Sentiment & Factor Performance

Can Factor Returns Be Improved via Big Data?

February 2020. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Stock sentiment can be aggregated from public sources using a big data approach

- Results indicate that sentiment has some predictability for short-term factor performance

- Positive sentiment resulted in higher subsequent returns than negative sentiment

INTRODUCTION

Albert Einstein famously stated that “information is not knowledge”, which is more relevant than ever as the amount of available information is increasing almost exponentially. As a private person, it is simple and instinctive to ignore most information, but many investors believe they need to be continuously updated and informed about the latest developments of markets and companies, which has become somewhat overwhelming compared to the pre-Internet period.

Fortunately, technology has evolved to facilitate information processing and is empowering investors to exploit big data and gain unique insights. Investors might acquire real-time data on the sales of a retailer via credit card transactions, observe the energy supply chain by watching the movement of oil tankers with satellite images, or analyze the stock sentiment via Twitter feeds.

Given this evolution, it should have become significantly easier to understand investment strategies, especially systematic ones like factor investing that feature a rules-based composition. However, despite all the data, there is still very little new knowledge on what is driving factor performance.

In this short research note, we will investigate how sentiment extracted from big data impacts the returns of the Momentum and Value factors in European equities (read Mapping My Mind: Value Factor).

METHODOLOGY

We focus on the Momentum and Value factors in the European stock market. Momentum stocks are selected based on their 12-month performance, excluding the last month, and Value stocks on a combination of price-to-book and price-to-earnings multiples. Only stocks with a minimum market capitalization of $1 billion are included. Portfolios are comprised of the top and bottom 10% of the universe sorted by the factors, rebalanced monthly, and each transaction incurs costs of 10 basis points.

We use aggregated sentiment scores in collaboration with Catana Capital, a quantitative asset manager focused on big data and artificial intelligence with access to various data sets. News, research, blogs, tweets, and similar types of public information of listed companies are assimilated into sentiment scores on a daily basis.

MOMENTUM & VALUE FACTOR PERFORMANCE IN EUROPE

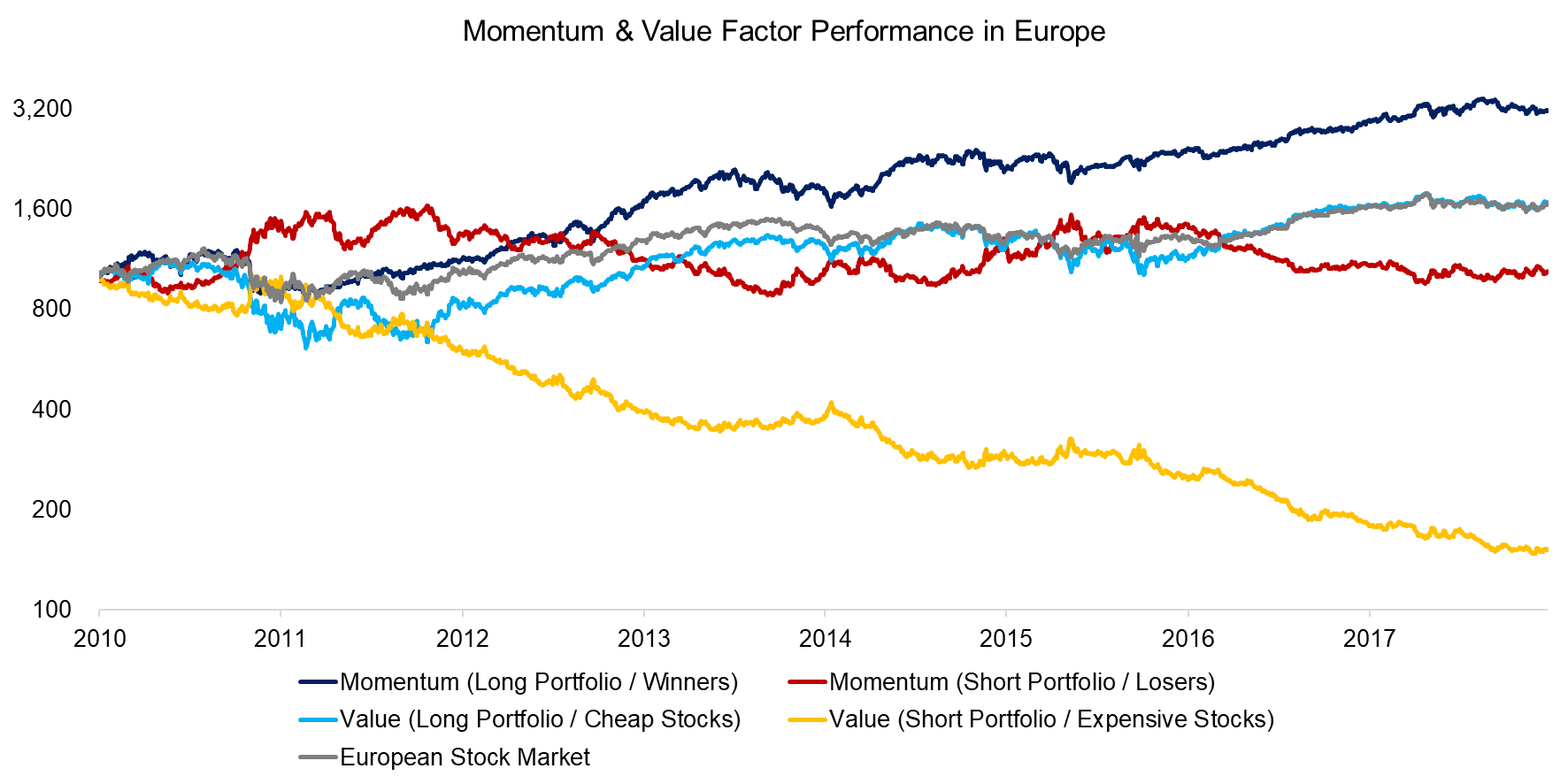

Factor performance is cyclical and there is no factor that generates consistent excess returns. In the period from 2010 to 2018, the long portfolio of Momentum, i.e. winning stocks, outperformed the European stock market while cheap stocks accomplished returns in line with the benchmark index.

Shorting expensive stocks generated consistently negative returns while shorting losing stocks resulted in a flat return. The performance of the Value factor in Europe was therefore negative from a long-short perspective, but positive for the Momentum factor.

Source: FactorResearch

The factor performance can be explained by different country and sector exposures. For example, from a country perspective, there was an overweight toward German stocks in the long portfolio of the Momentum factor while cheap stocks were frequently derived from Spain, Greece, Portugal, and Italy. Naturally, these biases mirror the European economic conditions of the last decade were the German economy prospered while Southern European nations experienced weak GDP growth.

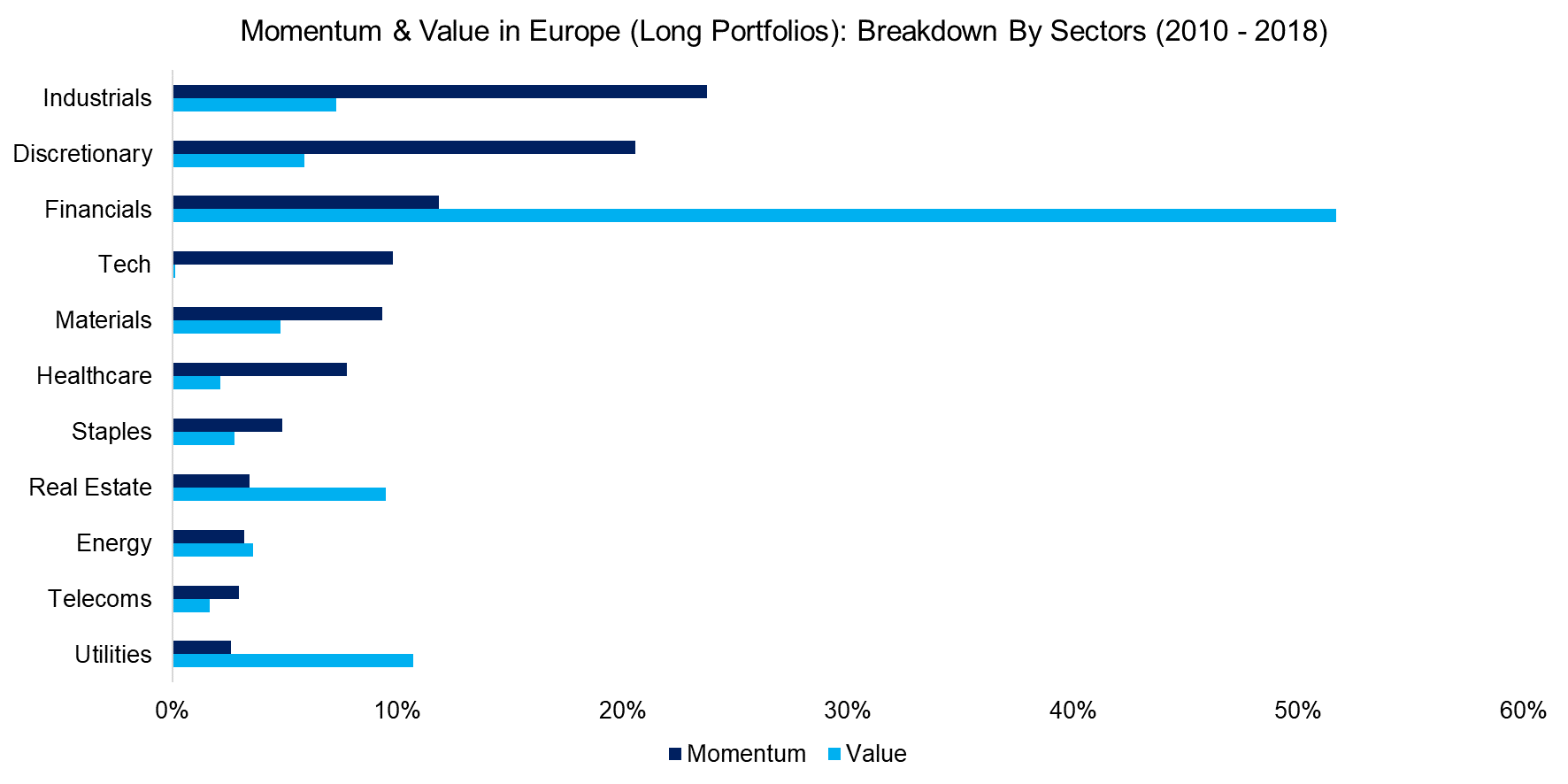

We observe similar over- and underweights when viewed from a sector perspective. Specifically, the long portfolio of the Momentum factor was biased toward the industrial, discretionary, and technology sectors, while the majority of Value stocks were contributed by the financial sector. Many European banks have failed to recover from the global financial crisis in 2008 and are currently trading at price-to-book multiples well below one (read Momentum Factor: Intra vs Cross-Sector).

Source: FactorResearch

VISUALIZING SENTIMENT SCORES

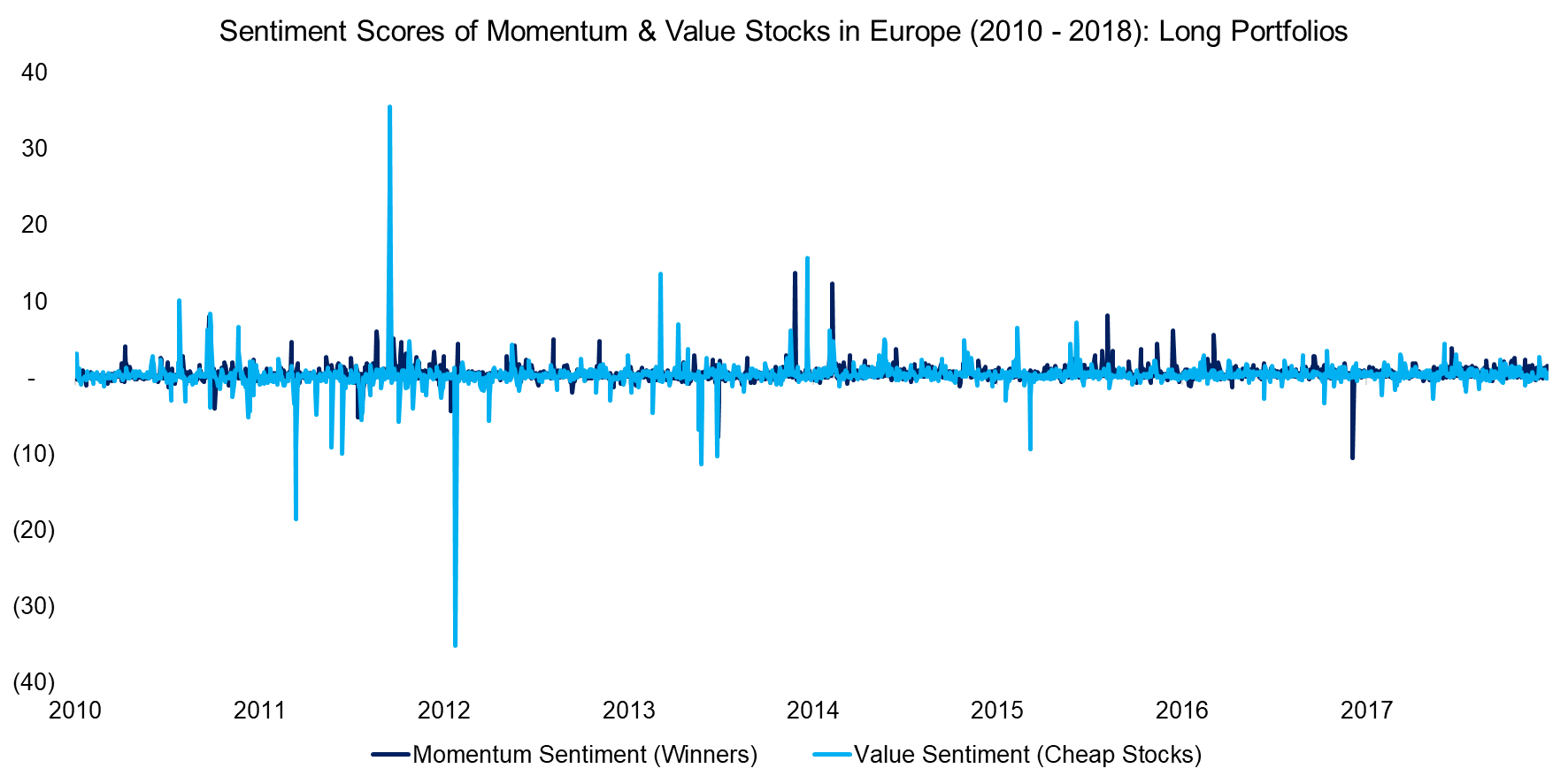

Next, we highlight the aggregated sentiment scores in cooperation with Catana Capital for the observation period between 2010 and 2018. All news and messages concerning stocks included in the factor portfolio were extracted from public sources and aggregated into daily raw scores for each company, which were then averaged across the long and short factor portfolios.

It is interesting to note that the median sentiment scores were positive for the long as well as short portfolios, which is explained by stock-specific news and messages being more positive than negative on average. Occasional spikes in the average sentiment score represent days where there were few relatively few news, but some that were interpreted as significantly positive for the companies. The sentiment score has become less volatile over time as the amount of information for each company available on a daily basis is increasing consistently.

Source: Catana Capital, FactorResearch

SENTIMENT & FACTOR PERFORMANCE

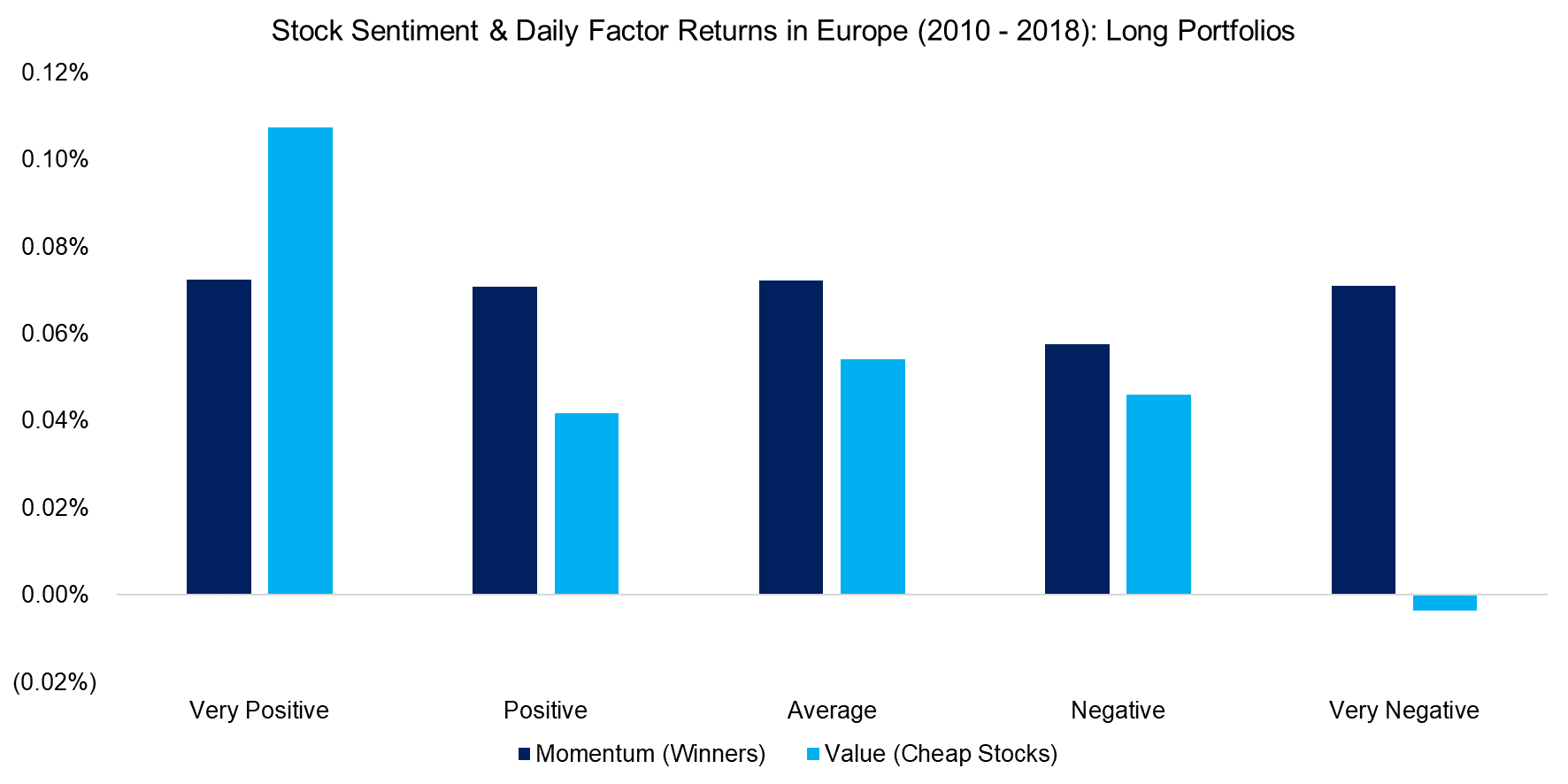

We create five sentiment categories by differentiating the scores from very positive to very negative. Each of the five categories comprises approximately the same number of days. Then we calculate the average factor returns for each of these categories on a daily basis. We observe the following for the long portfolios of the factors for the period from 2010 to 2018:

- Momentum: Almost the same daily returns across the sentiment categories.

- Value: Significantly higher returns when the sentiment was very positive and negative returns when the sentiment was very negative.

It is unlikely surprising that stocks trading at low valuations benefit more from very positive than very negative news. These are companies that have either structural or tempory issues like declining sales or earnings, too much leverage, poor management, or a lack of a sound corporate strategy. Investors will appreciate news that might indicate a turn-around of the company.

On the contrary, it is somewhat challenging to explain why sentiment seems to matter less for outperforming stocks.

Source: Catana Capital, FactorResearch

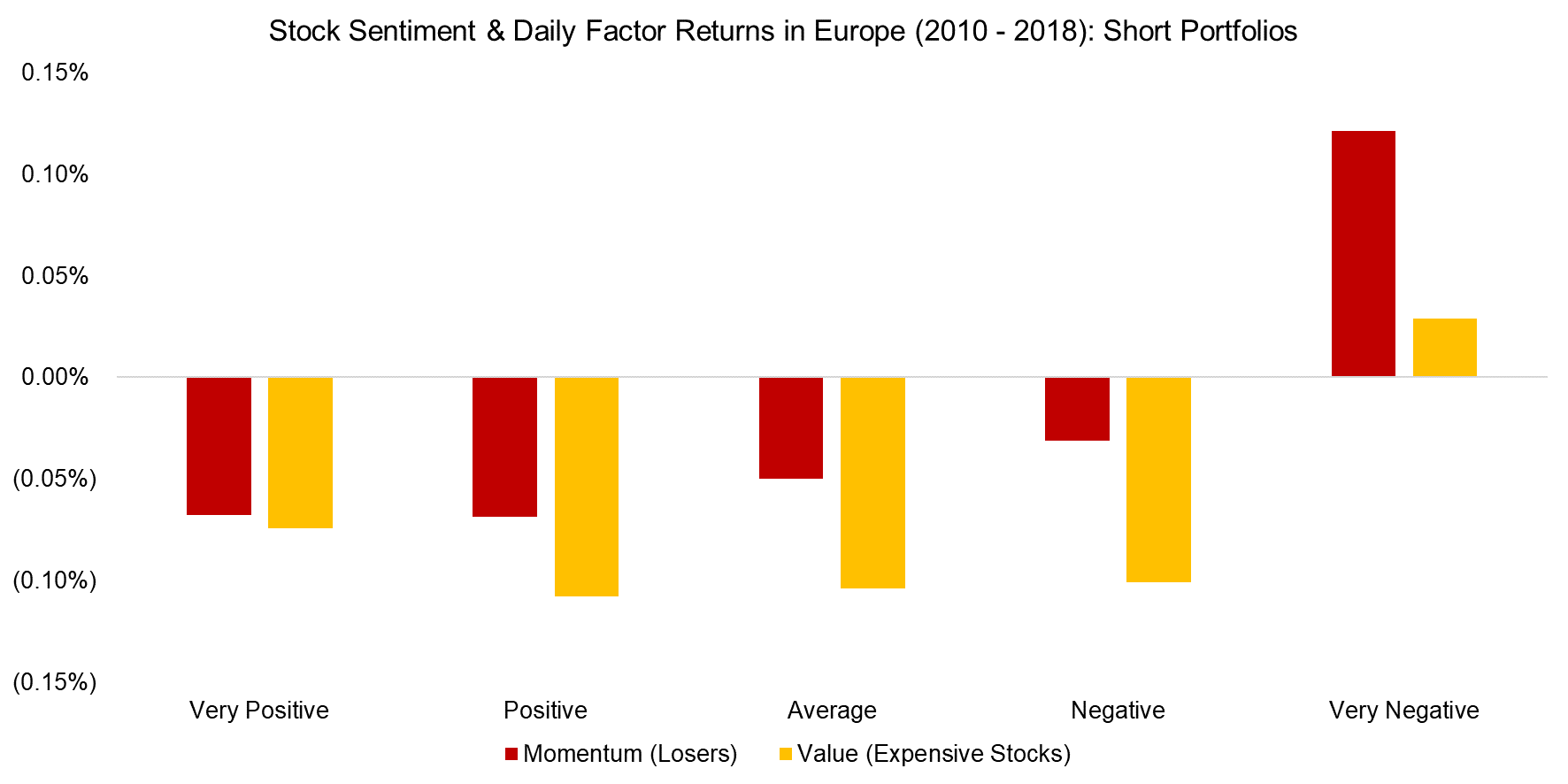

In terms of further investigating the sentiment scores for investment decisions, we can analyze these in relation to the short portfolios of the two factors. The results highlight the following:

- Momentum: The more positive the sentiment for underperforming stocks, the worse the return for the short positions.

- Value: Almost the same daily returns across the sentiment categories, except when very negative.

Sentiment seems to matter more for underperforming and cheap than outperforming and expensive stocks. Given that these types of stocks often correlate implies that the analysis of the long and short portfolios reconciles. The results also indicate that extreme news have a larger impact, which is intuitive.

Source: Catana Capital, FactorResearch

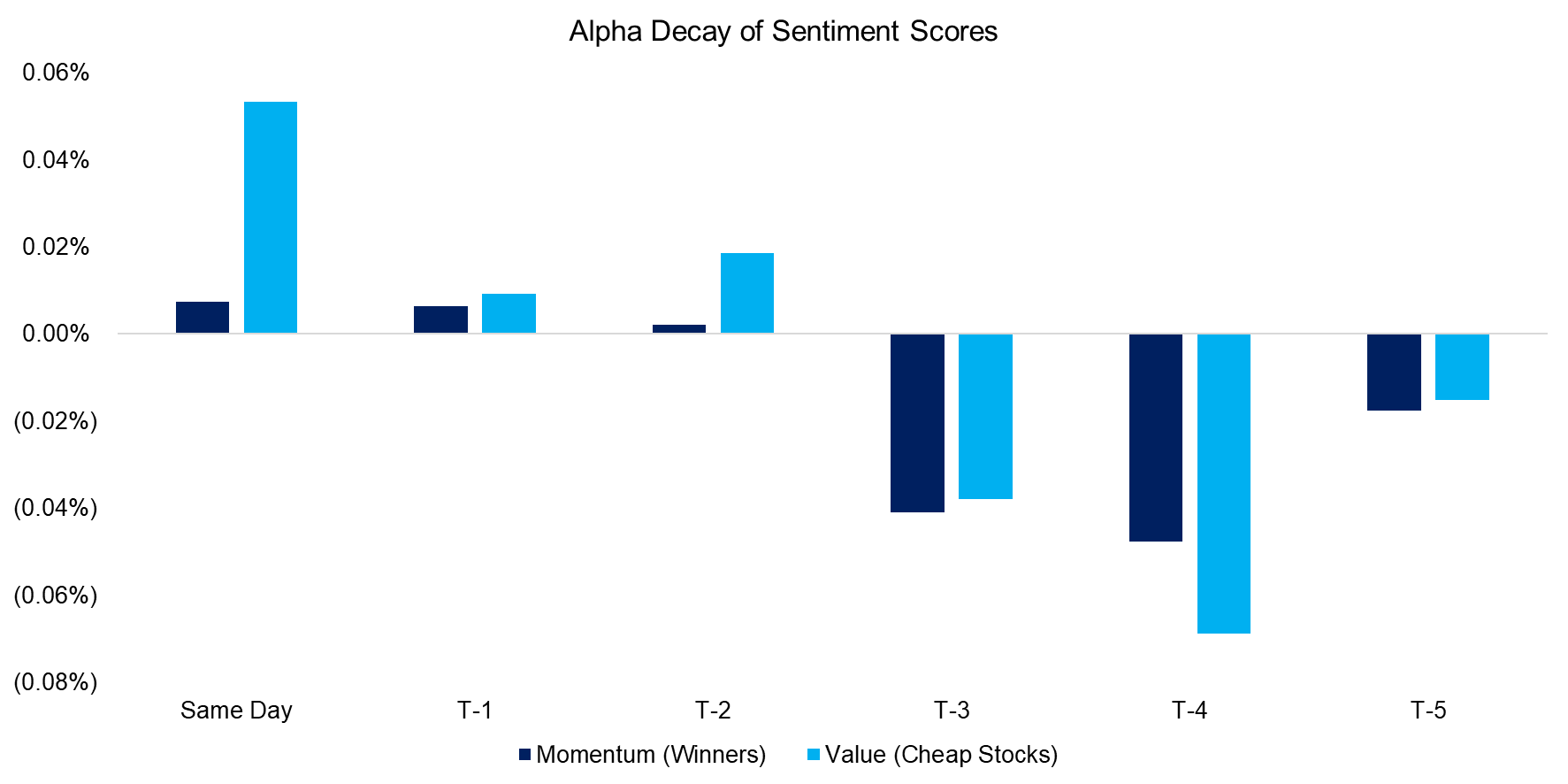

Given these results, investors might question if the sentiment scores can be used for actual trading. The sentiment scores are calculated on a daily basis based on the news of the previous day and aggregated by 5 am, which means investors could trade on these by participating in the opening auction of the stock market.

Investors might also question how quickly the market processes information. Therefore, we calculate the difference between the daily returns for various days when the sentiment was very positive or positive and negative or very negative.

As expected the difference is positive when using the sentiment score for today, i.e. all news from before 5 am, especially for the Value factor. As the performance is slightly positive when using the sentiment score from yesterday or the day before might indicate a minor market inefficiency in processing information, but could also be interpreted as random.

Source: Catana Capital, FactorResearch

FURTHER THOUGHTS

Although these results indicate that sentiment extracted from big data can be used to trade factors more efficiently, further validation is required. Testing sentiment data on other factors, in other regions, and across different time frames would be possible next steps.

It is also worth highlighting that using sentiment scores in a live trading strategy implies frequent trading given that sentiment changes on a daily basis, which is only suitable for few investors as it requires a robust execution infrastructure and extremely low transaction costs to make it profitable.

Once implemented as a trading strategy, it will be important to monitor the alpha decay over time as the market continuously becomes more efficient at processing information. However, creating the infrastructure for big data processing is not an easy feat and perhaps allows to build a moat over time that can be expanded by considering non-public and alternative data sets.

RELATED RESEARCH

CATANA CAPITAL

Catana Capital GmbH is a financial services institution licensed in compliance with Section 32 of the German Banking Act (KWG) and domiciled in Frankfurt am Main. The FinTech was founded in August 2015 and manages the Data Intelligence Fund, a public fund based entirely on big data and artificial intelligence. Catana Capital sees itself as a pioneer in the development of new approaches to asset management and offers innovative investment products for private investors and institutional clients.

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.