Resist the Siren Call of High Dividend Yields

The Dividend Factor Tends to Yield Negative Returns

October 2017. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Buying high yielding and selling low yielding stocks has been an attractive strategy since 2000

- However, it has been a highly unattractive strategy over the last century

- Investors should resist the Siren call of high yielding stocks and focus on other factors

INTRODUCTION

The search for yield has led investors and savers to consider quite adventurous investments in recent years. One contender for the top 10 list of most risky investments might be Argentina’s 100-year bonds given that the country defaulted on their bonds not too long ago. Mozambique’s bonds for its fleet of tuna ships could also be considered. In equity markets product providers have serviced the demand for yield by issuing dividend yielding products and about 20% of all smart beta ETFs are dedicated to this investment style. Given the immense interest in these products it’s worth evaluating the soundness of this strategy. In this short research note we will analyze the Dividend Yield factor across the globe.

METHODOLOGY

We focus on the Dividend Yield factor, which buys high yielding and shorts low yielding stocks, in all developed markets in Asia, Europe, and the US. We exclude any stocks with zero dividend yields. The factor is constructed as a beta-neutral long-short portfolio by taking the top and bottom 10% of the stock universe in the US, Europe and Japan and 20% in smaller stock markets. The analysis covers the period from 2000 to 2017 and includes costs of 10 bps per transactions.

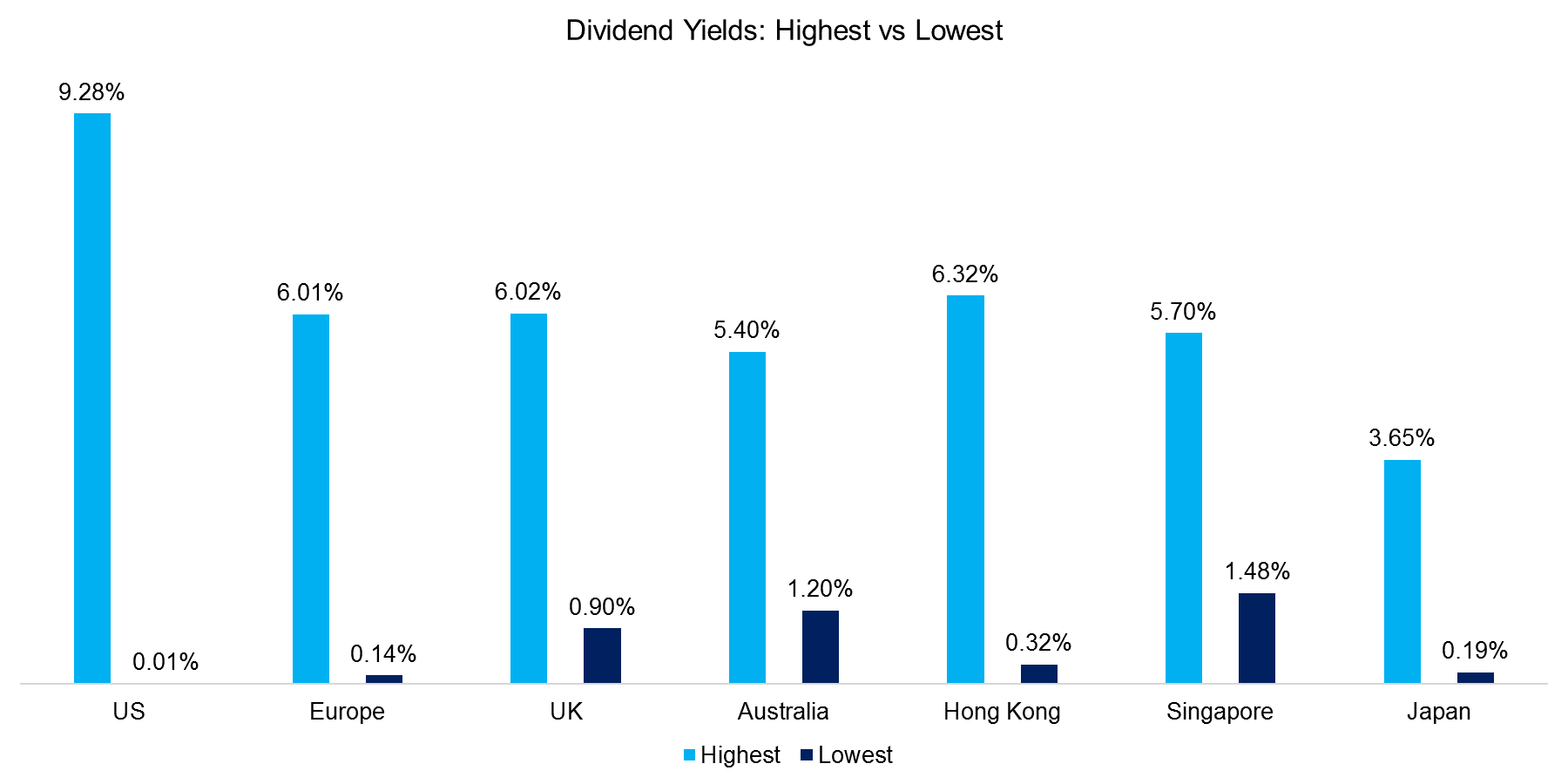

DIVIDEND YIELDS ACROSS THE GLOBE

The chart below shows the dividend yields for the portfolios with the highest and lowest yields across the globe. We can observe the largest discrepancy between high and low yielding stocks in the US, where some sectors, e.g. the Master Limited Partnerships (MLPs) of the energy sector, offer remarkably high dividend yields. Japan offers the lowest spread, which is to be expected given that the country’s central bank has pursued a low interest rate strategy for two decades.

Source: FactorResearch

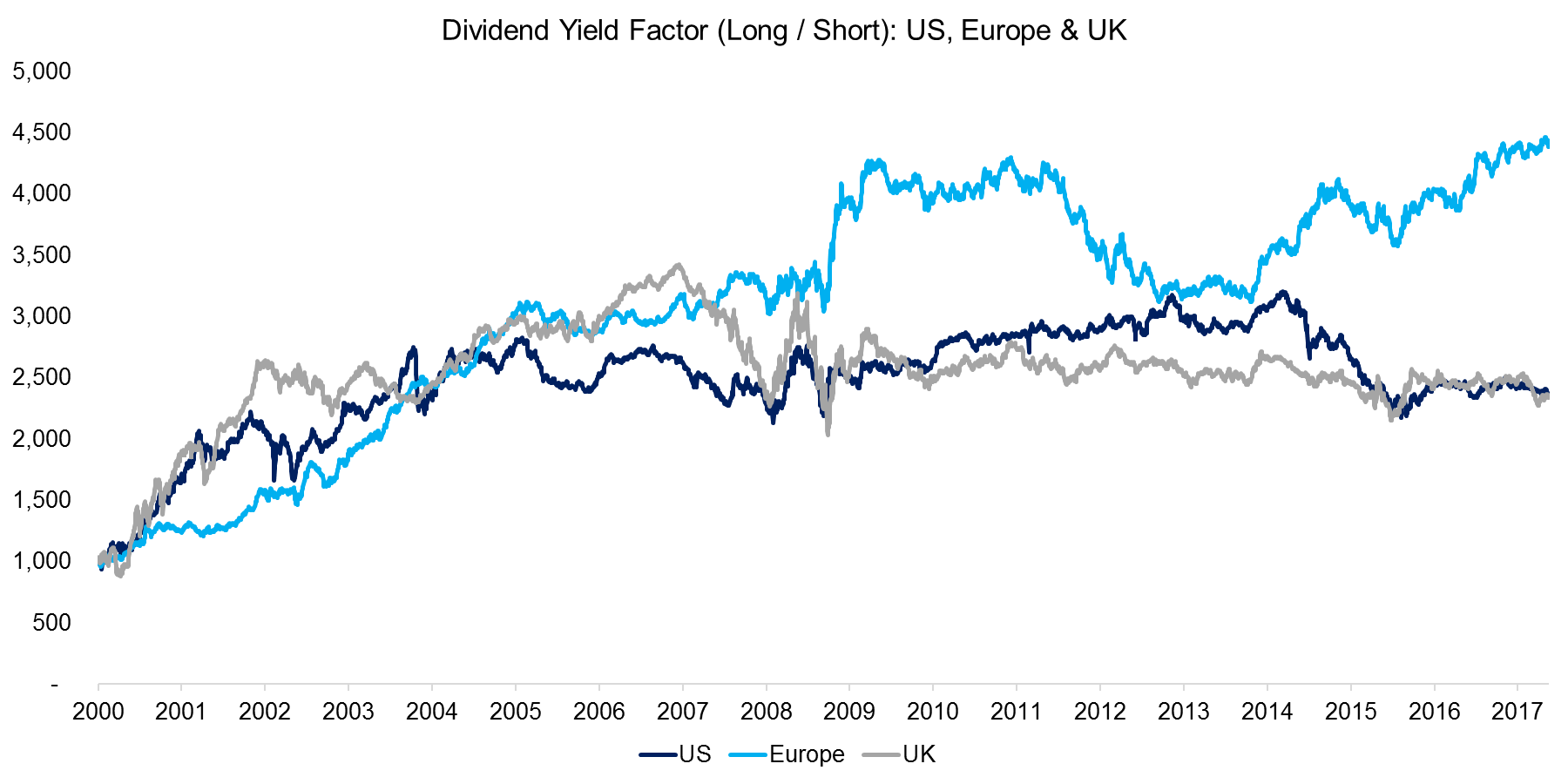

DIVIDEND YIELD FACTOR: US, EUROPE & UK

The next chart shows the Dividend Yield factor in the US, Europe and the UK. The factor performance has been positive between 2000 and 2017 and features similar trends across the three regions. In the most recent years the performance has been significantly better in Europe, likely driven by the aggressive monetary policies of the European Central Bank (ECB), where investors have been forced to seek yielding investments elsewhere given low interest rates on their savings accounts.

Source: FactorResearch

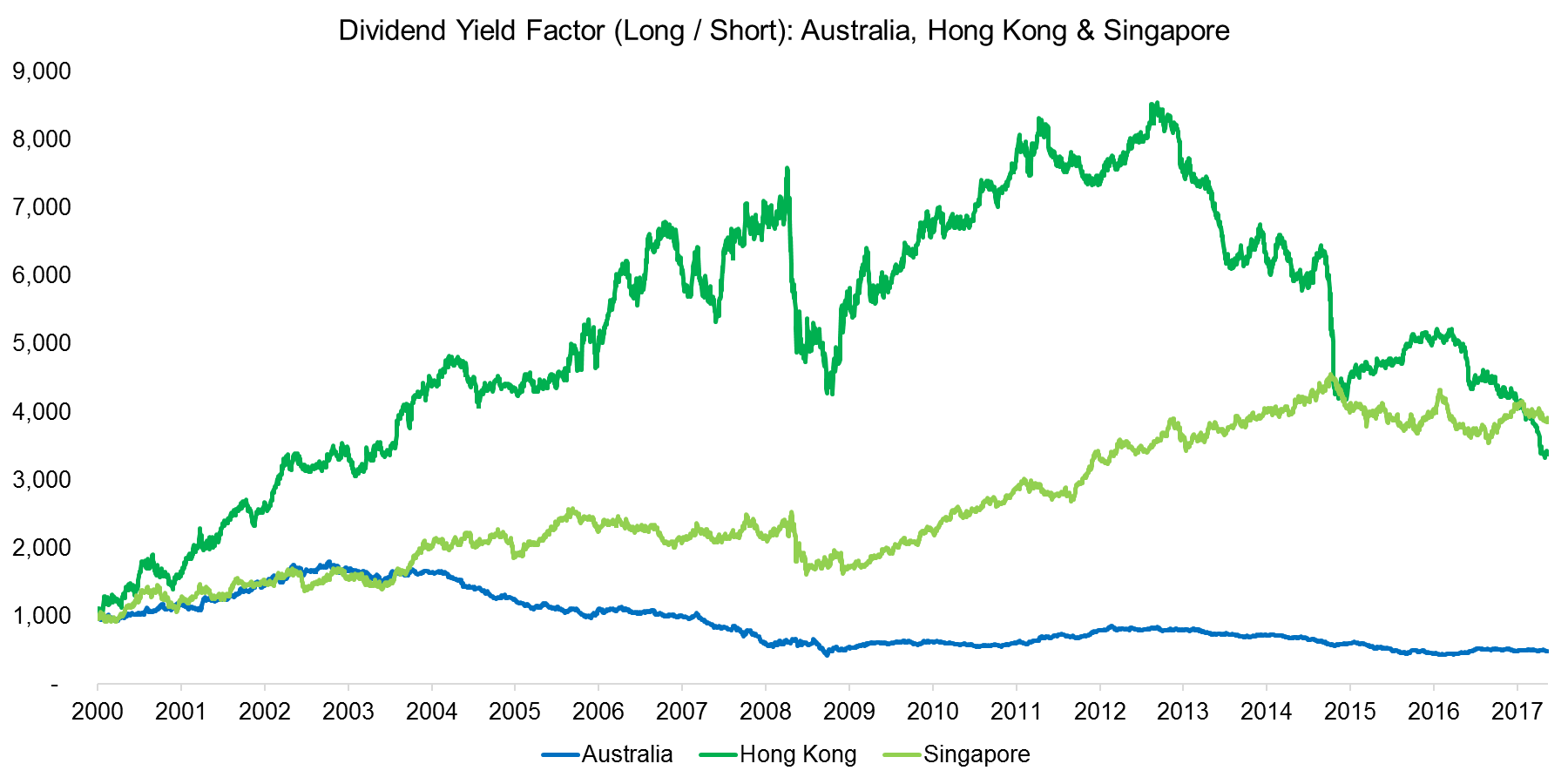

DIVIDEND YIELD FACTOR: AUSTRALIA, HONG KONG & SINGAPORE

The performance of the Dividend Yield factor varies across Australia, Hong Kong and Singapore. It is worth highlighting that the stock universes are relatively small in these markets and the dividend policies quite diverse, e.g. companies in Hong Kong and Singapore occasionally issue special dividends, which make dividend yields more volatile and difficult to predict compared to those in Australia, where companies tend to pay stable dividends.

Source: FactorResearch

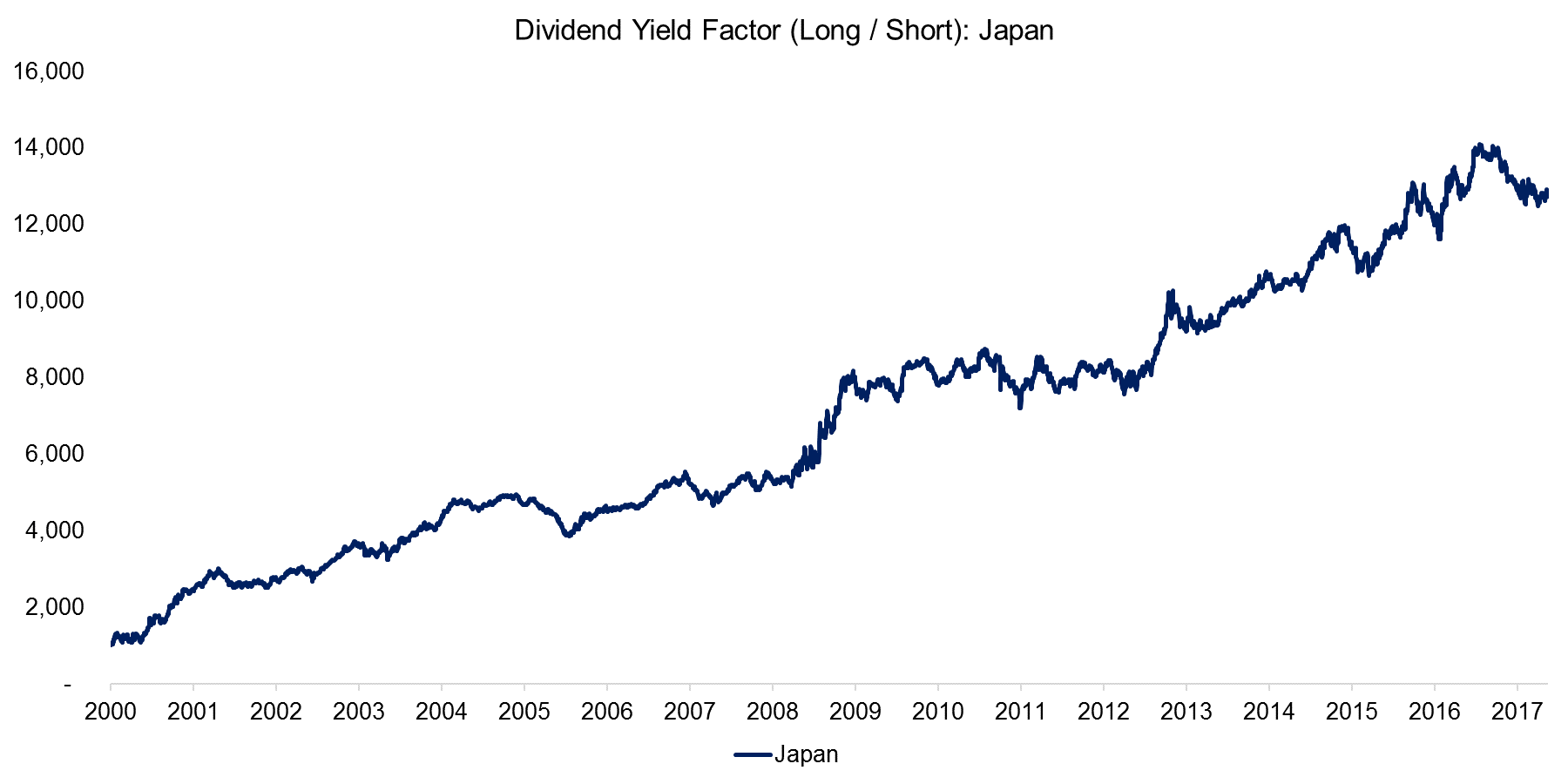

DIVIDEND YIELD FACTOR: JAPAN

Japan is the undisputed winner in terms of performance compared to the other developed markets. The factor has shown a consistent positive performance since 2000 with relatively few periods of drawdowns. Given that Japan has tried to stimulate its economy by pursuing a low interest rate policy for a couple of decades, the search for yield is well established in the country. However, Japanese bond yields are currently providing zero or negative yields and the highest dividend yields are 3.6% on average, so it might be questionable how much further room for yield compression there is (read Equity Factors In Japan).

Source: FactorResearch

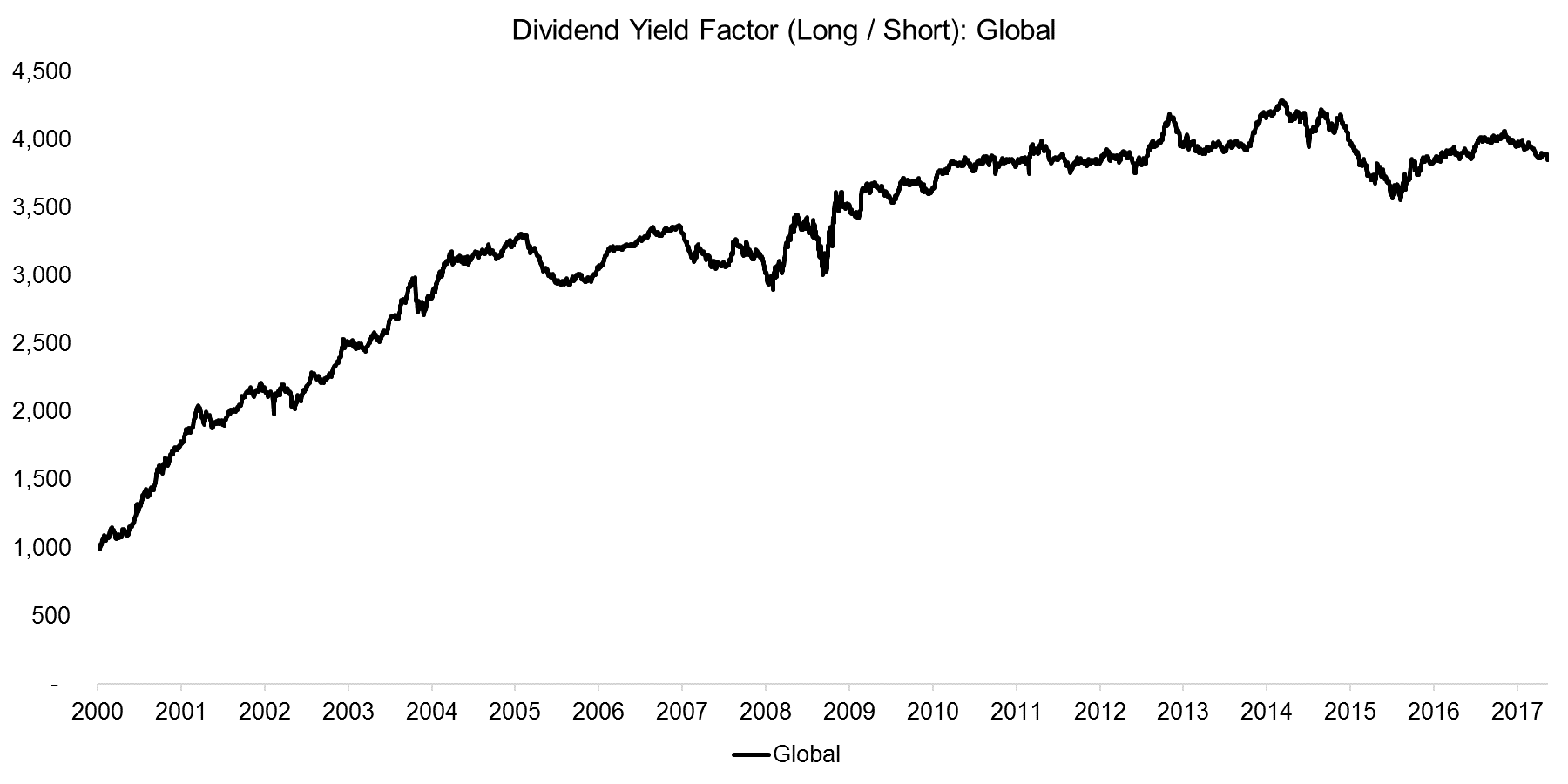

DIVIDEND YIELD FACTOR: GLOBAL

Next we combine the country factor profiles weighted by the number of stocks per country and create a global Dividend Yield factor portfolio. We can observe a strong performance between 2000 and the start of the Global Financial Crisis in 2008 & 2009 as well as a more muted performance thereafter. However, the chart is somewhat deceiving as before 2000 the Dividend Yield factor experienced a significant drawdown in the Tech bubble, where investors had a strong preference for low or zero yielding technology companies.

Source: FactorResearch

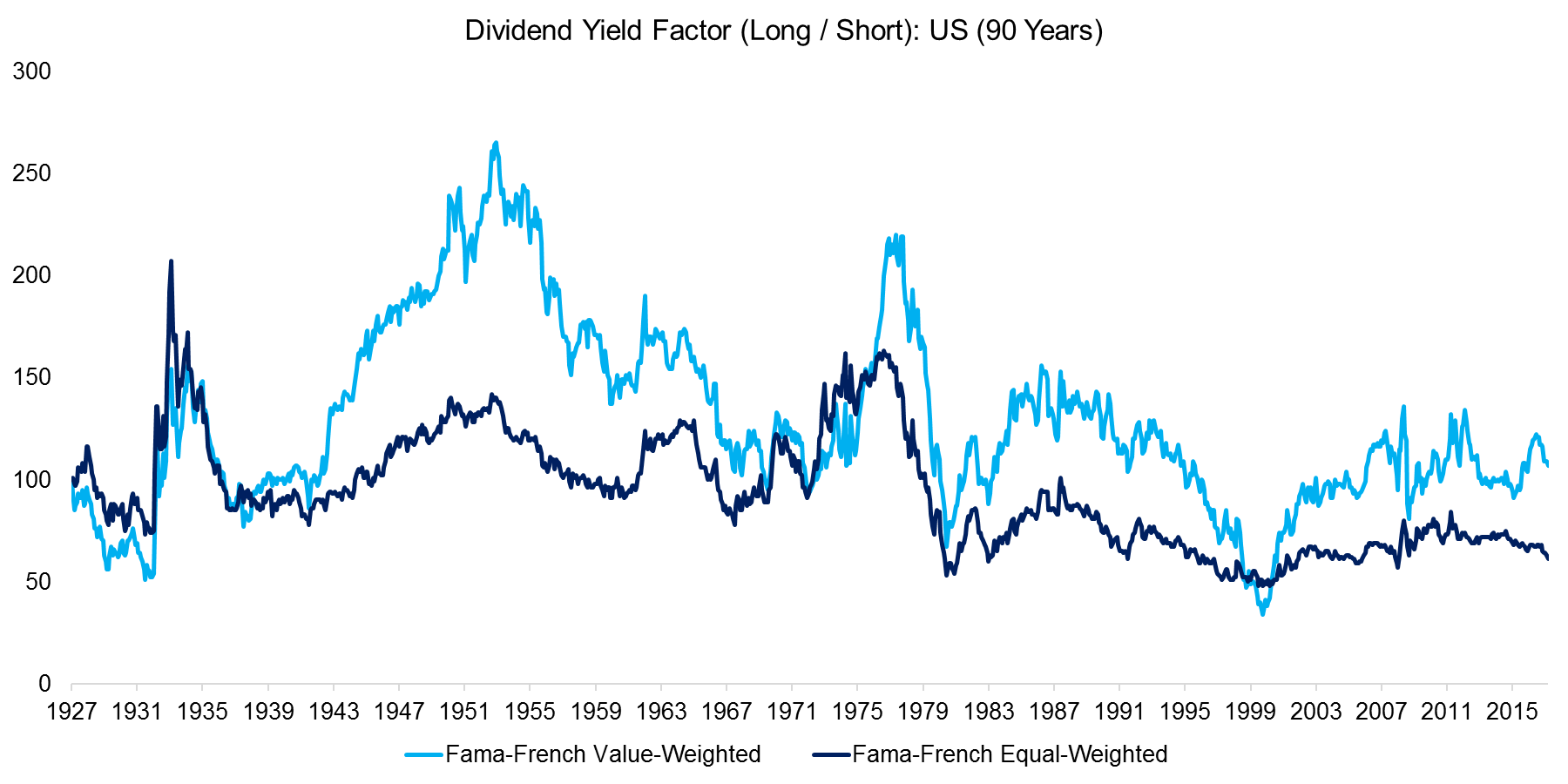

DIVIDEND YIELD FACTOR US: EXTENDING THE LOOKBACK

The results so far indicate that buying high yielding stocks might be an attractive strategy. We can extend the analysis by using Fama-French data all the way back to 1926. Although we can indeed see that the factor has generated positive returns the last 20 years, we can also observe several decade-long periods of significant drawdowns. It’s worth highlighting that the performance excludes transaction costs, is before taxes, which have a more negative impact on high than low yielding stocks, and before inflation. Given that the total return (pre-transaction costs, pre-tax and pre-inflation) is approximately zero after 90 years, the Dividend Yield factor does not seem attractive.

Source: FactorResearch

FURTHER THOUGHTS

This short research note highlights that although the Dividend Yield factor generated positive returns over last 20 years, the 90-year track record is highly unattractive. Investors might speculate that more countries become Japan-like given record levels of debt and poor demographics, which would likely force central banks to keep interest rates low and the search for yield high. However, interest rates are already low or negative and other factors exhibit much more consistent returns. It would be best for investors to resist the Siren call of high yielding stocks.

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.