Replicating Funds via S&P 500 & Smart Beta ETFs

Is the whole greater than the sum of the parts?

December 2023. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Mutual funds and ETFs can be replicated via the S&P 500 and long-short factors

- An even simpler replication with the S&P 500 and smart beta ETFs works equally well

- However, this is less effective for long-short or unique strategies

INTRODUCTION

Almost all investment products are bets on economic growth. Neither stocks, bonds, commodities, nor private asset classes like venture capital or private equity will do well when the economy is heading into a recession. Given this, most investment products can be decomposed into equities plus something, where a surprising number of asset classes and strategies like CLOs or convertible bonds represent nothing more than combinations of the S&P 500 and cash (read CLOs – Diversifier, or another Equity Clone? and Don’t Convert to Convertible Bonds).

Naturally this “something” can create value for investors in some cases, eg factor exposures that are desirable. Unfortunately for active fund managers, capital allocators have increasingly more tools at their disposal to dissect track records and replicate strategies using cheaper instruments.

In this research article, we will attempt to replicate factor-focused funds using smart beta ETFs.

MUTUAL FUND REPLICATION

We use the Homestead Value Fund (HOVLX) as a case study in this analysis. The fund has a concentrated portfolio of 47 stocks that are selected on trading at low valuations, manages $800 million of assets, and charges a management fee of 0.62% per annum, which is relatively reasonable for an active value-focused mutual fund.

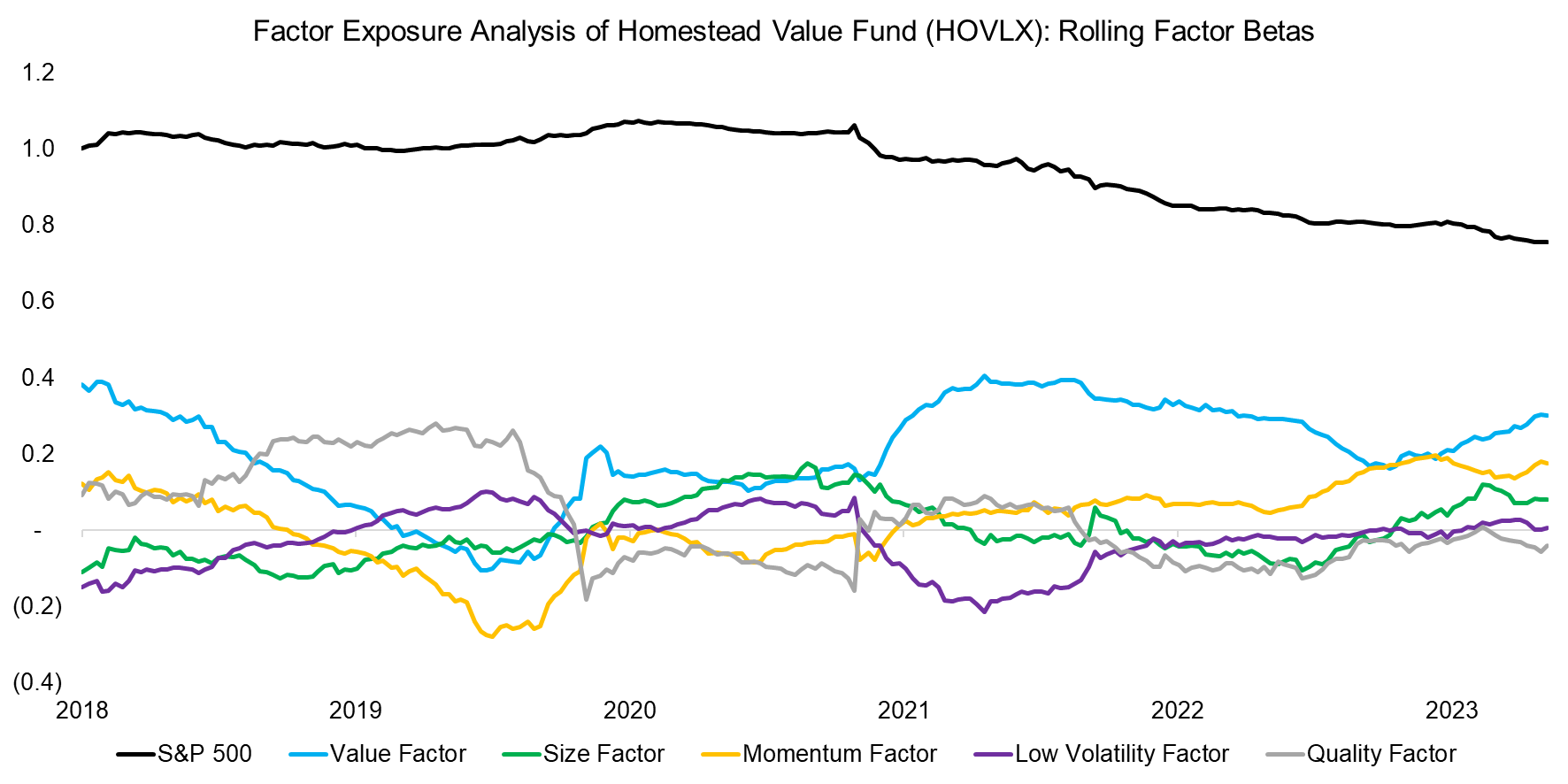

First, we run a factor exposure analysis for the last five years that highlights positive exposure to the value factor, and negligible exposures to other factors, in line with its investment philosophy. However, the beta to the S&P 500 was 0.96, which underlines that the fund is largely a bet on the U.S. stock market.

Source: Finominal

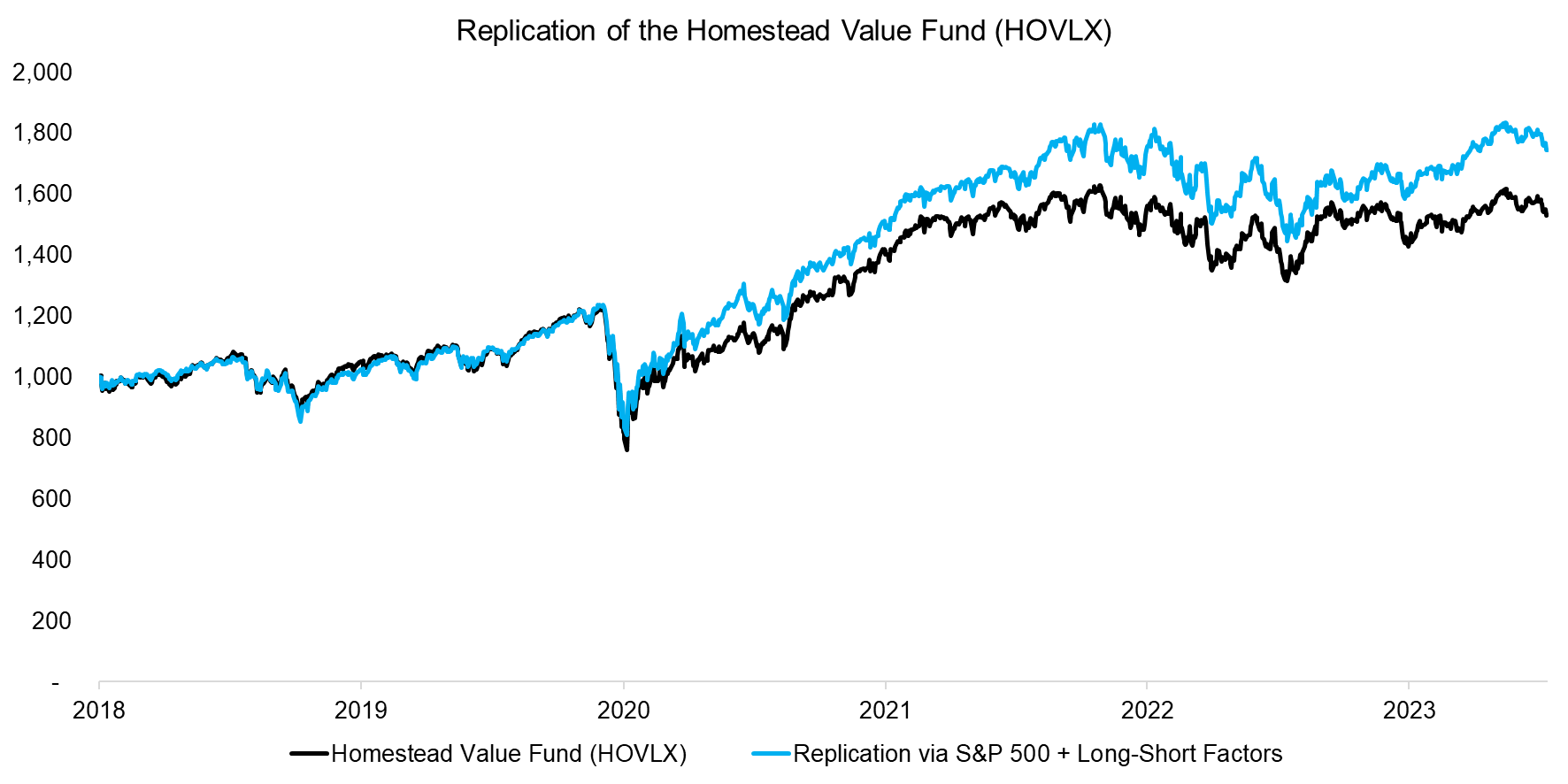

Next, we create a replication index for HOVLX using betas with a 12-month lookback from a regression analysis that features the S&P 500 and five long-short equity factors as independent variables. The index is calculated by taking the betas from the previous month, in order to make this an implementable approach.

We observe that the replication index almost perfectly replicated the performance of the Homestead Value Fund in the period from 2018 to 2023, which is underpinned by a correlation of 0.97.

Source: Finominal

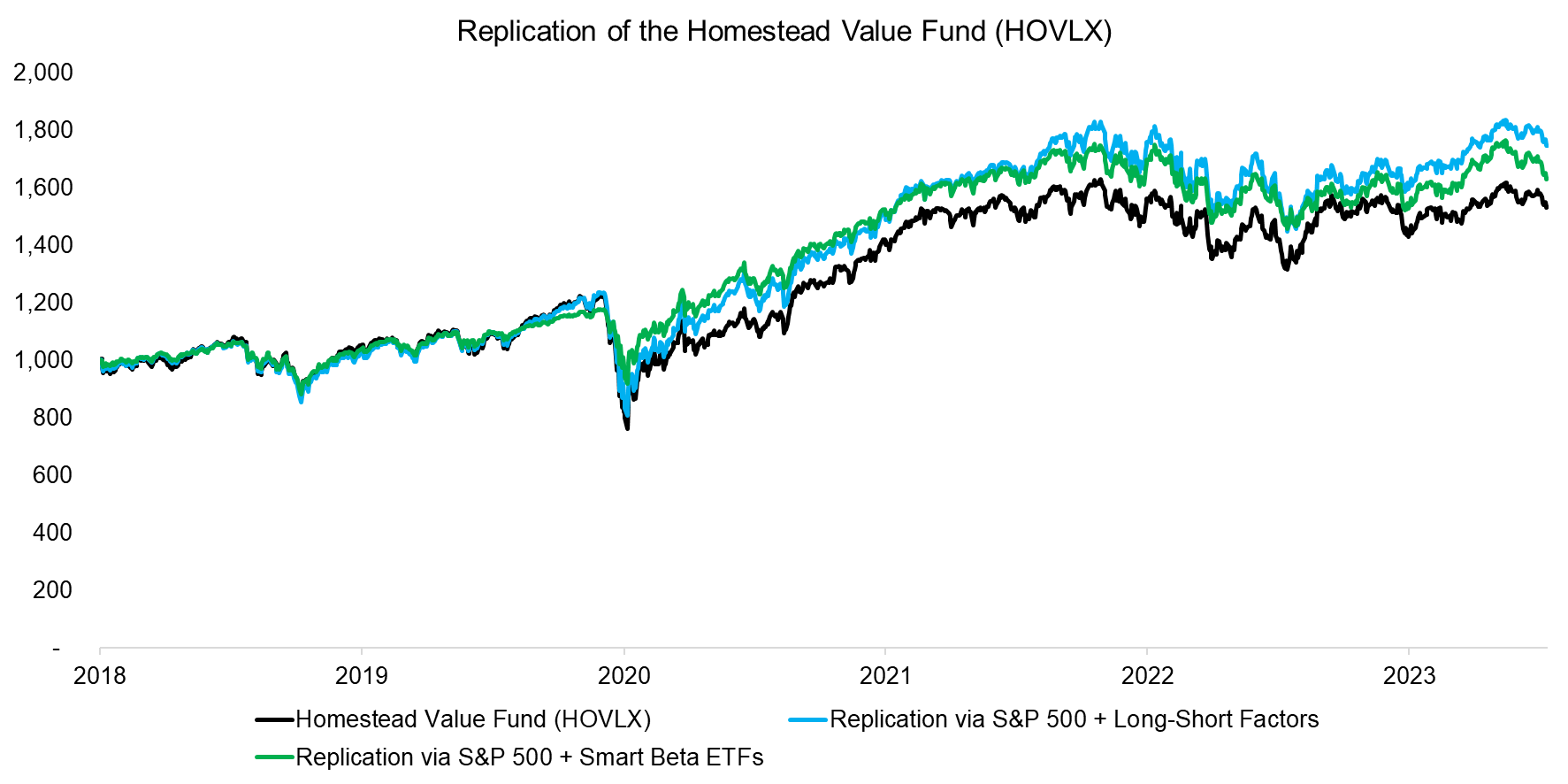

However, although the replication was close to the actual returns of the fund, most investors do not have access to individual long-short equity factors, which are primarily offered to institutional investors by investment banks. Given this, we replace the five long-short factors with five smart beta ETFs that act as proxies.

We observe that a replication using smart beta ETFs instead of long-short equity factors would have been almost equally successful.

Source: Finominal

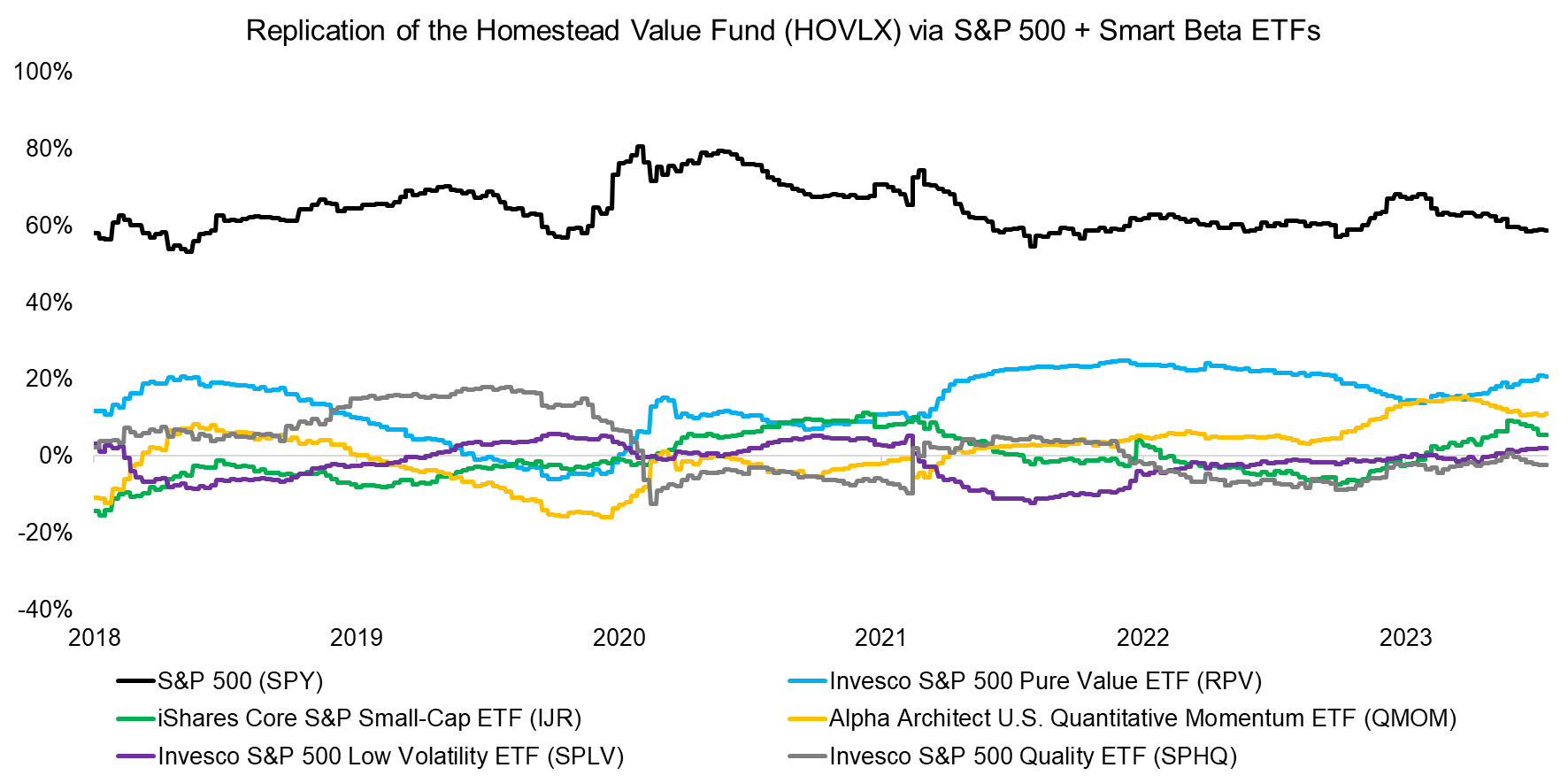

However, investors need to be aware that this would have required investors to short smart beta ETFs as some of the factor exposures were negative. Although shorting ETFs is not very easy, it is easier than signing an ISDA with an investment bank to get exposure to long-short equity factors via risk premia indices.

Source: Finominal

EXPANDING THE ANALYSIS

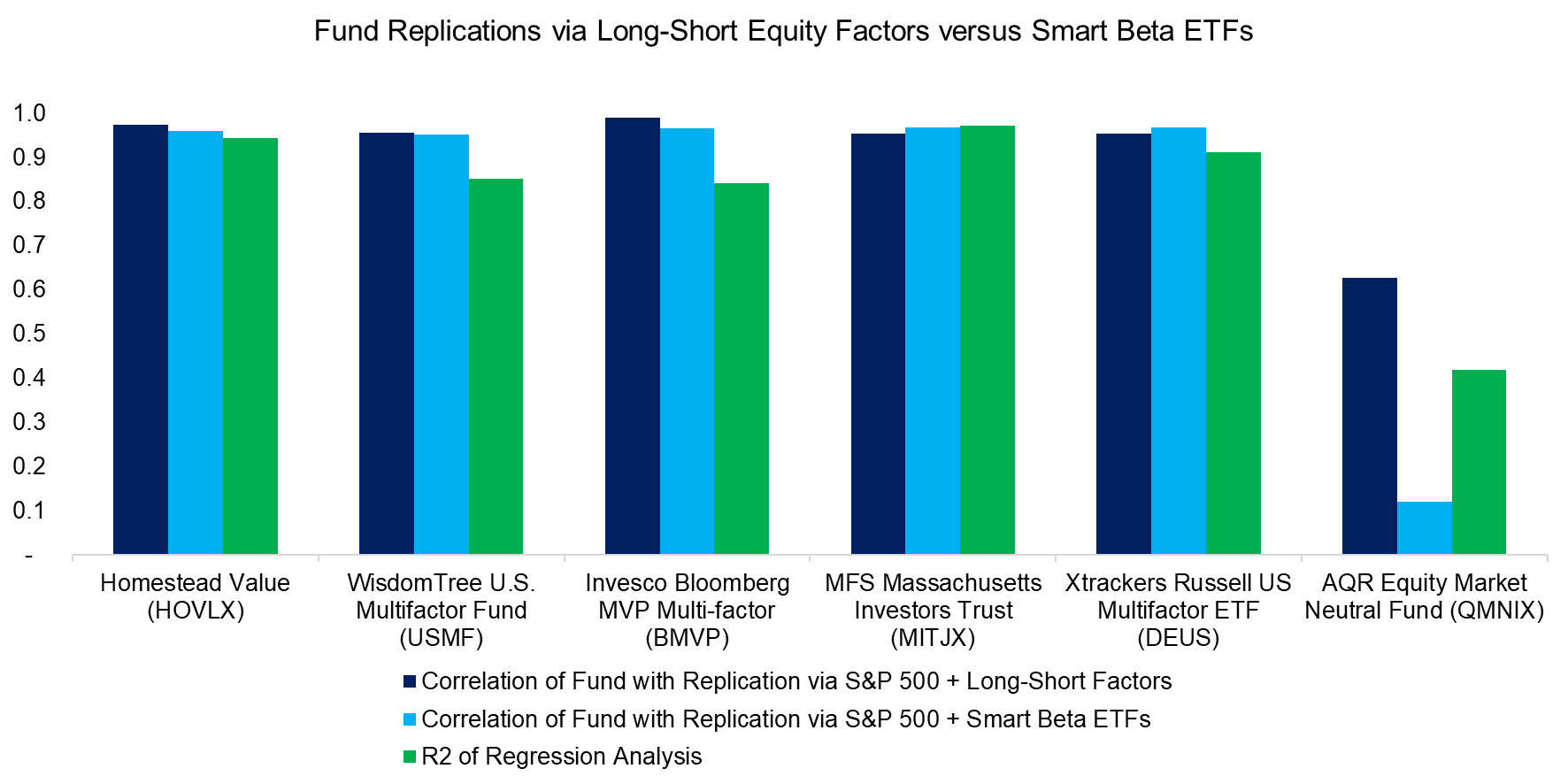

We expand our analysis from one to six funds and create replication indices for each of these. We observe that the correlations of the funds to their replication indices were close to one, regardless if long-short equity factors or smart beta ETFs were used. The only exception is the AQR Equity Market Neutral Fund (QMNIX), which is a long-short multi-factor fund.

Source: Finominal

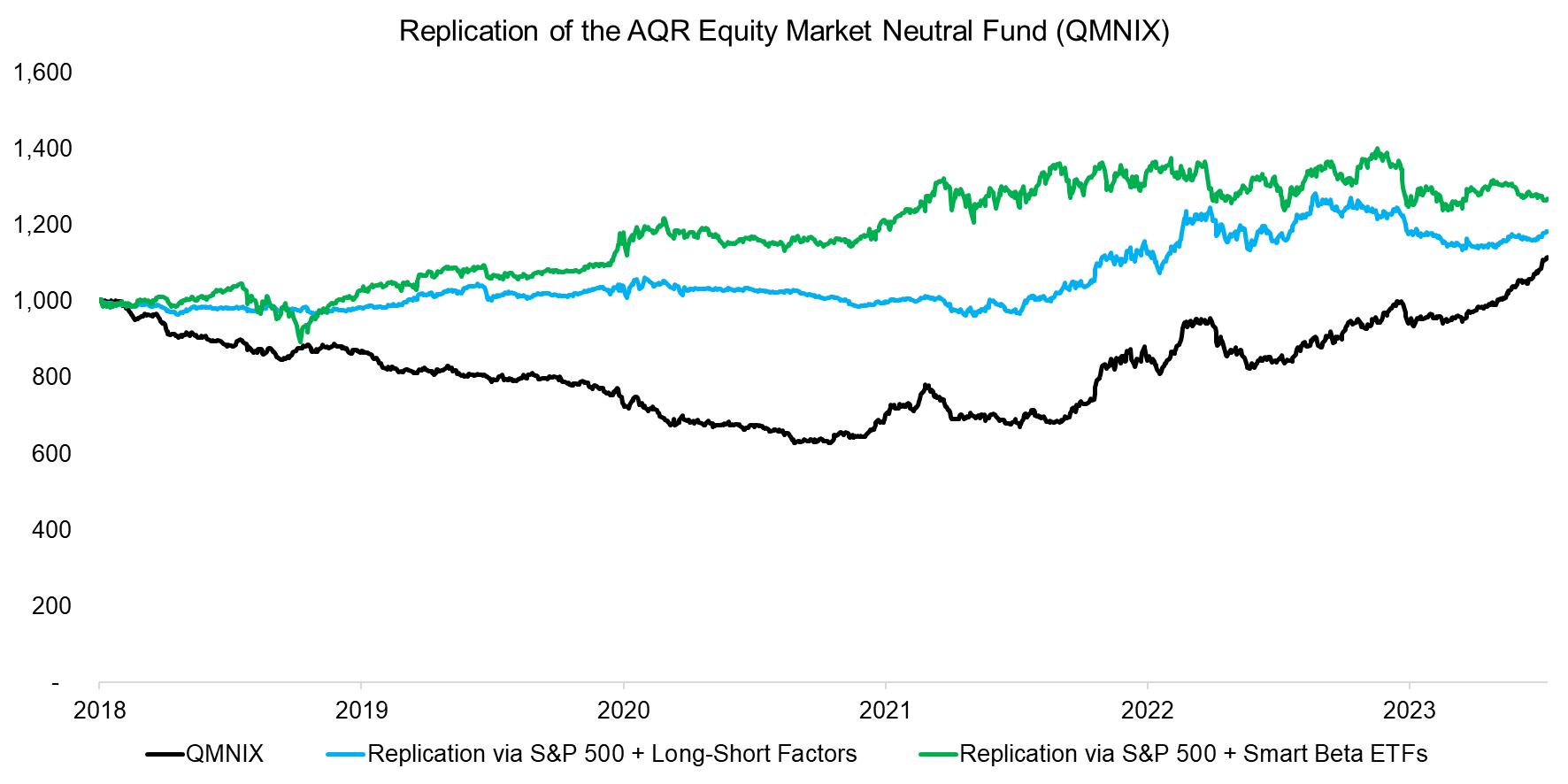

It is not surprising that our replication index comprised of the S&P 500 and smart beta ETFs fails to provide the same returns as the AQR Equity Market Neutral Fund (QMNIX) as smart beta ETFs represent long-only exposures and not beta-neutral long-short factors. However, it is curious that the replication index using the S&P 500 and equity factors was not more highly correlated to QMNIX as the fund offers precisely such exposures.

Source: Finominal

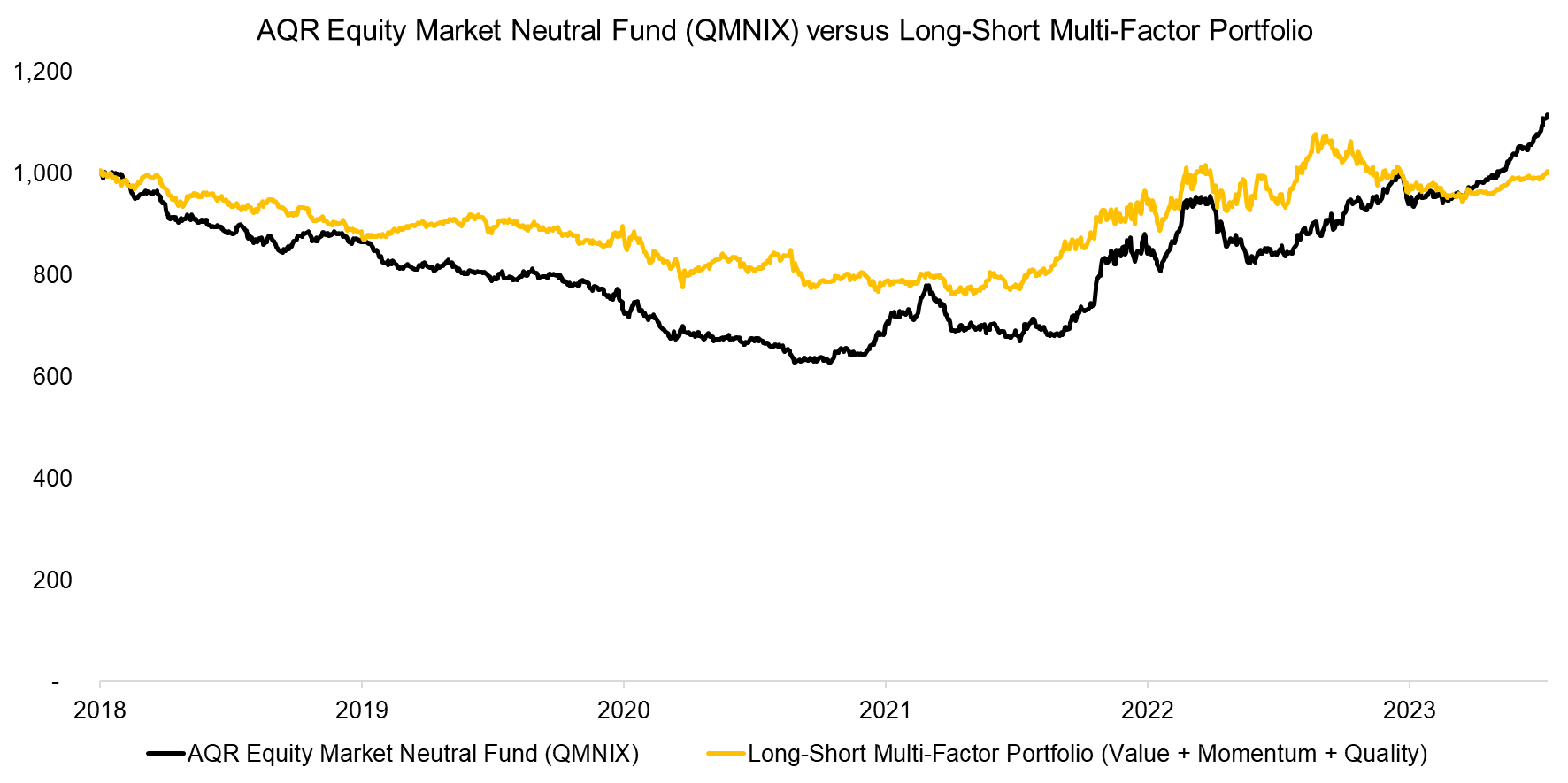

In fact, QMNIX can be replicated pretty easily via a combination portfolio of just three long-short factors, namely value, momentum, and quality. Given this, it is difficult to explain why this could not have been achieved via the regression-based replication approach (read Quant Strategies: Theory vs Reality).

Source: Finominal

FURTHER THOUGHTS

It seems that we can replicate factor-focused funds via the S&P 500 and smart beta ETFs, which enables capital allocators to replace attractive, but expensive funds with cheaper replication portfolios.

However, we also saw that this approach was ineffective for a long-short multi-factor fund, and it would also have not worked well for funds with unique exposures, eg an energy-focused fund. For this to be successful, the regression analysis would need to be expanded to include more variables like oil, gold, duration, or volatility, but this would increase the complexity, which is the opposite of what a replication index aims to achieve.

RELATED RESEARCH

Hedge Funds versus Hedge Fund Replication ETFs

Replicating Famous Hedge Funds

Smart Beta vs Alpha + Beta

Factor Exposure Analysis 108: Fixed Income Factors II

Factor Exposure Analysis 106: Macro Variables

Factor Exposure Analysis 102: More or Less Independent Variables?

Factor Exposure Analysis 101: Linear vs Lasso Regression

Factor Exposure Analysis 100: Holdings vs Regression-Based

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.