The Fallacy of Betting on the Best Stock Market

Performance chasing is not a sound investment strategy

December 2024. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Many U.S.-based investors see no point in investing in international equities

- The U.S. has outperformed over the recent decade, but underperformed in prior periods

- There is little performance consistency with winners becoming losers, and vice versa

INTRODUCTION

Many U.S.-based investors find little value in international diversification. The appeal of investing solely in indices like the S&P 500 or the Russell 3000 is straightforward: the U.S. stock market provides access to the world’s largest economy, these indices provide exposure to international markets via the numerous American companies that generate revenue overseas, and the majority of leading tech giants are headquartered in the United States. Finally, if investors had allocated to Europe, Japan, or Emerging Markets over the last decade, they would have generated a significantly lower return.

While these arguments are valid, U.S. stocks have become expensive, and as every regulatory disclosure reminds us, future performance is not guaranteed by past results. Relying solely on U.S. equities can amount to performance chasing – an unsound investment strategy (read Chasing Mutual Fund Performance).

In this research article, we will emphasize the risks associated with failing to diversify across the global equity markets.

U.S. VERSUS INTERNATIONAL STOCK MARKETS

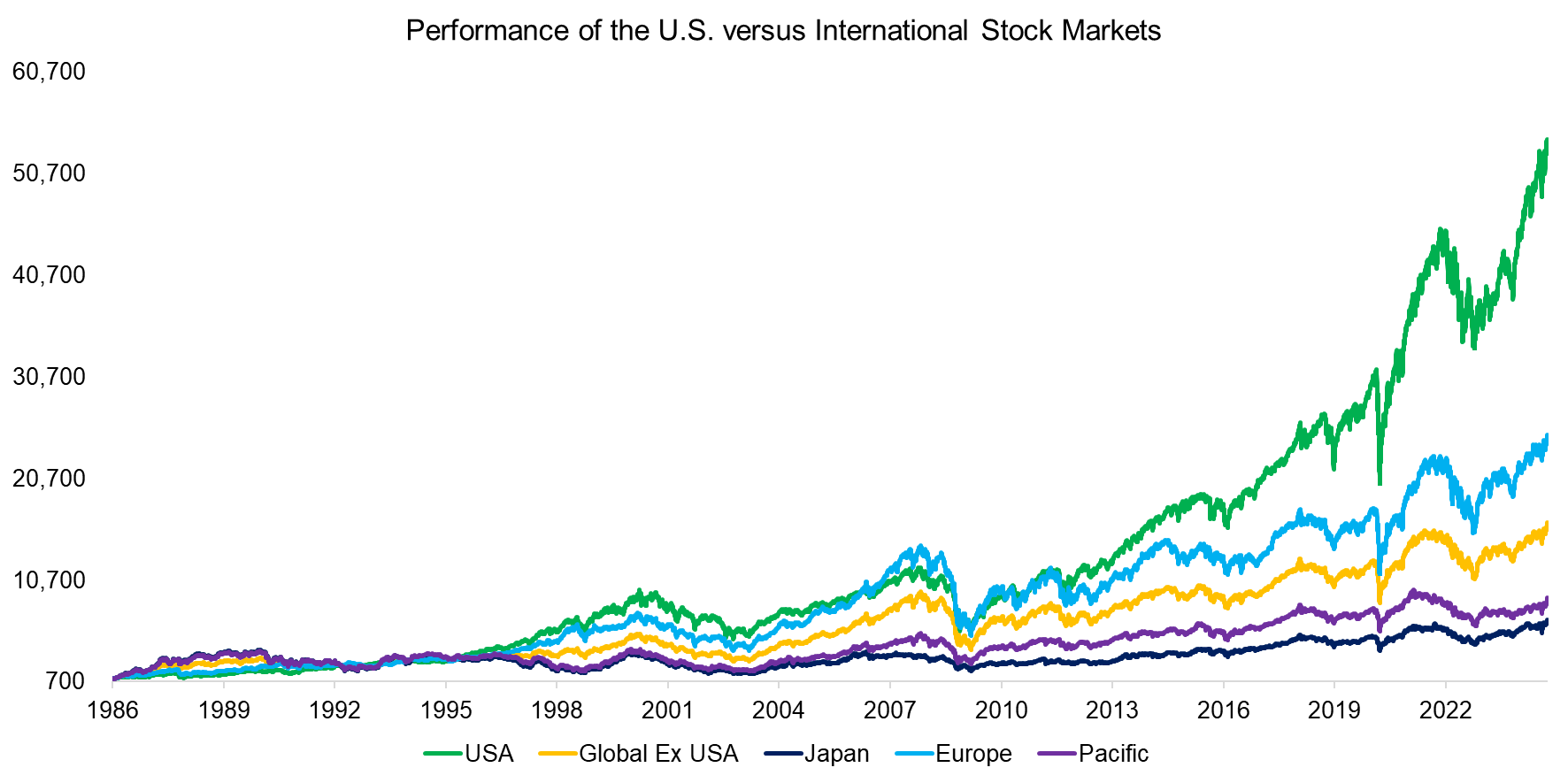

A comparison of U.S. stock performance with Global ex-USA, Japanese, European, and Pacific markets reveals no consistent dominance by U.S. equities. Between 1986 and 1996, Asian markets outperformed, while European markets delivered comparable returns until 2012. It was only in the last decade that U.S. stocks have significantly outpaced their global counterparts.

Source: AQR, Finominal

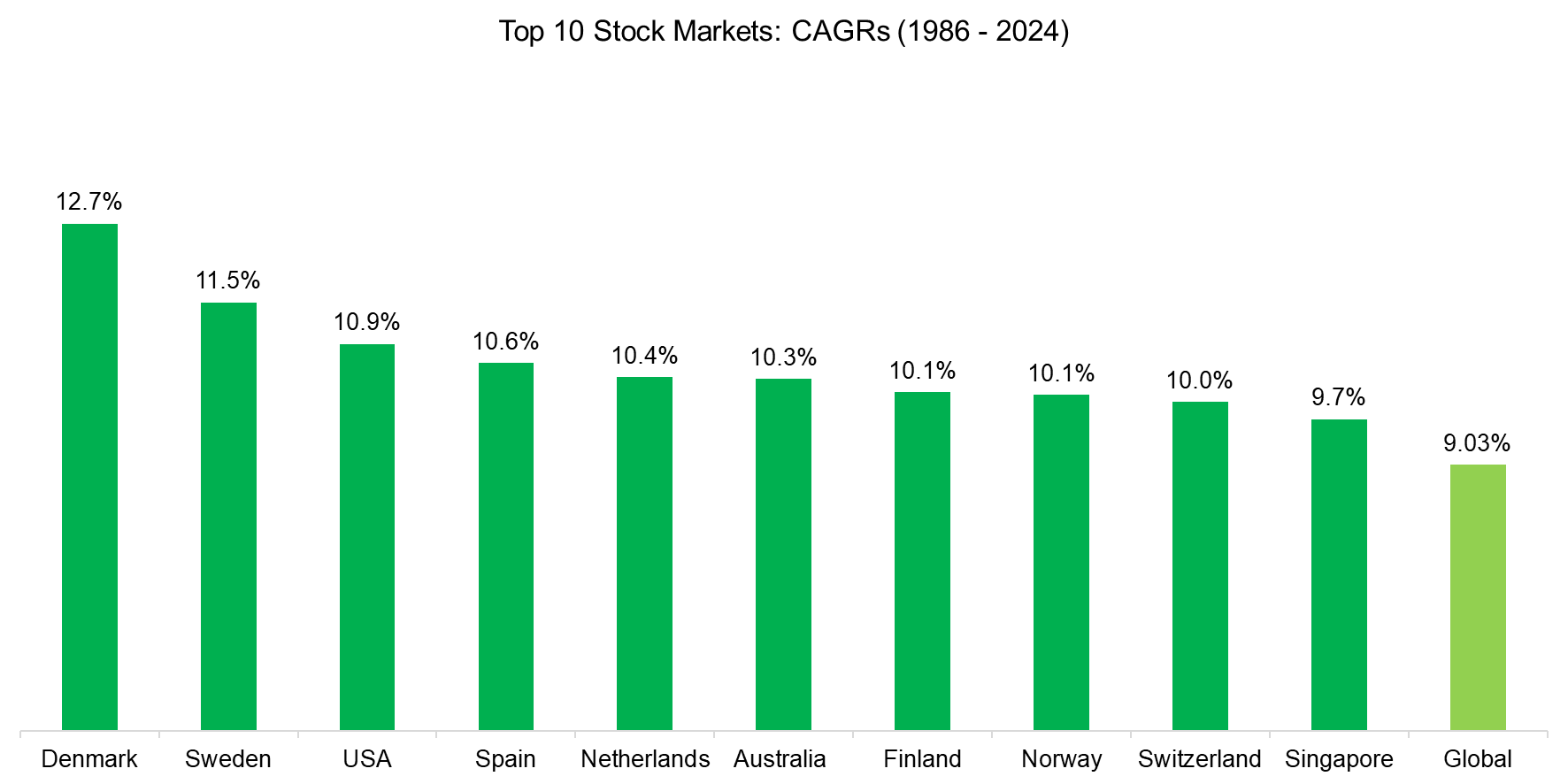

Using data from AQR, we calculated the compound annual growth rates (CAGRs) for 21 stock markets with available returns since 1986. While the U.S. stock market delivered strong returns over this period, it ranked third, trailing behind Denmark and Sweden.

Source: AQR, Finominal

PERFORMANCE CHASING IN GLOBAL EQUITIES

While Danish and Swedish stocks have outperformed U.S. equities since 1986, basing investment decisions solely on past performance would be unsound.

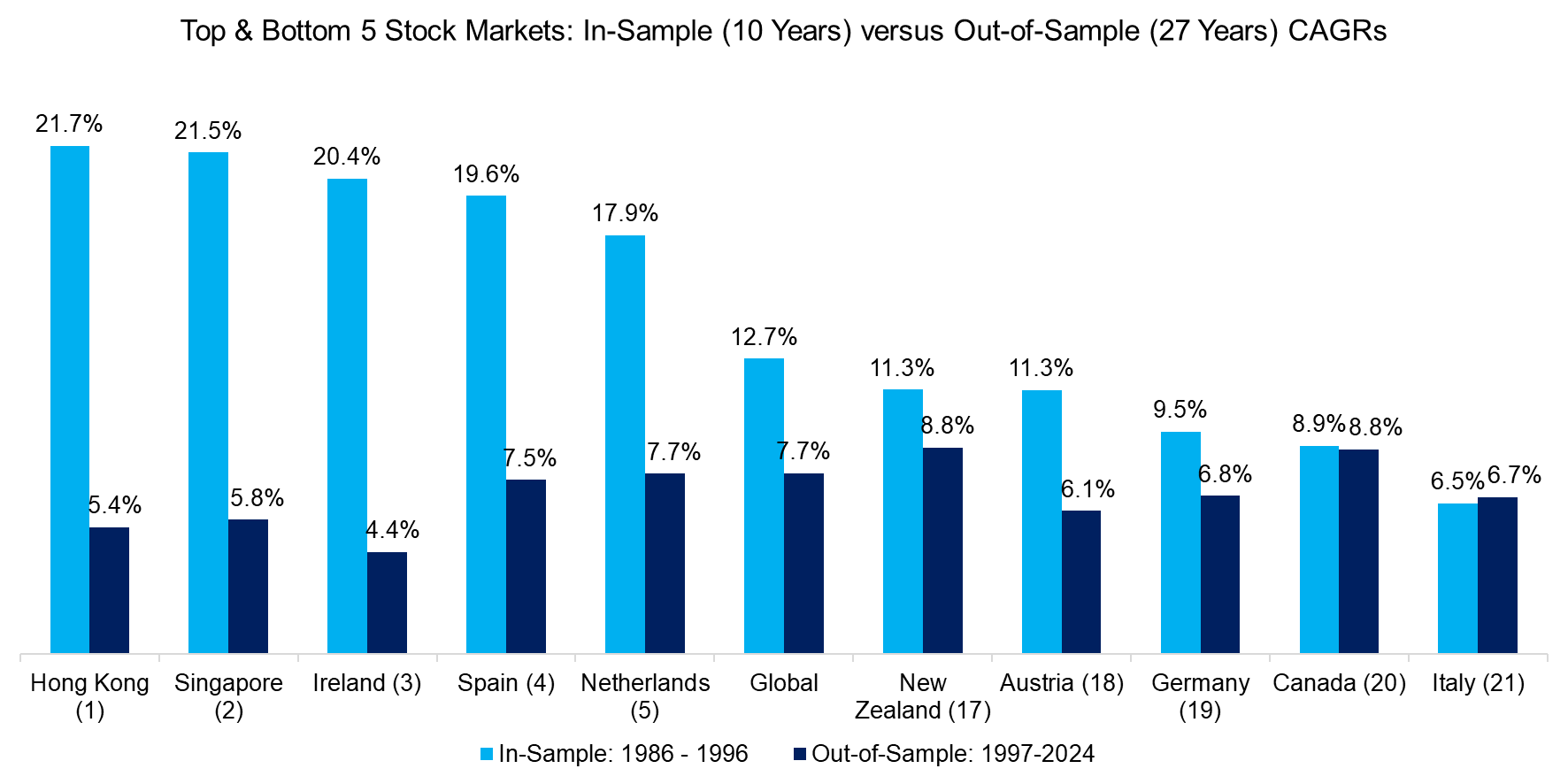

The dangers of performance chasing can be illustrated with a straightforward in-sample versus out-of-sample test. We begin by calculating the CAGRs for the top and bottom five stock markets during the 1986–1996 period. Intuitively, many investors might expect a degree of consistency, with the top-performing markets continuing to excel and the worst-performing ones lagging.

However, the out-of-sample results from 1997 to 2024 contradict this expectation. For example, Hong Kong led the in-sample period with a stellar CAGR of 21.7%, yet its performance dropped sharply to just 5.4% per annum out-of-sample. Conversely, Italy, which posted the lowest in-sample CAGR of 6.5%, managed to deliver a modestly improved 6.7% per annum over the following 27 years.

Source: AQR, Finominal

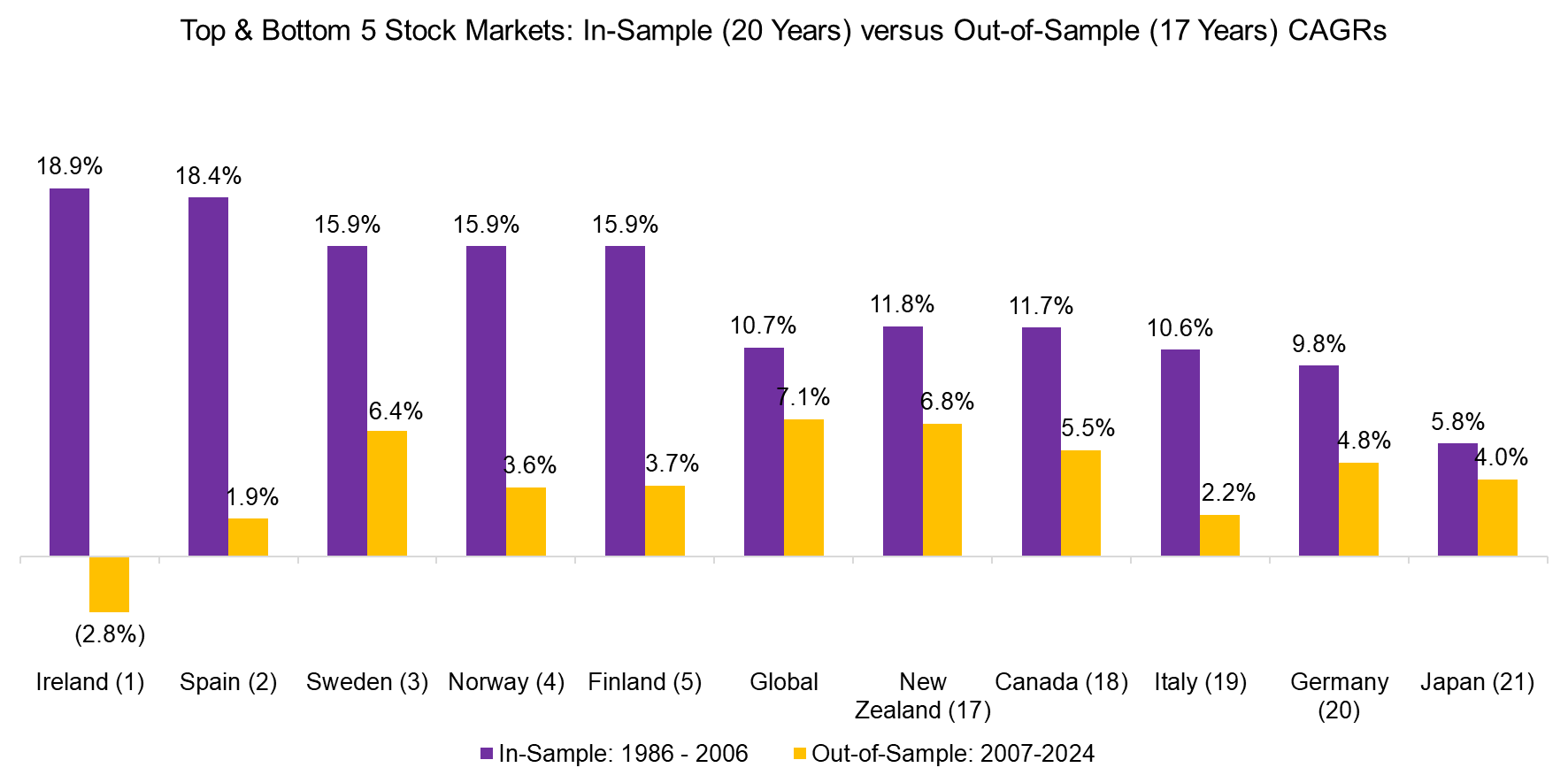

To address concerns about the short 10-year in-sample period, we extended the analysis to 20 years, examining performance from 1986 to 2006.

Even with this longer timeframe, no performance consistency emerges. Ireland, which led the in-sample period with a CAGR of 18.9%, delivered the lowest out-of-sample CAGR at -2.8%. Furthermore, all five markets that ranked at the bottom in-sample not only outperformed Ireland but also surpassed Spain, the second-best performer in the in-sample period, while the global portfolio beat all of the five best-performing markets out-of-sample.

Source: AQR, Finominal

FURTHER THOUGHTS

For U.S. investors, the appeal of international diversification might not be immediately obvious. However, as this analysis highlights, past performance is no guarantee of future results. For investors in other countries, the need for diversification should be apparent. A home bias is perfectly fine in sports, but not in investing.

RELATED RESEARCH

Stock Selection versus Asset Allocation

What´s Better than the S&P 500?

Outperformance via Leverage

Chasing Mutual Fund Performance

Thematic versus Momentum Investing

Cap-Weighted Benchmarks: Good Momentum Bets?

The Juggernaut Index

Top Fee Generating, Wealth Creating and Destroying ETFs

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.