Quality in Small versus Large-Cap Stocks

Quality stocks outperform, right?

December 2024. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Adding quality filters significantly improves small-cap investing

- However, the opposite occurs in the large-cap space

- Likely explained by more lower-quality companies in the small-cap space

INTRODUCTION

In the biblical fight between David and Goliath, most people favor David. Betting on the small guy to overcome power and adversity is universally appealing. However, in the stock market, David has been losing the fight as the size factor generated negative returns in 18 out of 21 stock markets over the last 30 years (read The Illusion of the Small-Cap Premium).

Intuitively, small-cap stocks should have outperformed large-cap stocks as small companies are riskier than large companies, but they have not. Naturally, investors can reduce the risk of small-caps by introducing quality filters, which may make small-cap investing attractive.

In this research article, we will compare small versus large-cap quality stocks.

SMALL-CAP QUALITY STOCKS

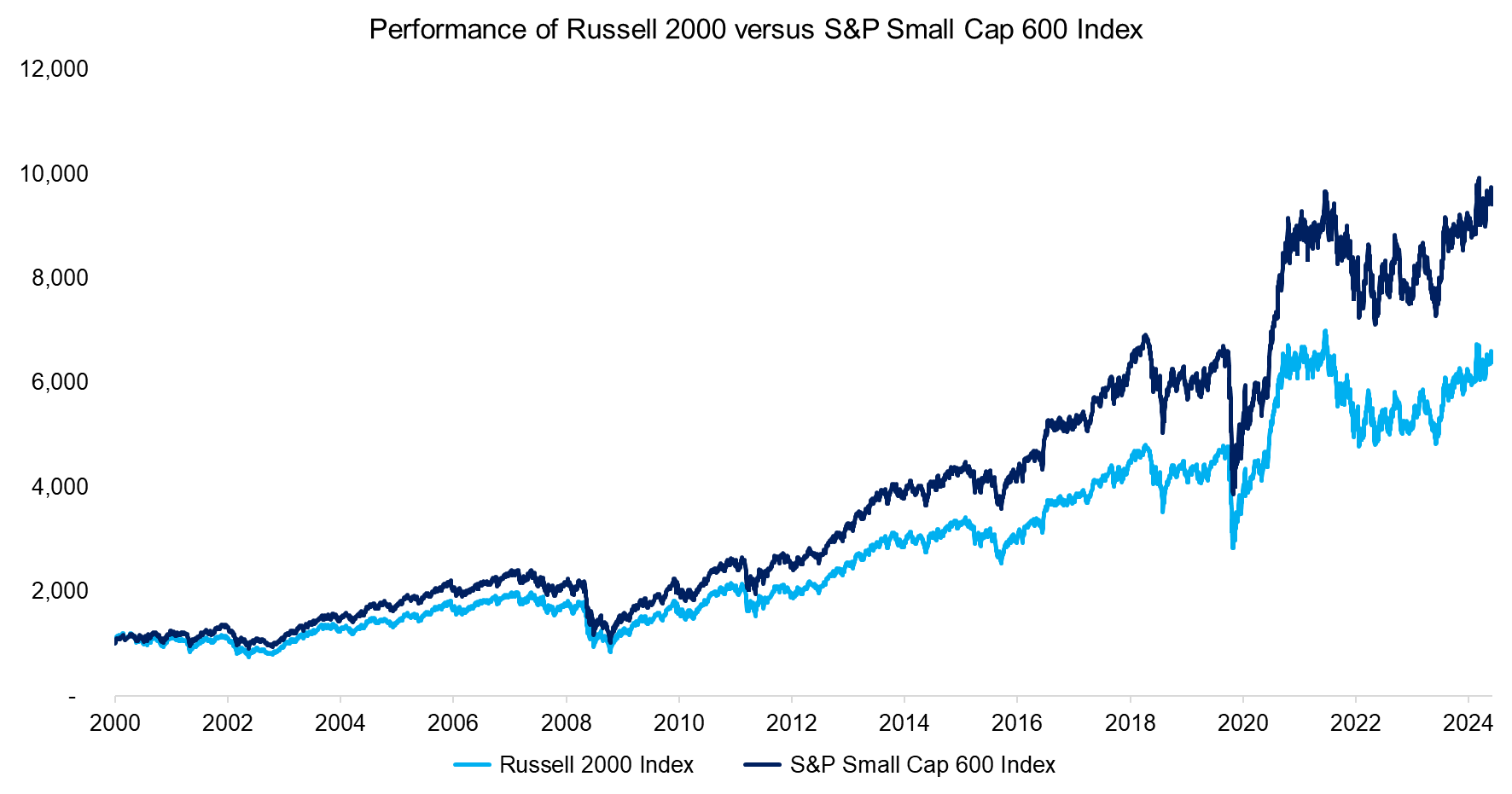

One of the popular charts of 2024 is the outperformance of the S&P Small Cap 600 versus the Russell Index 2000 Index. Both indices provide exposure to U.S. small-cap stocks, but the S&P index requires companies to have positive earnings over the last four quarters. This simple filter has led to a significant outperformance compared to the Russell 2000 Index since 2000.

Source: Finominal

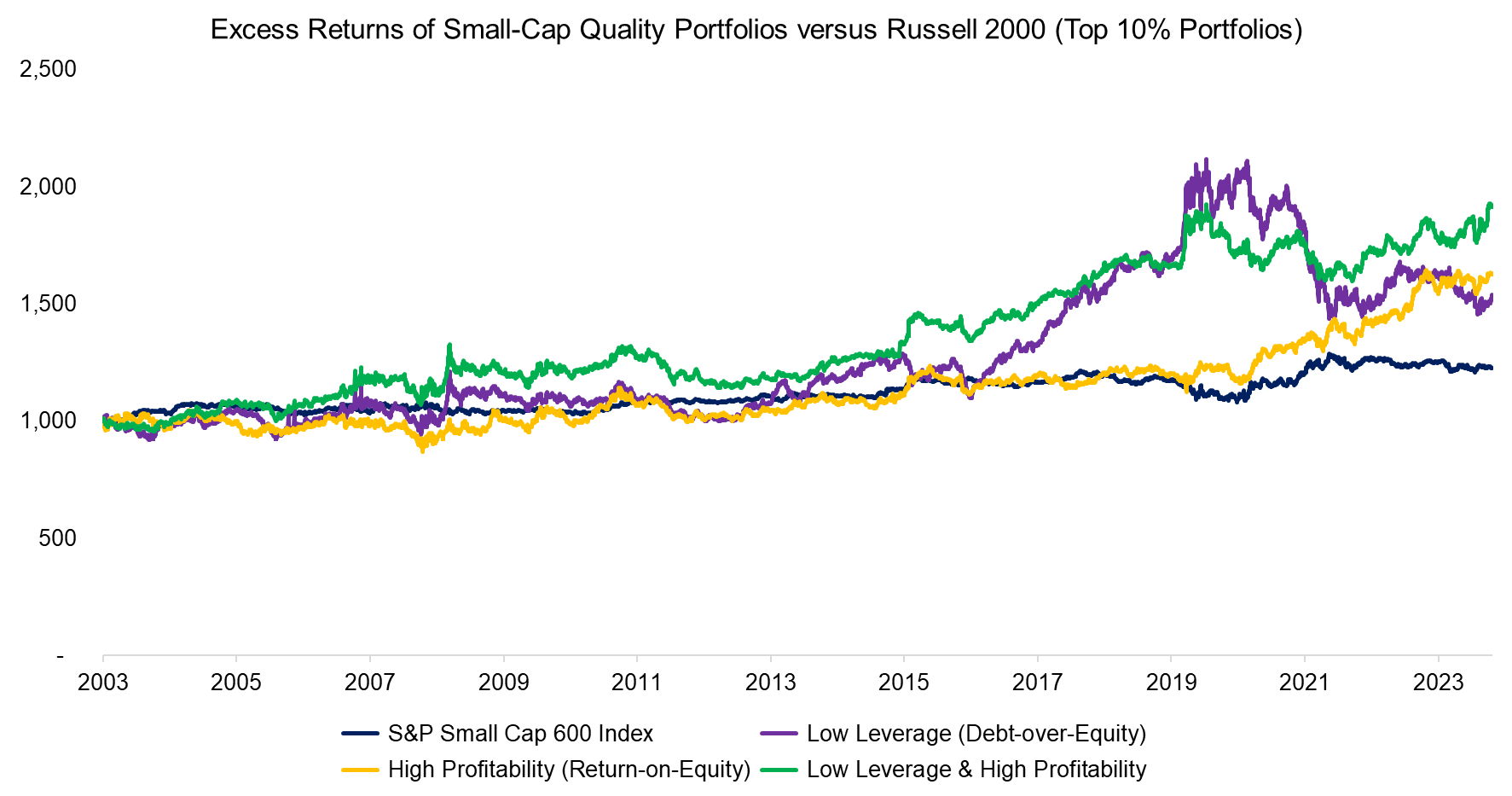

Quality stocks can be defined in various ways, and we use profitability and leverage in this analysis. We define small caps as all U.S. stocks with market capitalizations above $1 billion and below $7 billion, from which we select the top 10% with the highest return-on-equity (ROE) and lowest debt-over-equity (DOE), as well as by a combination of ROE & DOE. The portfolios are rebalanced monthly where 10 basis points are charged per transaction and stocks are weighted by market capitalization.

We compute the excess returns of these three quality-focused portfolios versus the Russell 2000 Index, which highlights significantly stronger outperformance than that of the S&P Small Cap 600 Index that can be attributed to more concentrated portfolios (180 versus 600 stocks). However, most outperformance was generated post-2015, and using low leverage did not produce consistent excess returns.

The strong excess returns of stocks with low leverage between 2015 and 2022 can be attributed to a bias toward technology stocks, which cratered once interest rates started increasing. Naturally, the rise in interest rates did not significantly impact the financials of companies with little debt, but it lowered investors´ preferences for exciting but unprofitable technology stocks.

Source: Finominal

LARGE-CAP QUALITY STOCKS

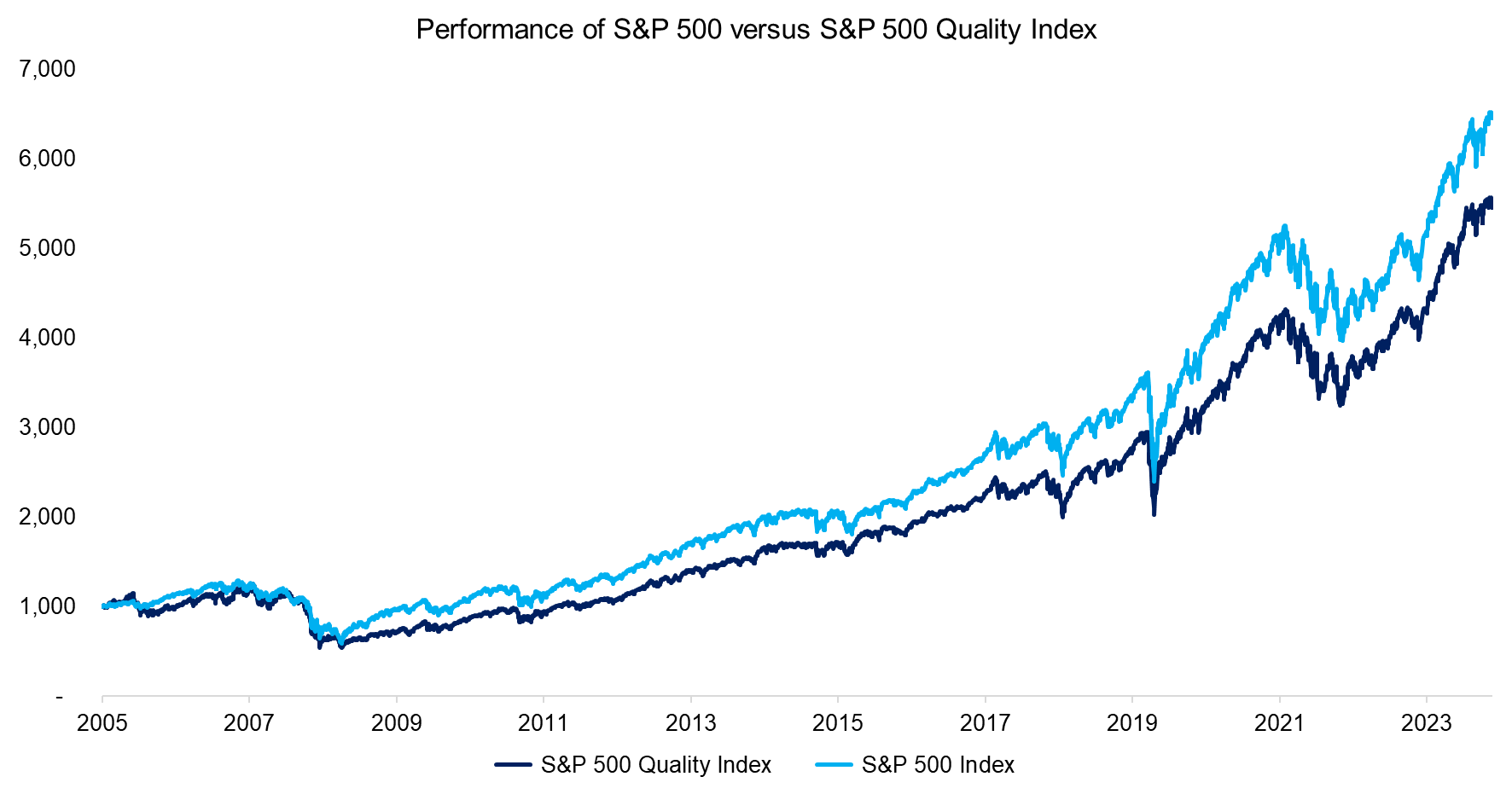

In contrast to the small-cap space, the S&P 500 Quality Index did not outperform the general S&P 500 Index between 2005 and 2024. The S&P 500 Quality Index has a more concentrated portfolio with approximately 130 holdings, features a median ROE of 33% compared to 18% for the S&P 500, and a median DOE of 42% versus 71%.

Source: Finominal

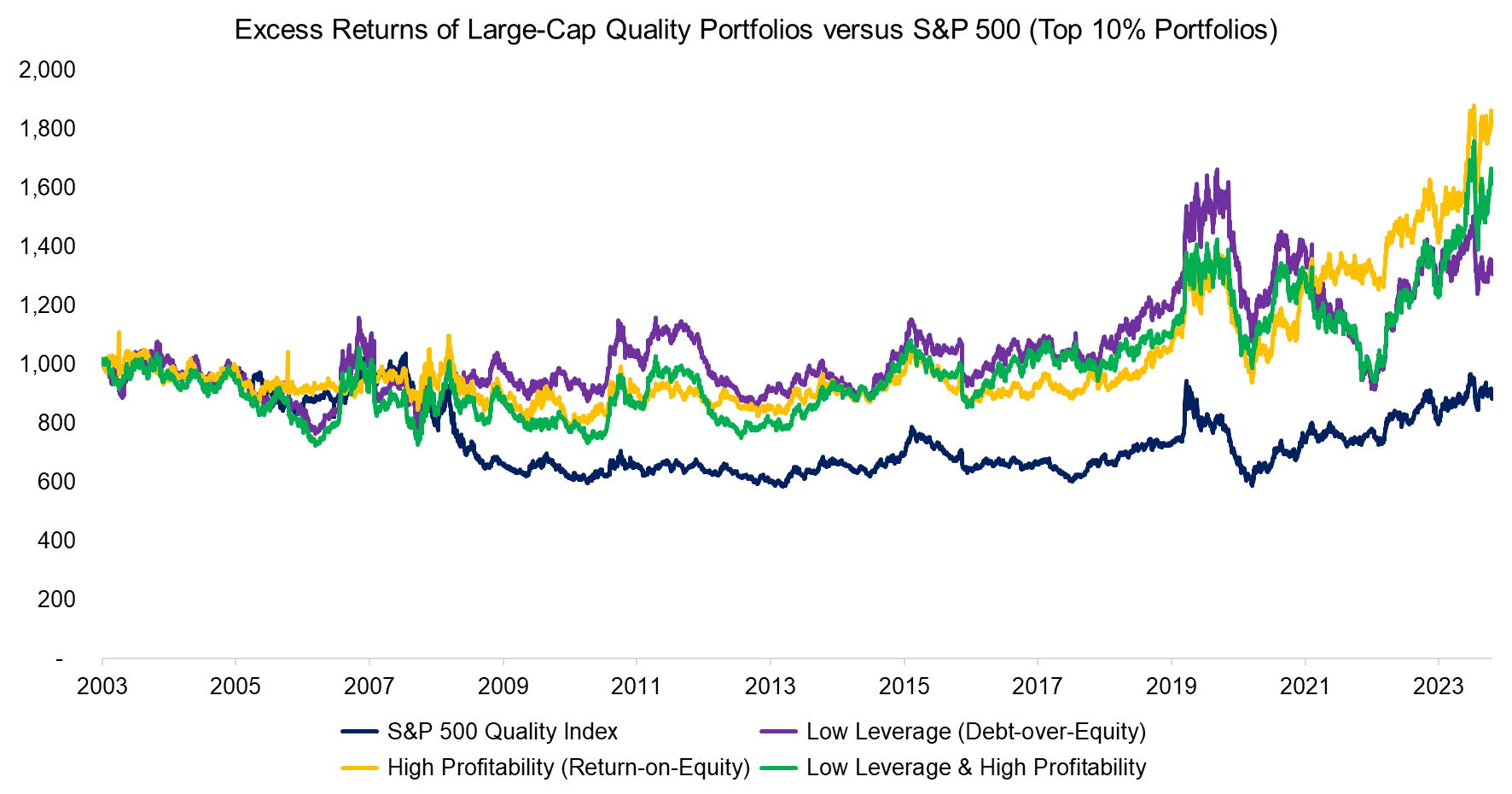

We again create three quality-focused portfolios by selecting U.S. stocks with a minimum market capitalization of $10 billion on ROE, DOE, and a combination of both metrics. We observe that the three portfolios exhibit the same trends in excess returns versus the S&P 500 as the S&P 500 Quality Index, which implies that this index used profitability and leverage in its stock selection process.

However, in contrast to the small-cap space, the excess returns of highly profitable and lowly leveraged companies have been relatively similar, except perhaps in 2022.

Source: Finominal

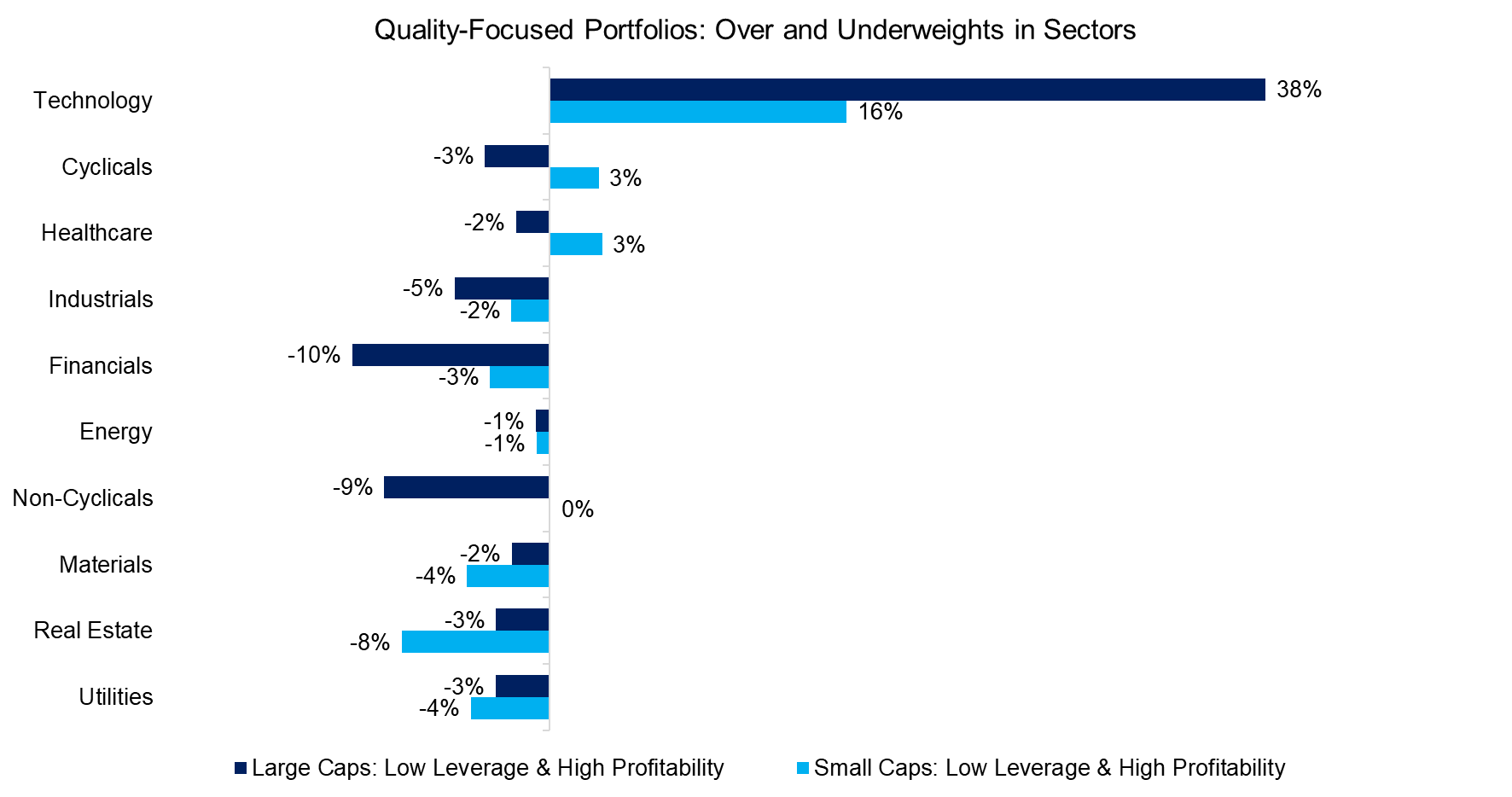

BREAKDOWN BY SECTORS

Next, we analyze the over and underweights of the small and large-cap quality portfolios that were created using a combination of ROE and DOE. As expected, we observe a significant bias toward technology stocks, and underweights to all other sectors. It is worth highlighting that most technology stocks feature low leverage, but not all are profitable, so the definition of quality has a large impact on the stock selection.

Source: Finominal

RISK-ADJUSTED RETURNS OF SMALL & LARGE-CAP QUALITY STOCKS

Although some investors may be disappointed that large-cap quality stocks have not outperformed consistently, this is economically rational as such stocks represent the most successful businesses, so investors should not be compensated with excess returns for holding these.

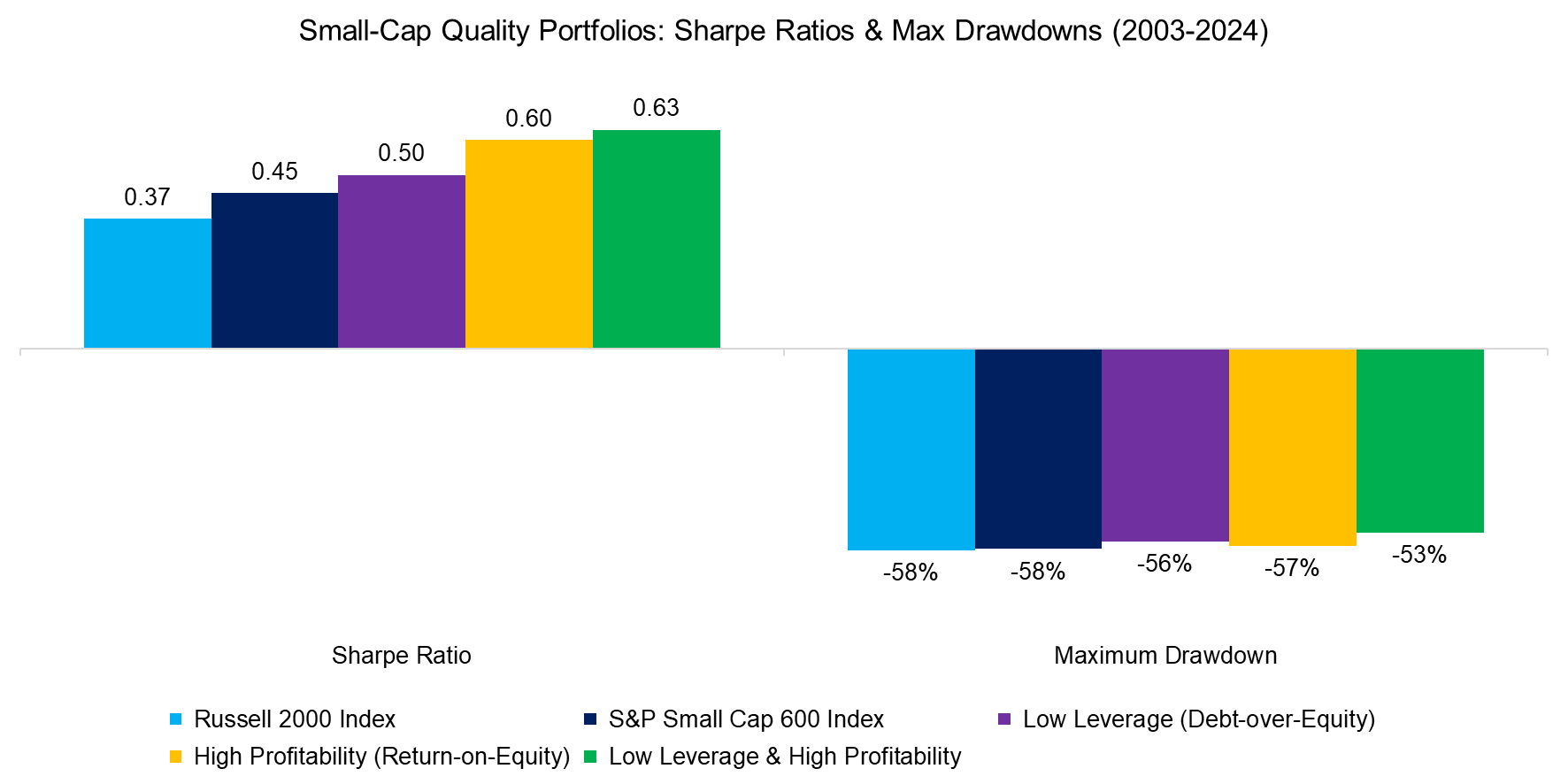

More realistic is to expect higher risk-adjusted returns. We compute the Sharpe ratios and maximum drawdowns for the small-cap quality portfolios, which highlights that adding either profitability or leverage filters would have improved the Sharpe ratios and decreased the maximum drawdowns when compared to the Russell 2000 Index in the period from 2003 to 2024.

Source: Finominal

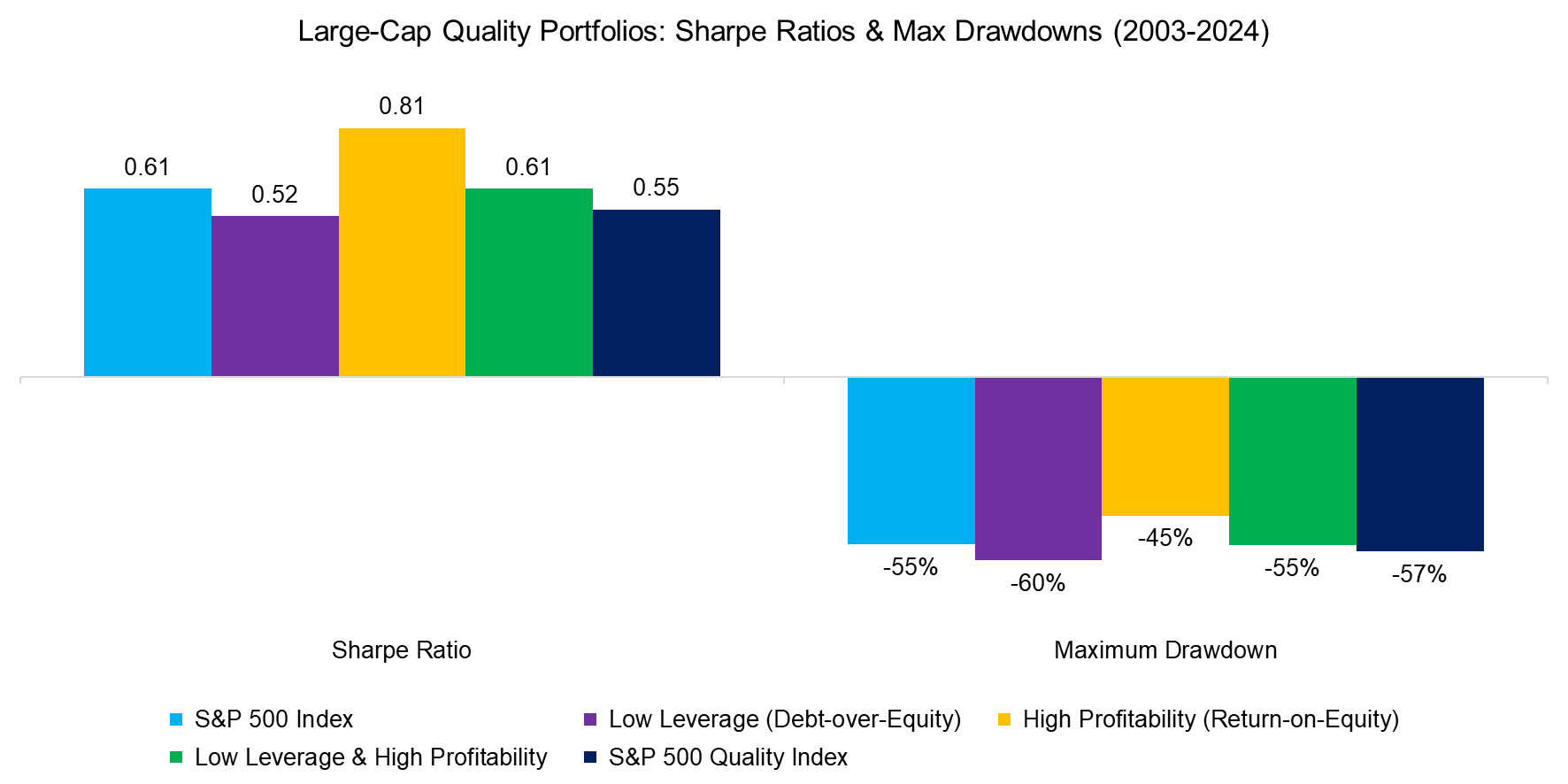

However, the Sharpe ratios and maximum drawdowns of large-cap quality portfolios did not improve, except when selecting stocks based on profitability.

Source: Finominal

FURTHER THOUGHTS

It is somewhat curious that quality filters improved small-cap investing, especially ones focused on profitability. Naturally, many unprofitable small companies will perish, but filtering out all stocks with negative or low profitability also excludes future juggernauts. It is worth recalling that Amazon and Tesla were unprofitable companies for many years.

RELATED RESEARCH

U.S. versus International Quality Stocks

Quality versus Low Volatility ETFs

Oh, Quality, Where Art Thou?

Picking Profitable Companies Can Be Unprofitable

Quality Factor: Zero Alpha for Most Investors

Building a Stock Portfolio for a Debt-Averse World

The Odd Factors: Profitability & Investment

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.