Smart Beta & Factor Correlations to the S&P 500

Diversification Is Difficult

August 2017. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Most smart beta products exhibit correlations of > 0.9 to the S&P 500

- Factors show correlations of zero on average

- However, factor correlations are highly volatile across the market cycle

INTRODUCTION

In our recent research note “Smart Beta vs Factors in Portfolio Construction” we analysed the impact of including Value & Growth smart beta ETFs in an equity-centric portfolio and concluded that there was no improvement in returns or decrease in drawdowns, compared to an improvement in the risk-return ratio when using Value & Growth factor exposures. Naturally Value and Growth are only two of many factors and investors face an abundance of smart beta products. However, the question remains if any of these offer diversification benefits, which is one of the few free lunches in the investment world. In this short research note we will focus on the correlations of various smart beta products and factors to the S&P 500.

METHODOLOGY

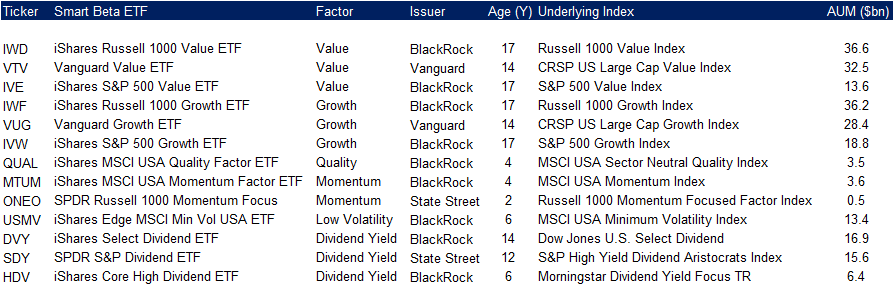

We’re going to focus on the S&P 500 and the following smart beta strategies: Value, Growth, Quality, Momentum, Low Volatility, and Dividend Yield. All smart beta ETFs have AUM of larger than $500m and many have a long trading history. We calculate the performance for all factors by creating long-short portfolios comprised of the top and bottom 30% of the US stock universe. The portfolios are constructed beta-neutral and include 10bps of transaction costs. It’s worth mentioning that we don’t cover Dividend Yield as a factor, but will be showing correlations as it’s a popular smart beta category. The table below shows the smart beta ETFs used in the analysis.

Source: ETF.com, FactorResearch

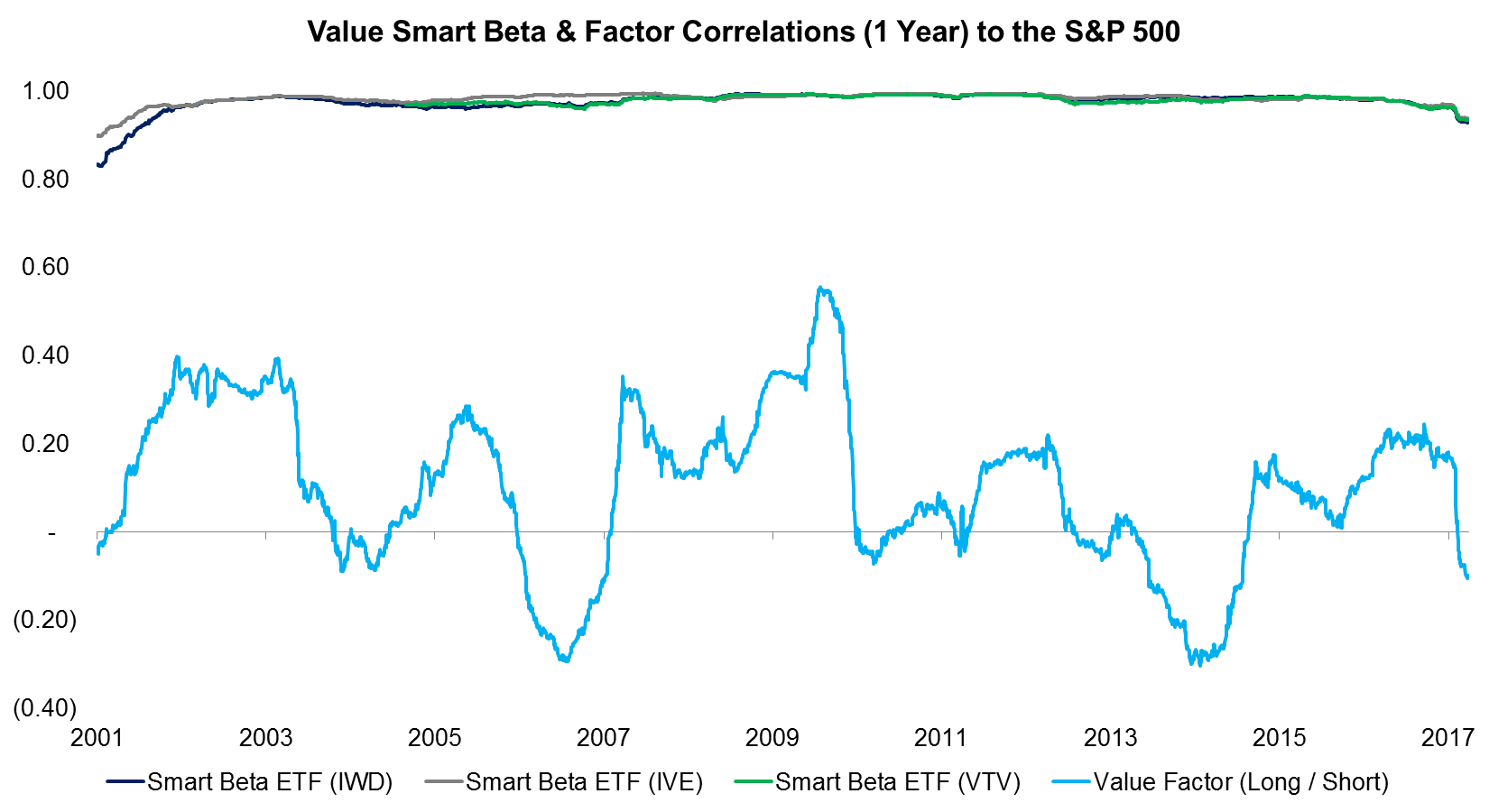

VALUE SMART BETA & FACTOR CORRELATIONS TO THE S&P 500

The Value smart beta ETFs have a long trading history and show correlations to the S&P 500 across a complete market cycle. We can observe very stable correlations of 0.98, which implies very little diversification potential for an equity-centric portfolio. The correlation of the Value factor, which is created via a long-short portfolio, is much less stable over time. The correlation was slightly positive on average with 0.15, but moved in a range between -0.3 and 0.5, which make the factor attractive for portfolio construction given diversification benefits. It’s worth highlighting that although the factors are constructed beta-neutral, it doesn’t imply that correlations to the index need to be consistently zero. Beta describes the sensitivity to the index while correlation measures the strength of the relationship.

Source: BlackRock, Vanguard, FactorResearch

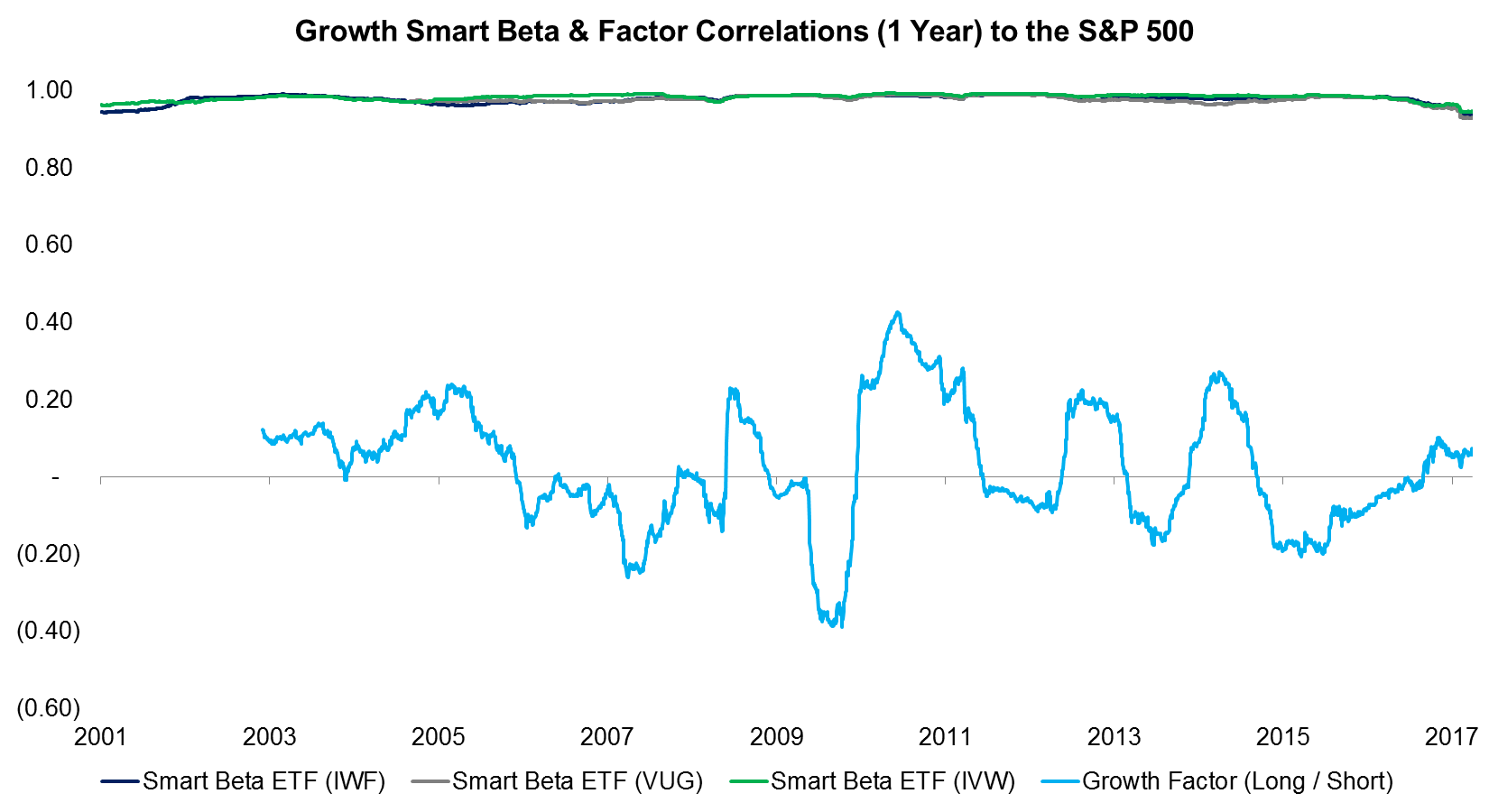

GROWTH SMART BETA & FACTOR CORRELATIONS TO THE S&P 500

Similar to the Value smart beta ETFs, the Growth products also have a long trading history and show similar high levels of correlation to the S&P 500. The factor correlation was zero on average and astute observers might notice the inverse relationship between the Value and Growth correlations. Given that these factors are partially the antithesis to each other, this is to be expected.

Source: BlackRock, Vanguard, FactorResearch

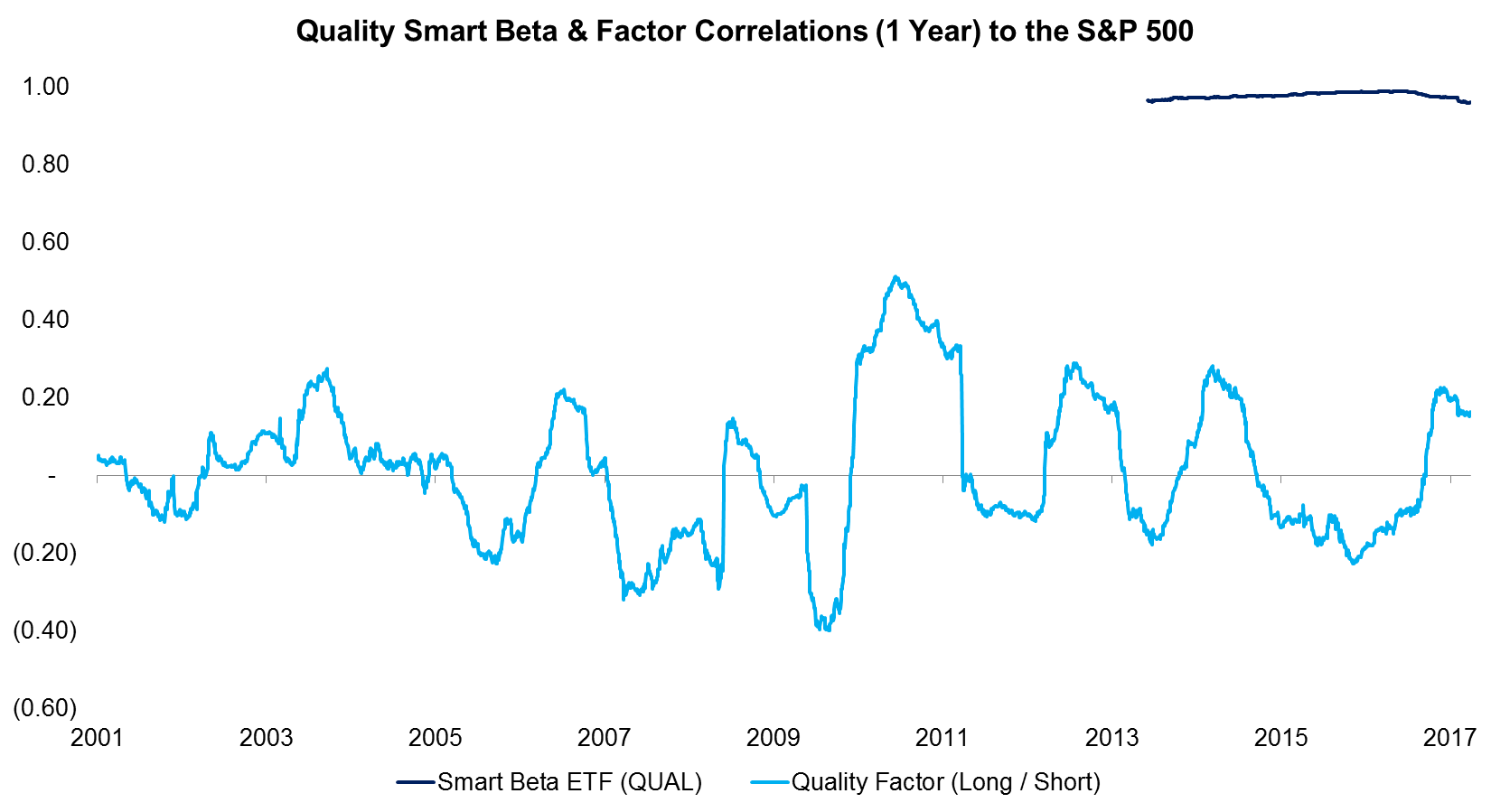

QUALITY SMART BETA & FACTOR CORRELATION TO THE S&P 500

The Quality smart beta ETF has only a short trading history of 4 years, however, we can observe a correlation of close to 1. Given that investors might want to buy a Quality-themed product for equity protection, the high correlation might be worrying when considering a financial downturn. The Quality factor correlation to the S&P 500 was low and the profile looks similar to the Growth correlation, highlighting shared portfolio characteristics.

Source: BlackRock, FactorResearch

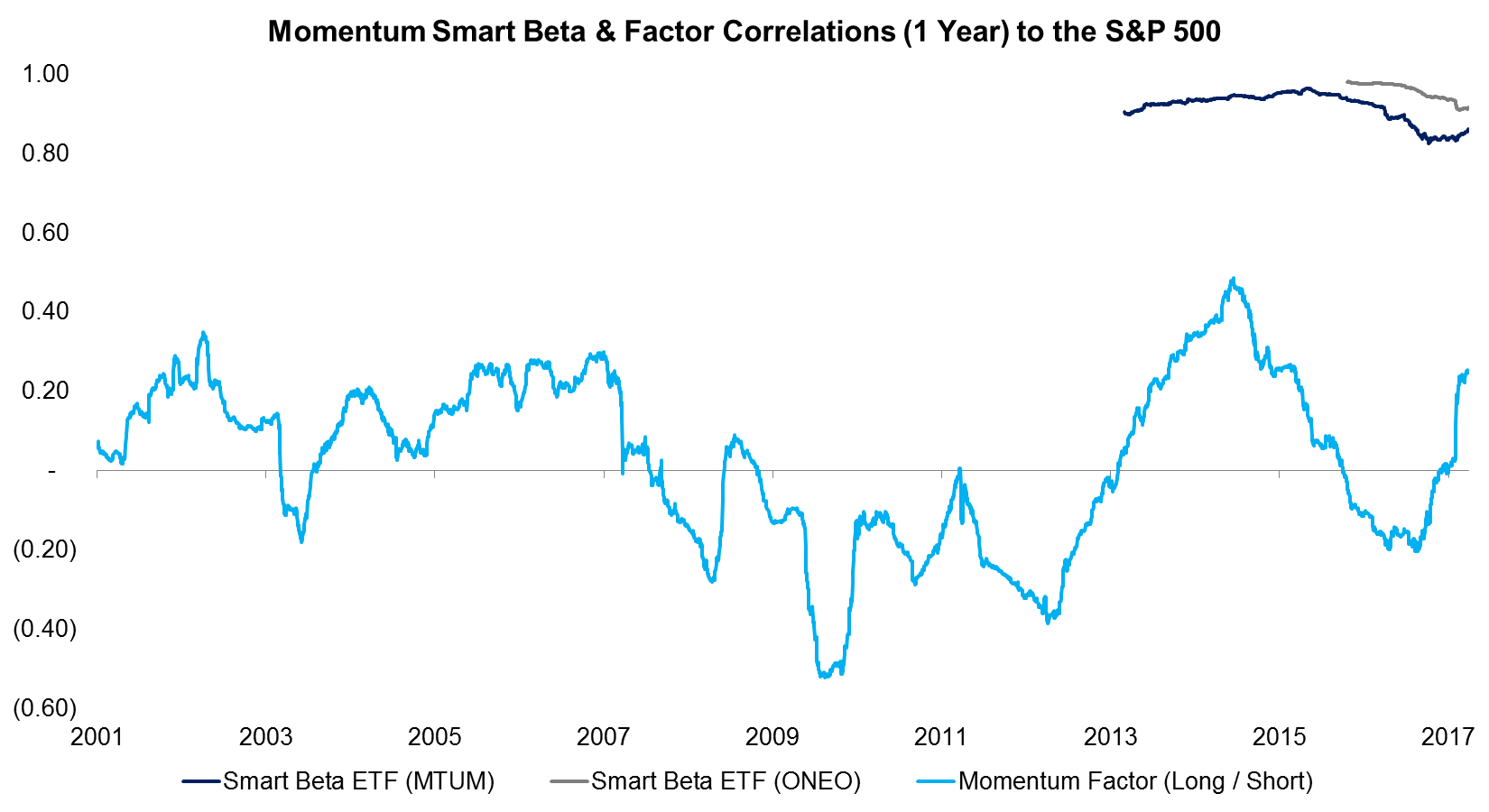

MOMENTUM SMART BETA & FACTOR CORRELATIONS TO THE S&P 500

The Momentum smart beta ETFs also have a limited trading history and show correlations that were slightly lower than for Value, Growth and Quality. The factor correlation was low on average, but traded in wide ranges from -0.5 to 0.6, which implies occasional strong positive or negative co-movements with the S&P 500. It might be spurious in nature, but it’s interesting to observe stronger and longer trends in the factor correlation since the Global Financial Crisis.

Source: BlackRock, State Street, FactorResearch

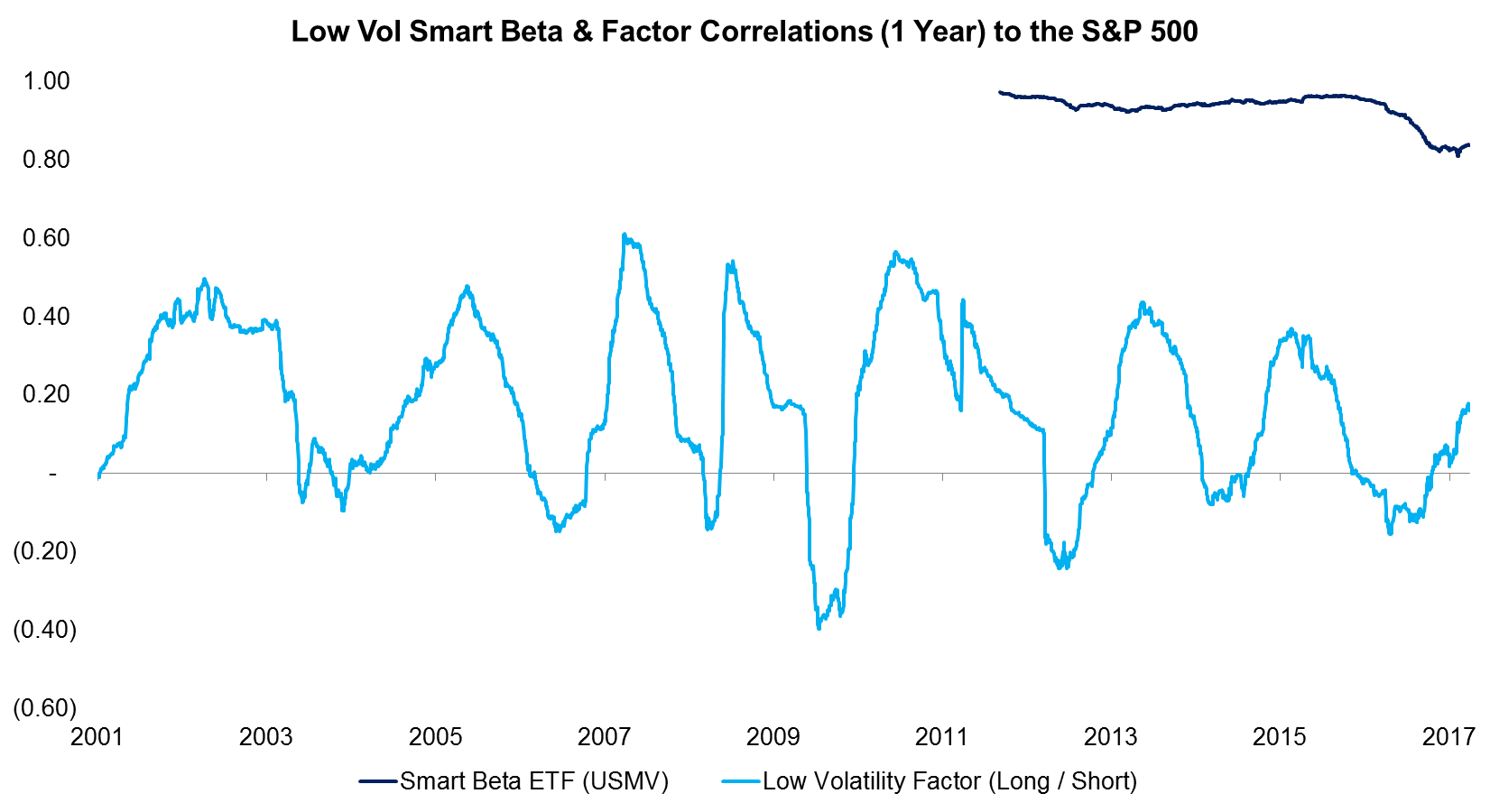

LOW VOLATILITY SMART BETA & FACTOR CORRELATIONS TO THE S&P 500

Low Volatility ETFs have been one of the success stories in the ETF market and accumulated significant assets over the last few years. The idea of investing into the stock market, which seems to promise high returns, but at low volatility, is intuitively appealing for investors. The correlation of the smart beta ETF is 0.93 and has been decreasing recently, which likely reflects the low correlations of stocks over the last year. The factor correlation was highly volatile over time and moved in a wide range.

Source: BlackRock, FactorResearch

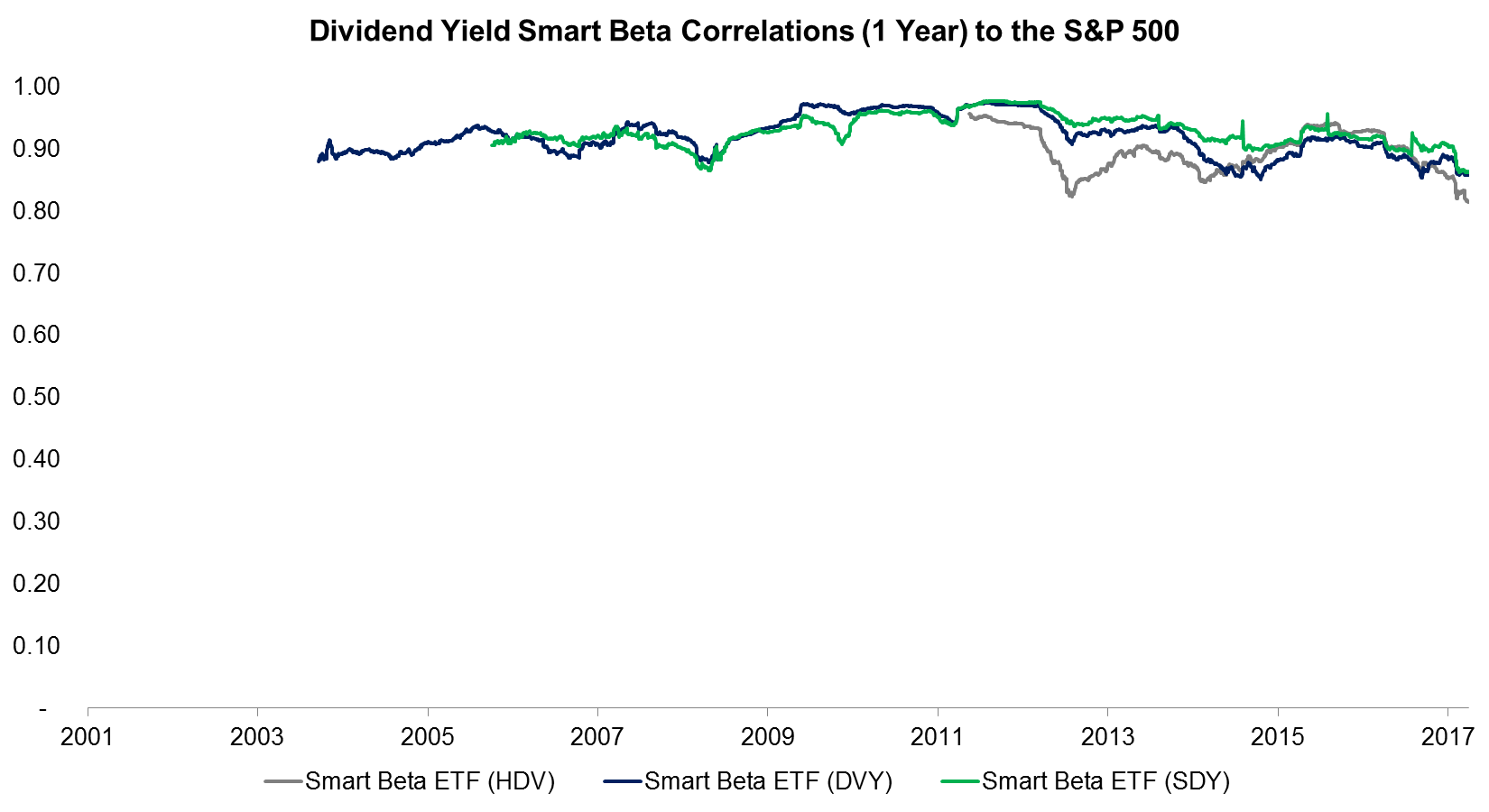

DIVIDEND YIELD SMART BETA CORRELATIONS TO THE S&P 500

The Dividend Yield smart beta correlations were the lowest on average and seem relatively volatile over time. At a first glance this might make these products more attractive given larger diversification benefits, but it’s worth highlighting that academic research has not provided strong evidence that there are structural positive returns for the Dividend Yield factor. It’s a very popular investment strategy, but the lack of empirical evidence for positive excess returns, especially after tax, is one of the reasons why we don’t cover the factor.

Source: BlackRock, FactorResearch

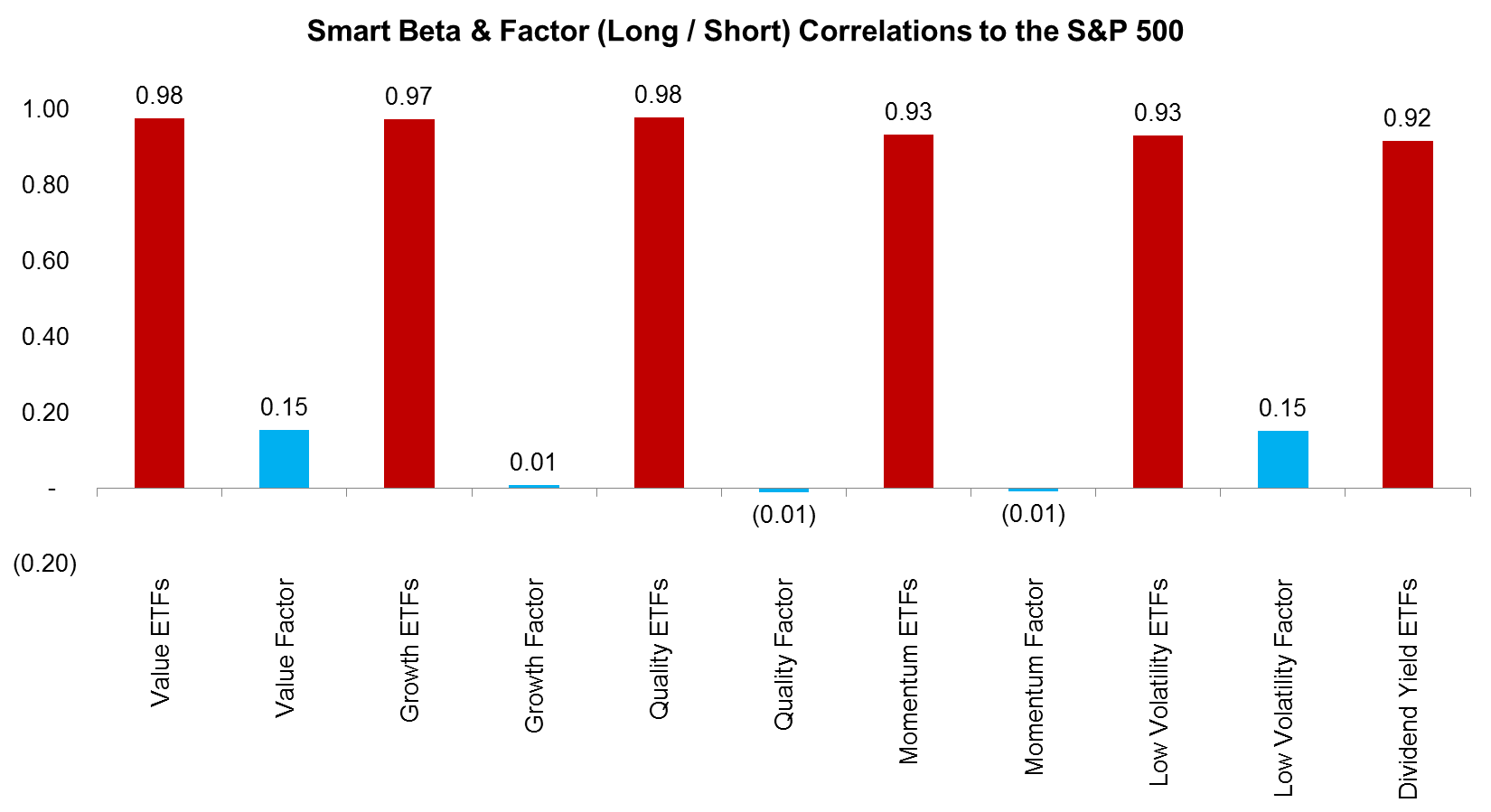

SUMMARY: SMART BETA & FACTOR CORRELATIONS TO THE S&P 500

The chart below shows the correlations of the smart beta ETFs compared to the factors over time. All smart beta products show correlations larger than 0.9 compared to mostly zero correlations for the factors, which is expected given that the factors represent long-short portfolios (read Smart Beta vs Factor Returns).

Source: FactorResearch

FURTHER THOUGHTS

Similar to our previous analysis, this short research note shows that most smart beta products are highly correlated to the S&P 500, compared to factors that exhibit low correlations. However, even factor correlations occasionally have highly positive and negative correlations, which are therefore important to monitor over time.

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.