Private Equity Performance Tracker: Q3 2025

PE vs. equities – and the winner is?

October 2025. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Public equities have outperformed PE funds YTD

- However, the medium-term outlook favors PE funds

- Correlations of PE & public equities have decreased

INTRODUCTION

The private equity (“PE”) industry has expanded dramatically – from a few hundred million dollars managed by a handful of asset managers in the 1980s to more than $10 trillion today, spread across thousands of funds. Despite its significance to institutional investors, reliable and timely performance data remains scarce. Fund holdings are typically valued on a monthly or quarterly basis, with valuations often smoothed in ways that fail to capture real-time economic conditions.

To address this gap, we introduced the Finominal Private Equity Index in August 2025. The index tracks private equity funds listed on European stock exchanges, providing investors with a current, daily snapshot of private equity performance based on live market pricing (read Private Equity Without the Lag).

In this research article, we review the recent performance of private equity funds and managers versus public equities.

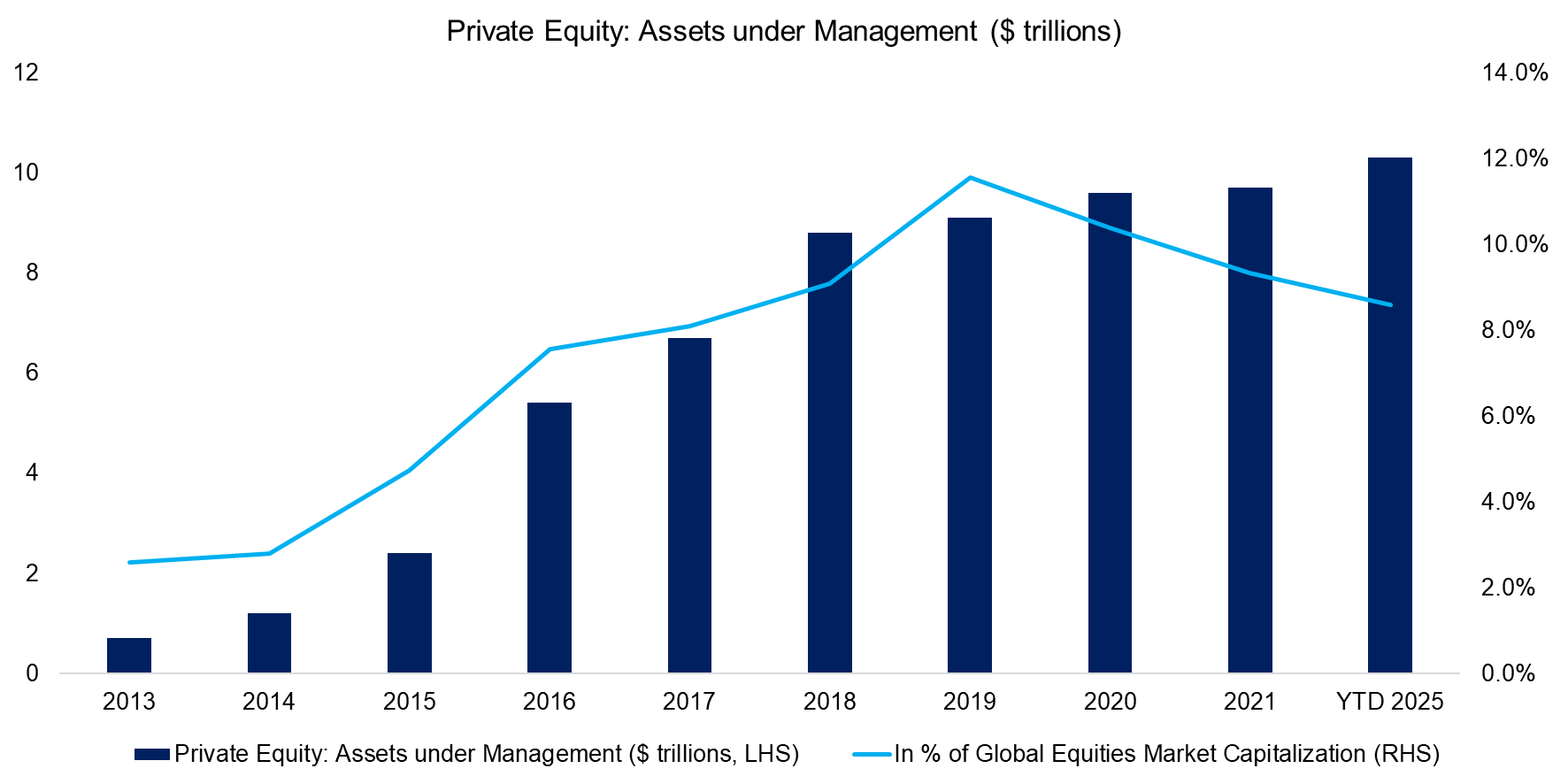

ASSETS UNDER MANAGEMENT

The growth of assets under management (AUM) in private equity has been nothing short of remarkable – rising from $700 billion in 2013 to $10.3 trillion today, according to JP Morgan. That said, growth has slowed significantly since 2018. A key reason is that most institutional investors already hold substantial allocations to private equity, leaving the market relatively saturated. While there have been efforts in markets such as the U.S. to broaden access to retail investors, these face regulatory hurdles as well as reluctance from individuals to commit capital for extended lock-up periods typical for PE funds.

We also note that the share of private equity AUM relative to global equity market capitalization peaked in 2019, which is noteworthy. This can largely be explained by the surge of the so-called Magnificent 7 technology companies and the boom in AI-focused stocks, which have driven public equity markets to record highs.

Source: JP Morgan, Finominal

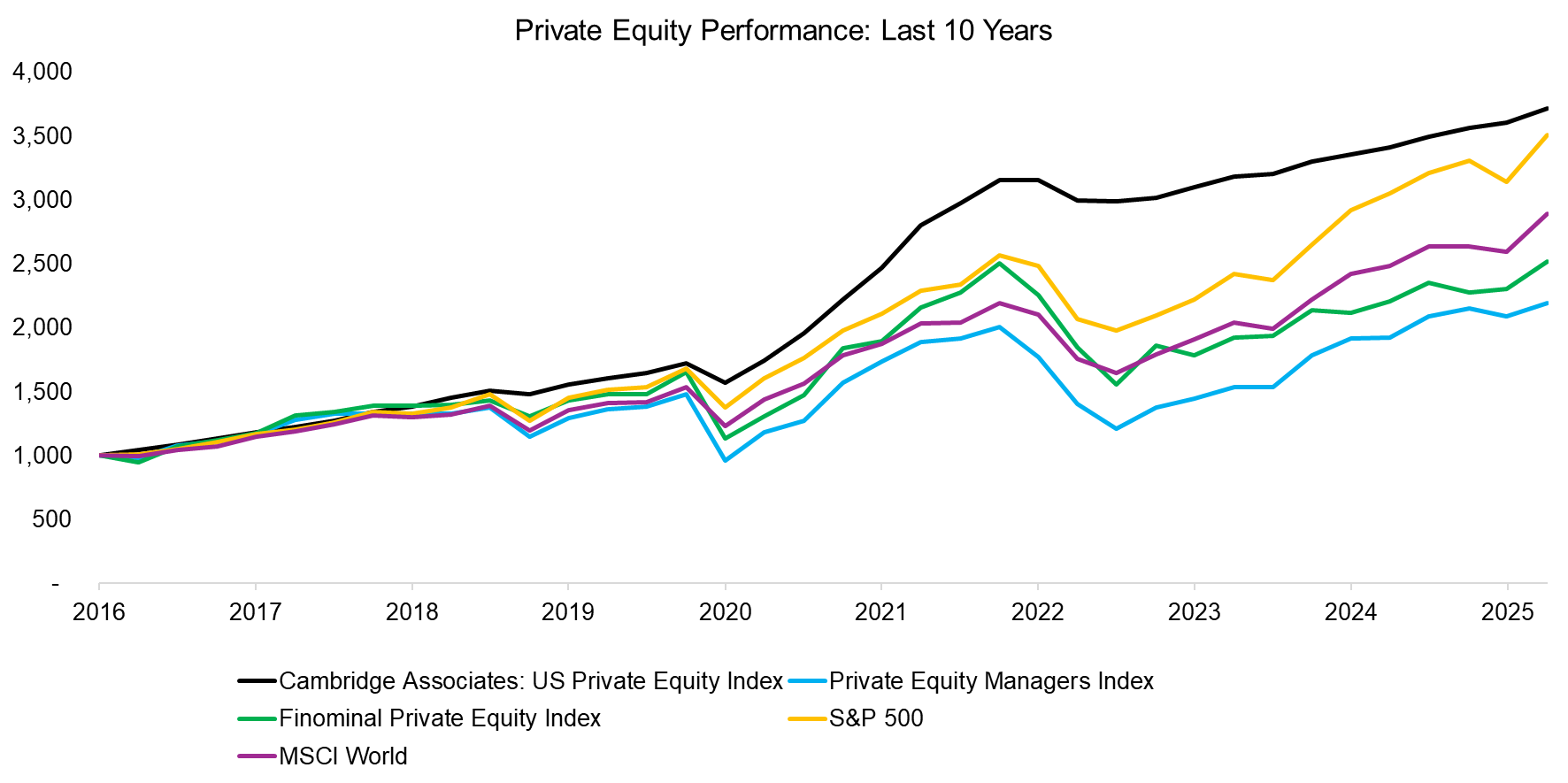

LONG-TERM PRIVATE EQUITY PERFORMANCE

We construct an index using quarterly IRRs of private equity funds as reported by Cambridge Associates, a leading U.S.-based investment consultant (the “Cambridge Associates: US Private Equity Index”). Technically, using IRRs – which are money-weighted returns – to create an index is not strictly correct, as they tend to overstate returns compared to asset-weighted returns used for indices such as the S&P 500. The index also suffers from survivorship bias as poorly performing funds usually stop reporting returns. Nevertheless, these IRRs remain one of the few publicly available data points, so we use them, but with due caution.

Over the past decade, the Cambridge Associates: US Private Equity Index has generated the highest returns, although the S&P 500 has performed closely behind. The Finominal Private Equity Index has underperformed relative to the S&P 500 and the MSCI World Index, but it has outperformed an index composed of the stocks of private equity fund managers, such as KKR and Blackstone.

Source: Finominal

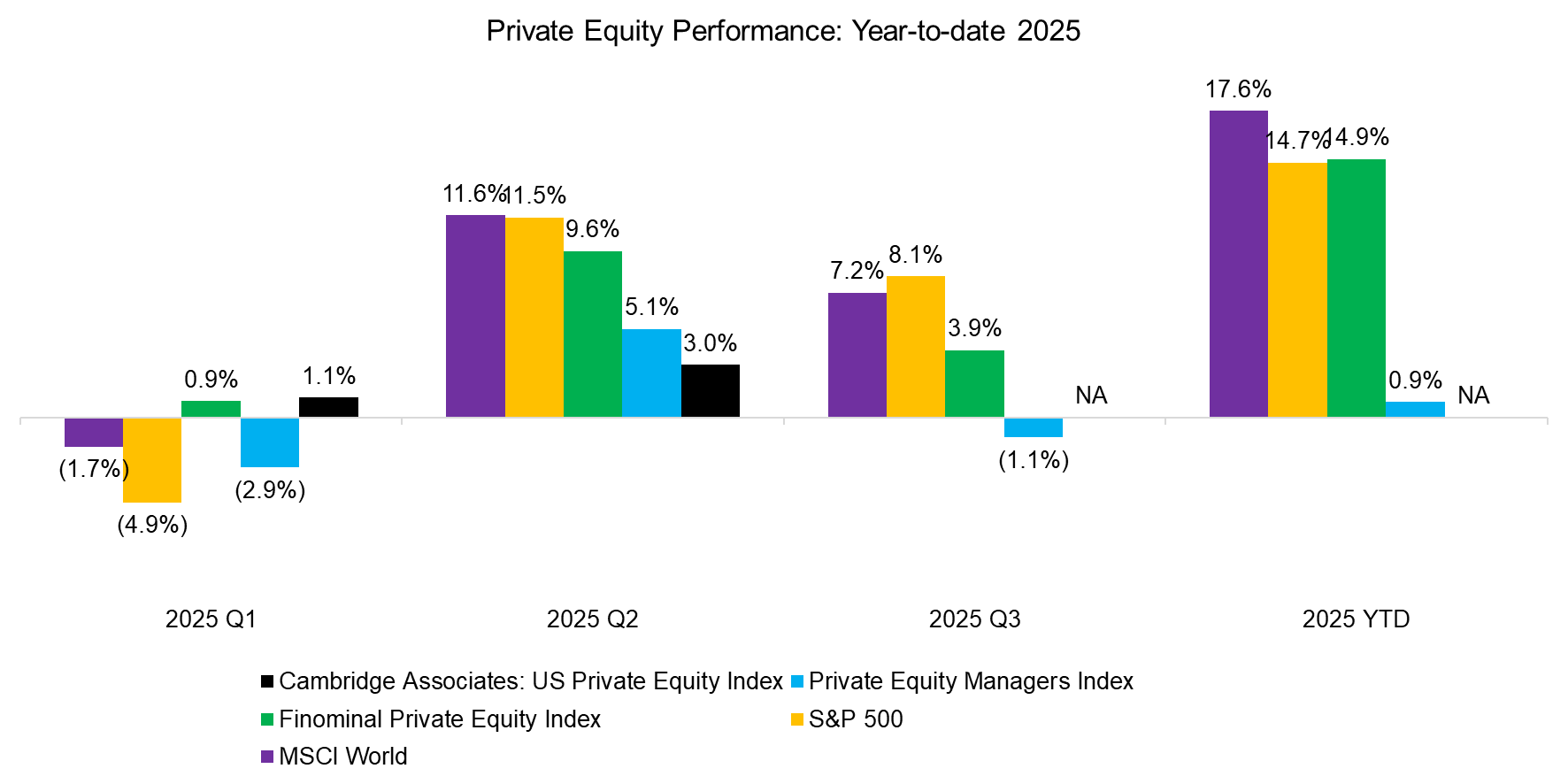

SHORT-TERM PRIVATE EQUITY PERFORMANCE

Shifting the focus to year-to-date performance in 2025, the MSCI World has generated the highest return, followed by the Finominal Private Equity Index and the S&P 500. Shares of private equity managers have performed poorly and have produced almost no return so far. Data from Cambridge Associates is only reported quarterly and with a significant delay, so no information is yet available for the third quarter of 2025.

Source: Cambridge Associates, Finominal

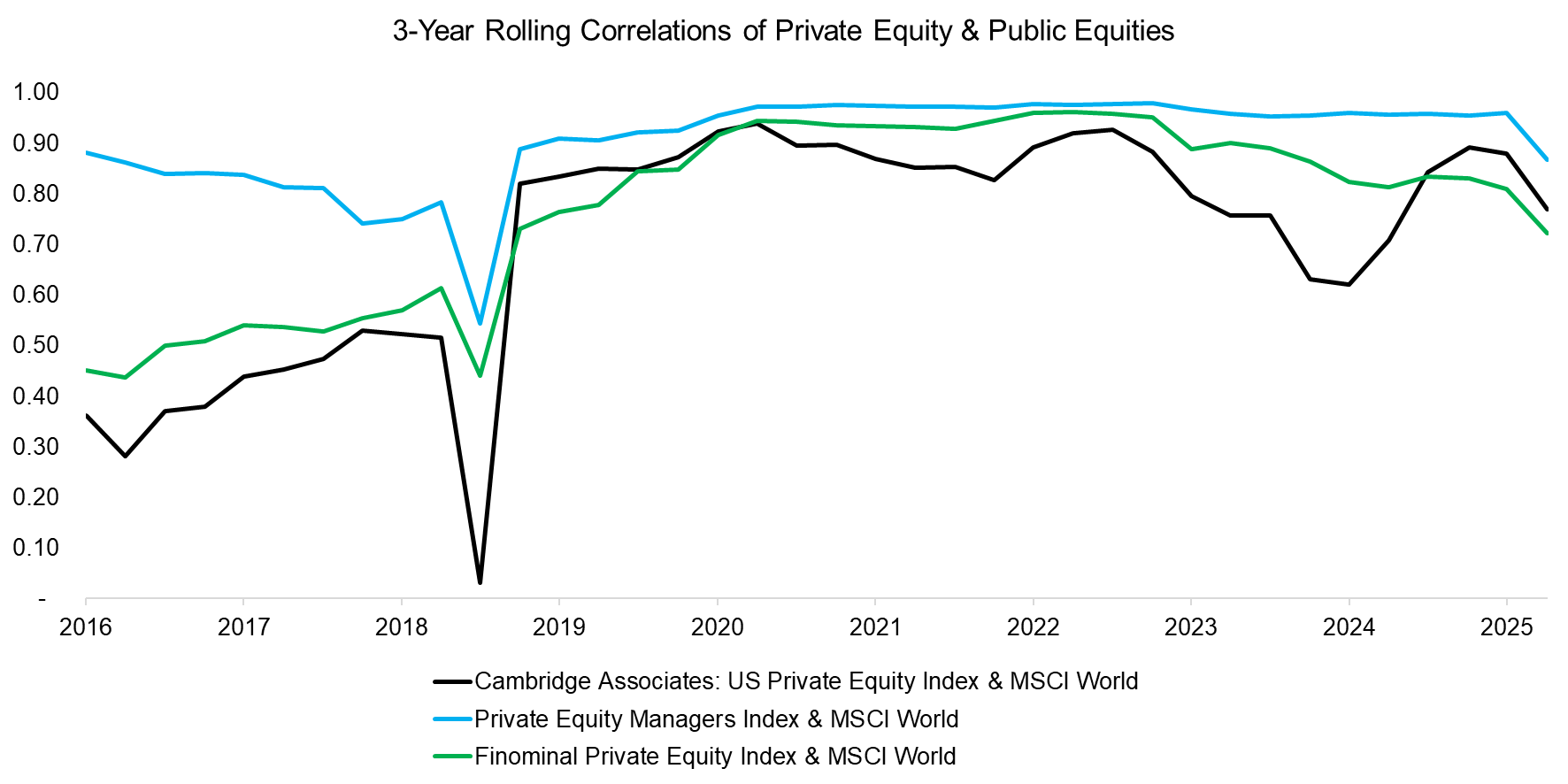

CORRELATION ANALYSIS

Private equity funds have often been marketed as providing returns uncorrelated with public equities. At first glance, this may appear true, but much of it can be explained by the lagged and smoothed valuations of private equity holdings. We calculated three-year rolling correlations of the Cambridge Associates U.S. Private Equity Index, the private equity managers index, and the Finominal Private Equity Index against the MSCI World, which were 0.7, 0.90, and 0.76, respectively, over the past ten years.

Correlations with public equities have been particularly high since 2019, coinciding with a significant increase in assets under management within the private equity industry. The diversity of funds across all types of companies has reduced the distinctiveness of previous investment styles, causing private equity returns to resemble public equity performance more closely (read Style Analysis of Private Equity Funds and Private Equity Is Still Equity, Nothing Special Here).

In 2025, we observe a decline in correlations, which can be attributed to public markets being dominated by a few large companies, such as NVIDIA and Microsoft, whose outsized performance has driven equity returns.

Source: Cambridge Associates, Finominal

FURTHER THOUGHTS

Anecdotal evidence from the private equity industry suggests that fundraising has become increasingly challenging. The two historical tailwinds for private equity performance – expanding valuation multiples and declining interest rates – have largely disappeared, and most institutional investors already have substantial allocations.

However, the combination of high valuations and significant concentration risk in public equities points to a weak return outlook. In this environment, private equity funds with broadly diversified portfolios may outperform over the short to medium term.

RELATED RESEARCH

Private Equity Without the Lag

Style Analysis of Private Equity Funds

Private Equity: The Emperor has No Clothes

Private Equity: Fooling Some People All the Time?

Private Equity Is Still Equity, Nothing Special Here

The Case Against Private Markets

Private Equity Managers vs Private Equity Funds

Listed Private Equity ETFs: The Real Deal?

Factor Exposure Analysis 101: Linear vs Lasso Regression

Venture Capital: Worth Venturing Into?

BDCs: Better Don’t Choose?

The Case Against REITs

A Crescendo in Private Credit?

Do Activist Investors Create Value?

Myth Busting: Alts’ Uncorrelated Returns Diversify Portfolios

What´s Better than the S&P 500?

Outperformance via Leverage

Complexity is the Enemy of Investing

Stock Selection versus Asset Allocation

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.