The Illusion of the Small-Cap Premium

Small-cap stocks outperform large-cap stocks, right?

SUMMARY

- Small-cap investing is intuitively appealing

- However, small-caps have underperformed in most markets

- Screening out low-quality small-caps has not helped significantly

INTRODUCTION

Investing means parting ways with your money, which is not something we tend to do lightly. The easiest way to get comfortable with an investment opportunity is if great performance is accompanied by a great story. The most popular theme currently is investing in anything AI-related, where story-telling is easy as artificial intelligence will impact our lives. However, if we go back a couple of years, it was the metaverse and blockchain businesses, before that marijuana stocks.

Most themes only last for a short time as company valuations tend to get driven to excessive levels by an enthusiastic investing crowd. At some point, investors realize that the underlying businesses are not able to match the lofty expectations, which leads to a collapse of the stock prices and the entire theme.

Naturally, some themes have more substance and longevity. Private equity firms highlight that investors can harvest an illiquidity premium by investing in their funds. Hedge funds are marketed as offering uncorrelated returns. Private credit funds showcase significantly higher risk-adjusted returns than the S&P 500. And so on (read Private Equity: Fooling Some People All the Time? and Myth Busting: Alts’ Uncorrelated Returns Diversify Portfolios) .

The issue with many of these longer themes is that their fundamentals erode as markets become more efficient, or that new data becomes available that paints a different picture. However, given vested interests of asset managers, the favorable old story keeps on being sold to investors.

In this article, we will explore one of the most popular stories of investing – the small-cap premium.

PERFORMANCE OF SMALL-CAP STOCKS IN THE U.S. STOCK MARKET

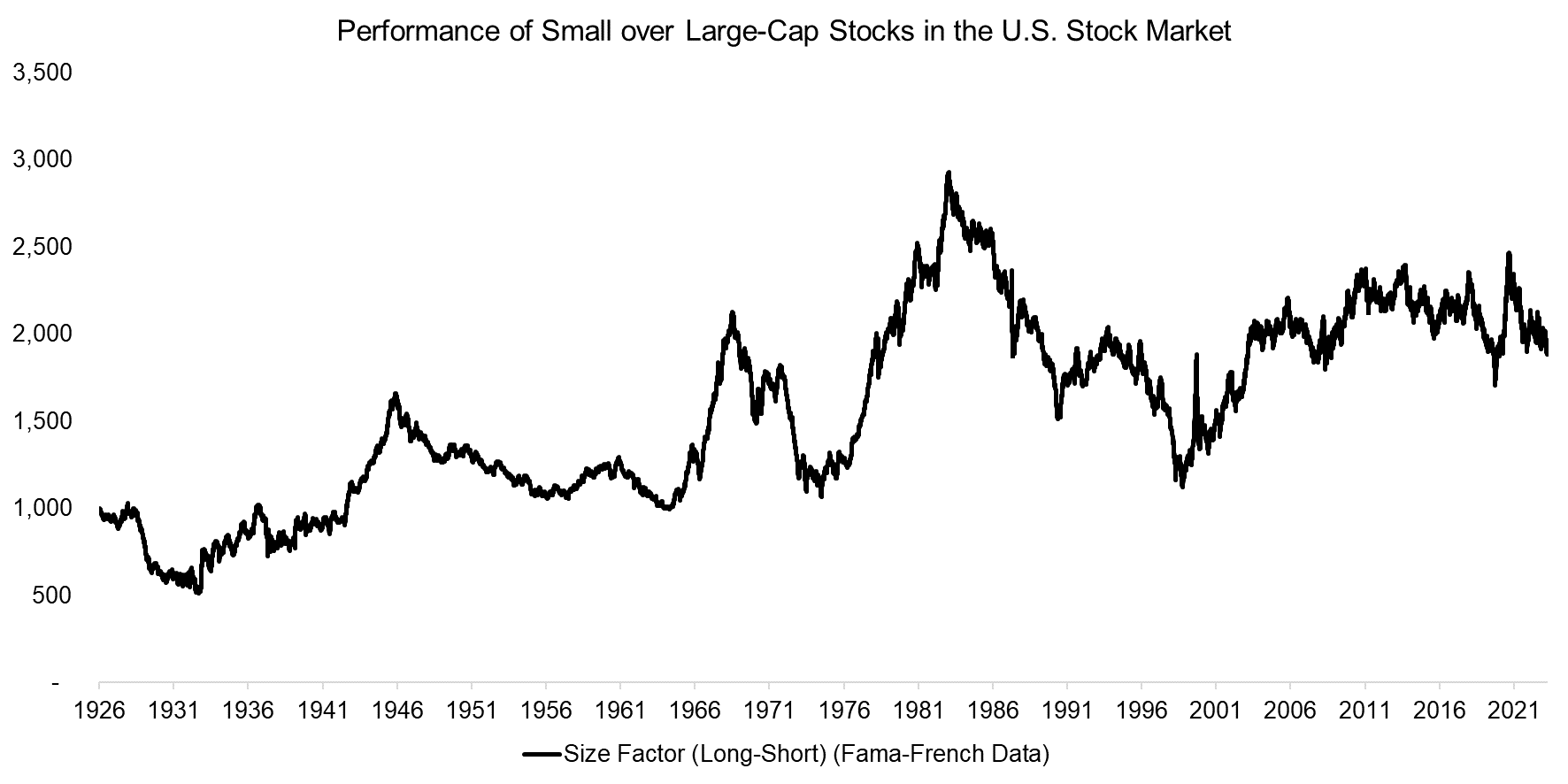

First, we evaluate the performance of small-cap stocks in the U.S. stock market, where we use data from the Kenneth R. French data library. Intuitively, small companies are more risky than large companies, and therefore investors should be rewarded with higher returns from allocating to these.

And indeed, the size factor, which is comprised of a long position in a diversified portfolio of small-cap and a short position in a portfolio of large-cap stocks, did generate a positive return over the period from 1926 to 2023.

However, the outperformance of small-cap stocks was anything but consistent and the CAGR of the size factor was a mere 0.7%, which would be reduced to approximately zero or negative if the data would have included transaction and market impact costs.

It is worth highlighting that Rolf W. Banz published his influential paper on the small-cap premium in 1981, which in hindsight represented the peak of small-cap stock performance over the 97-year period.

Source: Kenneth R. French Data Library, Finominal

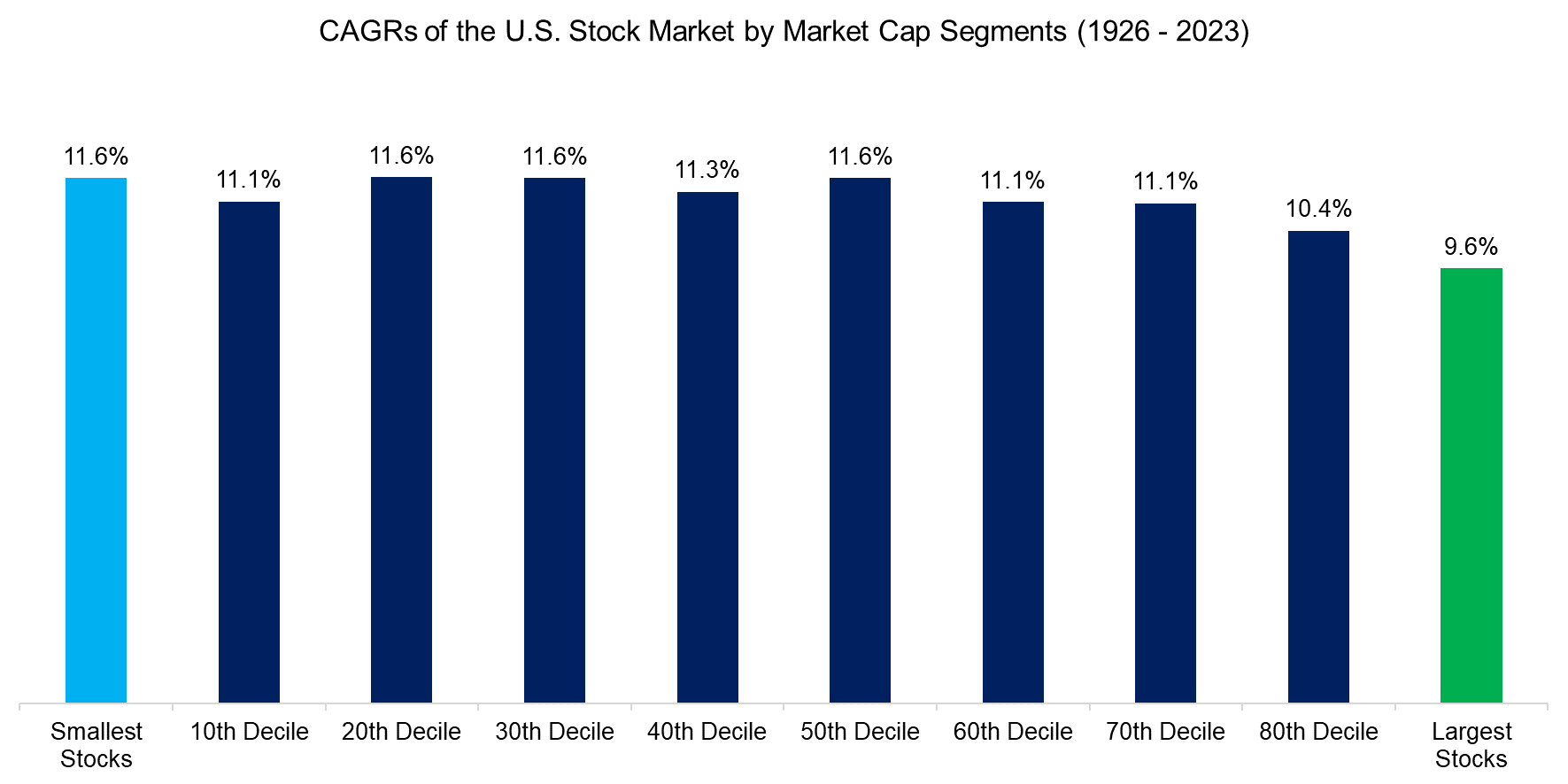

We can also dissect the performance of the U.S. stock market by market capitalization segments, which highlights that the smallest stocks have indeed generated the highest CAGR with 11.6% in the period from 1926 to 2023.

However, the 30th and 50th decile of stocks have produced the same 11.6% per annum. The largest stocks had the worst CAGR with 9.6%, which suggests that investors should be cautious about allocating to the largest stocks, but also that there is nothing unique about small-caps.

Source: Kenneth R. French Data Library, Finominal

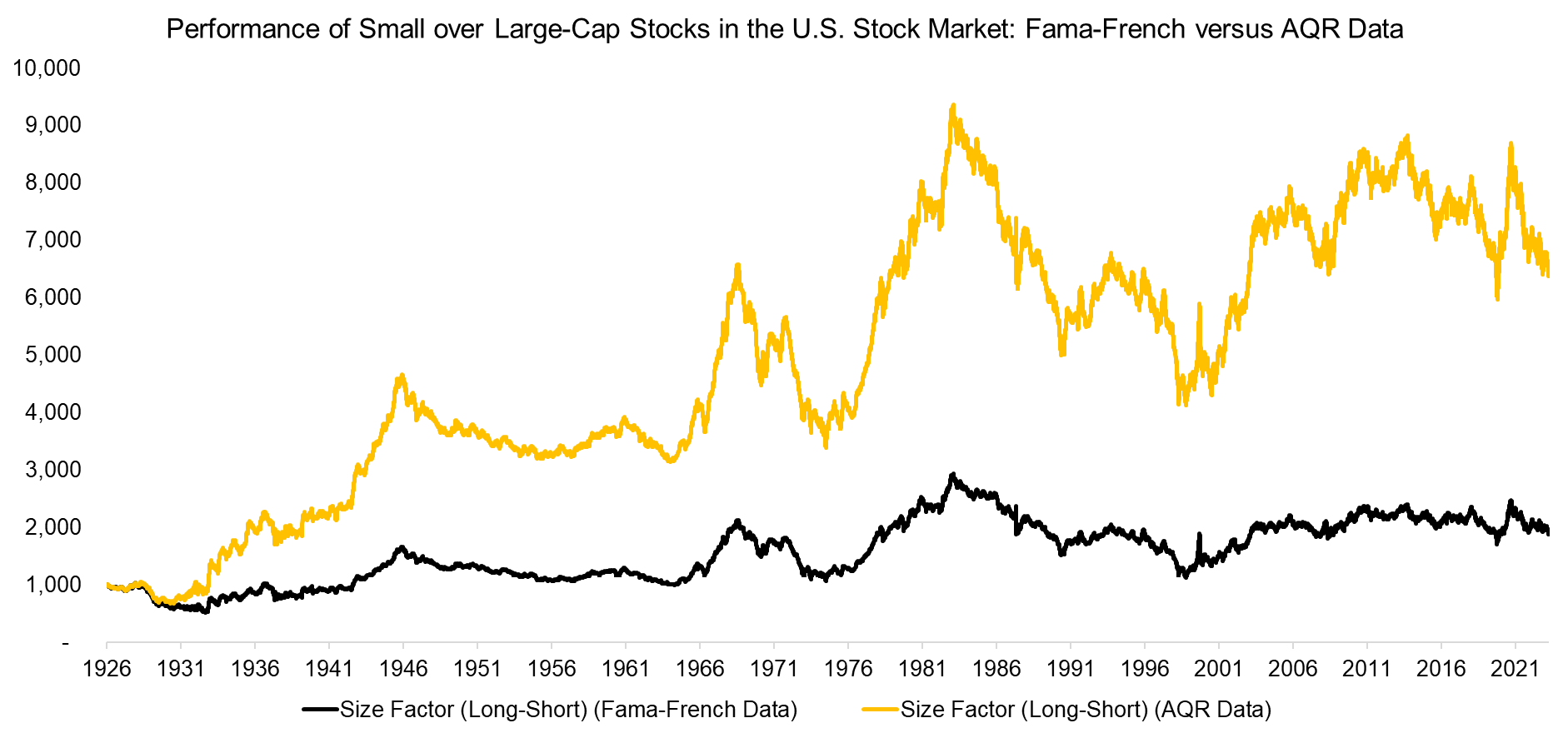

So far we have used data from the Kenneth R. French Data Library, but there are also other public sources of factor returns. We add the size factor as per data from AQR, a large quantitative asset management company, which highlights a higher return of 1.9% per annum, but also the same unattractive trends over time.

Source: Kenneth R. French Data Library, AQR, Finominal

PERFORMANCE OF SMALL-CAP STOCKS IN INTERNATIONAL STOCK MARKETS

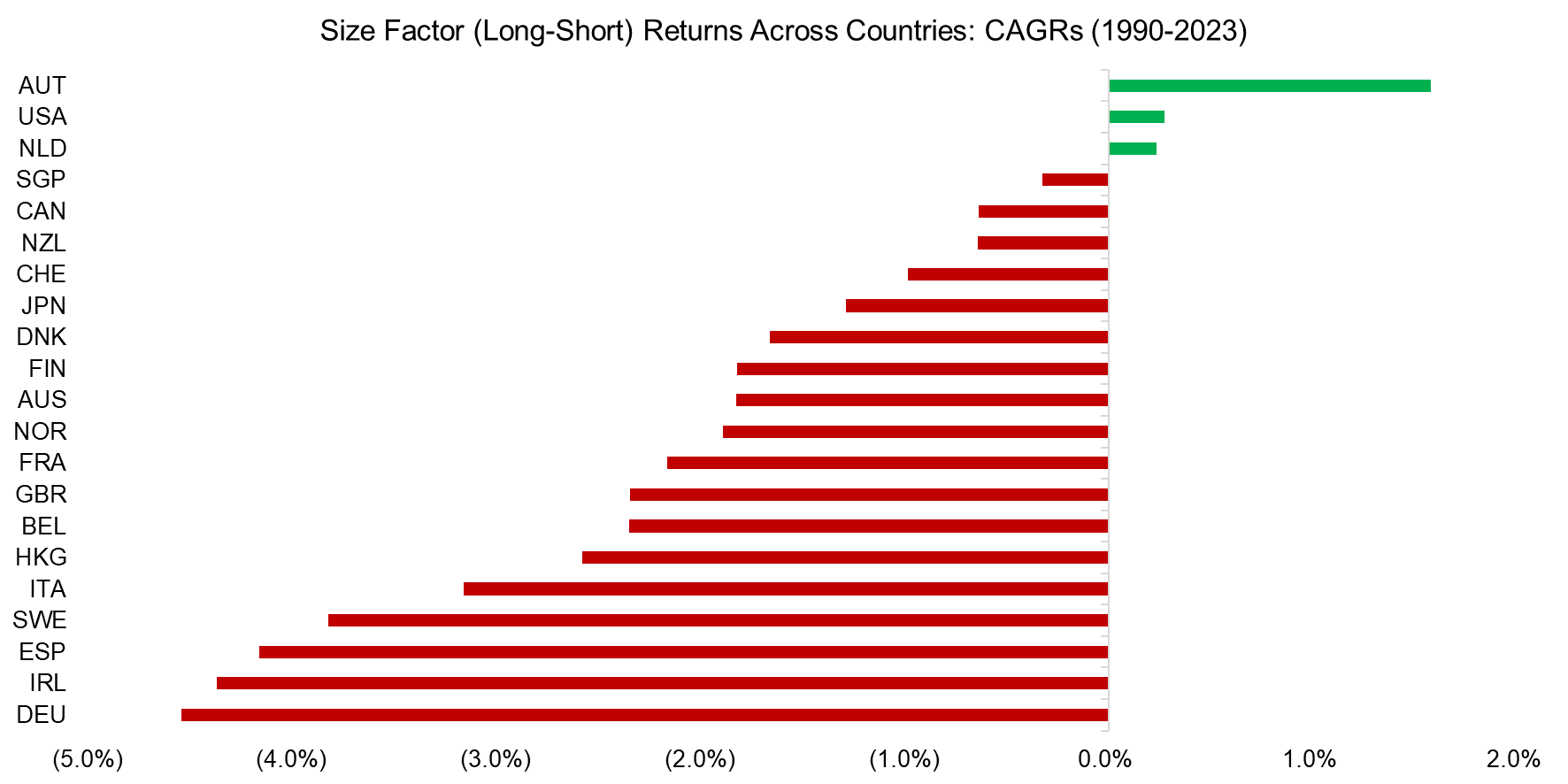

It is difficult to say if the data from the Kenneth R. French Data Library or AQR is more trustworthy. However, AQR also offers data for international stock markets, albeit only from 1990 onwards, which can perhaps improve the case for small-cap investing.

Calculating the CAGR of the long-short size factor for 21 stock markets highlights that only in three countries, namely Austria, the USA, and the Netherlands, small-caps outperformed large-caps. Furthermore, the outperformance ranged from 0.2% to 1.6% per annum, while the underperformance ranged from -0.3% to -4.5%.

Source: AQR, Finominal

FACTOR INVESTING IN SMALL-CAPS

The poor performance of the size factor is naturally reflected in the poor performance of small-cap funds. One common approach to market small-cap funds is to highlight that it is critical to differentiate between great and poor small companies, which can be done efficiently via factor investing. Stocks can be sorted by quality, low volatility, momentum, and similar metrics.

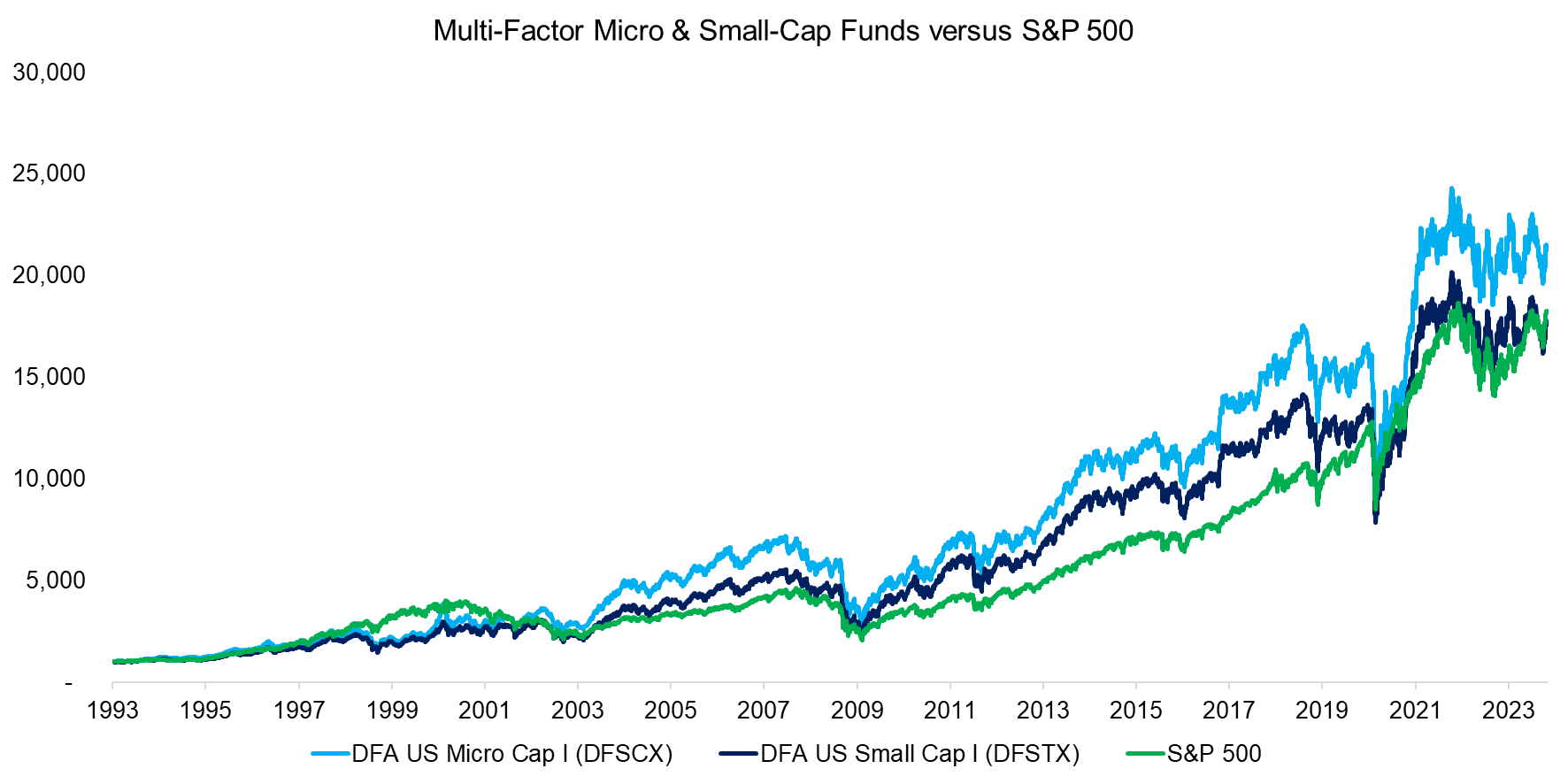

Dimensional Fund Advisors (DFA), a large asset management company that employs Eugene Fama and Kenneth French as board members, focuses on factor investing across market capitalization segments. We contrast the performance of the DFA US Micro Cap I (DFSCX) and DFA US Small Cap I (DFSTX) funds with the S&P 500. If there is a risk premium for small-caps over large-caps, then there should be even a higher one for micro-caps (read Factor Investing in Micro & Small Caps).

However, we only observe that DFSCX outperformed the S&P 500 over the 30-year period from 1993 to 2023, while DFSTX generated the same total return, despite the stock selection process screening out low-quality small-caps (read The Case Against Small Caps).

Source: Finominal

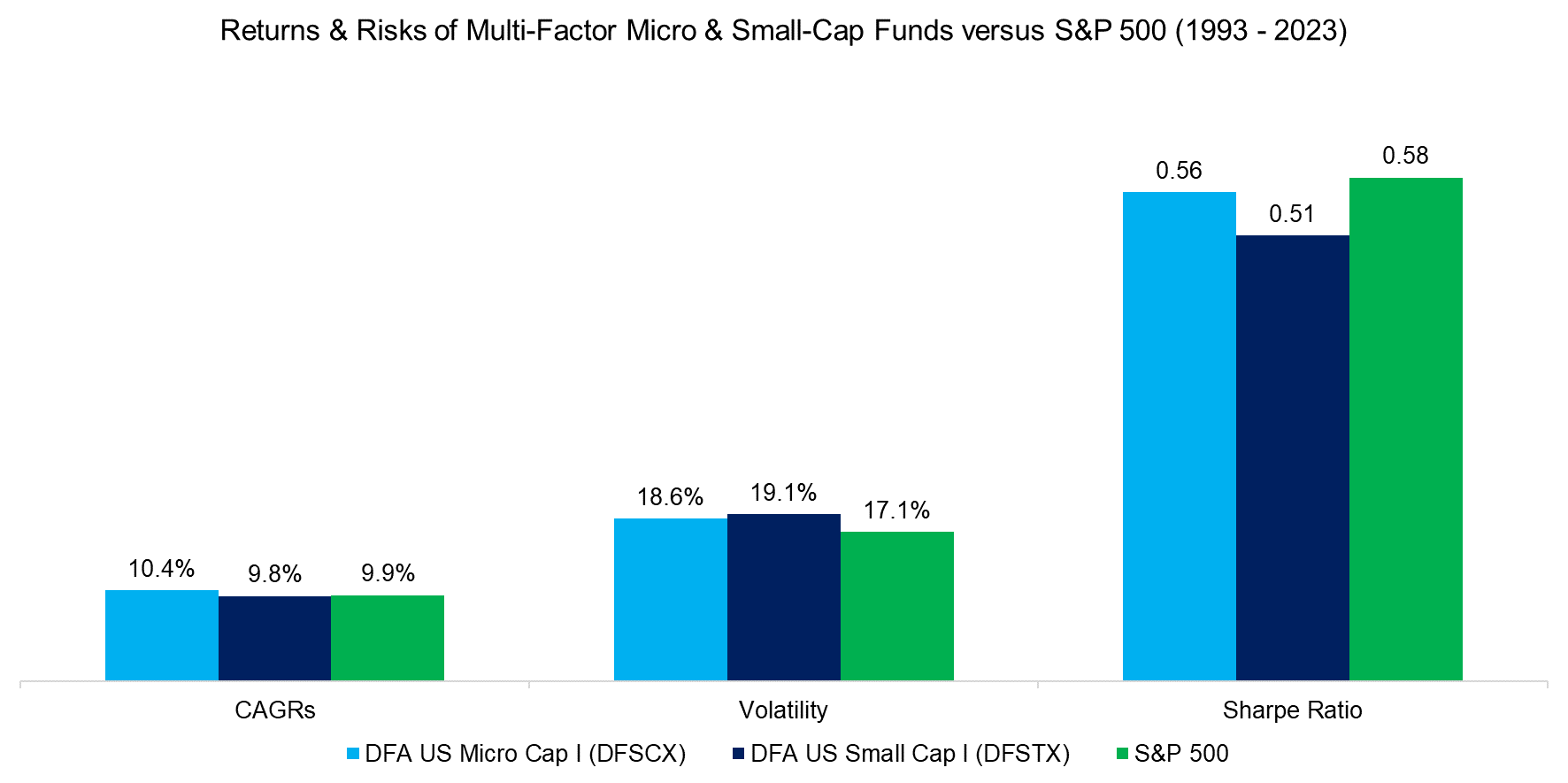

However, returns are only meaningful when reviewed with the risk undertaken to achieve these. Although the micro-cap fund did generate a higher CAGR than the S&P 500, its volatility was higher, therefore resulting in a lower risk-adjusted return since 1993. Similarly, the small-cap fund also offers a lower Sharpe ratio than the S&P 500.

Naturally, we could have selected a multi-factor large-cap fund, which would have outperformed the S&P 500 over the last 30-years, but it was not needed given the lack of evidence for a small-cap premium, even when screening out low-quality small-cap stocks.

Investors that require a higher return than what large-cap stocks offer, can simply buy a leveraged version of the S&P 500, which is available as an ETF.

Source: Finominal

FURTHER THOUGHTS

People love good stories and tend to favor David over Goliath, which makes small-cap investing intuitively appealing. However, as John Maynard Keynes is credited with saying: “When the facts change, I change my mind. What do you do, sir?”

RELATED RESEARCH

The Case Against Small Caps

Factor Returns: Small vs Large Caps

Factor Investing in Micro & Small Caps

Size Factor

How Risky Are Value Stocks?

REFERENCED RESEARCH

The Relationship between Return and Market Value of Common Stocks, Rolf W. Banz, 1981

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.