The Dark Side of Low-Volatility Stocks

Long Bonds?

October 2018. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Low-volatility stocks have outperformed the market over the last 25 years

- The strategy has reduced equity drawdowns in the US, Europe, and Japan significantly

- However, low-volatility stocks have partially been bond-proxies, which poses risk when rates rise

MARKETING INGENUITY IN FINANCE

Smart beta may be the best marketing concept ever invented in finance. Buying something labeled “smart beta” makes you intuitively feel both smart and good about the investment. But if smart beta is the best investment product label ever, low volatility is a strong contender for second place. It isn’t hard to see why.

After the global financial crisis, risk was front of mind for investors, so buying stocks with lower volatility, perhaps even bond-like characteristics, had obvious appeal. Since then, low-volatility strategies have rapidly gathered assets and today low-volatility exchange-traded funds (ETFs) in the United States account for about $46 billion in assets under management (AUM) (read Low Volatility, Low Beta & Low Correlation).

But the strategy isn’t immune to criticism. Some contend the underlying stocks are effectively bond proxies that have benefited from the declining interest rates over the last few decades. So just how does this low-volatility strategy perform across markets? And does it really suffer from interest-rate exposure as its critics claim?

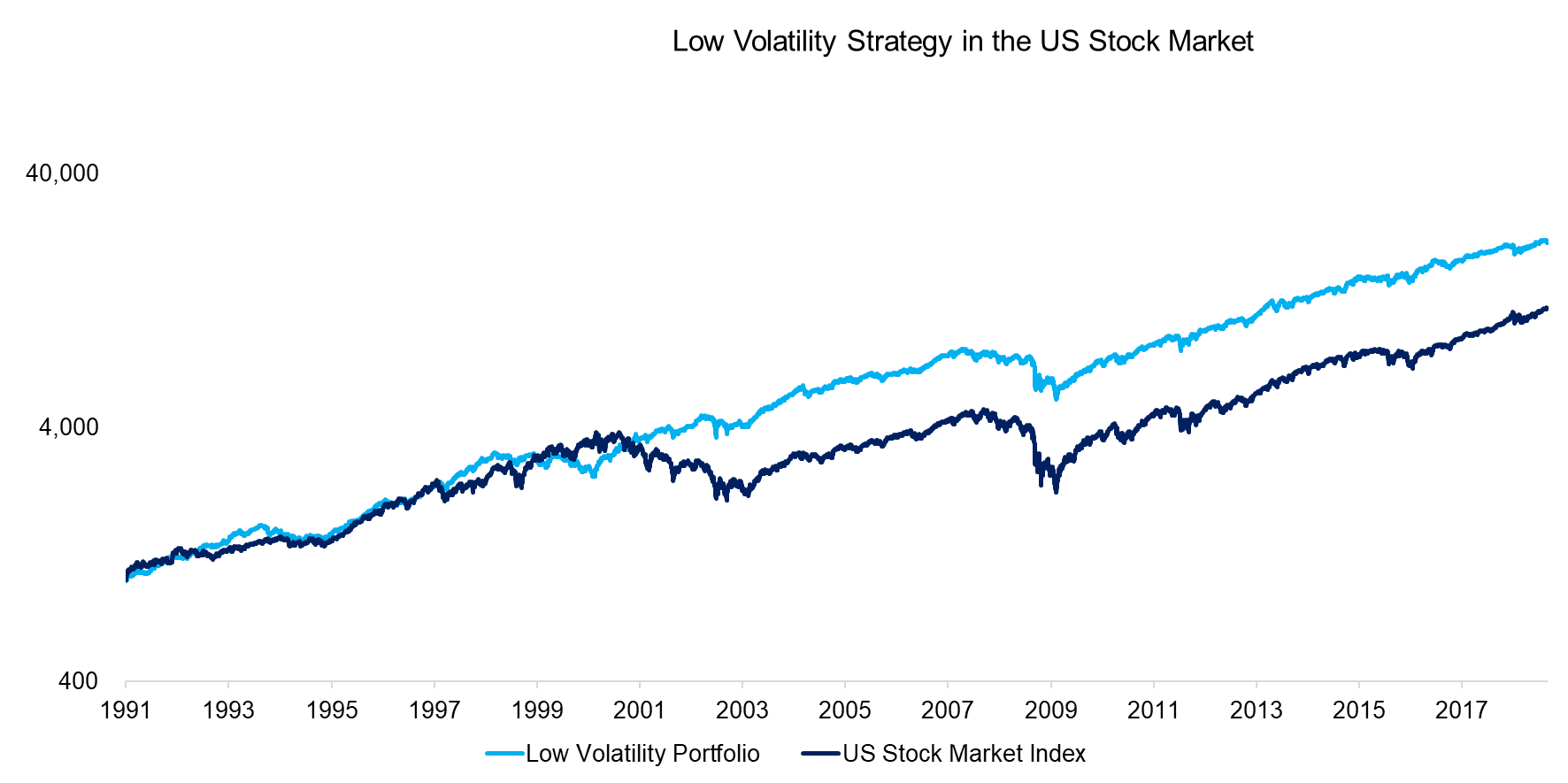

LOW-VOLATILITY STRATEGIES IN THE UNITED STATES

To answer these questions, we created a long-only portfolio composed of the top 10% of US equities ranked by price volatility over the last 12 months with monthly rebalancing. We then compared it to the US stock market. We found that the low-volatility portfolio outperformed the stock market since 1991. While there was a period of slight underperformance during the tech bubble, the portfolio outpaced the stock market during both the subsequent crash and the global financial crisis from 2007 to 2009. These initial results make a strong case for low-volatility stocks.

Source: FactorResearch

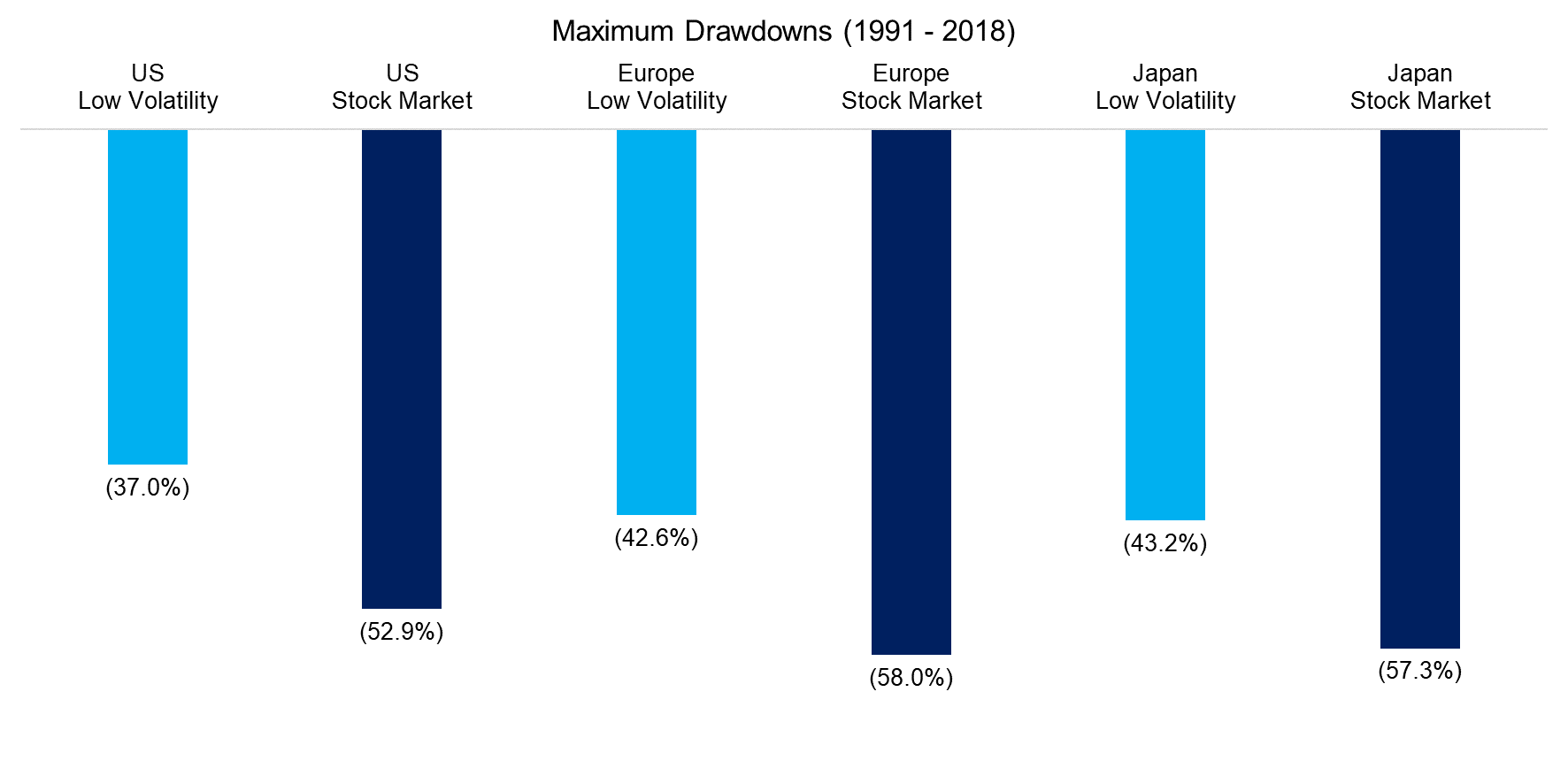

LOW-VOLATILITY STRATEGIES ACROSS MARKETS

Expanding our analysis to the European and Japanese stock markets, we shifted the focus to maximum drawdowns, since low-volatility funds are generally bought to reduce risk. Over the last 25-plus years, the low-volatility portfolios had much lower maximum drawdowns than their corresponding stock market indices. So, again, what’s not to like?

Source: FactorResearch

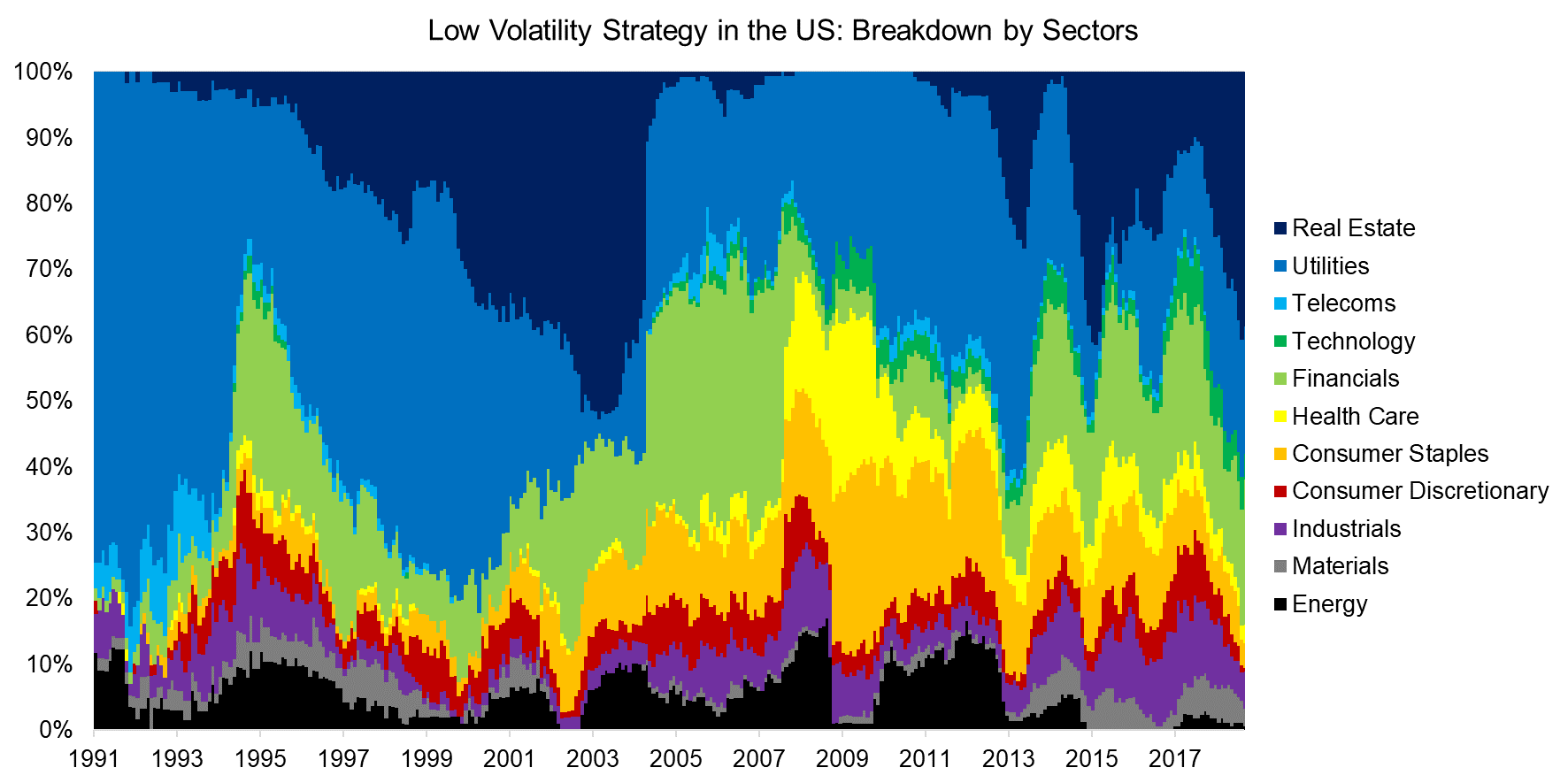

BREAKDOWN BY SECTOR

Thus far, low-volatility stocks seem to have highly attractive risk-return characteristics. However, a breakdown of the underlying US portfolio shows that the strategy was largely a bet on two sectors: real estate and utilities. Together, these accounted for more than 50% of the stocks across the time period (read Low Volatility Factor: Interest Rate Sensitivity & Sector-Neutrality).

Sectoral biases are to be expected since low-volatility stocks are typically mature businesses with stable cash flows. In fact, investors might find them a bit staid compared to Tesla or the FAANG companies.

Source: FactorResearch

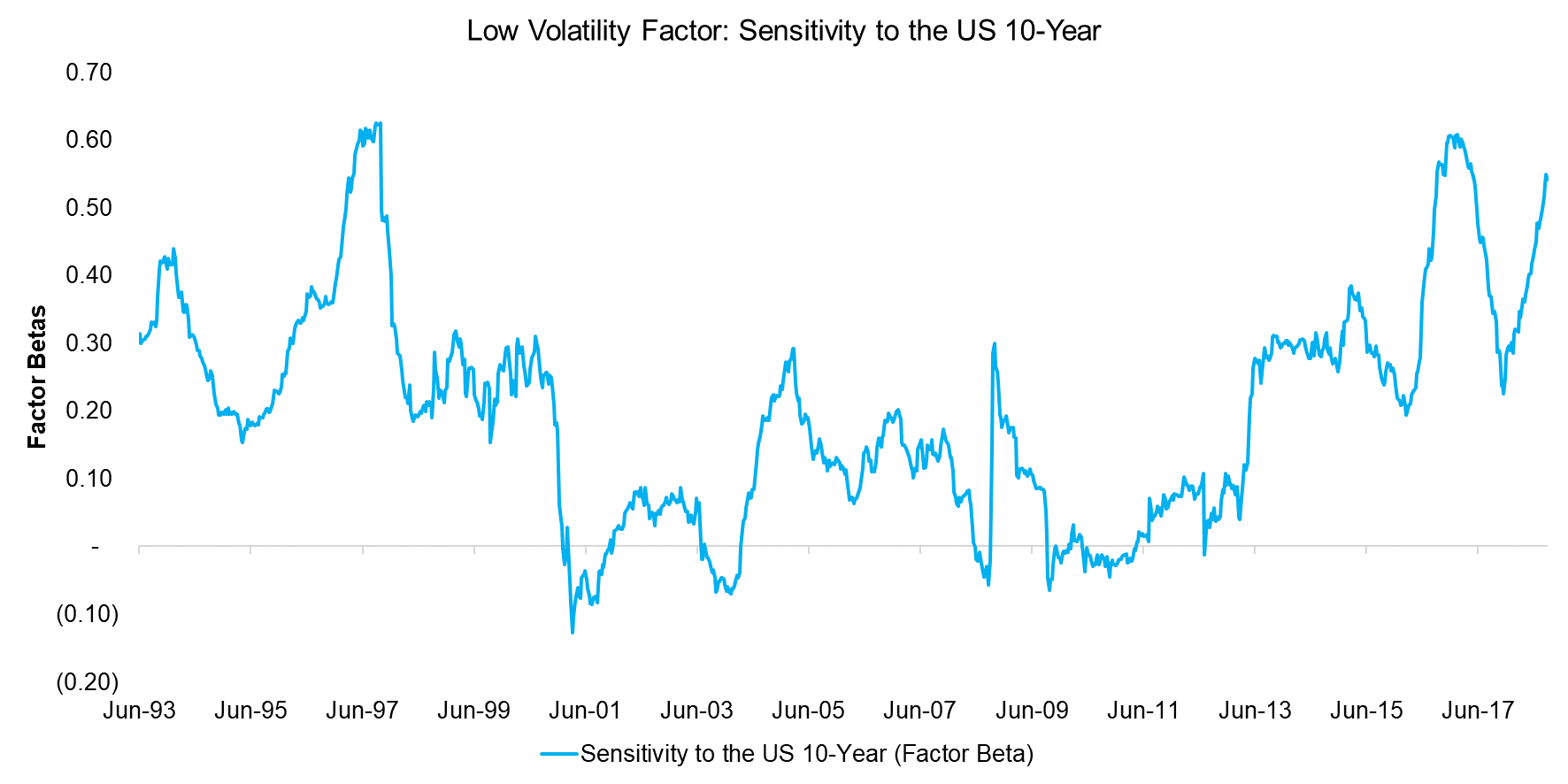

BETTING ON BONDS?

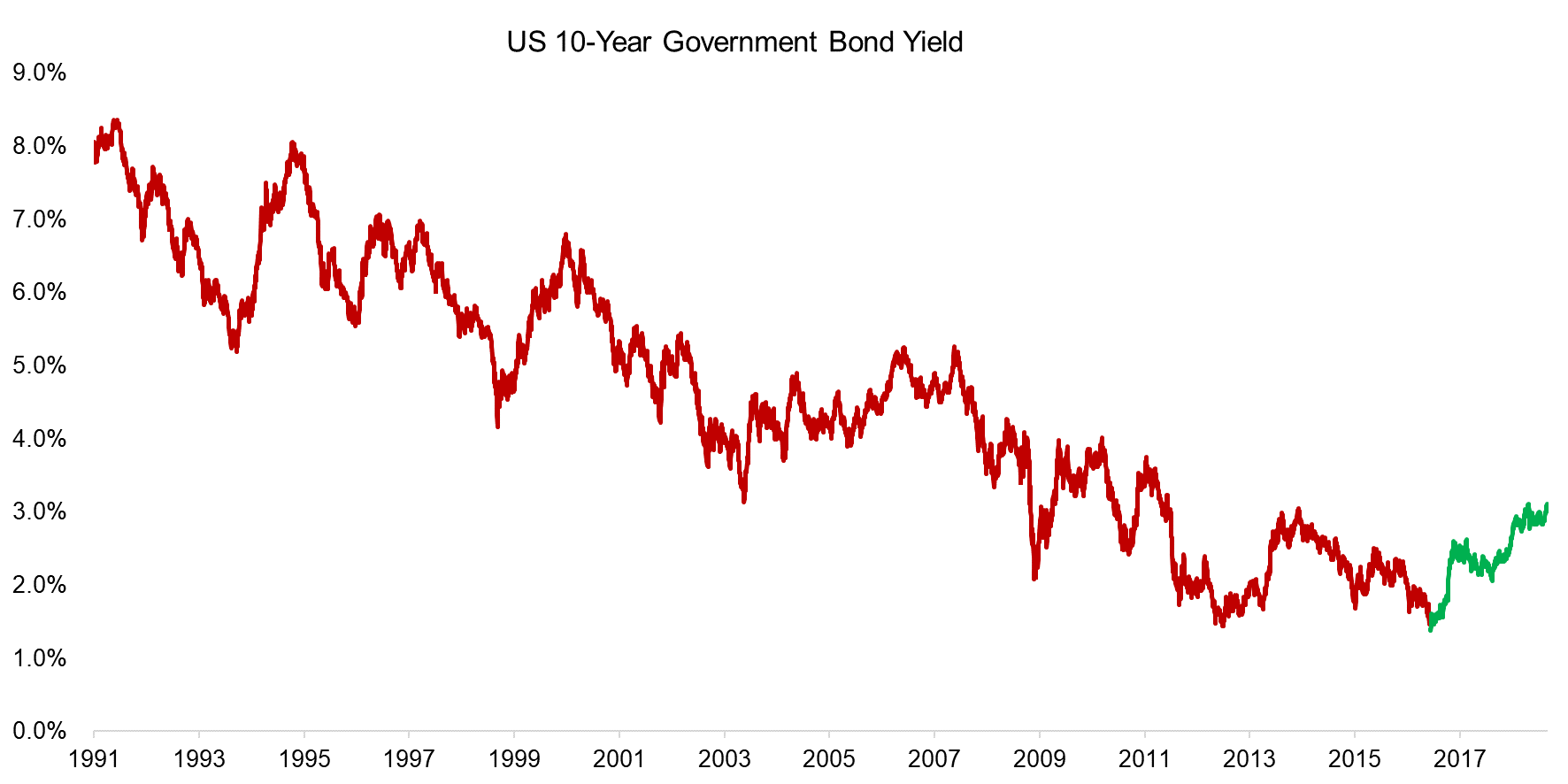

But stable businesses like these tend to be more levered. Given their debt levels, they are more sensitive to changes in interest rates. Comparing the US low-volatility portfolio to the 10-year US Treasury bond, we found periods of elevated sensitivity in the 1990s and since 2013.

The degree of sensitivity is partially explained by sectoral exposure. For example, from 2005 onward, the volatility of real estate stocks increased, a symptom of the boom-and-bust nature of the real estate cycle. Thus the portfolio’s exposure to the sector decreased in favor of financial stocks, which are not as responsive to interest rates.

Source: FactorResearch, Newfound Research for 10-year data

So is interest rate-sensitivity the reason for the low-volatility strategy’s stellar performance?

It certainly is a major component. After all, interest rates in the United States have been heading steadily downward for the last 30 years. This enabled levered companies to increase their earnings by continuously refinancing existing debt at lower rates.

But the outlook is changing and US interest rates are on the rise. So low-volatility stocks are becoming riskier bets. Moreover, it is an open question whether investors should hold indirect bond exposure in their equity portfolios when most diversified portfolios have direct exposure.

Source: FactorResearch

FURTHER THOUGHTS

Declining interest rates likely explain most of the low-volatility strategy’s attractive risk-adjusted returns. If the strategy is constructed long-short, creating a sector-neutral portfolio can reduce interest rate-sensitivity. However, this isn’t feasible in the long-only format — the structure available to most investors through ETFs and funds.

Low-volatility stocks were great for risk reduction over the last few decades, protecting capital during equity market downturns. But the long US bond bull market may have run its course, and if bond and equity markets correct simultaneously, low-volatility stocks may not provide so safe a haven.

RELATED RESEARCH

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.