The Case Against a Cryptocurrency Allocation

Why is the Maldivian Rufiyaa not going to the moon?

April 2024. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Bitcoin and Ethereum were often highly correlated to equities

- Active management in cryptocurrencies has not been a success

- The use case for blockchain and cryptocurrencies remains unclear

INTRODUCTION

Another boom in cryptocurrencies could kick off in 2024 as the SEC finally approved multiple Bitcoin ETF applications that have been years in the making. The Grayscale Bitcoin Trust (GBTC) still dominates with $24 billion of assets, but iShares’ Bitcoin Trust (IBIT) quickly accumulated $15 billion.

Fidelity’s Wise Origin Bitcoin Fund ranks third with more than $10 billion of assets under management, but this can be considered disappointing given that Fidelity manages more than $5 trillion, and has an outspoken cryptocurrency enthusiast, namely Abigail Johnson, as a CEO.

Buying coins or tokens via digital wallets has been painful or prohibitive for most investors, so being able to buy at least Bitcoin like any stock on the exchange is a game changer. However, easier access to an investment product does not make it a sound investment proposition per se.

In this article, we will evaluate the case for a cryptocurrency allocation.

CRYPTOCURRENCY AS DIVERSIFIER

Investors’ universe of investable assets steadily expands as asset managers in public and private markets continue to launch new products, which has made investing more complicated. However, we can reduce this complexity drastically by eliminating any products that are highly correlated to equities or fixed income, which are the cornerstones of most investors’ portfolios.

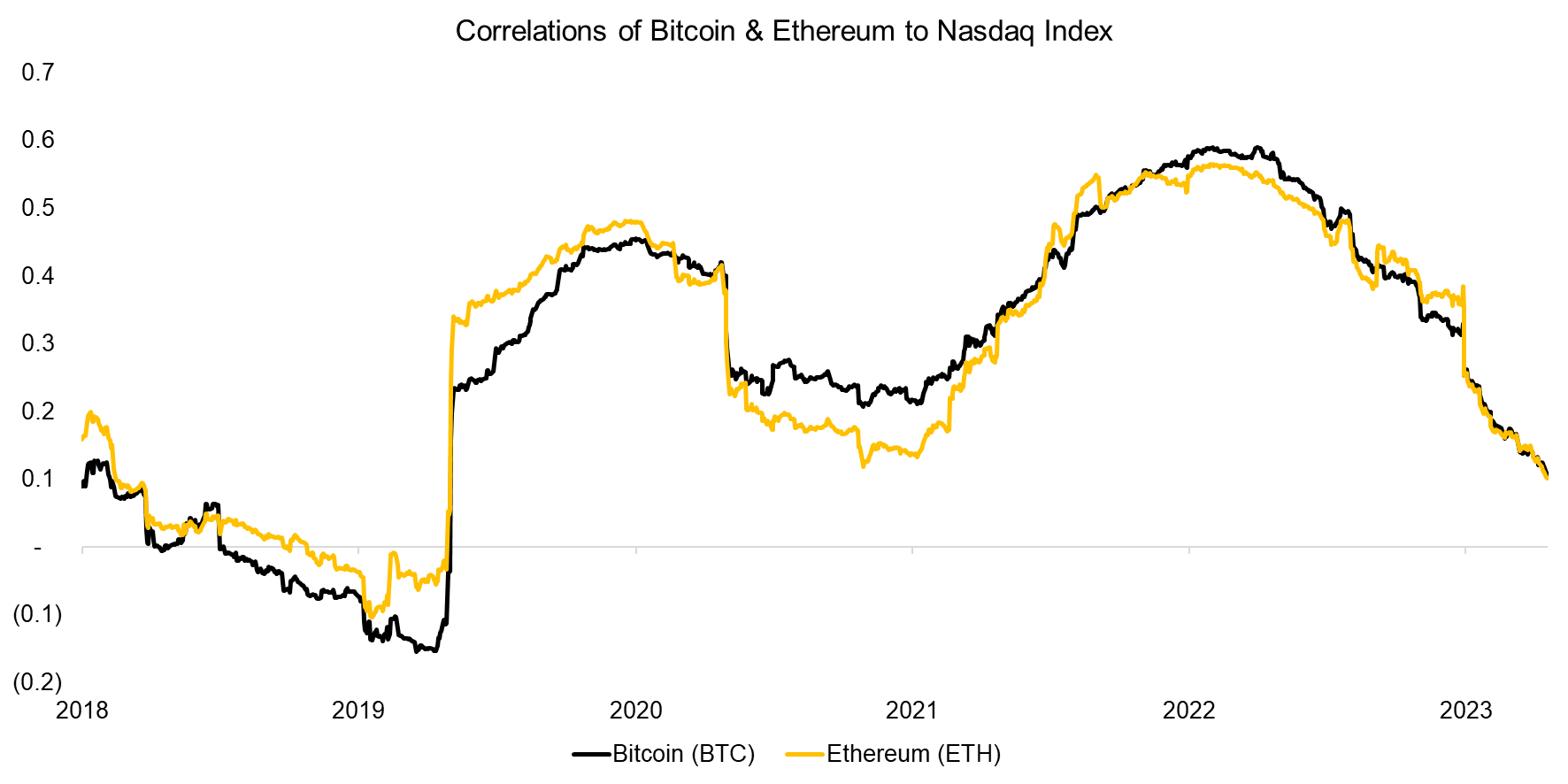

Intuitively, cryptocurrencies should not be correlated to stocks or bonds, but were actually during certain periods. Measuring the 12-month rolling correlation of the two largest cryptocurrencies by market capitalization, namely Bitcoin (BTC) and Ethereum (ETH), to the Nasdaq index shows highly positive correlations in 2020 and 2022.

Although the average correlation of both coins to the Nasdaq was only 0.3 since 2018, the high correlations are concerning as most investors have exposure to technology stocks via their equity allocation. Over the last nine years, the upside beta of BTC to the stock market was 0.71 and the downside beta was 1.43, which is an unfavorable ratio, and considerably worse than that of gold, which features an upside beta of 0.09 and downside beta of 0.03. Stated differently, BTC and ETH do not offer uncorrelated returns and offer less diversification benefits than likely expected.

Source: Finominal

CORRELATIONS OF TOP 10 CRYPTOCURRENCIES

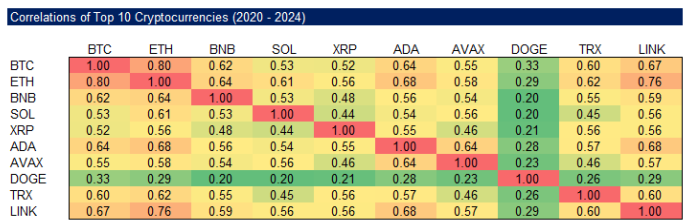

The correlation of BTC and ETH to the Nasdaq index also highlighted identical trends, which means that BTC and ETH are highly correlated to each other. We demonstrate this by calculating the correlations of the top 10 cryptocurrencies by market capitalization in the period between 2020 and 2024.

We observe that the correlations were all positive and ranged from 0.2 to 0.8, which is surprising as they seem to have different use cases, eg Bitcoin is considered digital gold, Ethereum is used to power most decentralized apps, Ripple (XRP) focuses on payments, and some, like Dogecoin (DOGE), have no obvious use case at all. Naturally, this implies that these ten cryptocurrencies are driven by systematic rather than idiosyncratic factors.

Source: Finominal

ACTIVE MANAGEMENT IN CRYPTOCURRENCIES

An investor seeking to invest in cryptocurrencies has the choice of thousands of coins and tokens, which may be overwhelming, especially when considering that most are not easily accessible via ETFs or futures, and require setting up complicated digital wallets. However, the large and complex universe should make cryptocurrencies a perfect playing ground for active managers.

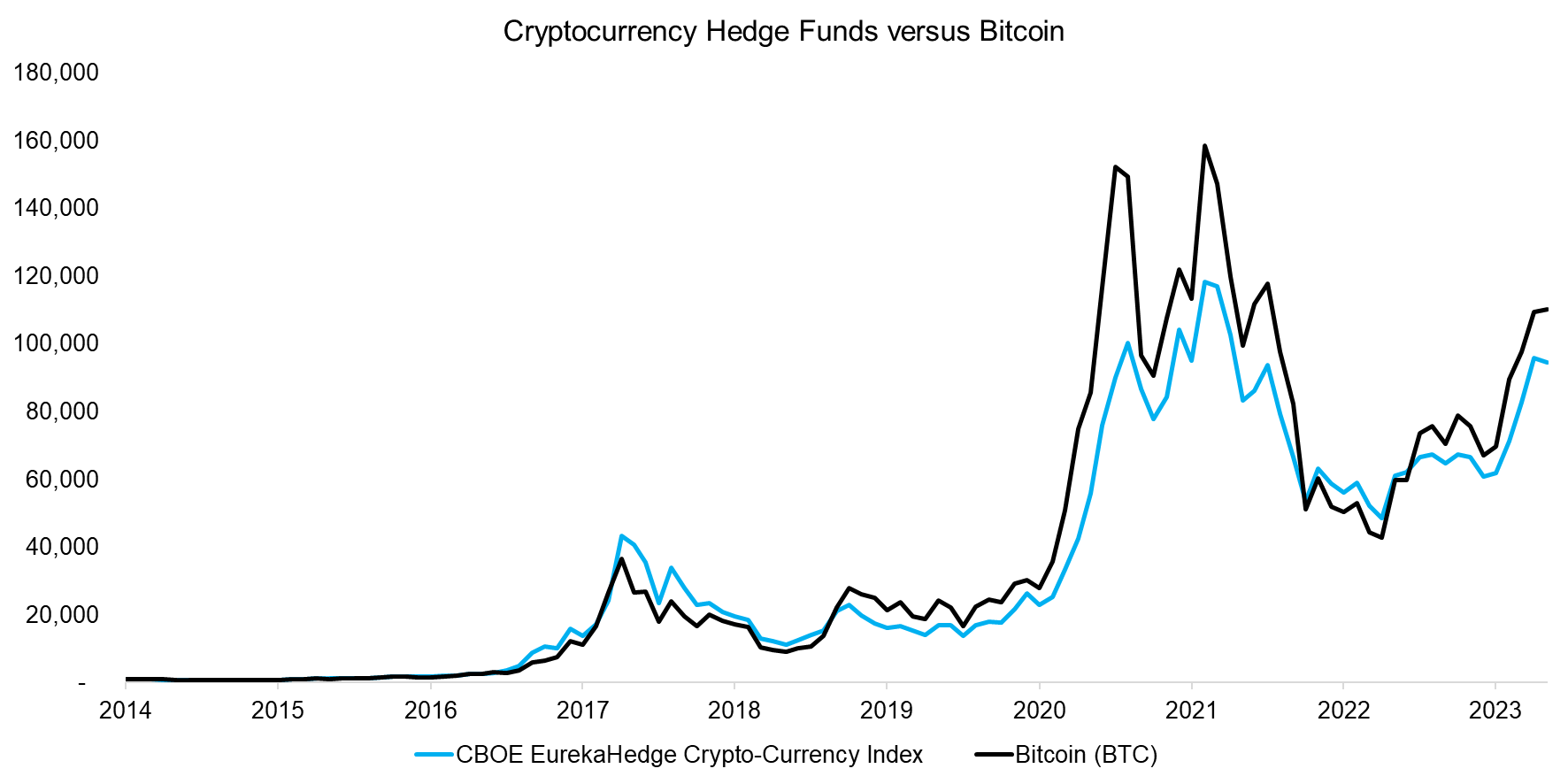

We plot the performance of the CBOE EurekaHedge Crypto-Currency Index, which represents an index of hedge fund managers that can take long and short positions in the entire universe of cryptocurrencies. Given the typical performance fees of hedge funds, these are highly incentivized fund managers who should be laser-focused on producing attractive and uncorrelated returns.

However, we see that these hedge fund managers do not seem to provide anything but exposure to BTC, including drawdowns of more than 80%. Intuitively, these active managers should have provided consistently positive returns by trading against the hordes of unsophisticated retail investors that dominate the cryptocurrency space (read Cryptocurrency Hedge Funds).

Source: Eurekahedge, Finominal

USE CASE OF CRYPTOCURRENCIES

Investing in stocks and bonds means providing capital to companies and governments for productive purposes, while investing in currencies and commodities is more about speculation. However, there are naturally clear use cases for the securities of the latter two asset classes, e.g. oil is utilized in industrial and consumer products and the Swiss Franc represents the currency of the country Switzerland.

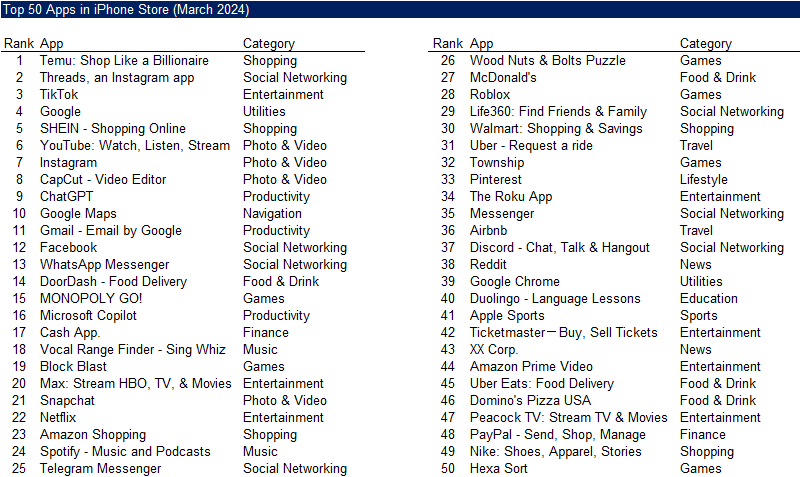

The use case for cryptocurrencies is less clear, despite the massive amount of talent that entered the space and billions of dollars that were invested into projects over the last few years. We can simply look at the top 50 apps on the iPhone store and it is challenging to identify any apps that are built on blockchain technology or use cryptocurrencies as primary means for payments.

Source: SimilarWeb, Finominal

FURTHER THOUGHTS

Investing has become more complex and despite more regulations, not less risky. Simplifying portfolios is crucial for achieving success, as it offers investors clarity and sharper focus.

Allocating to cryptocurrencies increases the complexity as coins and tokens are complicated. However, the case for or against an allocation to cryptocurrencies can be put into a simple question: should you invest in something that is often correlated to equities, where active managers struggle to outperform, and that has little utility aside from speculation?

RELATED RESEARCH

Crypto Tokens: Does Security Selection Matter?

Crypto Tokens and Coins: What Drives Performance?

Cryptocurrency Hedge Funds

Digital Asset ETFs: Not Crypto Enough?

Quant Strategies in the Cryptocurrency Space

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.