Multi-Strategy Hedge Funds & Replication ETFs

Worth replicating?

July 2024. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Despite stellar returns of some multi-strategy hedge funds, the category has not gained market share

- Multi-strategy hedge funds are highly correlated to equities, offering limited diversification benefits

- Replication ETFs offer the same unfavorable characteristics

INTRODUCTION

In 2022 multi-strategy hedge funds were hot. Citadel generated a return of 38.1%, DE Shaw 24.7%, and Millennium 12.4%, stellar returns for firms managing billions with tight risk management systems. Investors were desperate to allocate capital to such firms, but their capacity was constrained. Some took advantage of the favorable sentiment by introducing or increasing the lock-up periods for invested capital, copying the playbook of the private equity industry.

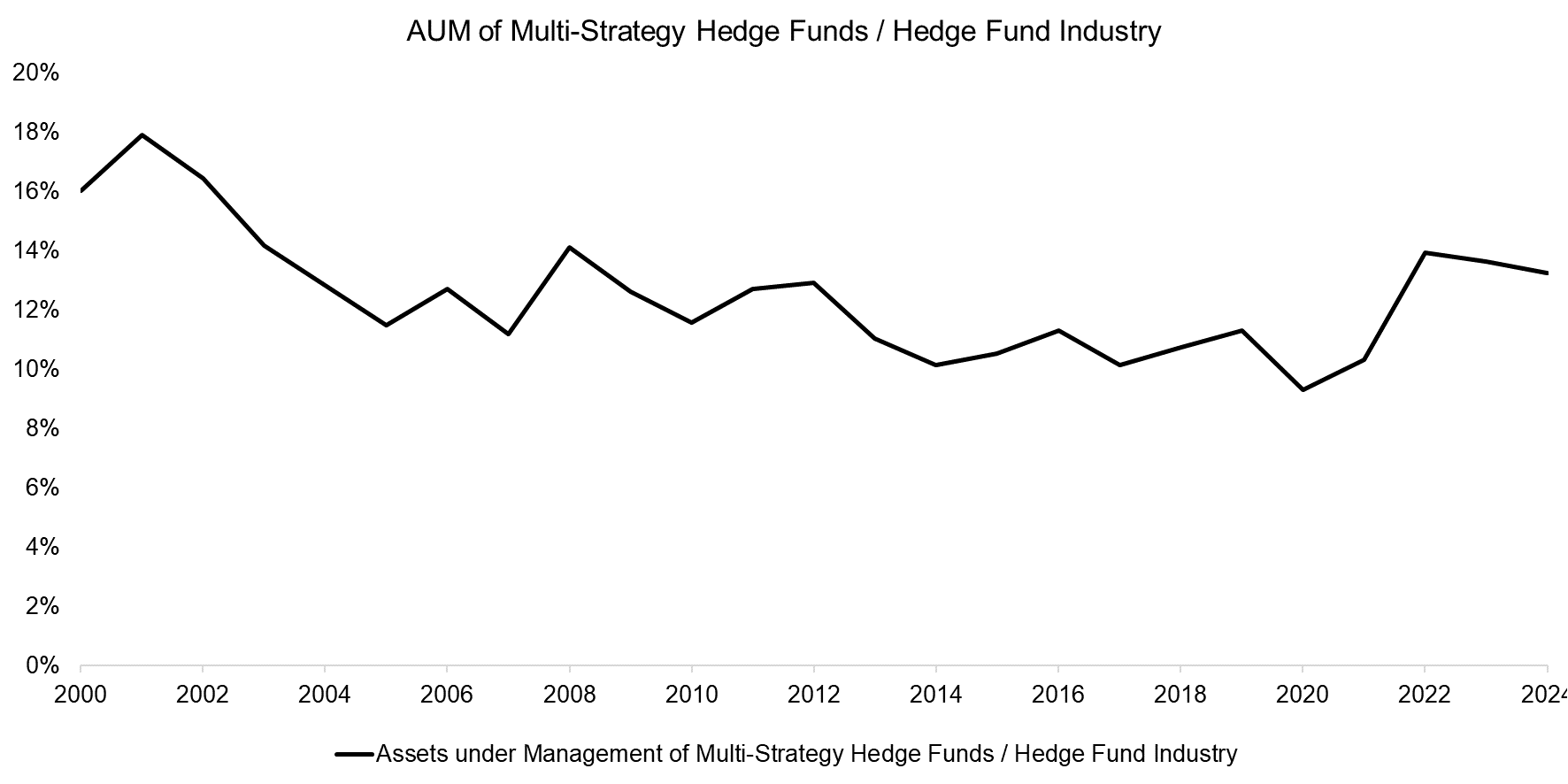

However, despite this recent increase in interest, the market share of multi-strategy hedge funds has not increased significantly and remains close to its long-term average of 12%. As of the end of 2023, $682 billion have been allocated to such funds, compared to $5.1 trillion for the entire hedge fund industry, based on data from BarclayHedge.

Source: BarclayHedge, Finominal

Instead of trying to invest in large multi-strategy hedge funds like Citadel or Millennium, which remains challenging for smaller investors and comes with harsh terms for larger ones, they can alternative allocate to ETFs that aim to replicate multi-strategy hedge fund indices, which we explore in this research article.

MULTI-STRATEGY HEDGE FUND PERFORMANCE

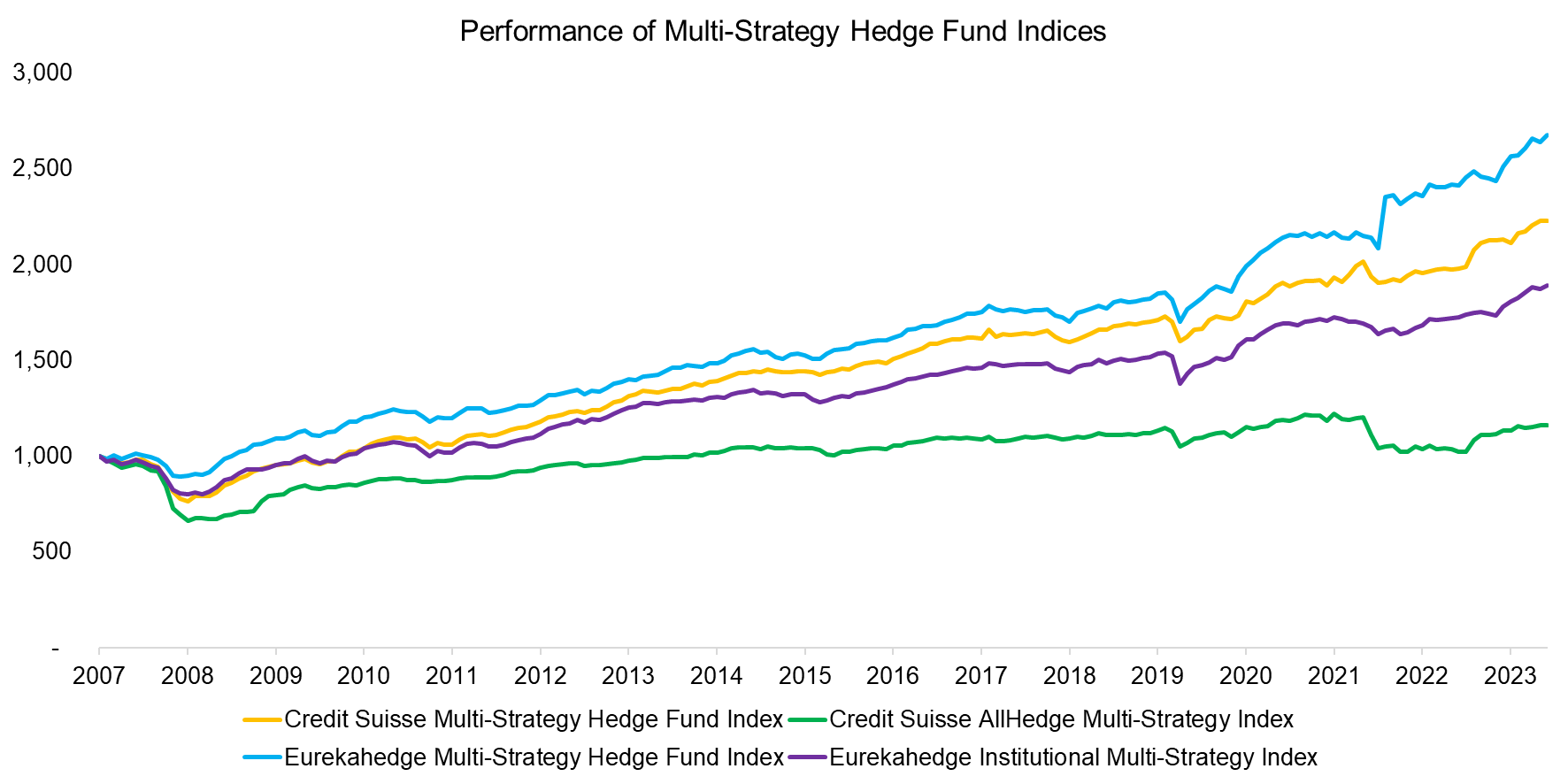

We use indices from Eurekahedge and Credit Suisse to review the performance of multi-strategy hedge funds, which highlights significantly divergent returns depending on which index is reviewed. For example, Eurekahedge’s Multi-Strategy Hedge Fund Index generated a CAGR of 6.2% in the period between 2009 and 2024, compared to 0.9% for Credit Suisse’s AllHedge Multi-Strategy Index.

However, the trends in performance of the four indices were identical with correlations ranging from 0.54 to 0.82. Some index providers allow funds to import past returns, which only successful hedge funds do, and suffer from not receiving returns when performance turns sour, i.e. are prone to backfill and survivorship bias. Stated differently, index returns are often over- and risks are understated, so investors should take the worst-performing index as the proxy for actual returns rather than the best-performing one.

Source: Finominal

CORRELATION ANALYSIS

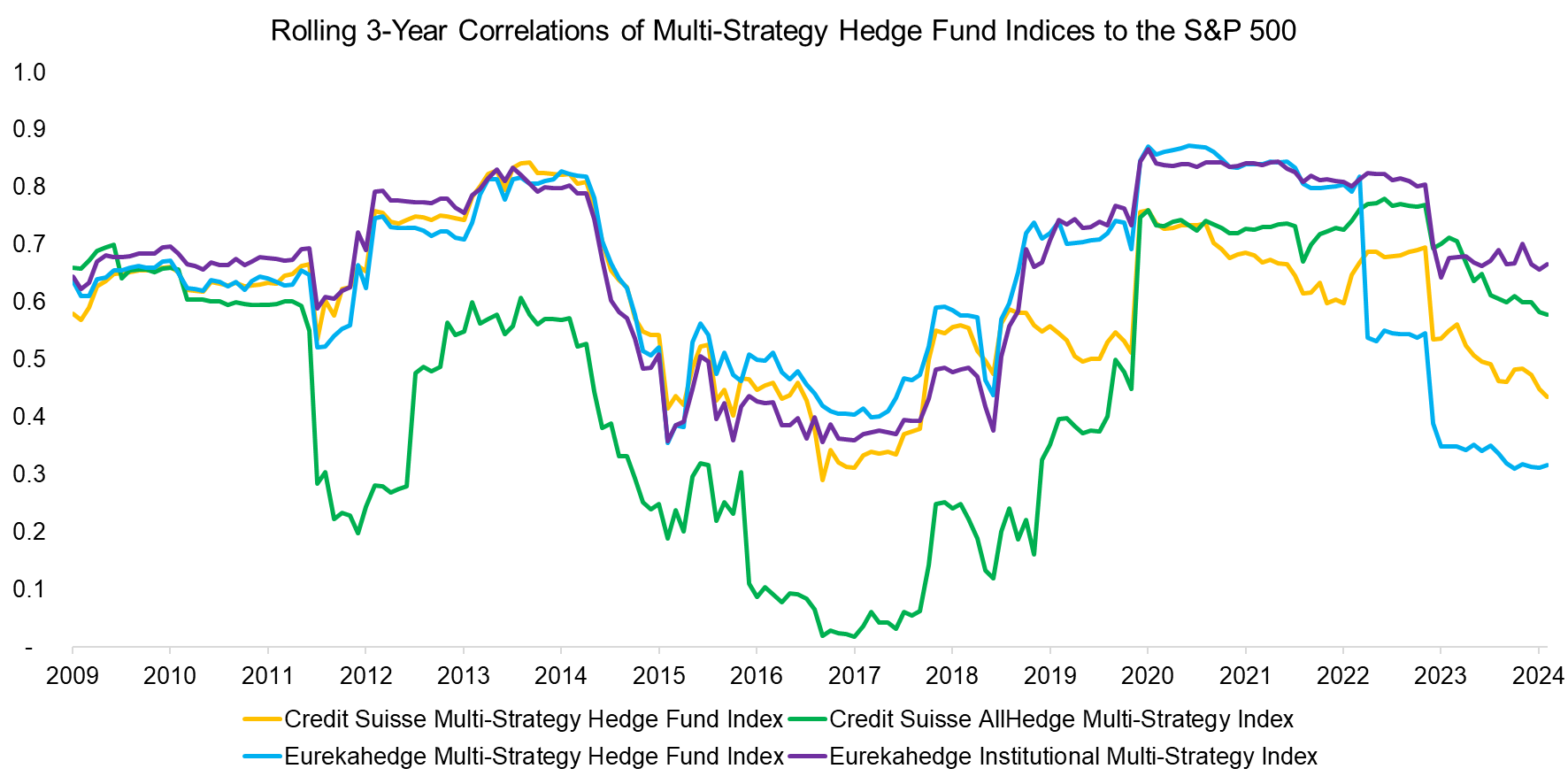

Theoretically, multi-strategy hedge funds combine various alpha sources into one attractive product that consequently behaves independently of the ups and downs of the stock market. However, we observe that all four indices declined during the global financial crisis in 2009 and the COVID-19 crisis in 2020, so we compute the correlations to the S&P 500.

The average correlations ranged from 0.55 to 0.71 over the last 25 years, and we observe that the rolling 3-year correlations reached 0.8 between 2012 and 2014, and between 2020 and 2023. Such high correlations are undesirable as that limits the diversification benefits from allocating to multi-strategy hedge funds.

Source: Finominal

REPLICATING MULTI-STRATEGY HEDGE FUNDS

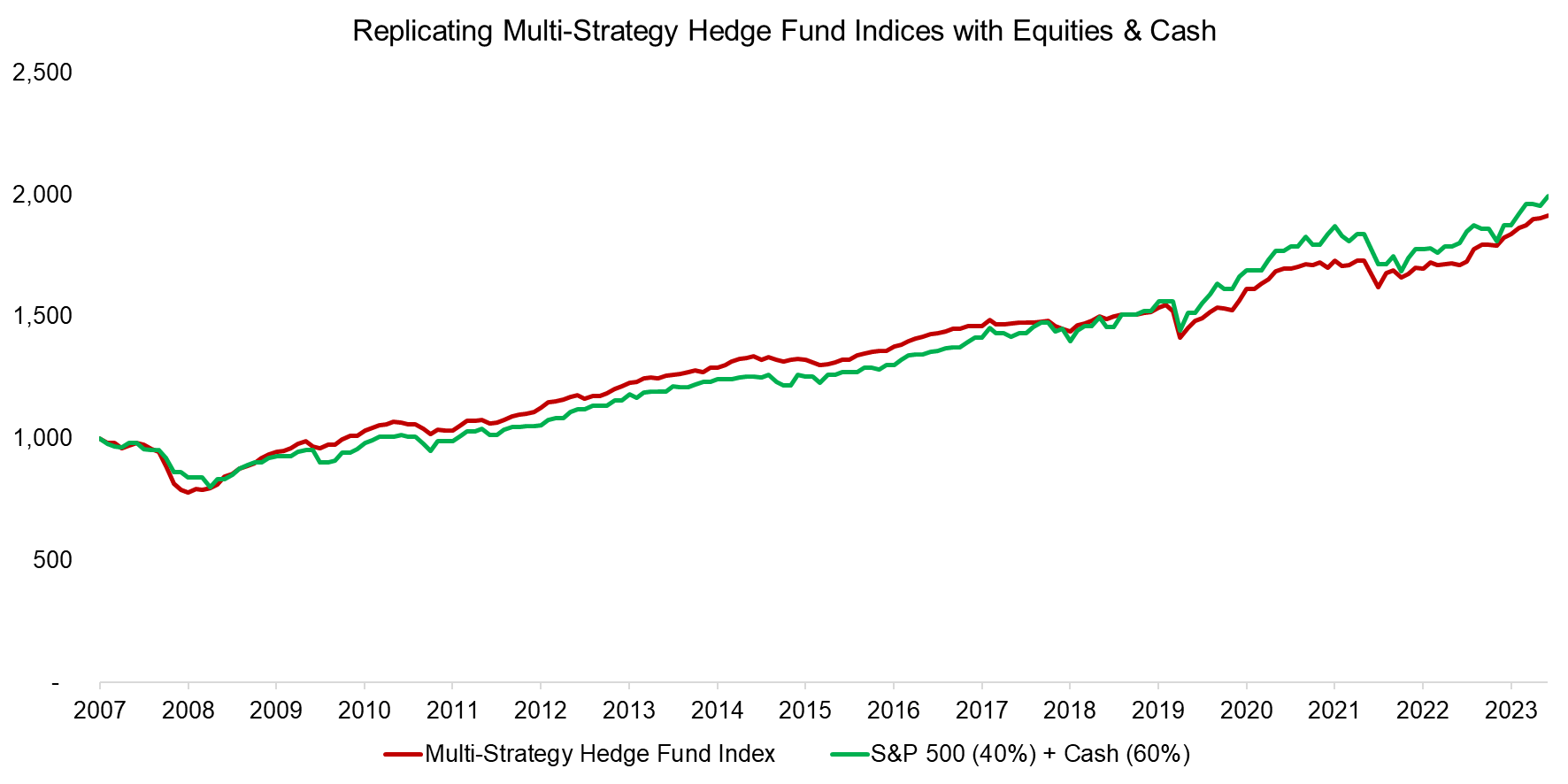

Given the high exposure to the stock market, we attempt to replicate the multi-strategy hedge fund indices by replicating these via the S&P 500 and non-interest-bearing cash. Indeed, a simple 40% allocation to the S&P 500 and a 60% allocation would have generated an almost identical return profile of an equal-weighted version of the four indices (read Multi-Strategy Hedge Funds: Jack of All Trades? and Multi-Strategy Hedge Funds: Equity in a Different Shade?).

Source: Finominal

MULTI-STRATEGY HEDGE FUND ETFS

There are two ETFs trading in the U.S. that aim to provide the returns of multi-strategy hedge funds. The IQ Hedge Multi-Strategy Tracker ETF (QAI) was launched in 2009, charges 0.59% per annum, and manages approximately $500 million of assets. It aims to diversify traditional sources of risk like interest rates and equity market beta as per the issuers’ website.

However, assuming the same level of volatility, we can create a replication index via a 35% allocation to the S&P 500 and a 65% allocation to cash that mirrors the performance over the last 15 years, albeit with a significantly higher total return and therefore a higher Sharpe ratio.

Source: Finominal

The Unlimited HFND Multi-Strategy Return Tracker ETF (HFND) was launched in 2022, charges 1.22%, and manages $34 million. The fund aims to generate superior risk-adjusted returns and provide diversification benefits as per the manager, but again we can create an equities (40%) and cash (60%) replication index that highlights the same trends in performance. Given the same volatility but higher returns, the replication index rather than HFND would have offered superior risk-adjusted returns.

Source: Finominal

FURTHER THOUGHTS

Although a few multi-strategy hedge funds have generated attracted uncorrelated returns for their investors, on average these funds simply represent equity exposure in disguise, which investors can replicate much easier by reallocating capital from equities to cash. Naturally, this comes at pretty much zero cost and does not require any due diligence or ongoing monitoring.

Unfortunately, this dooms ETFs that aim to replicate multi-strategy hedge funds. Replicating diluted equity exposure offers no real value for investors. As the saying goes: garbage in, garbage out.

RELATED RESEARCH

Multi-Strategy Hedge Funds: Jack of All Trades?

Multi-Strategy Hedge Funds: Equity in a Different Shade?

Myth Busting: Alts’ Uncorrelated Returns Diversify Portfolios

Equity Market Neutral Hedge Funds: Powered by Beta?

Global Macro: Masters of the Universe?

Merger Arbitrage: Arbitraged Away?

Hedge Fund ETFs

Replicating Famous Hedge Funds

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.