The Hard-Knock Life of Short Sellers

Low-quality stocks can outperform markets

February 2023. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Short-biased hedge funds provided negative S&P 500 beta until 2011

- Thereafter returns became less negatively correlated, but worsened

- The strategy has generated limited diversification benefits for investors

INTRODUCTION

Running a hedge fund is tough, but some types are tougher to manage than others. For example, an equity long-short fund benefits from a structurally rising stock market, which requires less skill than an equity market neutral fund where the market provides no help at all (read Market Neutral Funds: Powered by Beta?). Trying to provide pure alpha is like squeezing water from a stone.

The most difficult type of hedge fund is probably a short-biased one. The base expectation of the manager is to lose money as equity markets increase on average over time, so this strategy only works well when stocks crash or enter a bear market. Then, there is the hate of the investor community as most will hold long rather than short positions in stocks. The CEOs of companies have an even greater animosity to short-sellers as these are betting on the demise of their organizations, often with loudly publicized research reports that outline poor corporate strategies or even fraud.

However, in years like 2022, when most stocks have lost money, investors’ interest in short-biased hedge funds tends to increase. Theoretically, these might be good diversifiers, but theoretically, hedge funds should be hedged, which most are not.

In this research article, we will explore the performance of short-biased hedge funds.

PERFORMANCE OF SHORT-BIASED HEDGE FUNDS

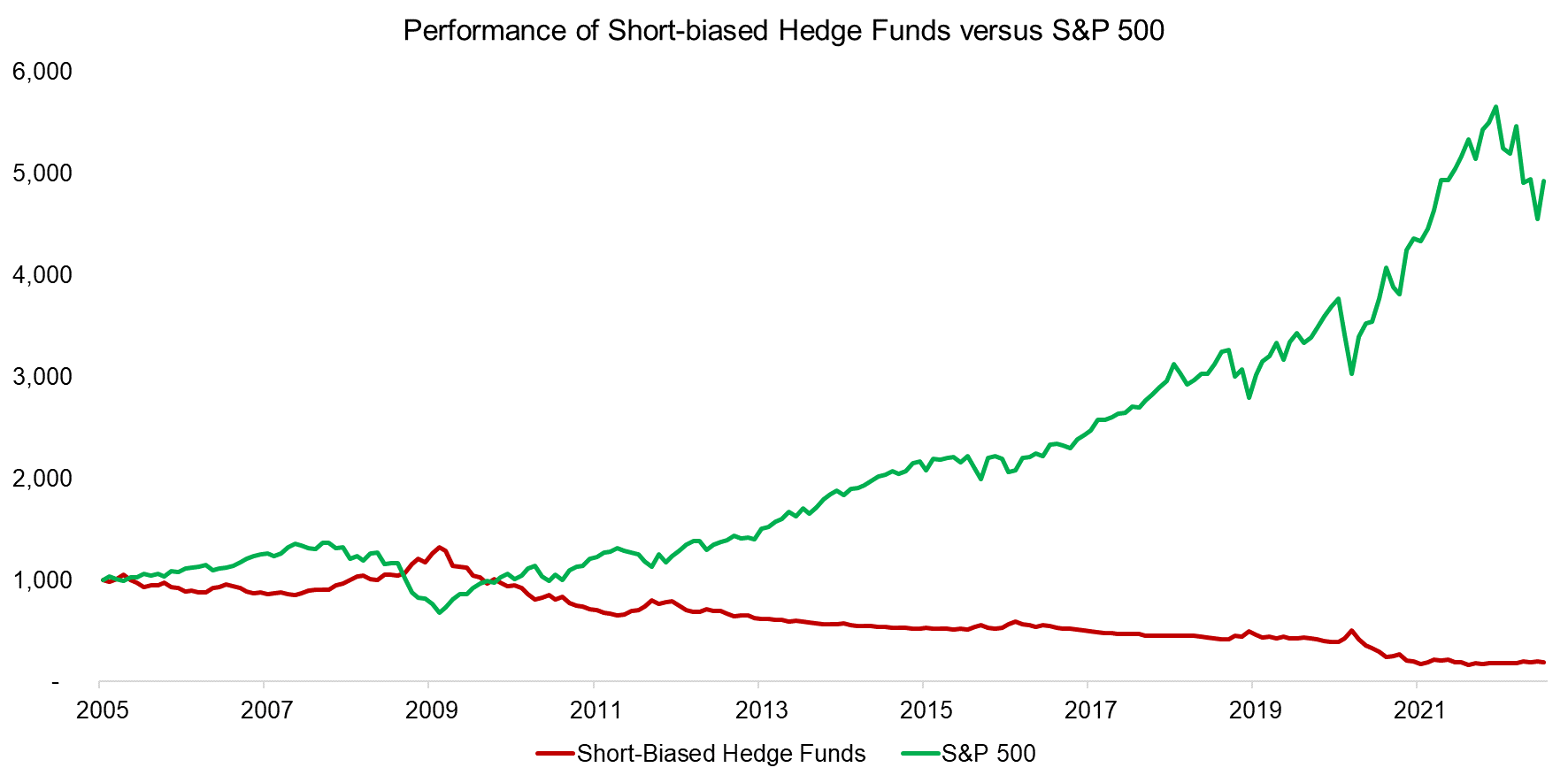

We use the Short Bias Index (HFRXSB) from HFR as a proxy for the performance of short-biased hedge funds. The index features monthly returns since 2005, so captures a variety of market and economic cycles.

Contrasting the short-biased hedge fund index to the S&P 500 highlights an almost asymmetrical performance, which is perhaps expected. The index’s performance has been poor and investing $1,000 in 2005 would only be worth $200 in 2022, i.e. investors would have experienced an 80% drawdown.

Source: Finominal

There are different types of strategies a short-seller can use to make profits, but the most common is betting against unprofitable companies or corporate frauds. The latter is likely the best way to make money for short-sellers as this risk is not reflected in stock prices, but it is difficult to prove and is met with fierce resistance by CEOs and their boards. Some hedge fund managers like Jim Chanos from Kynikos Associates or David Einhorn from Greenlight Capital went through multi-year battles with companies before they were eventually proven right.

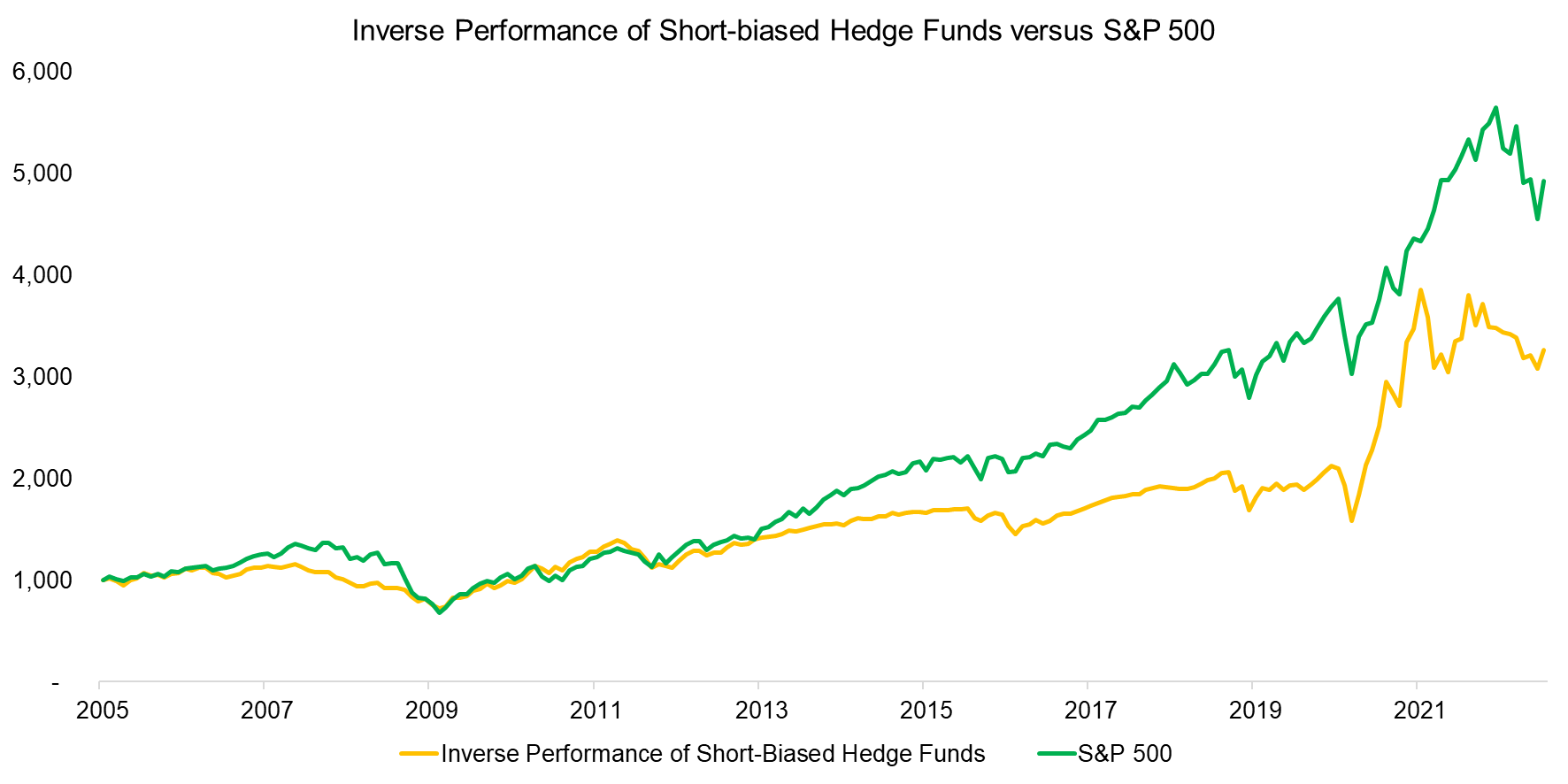

Betting against unprofitable companies is equally challenging as there are periods when the stock market does not care about profitability as long as there is strong revenue growth, which applies to the last decade. We can highlight this by contrasting the inverse performance of the short-biased hedge fund index to the S&P 500. From 2005 to 2013 their performance was almost identical, but thereafter the S&P 500 outperformed, which is likely explained by short-biased hedge funds betting against unprofitable tech stocks like Tesla that did surprisingly well.

Source: Finominal

CORRELATION OF SHORT-BIASED HEDGE FUNDS TO STOCKS

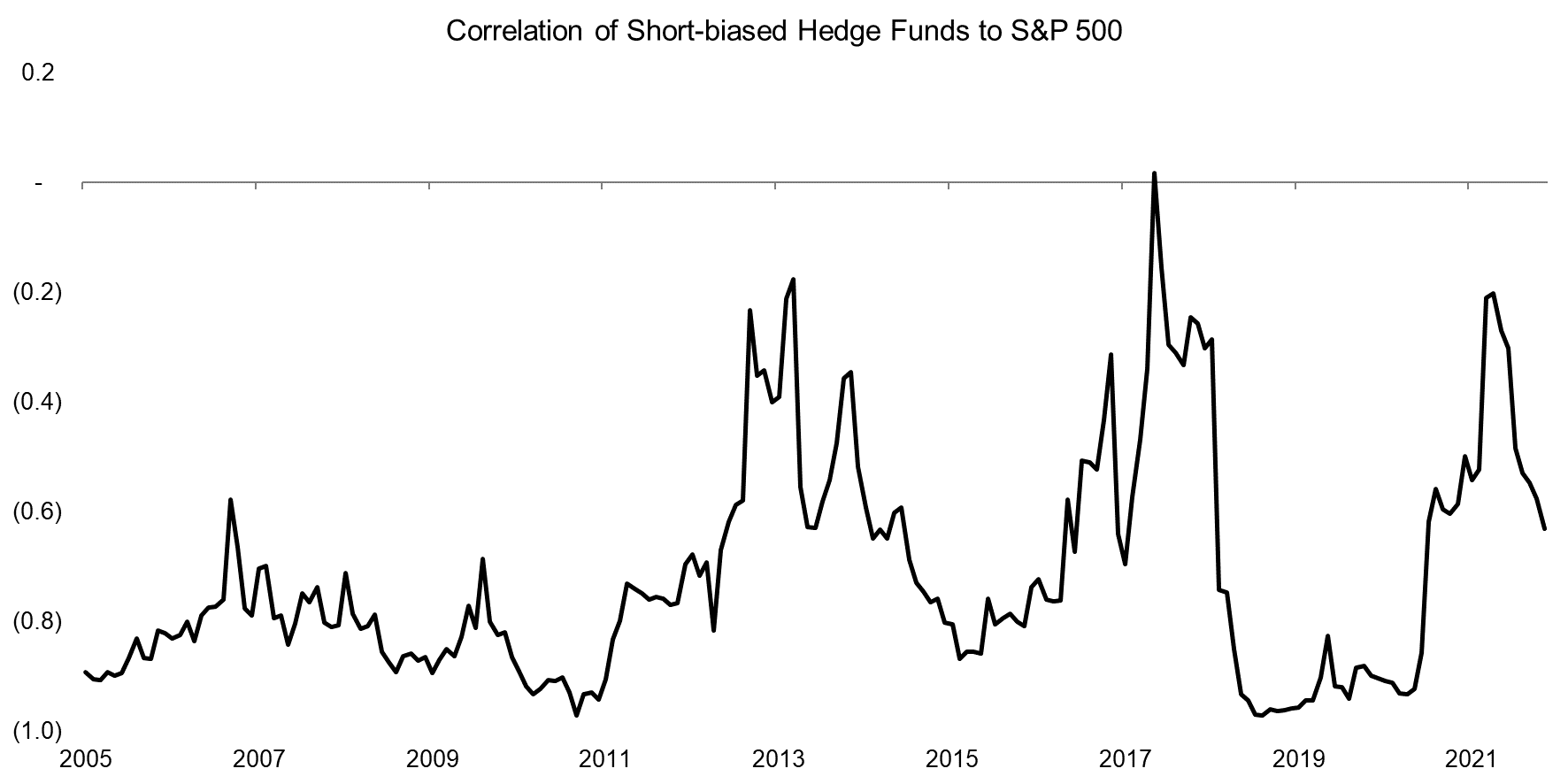

It is interesting to note that the correlation of short-biased hedge funds to the stock market has changed over time. In the period where the inverse performance matched that of the S&P 500, i.e. between 2005 and 2013, the correlation was -0.8 on average. Thereafter, when short-sellers “underperformed” the stock market, the correlation became less negative.

Stated differently, short-biased hedge funds evolved from simply providing a short position on the S&P to offering an uncorrelated portfolio. Although this has not worked well in the last decade, it represents a better product as investors can simply short the stock market via futures or inverse ETFs (read Myth Busting: Alts’ Uncorrelated Returns Diversify Portfolios).

Source: Finominal

PERFORMANCE OF SHORT-BIASED HEDGE FUNDS DURING STOCK MARKET CRASHES

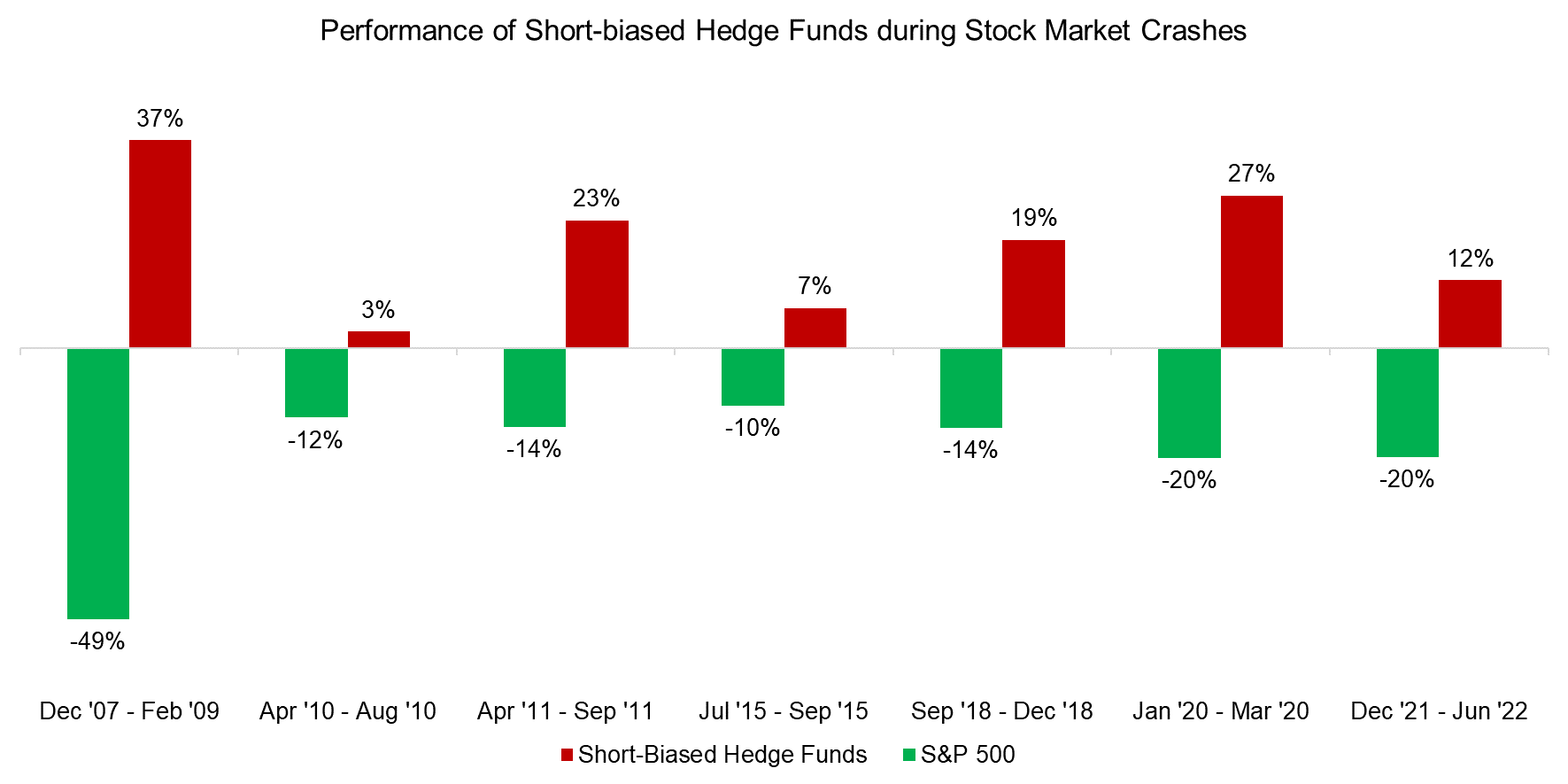

Next, we analyze the performance of short-biased hedge funds during stock market crashes. In general, we observe that short-sellers generated positive returns when stocks crashed. During some periods like the global financial crisis between 2007 and 2009, the S&P 500 declined by more than what hedge funds generated, while in others like in 2011 they made more profits.

Source: Finominal

DIVERSIFICATION BENEFITS FROM SHORT-BIASED HEDGE FUNDS

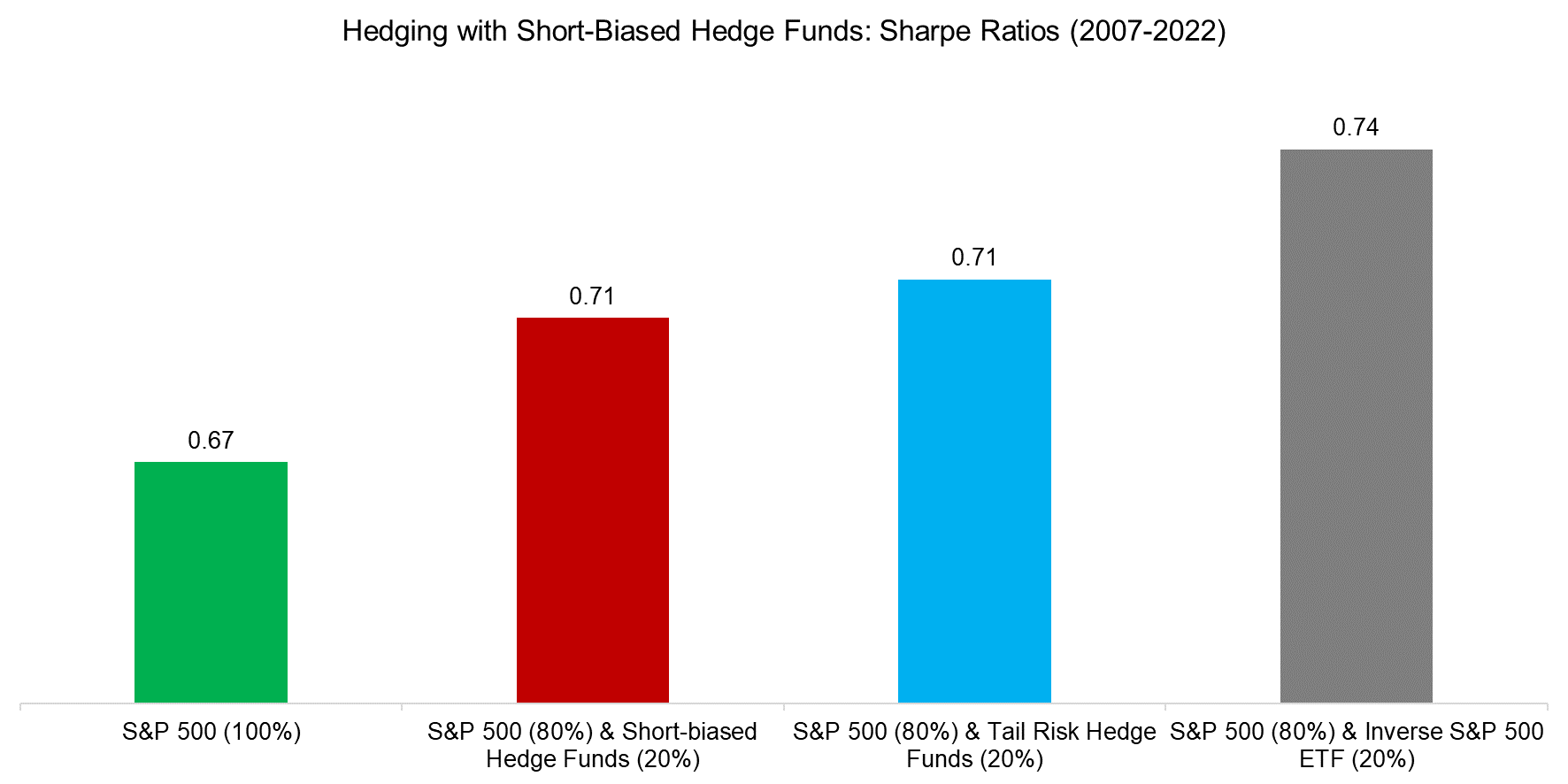

Finally, we evaluate the benefit of adding short-biased hedge funds to an equities portfolio. We also include tail risk hedge funds, which are represented by the CBOE Eurekahedge Tail Risk Hedge Fund index (read Tail Risk Hedge Funds), and an inverse S&P 500 ETF (SH) that simply offers the inverse performance of the S&P 500 without any leverage (read What is wrong with Inverse ETFs?).

We calculate the Sharpe ratios for the period from 2007 to 2022 and observe that a 20% allocation to short-biased hedge funds would have eased the risk-adjusted returns of an equities portfolio, but not more than when adding tail risk hedge funds or the inverse S&P 500 ETF.

It may seem unusual that an inverse ETF provided diversification benefits, but these do not track exactly the performance of the underlying index, especially when using monthly instead of daily returns for these calculations.

Source: Finominal

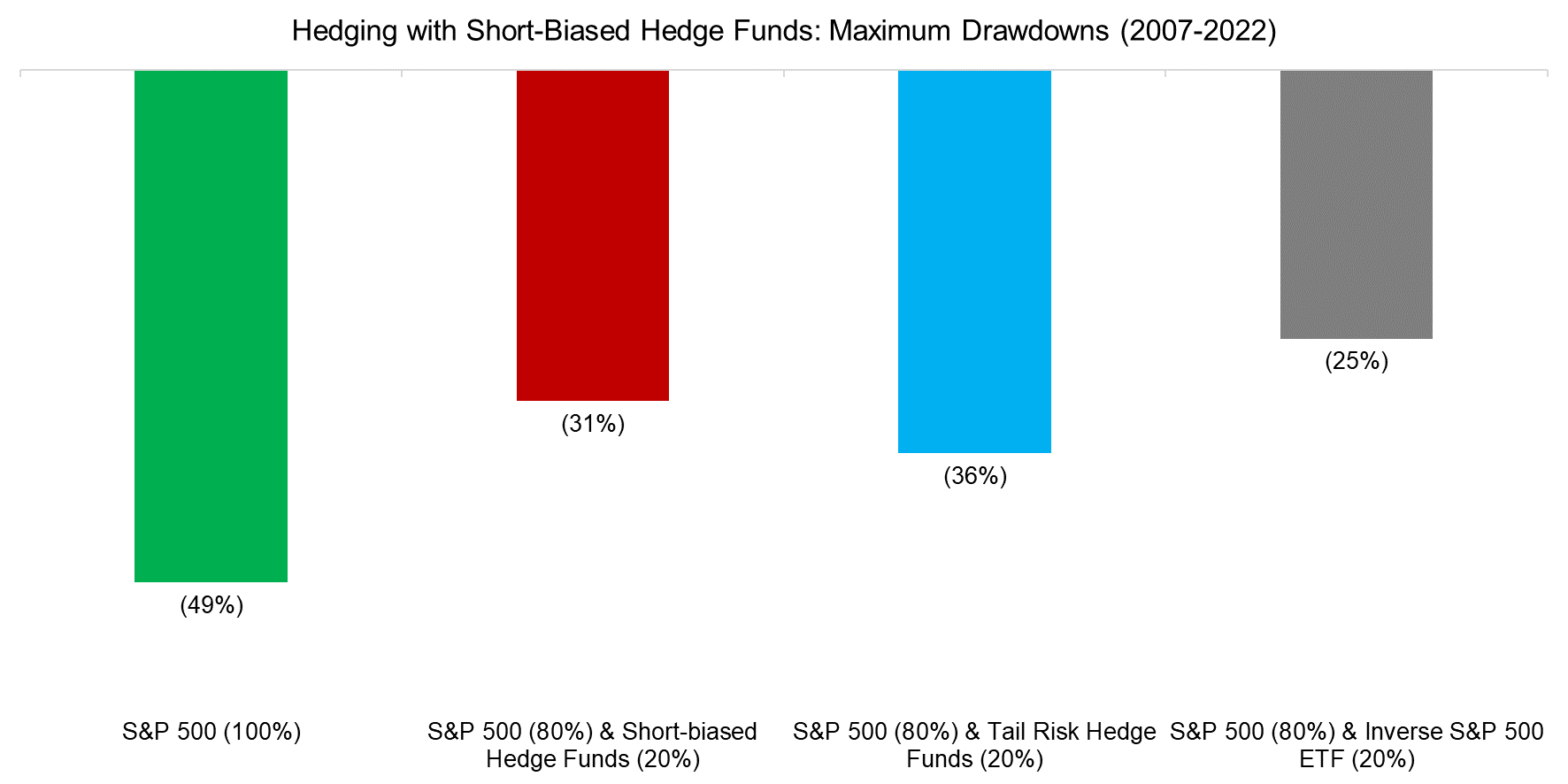

The maximum drawdown of an equities portfolio during the period from 2007 to 2022 would have been reduced by adding a 20% allocation to short-biased hedge funds and slightly more effective than with tail risk hedge funds, but not as much as when using an inverse S&P 500 ETF.

Source: Finominal

FURTHER THOUGHTS

Do short-biased hedge funds serve a purpose for investors?

Yes, and no. From a diversification perspective, they have added little value and other strategies like managed futures or long volatility strategies offer better characteristics for constructing a diversified portfolio (read Building a Diversified Portfolio for the Long-Term – Part II).

However, short-sellers are the equivalent of the police of stock markets. Long-biased investors might not buy the stock of a company where they suspect fraud, but they are not actively looking for such companies either. Democracies require journalists for their investigative work that keeps politicians and institutions in check, and so do capital markets.

RELATED RESEARCH

What is wrong with Inverse ETFs?

Tail Risk Hedge Funds

Thou Shall Not Short the VIX

Volatility Hedge Funds: The Good, the Bad, and the Ugly

Building a Diversified Portfolio for the Long-Term – Part II

Myth Busting: Alts’ Uncorrelated Returns Diversify Portfolios

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.