Myth Busting: Equities are an Inflation Hedge

Nominally yes, real no.

July 2021. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Equities generated attractive nominal returns across all inflation regimes

- However, real returns were zero when inflation was above 10%

- Energy and materials performed best, consumer-facing sectors worst

INTRODUCTION

“I came of age and studied economics in the 1970s and I remember what that terrible period was like,” U.S. Treasury Secretary Janet Yellen told a U.S. House subcommittee in May 2021. “No one wants to see that happen again.”

Inflation has dominated investing conversations in 2021. Many countries have rebounded strongly from the COVID-19 crisis and are experiencing significantly higher-than-expected inflation. The annual inflation rate in the United States jumped to 5% in May 2021, the highest level since August 2008.

While inflation is an evergreen topic for investors, ever since central banks rolled out their aggressive monetary policies during the global financial crisis, its prominence has grown. Though inflation has been trending downward since the 1980s, all that money printing has galvanized the inflation hawks. Some have even warned about potential hyperinflation reminiscent of that seen in the Weimar Republic of the 1920s (read Myth-Busting: Money Printing Must Create Inflation).

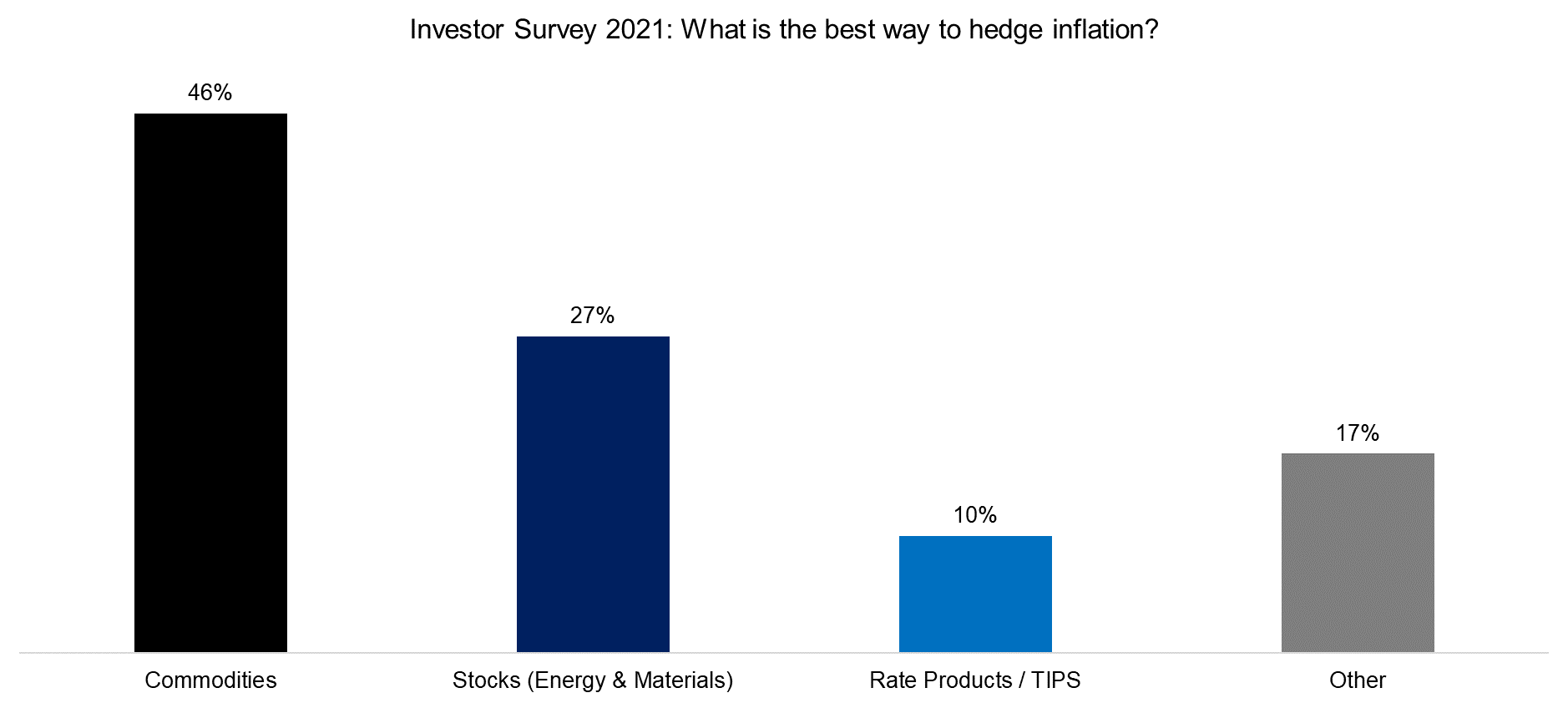

Whether the current higher readings are transitory or structural, how can investors hedge against inflation risk? According to a recent survey of quantitative investors at a JPMorgan conference, 47% of respondents believe commodities are the most effective security against inflation, followed by equities (27%), rate products and Treasury inflation-protected securities (TIPS, 10%), and other instruments (17%).

Source: JP Morgan, FactorResearch

The case for commodities like precious metals is clear. For equities it is less so: Since operating businesses can increase their prices at will, the theory holds, they can mitigate the negative effects of high inflation by simply raising their prices along with it.

Does the data support this argument? Are equities an inflation hedge? (read Bonds & The Invisible Thief)

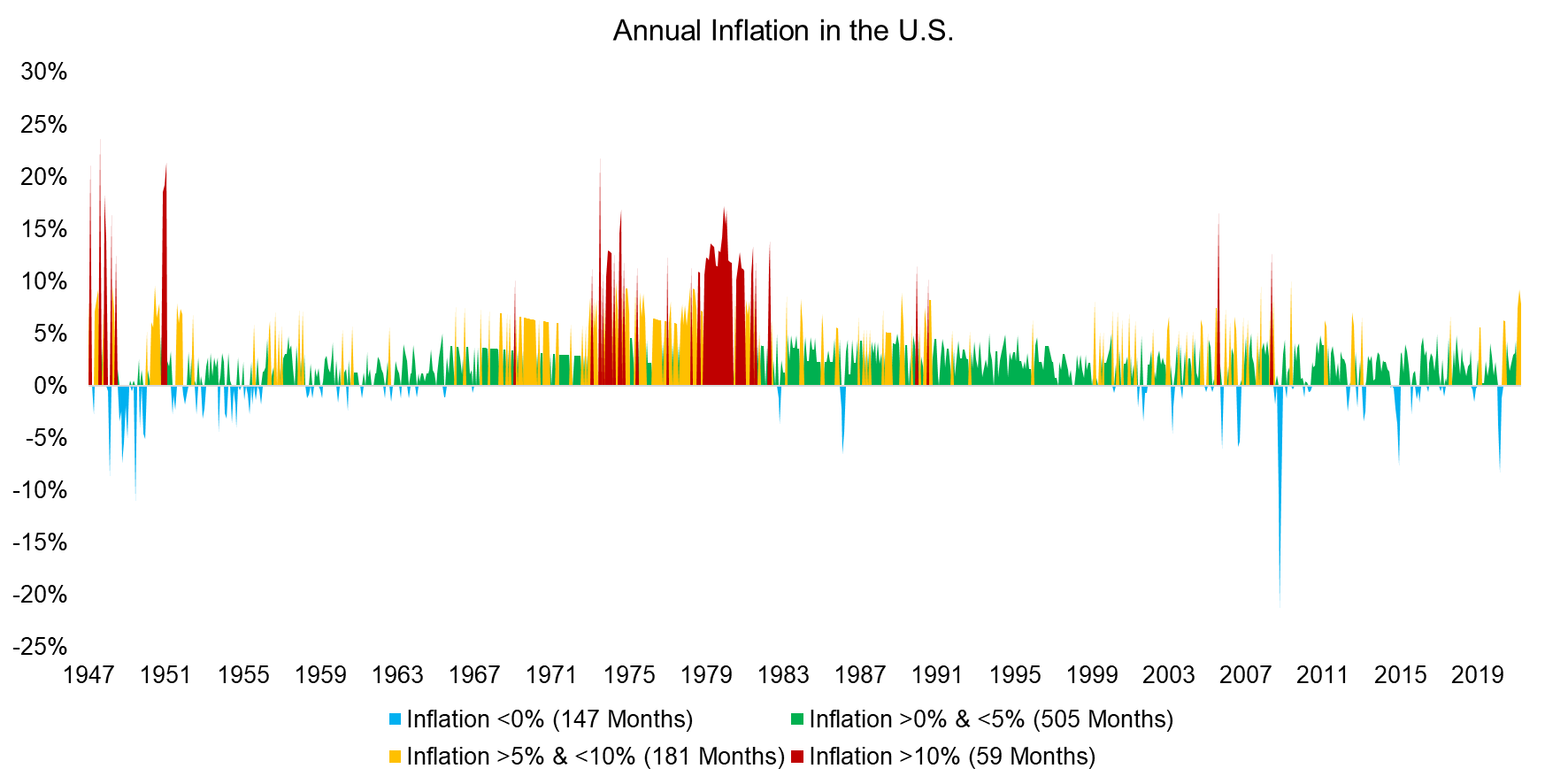

A LOOKBACK AT INFLATION IN THE U.S.

The average annual US inflation rate was 3.4% between 1947 and 2021. It only fell below 0% about 15% of the time and only exceeded 10% just 7% of the time. For 57% of the time, it stood between 0% and 5% and between 5% and 10% about 20% of the time.

For most investors in today’s developed markets, their only experience of high inflation is through the history books. Though it is frequently discussed, few traders have firsthand experience of the havoc it can wreak on economies and financial markets.

Source: FRED, FactorResearch

EQUITY RETURNS IN DIFFERENT INFLATION REGIMES

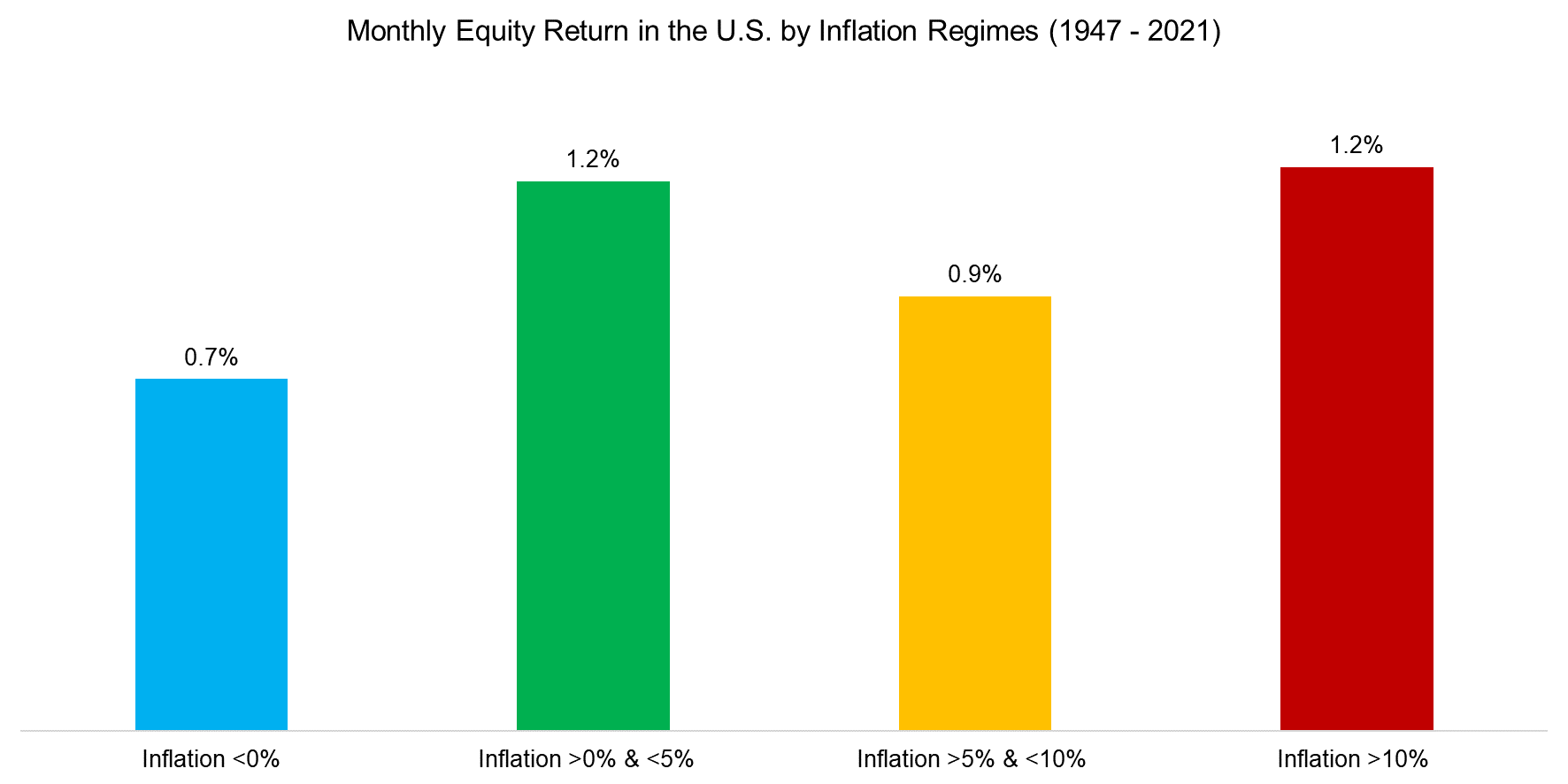

We created four inflation regimes for the 1947 to 2021 period using inflation data from the St. Louis Federal Reserve and stock market data from the Kenneth R. French Data Library.

Average monthly equity returns were comparable across these different environments. The lowest returns occurred during periods of deflation, which usually coincide with economic recessions. However, inflation above 10% did not seem to have a negative impact on stock market returns.

Source: FRED, Kenneth R. French Data Library, FactorResearch

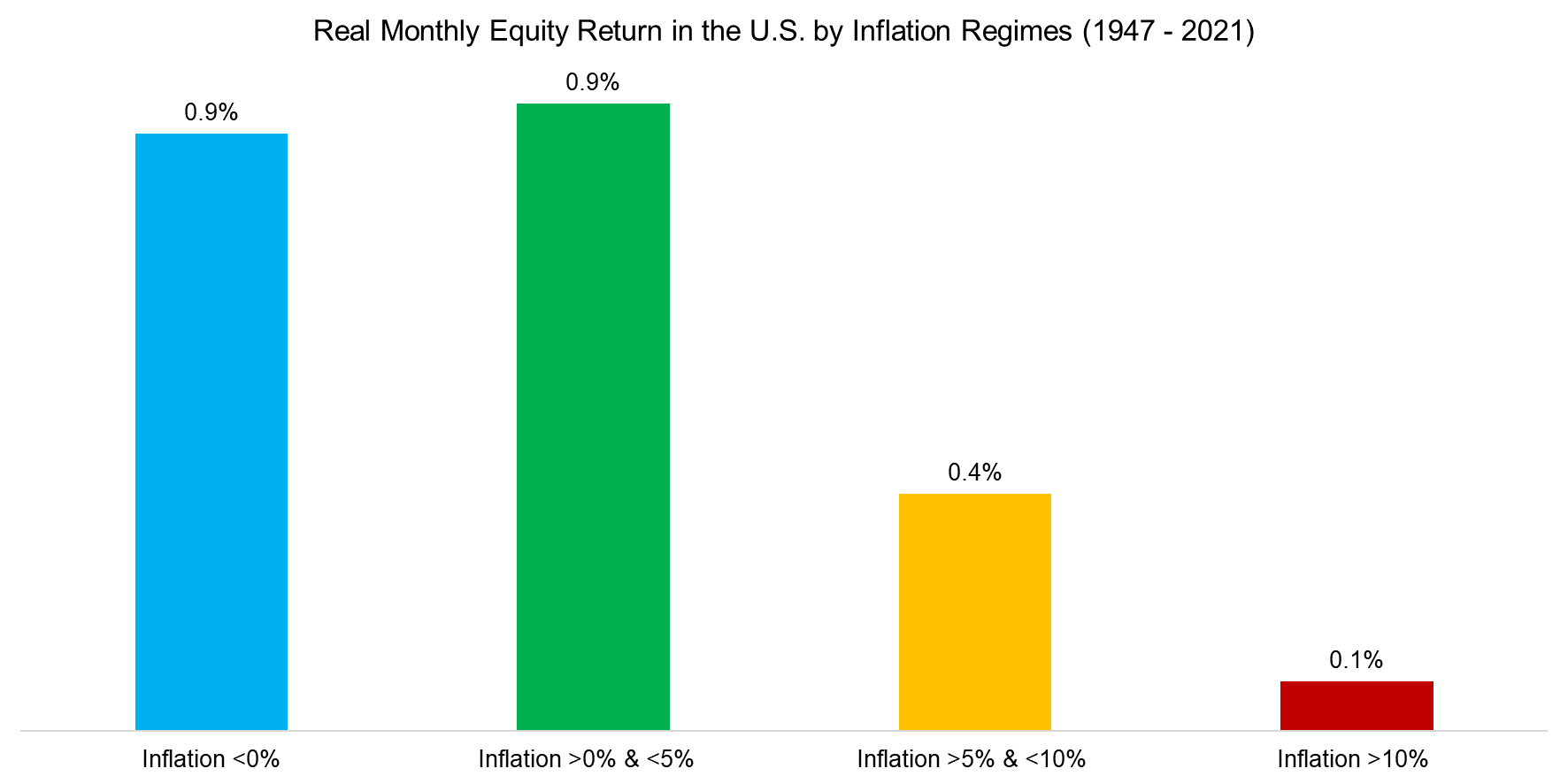

REAL VERSUS NOMINAL RETURNS

Of course, analyzing returns without correcting for inflation is a simple but frequent mistake. A savings account with a 2% interest rate is quite appealing when inflation is 0%, but not so much when it is 3% and implies a negative real interest rate.

Contrasting the nominal and real monthly equity returns in the four inflation regimes yields a very different perspective. In real terms, inflation over 5% sharply reduced returns, while inflation above 10% essentially made stocks unattractive.

Perhaps the real return is still positive and therefore equities did hedge against inflation. Nevertheless, stocks are volatile instruments and the average return conceals the dramatic drawdowns that occurred over the 70 years in question.

Source: FRED, Kenneth R. French Data Library, FactorResearch

INFLATION LOSERS

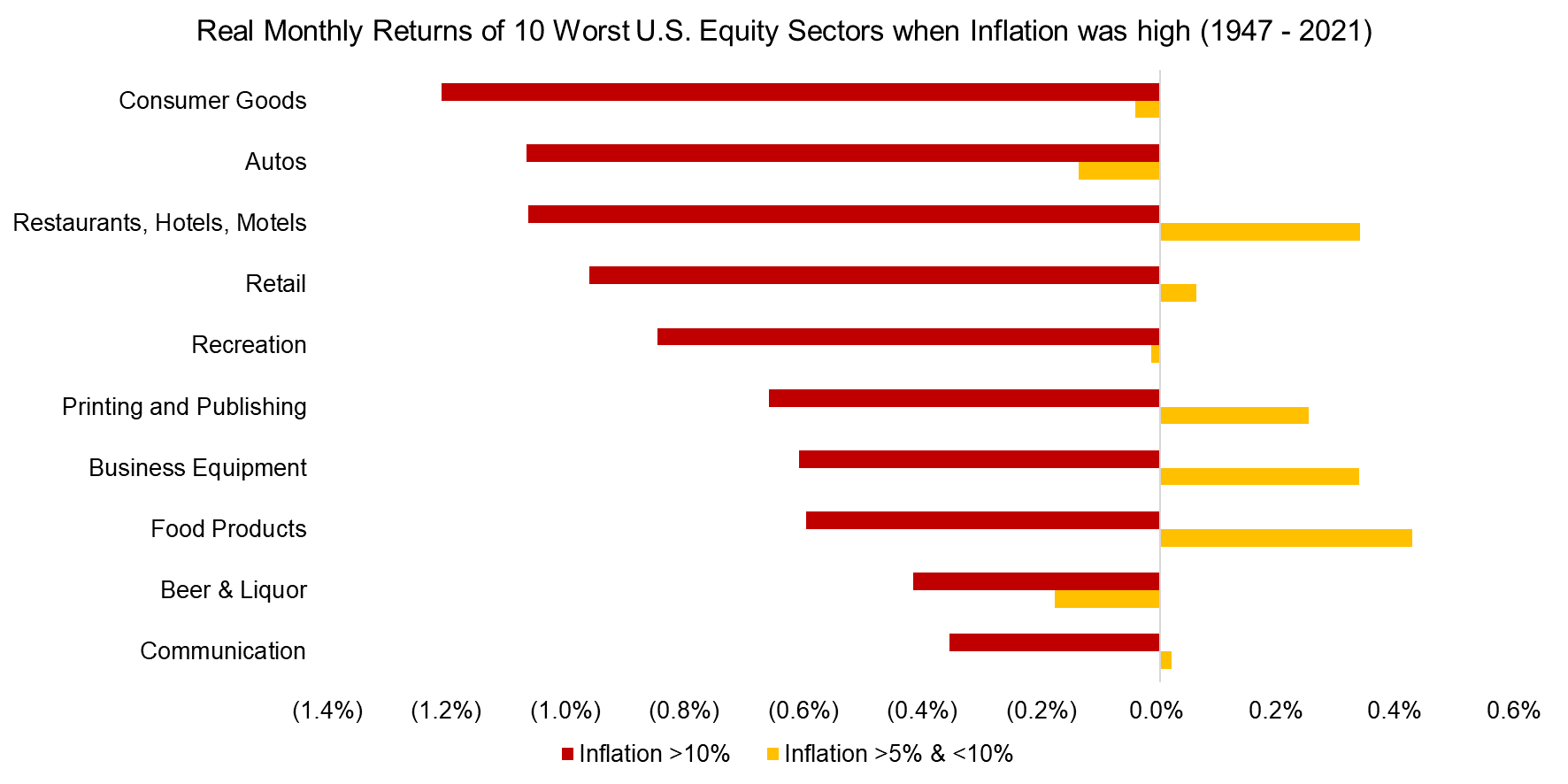

So which sectors suffered the most during the higher inflation regimes? Our analysis of the 30 sectors covered by the Kenneth R. French Data Library found that when inflation exceeded 10%, the worst-affected sectors were those that dealt directly with consumers — consumer goods, autos, retail, etc. Despite their ability to adjust their prices at will, these businesses seem to struggle to pass the increases to their customers.

A current manifestation of this is the European financial services industry. Banks have hesitated to impose negative interest rates on their retail savings acounts, but nevertheless have charged negative rates on the deposits of asset managers and other institutional customers.

Source: FRED, Kenneth R. French Data Library, FactorResearch

INFLATION WINNERS

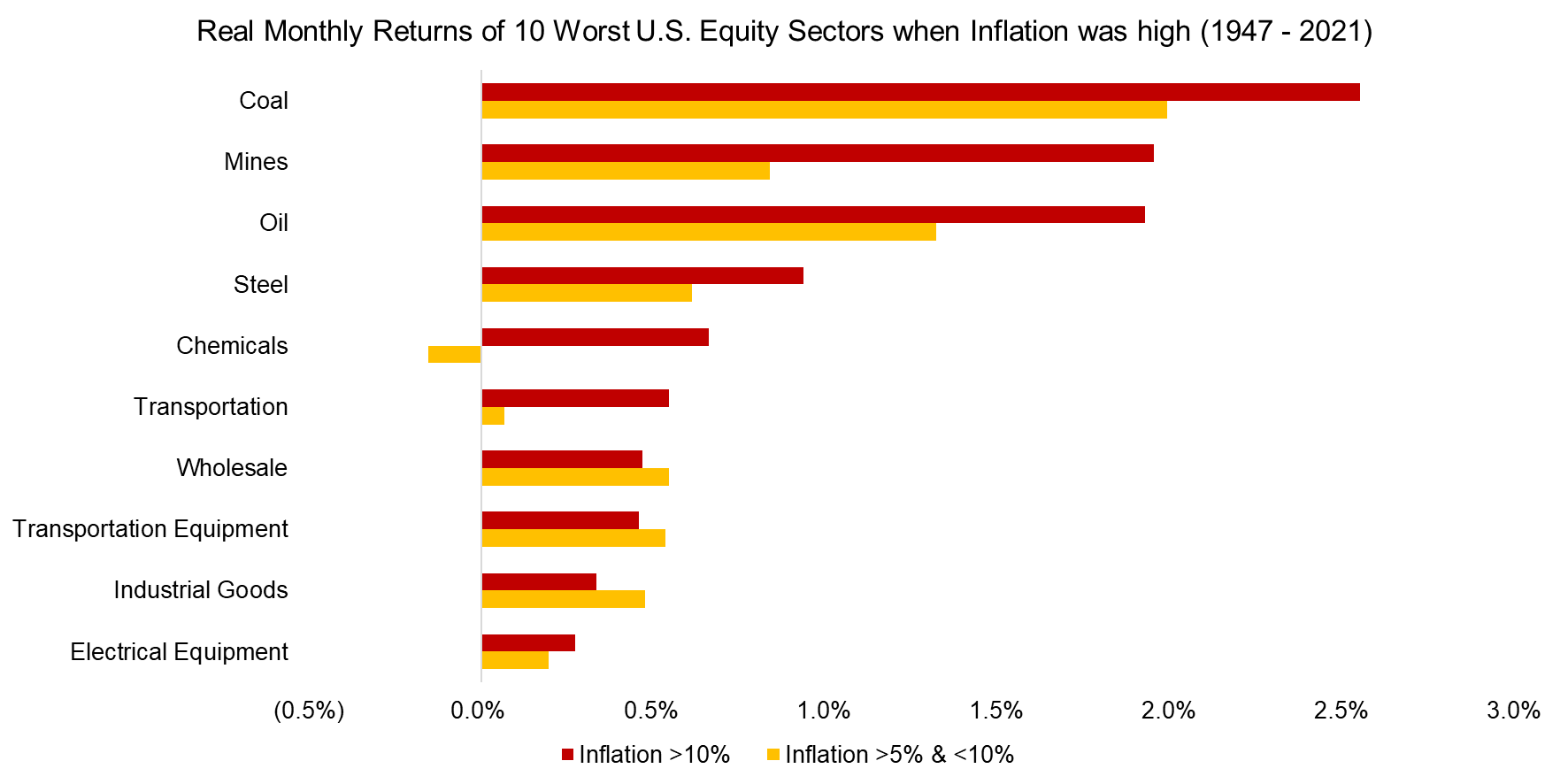

The same sectors did not uniformly underperform when inflation hovered between 5% and 10%. Some even generated positive returns. In contrast, the sectors that most benefitted from high inflation were almost identical during the two higher inflation regimes: specifically, energy and materials, which investors often rely on when positioning equity portfolios for higher inflation.

Source: FRED, Kenneth R. French Data Library, FactorResearch

Although this affirms the inflation-hedging properties of the usual suspects, there are caveats. The two high-inflation regimes occurred mostly during the 1970s, when US inflation reached 23.6%. Inflation was influenced by a spike in oil prices due to an OPEC embargo. The price of WTI crude jumped from $4 per barrel in 1973 to more than $10 in 1974, and then rose to $40 in 1980.

Oil price volatility is likely here to stay amid geopolitical unrest and theoretically prices could rise to new highs. But the world is reducing its dependence on fossil fuels and the US fracking industry has helped increase supply. So while the energy sector has been a good bet against inflation historically, that trend may not persist going forward.

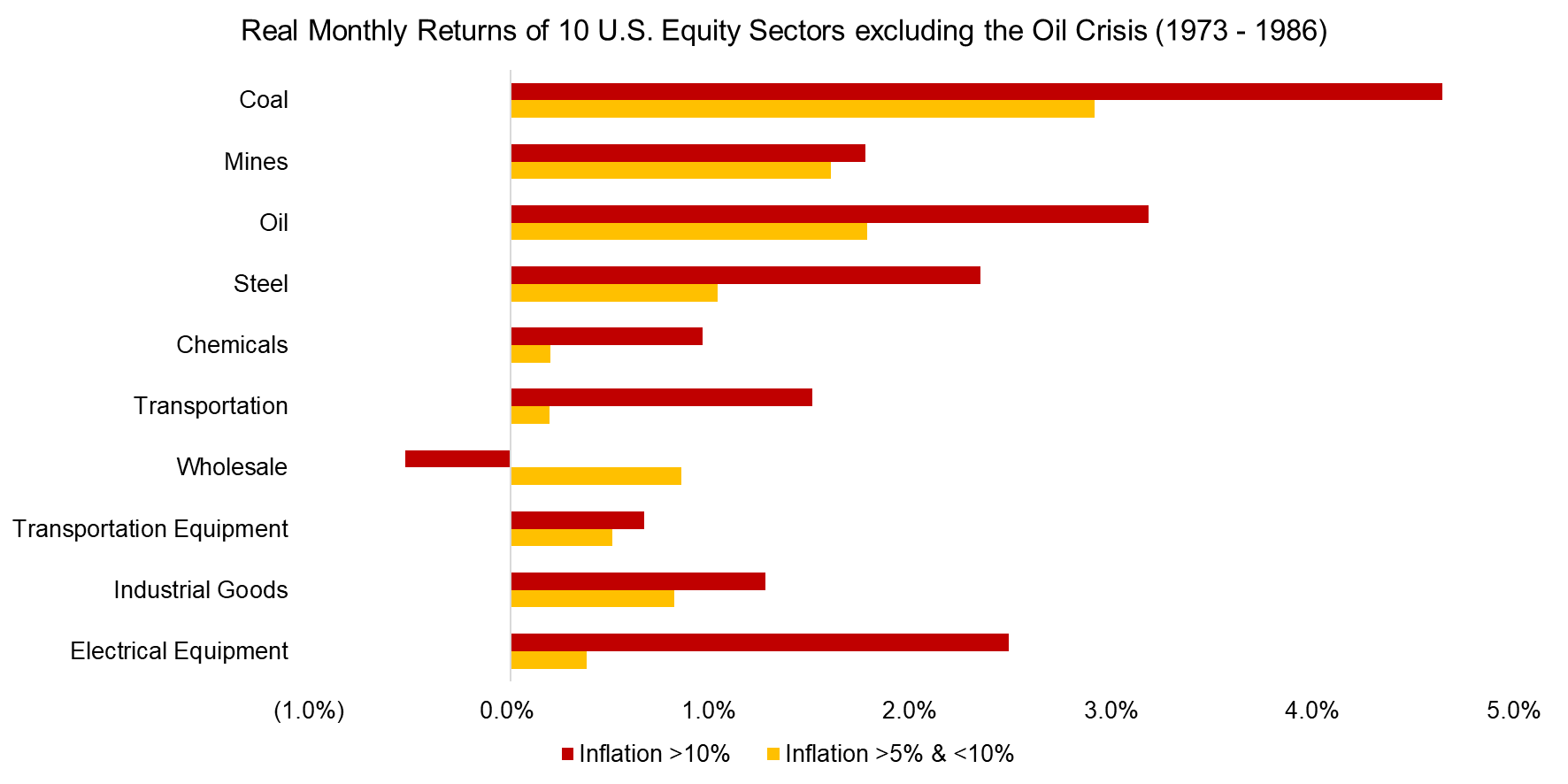

So what happens if we strip out the boom-and-bust oil price cycle and exclude the 1973 to 1986 period from our analysis? The same 10 sectors still do well amid high inflation regimes not driven by oil prices.

Source: FRED, Kenneth R. French Data Library, FactorResearch

FURTHER THOUGHTS

Although some equity sectors exhibited inflation-hedging characteristics, this data is of little practical value. To be useful, it would require market-timing skills. Moreover, such stocks are commodity proxies, so even if investors could predict inflation, they would probably be better served by holding direct commodity exposure.

And the case for holding commodities is a tenuous one. The Goldman Sachs Commodity Index (GSCI) trades today about where it did in 1990. Such a position would be unbearable for most investors. A bet on commodities is like a bet against human progress: It is probably a losing long-term proposition.

A more interesting inflation hedge might be to invest in trend-following, commodities-focused funds, or commodity trading advisors (CTAs). If oil or gold prices rise due to higher inflation, these funds will jump on the trend sooner or later. If prices decrease amid falling inflation, investors can short these asset classes. Naturally, this strategy won’t work perfectly all the time — the last 10 years is a stark reminder of that — but it may be a more elegant way of hedging against both inflation and deflation.

RELATED RESEARCH

Myth-Busting: Earnings Don’t Matter Much for Stock Returns

Myth-Busting: Low Rates Don’t Justify High Valuations

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.