Tactical ETFs: Tactfully No, Thank You?

“Strategy without tactics is the slowest route to victory. Tactics without strategy is the noise before defeat.” – Sun Tzu

May 2020. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Tactical investing aims to deliver better risk-adjusted returns and/or reduced drawdowns

- Tactical ETFs have not achieved either objective in recent years

- It is challenging to explain the consistent underperformance across different types of tactical ETFs

INTRODUCTION

Every investor is a tactician, whether they actively try or not. Warren Buffett and his lieutenants at Berkshire Hathaway pursue a well-known strategy of buying high-quality companies trading at moderate valuations for the long-term (“quality merchandise at a discount”), but still, tactically adapt their investment portfolio to the changing environment. They did this most recently, for instance, by selling their stakes in US airlines like Delta and United when their outlook became less attractive in the post-COVID-19 world.

It can be argued that even long-term buy-and-hold investors are tactically allocating capital when they decide on an asset allocation mix, portfolio rebalancing dates, investment products, capital deployment plans, etc. No one simply holds the market portfolio – even in the simple case where you only held the market, decisions regarding dividends and new cash would be tactical.

Some investors explicitly describe their investment process as tactical asset allocation, typically with the goal of avoiding large losses or minimizing drawdowns. Given the current COVID-19 crisis, it is interesting to explore how effective this type of strategy was in terms of capital preservation.

In this short research note, we will investigate the performance of tactical asset allocation ETFs.

DEFINING TACTICAL ASSET ALLOCATION

Defining tactical asset allocation is challenging as tactical is largely in the eye of the beholder. Discretionary fund managers change their portfolios frequently and many of their decisions can be categorized as tactical. The same applies to systematic strategies like multi-factor products that adapt the factor mix according to the market structure. However, many of these changes are marginal rather than dramatic, making it difficult to come up with a simple definition of tactical vs strategic.

We focus on ETFs traded in the US that make significant changes in asset allocation, e.g. by moving all capital from equities to fixed income based on discretionary decisions or quantitative signals. Many of these products feature the word “tactical” in their name. The first tactical ETF was launched in 2009 and our universe comprises merely 21 products, whereof only 14 are still trading. Cumulatively these manage approximately $1 billion of assets, which can not be considered a great commercial success when compared to $6 trillion invested in the ETF industry.

GLOBAL TACTICAL ASSET ALLOCATION

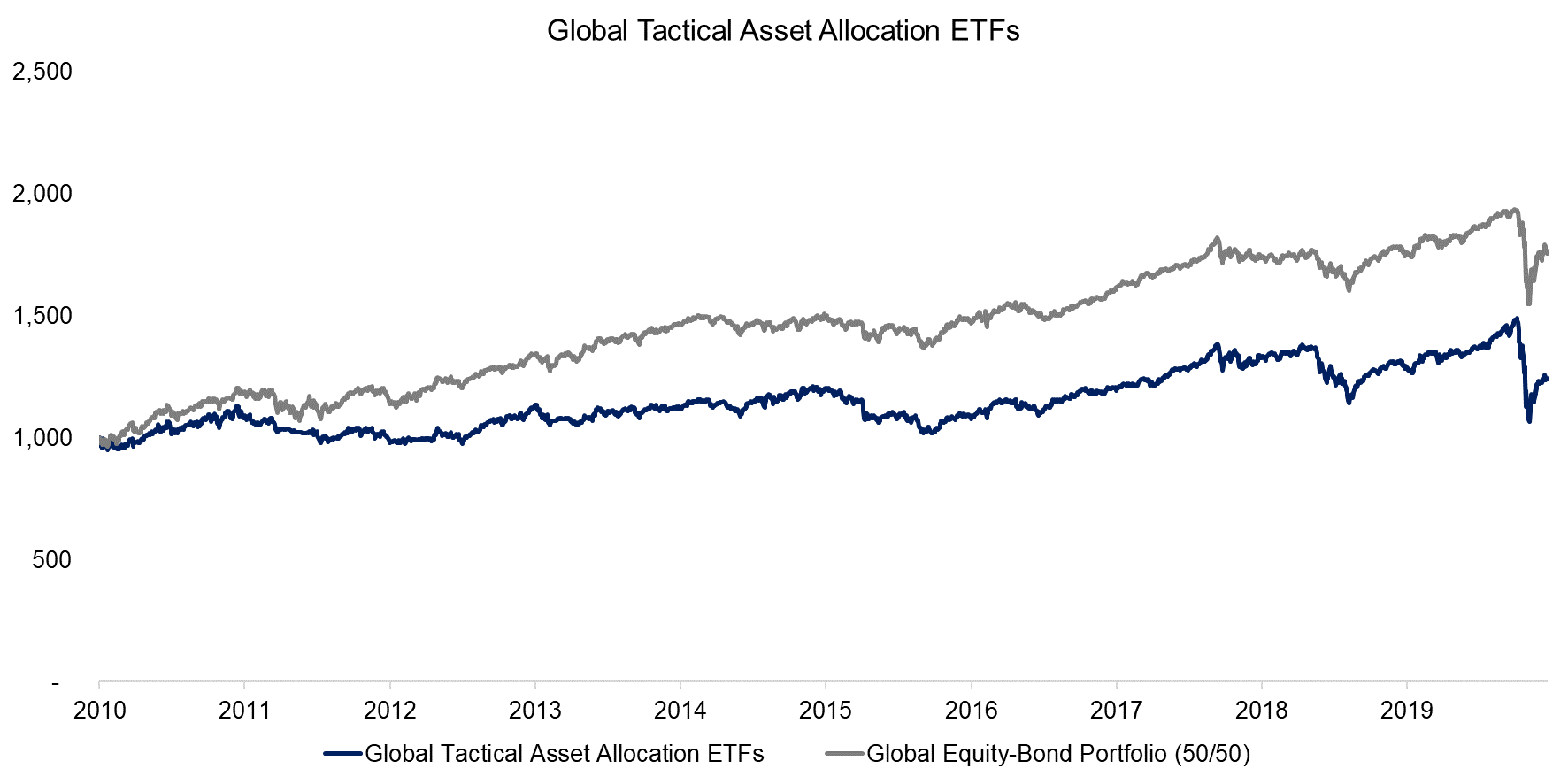

Global tactical asset allocation provides fund managers with the largest opportunity set to generate performance. Portfolios typically include equities, bonds, commodities, listed real estate, and occasionally short positions in asset classes.

We create an equal-weighted index of all ETFs focused on global tactical asset allocation and compare that to a naive straw man strategic portfolio that allocates equal capital to equities and bonds, i.e. an equal-weighted (50/50) global equity-bond portfolio. We observe that the trend in performance was comparable, which indicates that the ETF portfolios were mainly comprised of equities and bonds. However, tactical ETFs generated a significantly lower return in the period from 2009 to 2020.

The underperformance, as well as the low amount of assets under management in tactical ETFs, can be partially explained by high fees. The current average management fee is 0.87% per annum, which is significantly above plain-vanilla ETFs that track benchmark indices like the S&P 500, but also more expensive than smart beta or thematic products (read Thematic Investing: Thematically Wrong?).

Source: FactorResearch

US TACTICAL ASSET ALLOCATION

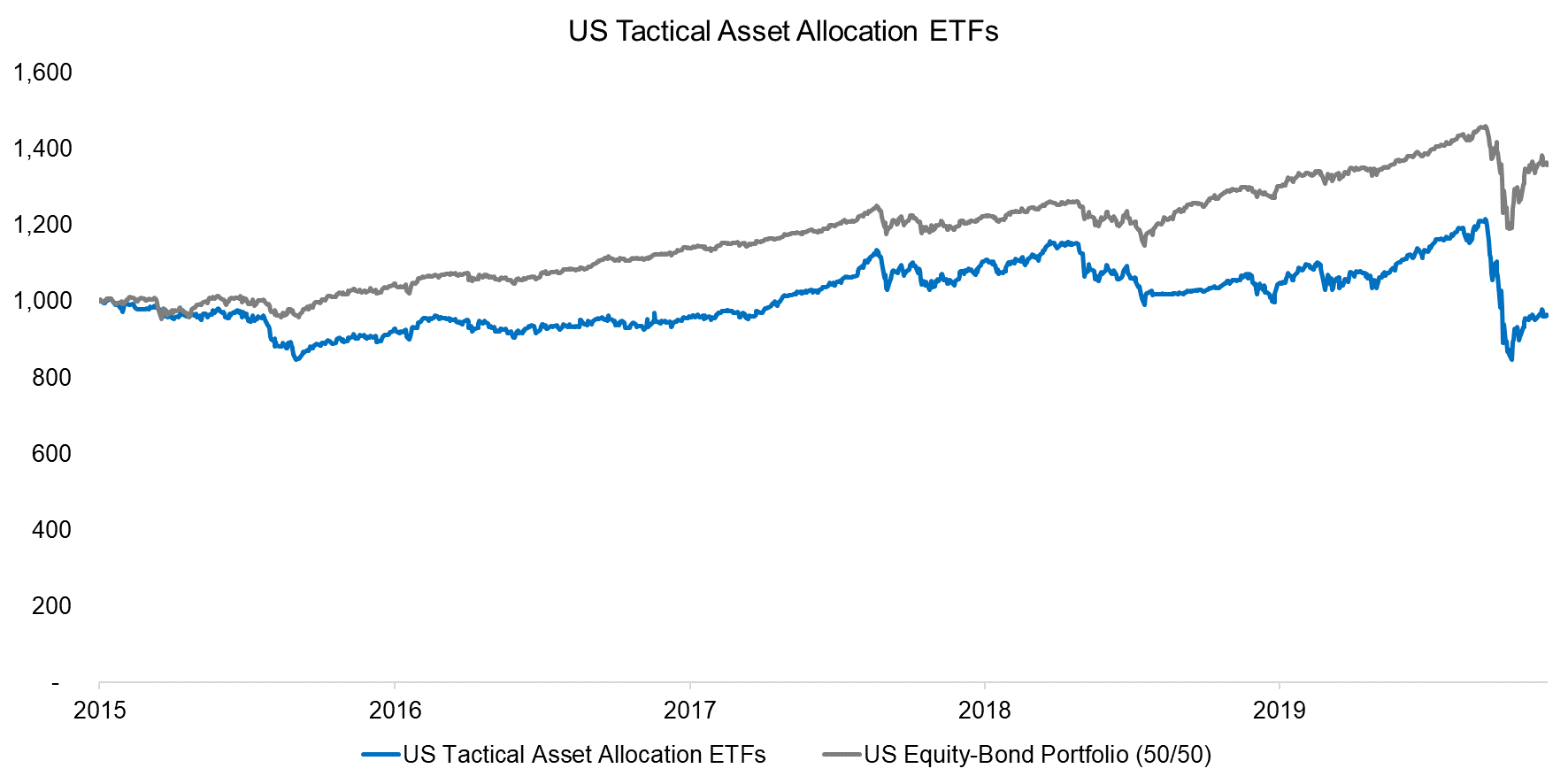

Another potential explanation for the underperformance of global tactical asset allocation ETFs might be the complexity of investing across the globe. Discretionary or systematic approaches to tactical investing that work in the US might be less effective in emerging or international markets, which have idiosyncratic features, thus making it detrimental to apply techniques that work in the US around the world without additional adjustments.

We can test if the previous explanation is true by looking at tactical ETFs that constrain themselves to US markets, which reduces the number of asset classes and complexity significantly. We note, however, that benchmarking US tactical allocation ETFs to a simple equal-weighted US equity-bond portfolio also highlights underperformance. The benchmark is appropriate given that the trends in performance were identical, so it just seems that tactical ETFs are destroying rather than creating value.

Source: FactorResearch

TACTICAL S&P 500 ETFs

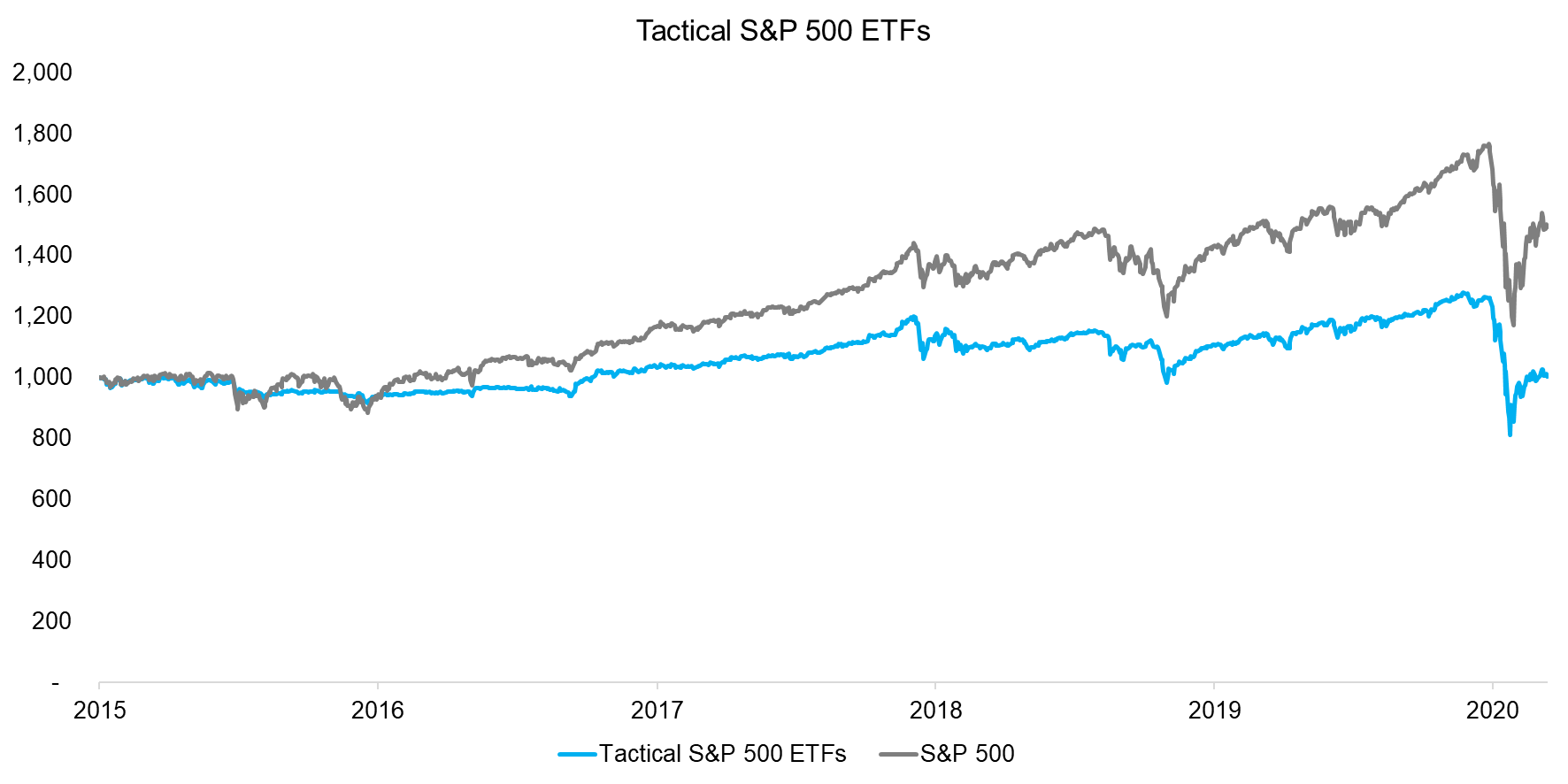

Finally, we analyze tactical ETFs that exclusively focus on the S&P 500, which shows similar underperformance to global and US tactical asset allocation products. Given that the period from 2015 to 2020 featured a bull market as well as a stock market crash, there was enough dispersion of scenarios and volatility for these ETFs to demonstrate their merit.

Source: FactorResearch

REDUCING RISK VIA TACTICAL ETFS?

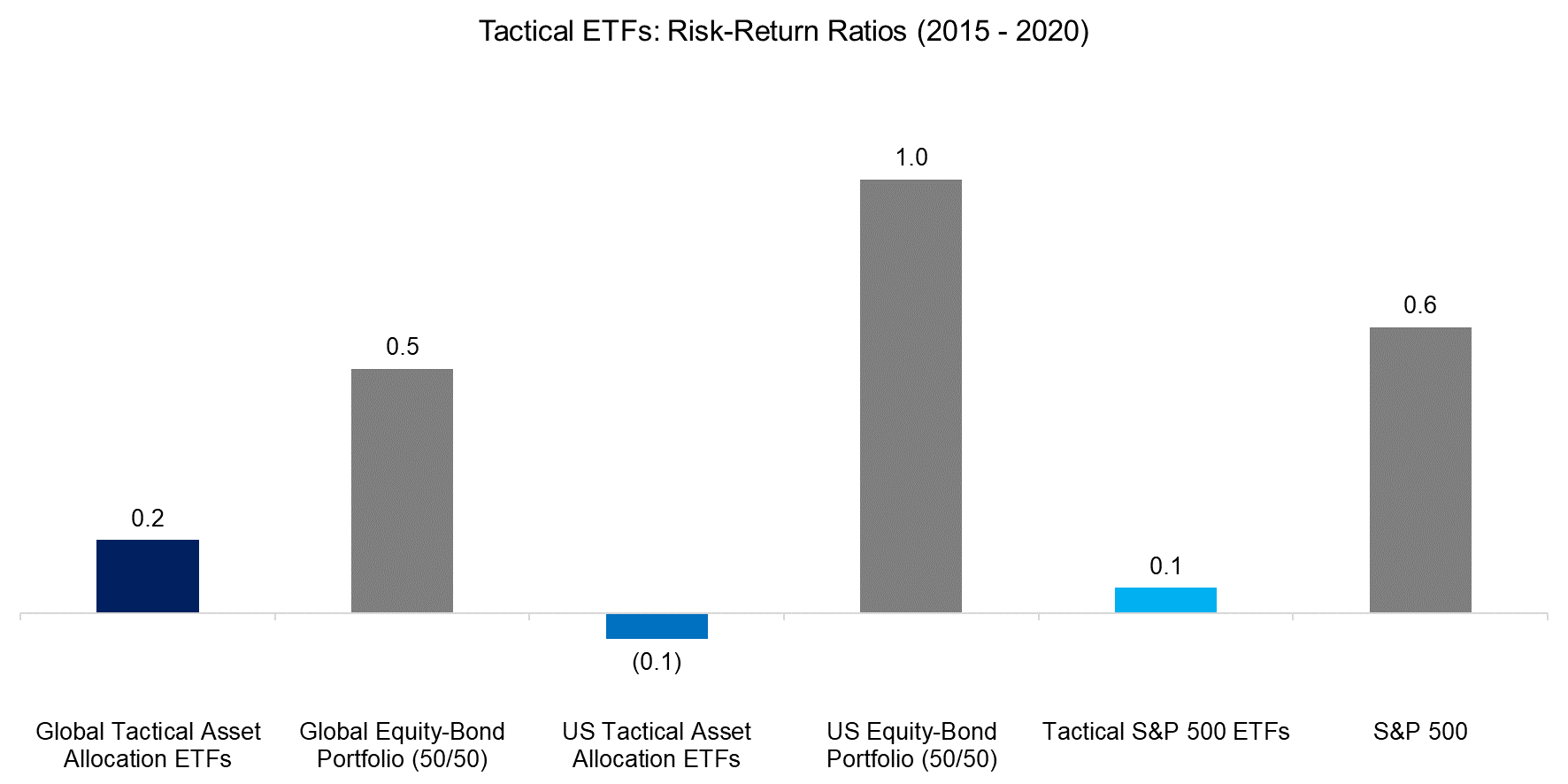

It is surprising that tactical ETFs in three categories underperformed simple equity-bond portfolios as investors might have expected some to do better, some to do worse, but on average to generate similar returns.

This analysis has emphasized total returns so far, but tactical ETFs typically market themselves as offering better risk-adjusted returns given a strong focus on risk management. Therefore, we calculate the risk-return ratios of the tactical ETFs, however, that does not change the conclusion that tactical ETFs have done poorly.

Source: FactorResearch

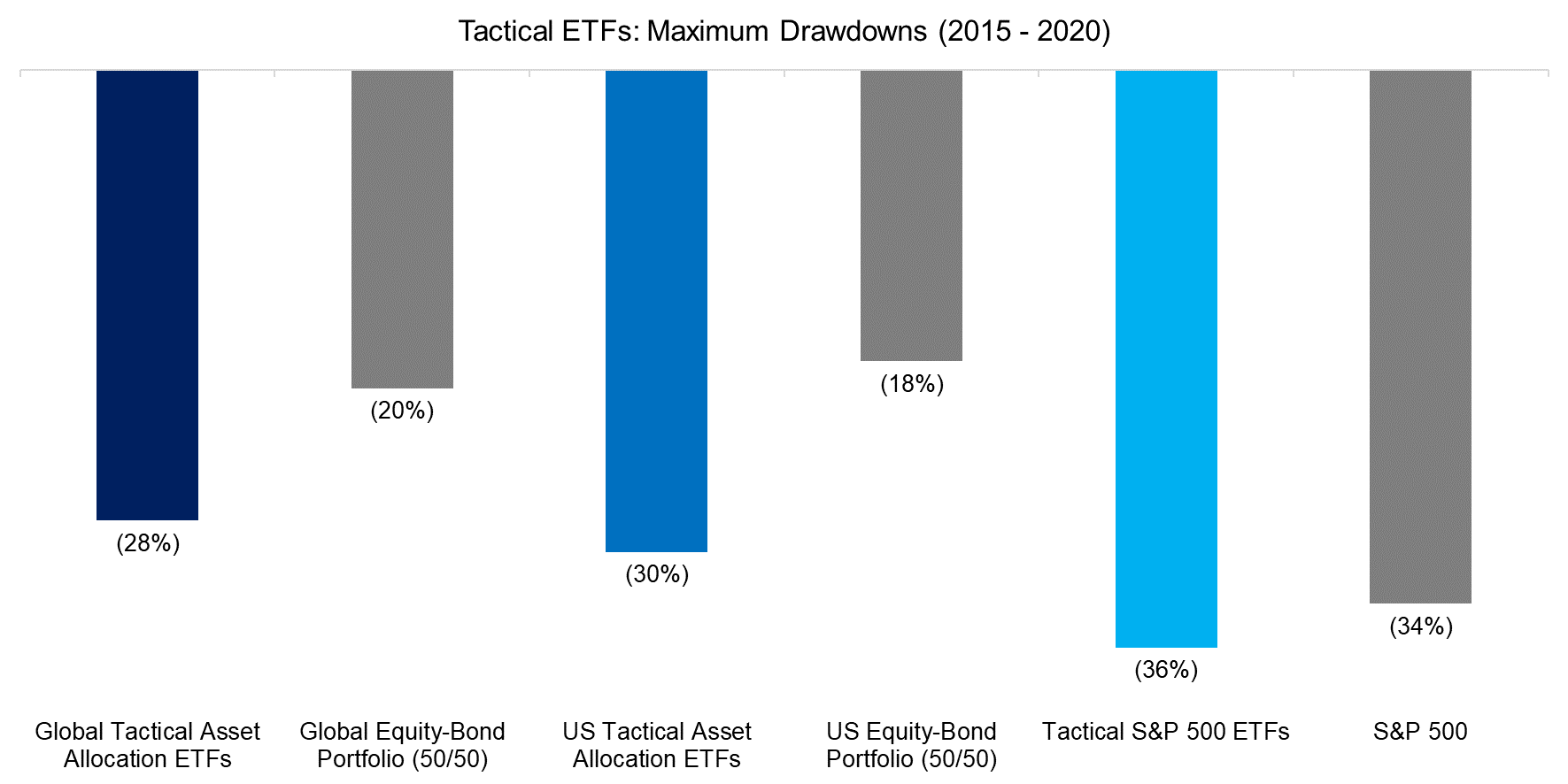

Furthermore, the maximum drawdowns of tactical ETFs during the COVID-19 crisis were worse than those of their benchmarks. Proponents of these strategies might argue that this crisis was unusual considering the speed of the market crash and government intervention, which perhaps did not provide the optimal conditions of tactical ETFs to shine. However, market crashes are always unusual and rarely behave similarly. It remains to be seen if tactical ETFs are better in the eventual economic and financial recovery.

Source: FactorResearch

FURTHER THOUGHTS

Some quantitative frameworks used by tactical asset allocation ETFs are supported by academic research and have shown to be effective in generating attractive risk-adjusted returns across asset classes and centuries, e.g. trend-following systems (read Quant Strategies: Theory vs Reality).

Given this, the poor performance of tactical ETFs is somewhat surprising, but it should be considered that the universe only included 21 ETFs, which represents a small sample size. The research could be expanded by exploring tactical asset allocation mutual funds, which would result in a larger universe with a longer track record and therefore more meaningful results.

Having said this, tactical mutual funds are not preceded by a reputation for generating superior investment returns. Tactics are essential for risk management frameworks, but being a successful tactician is easier said than done.

RELATED RESEARCH

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.