Smart Beta or Smart Marketing

The Unusual Choices of Evidence-based Investors.

April 2018. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Smart beta ETF investors seem to ignore empirical evidence

- Excess returns from smart beta are substantially different from factor returns

- Smart beta ETFs offer little diversification for an equity-centric portfolio

INTRODUCTION

Assets under management in smart beta products surpassed $1 trillion in 2017, according to Morningstar. That was three years earlier than predicted by BlackRock, the single largest issuer of smart-beta exchange-traded funds (ETFs).

Investors have not only embraced smart-beta products, which are long-only portfolios with factor tilts, but also allocated billions to long-short factor products. However, despite the enthusiasm shown for smart-beta ETFs, several concerns remain about the products and how investors are using them (read Smart Beta vs Factor Returns).

This article addresses four key challenges of smart-beta products:

• First, the difference between investor interests and empirical evidence

• Second, the gulf between simplicity and complexity

• Third, the gap between realised versus expected returns

• Finally, the difference between investors’ objectives and product characteristics

INVESTOR INTERESTS VERSUS EMPIRICAL EVIDENCE

Smart beta is based on factor investing, which has its foundation in the work of Eugene Fama and Kenneth French. In a seminal 1993 paper they explained equity returns in terms of market risk in combination with the Value and Size factors. Since then, their work has been replicated across time, countries and various asset classes. Other factors such as Momentum and Low Volatility have also gained support from academic researchers and finance professionals.

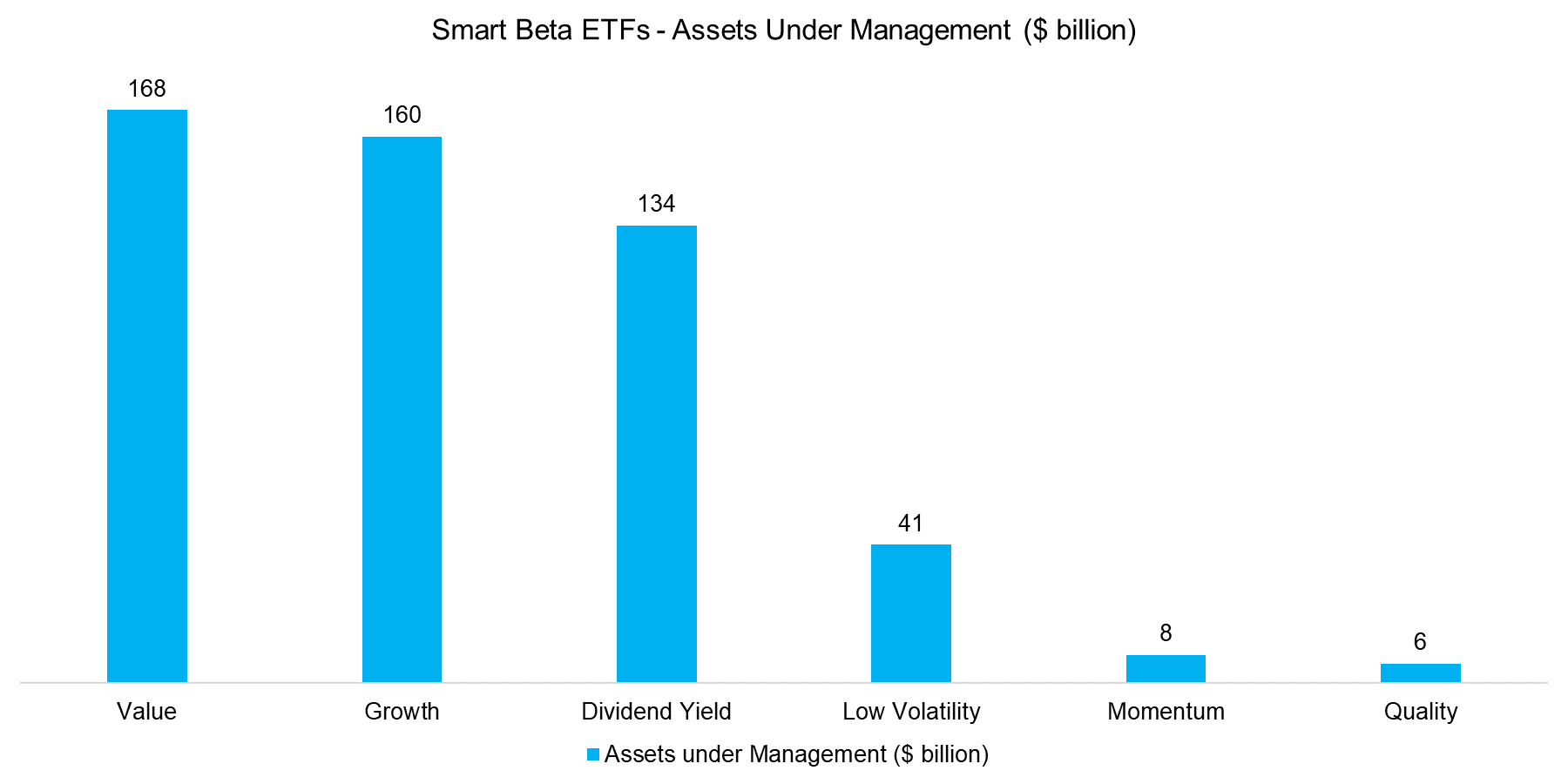

However, if the assets under management in smart-beta ETFs are analysed it becomes apparent that allocations are spread among both the well-established factors and factors that are less, if at all, supported by empirical evidence.

The chart below shows the assets under management in smart-beta products as of early 2018, highlighting that investors have allocated almost equally to both the Value and Growth factors. That is despite hardly any empirical evidence suggesting excess returns from the Growth factor are positive.

Moreover, Growth and Value tend to be negatively correlated, which implies that if value stocks show structural positive returns, then growth stocks are likely to generate negative excess returns over time.

Source: ETF.com, FactorResearch

Surprisingly, there are hardly any assets allocated to the Momentum factor, despite a significant amount of empirical evidence suggesting this factor generates attractive returns. Some research even suggests that the Momentum factor yields the highest returns of all factors over time.

Investors who consider smart-beta products to be part of their investible universe are likely to base that decision on the empirical research of factor investing. It is therefore somewhat perplexing that actual allocations seem unrelated to the results of empirical research.

SIMPLICITY VERSUS COMPLEXITY

The success of smart-beta ETFs can be explained by their foundation in solid academic research, low fees and transparency. They are much easier to analyse than mutual funds as their strategy is clearly defined, the complete holdings tend to be available on the websites of the issuers for immediate download, and they are exchange-traded instruments. As such, the simplicity of smart-beta ETFs is a winning formula.

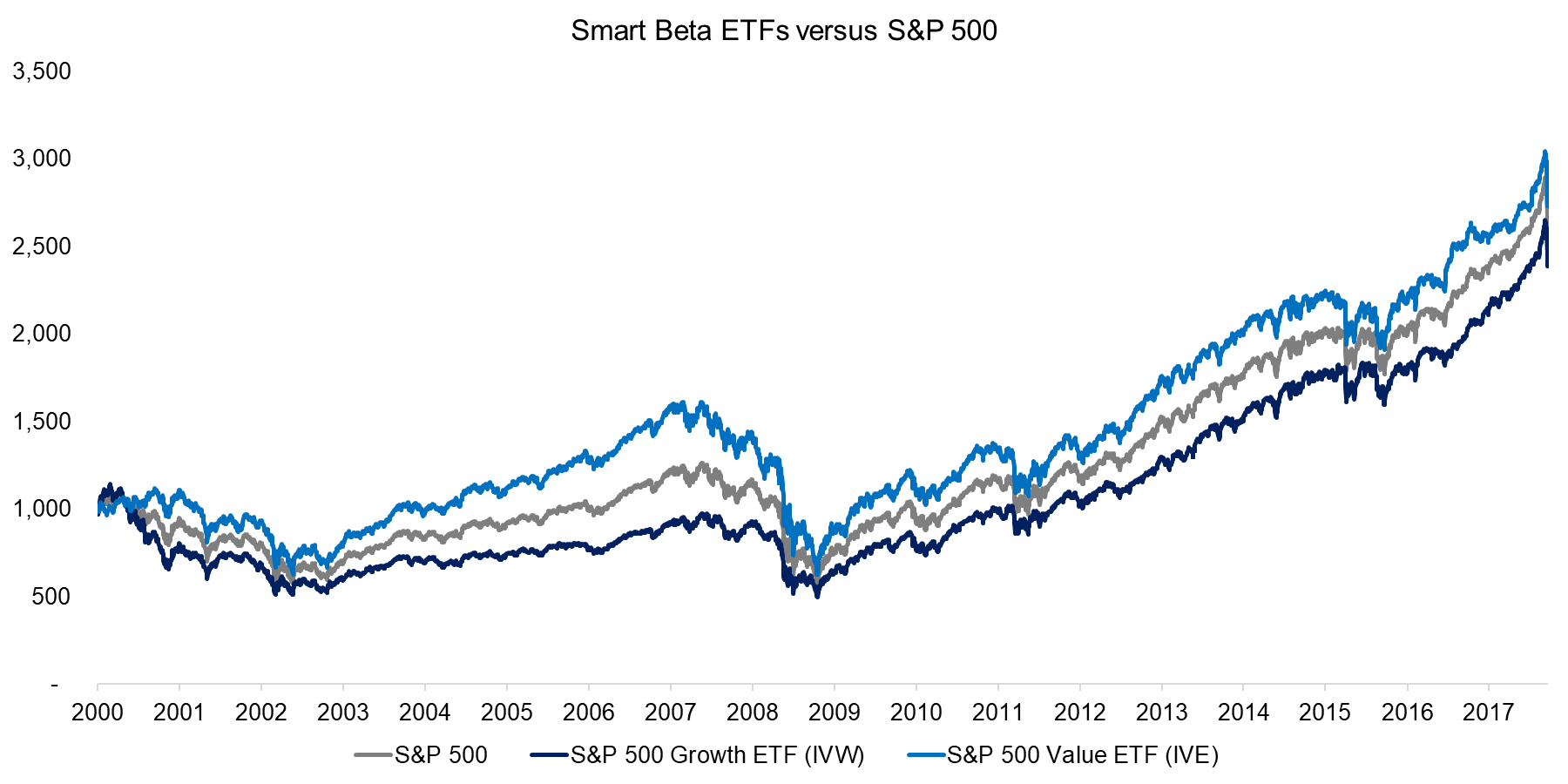

However, from a performance contribution perspective, smart-beta ETFs are not that simple and can be considered an unusual choice for harvesting factor returns. The chart below shows the performance of the S&P 500 versus the two largest smart-beta ETFs in the US. We can observe that while the Value smart-beta ETF has outperformed the S&P 500 and the Growth smart beta ETF since 2000, they are shown to be highly correlated.

Source: BlackRock, FactorResearch

Investors are likely to be challenged on a daily basis to explain if the positive or negative performance of their smart-beta ETFs can be explained by the beta or the factor. A more transparent investment strategy would be an allocation to the S&P 500, which can be achieved via an ETF at almost zero cost today, and a long-short factor portfolio.

Until a few years ago there were few ways available for investors to access factor returns directly. However, after the financial crisis most investment banks created risk premia desks, which allow institutional investors to buy long-short factor portfolios at competitive prices.

More recently, long-only factor futures have been launched for European and US stock markets. Such derivatives can be used efficiently to create long-short factor exposure by combining them with a short position in the index future. In the US, investors can even purchase long-short factor ETFs, even though these have relatively low assets under management.

Naturally, some investors are constrained from buying products with short positions. But this should be reconsidered, given that there are now more investible products that simplify factor investing.

REALISED VERSUS EXPECTED RETURNS

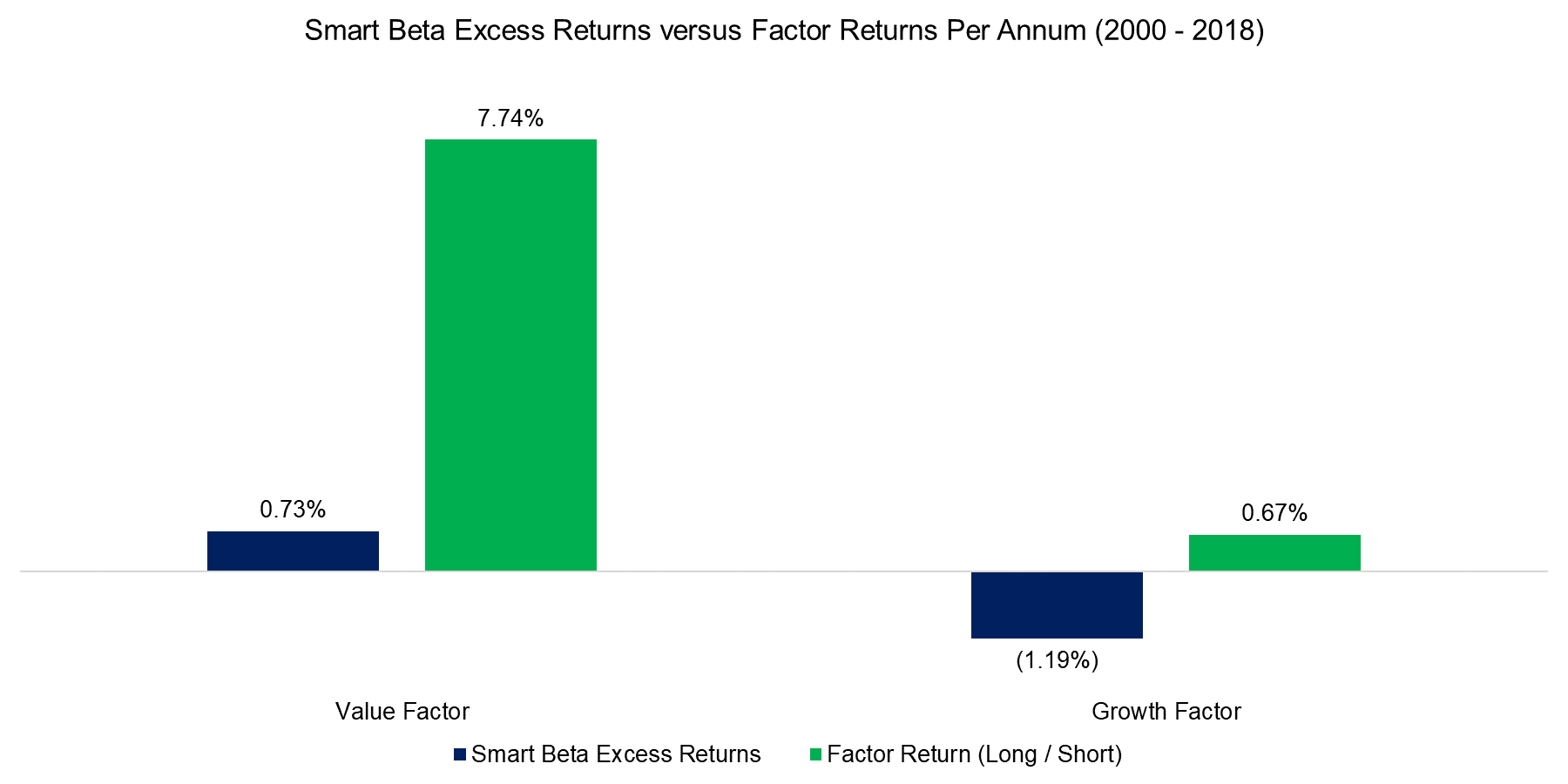

Investors allocating to smart-beta ETFs are likely to have consumed some of the research on factor investing and reasonably expect that they are able to harvest these factor returns, at least partially. However, it is worth highlighting that there is a significant difference between realised smart-beta excess returns and returns from theoretical long-short portfolios. The chart below shows the excess returns per year from the largest Value and Growth smart beta ETFs which were all issued in 2000. They therefore have the longest trading history of smart-beta ETFs as well as the theoretical factor returns. It is possible to observe that investors’ return expectations based on academic research would not have been fulfilled by investing in smart-beta ETFs.

Source: BlackRock, FactorResearch

The discrepancy in returns can likely be explained by the different portfolio construction. Smart-beta ETFs are essentially index trackers with factor tilts that are expressed in slight overweight and underweight positions. Long-short factor portfolios are created by taking the top and bottom of stocks ranked by factors, which results in more extreme portfolios.

INVESTOR OBJECTIVES VERSUS PRODUCT CHARACTERISTICS

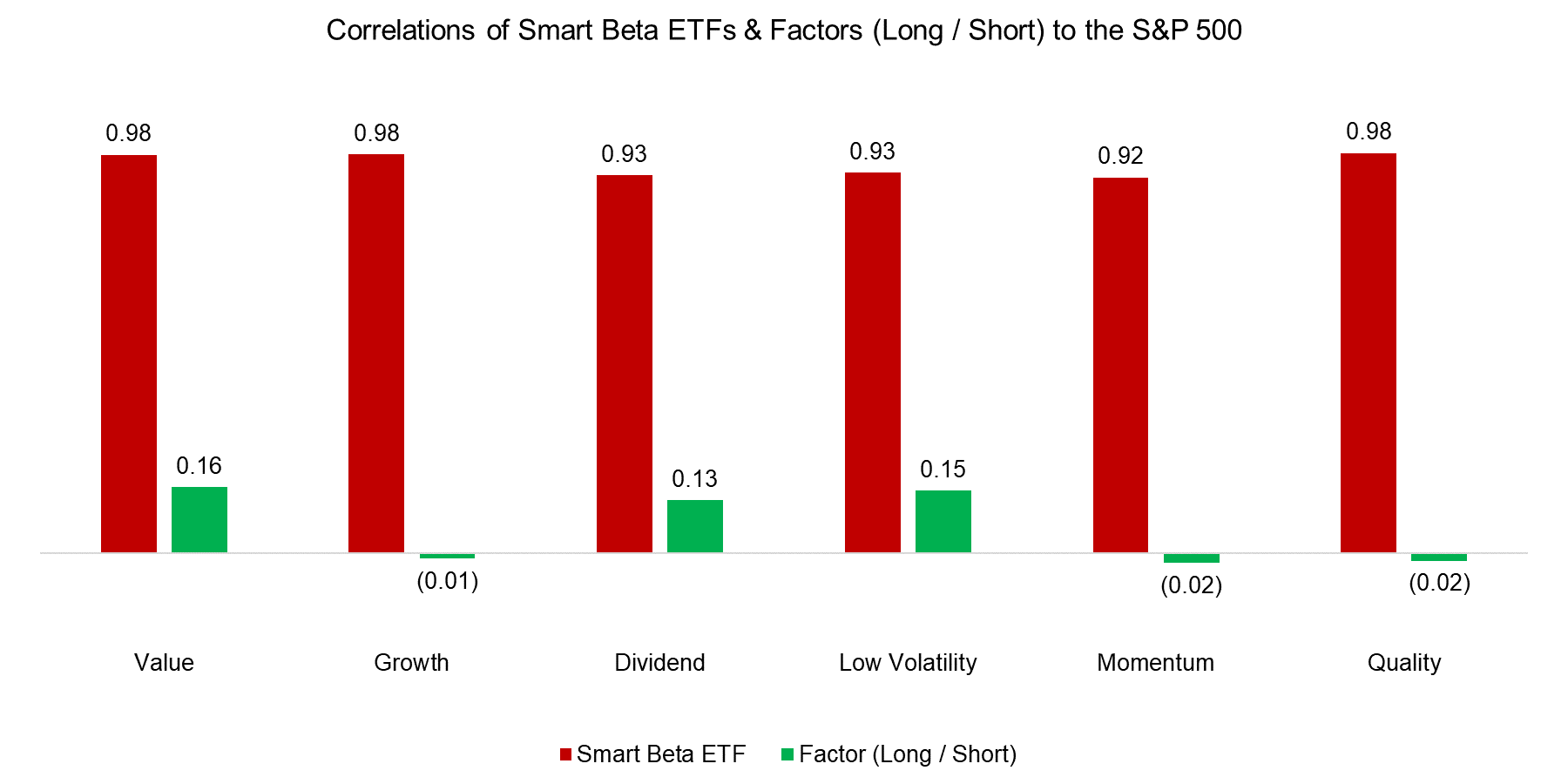

The FTSE Russell’s 2017 Smart Beta Investor Survey highlighted that the most important objective for allocating to smart beta strategies was risk reduction, followed by return enhancement. However, given that smart-beta ETFs are effectively long-only products with slight factor tilts, diversification benefits and an associated risk reduction are likely to be limited.

The chart below shows the correlations of the largest smart beta ETFs and long-short factors for the well-known factors in the US stock market to the S&P 500. The long-short factors are created by constructing beta-neutral portfolios by ranking the top and bottom 30% of the US stock universe by the factors, which are defined in line with academic and industry standards. The analysis highlights that the smart-beta correlations to the S&P 500 are well above 0.9, indicating limited risk reduction potential (read Smart Beta & Factor Correlations to the S&P 500).

Source: FactorResearch

As expected, the correlations of the long-short factors to the S&P 500 are almost zero. This makes these much more attractive additions to an equity-centric portfolio from a diversification and risk reduction perspective.

FURTHER THOUGHTS

Despite these challenges, smart-beta products remain a useful addition to the investment universe as they are mainly being used to replace core mutual funds, which is forcing active fund managers to reduce fees on these. Costs have a significant impact on returns, especially over the medium to long term, and from that perspective, smart-beta ETFs are a smart choice.

Having said this, investing should not be so complicated, and investors should have the opportunity to buy long-short factor exposure from various providers as efficiently as long-only exposure. It looks likely there will be more product launches that empower investors to directly harvest factor returns transparently and cost-efficiently.

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.