Myth-Busting: The Profitability Factor Is Profitable

What makes ROE so unique?

SUMMARY

- Selecting U.S. stocks on profitability metrics failed to generate excess returns

- Only return-on-equity produced outperformance, but not when equal-weighting stocks

- Difficult to explain why ROE worked, although it does not seem random

INTRODUCTION

In our recent article Quality versus Growth (read Quality vs Growth Factors), we showed that most portfolios constructed on traditional quality and growth metrics failed to deliver positive excess returns over the past 20 years. This is unsurprising: investors cannot consistently earn more than the market simply by holding stocks with appealing fundamentals – everyone loves these companies!

One notable exception was return-on-equity (ROE), which consistently generated attractive excess returns. Why does selecting companies based on ROE outperform metrics like operating margin, sales growth, low leverage, or low volatility? Is there anything unique about this metric?

In this research article, we examine various measures of profitability to answer this question.

LONG-TERM PERFORMANCE OF THE PROFITABILITY FACTOR

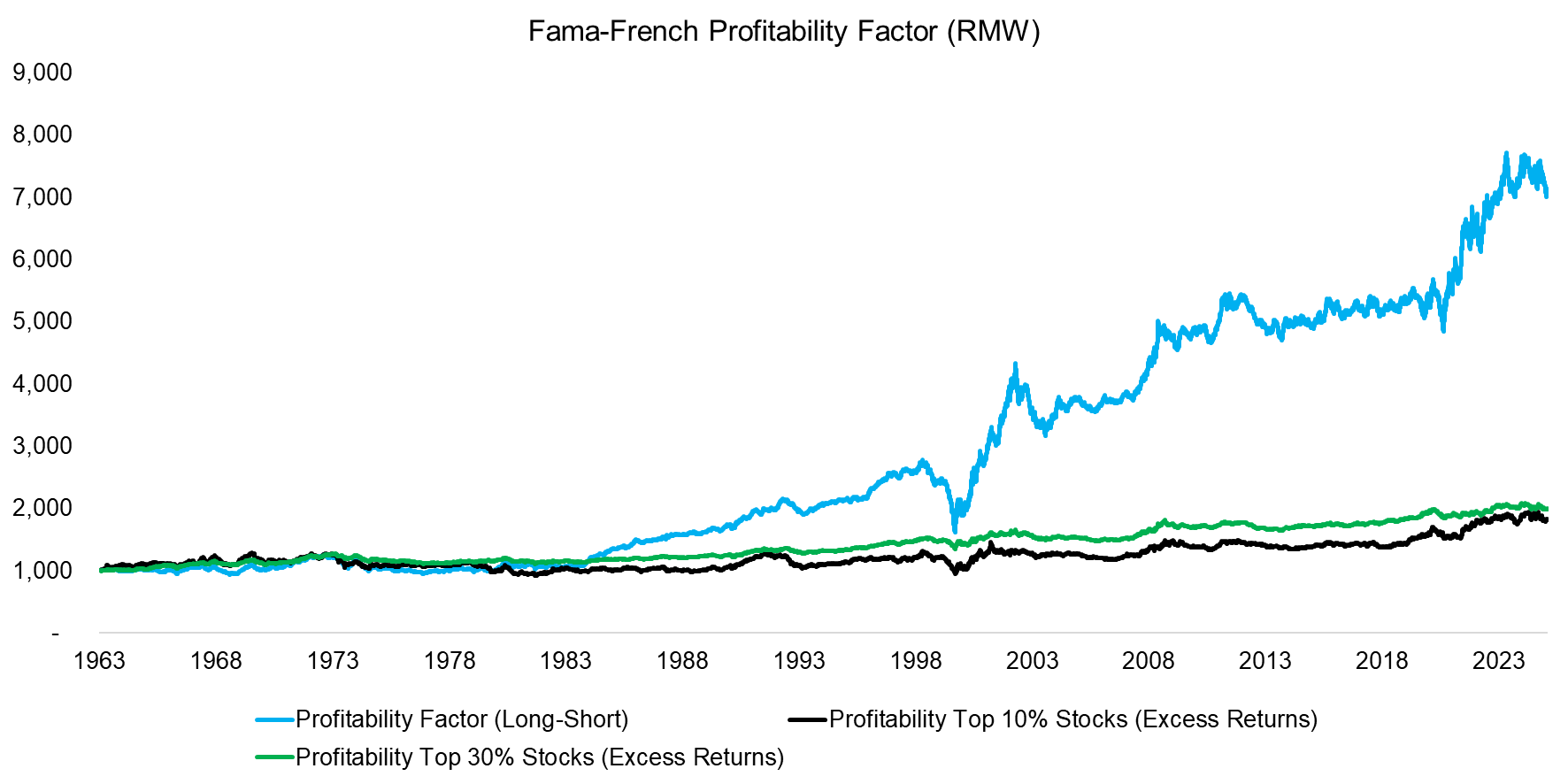

The profitability factor, or Robust minus Weak (RMW) in academic literature, is a key component of the Fama-French five-factor model. Plotting the long-short factor in the U.S. stock market over the past 60 years shows virtually zero excess returns from 1963 to 1983, followed by relatively consistent performance. The largest drawdown occurred during the 2000 tech bubble, when investors favored unprofitable technology firms.

Most investors, however, do not implement long-short portfolios and instead focus on top-ranked stocks. Looking at the top 10% and 30% most profitable U.S. stocks, excess returns relative to the market are positive, though smaller: the long-short factor achieved a CAGR of 3.2% from 1963 – 2025, compared with 1.0% for the top 10% and 1.1% for the top 30%.

Source: Kenneth R. French Data Library, Finominal

VALIDATING FAMA-FRENCH DATA

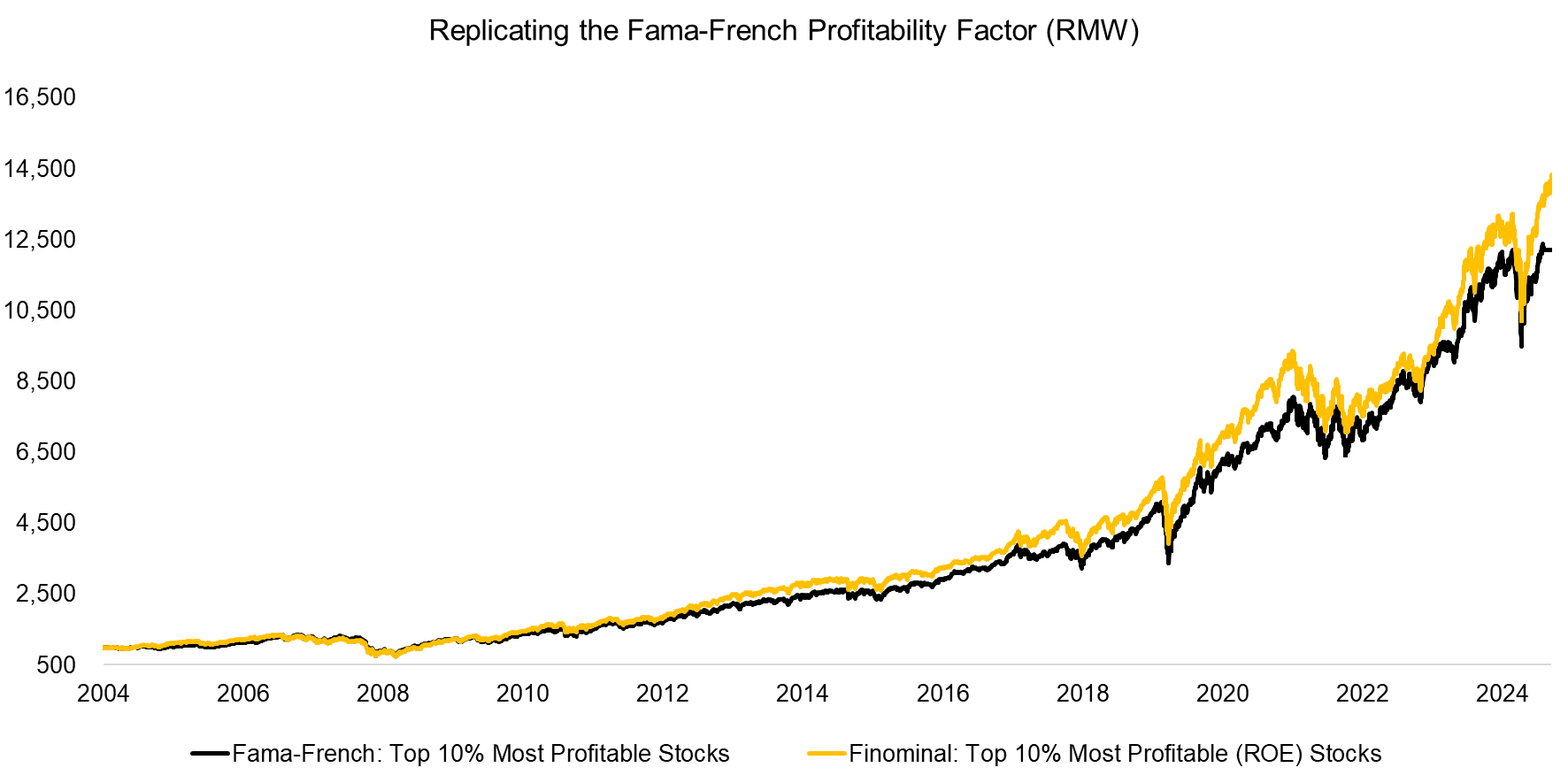

Fama-French data has limitations: returns are not adjusted for transaction costs, and the universe includes micro-caps that are illiquid for larger investors. To address this, we compare the top 10% most profitable stocks from Fama-French with an index we constructed that selects the top 10% by ROE, but only includes stocks with a minimum market capitalization of $1 billion and incorporates 10 basis points of transaction costs. Between 2004 and 2025, the performance of the most profitable stocks in both indices was broadly comparable, which validates the Fama-French data.

Source: Kenneth R. French Data Library, Finominal

COMPARING PROFITABILITY METRICS

Using ROE to measure profitability in U.S. stocks is problematic because book equity under U.S. GAAP reflects historical values, unlike IFRS countries where it is closer to mark-to-market. This leads to anomalies such as McDonald’s (MCD), which reports negative equity. Calculating ROE for such firms wrongly implies structural unprofitability. Quants often address this by excluding negative-equity stocks – shrinking the universe – or by transforming negatives into positives.

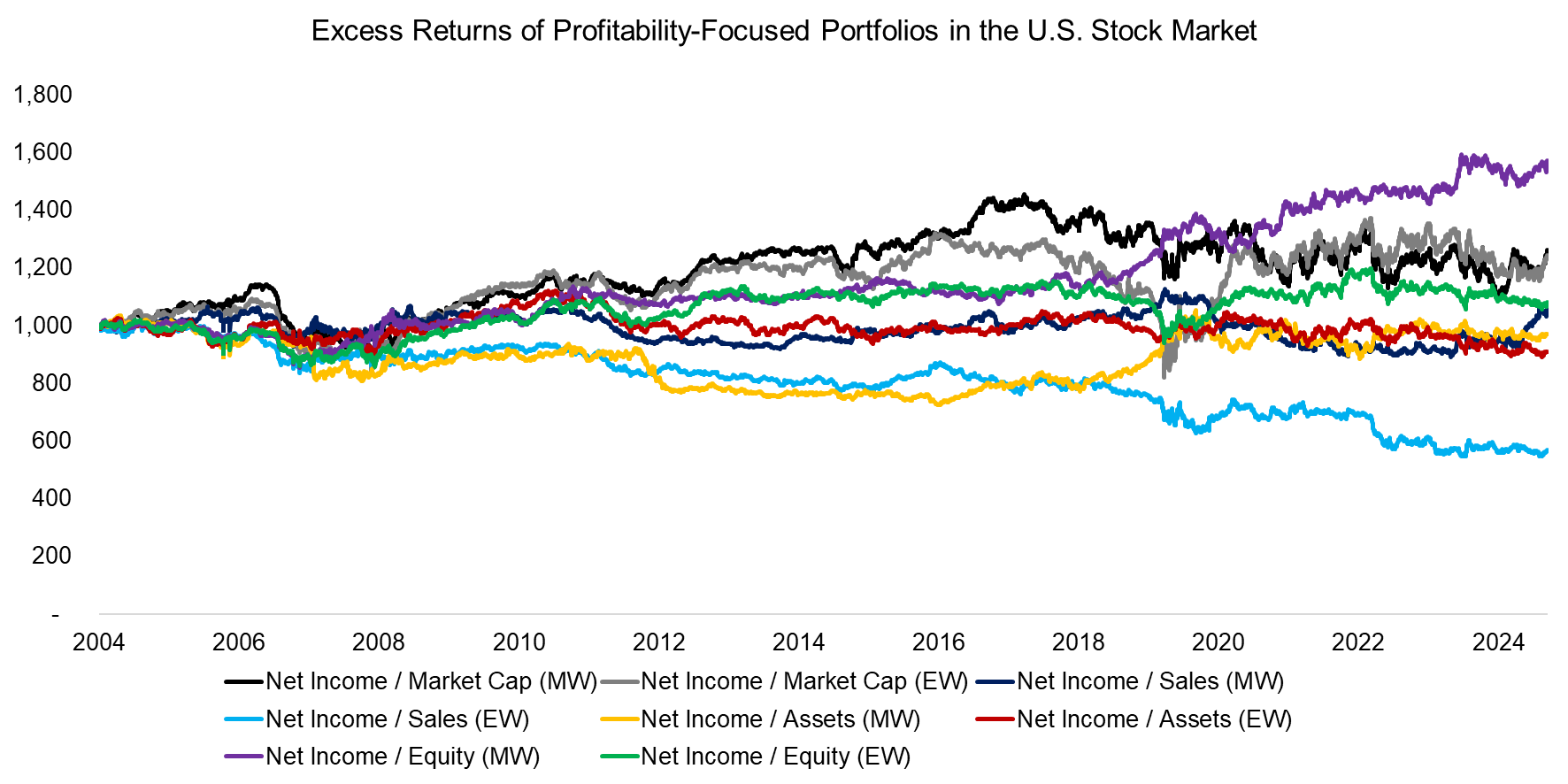

To test alternatives, we built equal- and cap-weighted portfolios replacing equity with market cap, sales, or assets. Surprisingly, only net income / equity with cap weighting delivered meaningful excess returns over the past 20 years – driven mostly by the post-2018 surge of the FAANG, later Magnificent 7, tech giants.

Source: Finominal

SHARPE RATIO ANALYSIS

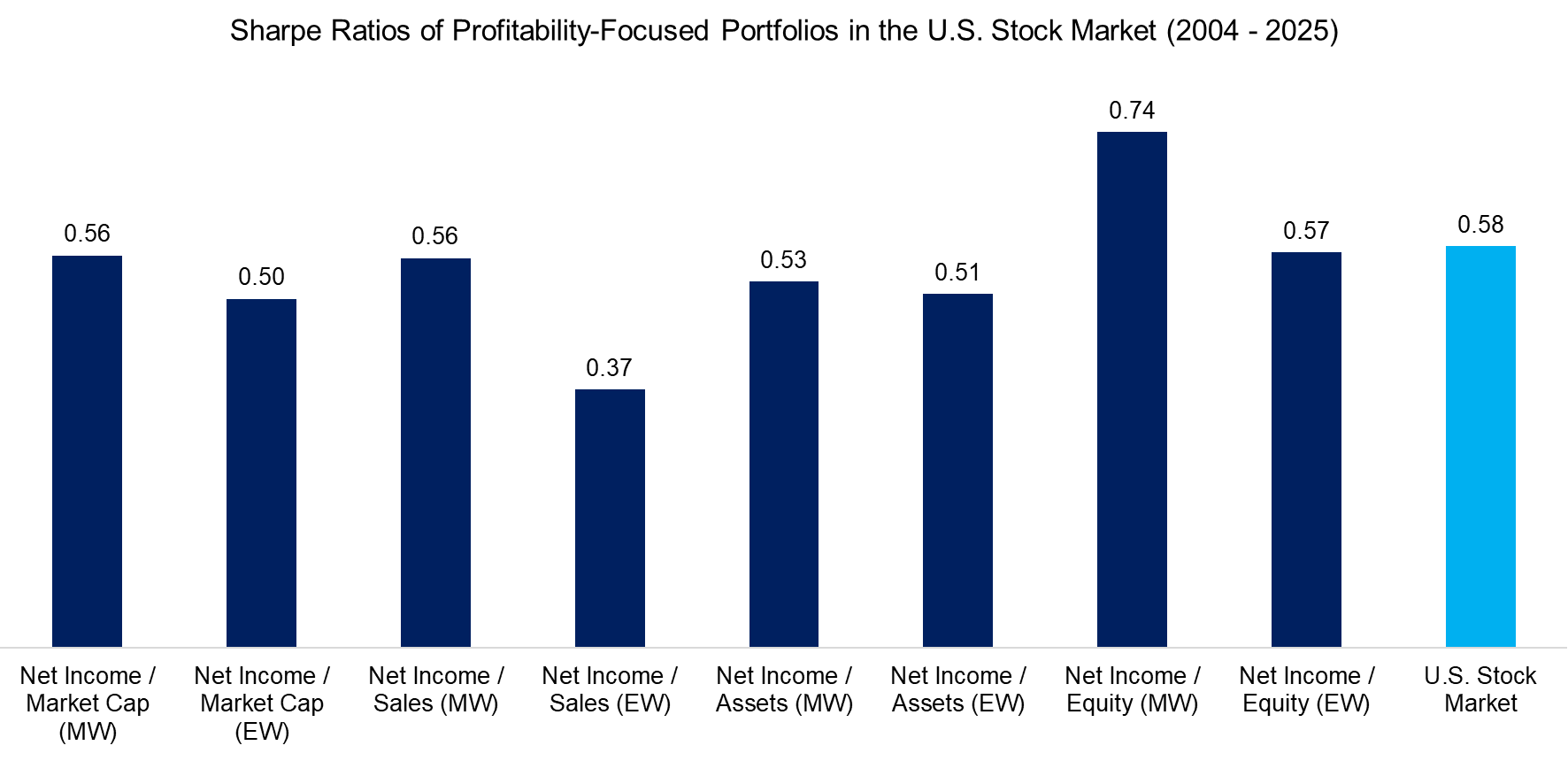

The main rationale for holding quality stocks is that they represent robust business models, making them less risky than the average company. Even if they fail to outperform the market, they should at least deliver superior risk-adjusted returns.

Yet, when comparing Sharpe ratios across eight profitability portfolios and the U.S. market, only the cap-weighted ROE portfolio has lived up to this expectation over the last 20 years. The same applies the maximum drawdown, where only the same portfolio had a lower one that the stock market. Stated differently, highly profitable stocks are not particular useful for hedging against stock market downturns.

Source: Finominal

BREAKDOWN BY SECTORS

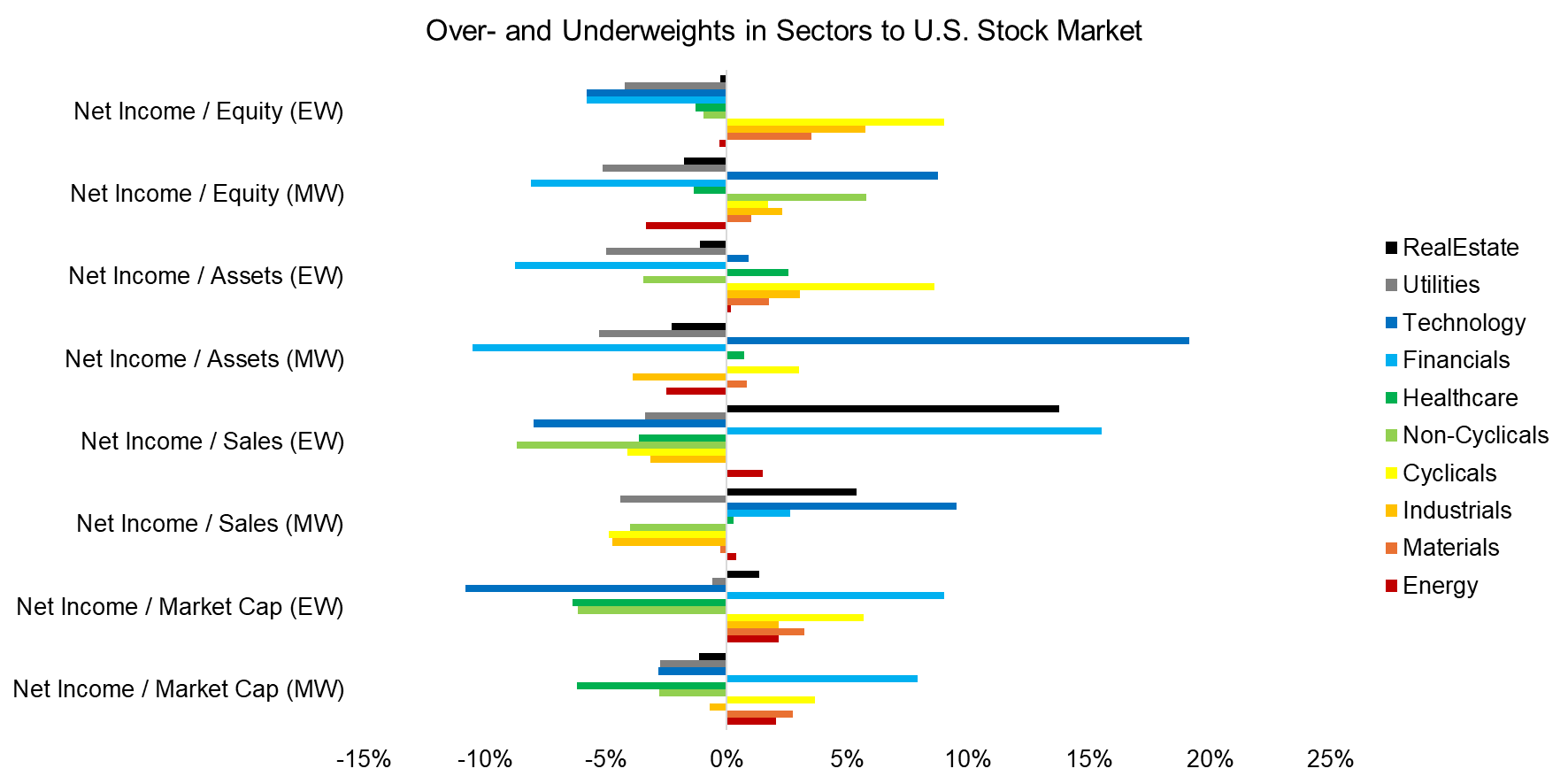

We also examined the sector composition of the eight profitability portfolios relative to the market. Each shows distinct – and often opposing – over- and underweights, partly due to the differences between cap- and equal-weighting. The largest divergences appear in the financial and technology sectors. Notably, the cap-weighted net income/equity portfolio, which delivered positive excess returns, was significantly overweight technology and non-cyclicals, while underweight financials and utilities.

Source: Finominal

FURTHER THOUGHTS

We set out to test different profitability metrics for stock selection in the U.S., but found that only cap-weighted net income/equity delivered meaningful excess returns over the past 20 years. At first glance, this might suggest ROE’s outperformance was random and should be dismissed. The case against ROE is further supported by the fact that book equity is often an irrelevant valuation measure, especially for technology companies.

Yet, we also validated the Fama-French returns that go back to 1963, where we observed that ROE produced positive excess returns in four out of six decades – making it harder to dismiss outright.

Why ROE works so well remains an open question.

RELATED RESEARCH

Quality vs Growth Factors

The Odd Factors: Profitability & Investment

Market-Neutral versus Smart Beta Factor Investing

Factor Exposure Analysis 113: Profitability vs Leverage Factors

Factor Exposure Analysis 112: Quality vs Growth Factors

Growth ETFs: Performance & Factor Exposures

What Are Growth Stocks?

Quality Factor: Zero Alpha for Most Investors?

Quality in Small versus Large-Cap Stocks

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.