Outperformance via Leverage

Active managers versus leveraged ETFs

September 2024. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Active fund managers have failed to generate outperformance

- Theoretically, investors could use leveraged ETFs to generate above-market returns

- However, the Sharpe ratios of these deteriorate significantly with leverage

INTRODUCTION

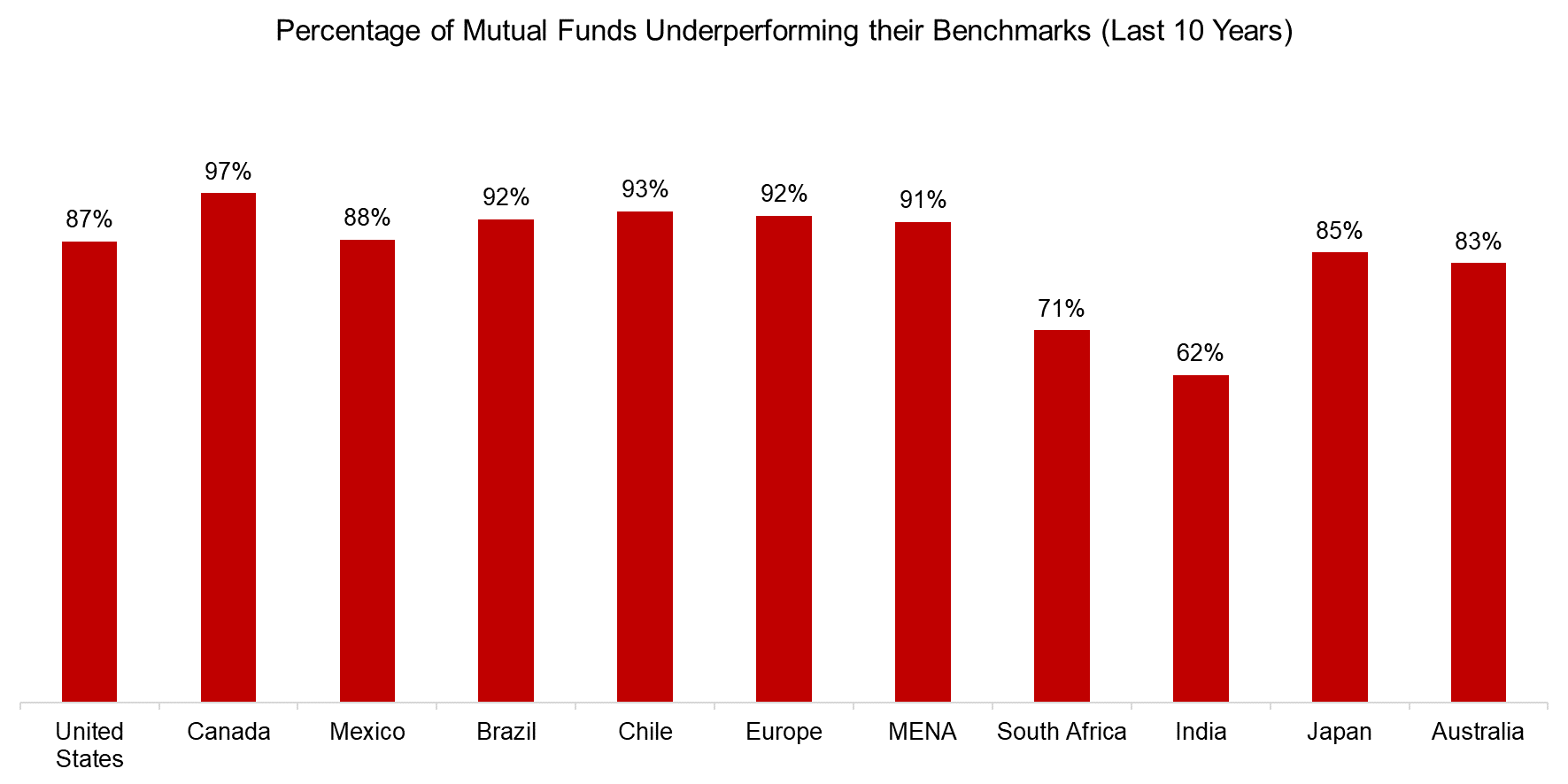

The capital asset pricing model (CAPM) assumes rational investors. However, if investors are rational, why do they allocate to actively managed mutual funds? In Canada, 97% of active mutual funds underperformed their benchmarks over the last 10 years according to research from S&P SPIVA, yet there are close to $2 trillion invested in mutual funds in Canada.

The situation is not particularly better in other markets. India seems to be the market that offers the best opportunities for generating outperformance, but only 38% of mutual funds beat their benchmarks.

Source: S&P SPIVA, Finominal

Most investors want higher returns than the markets offer, but betting on active managers to achieve these has been a poor bet.

Instead, why not simply consider a leveraged position on the market? Leveraged products will outperform the market per their design, assuming structurally rising equity markets. ETFs have become available that offer various levels of leverage on standard market indices like the S&P 500, so investors could perhaps simply disregard actively managed funds altogether.

In this research article, we will evaluate using leveraged ETF to outperform the market.

LEVERAGED ETFS

There are more than 100 ETFs trading in the U.S. that provide leveraged positions on stock market indices, single stocks, sectors, countries, commodities, and currencies, which typically offer 2x or 3x leverage. The combined assets under management are larger than $100 billion and the median management fee is 0.95%.

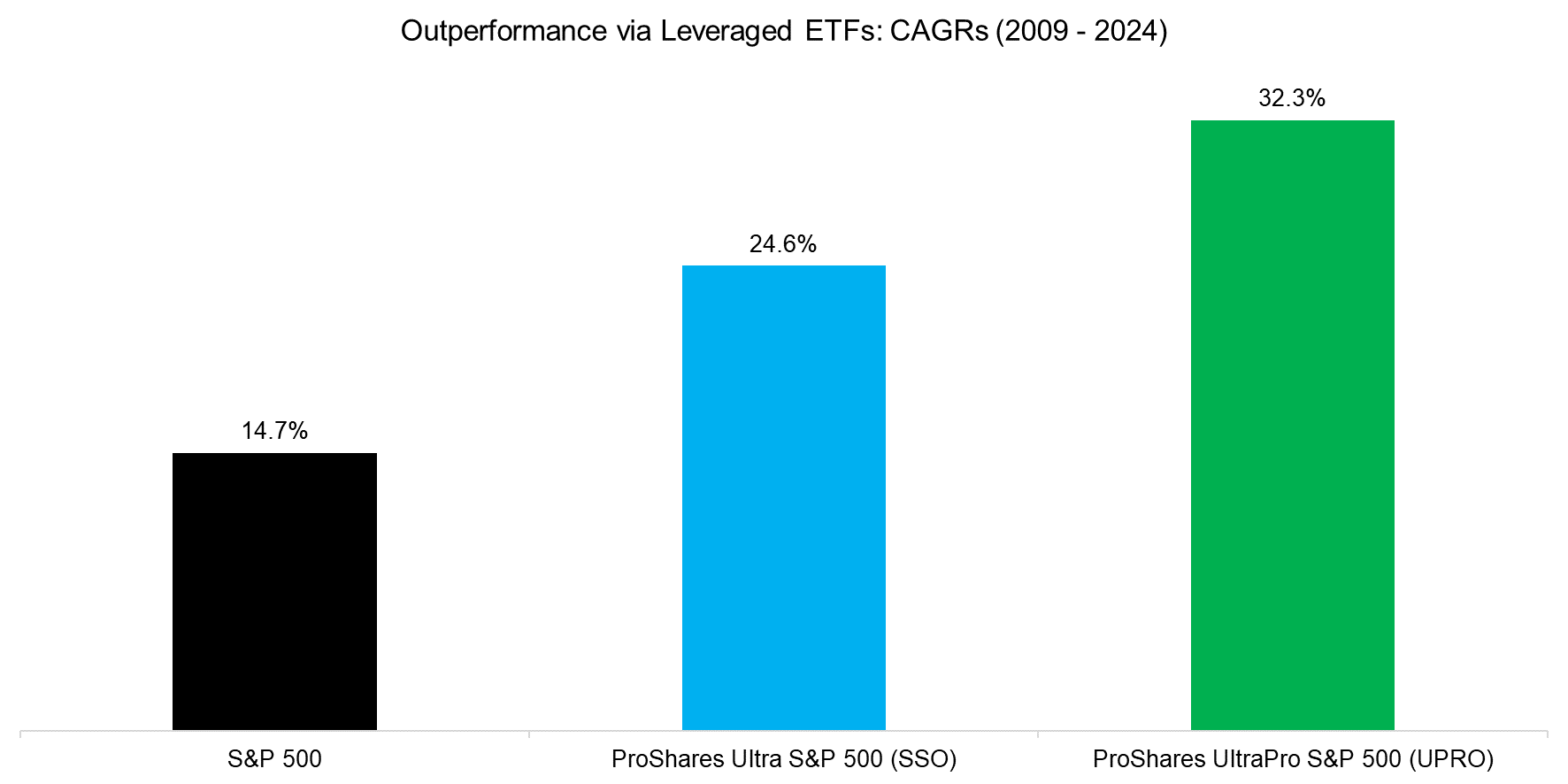

We will focus on two leveraged S&P 500 products, namely the ProShares Ultra S&P 500 (SSO) and ProShares UltraPro S&P 500 (UPRO), which offer 2x respectively 3x leverage. In the period from 2009 to 2024, the S&P 500 generated a CAGR of 14.7%, compared to 24.6% for SSO and 32.3% for UPRO.

Source: Finominal

REALIZED VERSUS THEORETICAL PERFORMANCE

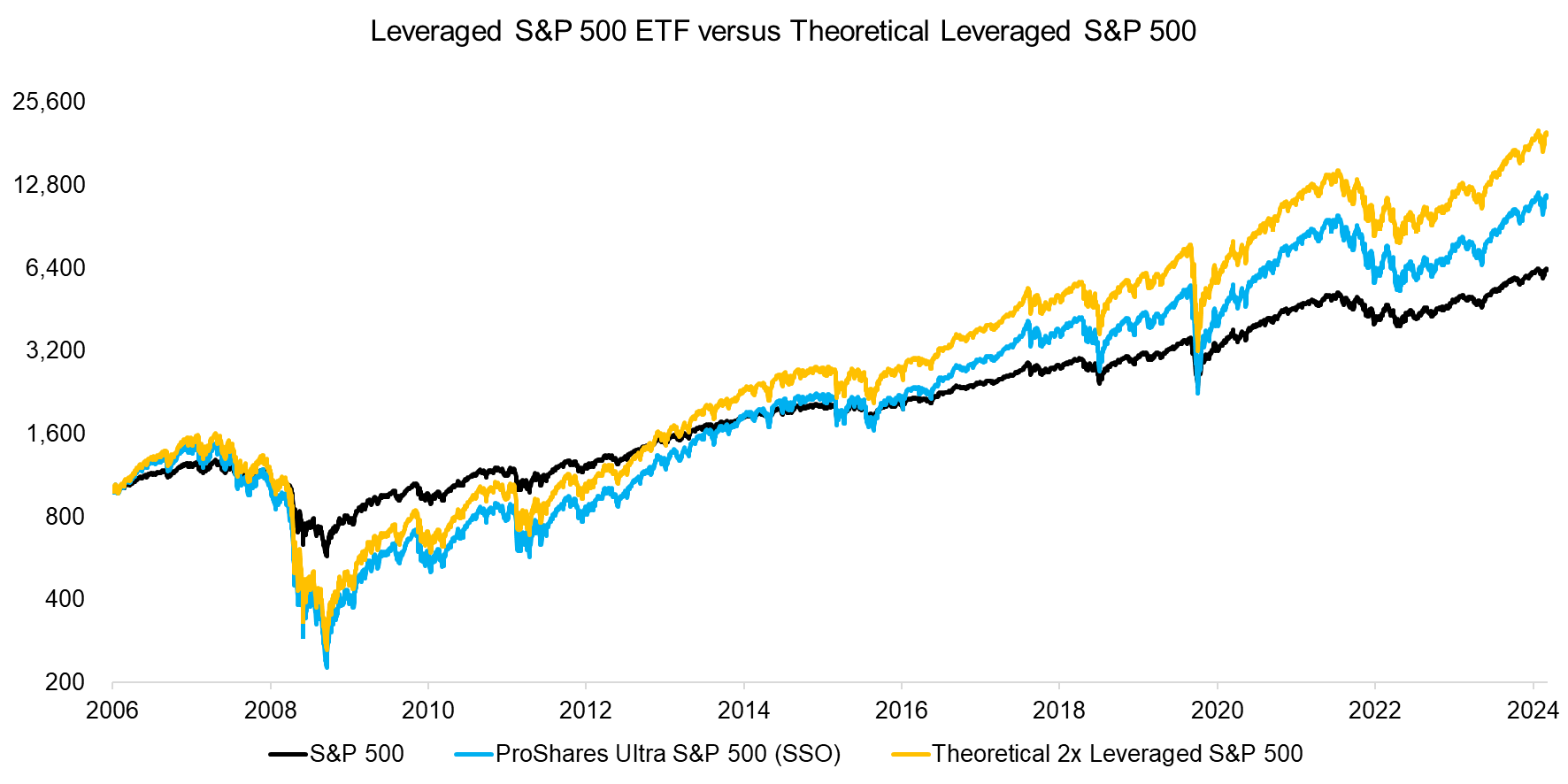

SSO offers 2x leverage on the S&P 500, but its CAGR was only 68% higher than the S&P 500 since 2009, while UPRO offers 3x leverage, but its CAGR was only 120% higher. Investors might have expected 100% respectively 200% higher returns given the leverage.

We can compare the performance of SSO versus a theoretically 2x leveraged S&P 500, which highlights an increasing difference in return, which we can attribute to SSO´s 0.91% management fee and the mechanics of the ETF. The leverage is applied daily, which leads to a significant difference over time given the compounding over negative returns.

Source: Finominal

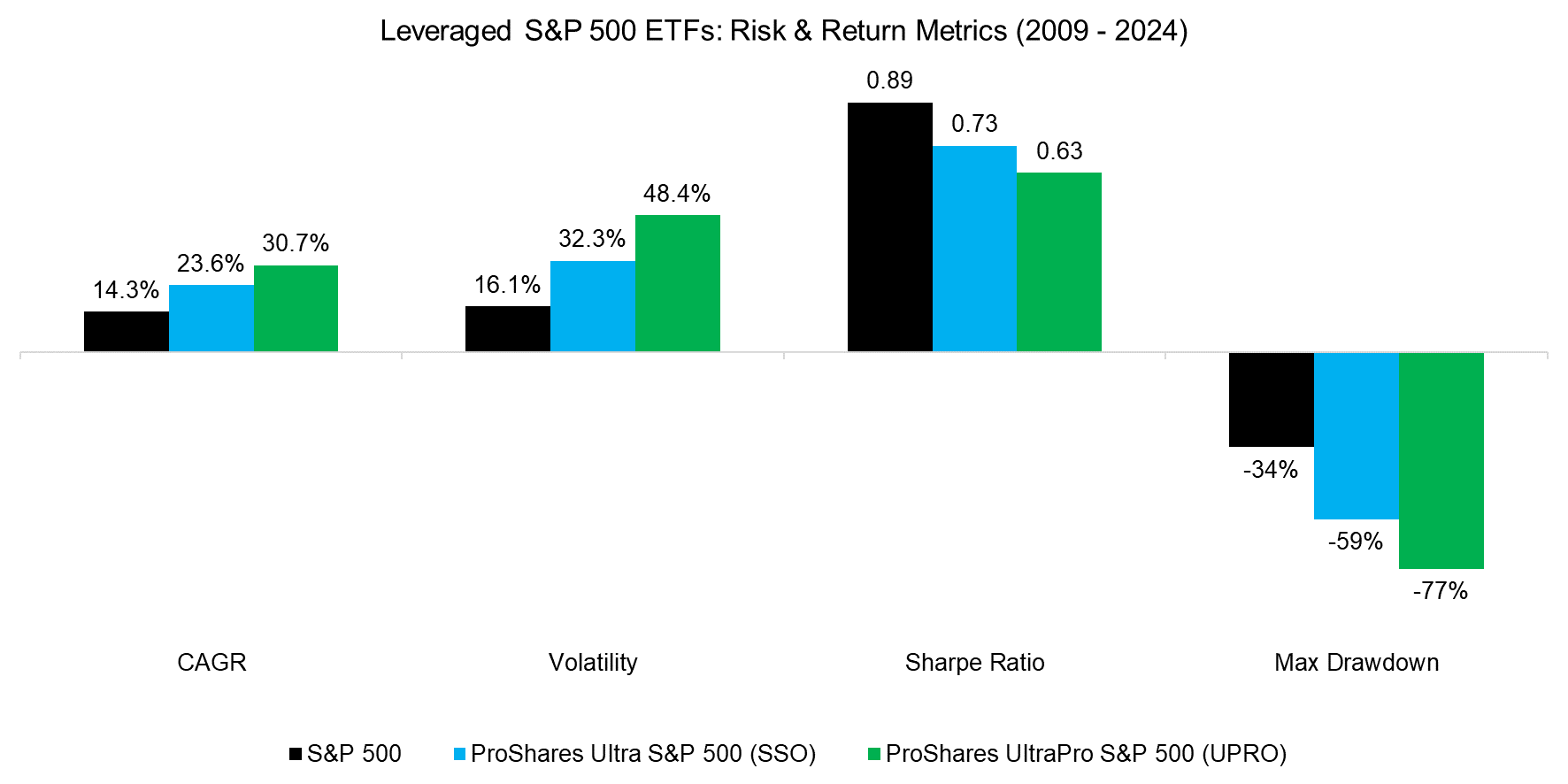

RISK & RETURN METRICS

Although leveraged S&P 500 products have achieved higher returns than the index, the annualized returns are far less than what is implied by the leverage. Worse, the volatility has increased by the magnitude of the leverage, e.g. UPRO features an annualized volatility approximately 3x of the S&P 500.

Given that the return has not increased by the magnitude of the leverage but volatility has, this leads to the leveraged ETFs having significantly lower Sharpe ratios than the market.

Source: Finominal

FURTHER THOUGHTS

As often in the investing world, there is a significant difference between theory and reality. Leveraged ETFs have achieved higher returns than the markets as per their design, but given the lower Sharpe ratios, these should be viewed cautiously.

Leveraged ETFs are typically marketed as instruments for short-term trading rather than buy-and-hold strategies by asset managers, but that itself is silly marketing as almost no one is good at that.

However, investors can simply use futures for creating a leveraged position on the S&P 500 or other markets, which is operationally more complex than buying ETFs, but has tax advantages, is cheaper given the lack of management fees, and the desired leverage can be highly customized. The Sharpe ratio of implementation via futures will be lower than for the market as there are some costs, but the deterioration would be far less than for leveraged ETFs. Outperforming has never been easier, it just requires a flexible mindset.

RELATED RESEARCH

What is wrong with Inverse ETFs?

Higher Volatility, Higher Alpha?

Outperformance Ain’t Alpha

Less Efficient Markets = Higher Alpha?

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.