Statistical Arbitrage in the US

Arbitraged Away?

October 2018. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Statistical arbitrage has attractive strategy characteristics

- However, the returns are highly dependent on transaction costs

- Best used as a tactical strategy when volatility is high

INTRODUCTION

Equity markets in 2018 can be characterized by divergence. There is the US, showing strong returns, versus most other developed and emerging markets, which are generating lower or negative returns. A common trade is therefore shorting the US and going long the rest of the world. The supporting thesis is that mean-reversion will set in as the US is fully integrated into the global economy.

However, most investors are likely to be cautious as there is no certainty when the outperformance of the US will cease. Investors can speculate on mean-reversion on index as well as stock level. On the latter, the opportunity set is much larger as there are thousands of individual stocks, which allows the creation of a diversified portfolio of pair trades. Furthermore, the strategy can be enhanced by using statistical measures to improve the pair selection process. In this short research note we will investigate statistical arbitrage in the US stock market.

METHODOLOGY

We focus on all stocks in the US with a market capitalization of larger than $1 billion. The strategy is to create a diversified portfolio of pair trades, which will be dollar-neutral. Each pair consists of a long and a short position of stocks from the same sector. In addition, the two stocks of a pair need to be cointegrated, which is measured with a one-year lookback and a maximum p-value of 0.3. A trade in a pair is entered when the z-score of the stock price ratio breaches +/- 2.0 and exited when the z-score reaches 0 subsequently. The z-score is calculated with a 21-day lookback.

It is worth noting that statistical arbitrage is a sophisticated strategy that comes in all kind of forms and requires many assumptions. Our methodology is in line with academic research and relatively simple.

CASE STUDY: STATISTICAL ARBITRAGE IN THE US REAL ESTATE SECTOR

Considering the nature of mean-reversion, some sectors should offer better opportunities than others. If the stock price of a biotech company jumps due to a drug approval from the US FDA, then it is not necessarily sound to short the stock and hedge it with a long position in another healthcare company. Sectors with high firm-risks are theoretically less attractive than sectors where stocks trade similarily due to the nature of their businesses.

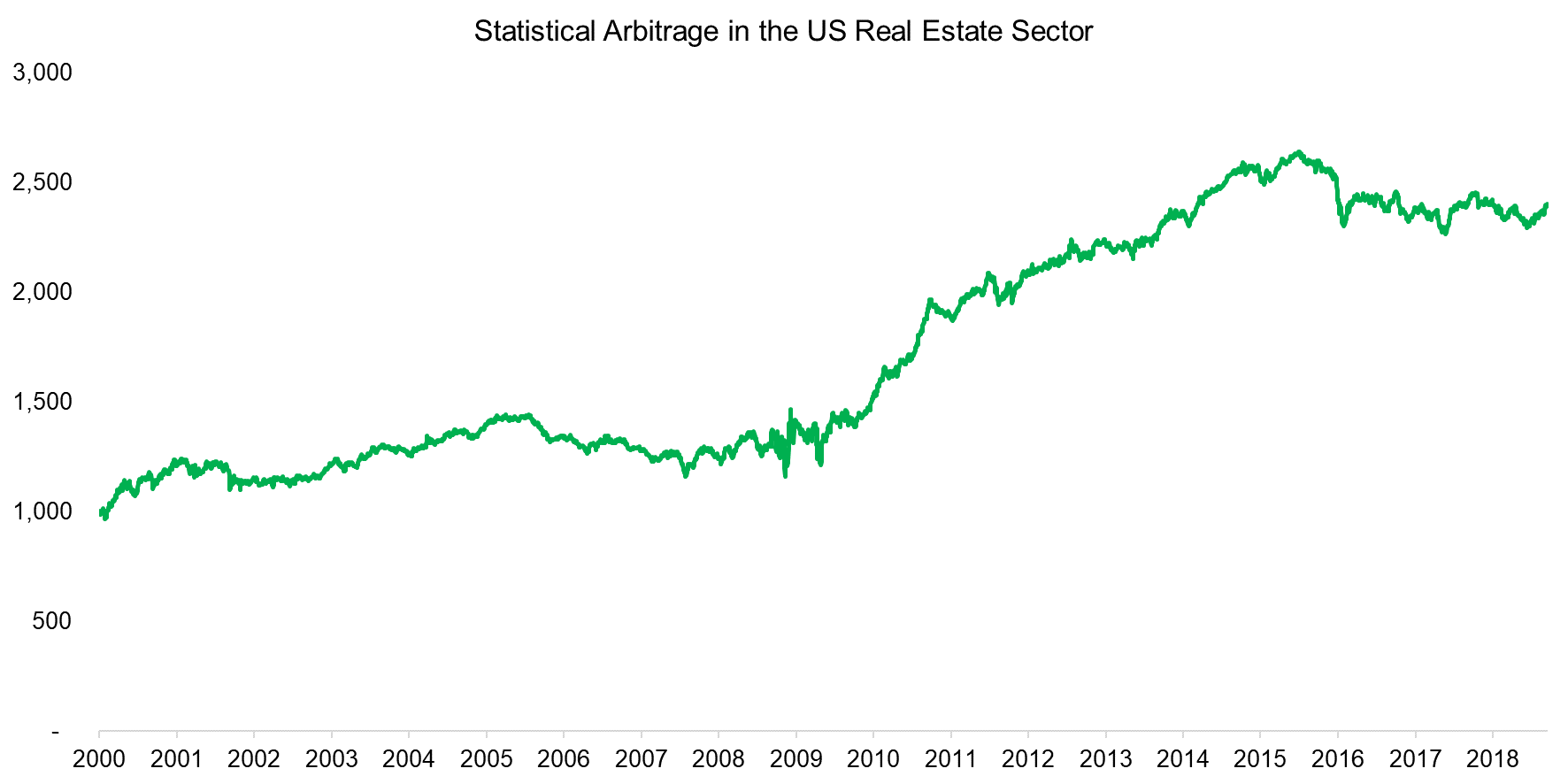

The chart below shows the performance of the statistical arbitrage strategy in the US real estate sector. Stocks from this sector feature low firm-risks as they are mainly driven by three macro variables: inflation, real GDP growth, and interest rates, which affect all companies in a similar fashion (read Equity Factors & GDP Growth). For example, if a large shopping centre company reports an earnings surprise, then other shopping centre stocks are likely to follow given common corporate drivers, which implies high mean-reversion potential.

Source: FactorResearch

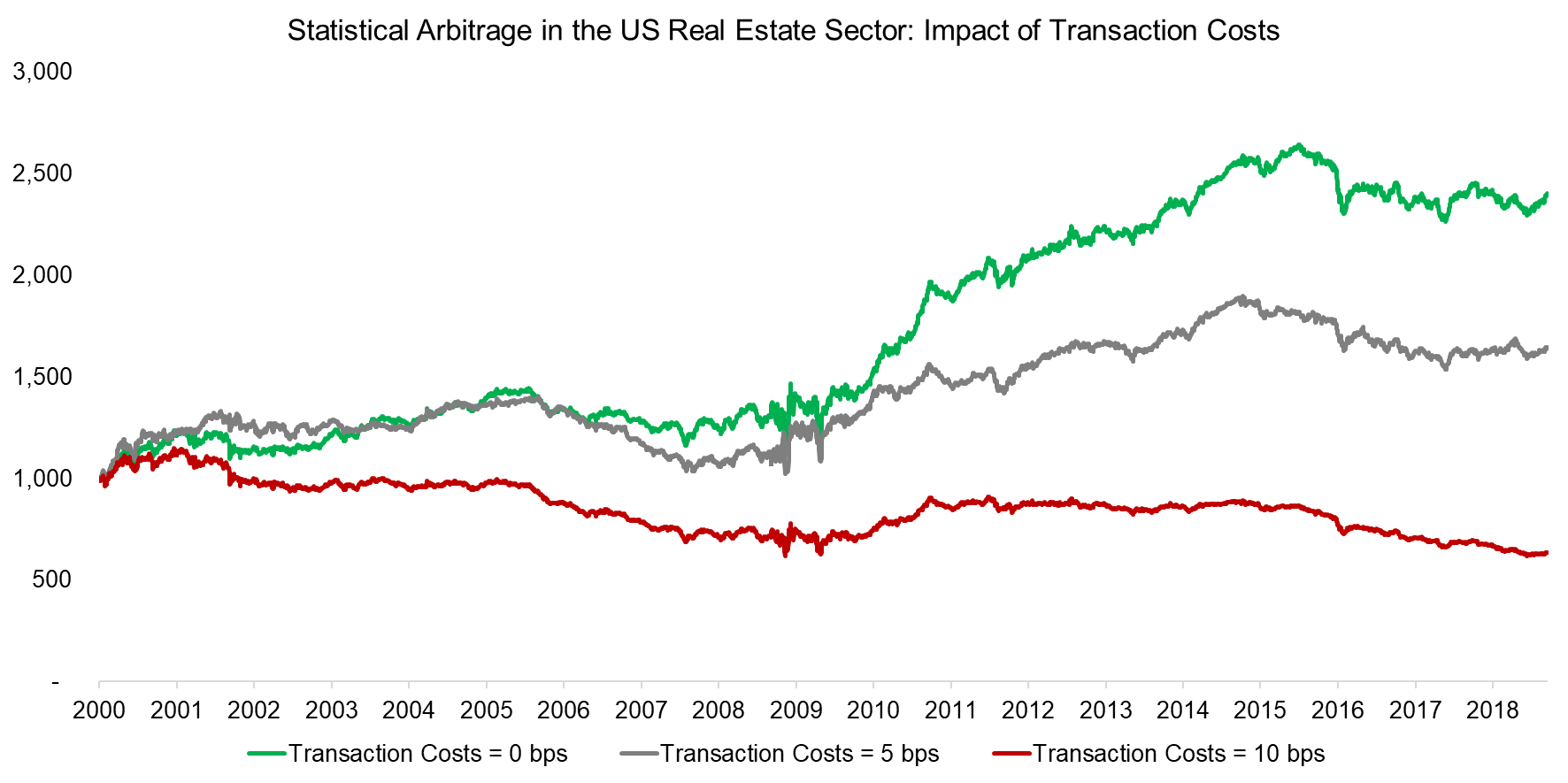

The performance of the statistical arbitrage strategy in the US real estate sector exhibits highly desirable features: consistent returns, low volatility and hardly any drawdowns. However, the returns are highly dependent on transaction cost assumptions. The analysis below highlights the impact of transaction costs on the performance of statistical arbitrage in the US real estate sector.

Commissions are less than 1 basis points (bps) for institutional investors, but there are also market impact costs, which typically range between 3 and 7 basis points. Some stock exchanges offer rebates for strategies like statistical arbitrage that provide liquidity, which makes transaction cost analysis challenging.

Source: FactorResearch

STATISTICAL ARBITRAGE ACROSS SECTORS IN THE US

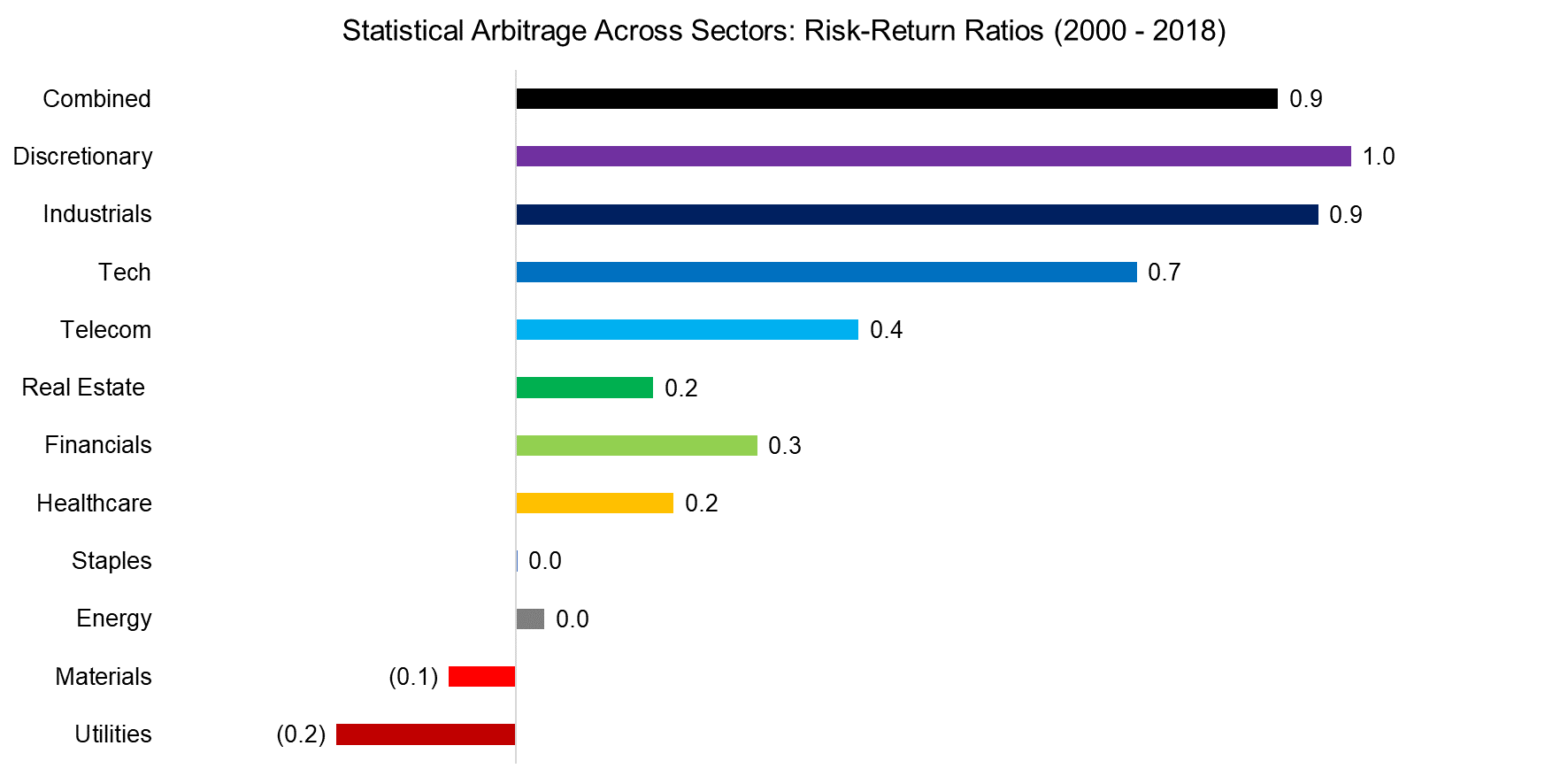

We can expand the analysis to include all sectors of the US stock market. The chart below shows the risk-return ratios assuming transaction costs of 5 basis points and includes a market-capitalization weighted combination portfolio of all sectors.

An investor might expect that sectors with low firm-risks offer higher risk-return ratios, but the results show a somewhat mixed picture. Utilities, which likely exhibit the highest systematic risks, generated the worst risk-return ratio, while real estate and telecom stocks are only moderately attractive. The consumer discretionary and industrial sectors, which have average firm-risks, featured the highest risk-adjusted returns. The results are likely impacted by the number of stocks in each sector as some, e.g. telecom, have only a few constituents, which leads to a less diversified portfolio of bets on mean-reversion (read Death, Taxes and Mean-Reversion).

Source: FactorResearch

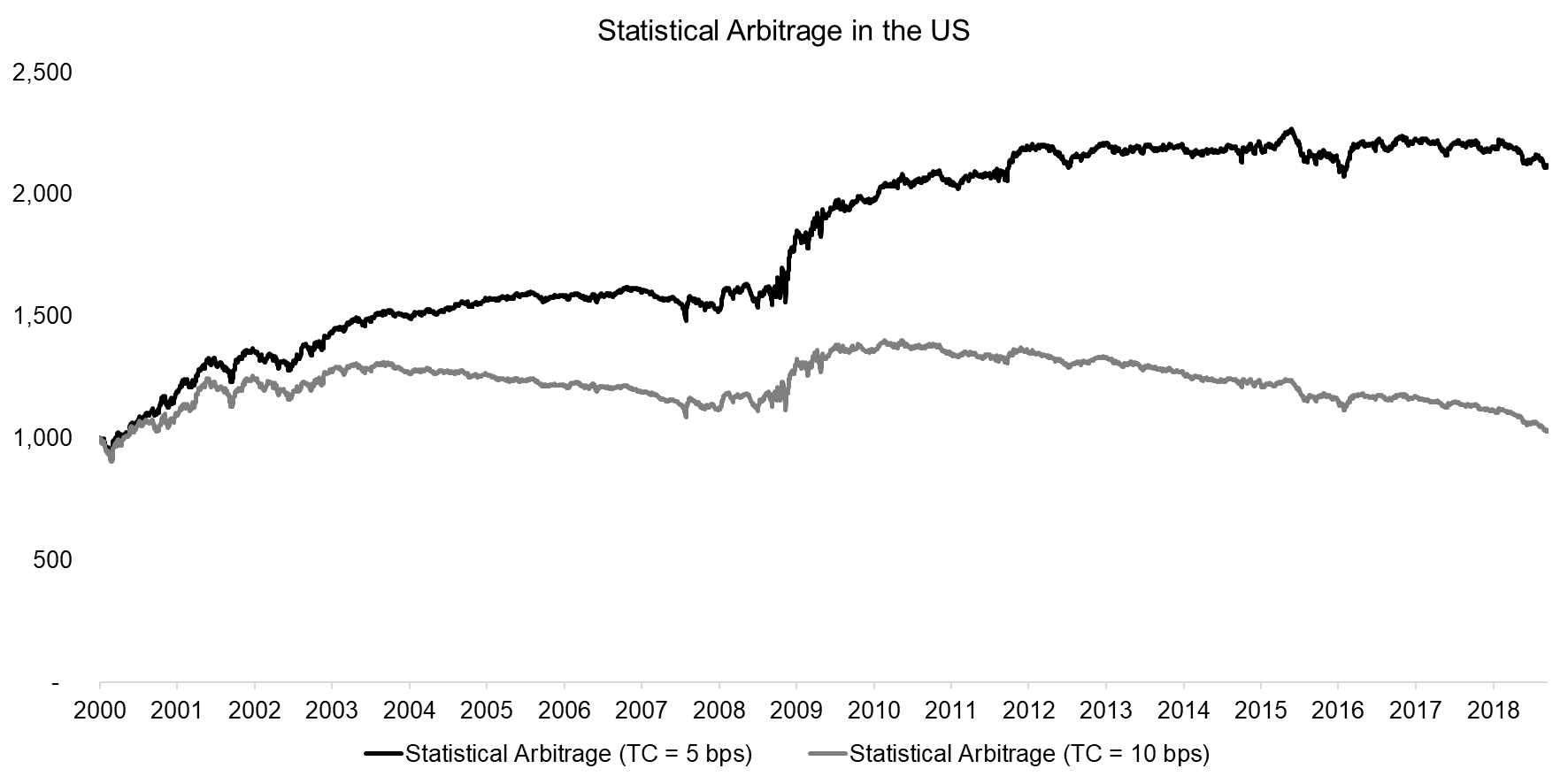

Next, we show the performance of the combined statistical arbitrage portfolio in the US, which is completely sector-neutral. The performance is attractive, albeit depending on transaction costs. We observe that the portfolio assuming transaction costs of 5 basis points exhibits hardly any drawdowns, albeit multi-year periods of flat performance. Higher costs make the strategy unattractive.

Source: FactorResearch

STATISTICAL ARBITRAGE AND THE VALUE FACTOR

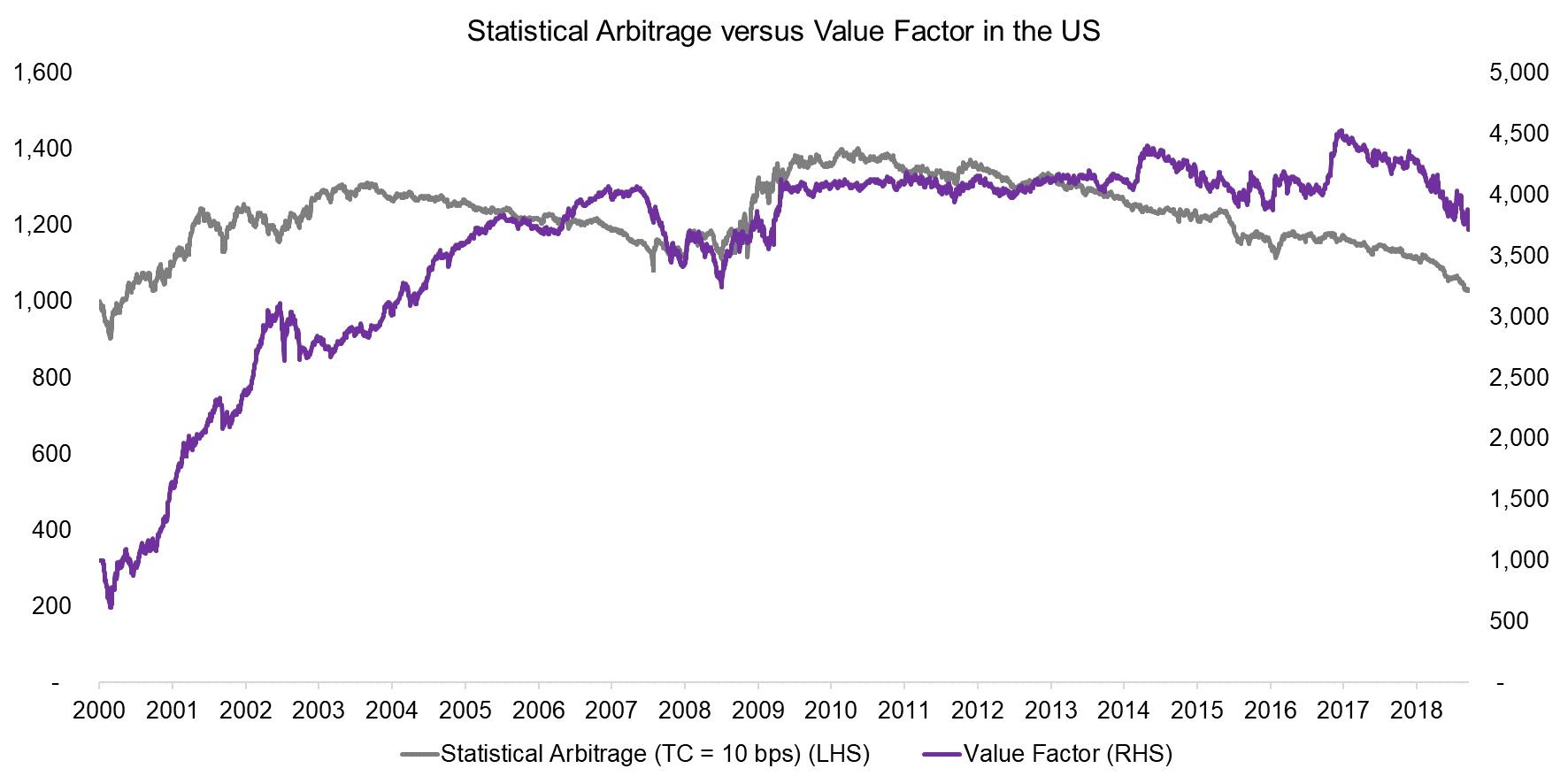

Investors familiar with factor investing might have noticed that the shape of the statistical arbitrage performance is comparable to that of the long-short Value factor. Both strategies showed a strong increase between 2000 and 2004, a rebound in the Global Financial Crisis in 2009, and a declining performance since 2010.

Value is also a mean-reversion strategy as investors speculate that cheap companies will increase in valuations and expensive companies will become more reasonably priced. However, beyond this, establishing a clear relationship between both is challenging. Statistical arbitrage returns are higher when volatility is elevated as it is a strategy that benefits from the mistakes of other investors that are buying or selling too quickly. The drivers of Value are less clear, but volatility is not one that is frequently cited.

Source: FactorResearch

FURTHER THOUGHTS

This short research note highlights that statistical arbitrage is an attractive strategy, albeit depending on transaction costs. Given that the strategy does not correlate with equities and features hardly any drawdowns, it may serve as an interesting diversifying strategy for an equity portfolio, especially when volatility is high. However, given the ongoing automation of financial markets, future returns for simple versions of this strategy are likely much lower than the backtesting results indicate.

RELATED RESEARCH

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.