Smart Money, Crowd Intelligence, and AI

Using human and artificial intelligence to beat the S&P 500

February 2022. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Smart money, crowd intelligence, and AI ETFs have underperformed the S&P 500 since their inception

- Somewhat surprisingly, all three have almost the same factor exposures

- Negative exposure to value, and positive exposure to size and momentum factors

INTRODUCTION

Welcome to the qualifying round of the 2022 US Investment Olympics.

The goal of the games is simple: beat the S&P 500, either by generating higher returns or playing dirty and going for higher risk-adjusted returns.

Let the games begin!

QUALIFICATION

Like the 2022 Winter Olympics in Beijing, the US Investment Olympics are not easy to qualify for. Mutual funds are automatically barred from participation: Their fees are just too high for them to have a realistic shot against the S&P 500. Hedge funds have even higher fees and theoretically should be hedged, so they can’t compete with the stock market either. In fact, the only securities capable of matching the index are exchange-traded funds (ETFs).

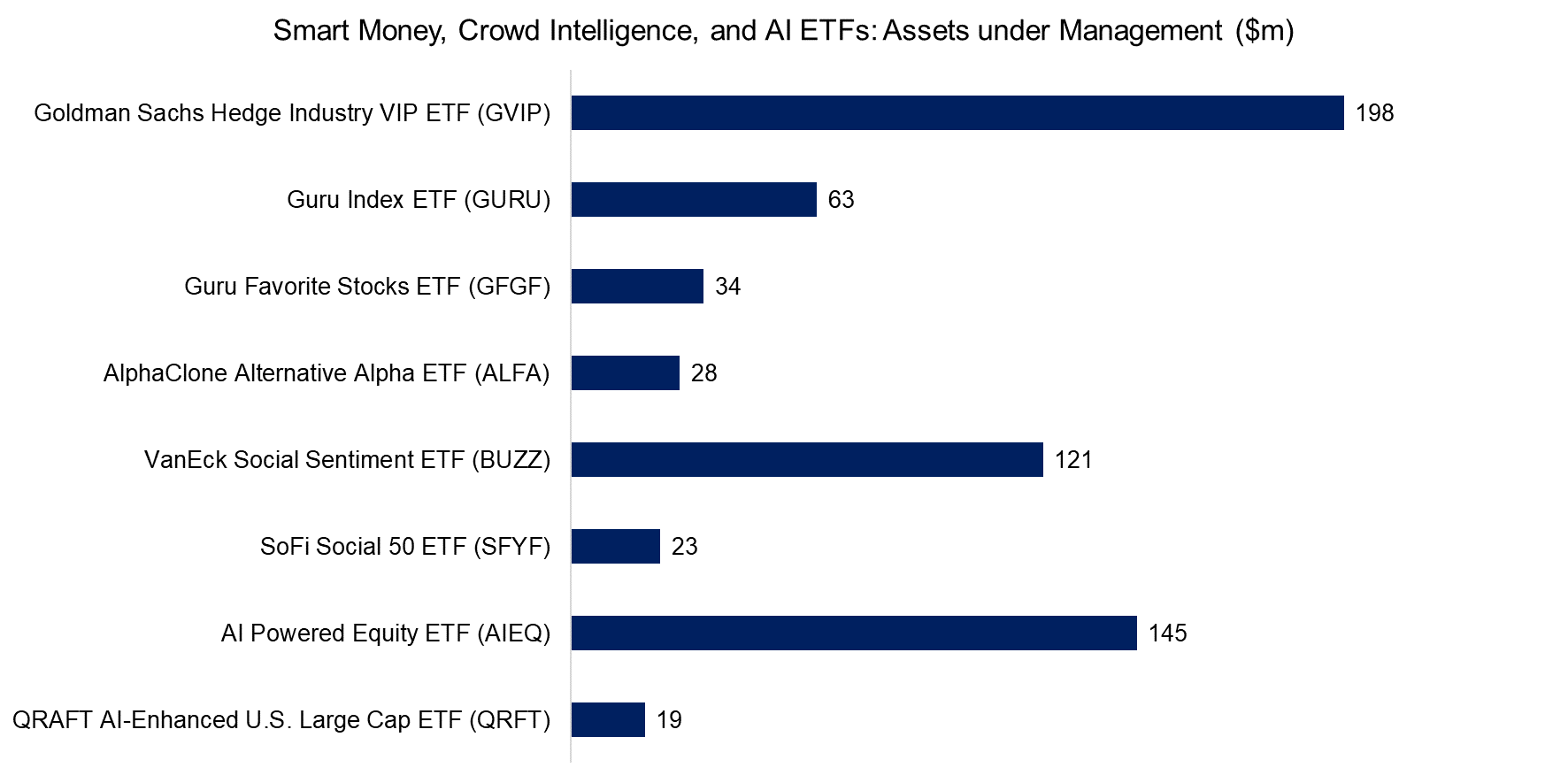

So far, there are eight ETF contestants representing three themes:

- Smart money (GVIP, GURU, GFGF, and ALFA): These ETFs mimic the trades of famous investors and mutual and hedge fund managers. Their pitch is high alpha at low fees.

- Crowd intelligence (BUZZ & SFYF): Stocks are selected based on the wisdom and sentiment of the crowd.

- Artificial Intelligence (AIEQ & QFRT): The equities in these ETFs are chosen by AI programs. In the case of AIEQ, IBM’s famous Big Watson makes the picks.

Although less expensive than the average mutual or hedge fund, the ETFs have fees of 64 basis points (bps) and are not cheap compared to low-cost index trackers. But then again, top-notch performance isn’t free (read Replicating Famous Hedge Funds).

Despite their contemporary themes, our ETFs have yet to resonate much with the investment community. Their cumulative assets under management (AUM) are only $700 million, even though some have track records going back to 2012. But then again, who doesn’t love cheering for the underdog?

Source: FactorResearch

PERFORMANCE OF SMART MONEY, CROWD INTELLIGENCE & AI ETFS

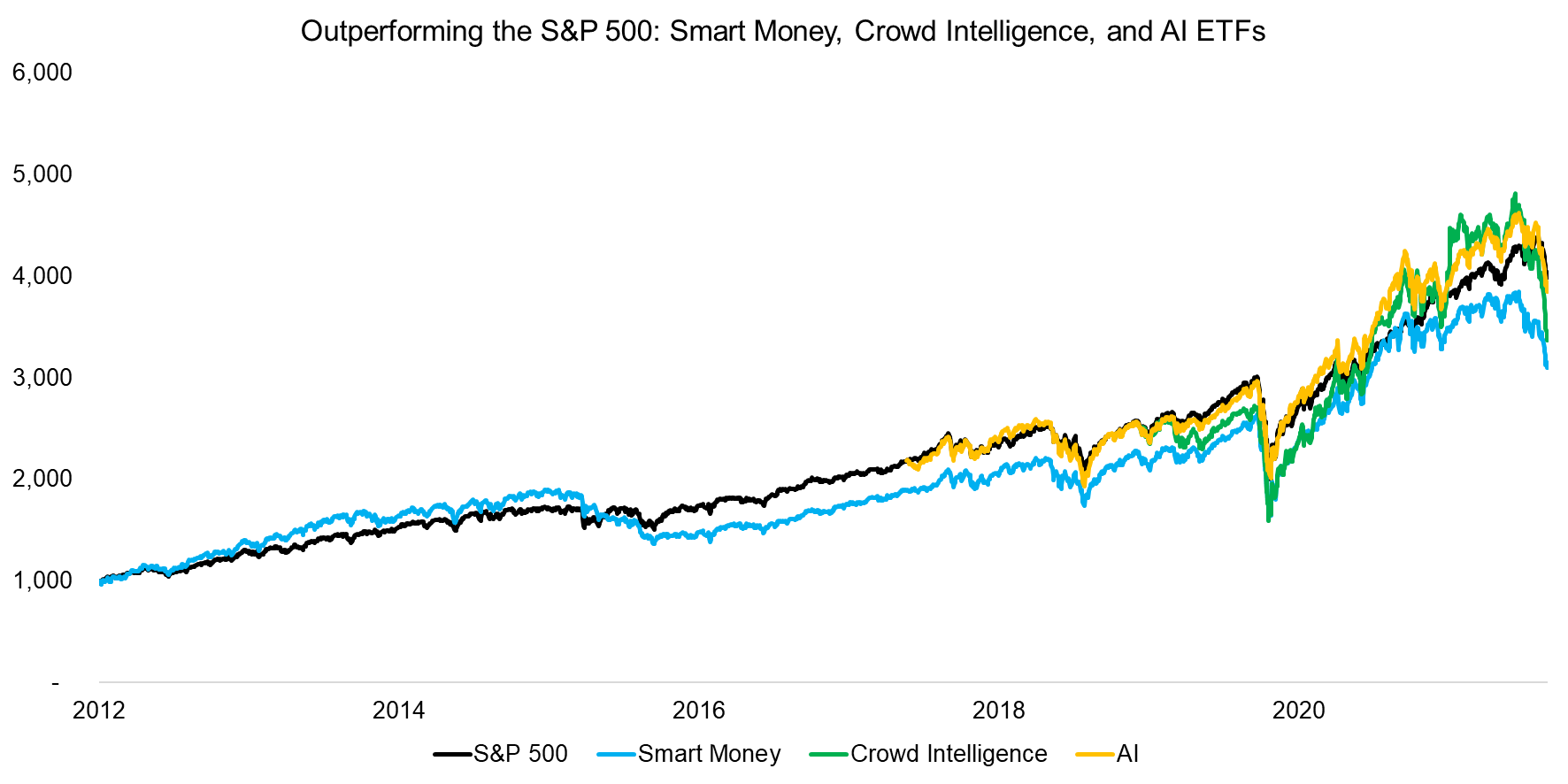

So how did our eight ETFs fare against the S&P 500? We created equal-weighted indices for the three groups, with Smart Money’s track record going back to 2012, AI’s to 2016, and Crowd Intelligence’s to 2019.

Since all invest in US stocks, they all performed in line with the S&P 500. Some have beaten the benchmark on occasion but not consistently. The judges are not especially impressed.

Source: FactorResearch

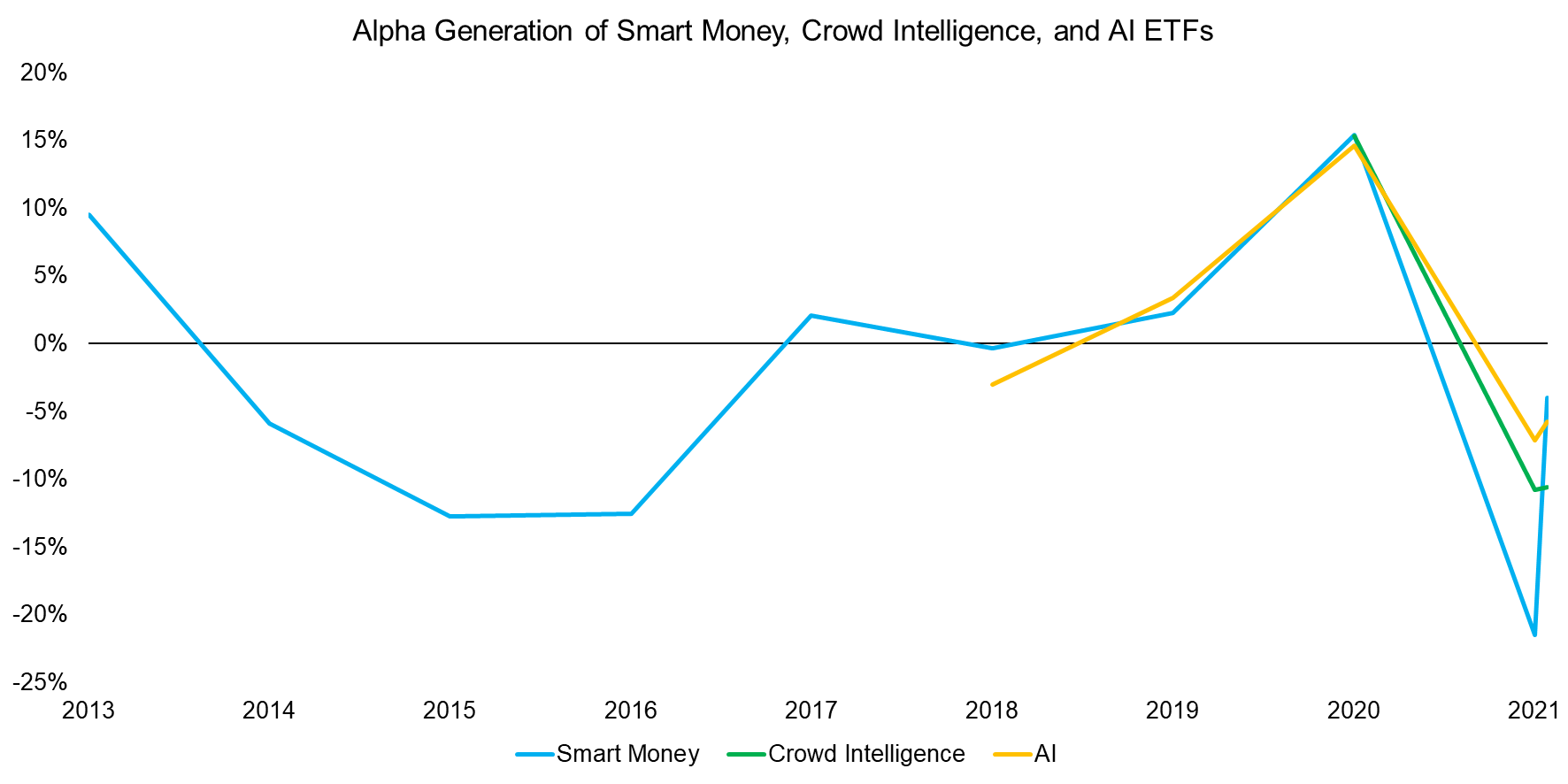

Of course, the Olympics, like finance, is all about data and details. Eyeballing an investment’s chart is not a particularly scientific approach to performance evaluation. The judges want to know what sort of alpha our competitors have generated since their inception. Smart Money yielded a negative alpha of -3.0% per annum since 2012, Crowd Intelligence -7.2% per year since 2019, and AI -0.9% since 2017.

A cynic might say the smart money isn’t that smart, the crowd not that wise, and AI not that intelligent.

Source: FactorResearch.

BETTER AT RISK MANAGEMENT?

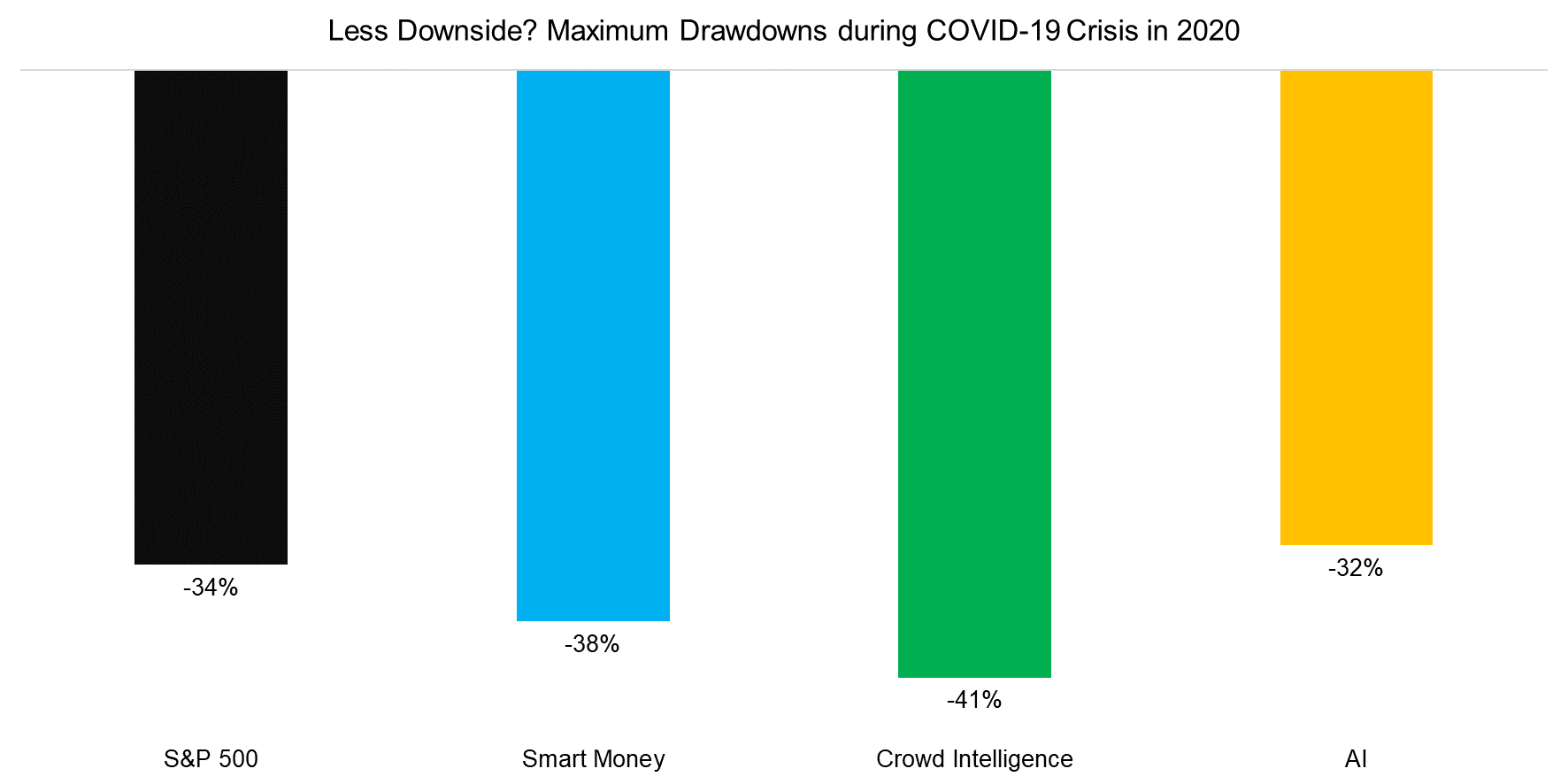

But before eliminating all these contestants from medal contention, our judges examine their risk-management characteristics. Our ETFs may not have the longest track records, but they all experienced the last severe stock market shock: the COVID-19 crisis. So how did they do?

Smart Money and Crowd Intelligence fell further than the S&P 500 in March 2020, while AI did marginally better. Perhaps humans are overrated and AI is better at risk management? (read AI, What Have You Done for Me Lately?)

Source: FactorResearch

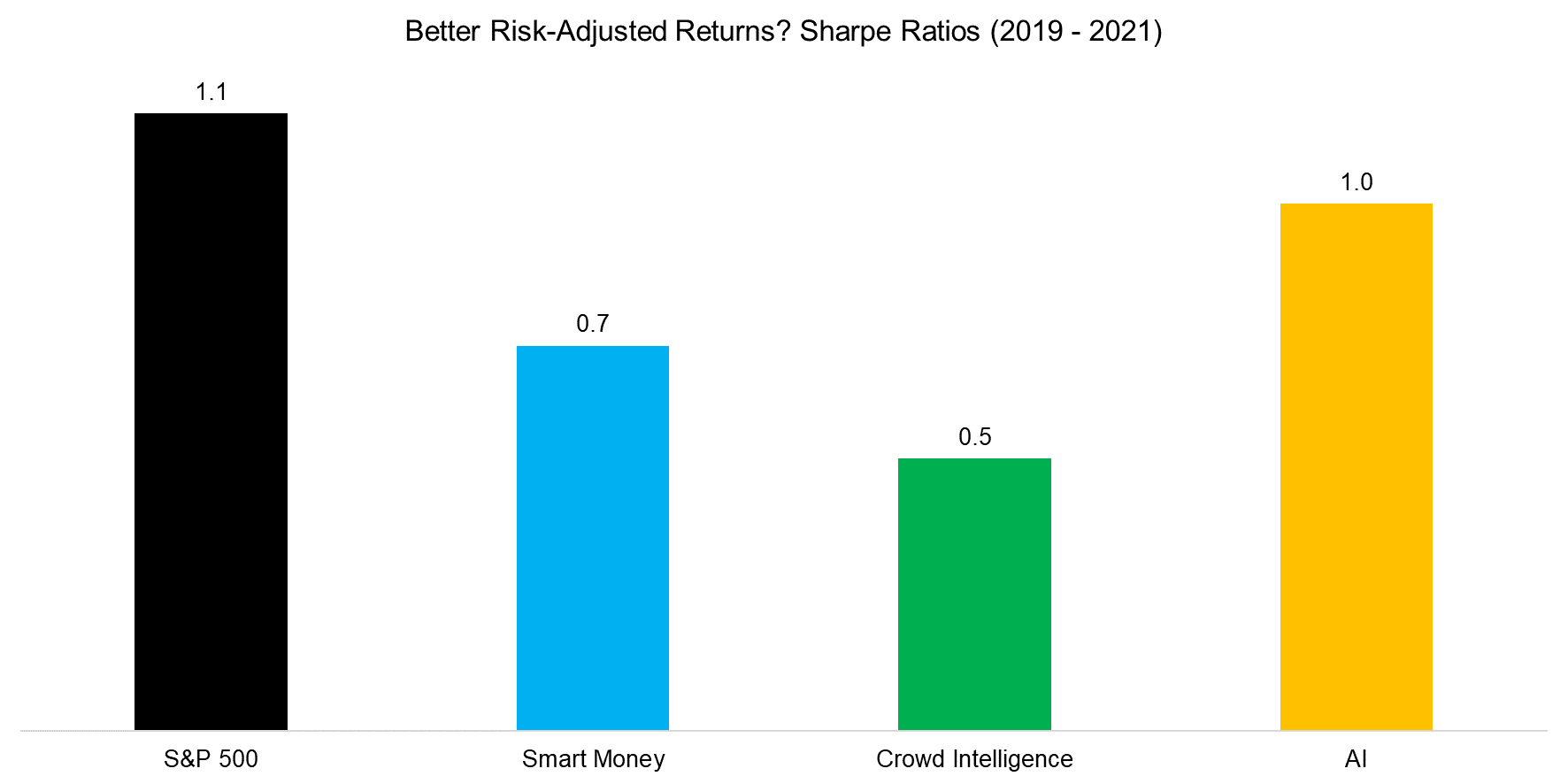

Although lower drawdowns may help investors stick to an investment strategy, on a stand-alone basis, they are not especially helpful metrics. After all, cash would outperform in a down market too, but it is unlikely to beat the benchmark over time. So the judges turn to risk-adjusted returns and the Sharpe ratio.

AI beat Smart Money and Crowd Intelligence, but none of our contenders generated higher Sharpe ratios than the S&P 500. That means none of them qualify to advance.

Source: FactorResearch

FURTHER THOUGHTS

Although these ETFs had distinct flavors, they exhibited similar behavior: In fact, they all outperformed the S&P 500 in 2020. The question is why.

A factor exposure analysis reveals that they have almost identical exposures: negative exposure to value and positive exposure to the size and momentum factors. Our competitors were all overweight outperforming small-cap growth stocks.

Smart money investors like hedge funds may not appreciate that the crowd is picking up the same risk exposure as they are. And they all might be surprised that the AI ETFs are too.

The right factor exposure can help outperform the S&P 500 over time, but it does not resemble alpha. In fact, it is the investment world equivalent of doping. Especially when hidden within thematic products.

Though it wouldn’t have mattered in this round, it would have been cause for disqualification.

Thus far, the S&P 500 is beating the field.

RELATED RESEARCH

Thematic Investing: Thematically Wrong?

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.