Risk-Managed Equity Exposure III

Valuation-sensitive tactical asset allocation

September 2025. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- TAA strategies can reduce risk, but also underperform significantly

- Typically these are tailored for bear markets, not for crashes

- Using valuations for risk management is ineffective

INTRODUCTION

Pacer’s Trendpilot US Large Cap ETF (PTLC) is arguably one of the simplest tactical asset allocation (“TAA”) funds in the market. The strategy invests 100% in U.S. large-cap stocks under normal conditions, but adjusts exposure based on a trend-following rule tied to the S&P 500’s 200-day moving average. Specifically:

- If the index closes above its 200-day moving average for five consecutive business days, the fund allocates a 100% to equities

- If the index closes below its 200-day moving average for five consecutive business days, the fund shifts to a 50/50 allocation between equities and U.S. T-Bills

- If the 200-day moving average is below its value from five days earlier, the fund moves entirely into U.S. T-Bills

Despite the crowded “graveyard” of liquidated tactical allocation products and the high 0.60% management fee, Pacer has successfully grown PTLC to more than $3 billion in assets under management (read Tactical ETFs: Tactfully No, Thank You? & Defining Tactical Asset Allocation).

The underlying concept is supported by a large body of academic and practitioner research (including our own) showing that simple regime-switching rules can improve risk-adjusted returns. That said, performance has struggled since the Global Financial Crisis in 2008. Frequent, shallow drawdowns followed by sharp recoveries – often fueled by central bank interventions – have hurt slow-moving trend-following strategies, which are prone to whipsaw in fast-changing markets.

In this note, we examine how incorporating valuations into tactical asset allocation strategies may enhance their effectiveness.

RISK-MANAGED EQUITIES ALLOCATION

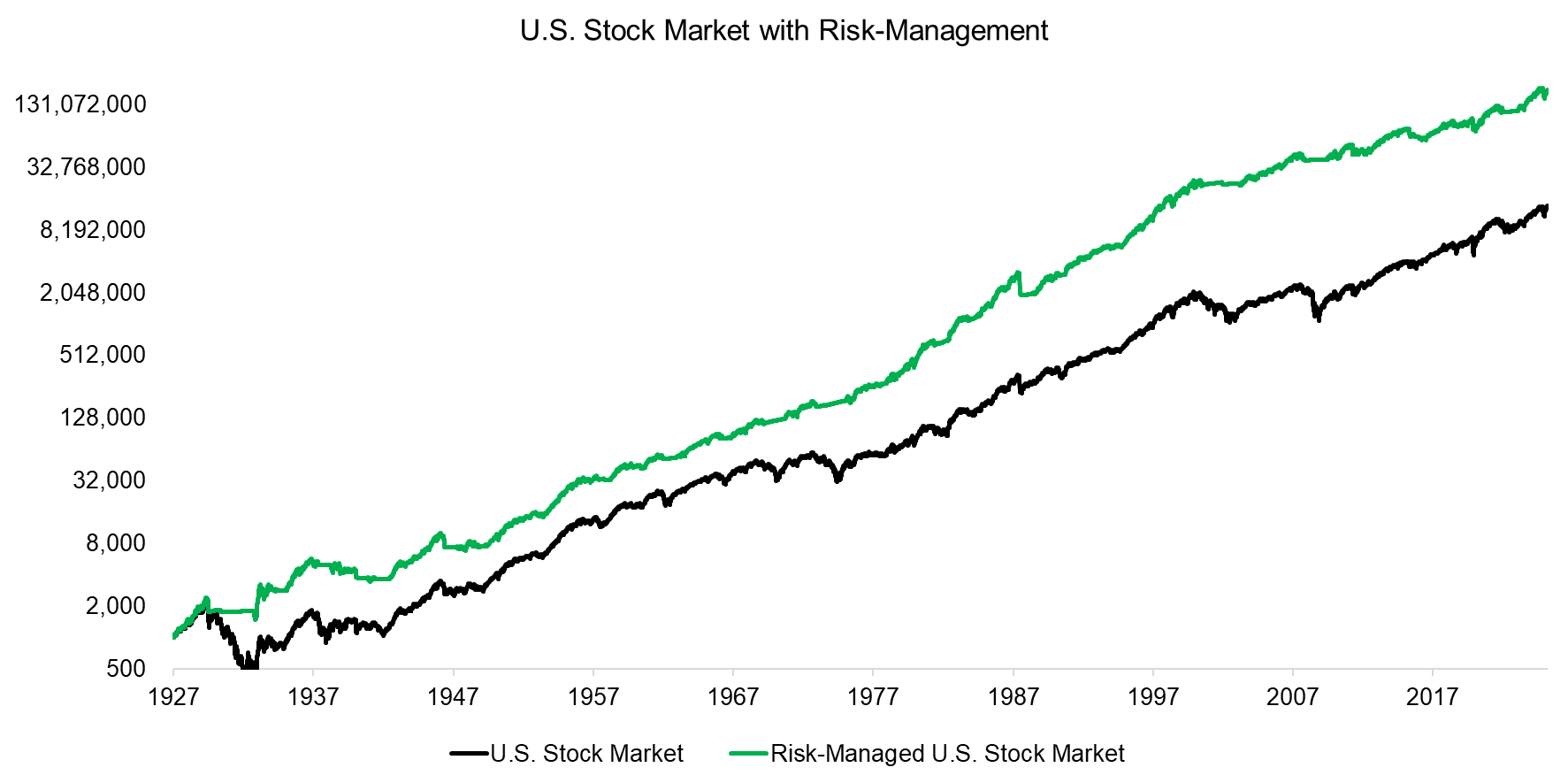

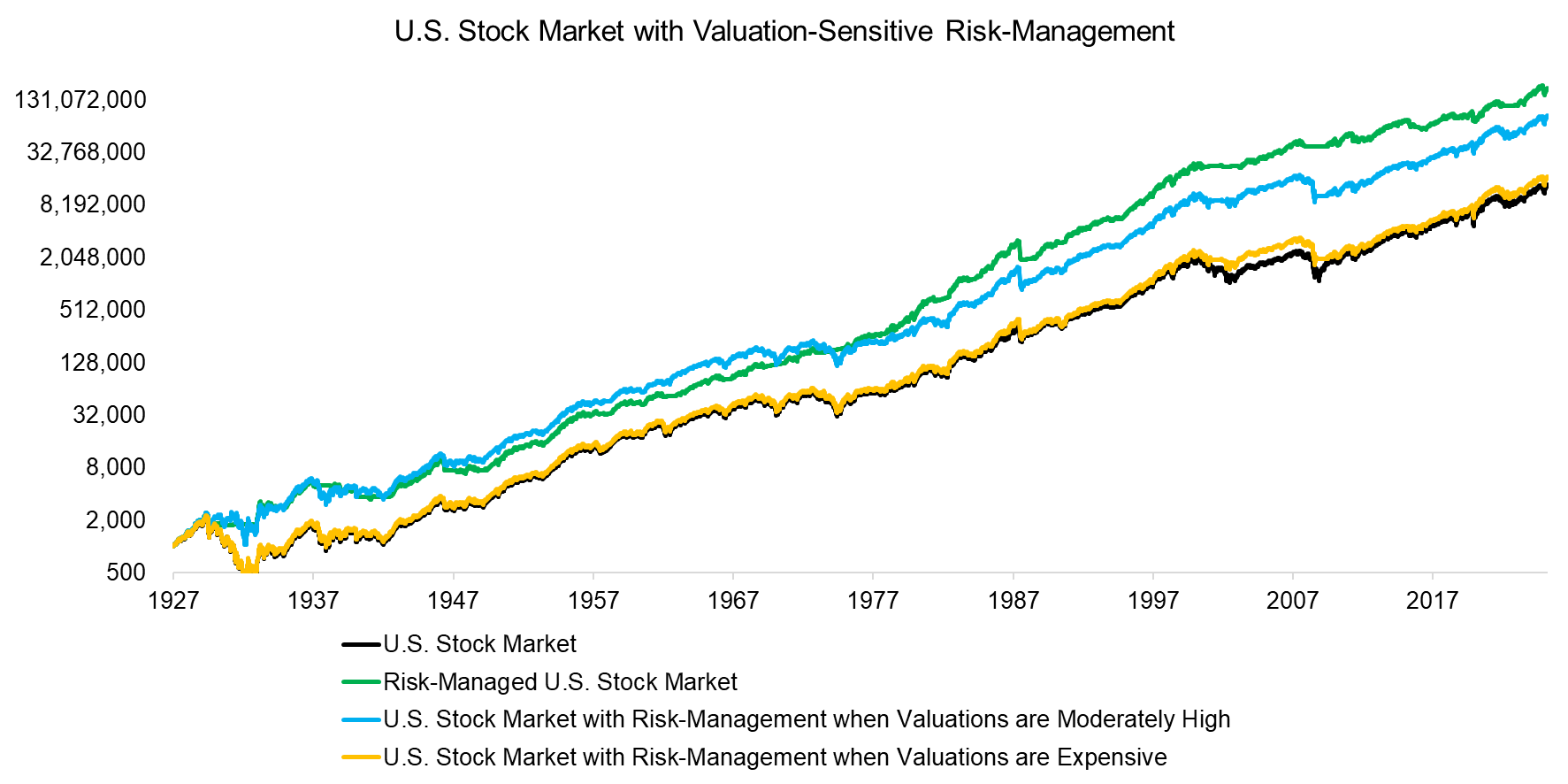

We use stock market return data from Professor French’s data library to construct a simple TAA strategy that switches between U.S. equities and U.S. T-Bills whenever the trailing 12-month return turns negative. Over the period from 1927 to 2025, this approach would have produced a CAGR of 13.1%, versus 10.2% for a buy-and-hold exposure to the market, excluding transaction costs (read Risk-Managed Equity Exposure II & Risk-Managed Equity Exposure).

Source: Finominal

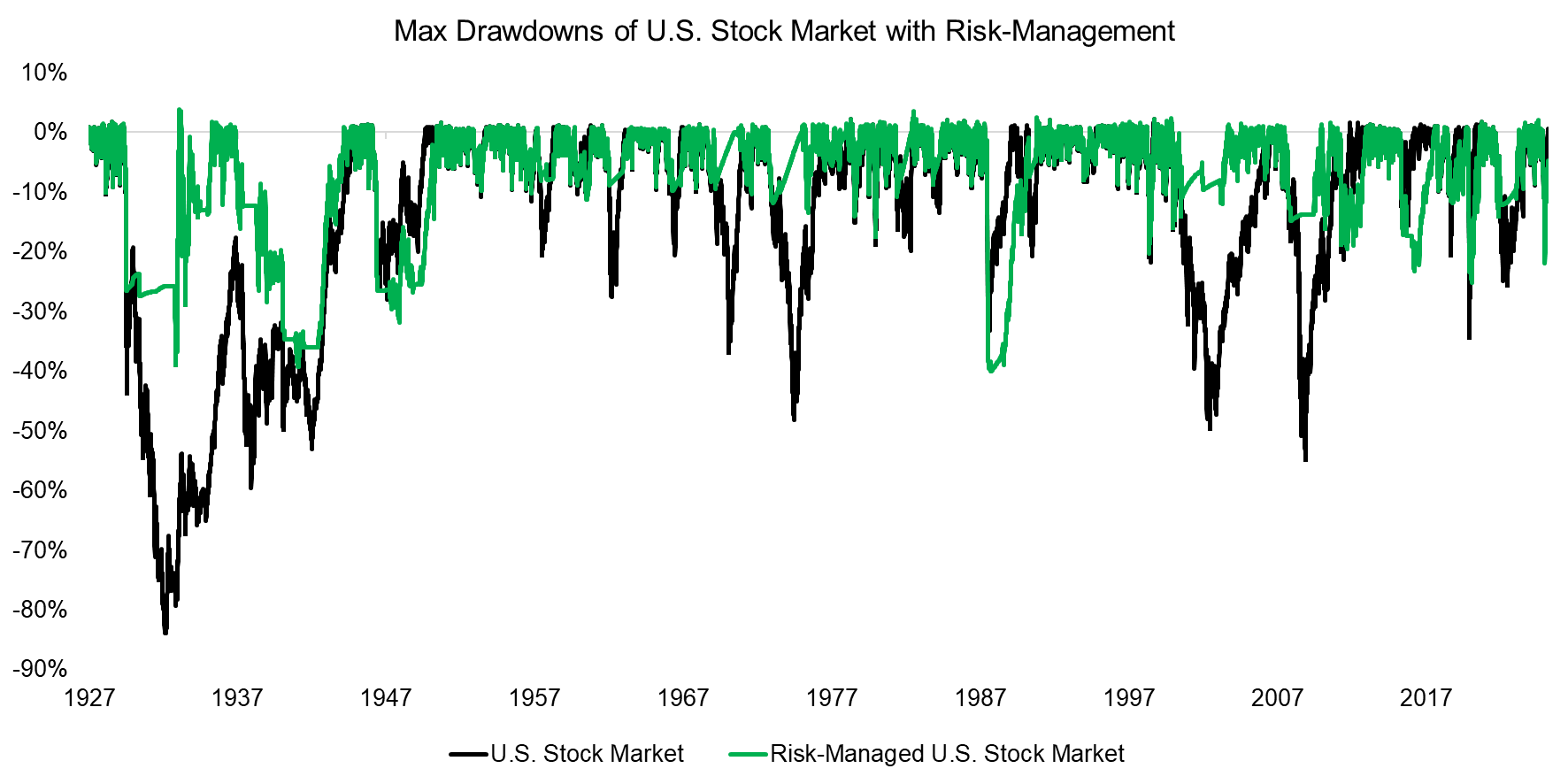

TAA strategies typically aim to mitigate risk rather than maximize returns, and our simple TAA approach demonstrates this well by limiting drawdowns during major market crises such as the Great Depression of the 1930s, the dot-com bust in 2001, and the Global Financial Crisis in 2008. However, the strategy does not uniformly reduce risk – at times, such as during the 1987 stock market crash, it actually resulted in deeper drawdowns.

Source: Finominal

RISK-MANAGED EQUITIES ALLOCATION SINCE 2010

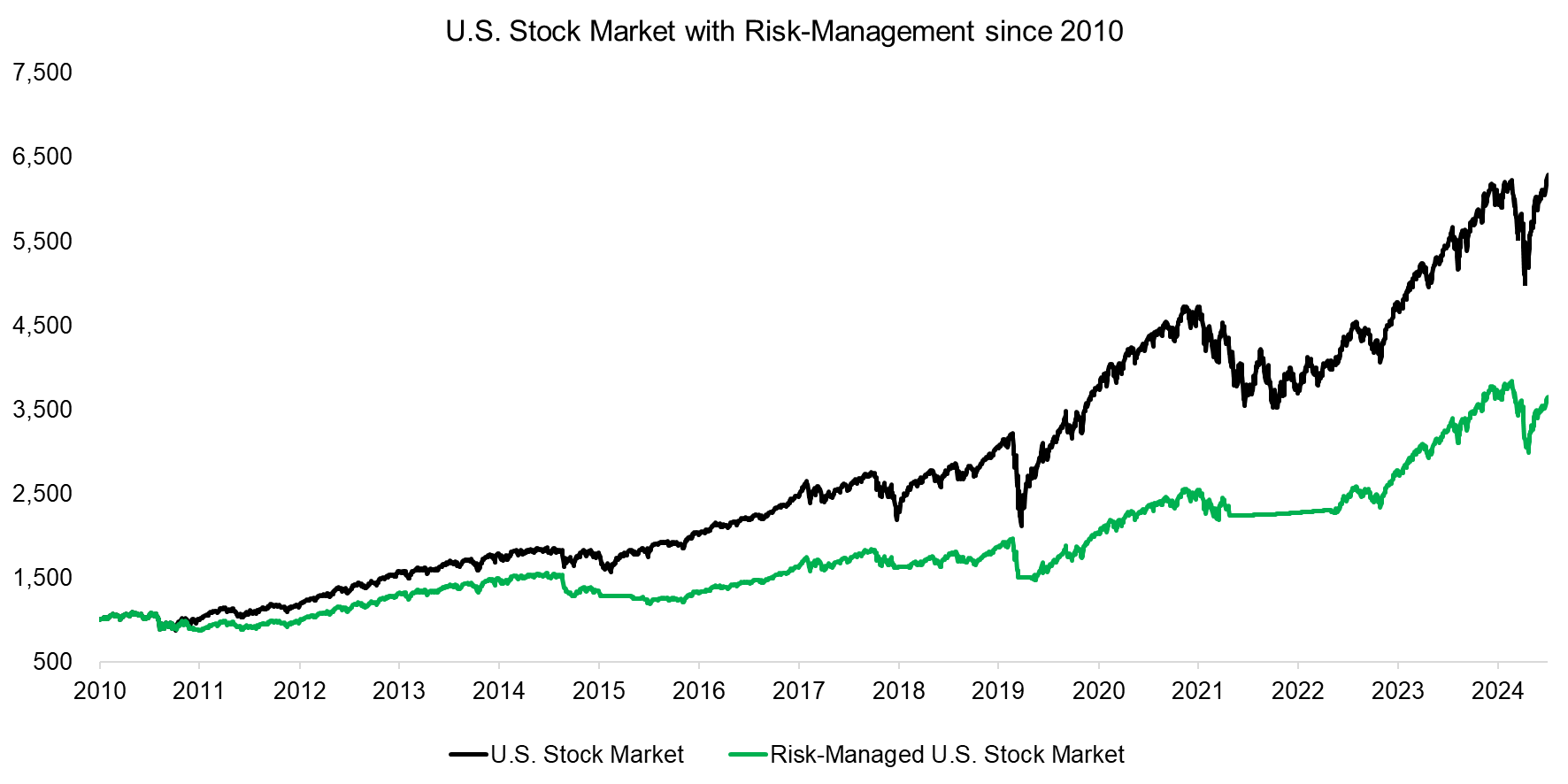

TAA strategies are fundamentally trend-following approaches that perform best when long-term trends persist. They tend to struggle during abrupt market crashes, such as in 1987, or during periods of frequent reversals, like the 2010s, when central bank interventions quickly countered any downturns. As a result, our strategy, as almost all listed TAA funds, has underperformed since 2010, a period characterized by the absence of prolonged bear markets.

Source: Finominal

VALUATION AS A RISK MANAGEMENT TOOL

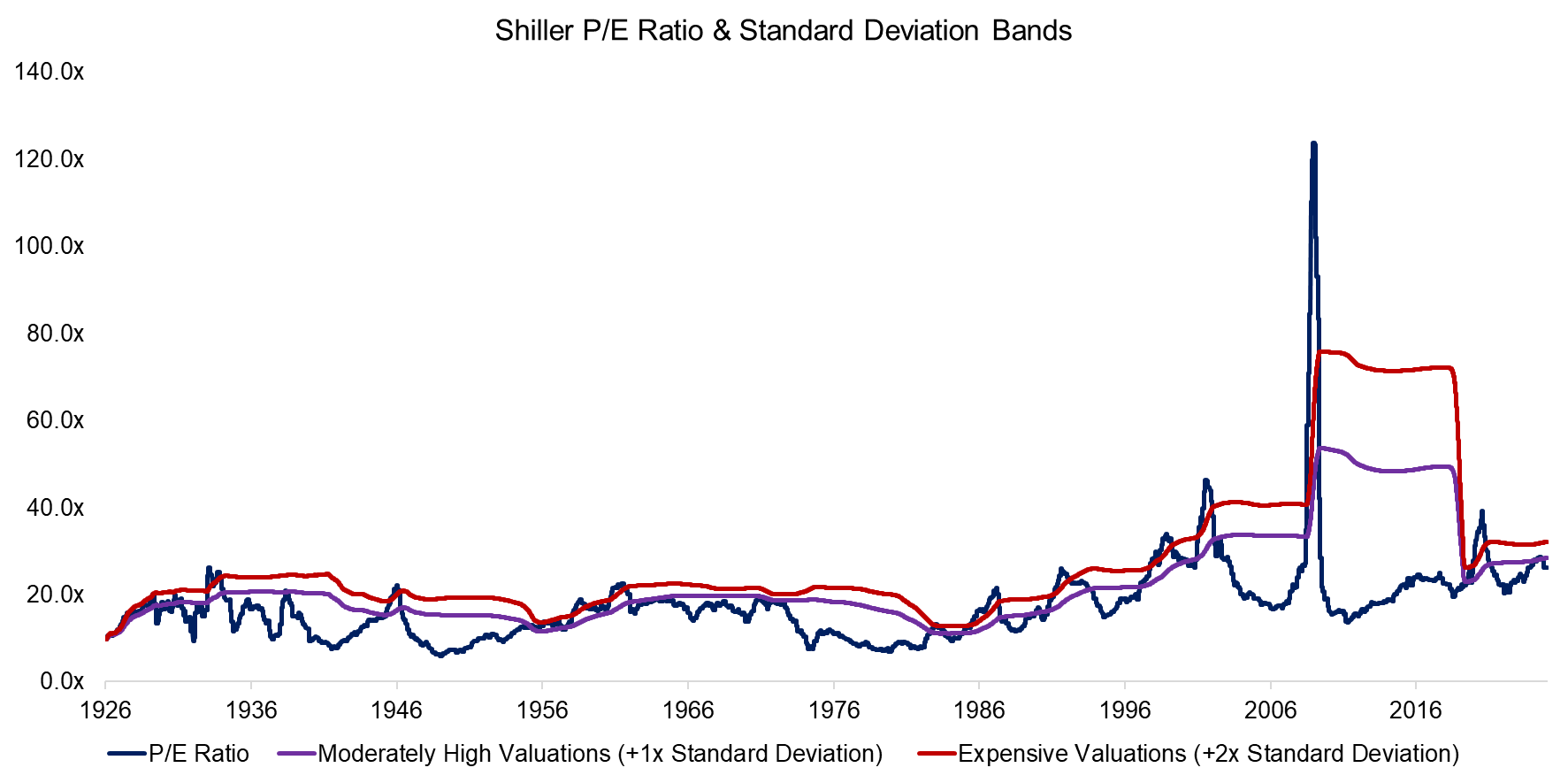

Valuations are not reliable predictors of short-term returns, but they play an important role over the long term – a relationship that holds true for both stocks and bonds. We use the Shiller P/E ratio and construct 10-year rolling bands based on one and two standard deviations above the mean, which we interpret as moderately high and expensive valuation levels, respectively. The key question we investigate is whether it makes sense to apply the risk management only when equities trade in these elevated valuation regimes.

One challenge, however, is that the P/E ratio can be distorted by extreme values. For example, during the Global Financial Crisis, earnings collapsed and the Shiller P/E briefly spiked to 123.3x. Because we use a 10-year rolling window, such outliers affect subsequent periods as well. While we could smooth, truncate, or otherwise adjust the data, doing so risks introducing model overfitting – an outcome we aim to avoid.

Source: Finominal

We construct two additional indices in which risk management is activated only when valuations are moderately high or expensive. Our findings show that applying risk management at moderately high valuation levels delivers returns from 1927 to 2025 that are broadly comparable to a pure trend-following approach. In contrast, restricting risk management to periods of expensive valuations results in it being applied only rarely.

Source: Finominal

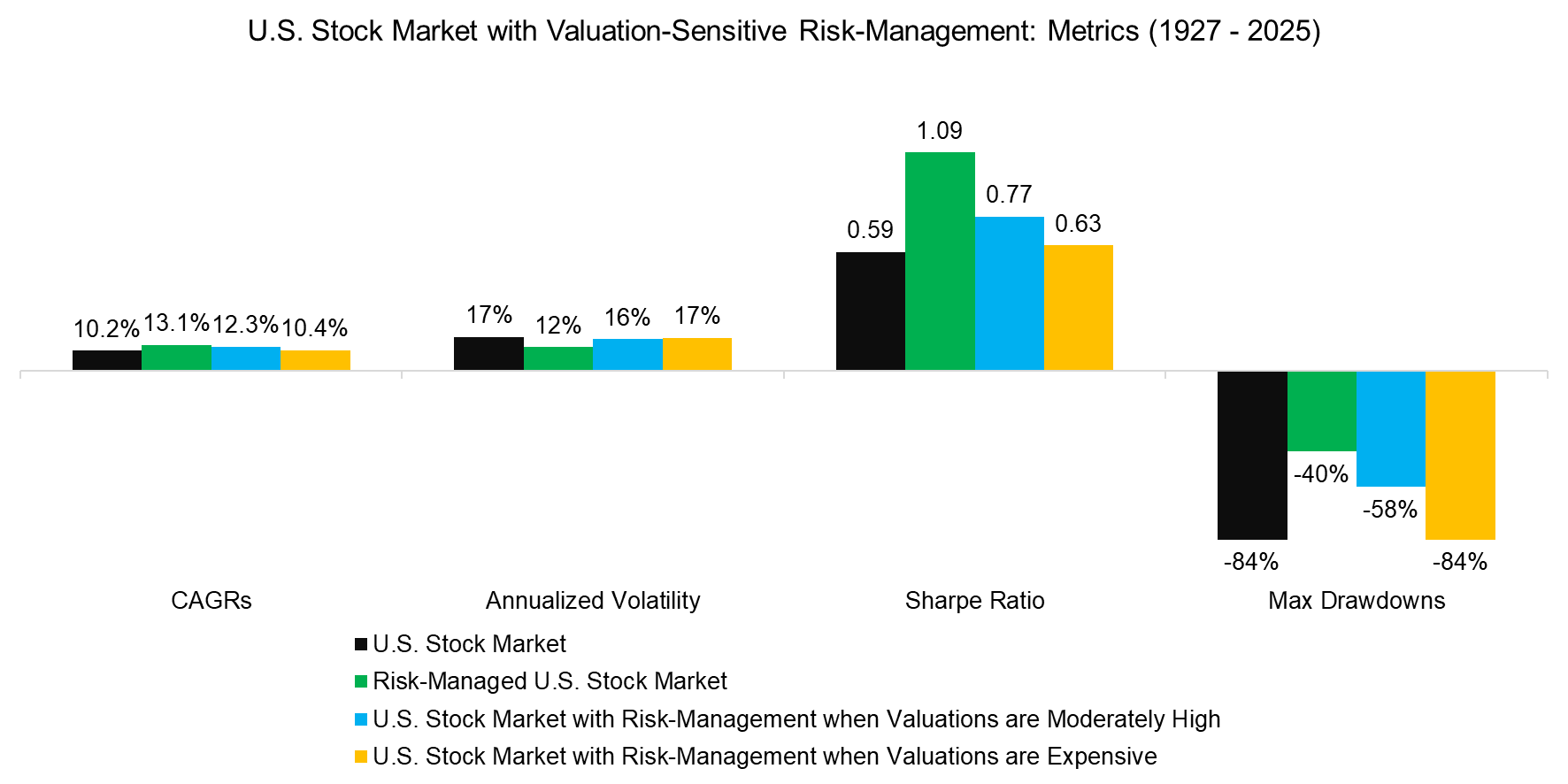

We calculate the CAGRs, annualized volatility, Sharpe ratios, and maximum drawdowns for all four indices. The results show that incorporating valuations did not enhance the core strategy. However, applying valuations as a trigger for risk management still proved beneficial overall, as the buy-and-hold approach delivered the lowest CAGR and Sharpe ratio.

Source: Finominal

FURTHER THOUGHTS

One could argue that applying valuations within a risk management framework is inherently flawed, since valuations have little relevance in the short term. Equity markets can remain at extreme levels for extended periods, as illustrated by Japan in the 1980s or the U.S. during the tech bubble.

Of course, many other indicators can be considered to enhance TAA strategies. Yet the fact that most TAA funds manage assets in the millions rather than billions underscores how challenging – if not impossible – it is to design a framework that consistently works across both fast- and slow-moving market environments.

RELATED RESEARCH

Risk-Managed Equity Exposure II

Risk-Managed Equity Exposure

Defining Tactical Asset Allocation

Revisiting the Performance of TAA ETFs

Tactical ETFs: Tactfully No, Thank You?

Risk versus Momentum-based Equity Allocations

Combining Risk-Managed Equities and Managed Futures – II

Market Timing vs Risk Management

Market Timing with Multiples, Momentum, and Volatility

Tail Risk Hedge Funds

Stock Selection versus Asset Allocation

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.