Profitability & Leverage of U.S. Sectors

How concerned should investors be about rising interest rates & corporate defaults?

July 2024. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- There were divergent trends in profitability and leverage across U.S. sectors

- Energy and materials showed the best improvement, while healthcare deteriorated the most

- However, overall U.S. companies should be poised well to sustain higher interest rates

INTRODUCTION

Post our recent research article on the profitability and leverage of U.S. listed companies (read Profitability & Leverage of U.S. Stocks) some readers commented that focusing on the entire stock market might have distorted our conclusion, which was that neither the profitability nor the leverage of U.S. stocks had significantly changed over the last 20 years. Given the dramatic change in interest rates throughout that period, this was somewhat unexpected.

In this research note, we will explore the profitability & leverage of U.S. sectors.

PROFITABILITY

We focus on 10 sectors and the entire U.S. stock market consisting of all stocks with a market capitalization larger than $1 billion, which is currently a universe of approximately 2500 stocks.

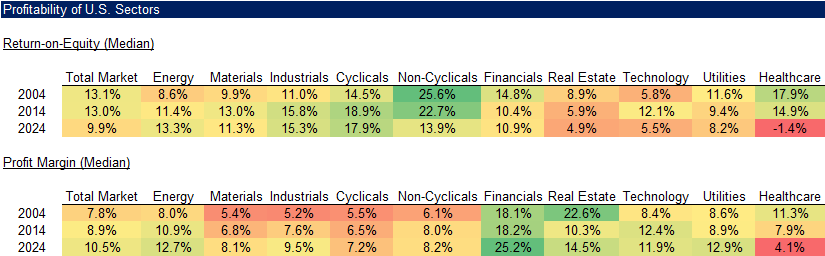

We compute the median return-on-equity (ROE) and profit margins for 2004, 2014, and 2024, which highlights divergent trends in these two metrics.

The median ROE of the U.S. stock market decreased over the last two decades, but the median profit margin increased. Industrials, cyclicals, and non-cyclicals feature the highest while real estate, tech, and utilities have the lowest average ROEs. However, when looking at profit margins, tech and real estate stocks rank above average.

Source: Finominal

LEVERAGE

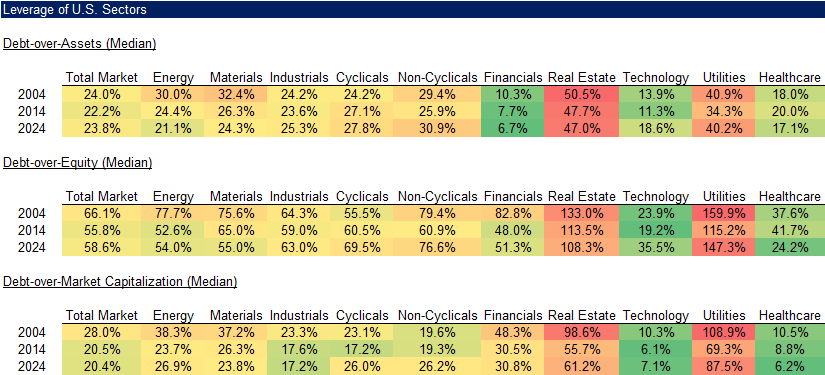

Next, we compute the median values for debt-over-assets, debt-over-equity, and debt-over-market capitalization, which highlights a slight deleveraging of the entire market since 2014.

In contrast to the two profitability metrics, there are more consistent trends as technology and healthcare were the least leveraged sectors while real estate and utilities were the most leveraged sectors across all metrics. Naturally, this is simply a reflection of business models, i.e. biotech companies with little to zero revenues are less likely to get debt financing compared to utility companies with stable and predictable cashflows (read Does Financial Leverage Make Stocks Riskier? Part II and Does Financial Leverage Make Stocks Riskier?).

Source: Finominal

INTEREST RATE COVERAGE

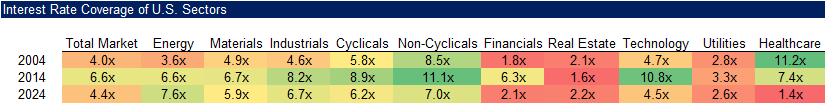

Then we calculate the median interest rate coverage (“ICR”), which highlights significantly different levels across the ten sectors. The sectors with the highest ROEs, namely industrials, cyclical, and non-cyclicals feature the highest ICRs, while the sectors with the lowest ROEs, namely financials, real estate, and utilities exhibit the lowest ICRs on average. However, we should ignore financials as for many banks interest represents the primary source of income.

It is worth highlighting that the ICR of most sectors increased between 2004 and 2014, likely a reflection of more conservative financing practices post the global financial crisis in 2009, but then decreased between 2014 and 2024, where perhaps CFOs became lax again.

Source: Finominal

CHANGE IN PROFITABILITY & LEVERAGE

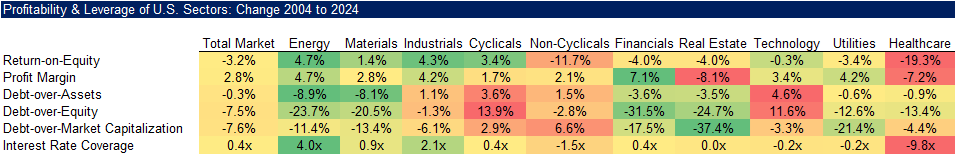

Finally, we compare the change in these metrics from 2004 to 2024, which highlights a divergent picture. Energy and materials are the only two sectors that increased their profitability and decreased their leverage across all metrics. The sector that has deteriorated most is healthcare, which can perhaps be explained by the growing number of unprofitable biotech stocks within that sector (read The Rise of Zombie Stocks).

Source: Finominal

FURTHER THOUGHTS

Should investors be concerned about certain sectors given higher interest rates than a few years ago?

Yes, and no. Real estate, utilities, and healthcare feature the lowest interest rate coverage, but the ICRs of real estate and utility companies were similar in 2004, where interest rates were at approximately the same levels as today. Given the deterioration in fundamentals of retail and office properties given the evolution of online shopping and working from home, the real estate industry is more likely at risk for higher defaults than utility companies. In contrast, the healthcare sector represents a mixed bag as it is comprised of a few highly profitable pharma and many highly risky biotech firms, but there is nothing new about that (read Building a Stock Portfolio for a Debt-Averse World).

RELATED RESEARCH

Profitability & Leverage of U.S. Stocks

Does Financial Leverage Make Stocks Riskier? Part II

Does Financial Leverage Make Stocks Riskier?

The Rise of Zombie Stocks

Building a Stock Portfolio for a Debt-Averse World

Picking Profitable Companies Can Be Unprofitable

Corporate Debt in the Chinese Stock Market

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.