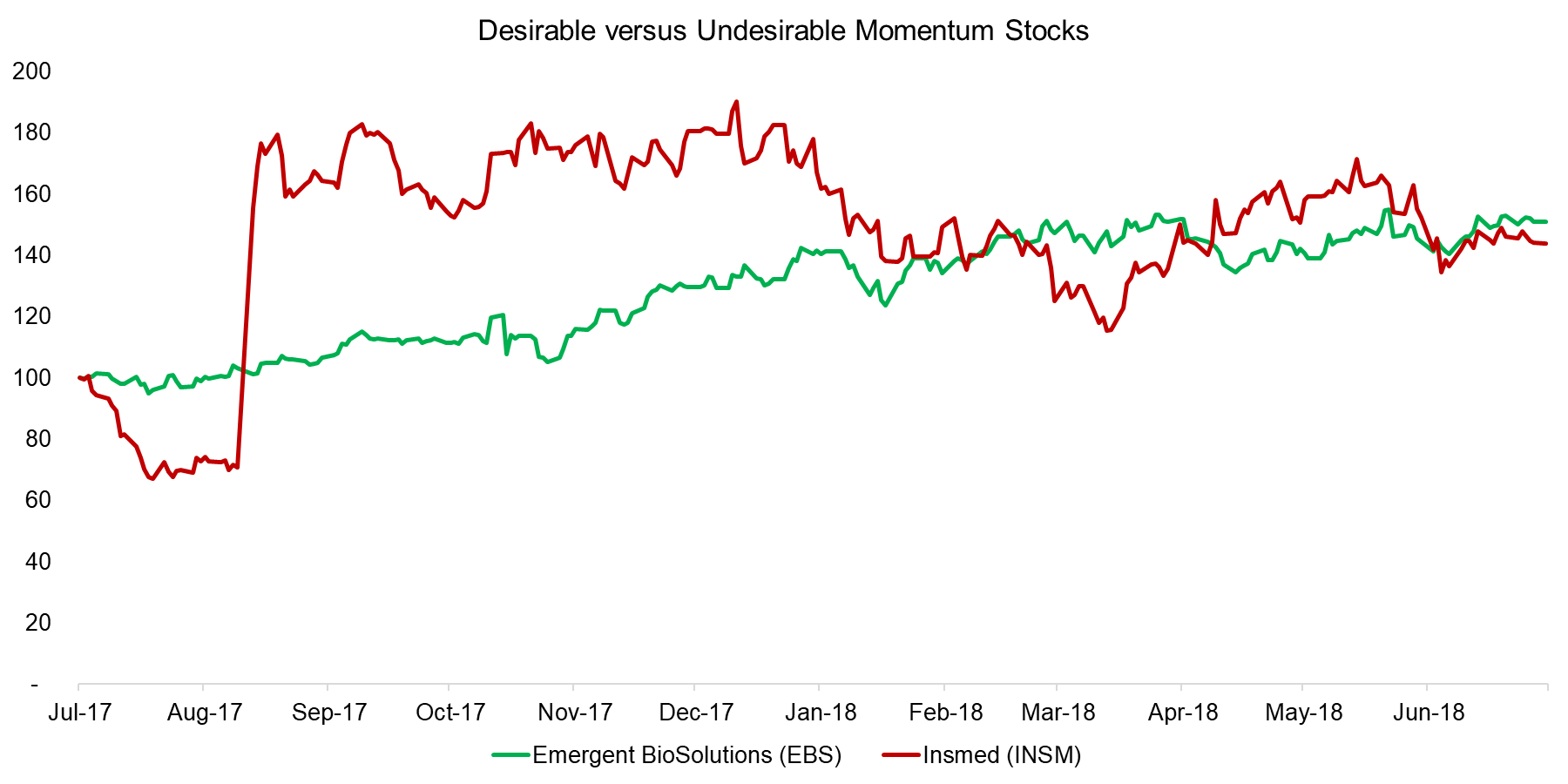

Momentum is a trend-following strategy, but defining a trend is as much art as science. The chart below shows the indexed stock performance of two biotech companies. Emergent BioSolutions (EBS), which develops medical countermeasures for biological and chemical threats as well as for infectious diseases, showed a consistent upward trend over the last 12 months. In contrast, Insmed (INSM), which develops drugs for rare diseases, shows a flat performance over the same time period, except for September 2017, where the stock price doubled in one day after the company announced a successful drug trial. Investors typically prefer consistent upward trends versus sporadic jumps in stock prices as these might not be repeated in the future. The objective of some of the Momentum variations is to identify stocks with higher trend consistency.

Source: FactorResearch

MOMENTUM VARIATIONS IN THE US

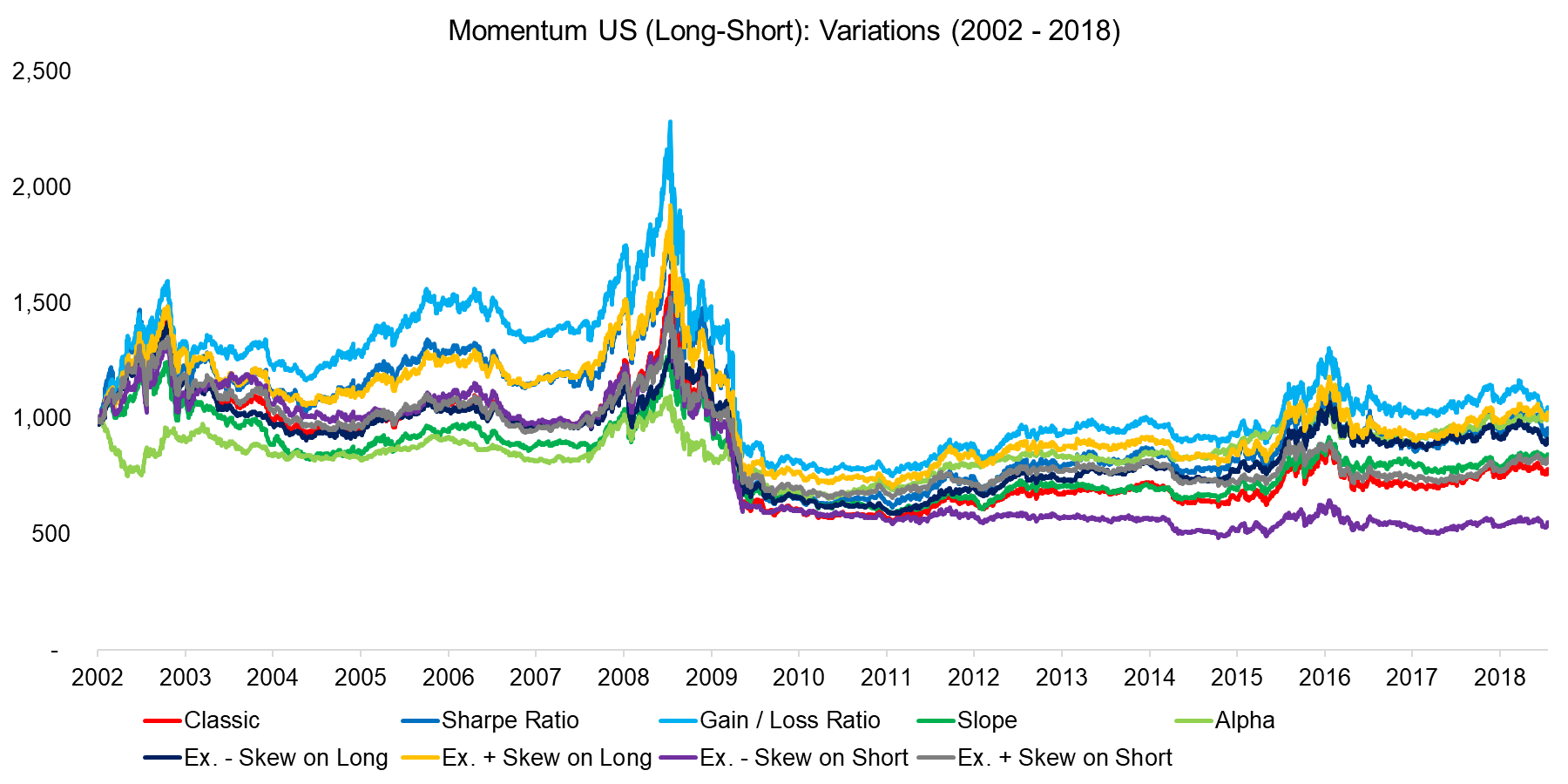

The chart below highlights the long-short Momentum variations from 2002 to 2018. We can observe that in general the trends in the various profiles are very similar, despite quite different factor definitions, which reflects the robustness of the strategy. Alpha Momentum showed the inverse performance of all other variations in the first years of the analysis but performed in line thereafter. Excluding negatively skewed stocks, i.e. stocks that exhibited sharp stock price decreases, in the short portfolio, led to a lower performance compared to the Classic Momentum factor. Interestingly, excluding negatively skewed stocks in the long portfolio increased performance, which implies that investors dislike sharp drawdowns when stocks are increasing or decreasing.

Source: FactorResearch

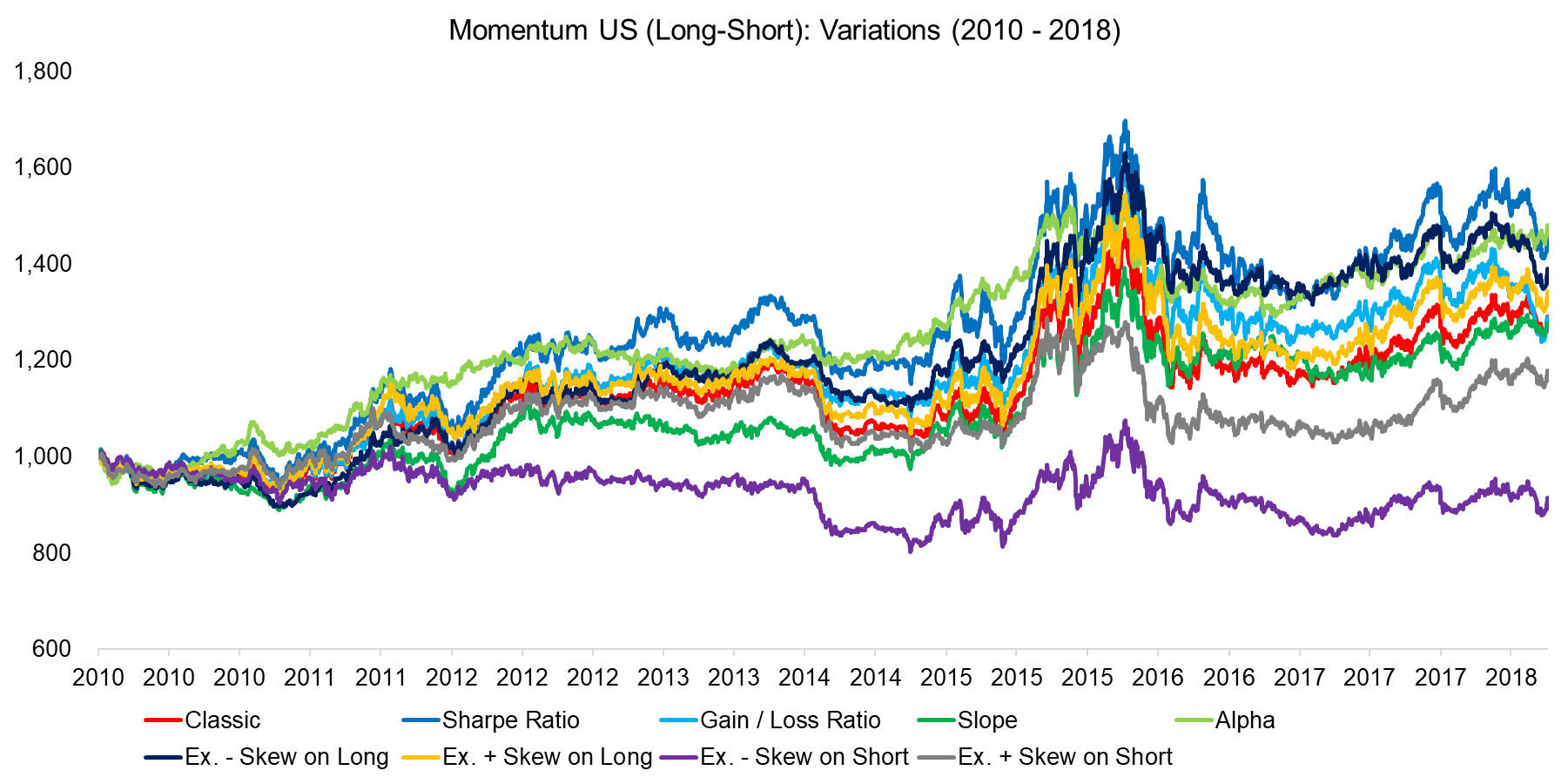

The previous analysis included the Global Financial Crisis and the well-documented Momentum crash in 2009, which makes it somewhat difficult to analyse the trends. The chart below shows the performance since 2010, which highlights again the similarity of return profiles. Although excluding the negatively skewed stocks in the short portfolio decreased the performance, it is challenging to identify any variation that represents a significant improvement to the Classic Momentum factor.

Source: FactorResearch

MOMENTUM VARIATIONS ACROSS MARKETS

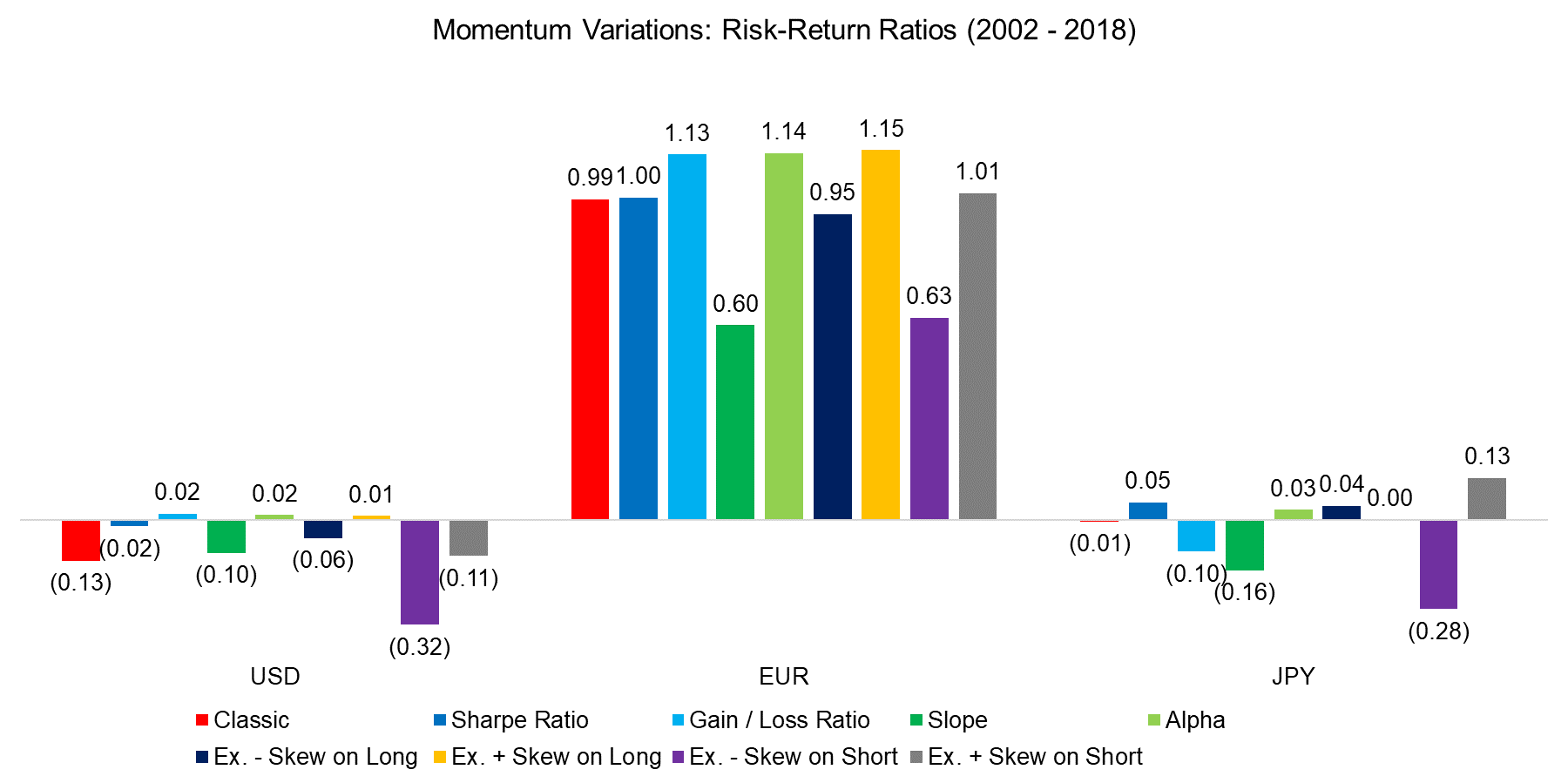

In order to investigate the Momentum variations further, we expand the analysis to Europe and Japan and focus on risk-adjusted returns. The chart below shows that in the period from 2002 to 2018 Momentum only generated attractive risk-return ratios in Europe. The analysis fails to highlight any Momentum variations that are consistently and significantly better than the Classic Momentum strategy, although Slope and excluding negatively skewed stocks in the short portfolio exhibit lower ratios across the three markets.

Source: FactorResearch

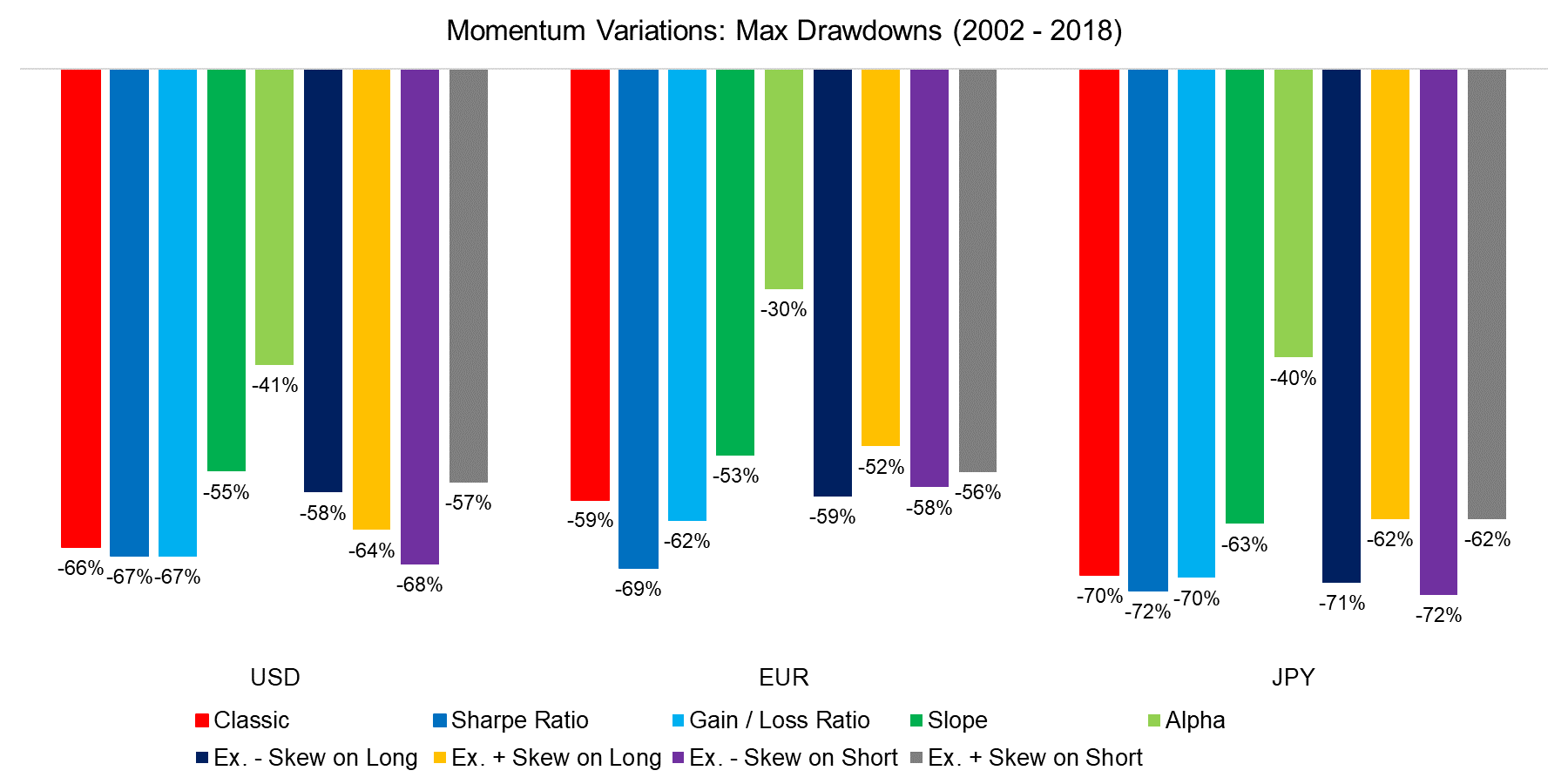

Finally, we analyse the maximum drawdowns of the Momentum variations, which highlights that Slope and Apha Momentum exhibit consistently reduced drawdowns. Slope Momentum is not particularly attractive given below average risk-return ratios, but Alpha Momentum offers higher risk-adjusted returns. The severe drawdowns represent the Momentum crash in 2009, which occurred when the sentiment changed and financial markets recovered. Classic Momentum and most other variations had significant negative exposure to other factors, e.g. Value, which generated negative returns when markets and these factors recovered. Alpha Momentum exhibits significantly less factor exposure as it represents residual or idiosyncratic Momentum, therefore was less affected by the recovery (please see our report Alpha Momentum).

Source: FactorResearch

FURTHER THOUGHTS

This short research note highlights variations of the long-short Momentum factor in equities, which results in relatively comparable return profiles, despite different factor definitions. There are many assumptions in the factor and portfolio construction process that can be evaluated, but the similarity of the results of this analysis reflects an attractive robustness of the strategy. Although the more complex variations do not show significantly higher risk-adjusted returns than the Classic Momentum factor, they might be combined into a multi-metric Momentum portfolio, which is a research topic worth exploring further.

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.