Risk versus Momentum-based Equity Allocations

Which strategy prevails?

July 2025. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Risk & momentum-based equity allocation strategies outperformed over the last 38 years

- However, the outperformance diminished over a shorter lookback

- Financial research is highly sensitive to assumptions like the lookback period

INTRODUCTION

A leading hedge fund manager recently released research promoting risk-based equity allocations as a way to reduce exposure to overpriced U.S. stocks. The study found that risk-weighting allocations across global markets outperformed the MSCI ACWI and even kept pace with the S&P 500 -while delivering a higher Sharpe ratio. Sounds great, right?

Not so fast. The analysis begins in 2000, during the aftermath of the tech bubble, a period when U.S. stocks – heavily weighted toward tech – underperformed other markets. In financial research, the starting point can heavily influence outcomes, and shifting it by just a few months can lead to very different conclusions.

In this article, we’ll examine risk-based equity allocation strategies and compare them to alternative approaches.

RISK-BASED VS MOMENTUM-BASED EQUITY STRATEGIES

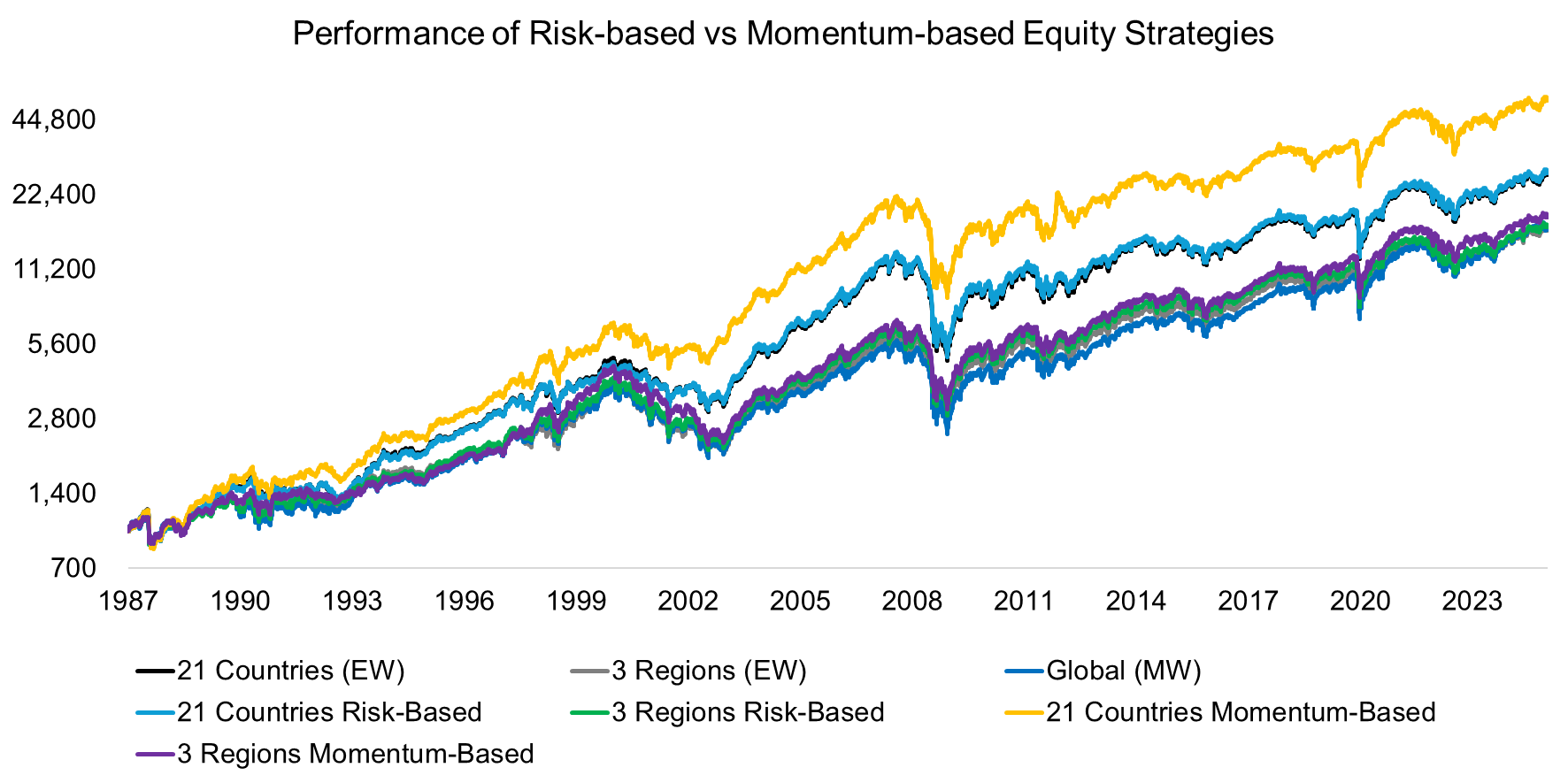

We use stock market data from AQR covering 21 primarily developed countries and three regions – Europe, Asia Pacific, and North America. From this, we construct three types of indices for each group: equal-weighted (“EW”) indices, risk-based indices using rolling 12-month volatility, and momentum-based indices based on whether the 12-month rolling return is positive. We show the global market capitalization-weighted (“MW”) portfolio as the standard benchmark index.

Analyzing performance from 1987 to 2025, the momentum-based strategy across the 21 countries delivered the highest returns, followed by the risk-based and then the equal-weighted strategies. There was little differentiation between the remaining indices.

Source: Finominal

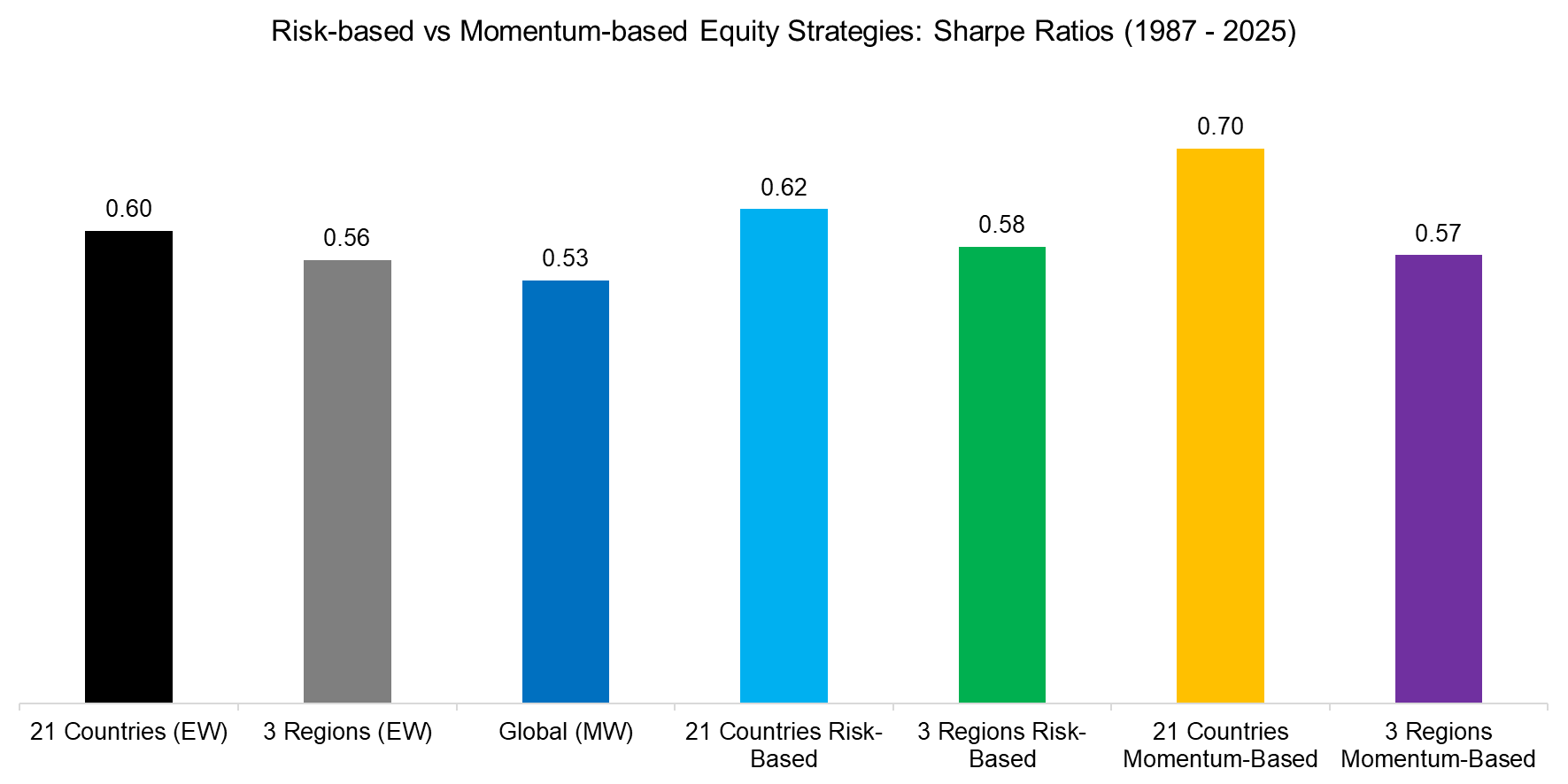

SHARPE RATIOS

Next, we assess the Sharpe ratios of the seven strategies, revealing that the three top-performing approaches also delivered the highest risk-adjusted returns since 1987. In contrast, the market cap-weighted global portfolio recorded the lowest Sharpe ratio at 0.53.

Source: Finominal

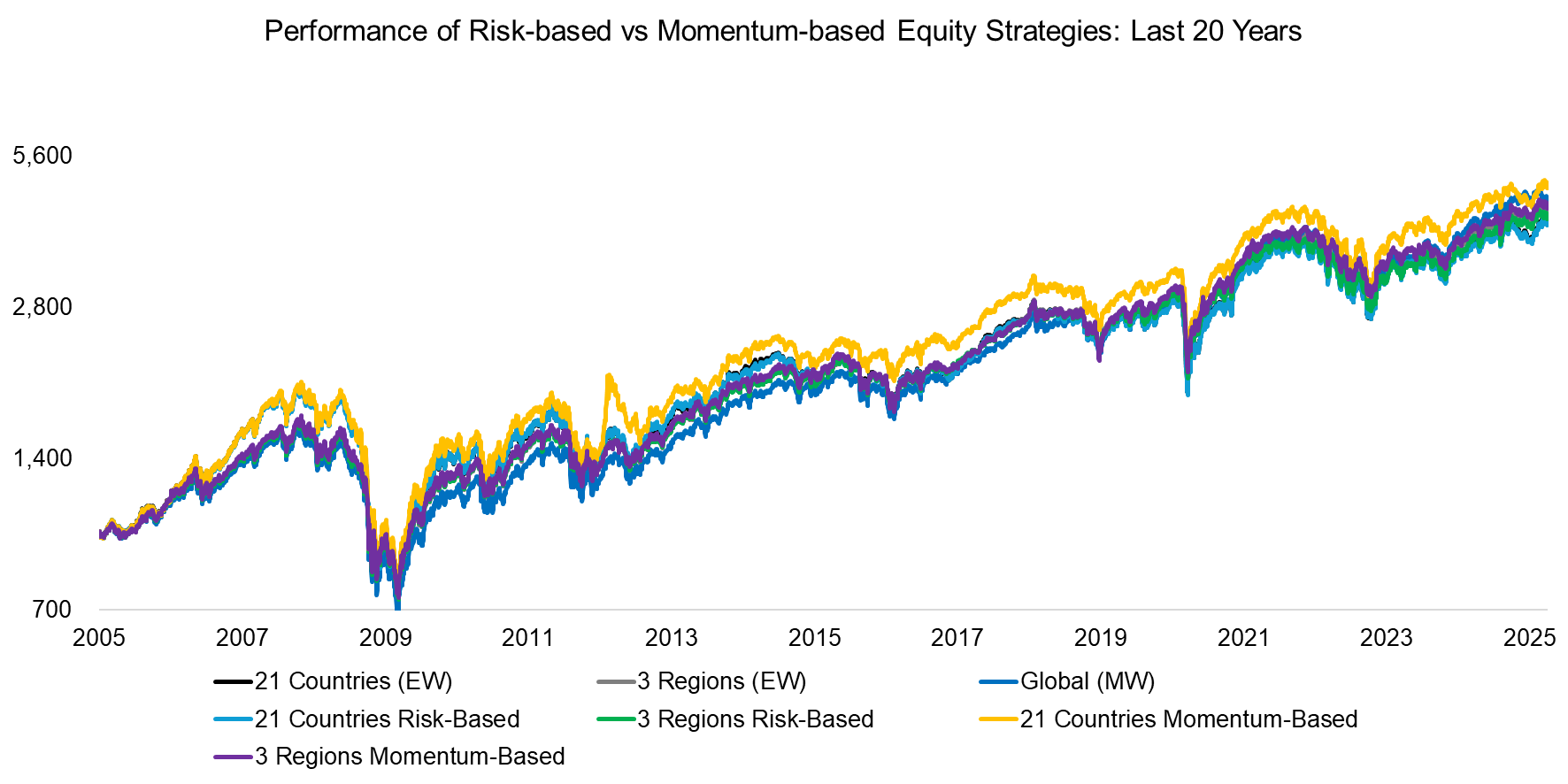

PERFORMANCE LAST 20 YEARS

As noted in the introduction, the choice of start and end dates can significantly affect return and performance metrics. To account for this, we rebase the indices to 2005, creating a 20-year – albeit arbitrary – lookback period. The momentum-based strategy across the 21 countries still leads, but only slightly. Overall, the performance differences among the strategies are minimal.

Source: Finominal

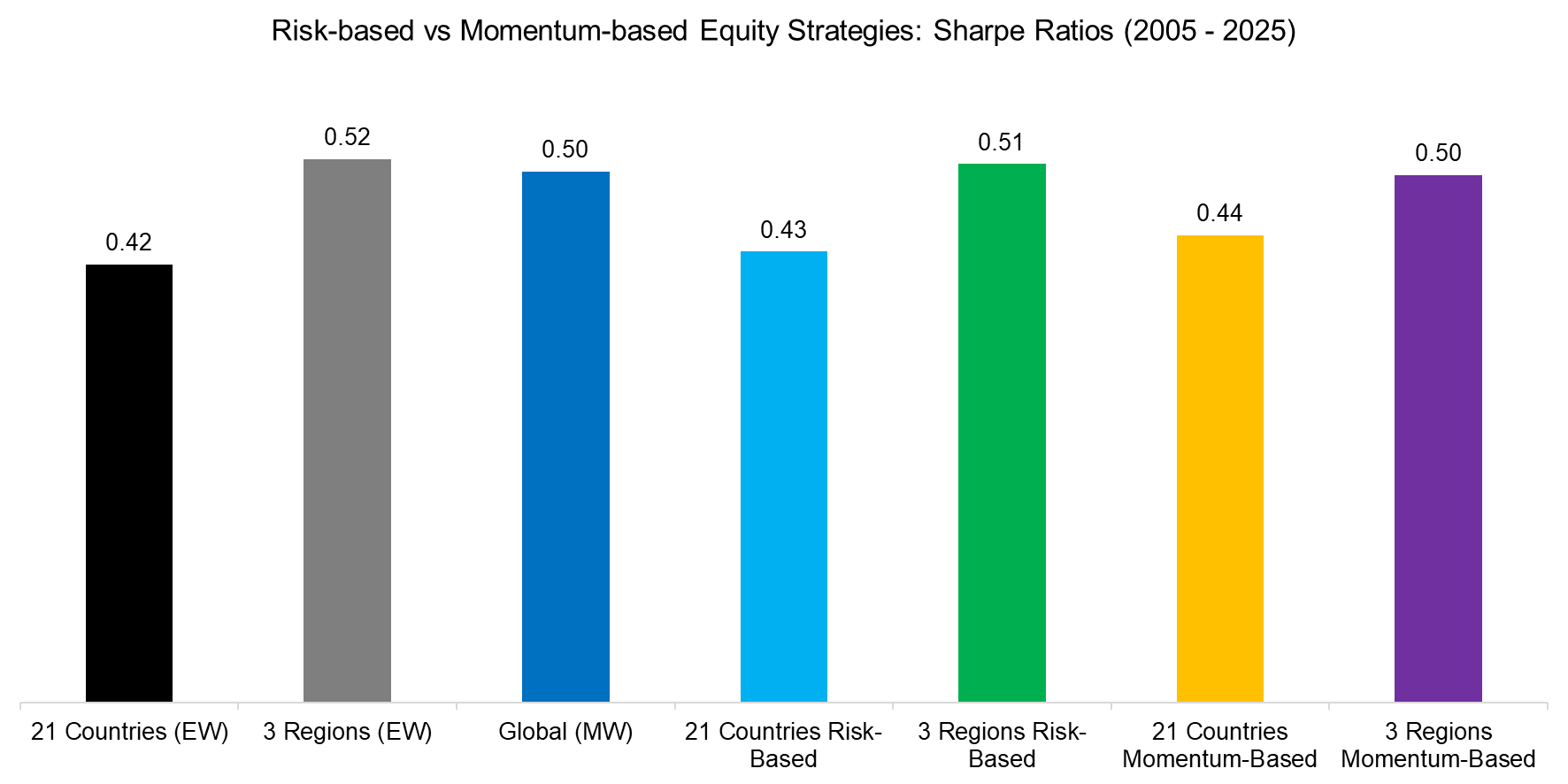

While the momentum-based strategy across 21 countries delivered weaker performance over the past 20 years compared to the full 38-year period, its risk-adjusted returns were even less compelling, with a Sharpe ratio of just 0.44. In contrast, the market cap-weighted global portfolio achieved a higher Sharpe ratio of 0.50 during this shorter period, reflecting the strong performance of the U.S. equity market.

Source: Finominal

FURTHER THOUGHTS

This simple analysis underscores how sensitive results are to the chosen lookback period. While there are methods to make financial research more robust, much of the published work would likely not hold up to even basic scrutiny like this.

Compounding the issue is the academic norm of presenting findings in tables, which often fail to convey the consistency or stability of returns – something a basic chart would reveal more clearly. After all, investors don’t have the luxury of managing capital over a hundred-year horizon.

RELATED RESEARCH

Chasing Mutual Fund Performance

Measuring Performance Chasing

The Fallacy of Betting on the Best Stock Market

Thematic versus Momentum Investing

An Anatomy of Thematic Investing

Thematic Investing: Thematically Wrong?

Stock Selection versus Asset Allocation

The Juggernaut Index

Top Fee Generating, Wealth Creating and Destroying ETFs

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.