Size Factor

Is Small Cap Exposure Worth It?

- Size as a factor shows little consistency in generating positive returns over time

- Investors do not seem to get compensated for the higher risks of holding small caps

- If small cap exposure is still desired, best to implement via a small cap ETF

ORIGINS OF THE SIZE FACTOR

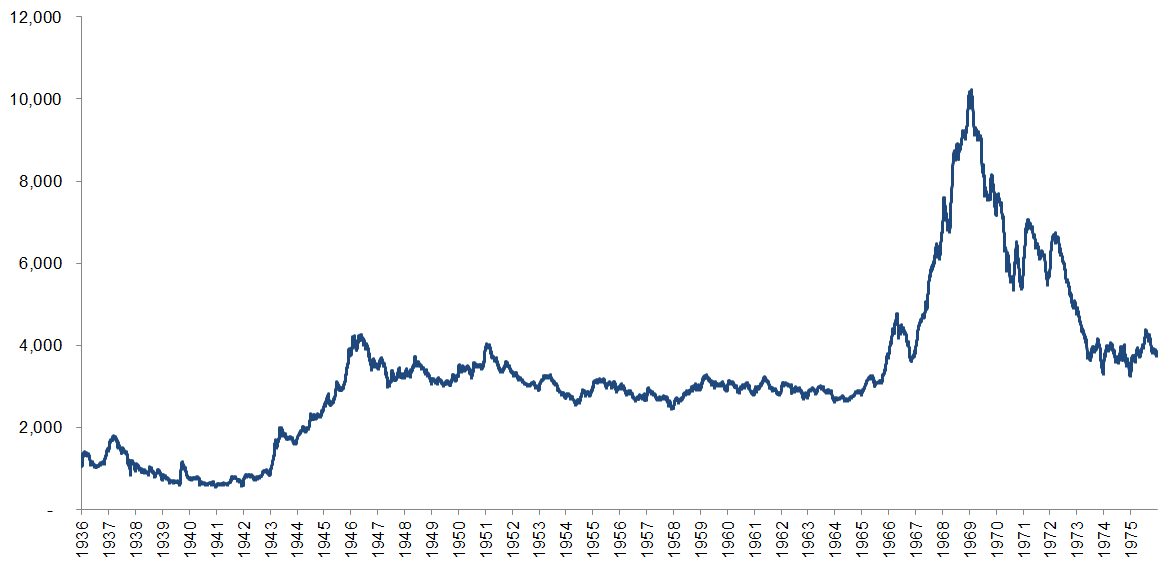

The Size factor is likely the simplest factor as it means buying companies with a small market capitalization and selling companies with a large market capitalization. The first influential paper on this factor was published by Banz in 1981, which highlighted abnormal returns from the Size effect over the period 1936 to 1975.

Using Fama-French data we can visualize the abnormal returns, which are calculated by using the difference between the bottom 10% (smallest companies) and top 10% (largest companies) for that period. It’s worth noting that the Fama-French returns are without transaction costs and include some very small companies that are too illiquid to actually trade.

Size Factor (1936 – 1975)

Source: Fama-French

The chart above does show positive abnormal returns, but very little consistency with one long period of flat returns between 1946 and 1966 and one bubble-like period between 1968 and 1972. From an academic perspective the positive returns might be interesting, but for a fund manager the inconsistency would represent a significant risk.

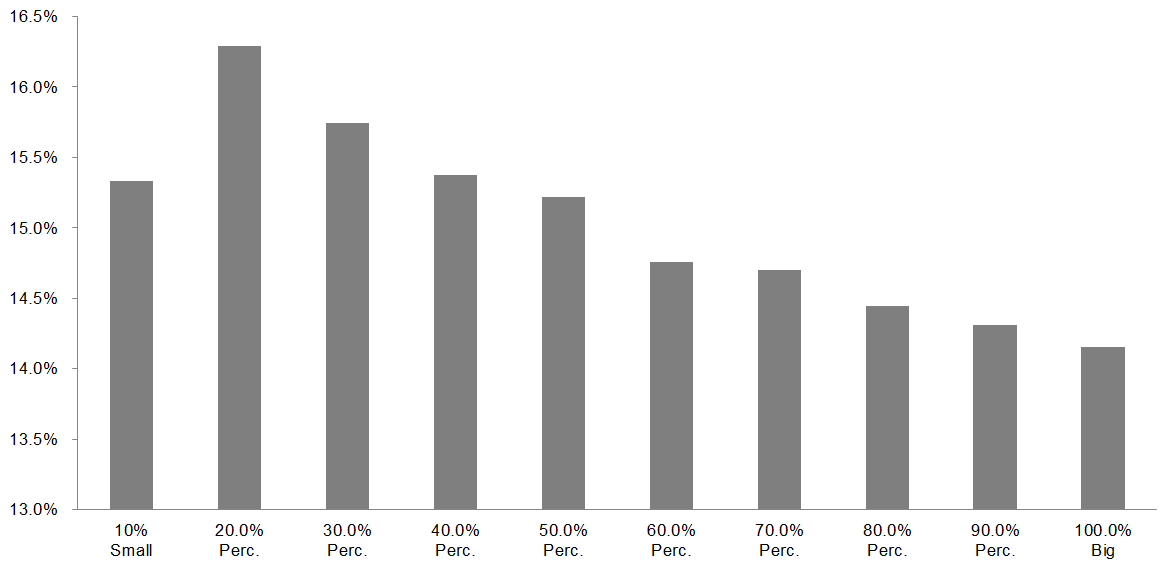

ARE SMALL CAPS MORE RISKY?

The thesis for abnormal returns from the Size factor is that small companies are more risky and therefore investors should be compensated for holding these companies. They are covered by fewer research analysts, are less diversified in terms of products and services, have less access to capital markets, amongst other differences. The following chart shows that the stock volatility decreases almost monotonically the larger companies become in terms of market capitalization.

Stock Volatility of Small vs Large Caps (1926 – 2017)

Source: Fama-French, FactorResearch

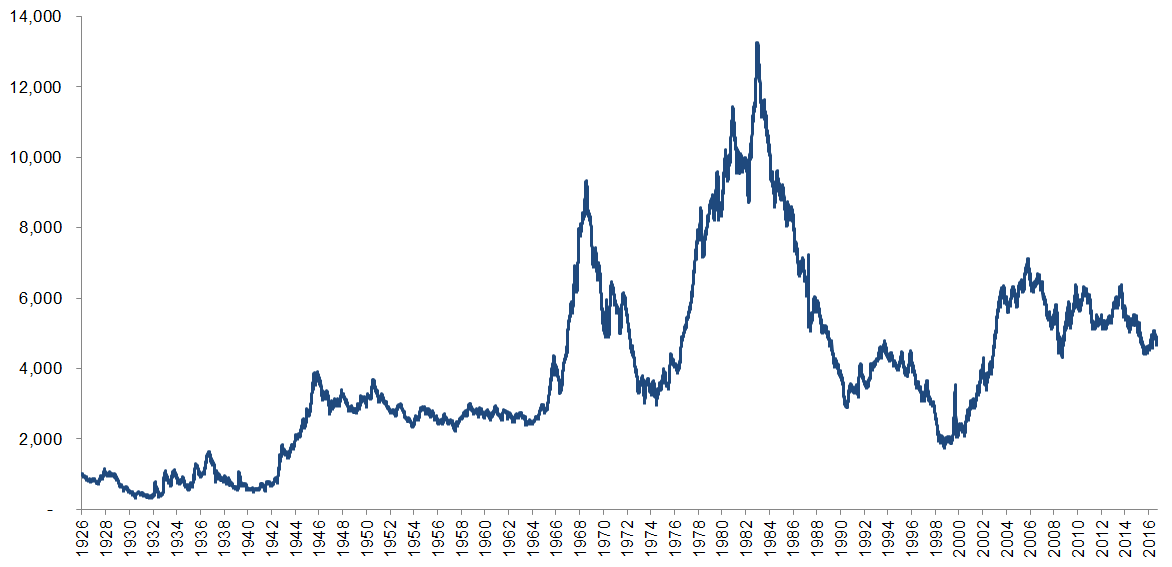

LOOKING AT THE FULL PICTURE

Having looked at the period that Banz was analysing, we can widen the observation period to a full 90 years. We see that post 1975 there was another, even more aggressive boom and bust period in the Size factor between 1977 and 1992. The abnormal returns are still positive over the entire period, but it’s certainly not a factor with a particularly attractive risk-return profile. Even if Size is added for diversification to a multi-factor portfolio, this might be challenged on the basis of significant, decade-long drawdowns.

Size Factor (1926 – 2017)

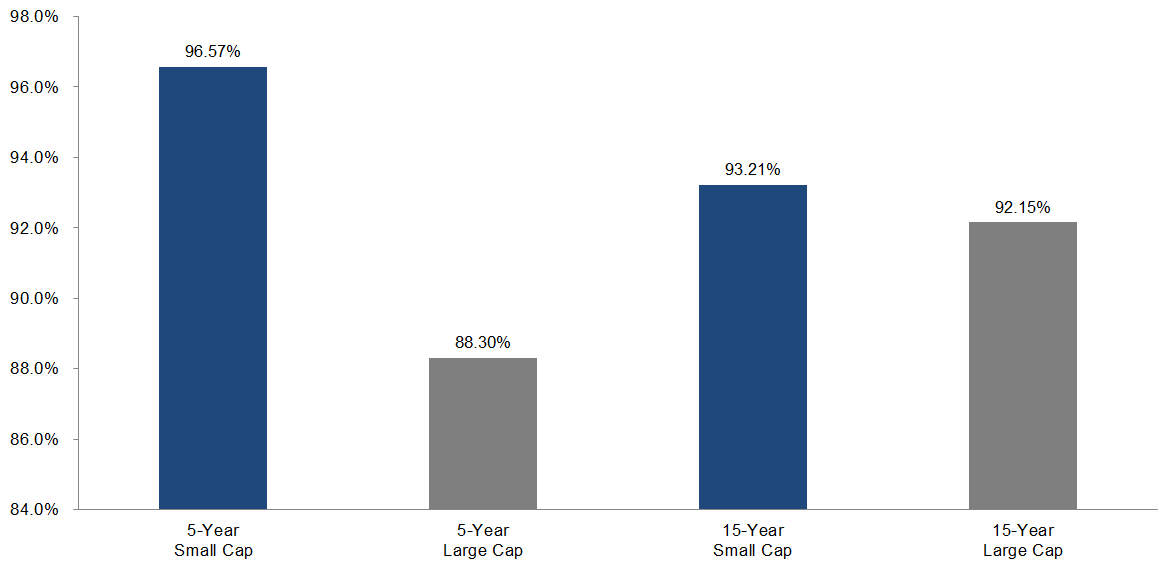

IMPLEMENTATION

If an investor still wants to gain exposure to small caps, then seeking a small cap ETF might be the best solution. S&P recently released its SPIVA US Scorecard for US fund managers, which showed that over the last 5 years 96.57% and over the last 15 years 93.21% of small cap managers underperformed their benchmarks. Interestingly large cap fund managers did slightly better, which is perplexing as small cap fund managers should be able to exploit information asymmetries in less researched companies.

US Fund Managers Underperforming Their Benchmark

FURTHER THOUGHTS

There are many more points to note about the Size factor, e.g. the impact of the January effect, the combination with other factors, potential drivers for the factor. We will cover these in subsequent research notes.

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.