Stock Selection versus Asset Allocation

What matters more?

November 2024. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

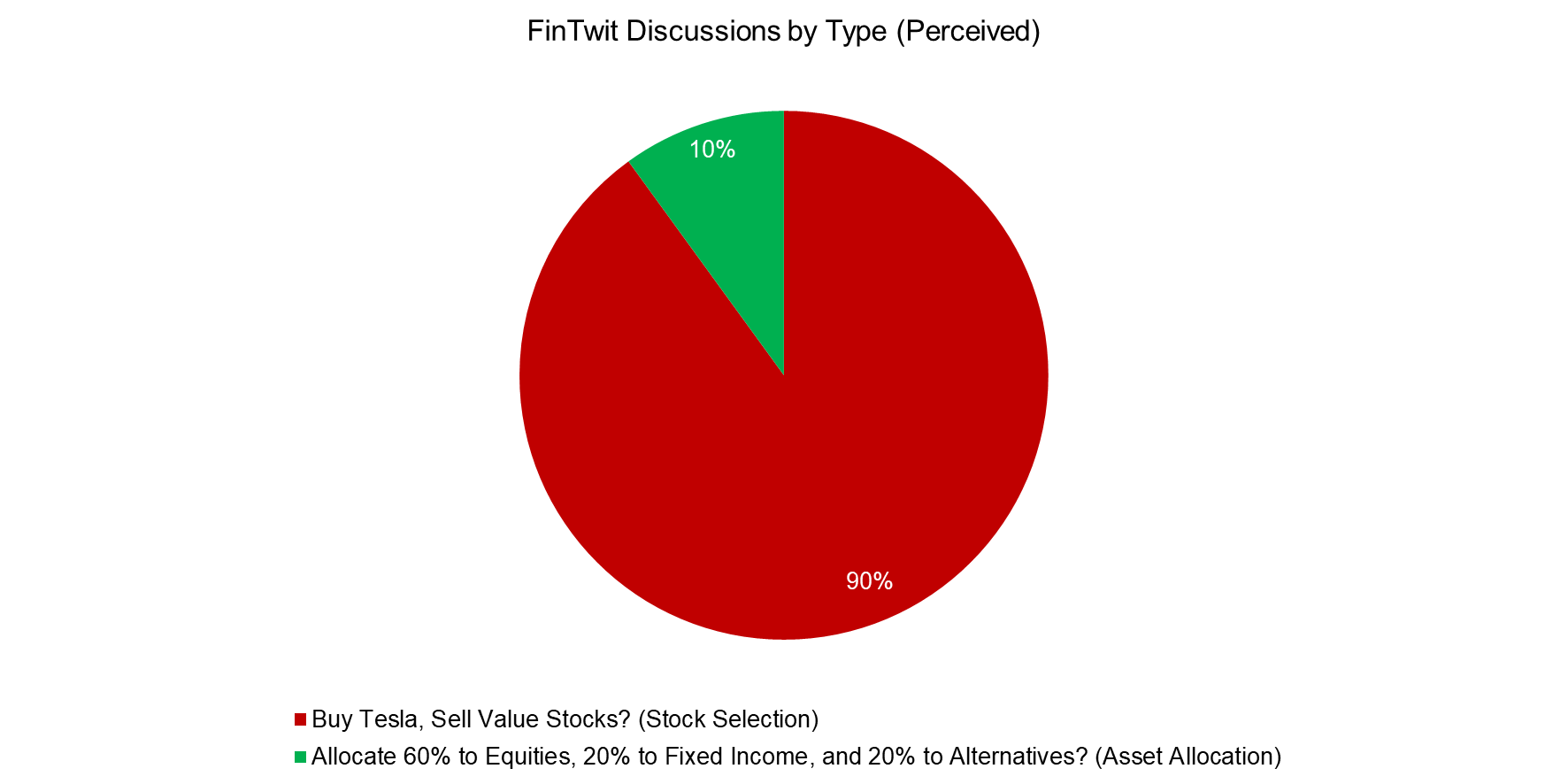

- Most investors seem to spend more time on stock selection rather than asset allocation decisions

- However, small asset allocation choices can have large impacts on expected returns

- It likely would be wise to focus more on asset allocation than stock selection

INTRODUCTION

Some of LinkedIn’s most popular financial influencers focus on educating their followers on analyzing stocks using fundamental data, where valuation and quality metrics dominate. However, what´s the point of this?

Professional fund managers have more experience and superior infrastructure than the average retail investor, yet most funds still underperform their benchmark indices. It seems like a colossal waste of time and money for folks to learn the difference between ROA and ROE and then create a portfolio of stocks, rather than buying an ETF tracking the MSCI World Index.

Unfortunately, this behavior seems to extend from retail to institutional investors, where more time appears to be spent on stock selection rather than asset allocation.

Source: Finominal

In this research article, we will compare the impact of stock selection versus asset allocation decisions.

STOCK SELECTION

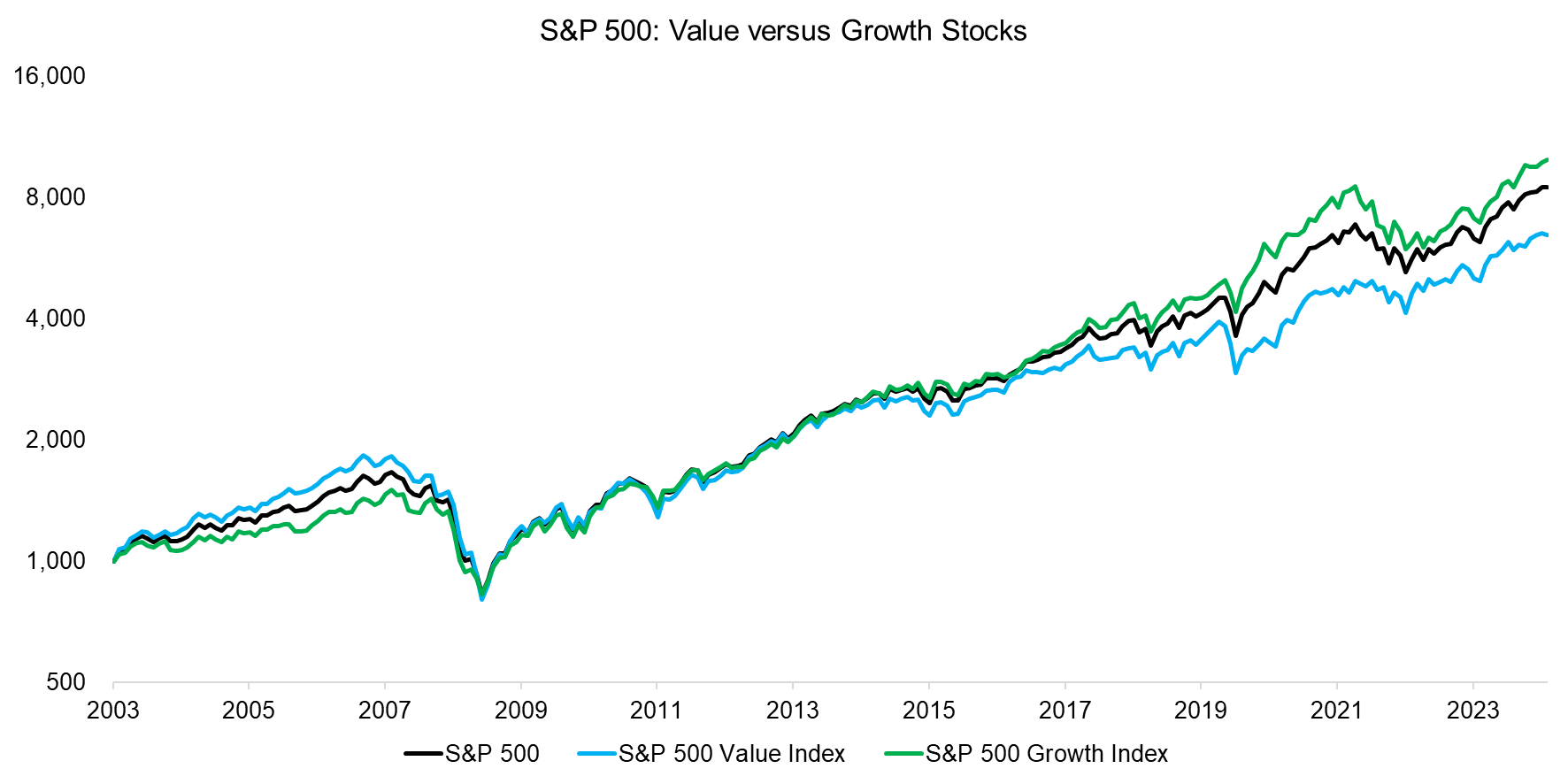

Stock selection is typically used for creating a portfolio that is expected to outperform a benchmark index like the S&P 500. In this analysis, we will use two ETFs that offer exposure to value and growth stocks within the S&P 500, namely the iShares S&P 500 Value ETF (IVE) and iShares S&P 500 Growth ETF (IVW), as proxies for the stock selection process.

The S&P 500 generated a CAGR of 10.7% since 2003, compared to 9.2% for value and 11.5% for growth stocks. However, the outperformance of growth stocks was not consistent, eg these underperformed in the period between 2003 and 2008.

Source: Finominal

STOCK SELECTION VERSUS ASSET ALLOCATION

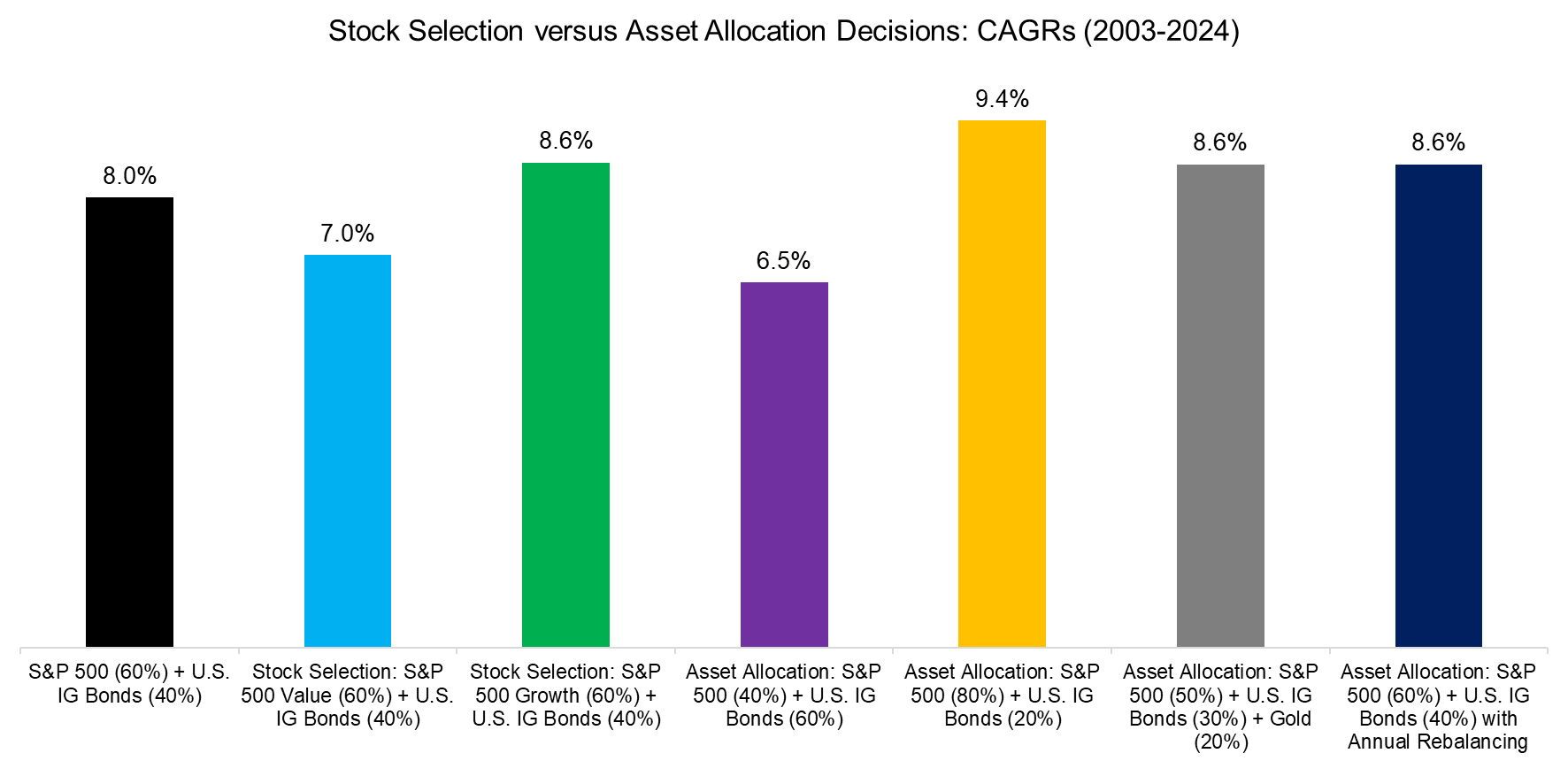

We create several portfolios to measure the impact of stock selection versus asset allocation. The base case portfolio is comprised of the S&P 500 (60%) and U.S. Investment-Grade Bonds (40%), and is rebalanced quarterly.

When we focus on stock selection by replacing the S&P 500 with either value or growth stocks, the CAGR decreased from 8.0% to 7.0%, respectively increased to 8.6%, in the period from 2003 to 2024, which are meaningful differences. Stock selection matters.

However, we also observe that asset allocation matters, e.g. changing the weights of the equities/bond port from 60/40 to 40/60 or 80/20 moved the CAGR to 6.5% respectively 9.4%. Adding a 20% gold allocation would have increased the CAGR to 8.6%, the same as changing the rebalancing frequency from quarterly to annually.

Source: Finominal

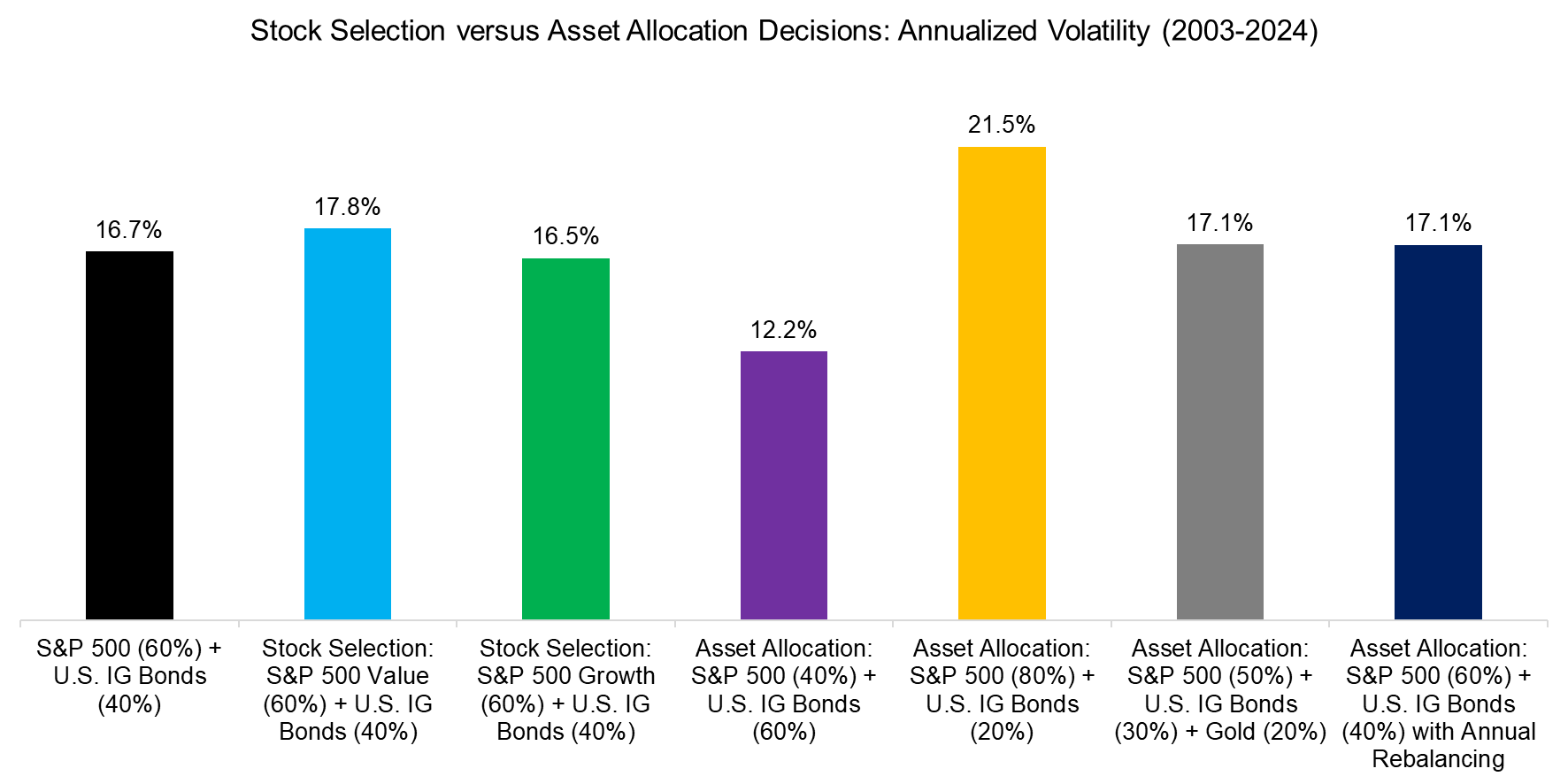

We can also observe the impact of stock selection and asset allocation decisions on the annualized volatility. Although changing what type of stocks are selected led to changes in the volatility of this 60/40 portfolio, these were minor compared to when increasing or decreasing the 60% allocation to equities.

Source: Finominal

FURTHER THOUGHTS

Few investors spend much time evaluating whether portfolios should be rebalanced annually or quarterly, yet the impact of the rebalancing frequency on the CAGR of a classic 60/40 portfolio was as large as deciding between growth versus value stocks.

Asset allocation is boring compared with stock selection. Everyone wants to invest like Warren Buffett and focus on identifying and buying great businesses. However, despite millions of failed attempts, no one has replicated the investment track record of the Oracle of Omaha. Investing should be boring.

RELATED RESEARCH

What´s Better than the S&P 500?

Outperformance via Leverage

Chasing Mutual Fund Performance

Thematic versus Momentum Investing

Cap-Weighted Benchmarks: Good Momentum Bets?

The Juggernaut Index

Top Fee Generating, Wealth Creating and Destroying ETFs

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.