Profitability & Leverage of U.S. Stocks

How concerned should investors be about rising interest rates & corporate defaults?

July 2024. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- U.S. listed companies have become more profitable over the last 20 years

- Corporate leverage has not increased despite the low-interest rate regime

- Interest rate coverage has been declining, but is not an intermediate concern

INTRODUCTION

Calling for the demise of a company, sector, or even country is easy, but getting the timing right is almost impossible. Investors have been betting on the implosion of the Japanese financial system given record levels of public debt and a declining population to finance this for decades, but it has not happened yet.

Many investors speculated that rising interest rates would lead to the end of all sorts of speculative bubbles. And indeed, fixed income investors have taken heavy losses over the last two years, and real estate investors have also started to feel the pain of higher financing costs and lower property valuations.

However, corporate America seems to be doing fine and default rates have not spiked significantly. How can we explain this?

In this research report, we will explore the profitability and leverage of U.S. listed companies.

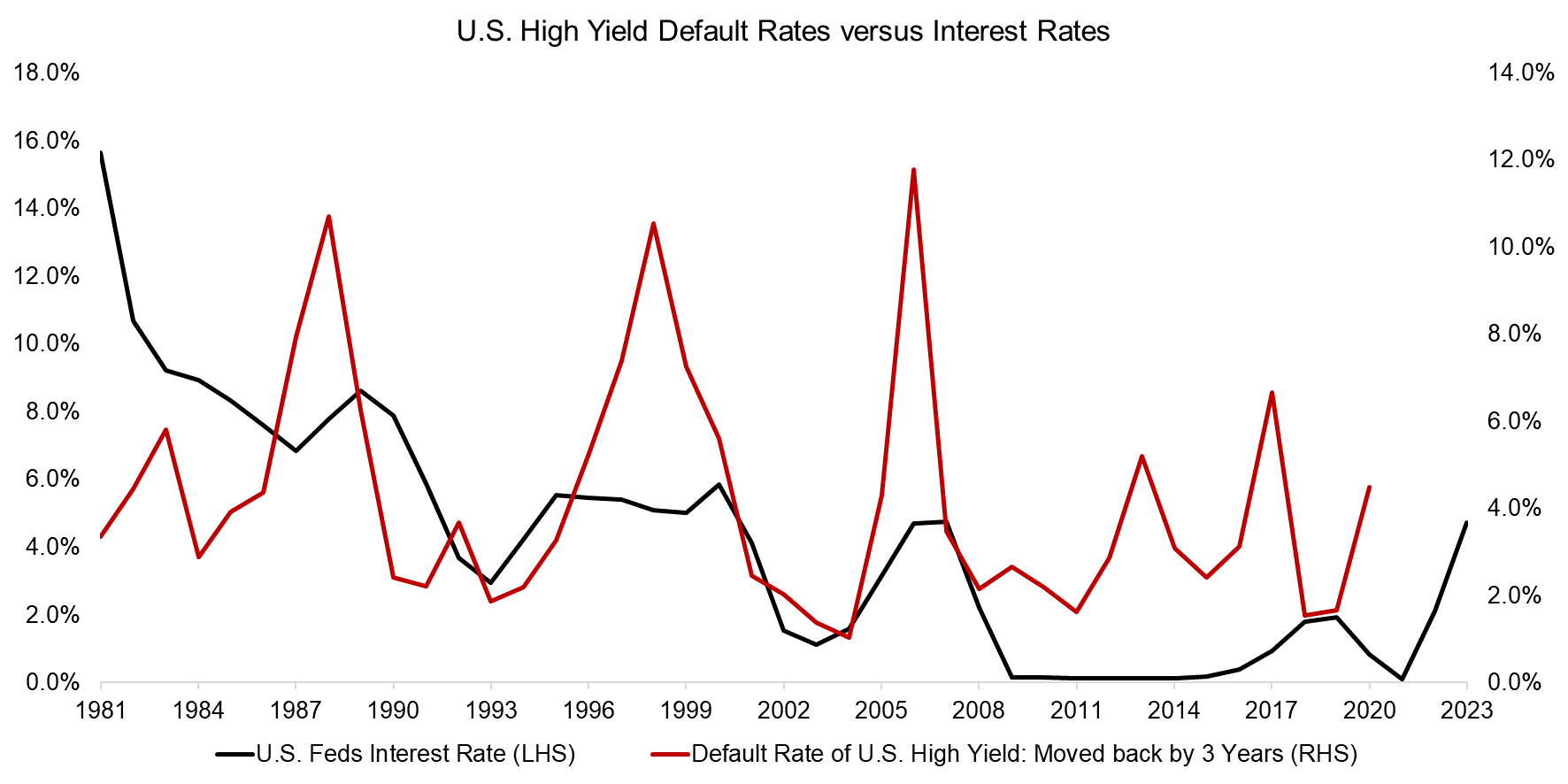

DEFAULT RATES & INTEREST RATES

Reviewing the default rate of U.S. high yield corporate borrowers in the four decades from 1981 to 2023 highlights that this ranged from 0.6% to 11.8%, but that there does not seem a high correlation to interest rates, which declined almost consistently from 16% to 0%. Intuitively, we would have expected higher default rates when interest rates were in the double digits.

Naturally, rising interest rates do not affect companies immediately as these tend to have financing fixed for multiple years. We therefore shift the default rate by three years into the past, which highlights a slightly better relationship, albeit not a great one.

Source: S&P Global, St. Louis Fed, Finominal

PROFITABILITY

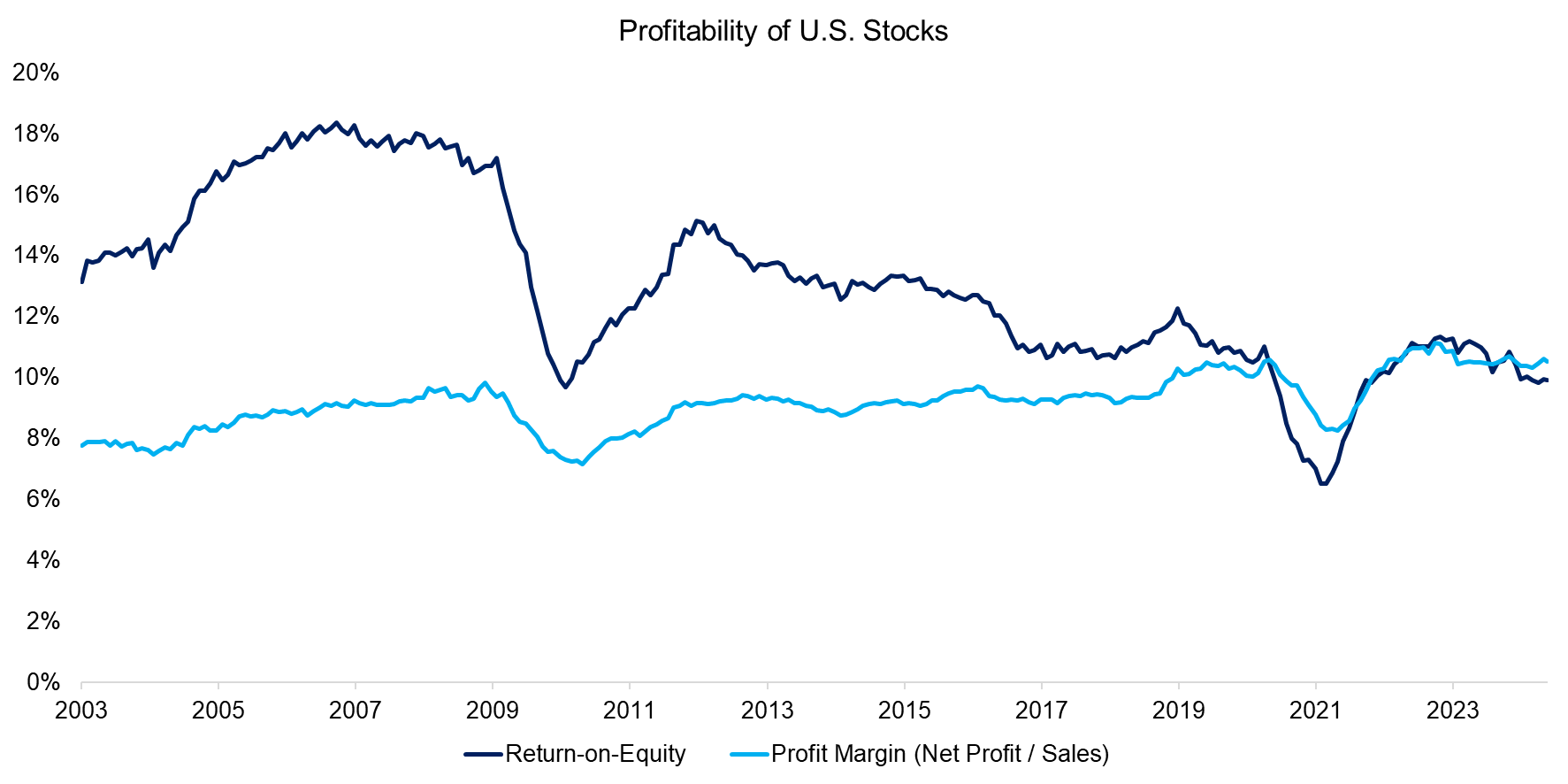

Rising interest rates should affect less profitable companies more negatively than highly profitable ones, assuming they feature the same leverage. In order to assess the profitability of U.S. stocks, we compute the median return-on-equity (ROE) and profit margin of all stocks trading in the U.S. with a market capitalization larger than $1 billion, which is a universe of approximately 2500 stocks as of today (read Does Financial Leverage Make Stocks Riskier? Part II and Does Financial Leverage Make Stocks Riskier?).

We observe that the median ROE of U.S. listed companies declined from 14% in 2003 to 10% in 2024, while the median profit margin has increased from 8% to 11%. Perhaps this can be explained by the equity in the U.S. companies representing stale book values, e.g. McDonald’s features a negative book value of approximately $5 billion. Stated differently, investors might pay more attention to the profit margin than the ROE.

Various reasons might explain the improvement in profit margins, e.g. industry consolidation, a shift to asset-light and higher-margin businesses, lower taxes, lower financing costs, productivity gains, and so on.

Source: Finominal

LEVERAGE

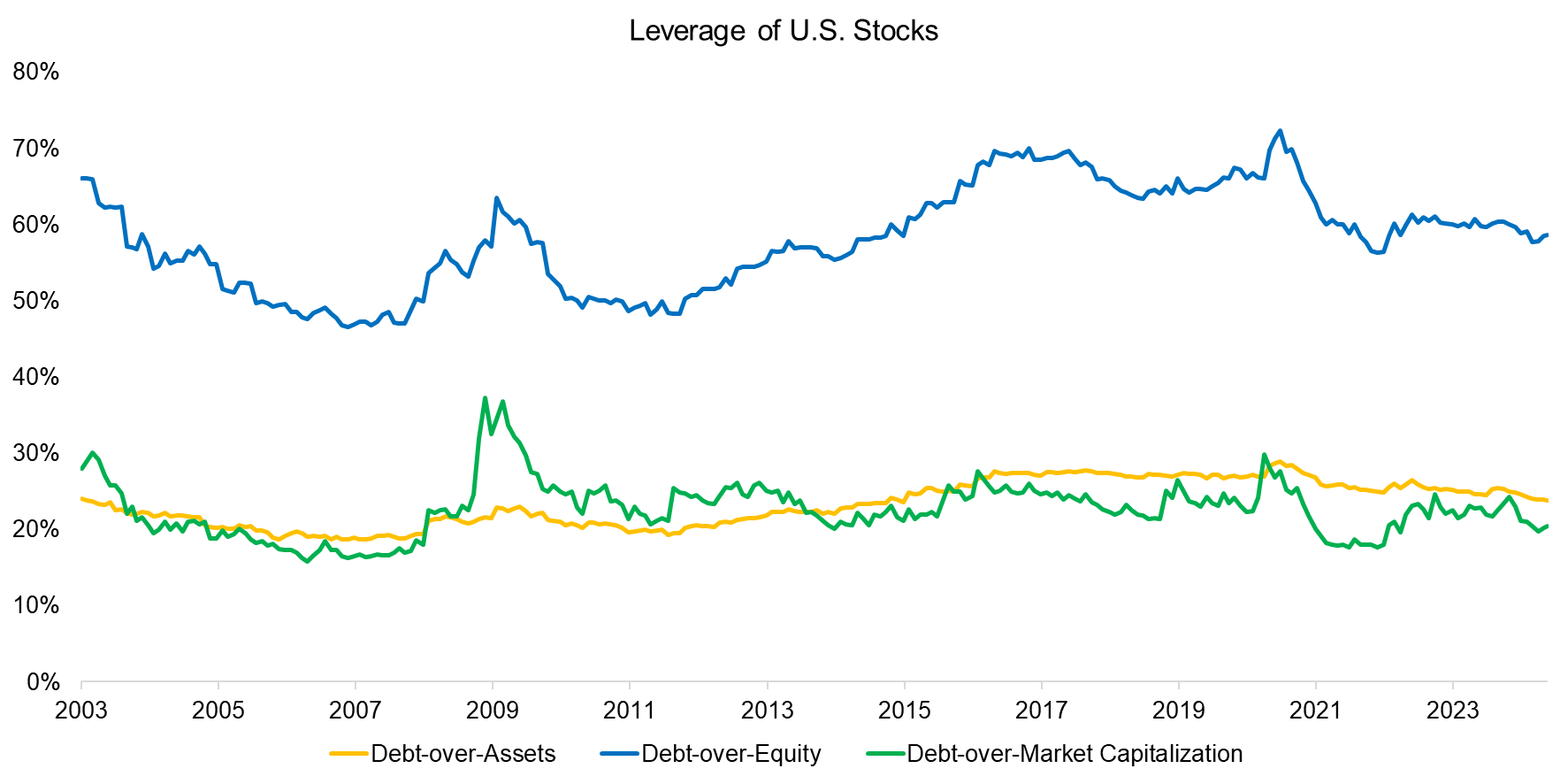

Next, we review the leverage of U.S. listed companies, where we use debt-over-assets, debt-over-equity, and debt-over-market capitalization as metrics, where we need to acknowledge again that assets and equity represent book rather than market values given U.S. GAAP accounting.

We observe that the trends in leverage were identical across the three ratios in the period between 2003 and 2024. However, again there is no consistent relationship between leverage and interest rates, i.e. between 2003 and 2005 rates declined, but so did leverage, while leverage and rates then increased between 2011 and 2020.

It is somewhat surprising that the leverage of U.S. listed companies did not increase to higher levels during the low-interest rate environment of the recent decade. In contrast, almost all countries steadily increased their GDP-to-debt ratios, which now are at all-time highs. The U.S. recently exceeded its previous high from 1945.

Source: Finominal

INTEREST RATE COVERAGE

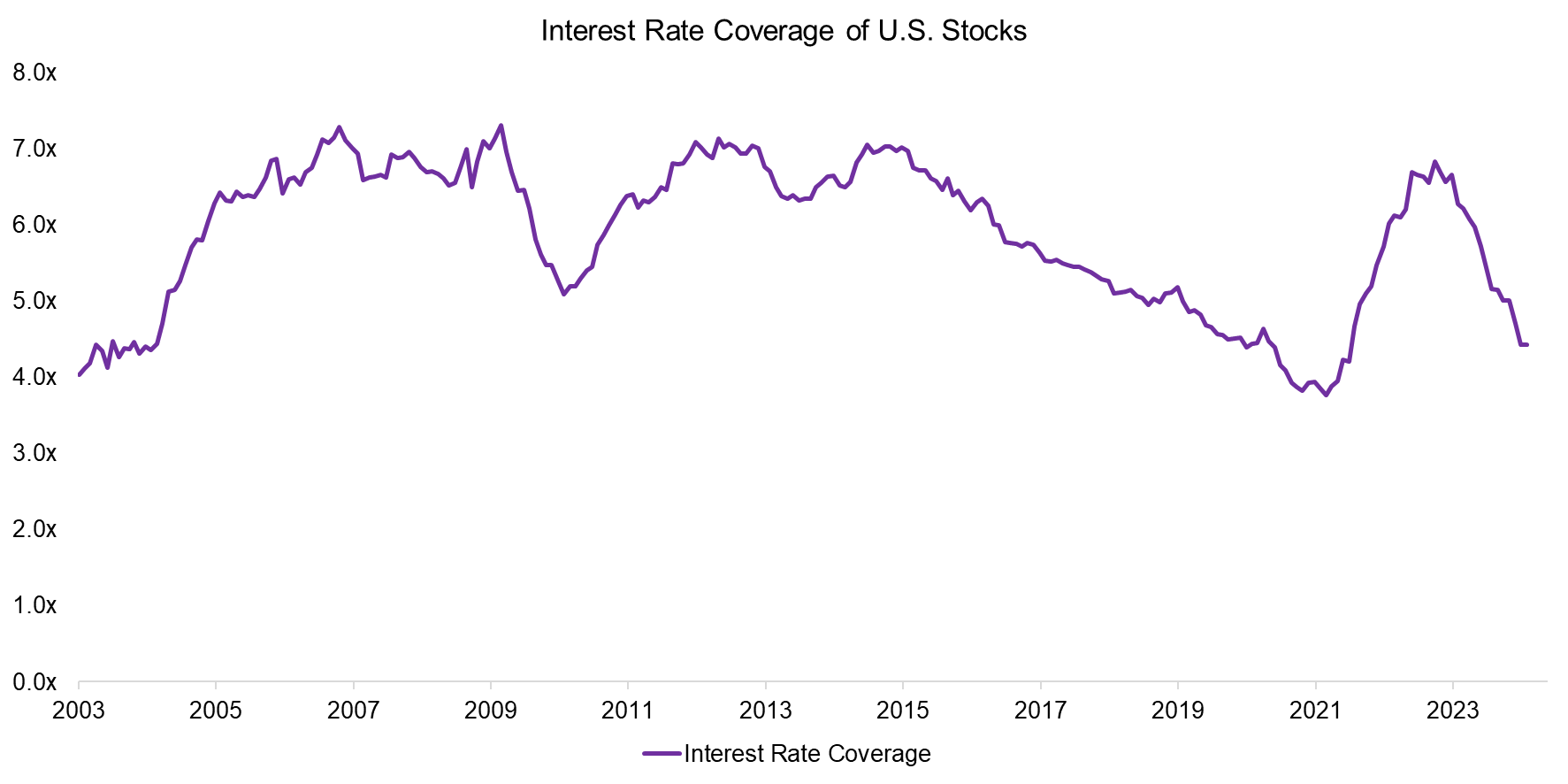

High leverage is not an issue per se, if the interest and amortization can be paid, e.g. utility companies can bear high leverage given monopolistic business models and consistent, predictable cashflows.

Given that the profitability of U.S. listed companies has improved and leverage has not increased significantly over the last 20 years, this should allow stocks to weather higher interest rates.

Finally, we evaluate the ability of U.S. listed companies to carry their debt. The median interest rate coverage has been declining throughout most of the last decade, but then spiked during the COVID-19 crisis in 2020. Since then, the ratio has been declining again, although it still stands at a relatively comfortable level of 4.4x.

Source: Finominal

FURTHER THOUGHTS

Should investors be concerned about the leverage of U.S. listed companies?

Based on this analysis, there is no short-term concern as U.S. stocks have become more profitable, do not carry more debt than historically, and the interest rate coverage is well above a critical level.

However, we analyzed the entire U.S. stock market and aggregated data often portrays only one perspective. A deeper analysis of the various segments of the stock market and sectors might reveal a different picture. It is also questionable how well the stock market reflects the economy, e.g. there are thousands of companies that were acquired by private equity funds, which typically employ high leverage when buying companies. Strong currents often lurk beneath what seems like a calm ocean (read The Rise of Zombie Stocks).

RELATED RESEARCH

Does Financial Leverage Make Stocks Riskier? Part II

Does Financial Leverage Make Stocks Riskier?

The Rise of Zombie Stocks

Building a Stock Portfolio for a Debt-Averse World

Picking Profitable Companies Can Be Unprofitable

Corporate Debt in the Chinese Stock Market

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.