Stock Portfolio Optimization

Measuring and Tuning Factor Exposure

July 2018. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Portfolios frequently contain stocks representing duplicate factor risks or insignificant weights

- An optimisation process focused on factor exposure can increase the portfolio efficiency

- Increasing or decreasing factor exposure requires a view on expected factor performance and risks

INTRODUCTION

Gardens tend to lose their curated design quickly, if not cared for constantly, as grass, bushes and trees grow according to nature’s will. Stock portfolios share this feature as they can look dramatically different, if left unattended for a period of time. Some stocks might dominate in size, others become insignificant and some just represent duplicate risks. However, investors have a variety of tools at hand to keep portfolios in shape. In this short research note we will investigate the application of an optimisation process for an investor targeting to increase the Value factor exposure of a stock portfolio with a Quality focus while improving the overall portfolio efficiency (read Value+Quality or High Quality Value Stocks).

METHODOLOGY

We measure the exposure of the stock portfolio to seven common equity factors namely Value, Size, Momentum, Low Volatility, Quality, Growth and Dividend Yield in the US stock market. The factor definitions are in line with industry standards and the factor exposure is measured ranking-based, i.e. each stock is ranked on each factor relative to all other stocks and then assigned a ranking score, which is then aggregated on portfolio level for each factor.

FACTOR EXPOSURE ANALYSIS

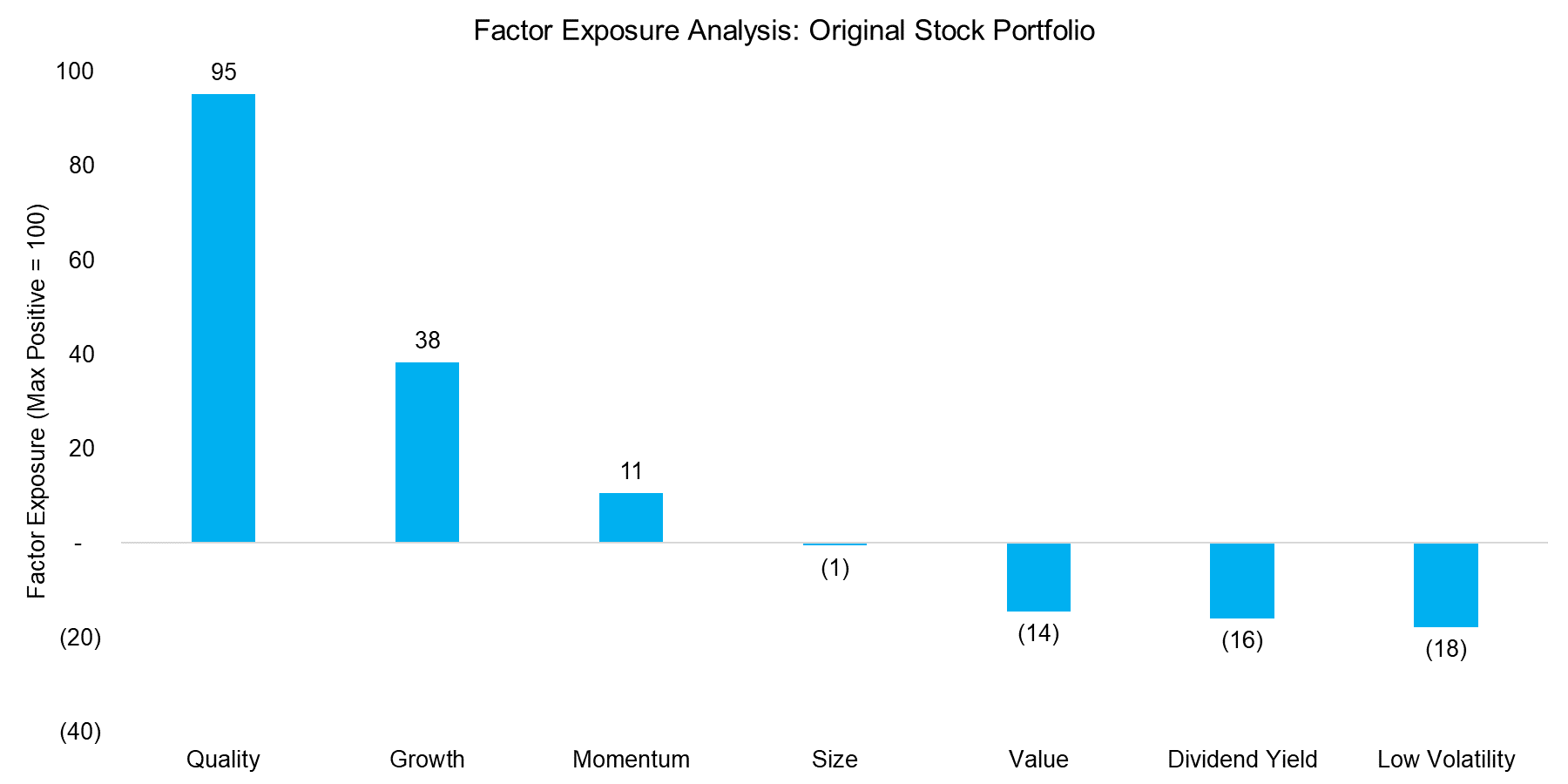

As a first step we conduct a factor exposure analysis of the current portfolio, which can be seen in the chart below. Unsurprisingly, the analysis reveals high exposure to the Quality factor, which is defined as a combination of return-on-equity and debt-to-equity metrics (read Quality Factor: How To Define It?). We can also observe positive exposure to Growth and Momentum as well as negative exposure to Value, Dividend Yield and Low Volatility. It is quite typical that portfolios with specific factor tilts exhibit significant exposure to other factors, which can be considered as desirable or undesirable.

Source: FactorResearch

OPTIMISATION PROCESS

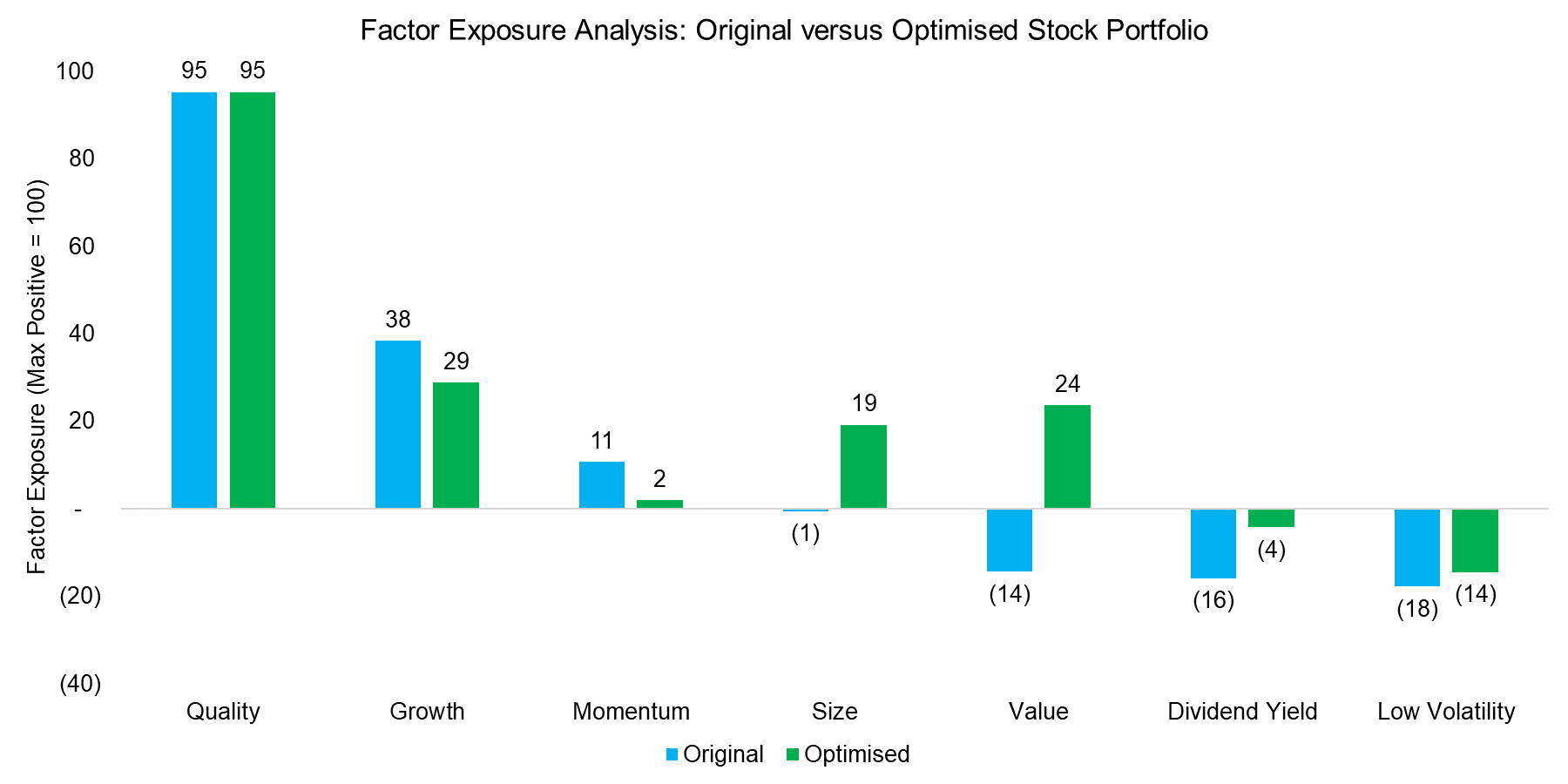

An optimisation process can be applied to the stock portfolio with the following objectives:

- Maintain the high Quality factor exposure

- Increase the Value factor exposure

- Sell stocks with duplicate factor exposure

- Sell stocks with insignificant portfolio weights

Naturally investors can define many more objectives and constraints; however, the more rules, the narrower the outcome. The analysis below shows the factor exposure of the original and optimised portfolios. We can observe that the optimisation process was effective in maintaining the high Quality exposure while increasing the Value exposure. The exposure to other factors also changed, e.g. to the Size factor, which implies the average market capitalisation decreased.

Source: FactorResearch

IMPACT ON PORTFOLIO VALUATIONS

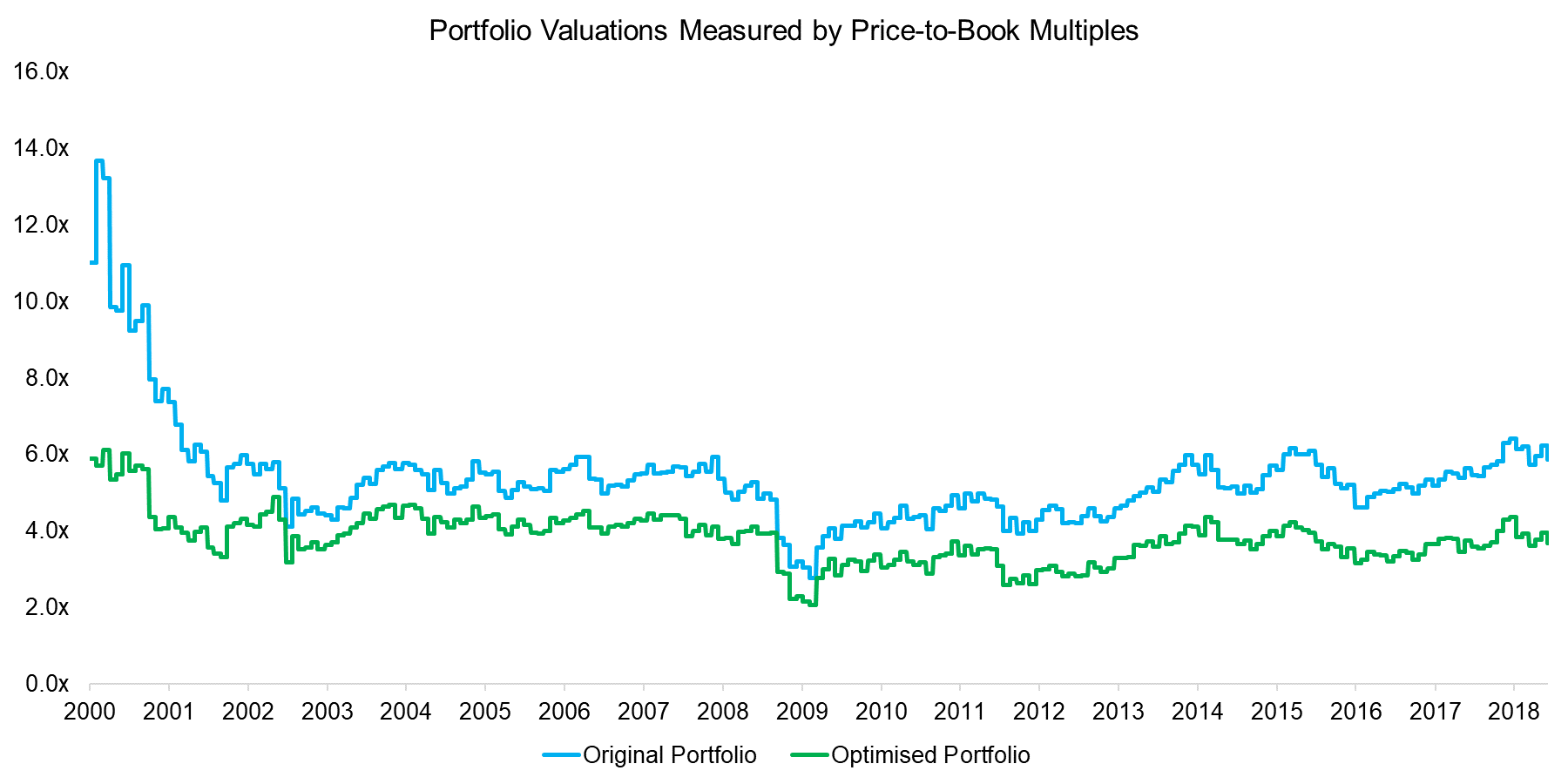

We can highlight the increased exposure to the Value factor by analysing the average portfolio valuations via price-to-book multiples. The analysis below shows that the average price-to-book multiple was reduced significantly, i.e. the portfolio has become cheaper. Given that the Quality exposure has been maintained, it implies an improvement in the attractiveness of the portfolio as investors typically prefer cheap to expensive valuations.

Source: FactorResearch

PORTFOLIO CHARACTERISTICS

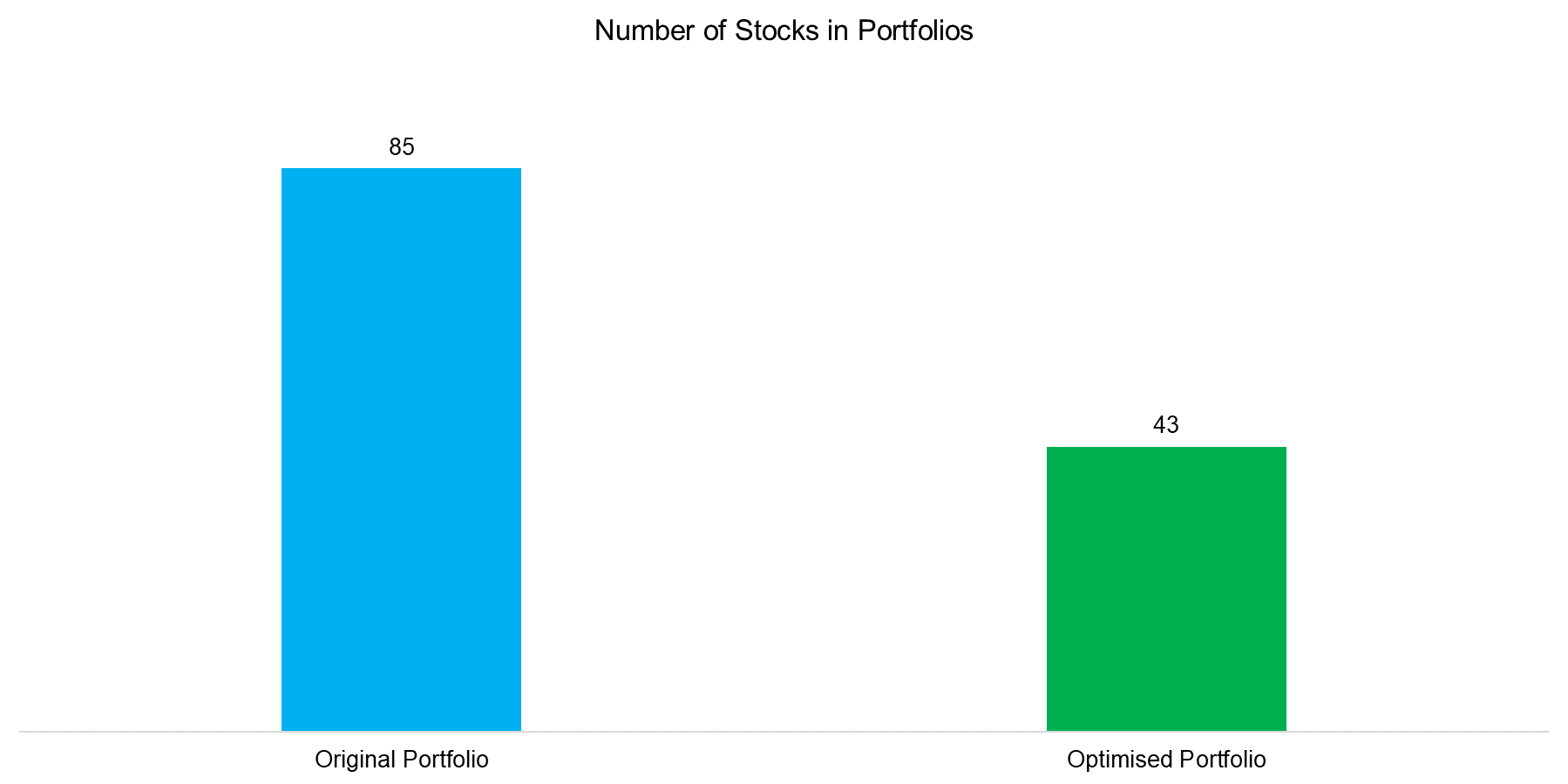

In addition to the objective of changing the factor exposure, the optimisation process targeted to improve the portfolio efficiency by reducing positions with insignificant weights, which often consume an over-proportional amount of the investor’s time, and duplicate factor exposure. The analysis below highlights that the number of stocks decreased from 85 to 43, which still can be considered a well-diversified portfolio.

Source: FactorResearch

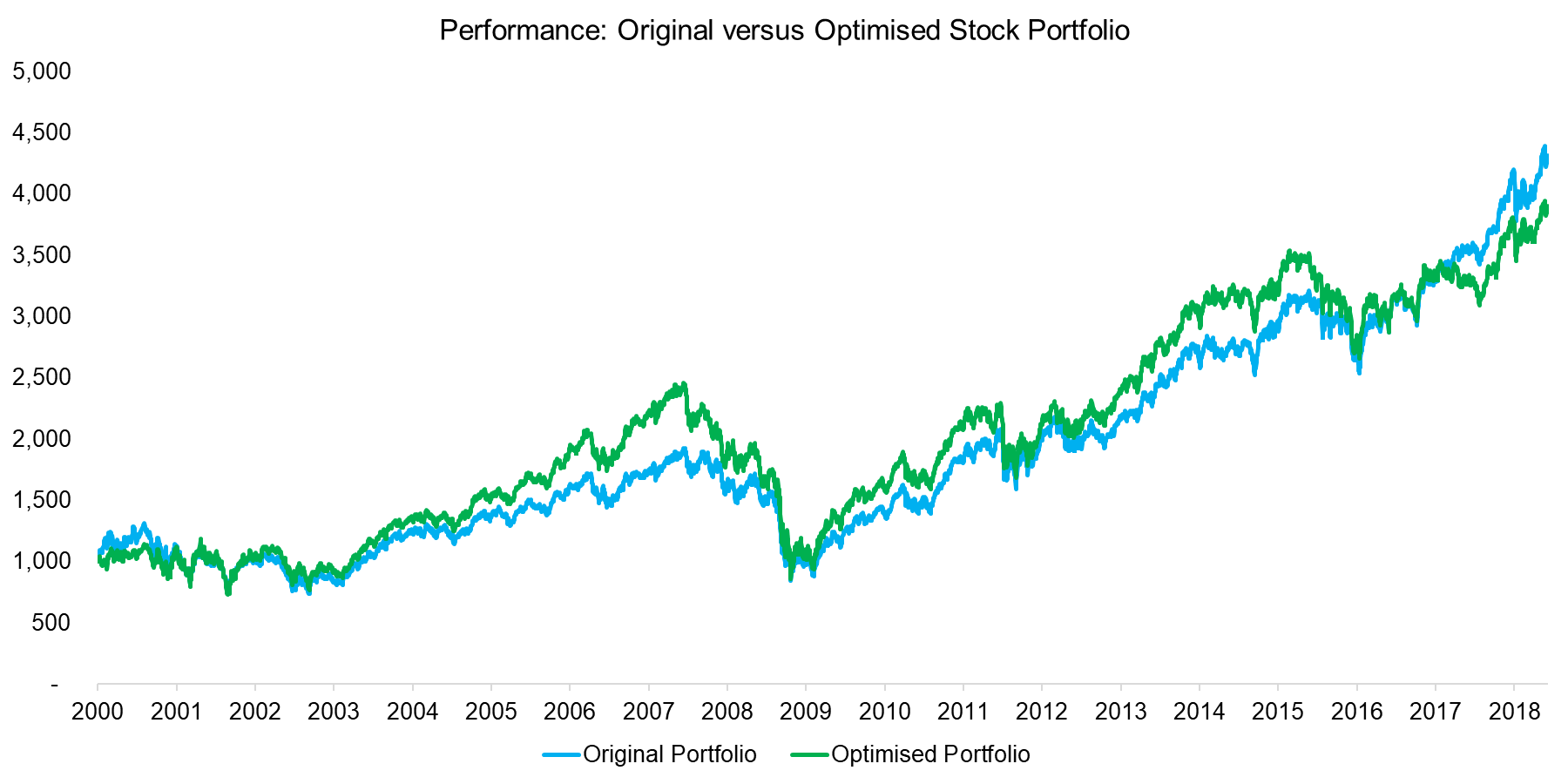

PERFORMANCE COMPARISON

The change in portfolio composition resulted in the optimised portfolio outperforming the original portfolio most of the time, except in the most recent years, which can be explained by the poor performance of the Value factor. The Quality factor has been performing strongly and was highly correlated to the Growth factor as both were driven by the Technology stocks, which feature low debt, high margins as well as strong sales and earnings growth. The objective of the optimisation process does not need to be higher performance, it may be an equivalent performance with higher portfolio efficiency, a more defensive profile or more diversified factor exposure.

Source: FactorResearch

FURTHER THOUGHTS

This short research note highlights how an optimisation process empowers investors to improve the efficiency of a stock portfolio. However, although the portfolio may be more efficient, it does not necessarily imply higher performance. The optimisation process requires inputs like desired and undesired factor exposure, which require a view on expected factor performance and risk contribution.

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.