Risk-Managed Equity Exposure II

One ETF to rule them all?

March 2022. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Relying on single entry and exit signals for trading introduces model risk

- However, simple tactical asset allocation strategies are surprisingly robust

- Necessity of signal diversification is questionable

INTRODUCTION

Last week, we explored a simple risk management system for an equity allocation that might be suitable for investors with a cautious outlook on stock markets. Given record-high valuation multiples, all-time high debt levels, and poor demographics in most countries, the stock returns for the next 20 years will likely be less attractive than those of the previous two decades. Caution is warranted (read Risk-Managed Equity Exposure).

Our analysis highlighted that using a simple 200-day trend system would have increased the Sharpe ratios and reduced drawdowns of an equity allocation in the period from 1985 to 2021. Sweet and simple.

However, plenty of questions remain on such a strategy. How robust is this methodology? Is it implementable from a practical and behavioral perspective?

In this research note, we will continue our journey of exploring a risk management strategy for an equity allocation that is as simple as possible.

WHAT IS THE BENEFIT OF RISK MANAGEMENT FOR EQUITIES?

From a historic perspective, risk management for equities was unnecessary for most investors in the US as bonds provided attractive and mostly negatively correlated returns, which generated attractive diversification benefits over the last few decades (read No Longer Superheroes? Twilight of the Bonds).

However, lower bond yields globally have made fixed-income allocations less attractive. Also, correlations between stocks and bonds were not always negative and in certain periods both asset classes fell simultaneously. Stated differently, investors should consider additional risk management strategies for equities going forward.

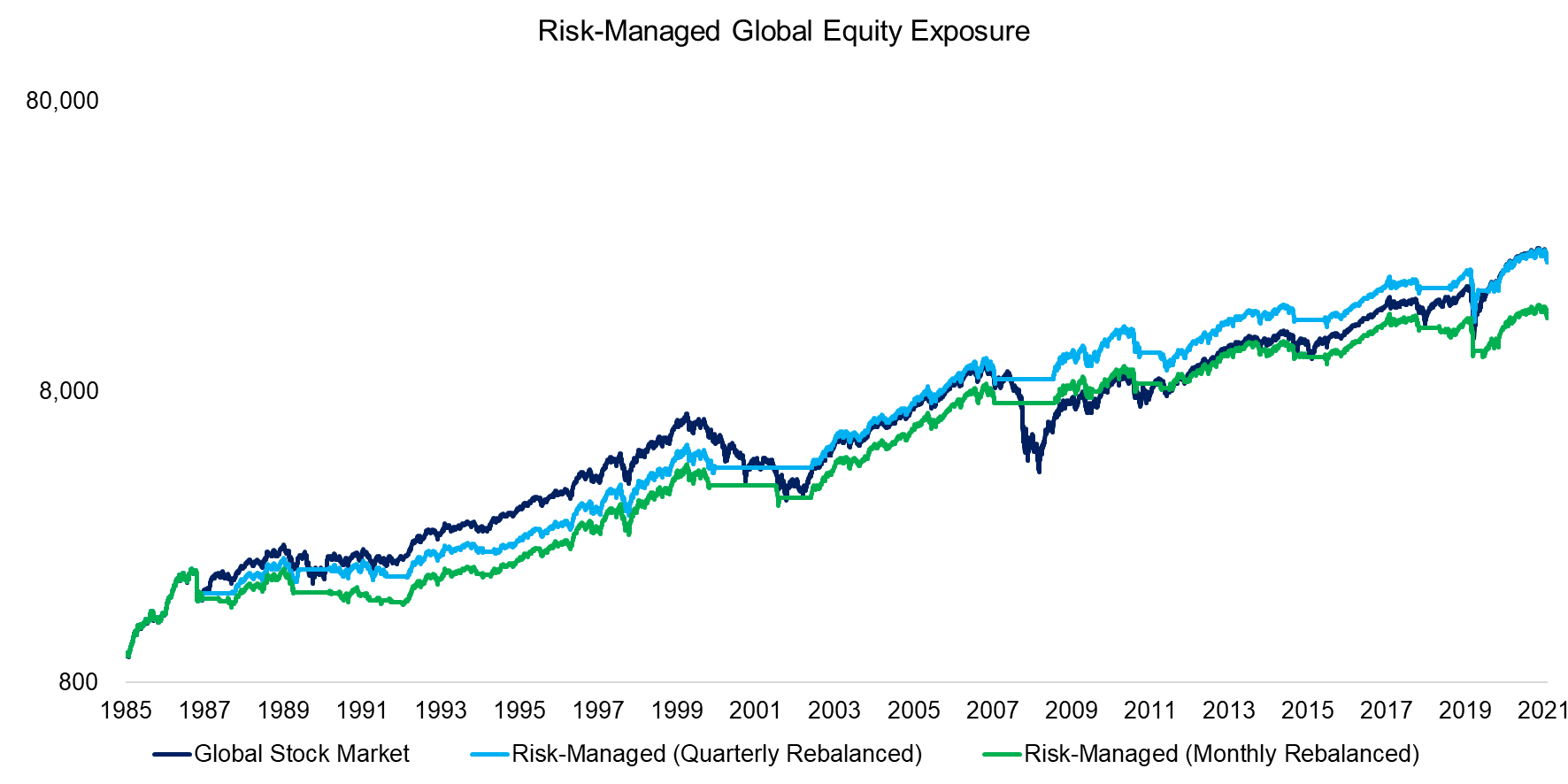

A simple strategy is to allocate 100% to equities when the trend is positive, eg by using a 200-day lookback, and moving to cash when negative. Applying such a strategy with daily rebalancing would not be particularly expensive today given low costs for trading futures and ETFs, but operationally slightly burdensome for most investors, compared to monthly or quarterly rebalancing. We therefore focus on less frequent rebalancing and observe that such risk-managed global equity portfolios would have approximately resulted in the same return as the global stock market in the period between 1985 and 2021.

We also notice that such a strategy did not protect investors against sudden stock market crashes like in 1987 or in 2020 during the COVID-19 crisis, so is not a tail risk strategy. However, it would have significantly reduced the drawdowns during bear markets like in 2001 and 2009.

Source: FactorResearch

PORTFOLIO CONSTRUCTION CONSIDERATIONS

Although diversification across asset classes has become more challenging, it naturally remains an essential concept when considering the portfolio construction of strategies. There is a significant model risk when relying on a single signal like the 200-day trend for timing the entry and exit for an asset class like equities.

Given this, it might be better to apply the risk management strategy not to a global equities portfolio, but to all major stock markets, or even on a country basis. The hope is to mitigate the model risk by diversifying the signal.

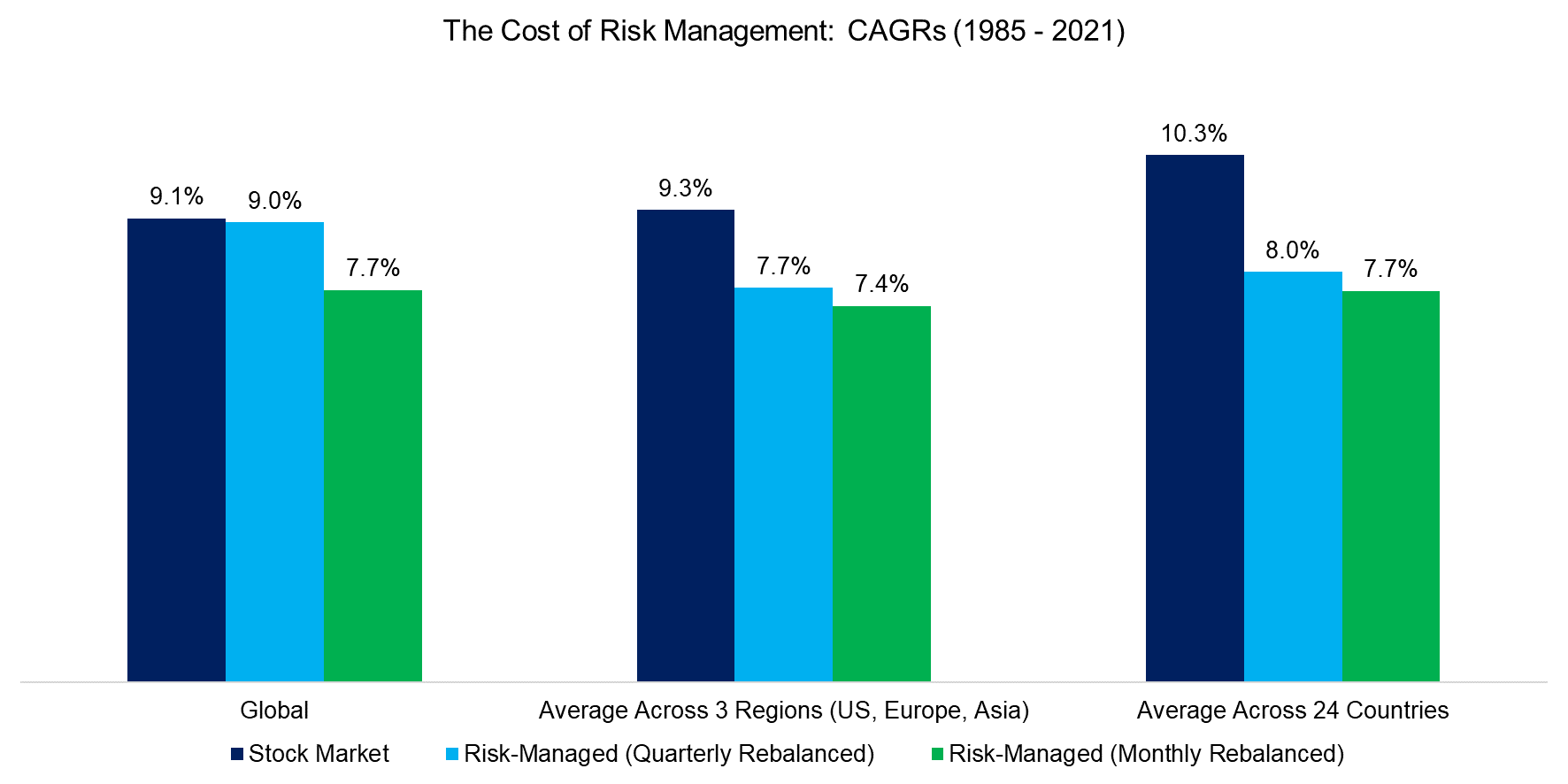

We calculate the CAGRs for the stock market and risk-managed portfolios for the three major economic regions, ie the US, Europe, and Asia, as well across 24 developed stock markets. We observe that all risk-managed portfolios generated lower returns in the period from 1985 to 2021 compared to the global stock market. However, there are no significant differences between using monthly or quarterly rebalancing, or applying the system across regions or countries.

Source: FactorResearch

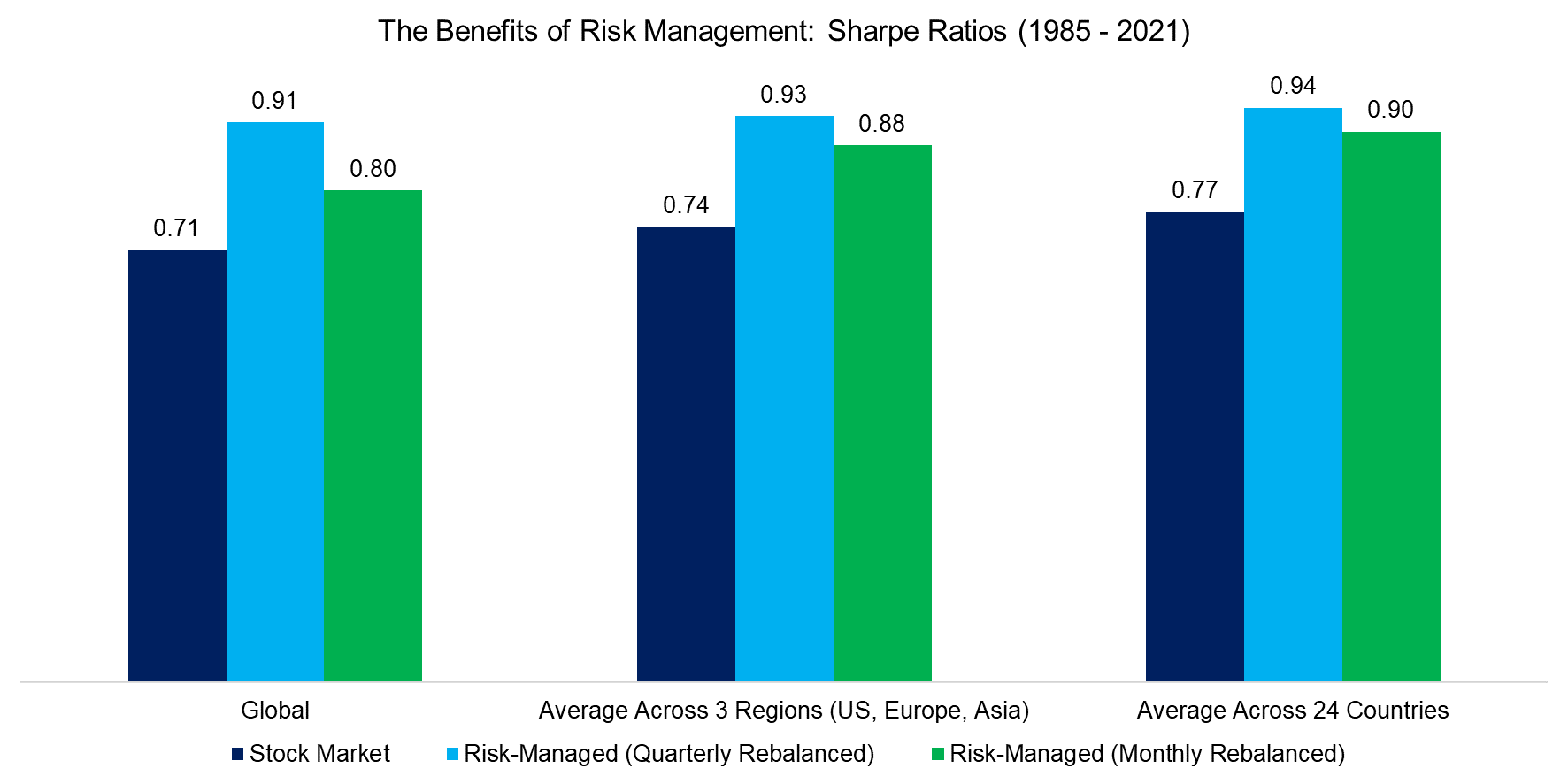

Next, we turn to risk-adjusted returns, which highlights that all risk-managed portfolios generated higher Sharpe ratios than the plain-vanilla equity portfolios. Quarterly rebalancing was consistently better than monthly rebalancing, but we should not read too much into these results as these slightly change when changing the observation period, the starting and end dates of the analysis, etc. It is about the big picture that shows risk-managed portfolios generated higher risk-adjusted returns, despite lower absolute returns.

Source: FactorResearch

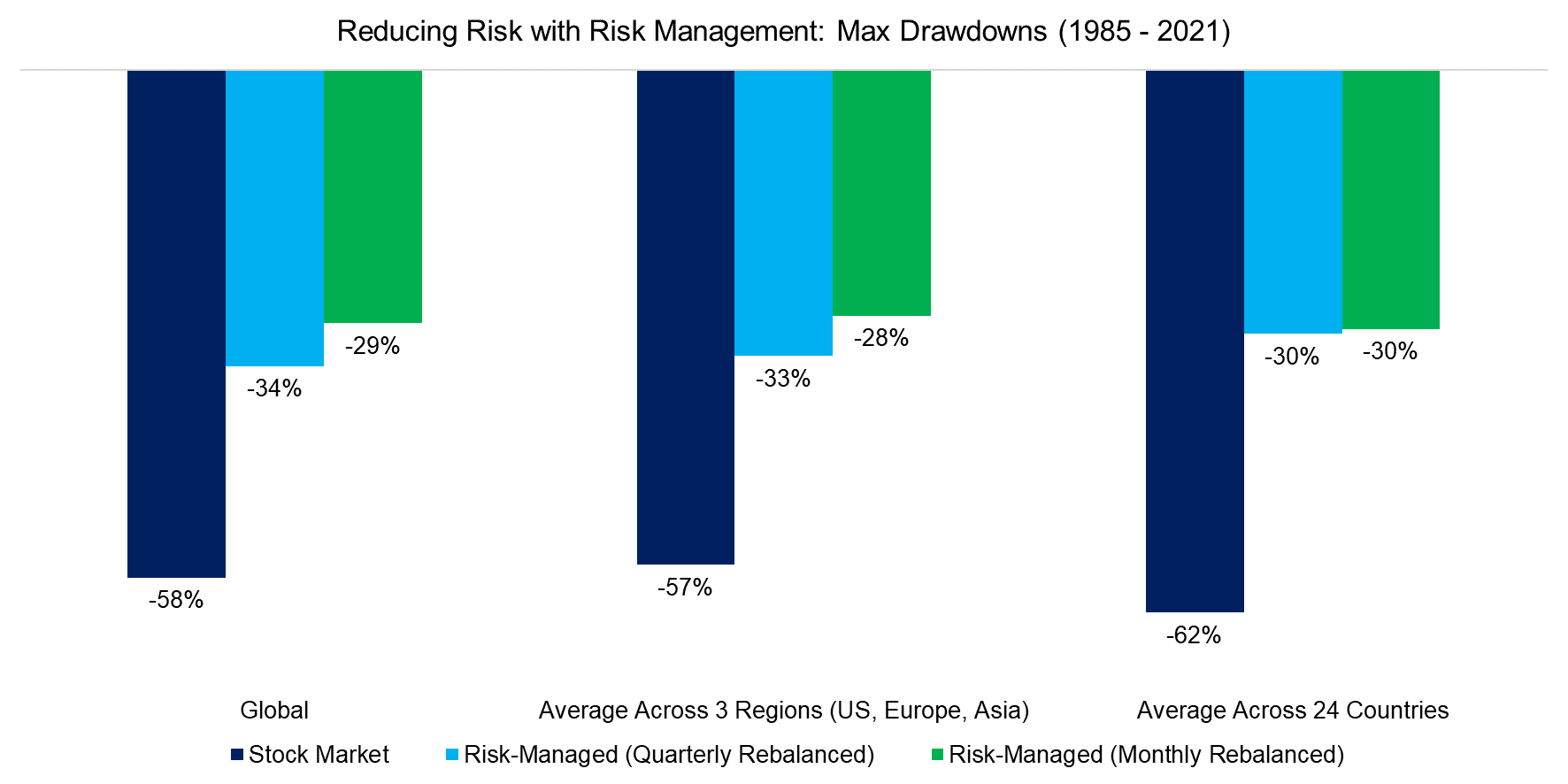

Although likely obvious, the risk-managed portfolios scored exceptionally well on their primary objective – risk reduction. We observe that the risk-managed equity portfolios had approximately 50% lower maximum drawdowns than the global stock market.

Again, the rebalancing frequency and geographical diversification did not seem to have mattered much, which indicates more robustness to this strategy than perhaps expected.

Source: FactorResearch

FURTHER THOUGHTS

This analysis could be easily enhanced by exploring different types of signals and combining these to a complex tactical asset allocation model, but that was not its objective. Complexity is mostly a negative force when it comes to investing strategies as they are less robust and, per definition, more difficult to understand.

Based on these results, an investor could conclude that he might not even need to diversify across regions or countries, but simply take a global equity ETF and overlay the risk management strategy. This would be correct and it would probably serve most investors well.

The challenge is consistently sticking to this strategy over time. Most investors would struggle with long periods out of the market, especially when stocks are going up, and would start fiddling with the strategy or simply abandon it. Simplicity has its own complexity.

RELATED RESEARCH

Market Timing vs Risk Management

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.