The Case Against Equity Income Funds

Gaining Income While Losing Capital?

October 2019. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Equity income mutual funds have underperformed the S&P 500 since 1988

- Especially on a post-tax basis

- Investors can create tax-efficient equity portfolios, but it does not represent a free lunch

INTRODUCTION

Warren Buffett is probably the most well-known and well-liked investor, which is easily explained by the immense wealth he achieved through extraordinary investment acumen and his charming nature. Unfortunately, his advice, which he provides generously at any occasion, and actions are often misunderstood by investors.

Take his perspective on dividends for example. Buffett has a preference for companies that consistently and sustainably pay dividends as he regards this as a sign of quality in a business and can reinvest income in the Berkshire Hathaway empire. However, he is more concerned about the total return of his investment than an exceptionally high dividend yield. Furthermore, he frequently explains that dividends are unattractive from a taxation perspective. Consequently, Berkshire Hathaway has only distributed excess cash to shareholders through share buybacks and never via dividends (read Warren Buffett: The Greatest Factor Investor of All Time?).

Unfortunately many investors are enamored with equity income funds that pay regular dividends. It is intuitive that certain types of investors like receiving regular income from their investment portfolio. For example, retired workers tend to perceive dividends as a substitute for wages. However, investors might consider Buffett’s advice and question the soundness of dividend strategies.

In this short research note, we will investigate the track record of equity income mutual funds in the US as well as consider alternatives that might be more favourable from a taxation perspective.

US EQUITY INCOME MUTUAL FUNDS VS S&P 500

Simple equity income strategies that focus on maximising dividend yields are often criticised for selecting low-quality companies as high dividend yields typically reflect high risks given poor business or industry characteristics. However, it is worth noting that equity income mutual funds are actively managed, where fund managers aim to avoid these kind of companies. Stocks are typically selected on a combination of dividend yield as well as dividend growth and sustainability.

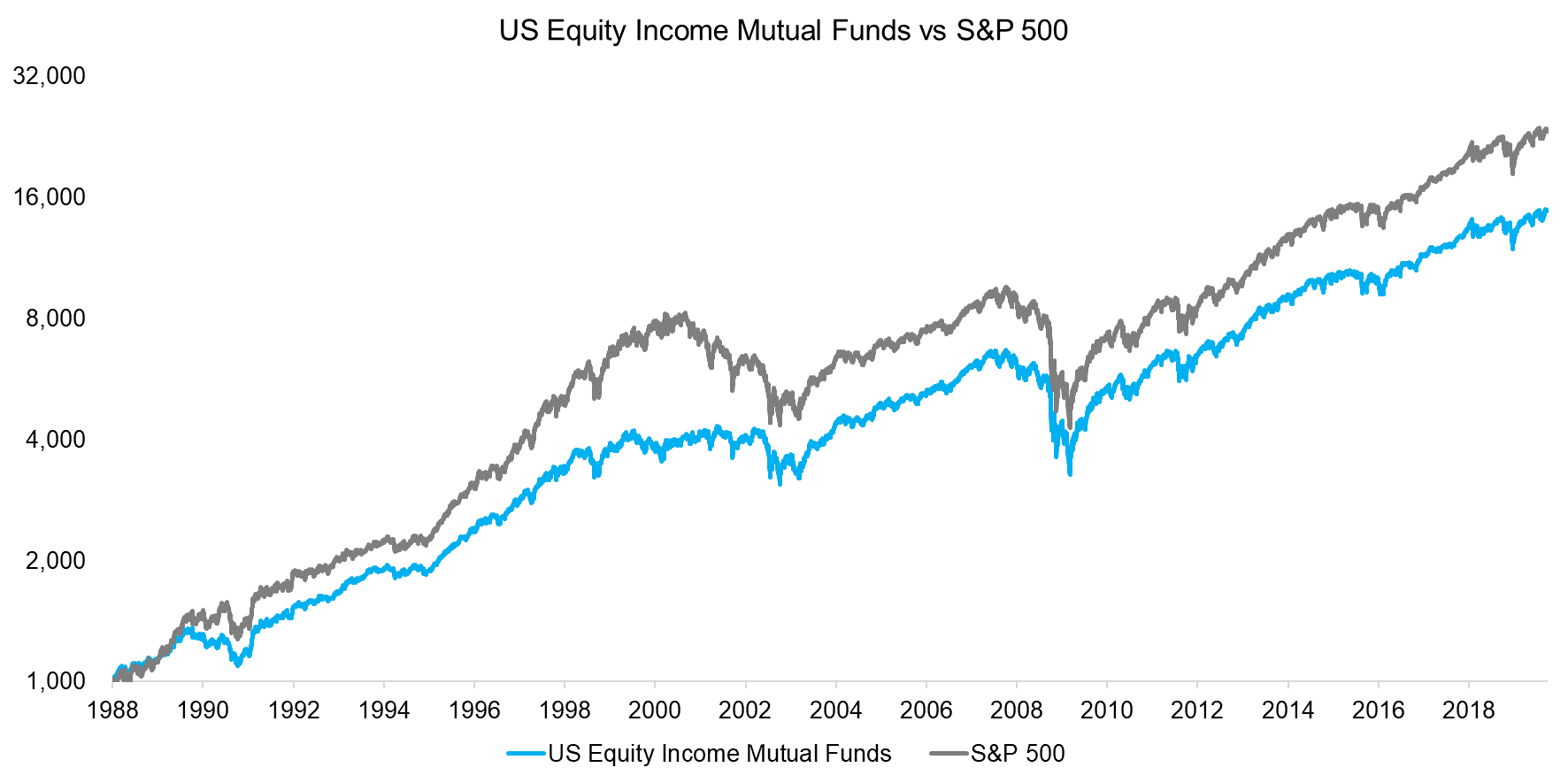

Some of the equity income funds in the US count among the oldest and largest of mutual funds, which perhaps indicates that investors view these as portfolio staples and are less likely to rotate out of them than other strategies. We create an equal-weighted index of equity income mutual funds that focus on large capitalization stocks in the US, where the S&P 500 is the appropriate benchmark. We observe that these funds would have underperformed the stock market on a total return basis since 1988.

Source: FactorResearch

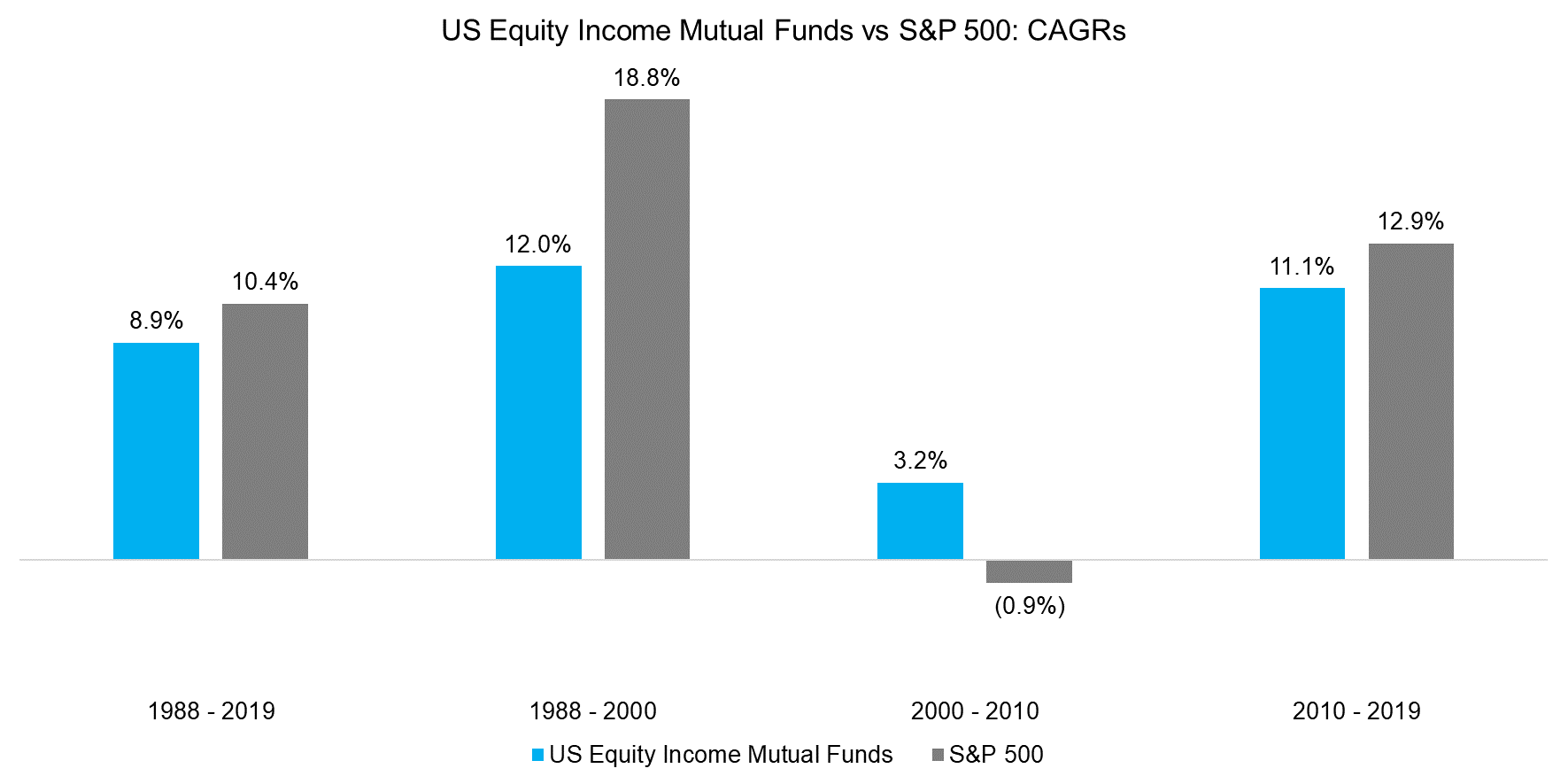

Investors can challenge that the results might change by taking a different starting point for benchmarking the equity income funds. However, if we analyse the CAGRs per decade, we observe that in two out of three dividend-focused strategies underperformed. Only between 2000 and 2010 equity income funds outperformed, which can be contributed to the implosion of the tech bubble in 2001, where low or zero-yielding technology stocks generated significant losses.

However, it is worth noting that although these funds generated lower returns than the stock market over the last 30 years, they also featured significantly lower volatility and a lower maximum drawdown during the global financial crisis, which are attractive features.

Source: FactorResearch

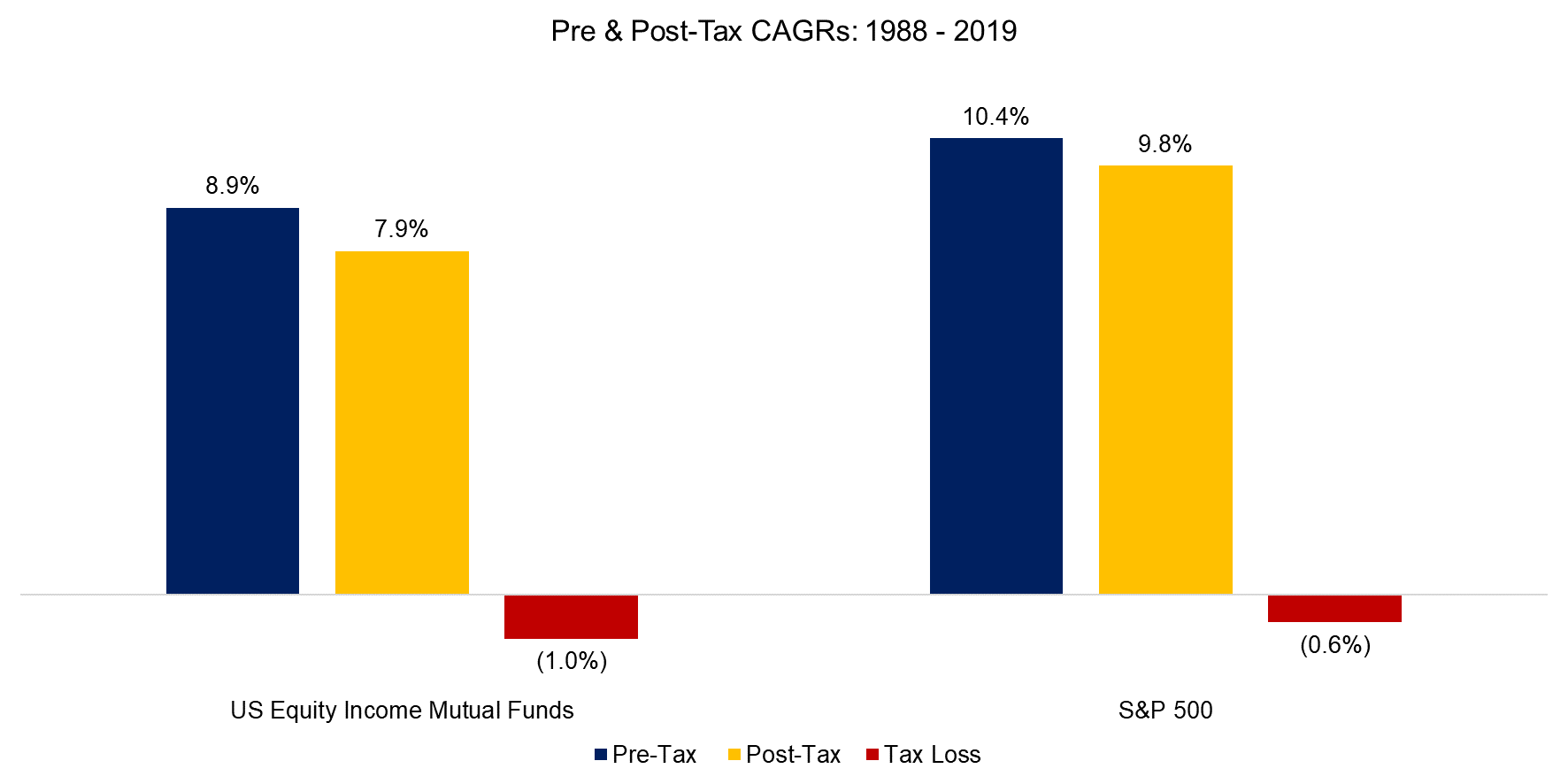

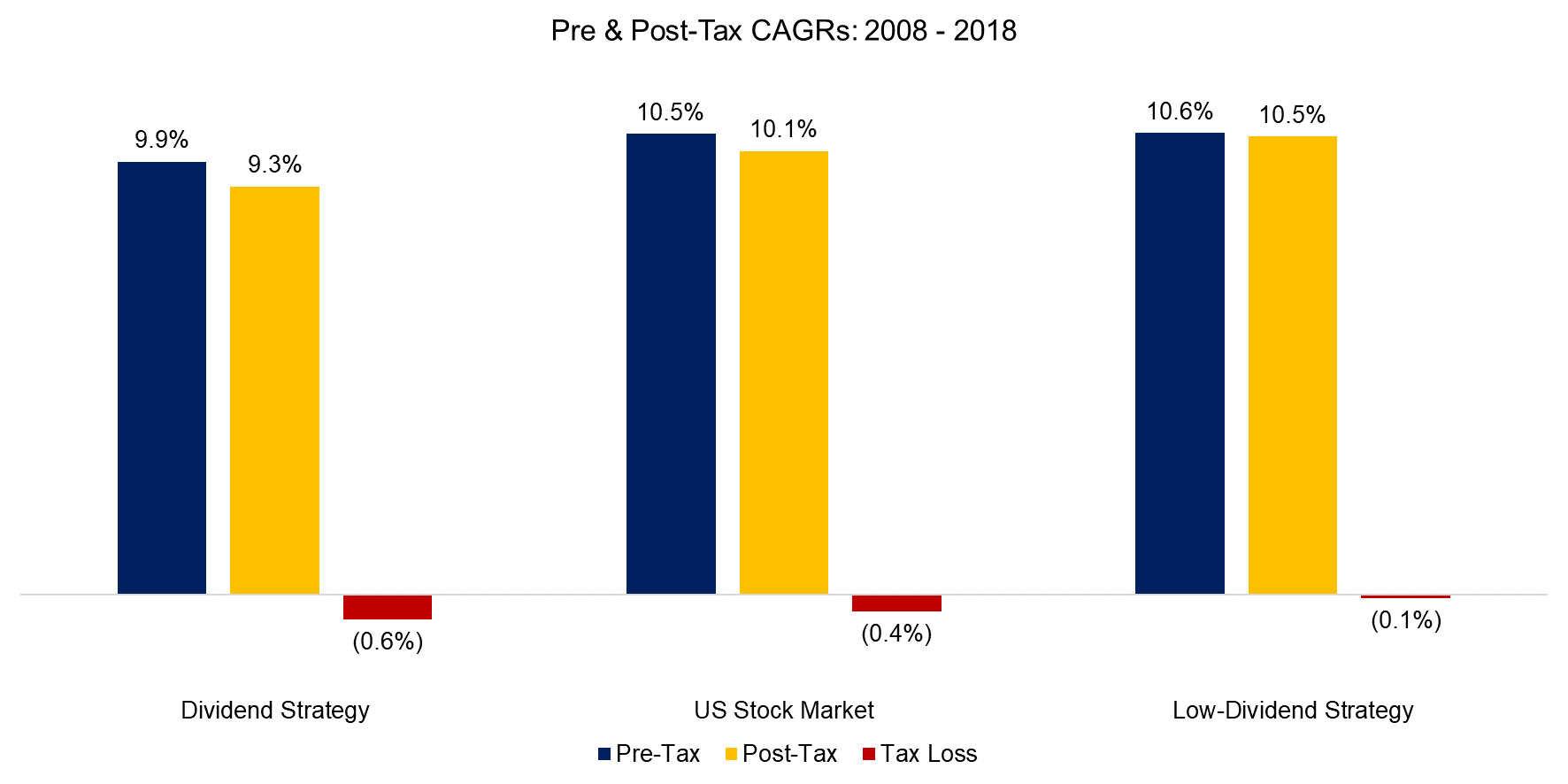

The results so far highlighted pre-tax returns, but many types of investors face taxes on dividends and capital gains. In the US, dividends tend to be taxed higher than capital gains, especially compared to when stocks are held longer than one year. A US investor in the highest tax bracket would have generated significantly lower post-tax return per annum with equity income funds than by simply holding the S&P 500.

Source: FactorResearch

TAX-OPTIMIZING EQUITY PORTFOLIOS

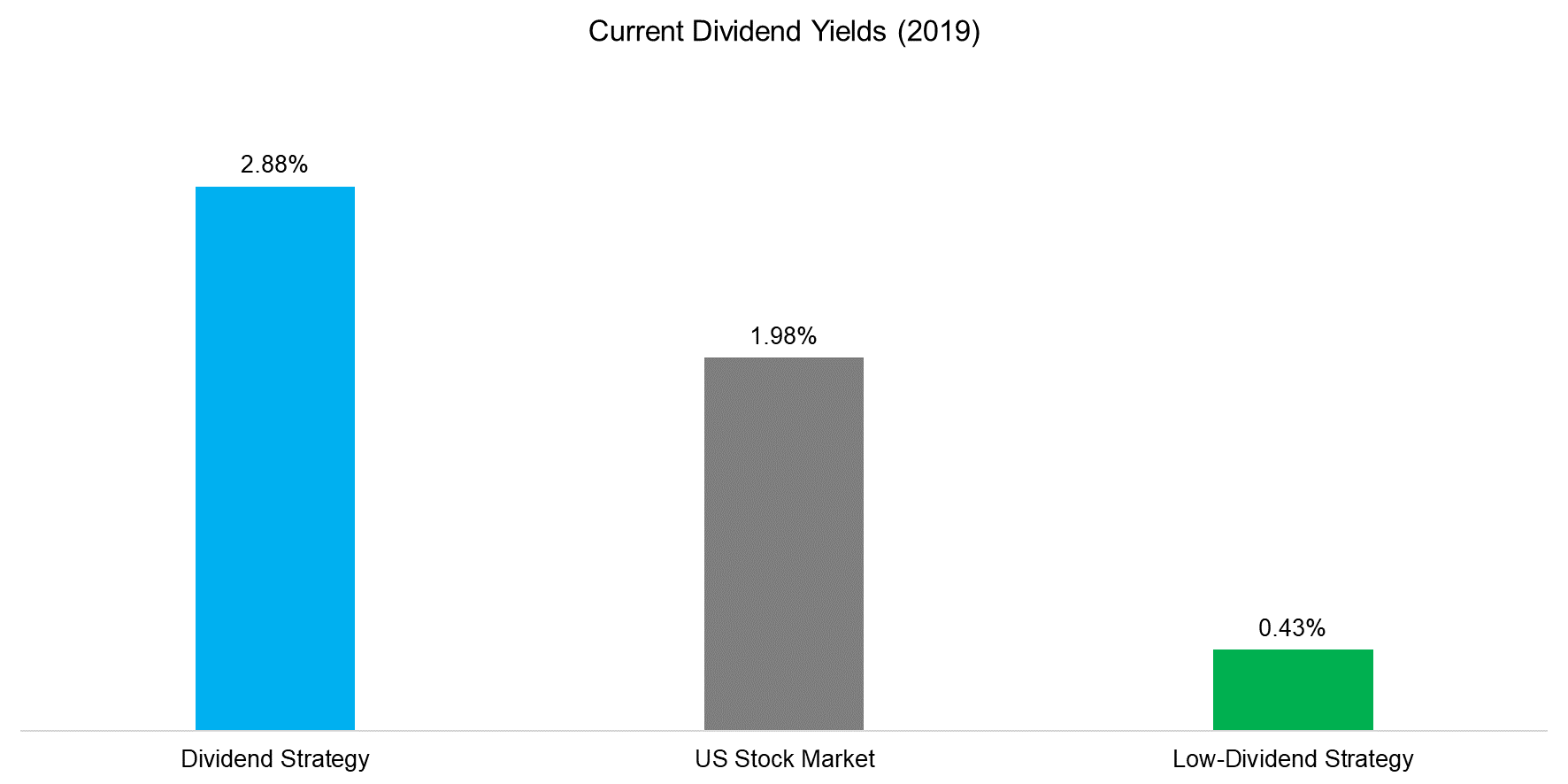

Given that dividends are typically unattractive from a taxation perspective, investors may consider creating equity portfolios that are more tax-efficient (read Value Factor: Improving the Tax Efficiency). Although we could create a portfolio with stocks that pay zero dividends, this would result in a significant tracking error to the S&P 500. We therefore create a portfolio that selects stocks that pay little or no dividends, where the dividend yield is substantially below that of the stock market and a dividend strategy.

Source: FactorResearch

We observe that the low dividend-strategy approximately generated the same pre-tax return per annum as the stock market in the US from 2008 to 2018, but more favourably on a post-tax basis. The difference to a dividend strategy accumulates to more than 1% per annum when comparing post-tax returns.

It is worth noting that the difference between pre- and post-tax returns, i.e. the tax loss, has decreased in the last decade compared to prior periods. Dividend yields have decreased along bond yields over the last 30 years and the S&P 500 currently yields less than 2%, in contrast to above 3% in the 1980s. Similarly, dividend taxes were significantly reduced over time and are currently a maximum of 20%. Investors still benefit from structuring portfolios tax-efficiently, but far less than historically.

Source: FactorResearch

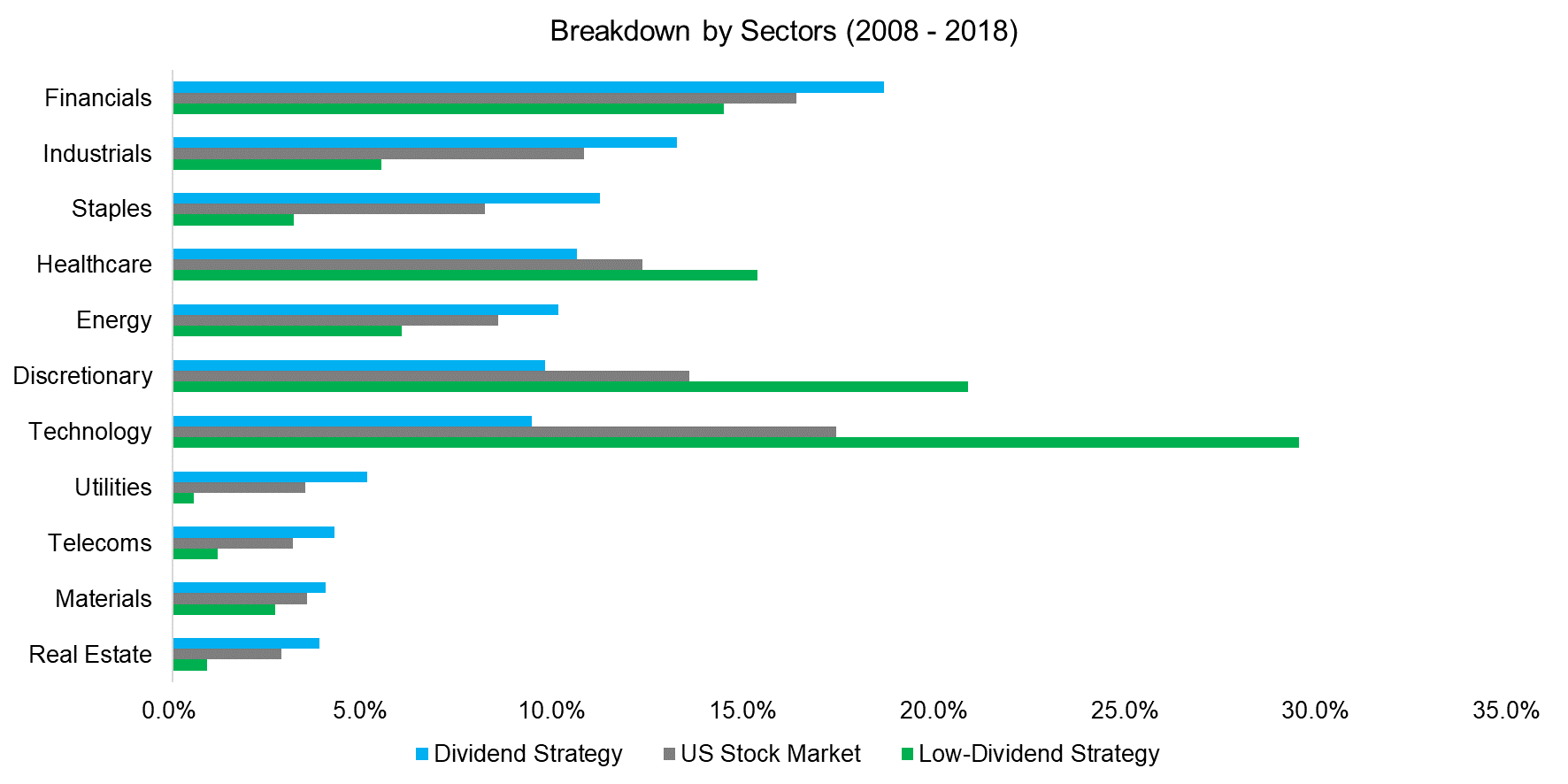

Investors interested in maximizing post-tax returns might consider the low-dividend strategy attractive, but we should highlight that the portfolio differs substantially from the stock market.

We can analyse the portfolios by the sector exposures, which shows that the dividend strategy overweights utilities, real estate, and staples, while it underweights technology, healthcare, and consumer discretionary stocks. Unsurprisingly, the low-dividend strategy exhibits the opposite over- and underweights.

These sectors biases are structural given industry characteristics. They don’t represent additional risks compared to plain beta, simply different risks. The dividend portfolio underperformed in recent years given an underweight to technology stocks, but might outperform if the sentiment towards technology stocks changes. Inversely, a low-dividend strategy would suffer in such a scenario.

Source: FactorResearch

FURTHER THOUGHTS

It is easy to understand why investors like to receive income, but exposure to dividend strategies might be challenged given lower returns, especially on a post-tax basis.

If investors require income, then they can create their own dividends by simply selling shares. Investors frequently forget that each time a stock distributes a dividend, the price approximately decreases by the same amount. There is no difference from a portfolio perspective between a company distributing cash or a stockholder selling a few shares, except from a taxation perspective, which is more favourable for synthetic than normal dividends.

RELATED RESEARCH

Resist the Siren Call of High Dividend Yields

Value Factor: Improving the Tax Efficiency

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.