Style Analysis of Private Equity Funds

How has private equity investing changed over time?

September 2025. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Private equity investing has been compared to small-cap value investing

- One dataset validates this, another one challenges it

- Given $6 trillion of AUM, a consistent investing style has become unlikely

INTRODUCTION

When Henry Kravis, George Roberts, and Jerome Kohlberg founded KKR in 1976, private equity as we know it today barely existed. Their strategy was straightforward: acquire businesses that could be improved through professionalized management, stronger incentives, or carve-outs from sprawling conglomerates. Firms trading at lower valuations often offered more scope for improvement. With limited capital of their own, KKR relied heavily on leverage to amplify returns. In factor terms, early private equity resembled investing in cheap small-cap stocks with steady cash flows.

By 1988, however, KKR was bidding $25 billion for RJR Nabisco – a giant conglomerate selling cigarettes and snacks. While its cash flows were robust, RJR Nabisco was neither small nor cheap; it was a blue-chip company, far removed from the archetype of early private equity targets.

Fast forward to today, the private equity industry manages more than $6 trillion across a wide spectrum of strategies and fund types. This research article explores how the style and focus of private equity investing have evolved over time.

FACTOR EXPOSURE ANALYSIS USING FAMA-FRENCH FACTORS

For private equity funds, we rely on the Finominal Private Equity Index, which tracks listed private equity funds traded on the European stock exchanges. This index offers daily return data, a valuable feature given that private equity funds traditionally report performance only on a quarterly basis. The universe includes established names such as HgCapital, ICG, and Apax (read Private Equity Without the Lag).

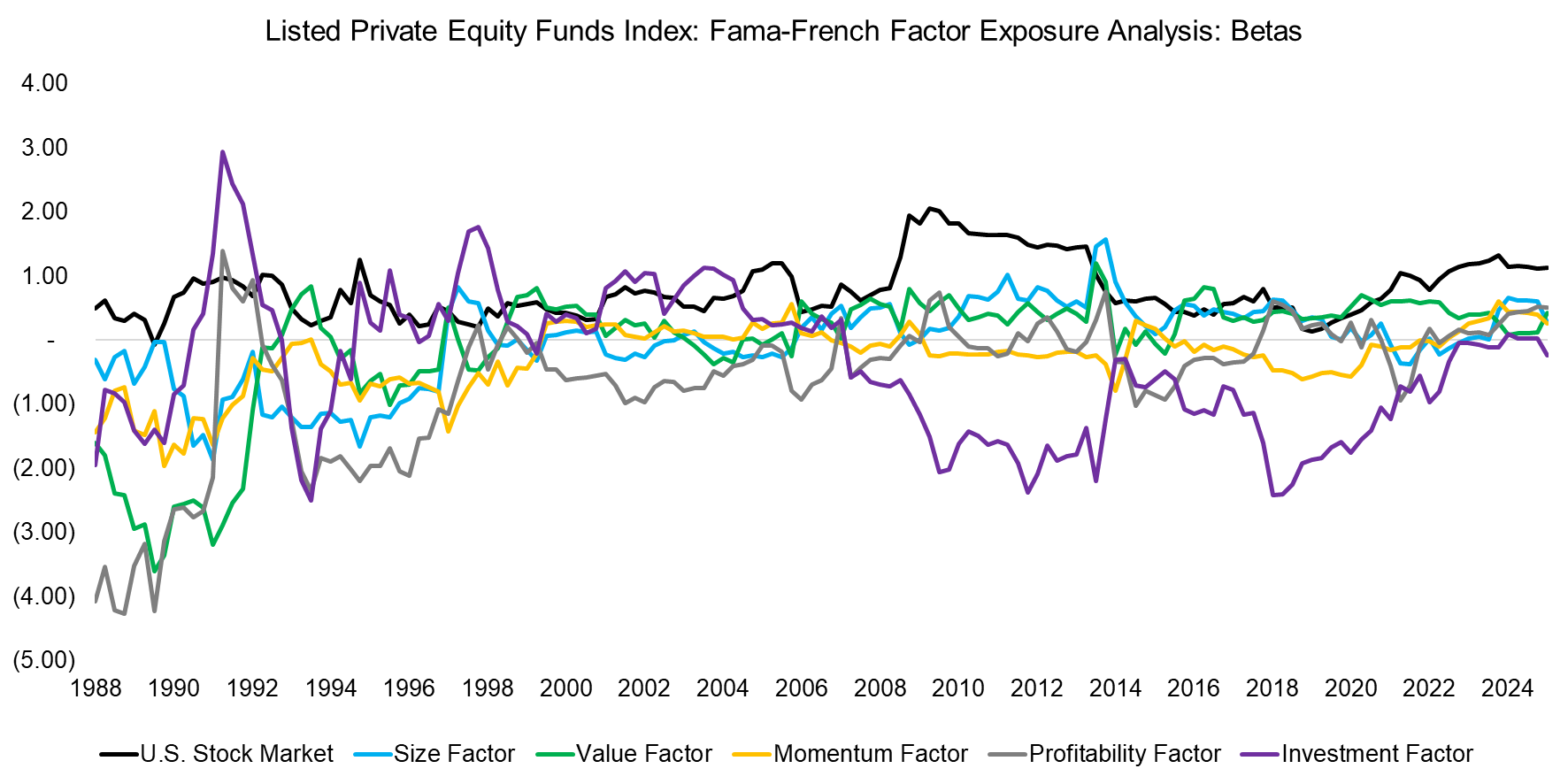

For factor analysis, we employ the Fama–French five-factor model augmented with the momentum factor. Using quarterly returns over rolling five-year windows, we estimate factor exposures through regression. The results show a stable positive beta to the U.S. stock market of approximately 0.8 from 1988 to 2025, while exposures to the other factors display greater variation over time.

Source: Finominal

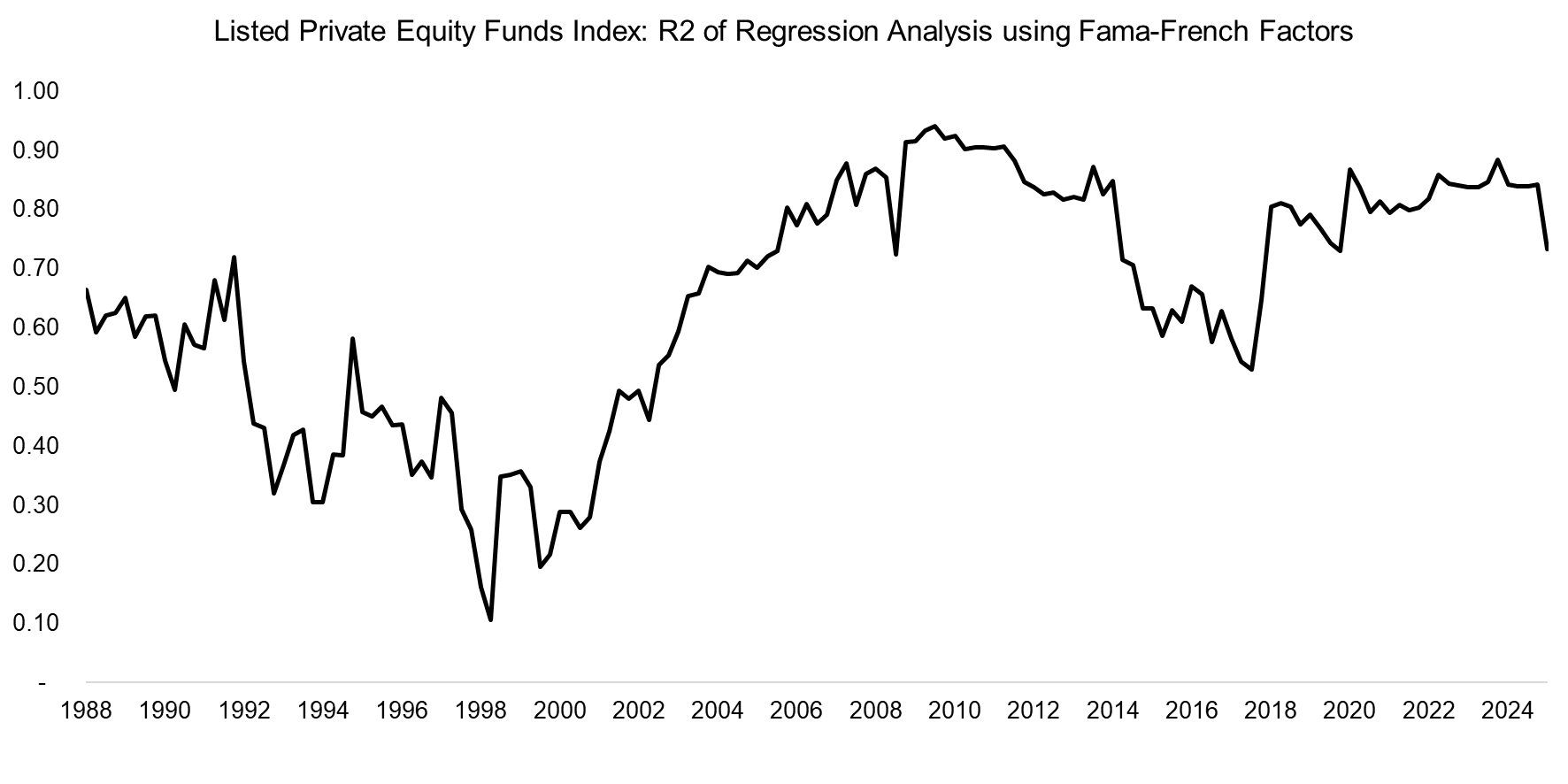

However, the regression’s R2 was relatively low between 1988 and 2004, which can be attributed to the Finominal Private Equity Index containing fewer than 10 constituents until 2000. As the number of constituents expanded thereafter, the model’s explanatory power improved.

Source: Finominal

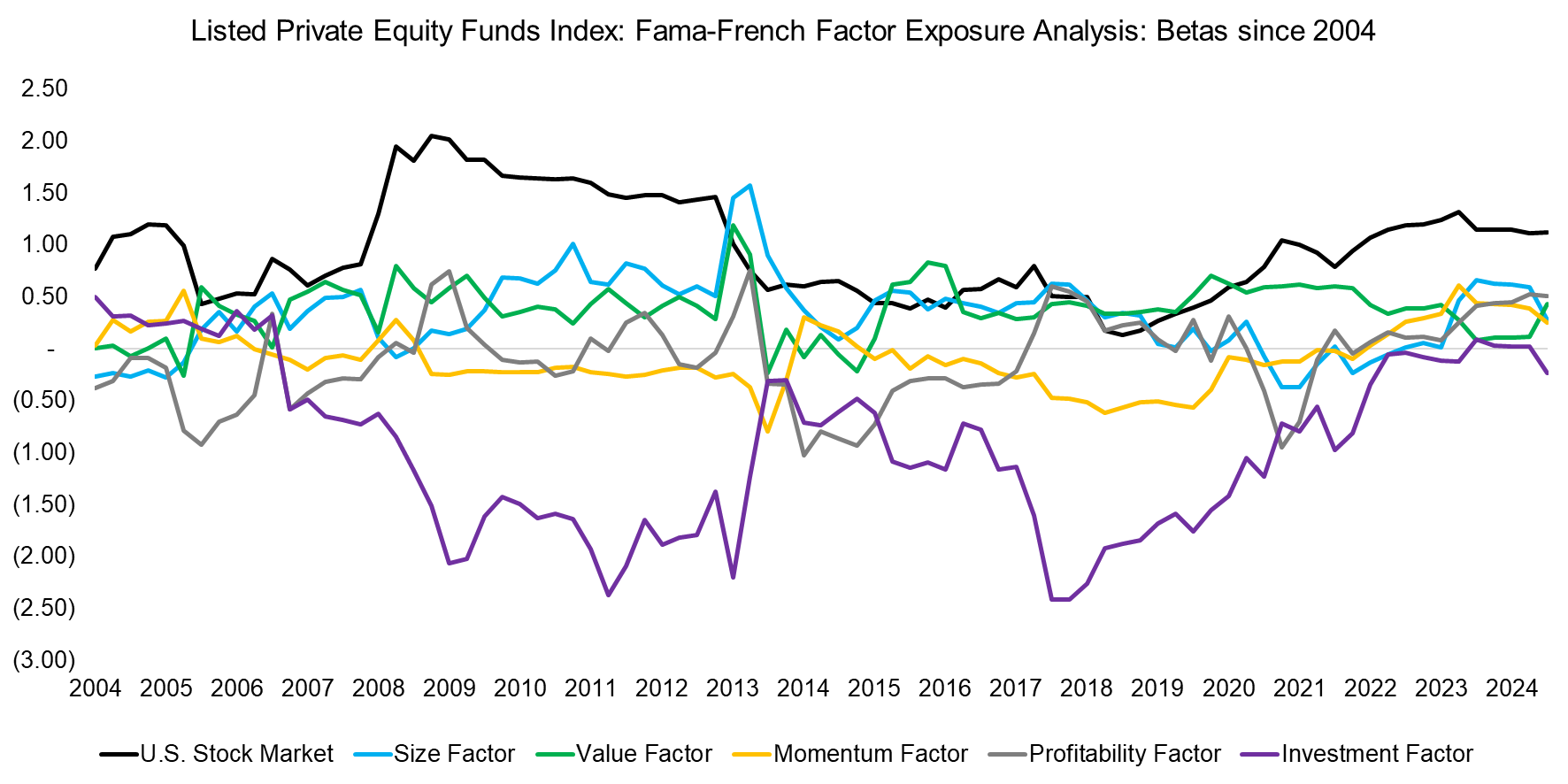

We shift the starting point of the observation period to 2004, after which the regression averaged 0.8.

The market beta increased to 0.96, and the factor profile became clearer: exposures to the value and size factors were consistently positive, while momentum and profitability remained near zero, and the investment factor was negative. This suggests that private equity funds during this period tended to focus on companies that were small, trading at below market valuations, and exhibiting rapid asset growth.

Source: Finominal

FACTOR EXPOSURE ANALYSIS WITH FINOMINAL FACTORS

While the Fama-French framework forms the foundation of factor investing, the factor indices from the Kenneth R. French data library have some limitations. Their universe includes micro-cap stocks, the portfolios are market-neutral rather than beta-neutral, the investment factor is rarely used in practice, and the low volatility factor is absent.

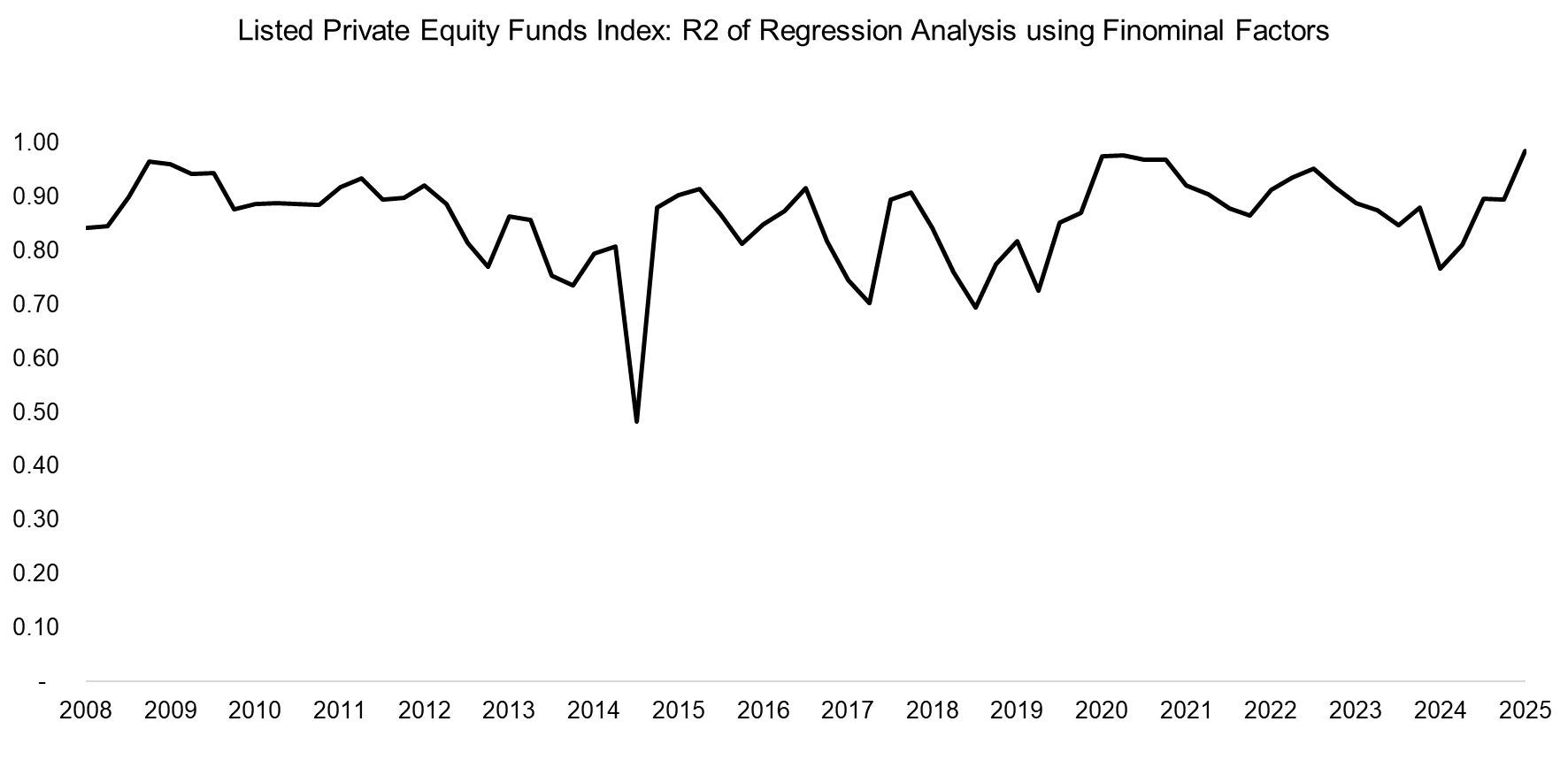

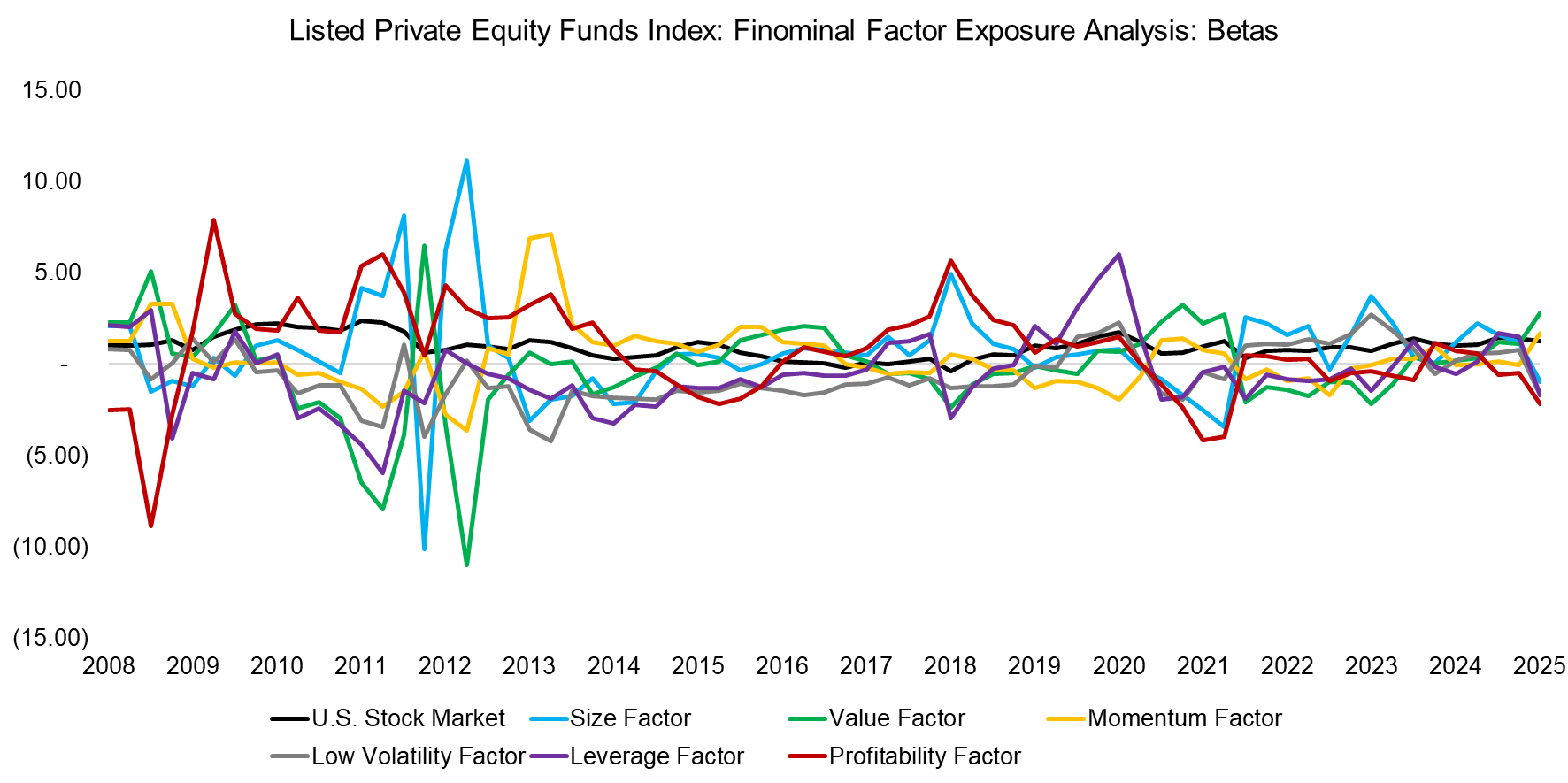

To address these issues, we replicate the analysis using Finominal factors, which exclude micro-caps, are constructed to be beta-neutral, and capture the most commonly employed investment styles. Using these factors, the regression rises to 0.86 from 2008 to 2025, slightly higher than the 0.79 observed with Fama-French factors over the same period.

Source: Finominal

Using Finominal factors, we again observe a strong positive market beta of 0.95. However, exposures to the other factors have varied over time. Examining the time series of betas suggests that private equity funds did not consistently follow a single, uniform investment style.

Source: Finominal

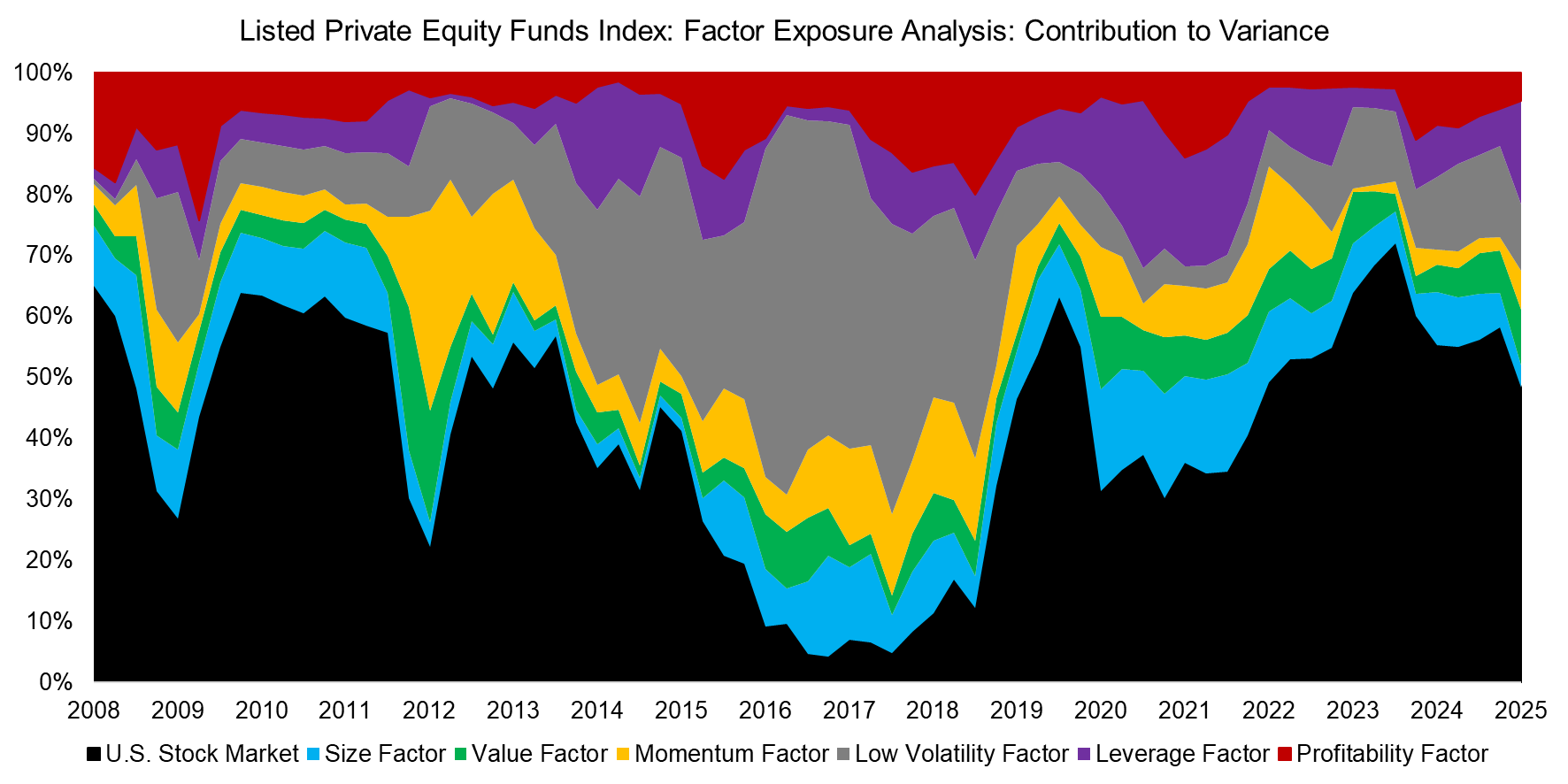

CONTRIBUTION ANALYSIS

Finally, we conduct a contribution-to-variance analysis using the Finominal factors. The results show that, after the U.S. stock market, the low volatility factor accounts for the largest share of private equity funds’ volatility. This does not necessarily imply that private equity managers systematically select low-risk businesses; rather, it suggests that private equity investments are influenced by the same dynamics that drive low-volatility equities. A key reason is that both strategies rely heavily on leverage, making them similarly sensitive to interest rate movements.

Source: Finominal

FURTHER THOUGHTS

Have private equity funds managers changed their investing style?

The Fama-French factors indicate a structural tilt toward smaller, cheaper, and high asset-growth companies. In contrast, our factors – which yield a higher R2 – indicate a lack of recurring company characteristics. Given the rapid growth of private equity assets under management to $6 trillion and the diversity of strategies across market segments and company types, this latter indication is likely more accurate.

Ironically, the very success of private equity has also created its demise. While a focused small-cap value strategy has empirical support for generating outperformance, a broad “buy-everything” approach does not, once high management and performance fees are taken into account.

RELATED RESEARCH

Private Equity Without the Lag

Private Equity: The Emperor has No Clothes

Private Equity: Fooling Some People All the Time?

Private Equity Is Still Equity, Nothing Special Here

The Case Against Private Markets

Private Equity Managers vs Private Equity Funds

Listed Private Equity ETFs: The Real Deal?

Factor Exposure Analysis 101: Linear vs Lasso Regression

Venture Capital: Worth Venturing Into?

BDCs: Better Don’t Choose?

The Case Against REITs

A Crescendo in Private Credit?

Do Activist Investors Create Value?

Myth Busting: Alts’ Uncorrelated Returns Diversify Portfolios

What´s Better than the S&P 500?

Outperformance via Leverage

Complexity is the Enemy of Investing

Stock Selection versus Asset Allocation

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.