The Case Against Private Markets

Who are we fooling with stale valuations?

May 2024. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- There can be large discrepancies between private and public market valuations

- Blackstone’s Real Estate Income Trust (BREIT) seems to have been immune to the downturn in property markets

- It is difficult to explain this except by stale valuations, which represents significant downside risk

INTRODUCTION

Alternative asset classes like private equity have exhibited strong asset growth as institutions have increased their allocations consistently since the global financial crisis in 2009, attracted by strong and consistent returns. Lately, even financial advisors and retail investors have gotten access to such strategies via dedicated wealth tech platforms such as iCapital in the U.S. and Moonfare in Europe.

It was a rare setback for alternative asset managers in April 2024 when the Norwegian government denied the Norges Bank Investment Management, the world’s largest sovereign wealth fund with $1.6 trillion of assets under management, to allocate 5% to private equity investments. The Norwegian Finance Minister explained his decision with fees being too high and transparency being too low.

The success of private equity can be explained by buying businesses with debt and benefitting from declining interest rates over the last four decades, by increasing equity multiples, and not having to mark to market its assets, which understates the volatility of investments but makes them look superior on paper. If the market for selling private assets does not look favorable, then investments are simply held longer, even if it means extending the lives of private equity funds.

This playbook has been a recipe for success that propelled the assets under management in private equity to more than $4 trillion, but has come to an end when interest rates started increasing in 2022. However, most alternative asset managers do not want the party to end and some continue to live in castles in the sky, along with many institutional investors.

In this article, we will highlight the discrepancy between public and private markets using the Blackstone Real Estate Income Trust (BREIT) as a case study.

BREIT OVERVIEW

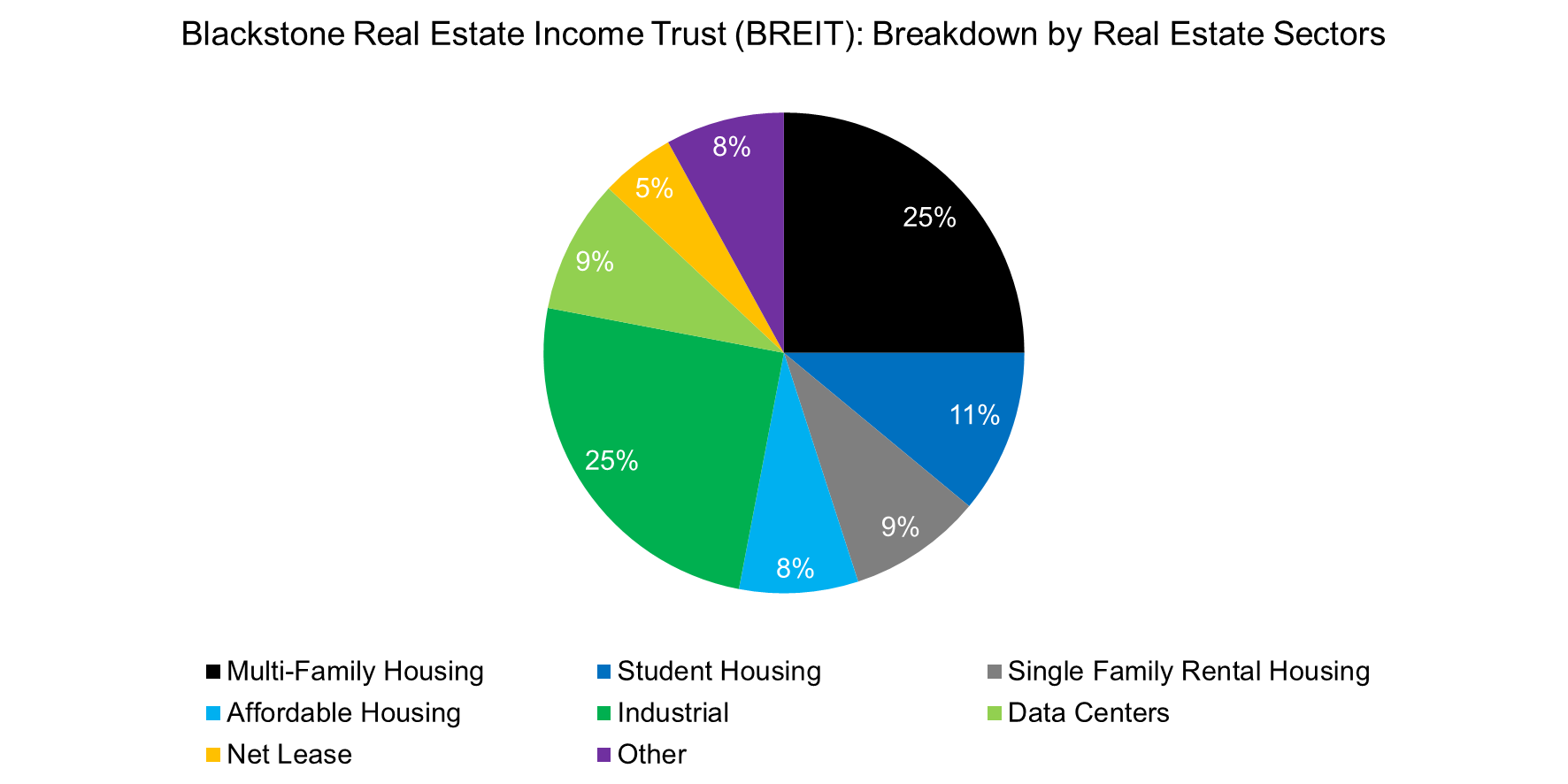

The Blackstone Real Estate Income Trust (BREIT) is the world’s largest private equity real estate fund with a portfolio worth $113 billion as of March 2024. The fund primarily invests in property in the south and west of the U.S. and features an occupancy rate of 95%. The portfolio is dominated by housing (53%) and industrial (25%) real estate assets.

Source: BREIT, Finominal

BREIT VERSUS REITS

BREIT’s portfolio is leveraged by approximately 50%, comparable to the average real estate investment trust (REIT). Given that BREIT’s portfolio is valued at more than $100 billion, this represents a diversified portfolio that is akin to an index with a focus on residential and industrial assets.

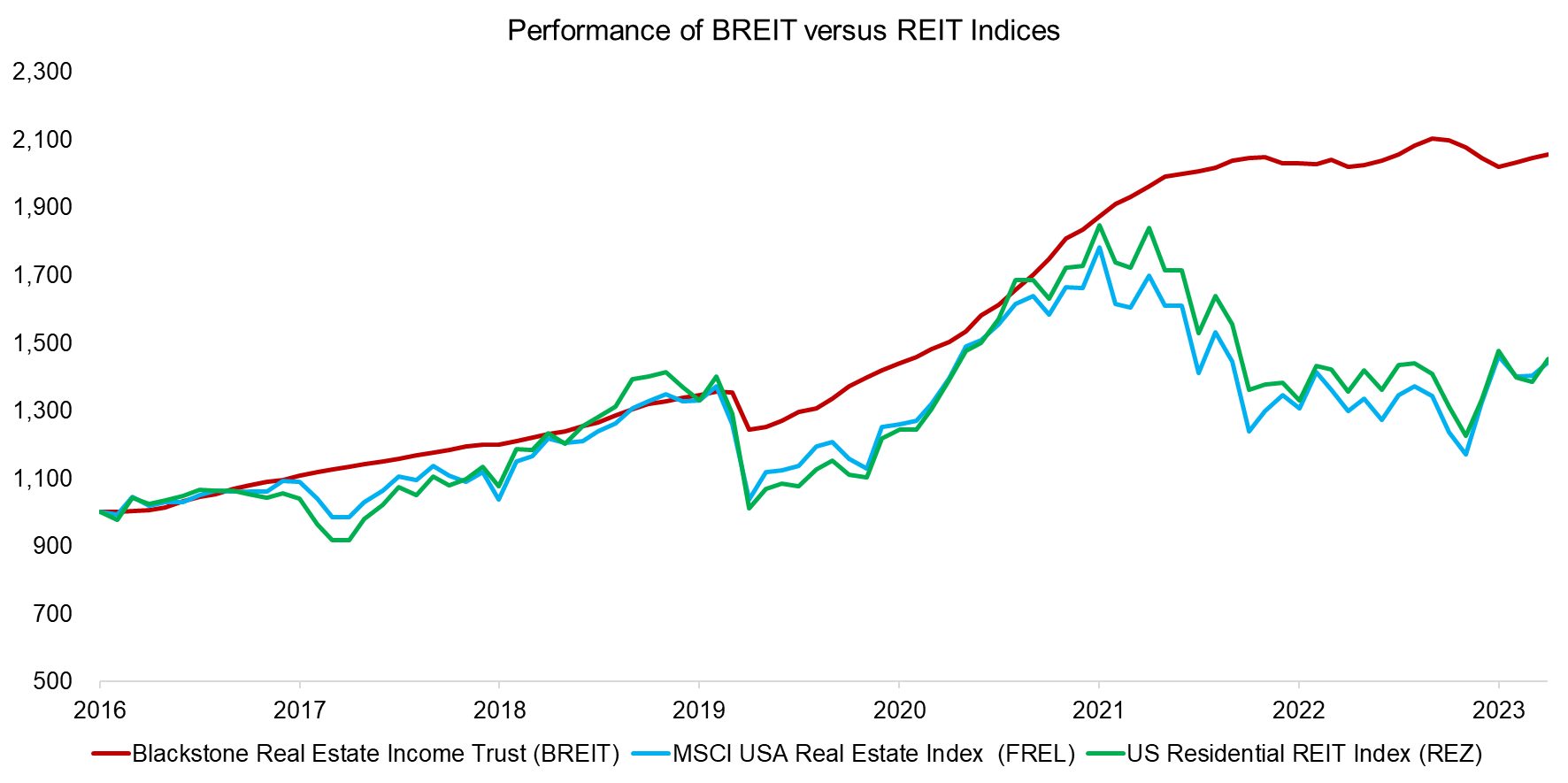

We can compare the performance of BREIT to the REIT indices that offer such exposures, which are the broad MSCI USA Real Estate Index and the more narrow US Residential REIT Index. These two indices are available as ETFs via the Fidelity MSCI Real Estate Index ETF (FREL) and IShares Residential And Multisector Real Estate ETF (REZ).

Both REIT indices generated almost identical performance between 2016 and 2024, which simply reflects that large real estate portfolios are driven primarily by systematic rather than idiosyncratic risks. In the case of real estate, these drivers are interest rates and economic growth (read The Case Against REITs).

We observe that BREIT performed markedly differently in certain periods, despite offering a similar exposure to real estate markets. First, BREIT did not revalue its assets when REITs declined during the first quarter of 2018, then it did during the COVID-19 crisis in 2020, but then again did not in 2022 when the U.S. Federal Reserve started raising interest rates. Real estate valuations are primarily a function of interest rates as these are the discount rates in the valuation models. When rates increase, then real estate valuations tend to decrease.

Source: Finominal

It is worth highlighting that private equity fund managers live off their pitch to produce consistent returns with little volatility, which is only possible by not marking their assets to the market. If there is a small correction in stock markets, then often the valuation remains unchanged, as private equity fund managers hope for a recovery to avoid any write-downs. Naturally, this tactic did not work during this COVID-19 crisis or the GFC in 2009 as these events were too large to be ignored by private equity firms and their external appraisers.

However, it is remarkable that BREIT did not revalue its assets in 2022 or 2023, where Blackstone might have misjudged the economy and its outlook. If inflation were only transitory as presumed by the Fed initially, then rates would be decreased and real estate valuations increased again, allowing BREIT to avoid any of the ugly volatility of REITs. However, inflation turned out not to be transitory and BREIT does not seem to have written down the values of its assets. Some investors have realized this and asked for their money back, which they can as BREIT is structured as an open-ended fund, but Blackstone has managed to avoid a liquidity crisis by sticking to its valuations and only offering partial redemptions.

RISK & RETURNS OF PUBLIC VERSUS PRIVATE ASSETS

Naturally, the market value of the assets held in BREIT have decreased over the last two years, but this will only come to light when Blackstone has to sell an asset, so until then it’s make-believe.

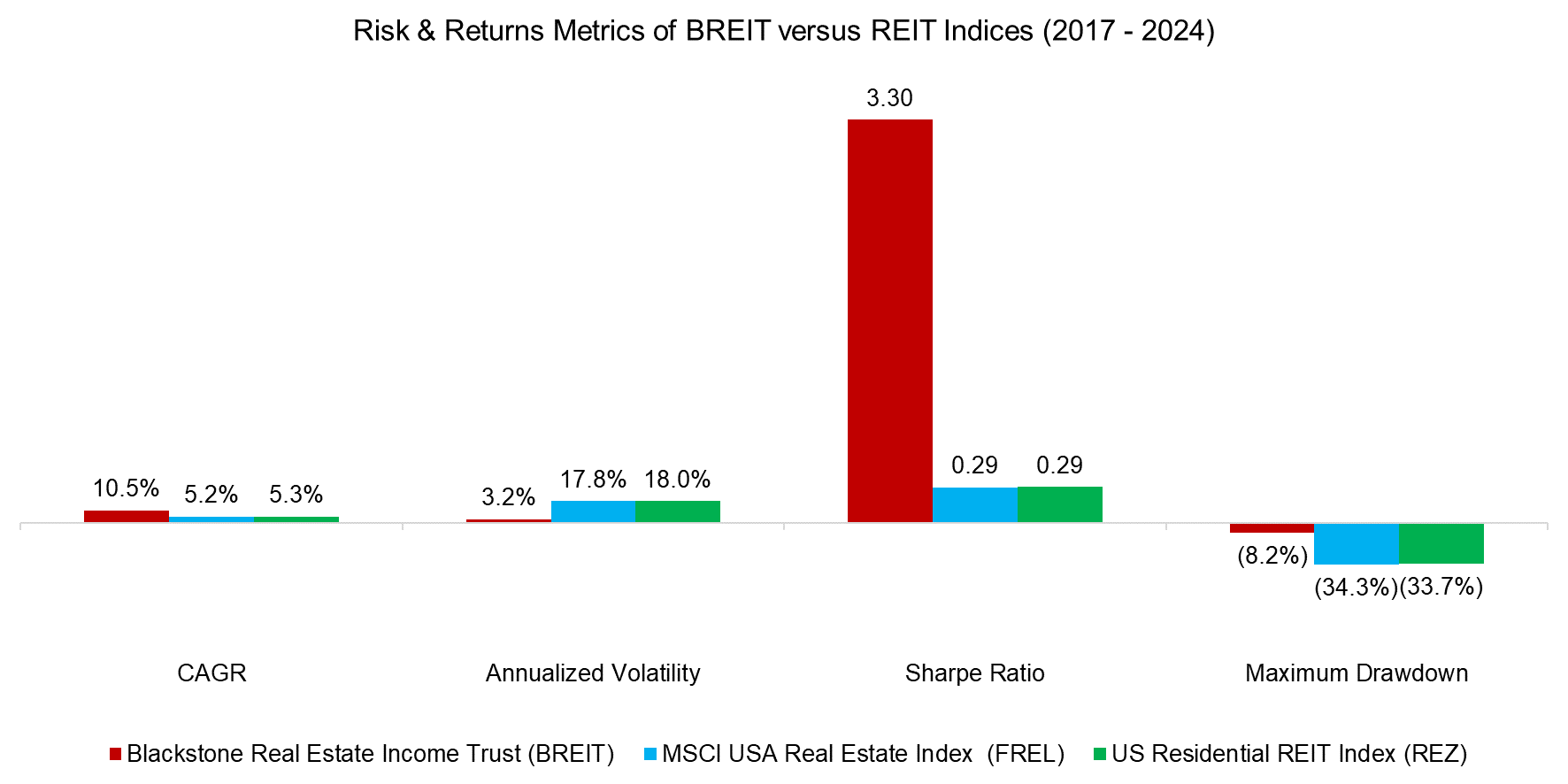

We can highlight how extreme the effect of stale valuations in private markets are by comparing the risk and return metrics of BREIT and the two REIT indices. BREIT sports a CAGR that is double that of the MSCI USA Real Index and US Residential REIT Index (10.5% versus 5.2% & 5.3%), despite having an annualized volatility that is a fraction (3.2% versus 17.8% & 18.0%), which results in a Sharpe ratio of 3.30, compared to 0.29 respectively 0.29, in the period from 2017 to 2024. Finally, BREIT’s maximum drawdown was a mere 8.2%, compared to 34.3% respectively 33.7% for the REIT indices (read Private Equity: Fooling Some People All the Time? and Private Equity: The Emperor has No Clothes).

Source: Finominal

FURTHER THOUGHTS

Naturally, there are private equity and real estate funds that can outperform their markets, but how likely is that for a $113 billion fund?

It will be interesting to see the performance of BREIT over the next few quarters, as something has to give. Perhaps real estate valuations will increase and Blackstone will get lucky by being able to avoid a drawdown in BREIT.

However, more likely is that BREIT’s external appraisers, which theoretically are independent but practically are conflicted as they get paid by Blackstone, will slowly decrease valuations to get these closer to the market. If that leads to an increase in redemptions, then this will likely result in steady losses in BREIT as Blackstone is forced to sell and write down the portfolio asset by asset.

Unfortunately, BREIT is not unique, and stale valuations are not a bug but a feature of private markets. Private equity is still equity, but with high fees and a lack of transparency. Hopefully, more investors will follow the Norwegian government and say “Nei”.

RELATED RESEARCH

Listed Private Equity ETFs: The Real Deal?

Private Equity: Fooling Some People All the Time?

Private Equity: The Emperor has No Clothes

Venture Capital: Worth Venturing Into?

BDCs: Better Don’t Choose?

The Case Against REITs

A Crescendo in Private Credit?

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.