Short-Term Momentum in Equity Factors

Does Short-Term Performance Chasing Work?

September 2018. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Short-term momentum persists in common equity factors

- The persistence is strong in Value and Dividend Yield

- However, these results conflict with short-term mean-reversion on equity index level

INTRODUCTION

When Trump won the US presidential election in November 2016, small and cheap stocks started rallying, which surprised most investors as the consensus was a risk-off positioning. As new trends emerge, a frequent question is if these trends will sustain. Momentum, which is a trend following strategy, works when measured over longer time periods, but some investors might be more intrigued by chasing performance on a shorter time frame. In this short research note, we will evaluate short-term momentum in common equity factors across markets (read Momentum Variations).

METHODOLOGY

We focus on a universe of seven factors namely Value, Size, Momentum, Low Volatility, Quality, Growth and Dividend Yield in the US, European, UK and Japanese stock markets. The factor performance is calculated by constructing long-short beta-neutral portfolios of the top and bottom 10% of stocks ranked by the factor definitions, which are in line with academic and industry standards. Only stocks with a minimum market capitalisation of $1 billion are included. Portfolios are rebalanced monthly and each transaction incurs costs of 10 basis points.

Short-term momentum is defined as a time series momentum strategy, i.e. we buy the factor if last week’s performance was positive and short the factor if the performance was negative. A trade is entered each day and held for a week. The portfolio can therefore be theoretically 100% net long or short a factor. Transaction costs are ignored, which makes this analysis more interesting from a theoretical than practical perspective.

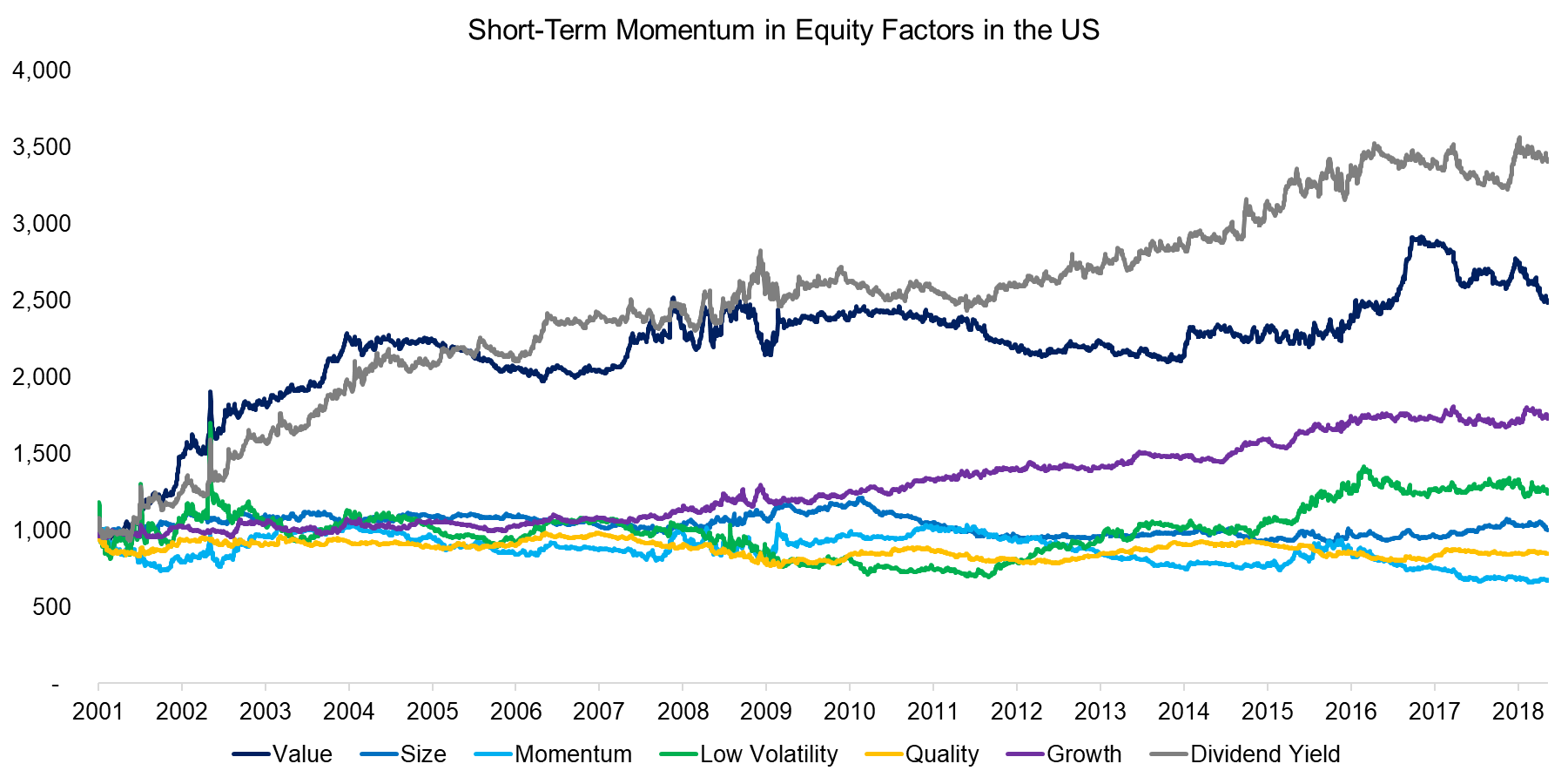

SHORT-TERM MOMENTUM IN US EQUITY FACTORS

The chart below shows the performance of the short-term momentum strategy applied to common equity factors in the US. We can observe that most factors do not exhibit performance persistence, except for Value, Growth and Dividend Yield. Growth generated a lower return than Value or Dividend Yield, but has been highly consistent since 2009.

Source: FactorResearch

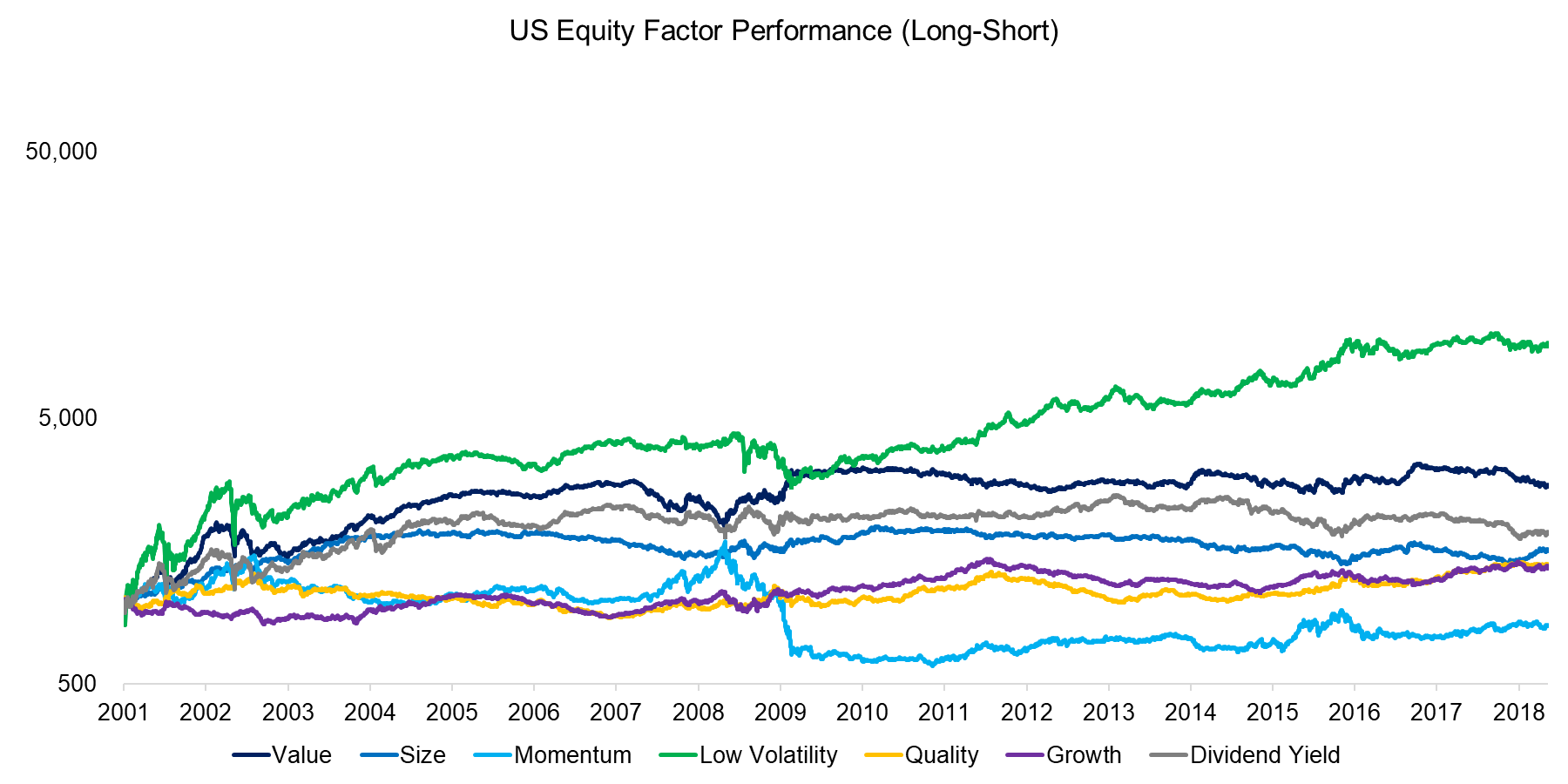

US EQUITY FACTOR PERFORMANCE

Investors might expect that there is a relationship between the persistence of performance and factor performance. Interestingly, the three factors that exhibited strong short-term momentum, i.e. Value, Growth and Dividend Yield, do not distinguish themselves from other factors in terms of underlying performance, at least not from a subjective perspective gained by viewing the chart below. The Low Volatility factor generated the strongest performance since 2001, but does not exhibit any persistence, indicating frequent short-term reversals (read Low Volatility Factor: Interest Rate Sensitivity & Sector-Neutrality).

Source: FactorResearch

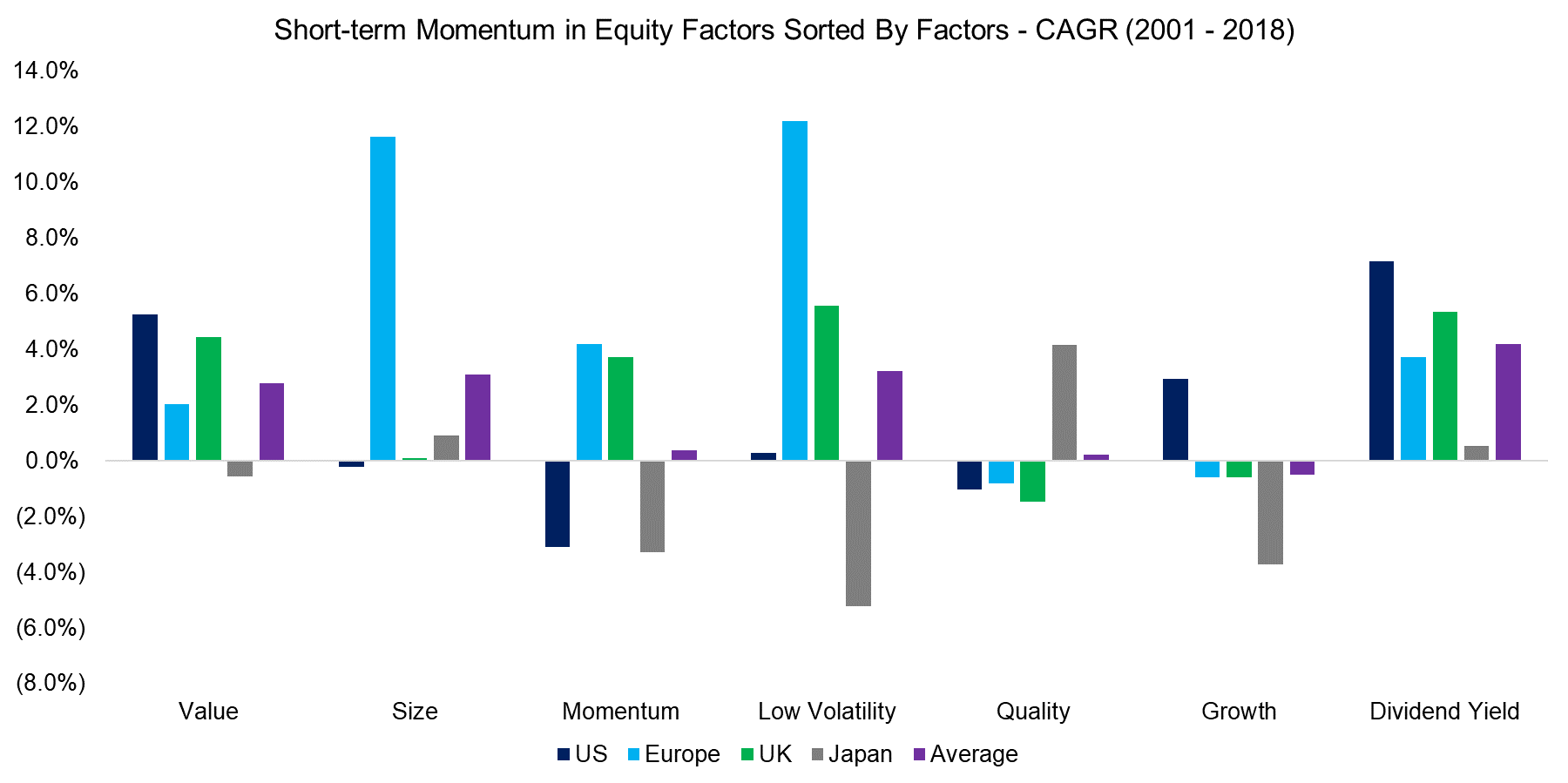

SHORT-TERM MOMENTUM IN EQUITY FACTORS SORTED BY FACTORS

We can expand the analysis to other markets to investigate if the performance persistence found in the Value, Growth and Dividend Yield factors in the US can be validated elsewhere. The chart below highlights that Value and Dividend Yield, which are related factors, exhibited short-term momentum across markets, although this does not hold for Growth. It is worth noting that the average performance of the short-term momentum strategy is positive for six out of seven factors, highlighting that chasing short-term factor performance has merit, at least theoretically when excluding transaction costs.

Source: FactorResearch

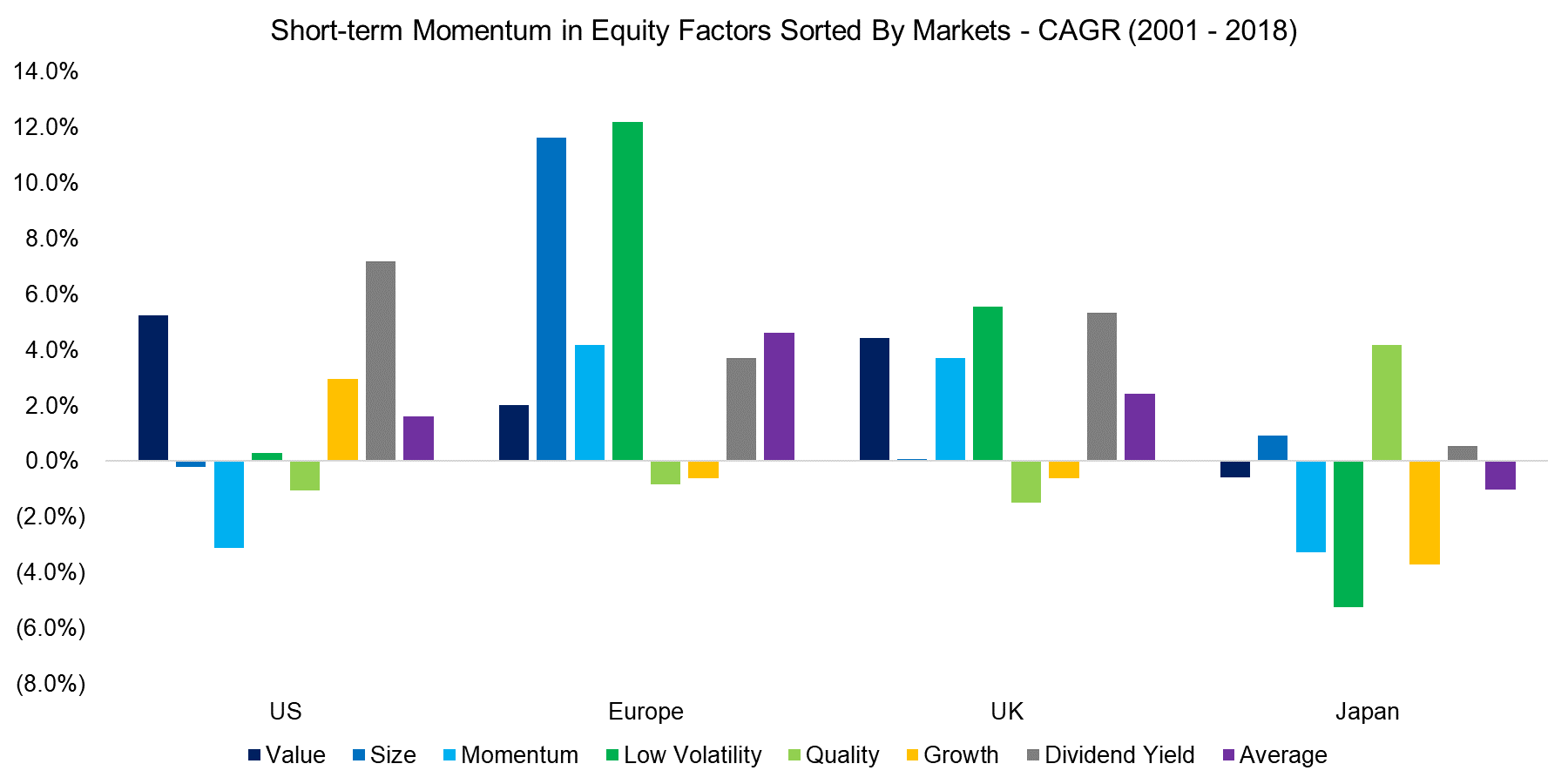

SHORT-TERM MOMENTUM IN EQUITY FACTORS SORTED BY MARKETS

We can change the perspective by displaying the short-term momentum strategy by markets, which reveals that factors exhibit performance persistence across markets, except for Japan. Other researchers have similarly concluded in studies of quantitative strategies that Japan’s stock market is driven more by mean-reversion than by momentum.

Source: FactorResearch

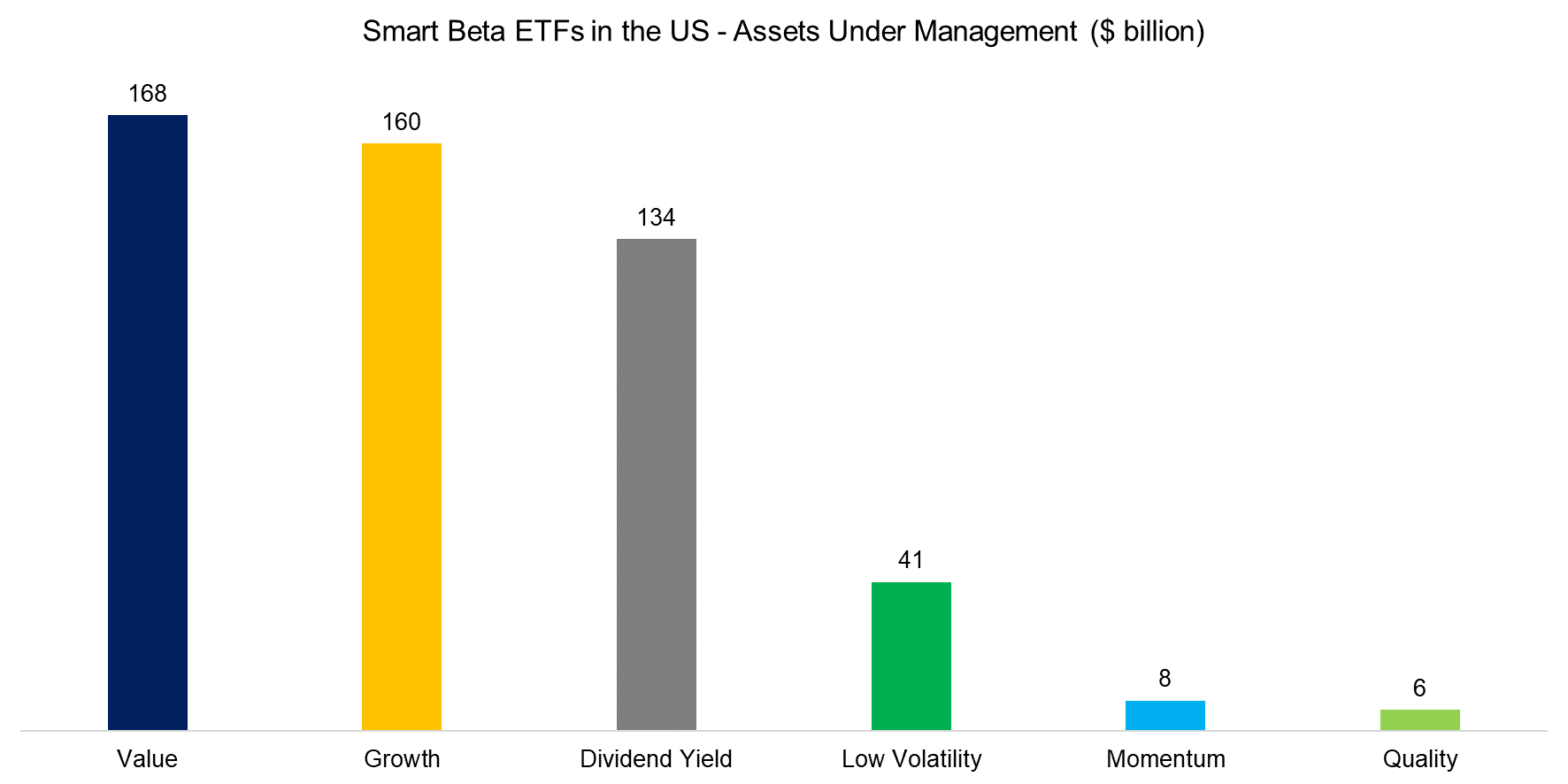

PERFORMANCE PERSISTENCE REQUIRES PRODUCTS

Value and Growth represent the most widely-followed investment styles and factors with the largest assets under management. Using smart beta ETFs in the US as a proxy, we can visualize the assets allocated to these two styles as well as to Dividend Yield. All three exhibited performance persistence, which likely is stronger the more products are available that allow performance chasing. ETFs are naturally highly suitable for this given low transaction costs and daily liquidity.

Source: FactorResearch

FURTHER THOUGHTS

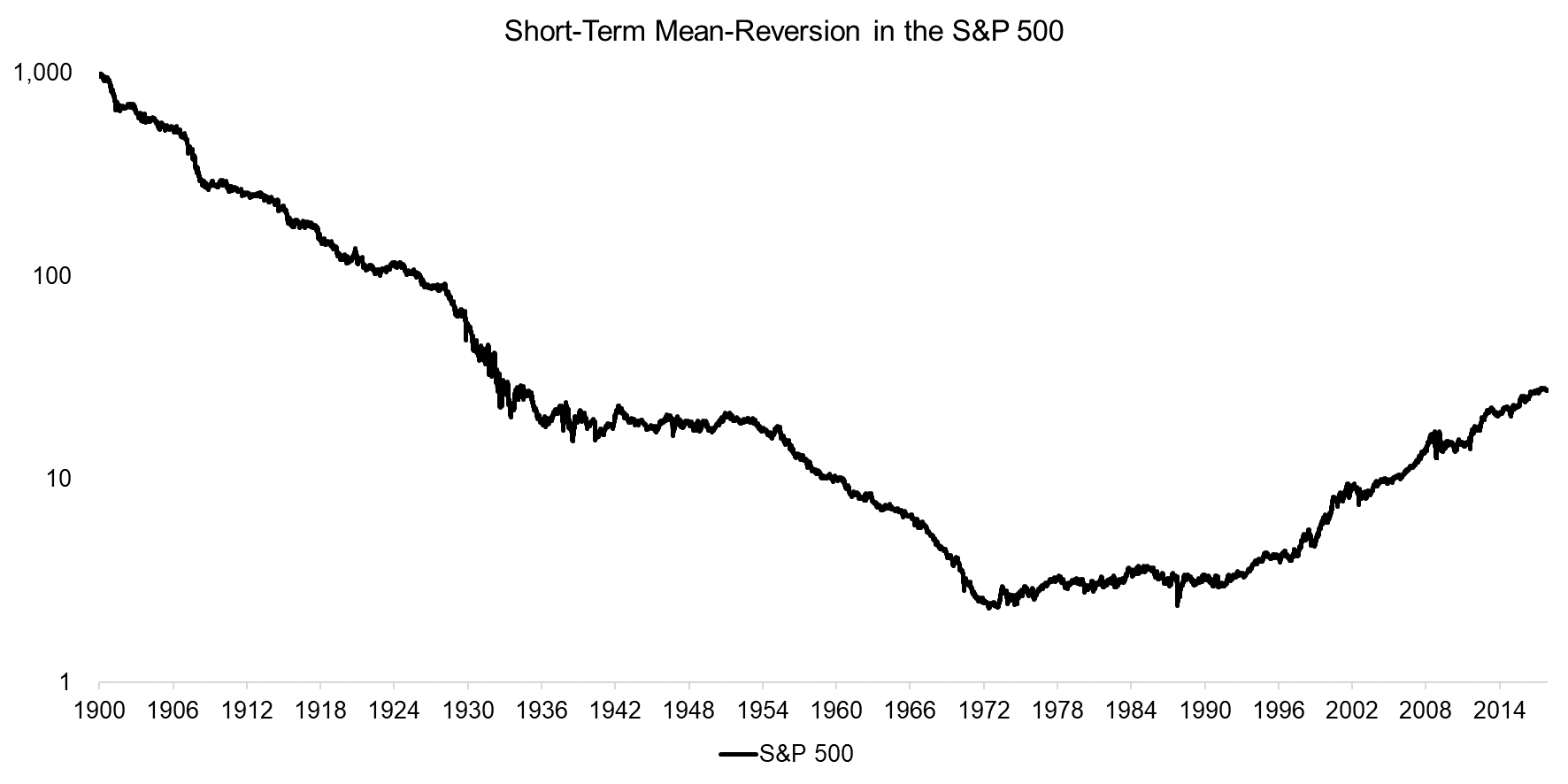

This short research note highlights that common equity factors exhibit performance persistence in most markets. However, these results conflict with investor behaviour on equity index level, which is dominated by short-term mean-reversion, i.e. the inverse of short-term momentum. The chart below shows that the S&P 500 exhibited short-term momentum from 1900 to the 1970s, but has been dominated by short-term mean-reversion since then.

Source: FactorResearch

RELATED RESEARCH

Mean-Reversion on Equity Index Level

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.